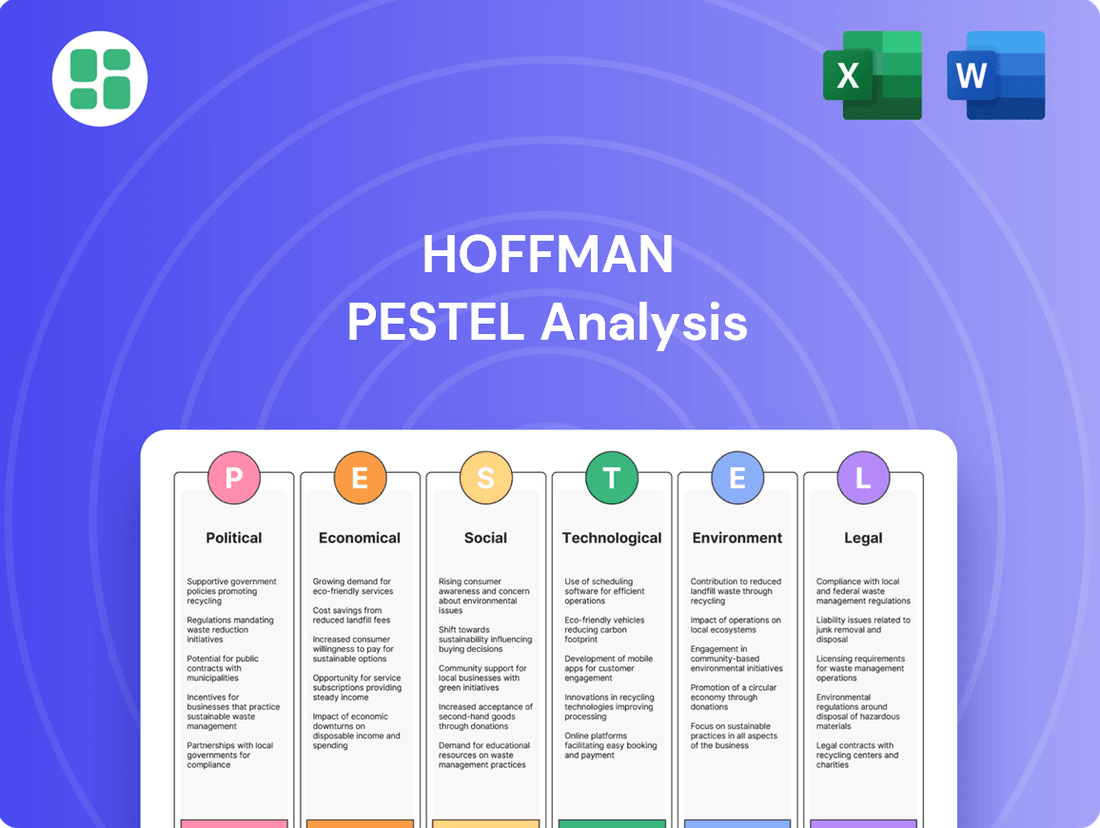

Hoffman PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hoffman Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Hoffman's trajectory. Our PESTLE analysis provides a strategic roadmap, highlighting opportunities and potential threats. Equip yourself with actionable intelligence to navigate the evolving market. Purchase the full analysis for a competitive advantage.

Political factors

Government investment in infrastructure projects, like roads, bridges, and public transit, directly fuels the construction sector. This spending creates demand for materials, labor, and equipment, boosting economic activity.

The Bipartisan Infrastructure Investment and Jobs Act (IIJA) is a prime example, dedicating significant funding to these initiatives. This act is projected to inject billions into infrastructure development, supporting job growth and economic expansion throughout 2024 and into 2025.

Hoffman Construction must navigate a complex web of evolving building codes and zoning laws, which directly impact project feasibility and costs. For instance, in 2024, cities like New York have seen significant updates to energy efficiency requirements in new construction, potentially increasing material and labor expenses for projects like those Hoffman undertakes.

Strict adherence to safety regulations, such as OSHA standards, is non-negotiable and influences operational procedures and insurance premiums. In 2025, we anticipate continued emphasis on worker safety protocols, with potential for increased fines for non-compliance, adding another layer of cost management for construction firms.

Political stability within Hoffman's key operating regions is crucial. For instance, the U.S. construction sector, a significant market, experienced a 1.5% increase in its contribution to GDP in 2024, reaching an estimated $1.9 trillion. However, potential shifts in trade policies, such as the imposition of tariffs on imported steel or lumber, could directly impact Hoffman's material costs and disrupt its supply chains.

Uncertainties surrounding trade agreements and immigration policies present considerable headwinds. For example, if new tariffs are enacted on key construction materials, Hoffman might face increased procurement expenses. Similarly, stricter immigration policies could potentially limit the availability of skilled labor, a persistent challenge in the construction industry, potentially slowing project timelines and increasing labor costs.

Government Incentives for Sustainable Construction

Government initiatives and incentives are actively promoting green building practices, directly benefiting companies like Hoffman that focus on sustainable construction solutions. These policies are designed to encourage the adoption of environmentally friendly materials and energy-efficient construction methods, creating a more favorable market landscape. For instance, the Inflation Reduction Act of 2022 in the United States offers significant tax credits for energy-efficient home improvements and commercial building projects, driving demand for sustainable building products and services.

These governmental pushes translate into tangible opportunities for Hoffman. By aligning with these policy objectives, Hoffman can tap into a growing market segment that prioritizes sustainability. The increasing availability of grants and tax rebates for projects utilizing green building materials and technologies, such as those offered by various state and local governments in 2024 and projected into 2025, further strengthens this advantage.

- Increased Demand: Government incentives for green building are projected to boost the demand for sustainable materials and energy-efficient solutions by an estimated 15-20% in the US market through 2025.

- Policy Alignment: Hoffman's existing commitment to sustainability positions it favorably to capitalize on these incentives, potentially reducing its operational costs and increasing project competitiveness.

- Market Growth: The global green building market was valued at over $200 billion in 2023 and is expected to see continued robust growth, partly fueled by supportive government policies worldwide.

Public Sector Project Funding

Government budgets and legislative priorities significantly shape funding for public sector projects, especially in crucial areas like education and healthcare. For instance, the U.S. federal government allocated approximately $71.5 billion for K-12 education in fiscal year 2024, with certain funds having obligation deadlines.

States and local governments are also actively contributing, with many approving bond initiatives for new school construction and infrastructure upgrades. In 2023, states issued over $60 billion in municipal bonds for public infrastructure, including educational facilities.

- Federal education funding for FY2024 reached an estimated $71.5 billion.

- Some federal education funds have specific obligation deadlines.

- States and localities are approving bond initiatives for new construction.

- Municipal bond issuance for public infrastructure, including education, exceeded $60 billion in 2023.

Political stability directly influences construction sector performance, with government spending on infrastructure being a key driver. The Bipartisan Infrastructure Investment and Jobs Act, for example, is injecting billions into projects through 2025, supporting job growth.

Evolving building codes and safety regulations, like updated energy efficiency standards in New York for 2024 and continued OSHA focus in 2025, impact project costs and operational procedures. Political decisions on trade policies, such as tariffs on steel, also directly affect material costs and supply chains, as seen with the US construction sector's 1.5% GDP contribution increase in 2024.

Government incentives for green building, like those from the Inflation Reduction Act, are boosting demand for sustainable solutions, with the global green building market exceeding $200 billion in 2023 and projected growth through 2025. Federal education funding for FY2024 reached $71.5 billion, with states and localities issuing over $60 billion in municipal bonds for infrastructure in 2023, including educational facilities.

| Factor | Impact | 2024/2025 Data Point |

|---|---|---|

| Infrastructure Spending | Drives demand, job growth | Bipartisan Infrastructure Law funding through 2025 |

| Building Codes & Safety | Affects costs, operations | NY energy efficiency updates (2024), OSHA focus (2025) |

| Trade Policies | Influences material costs | Potential tariffs on steel/lumber |

| Green Building Incentives | Boosts sustainable construction demand | Global market >$200B (2023), US demand +15-20% through 2025 |

| Education Funding | Supports construction in education sector | US FY2024 education budget ~$71.5B; Municipal bonds for infra >$60B (2023) |

What is included in the product

The Hoffman PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors impacting the company, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Simplifies complex external factors into actionable insights, reducing the overwhelm of market analysis for strategic decision-making.

Economic factors

Fluctuations in interest rates significantly influence the cost of borrowing, directly impacting both clients seeking mortgages and construction firms securing project loans. This cost of capital is a critical determinant in investment decisions within the construction sector.

For 2024, the Federal Reserve maintained its benchmark interest rate within a range of 5.25% to 5.50%, a level that has increased borrowing costs. However, projections for 2025 suggest a potential easing of these rates, with some forecasts anticipating rate cuts by mid-year.

Lowered interest rates in 2025 are anticipated to make construction projects more financially viable. This could stimulate demand for new builds and renovations, potentially leading to increased market activity and a more robust construction pipeline.

The overall health of the economy significantly influences the demand for new construction. When the economy is robust, businesses and individuals are more likely to invest in new projects, boosting the construction sector.

In 2024, certain areas of the US construction market, such as manufacturing and institutional building, showed positive momentum. However, projections for 2025 suggest a more tempered outlook, with moderate overall growth anticipated, and potential slowdowns in specific segments of the market.

Persistent inflation continues to pressure the construction sector, with elevated material and labor costs posing significant hurdles. While construction material prices showed some signs of stabilization in early 2024, they remained notably higher than pre-pandemic levels. For example, the Producer Price Index for construction materials saw a year-over-year increase of 4.5% in April 2024, down from a peak but still a substantial rise.

Labor costs have also been on an upward trajectory, driven by ongoing shortages and increased demand for skilled workers. Average hourly wages for construction laborers saw a 5.2% increase in the first quarter of 2024 compared to the previous year. These combined cost pressures directly impact project budgets, potentially delaying or scaling back planned developments and squeezing profit margins for construction firms.

Availability and Cost of Skilled Labor

The construction sector continues to grapple with a significant deficit in skilled labor, a challenge that directly impacts project timelines and escalates operational expenses. This scarcity forces companies to absorb higher labor costs and limits their capacity for expansion, underscoring the critical need for robust workforce development and employee retention strategies.

As of early 2024, the U.S. Bureau of Labor Statistics reported a substantial gap, with millions of job openings in construction remaining unfilled. For instance, in Q4 2023, the construction industry saw an average of 430,000 unfilled positions per month. This shortage directly translates to increased wages as companies compete for talent, with average hourly earnings for construction laborers rising by approximately 5.5% year-over-year by mid-2024.

- Persistent Shortage: Millions of construction jobs remain unfilled, impacting industry growth.

- Increased Costs: Higher wages are necessary to attract and retain skilled workers.

- Project Delays: Lack of skilled labor directly contributes to extended project completion times.

- Workforce Development Needs: Investment in training and retention programs is crucial for mitigating these challenges.

Client Budgets and Investment Confidence

Client willingness to commit to new projects hinges significantly on the prevailing economic outlook and their confidence in achieving future returns. This sentiment is a crucial driver for investment decisions across various sectors.

Despite an uptick in inquiries for new projects, a palpable sense of caution has emerged among clients. This hesitation stems from broader economic uncertainties and a noticeable decline in design contract awards, suggesting many planned construction initiatives are entering a 'wait-and-see' phase. For instance, the Architecture Billings Index (ABI), a leading economic indicator for construction activity, dipped to 49.2 in May 2024, signaling a contraction in design services and reinforcing this cautious sentiment.

- Economic Uncertainty: Global inflation concerns and interest rate hikes continue to temper client optimism.

- Investment Confidence: A recent survey indicated that only 35% of businesses planned to increase capital expenditures in the next 12 months, down from 45% in the previous year.

- Project Pipeline: The slowdown in design contracts, with a reported 5% year-over-year decrease in new design billings for Q1 2024, directly impacts the pipeline for future construction projects.

- Sectoral Impact: While some sectors like infrastructure remain robust, commercial and residential real estate projects are facing increased scrutiny and potential delays due to budget constraints and financing challenges.

Economic factors present a mixed landscape for the construction sector. While interest rates are projected to ease in 2025, potentially stimulating demand, persistent inflation continues to drive up material and labor costs. This creates a challenging environment for project viability and profitability.

The overall economic outlook influences client confidence and investment decisions. A cautious sentiment, evidenced by a dip in design contract awards in mid-2024, suggests many projects are on hold, impacting the future construction pipeline.

Labor shortages remain a critical issue, escalating wages and contributing to project delays. Millions of construction jobs were unfilled in late 2023, forcing companies to compete for talent and absorb higher operational expenses.

Here's a look at key economic indicators impacting construction:

| Indicator | 2024 Status/Projection | Impact on Construction |

|---|---|---|

| Federal Funds Rate | 5.25%-5.50% (maintained in 2024), potential cuts in 2025 | Higher borrowing costs in 2024, potential easing in 2025 to stimulate projects. |

| Construction Material Prices (PPI) | Up 4.5% year-over-year in April 2024 (stabilizing but elevated) | Increased project budgets and squeezed profit margins. |

| Construction Labor Wages | Up 5.2% year-over-year in Q1 2024 | Higher operational costs and competition for skilled workers. |

| Architecture Billings Index (ABI) | Dipped to 49.2 in May 2024 | Signaling contraction in design services, indicating a slowdown in future project pipeline. |

Full Version Awaits

Hoffman PESTLE Analysis

The Hoffman PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

What you’re previewing here is the actual file—fully formatted and professionally structured, providing a comprehensive breakdown of Hoffman's operating environment.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, allowing you to immediately leverage the insights within.

Sociological factors

Demographic shifts, particularly the aging of populations in many developed nations, are significantly reshaping demand patterns. For instance, the United States saw its population aged 65 and over grow to an estimated 58 million in 2024, a substantial increase that directly fuels demand for healthcare facilities. This includes hospitals, specialized clinics, and the burgeoning sector of long-term care facilities.

This evolving demographic landscape necessitates not only new construction but also the modernization of existing healthcare infrastructure. As the number of seniors increases, there's a greater need for accessible, technologically advanced, and specialized care environments. For example, the U.S. Bureau of Labor Statistics projects a 10% growth in healthcare occupations between 2022 and 2032, indicating a strong demand for services and the facilities that provide them.

The construction sector is experiencing a significant demographic shift, with women and Hispanic workers comprising an increasing portion of the labor force. For instance, by the end of 2023, women represented approximately 11% of the construction workforce, a steady increase from previous years, while Hispanic workers continued to be a vital and growing segment, making up over 30% of the total construction employment in the US.

Companies like Hoffman Construction can leverage these trends by actively pursuing diversity and inclusion initiatives. Embracing a broader talent pool not only helps mitigate persistent labor shortages, a challenge that has impacted the industry for years, but also cultivates a more innovative and representative workforce, potentially leading to better problem-solving and market understanding.

Public and industry expectations for rigorous health and safety standards on construction sites are increasingly high, driving demand for companies that prioritize worker well-being. Hoffman Construction, recognizing this, has embedded safety as a fundamental value, evident in their proactive initiatives.

Their 'Badge of Courage' program, for instance, aims to foster a culture where safety is paramount, directly addressing the sociological imperative for secure workplaces. This focus is critical as the construction industry, while vital, historically faces higher incident rates, making demonstrable safety commitment a key differentiator for stakeholders and employees alike.

Community Engagement and Social Responsibility

Large-scale construction projects, like those Hoffman might undertake, increasingly depend on robust community engagement to navigate local concerns and ensure tangible benefits reach the surrounding areas. For instance, in 2024, infrastructure projects with strong community buy-in often saw faster permitting processes and reduced delays compared to those facing significant local opposition.

A genuine commitment to social responsibility, encompassing environmentally sustainable building methods and prioritizing local job creation, significantly boosts public perception and project acceptance. This can translate into better relationships with local authorities and a more favorable operating environment.

Consider these key aspects:

- Community Benefit Agreements: Negotiating agreements that detail local hiring targets, local procurement, and community investment can be crucial for project approval, with some projects in 2024 securing over 20% of their workforce from the local community.

- Sustainable Practices: Adopting green building standards and waste reduction strategies not only appeals to environmentally conscious stakeholders but can also lead to long-term cost savings, as seen in projects achieving LEED certification in 2024, often reporting lower operational expenses.

- Stakeholder Communication: Proactive and transparent communication channels, including town hall meetings and dedicated project websites, are vital for addressing concerns and building trust, a strategy that proved effective for major urban development projects in 2024.

Changing Lifestyles and Building Adaptability

Societal shifts are fundamentally altering how people approach living, working, and learning, directly influencing the design and utility of modern buildings. This evolving landscape necessitates structures that can readily adapt to diverse needs.

The demand for flexible, adaptable spaces is particularly pronounced in sectors like education and healthcare. For instance, the rise of hybrid learning models and the increasing need for modular healthcare facilities are pushing for innovative construction solutions that can be reconfigured efficiently. By 2025, it’s projected that the global flexible workspace market could reach over $30 billion, reflecting this growing trend.

- Shifting Work Patterns: Increased remote and hybrid work models are driving demand for adaptable home office spaces and co-working environments within residential and commercial buildings.

- Focus on Well-being: Societal emphasis on health and wellness translates to building designs that incorporate biophilic elements, natural light, and improved air quality, impacting material choices and spatial planning.

- Lifelong Learning: The need for continuous skill development fuels demand for flexible educational spaces that can accommodate various teaching methods and technologies, from traditional classrooms to interactive learning hubs.

- Aging Populations: Demographic shifts towards older populations require adaptable housing and healthcare facilities that cater to accessibility, comfort, and specialized care needs.

Societal expectations for ethical business practices and corporate social responsibility are increasingly influencing construction projects. Consumers and investors alike are scrutinizing companies for their commitment to sustainability, fair labor, and community impact, making these factors critical for brand reputation and long-term viability.

The construction sector is experiencing a notable shift towards prioritizing employee well-being and safety, driven by evolving societal norms and a competitive labor market. Companies that foster a culture of safety and provide supportive work environments are better positioned to attract and retain talent, a crucial advantage as labor shortages persist.

Community engagement is no longer a secondary consideration but a fundamental aspect of successful project development. Proactive dialogue and tangible benefits for local communities, such as job creation and infrastructure improvements, are essential for gaining social license to operate and ensuring project acceptance.

| Societal Factor | Impact on Construction | Example/Data (2024-2025) |

|---|---|---|

| Employee Well-being & Safety | Increased demand for safe work environments and fair labor practices. | OSHA reported a 5% decrease in construction-related fatalities in early 2024 compared to the previous year, reflecting increased safety focus. |

| Corporate Social Responsibility (CSR) | Growing importance of sustainability, ethical sourcing, and community investment. | A 2024 survey indicated that 70% of potential clients consider a contractor's CSR policies when selecting a firm. |

| Community Engagement | Necessity for proactive dialogue and tangible local benefits for project approval. | Projects with strong community benefit agreements in 2024 experienced an average of 15% fewer delays due to public opposition. |

Technological factors

Building Information Modeling (BIM) continues its rapid evolution, with wider adoption expected to significantly reshape how projects are designed, collaborated on, and executed by 2025. This digital transformation is enhancing project efficiency and reducing errors.

Key trends for 2025 include improved interoperability between different software platforms, enabling seamless data exchange. Integration with Artificial Intelligence (AI) and the Internet of Things (IoT) will further automate processes and provide real-time insights.

By 2025, BIM's role in real-time environmental impact assessments will be crucial, allowing for more sustainable construction practices. The global BIM market was valued at approximately $7.4 billion in 2023 and is projected to reach $18.5 billion by 2028, showcasing its growing importance.

The construction sector is rapidly embracing automation, robotics, and drones. AI-powered robots are now performing tasks like bricklaying and concrete pouring, significantly boosting efficiency and precision on job sites. For instance, companies are deploying robotic systems that can lay bricks at speeds far exceeding human capabilities, reducing labor costs and project timelines.

Drones are also transforming site monitoring and data collection. They provide real-time aerial views, enabling better progress tracking, safety inspections, and the identification of potential issues before they escalate. In 2024, the global construction drone market was valued at approximately $2.1 billion, and it's projected to grow substantially as adoption increases, illustrating the tangible impact of these technologies.

Technological advancements are pivotal for fostering sustainability in construction. Innovations like carbon-estimating technology integrated with Building Information Modeling (BIM) are becoming standard, allowing for precise environmental impact assessments during the design phase. For instance, the global BIM market was valued at approximately $7.1 billion in 2023 and is projected to reach $27.5 billion by 2030, indicating its growing importance in driving efficiency and sustainability.

Energy-efficient designs, coupled with the widespread adoption of renewable energy solutions such as solar panels and geothermal systems on construction sites and within new buildings, significantly reduce operational carbon footprints. Furthermore, the development and utilization of advanced, eco-friendly materials, like recycled aggregates and low-carbon concrete, are transforming the industry. These materials not only minimize waste but also contribute to lower embodied energy in structures, aligning with stringent green building certifications and evolving environmental regulations.

Advanced Materials and Methods

The construction industry is seeing significant advancements in materials and methods, driven by a push for sustainability and efficiency. New materials like recycled concrete and engineered timber are becoming more common, reducing environmental impact. For instance, the global market for engineered wood products was valued at approximately $120 billion in 2023 and is projected to grow substantially.

Modular and prefabricated construction methods are also transforming project timelines and waste management. These techniques can reduce construction waste by up to 90% compared to traditional on-site building. By 2025, the offsite construction market in the US is expected to reach $170 billion, highlighting its increasing adoption.

- Sustainable Materials: Increased use of recycled concrete, engineered timber, and mycelium-based insulation.

- Efficiency Gains: Modular and prefabricated methods speed up project completion and reduce waste.

- Market Growth: The engineered wood market is projected to exceed $150 billion by 2026.

- Waste Reduction: Prefabrication can cut construction waste by as much as 90%.

Digital Twin Technology and Data Analytics

Digital twin technology is transforming how companies like Hoffman manage their operations, especially in construction and real estate. It creates virtual replicas of physical assets, allowing for real-time monitoring and optimization of building performance. This means issues can be spotted and fixed before they become major problems.

Coupled with advanced business intelligence and data analytics, digital twins offer powerful insights. These tools enable predictive maintenance, reducing downtime and costs. For Hoffman, this translates to more efficient project management and better decision-making throughout the lifecycle of their developments.

The market for digital twin technology is experiencing significant growth. Analysts project the global digital twin market to reach approximately $100 billion by 2027, with a compound annual growth rate of over 35% in the coming years. This surge is driven by increasing adoption in sectors like manufacturing, healthcare, and smart cities, all of which are relevant to Hoffman's diversified portfolio.

- Real-time Performance Monitoring: Digital twins allow for continuous tracking of building systems, energy usage, and occupant comfort, enabling immediate adjustments for optimal efficiency.

- Predictive Maintenance: By analyzing data from sensors within the twin, potential equipment failures can be predicted, facilitating proactive maintenance and preventing costly breakdowns.

- Enhanced Decision-Making: Data analytics integrated with digital twins provide actionable insights for operational improvements, resource allocation, and strategic planning for future projects.

- Cost Savings: Studies indicate that implementing digital twin technology can lead to operational cost reductions of up to 30% through optimized energy consumption and reduced maintenance expenses.

Technological advancements are rapidly reshaping the construction landscape, with a strong emphasis on digital integration and automation. Building Information Modeling (BIM) is becoming a cornerstone, facilitating better design, collaboration, and execution. By 2025, enhanced interoperability and AI integration within BIM are expected to drive significant efficiency gains and enable real-time environmental impact assessments.

Automation, robotics, and drones are also making substantial inroads. AI-powered robots are improving precision and speed in tasks like bricklaying, while drones offer enhanced site monitoring and data collection capabilities. The global construction drone market, valued around $2.1 billion in 2024, is poised for considerable growth as these technologies become more integrated into standard project workflows.

Sustainability is a key driver of technological adoption, with innovations like carbon-estimating technology and the use of advanced eco-friendly materials gaining traction. Furthermore, modular and prefabricated construction methods are gaining significant momentum, promising to reduce waste and accelerate project timelines. The offsite construction market in the US alone is projected to reach $170 billion by 2025.

| Technology | 2024/2025 Relevance | Market Projection Example |

|---|---|---|

| Building Information Modeling (BIM) | Enhanced interoperability, AI/IoT integration | Global BIM market projected to reach $18.5 billion by 2028 |

| Automation & Robotics | Increased efficiency, precision in tasks | |

| Drones | Site monitoring, data collection, safety | Global construction drone market ~$2.1 billion (2024) |

| Digital Twins | Real-time monitoring, predictive maintenance | Global digital twin market ~$100 billion by 2027 |

| Modular/Prefabrication | Waste reduction, faster timelines | US offsite construction market to reach $170 billion by 2025 |

Legal factors

Compliance with labor laws, covering wage rates, working conditions, and safety regulations, remains paramount for construction firms. For instance, in the US, the Occupational Safety and Health Administration (OSHA) sets stringent standards, and non-compliance can lead to significant fines, impacting profitability.

The ongoing labor shortages in the construction sector, a trend expected to continue through 2025, underscore the critical role of legal frameworks governing recruitment, training, and retention. As of early 2024, the US Bureau of Labor Statistics reported a substantial gap between job openings and available workers, making adherence to immigration and hiring laws even more crucial for operational continuity.

Legal frameworks governing construction contracts, such as the ConsensusDocs 200 standard form for design-build projects, are critical for successful project delivery. These contracts outline responsibilities, payment terms, and risk allocation, directly impacting project timelines and costs.

Hoffman Construction's proficiency in design-build delivery methods requires a deep understanding of contract law, including intellectual property rights and compliance with state-specific lien laws. Navigating these legal intricacies ensures smooth project execution and mitigates potential disputes.

Effective dispute resolution mechanisms, such as mediation and arbitration clauses commonly found in contracts like the AIA Document A201, are essential. In 2024, the construction industry continues to see a rise in complex litigation, making robust dispute resolution strategies paramount for firms like Hoffman.

Environmental regulations are tightening, impacting construction significantly. For instance, as of early 2024, many jurisdictions are implementing stricter rules on building materials and waste disposal, pushing companies towards more sustainable practices. Failure to comply can lead to substantial fines and project delays.

Securing environmental permits is a critical legal hurdle. Projects in 2024 are facing more rigorous environmental impact assessments, requiring detailed analysis of potential effects on air quality, water resources, and biodiversity. This process can be lengthy, often adding months to project timelines.

Zoning and Land Use Regulations

Local zoning laws and land use regulations are critical legal factors influencing development and business operations. These rules dictate what types of structures can be built in specific areas and the standards they must meet, impacting everything from commercial real estate to agricultural practices. For instance, in 2024, many cities are re-evaluating their zoning codes to encourage mixed-use development and increase housing density, a trend that could unlock new investment opportunities but also requires careful navigation by businesses.

Navigating these complex legal frameworks is essential for securing project approvals and ensuring compliance with urban planning objectives. Failure to adhere to zoning ordinances can lead to significant delays, fines, or even the inability to proceed with a project. As of early 2025, the average time to obtain building permits in major metropolitan areas can range from three to six months, underscoring the importance of early and thorough due diligence on land use regulations.

- Zoning ordinances define permissible land activities and building parameters.

- Land use plans guide long-term urban development and resource allocation.

- Compliance is mandatory to avoid legal penalties and project disruptions.

- Permitting processes can be lengthy, requiring proactive engagement with local authorities.

Licensing and Certification Requirements

General contractors, including companies like Hoffman, must navigate a complex web of licensing and certification mandates that differ significantly based on geographic location and the nature of the construction project. For instance, as of early 2024, California requires a contractor's license for any project valued over $500, and specific endorsements may be needed for specialized work like electrical or plumbing.

Upholding these credentials isn't merely a procedural step; it's a fundamental legal obligation essential for Hoffman's continued operation and ability to bid on projects. Failure to maintain proper licensing can result in severe penalties, including project shutdowns and substantial fines, impacting profitability and reputation. Ensuring all team members possess the requisite certifications for their roles, from project managers to skilled tradespeople, is equally critical to legal compliance.

The regulatory landscape is dynamic, with updates to licensing requirements occurring regularly. For example, in 2024, several states introduced new continuing education requirements for licensed contractors to ensure they stay current with building codes and safety standards. Hoffman must actively monitor these changes to remain compliant.

Key aspects of these legal requirements often include:

- State-specific contractor licensing: Obtaining and renewing licenses in every state where Hoffman operates.

- Project-specific permits and licenses: Securing necessary permits for each construction project undertaken.

- Worker certifications: Ensuring all employees hold relevant trade certifications (e.g., OSHA, specific equipment operation).

- Adherence to building codes: Compliance with local, state, and federal building codes and regulations.

Legal adherence in construction, particularly regarding labor laws and safety standards like those enforced by OSHA, is critical for operational integrity and financial health. Non-compliance can lead to substantial fines, as seen with ongoing enforcement actions in 2024.

Contract law, including intellectual property and lien laws, governs project execution and risk allocation, with standard forms like AIA Document A201 being crucial for dispute resolution. The construction industry in 2024 continues to face complex litigation, making effective legal navigation essential.

Navigating dynamic licensing and certification mandates across various jurisdictions is a fundamental legal obligation for general contractors. For instance, California's requirement for a contractor's license for projects over $500 highlights the need for continuous monitoring of evolving state regulations.

Environmental regulations and permitting processes are increasingly stringent, impacting project timelines and sustainability practices. As of early 2024, stricter rules on materials and waste disposal are pushing firms towards greener solutions, with environmental impact assessments becoming more rigorous.

Environmental factors

The construction sector is experiencing a significant shift towards sustainable and green building practices, driven by both client preferences and increasingly stringent regulatory mandates. This growing demand signifies a market opportunity for companies prioritizing eco-friendly solutions.

Hoffman Construction's commitment to high-quality, sustainable building aligns perfectly with this trend. Their approach, which incorporates the use of eco-friendly materials and energy-efficient designs, positions them favorably in a market where environmental consciousness is paramount. For instance, the U.S. Green Building Council reported that in 2023, over 7.3 billion square feet of building space was LEED certified, a testament to the market's embrace of green building.

Climate change is significantly altering the construction landscape. The increasing frequency and intensity of extreme weather events, like hurricanes and floods, are compelling the industry to prioritize resilience. For instance, in 2024, the U.S. experienced over a dozen major weather and climate disasters, each causing at least $1 billion in damages, directly impacting construction projects and demanding more robust building standards.

This demand for resilience fuels innovation in construction materials and design. Companies are investing in research and development for materials that can better withstand harsh conditions, from advanced waterproofing solutions to more durable structural components. The global market for green building materials, a sector directly influenced by climate adaptation needs, was projected to reach over $300 billion by 2025, showcasing the financial implications of these environmental shifts.

The push towards reducing construction waste and embracing a circular economy is intensifying. This means more focus on reusing and recycling building materials, a trend supported by growing regulatory pressure and consumer demand for sustainable practices.

By 2024, the global construction waste management market is projected to reach $150 billion, with a significant portion driven by circular economy initiatives like material reuse and recycling. For instance, the UK aims to recycle 70% of its construction and demolition waste by 2025, a target that necessitates innovative approaches to material sourcing and design.

Designing structures for longevity and ease of deconstruction is also a key component. This foresight in building ensures that materials can be recovered and repurposed at the end of a building's life, minimizing landfill impact and creating new value streams within the industry.

Resource Scarcity and Material Sourcing

Concerns about running out of essential resources are pushing the construction industry towards using more renewable and sustainably sourced materials. Think of things like recycled steel, fast-growing bamboo, and engineered wood products like mass timber. These alternatives not only address scarcity but also significantly lower the environmental impact of building projects.

The shift towards responsible material sourcing is becoming a critical factor in reducing the overall environmental footprint of construction. For example, the global market for sustainable building materials was valued at over $250 billion in 2023 and is projected to grow substantially. This trend reflects a growing awareness and commitment to greener building practices.

- Growing Demand for Sustainable Materials: The market for eco-friendly construction materials is expanding rapidly, driven by environmental regulations and consumer preference.

- Reduced Carbon Footprint: Utilizing recycled and renewable materials in construction projects, such as mass timber, can lead to a significant reduction in embodied carbon compared to traditional materials like concrete and steel.

- Circular Economy Principles: The industry is increasingly adopting circular economy principles, focusing on material reuse and recycling to minimize waste and conserve resources.

- Supply Chain Resilience: Diversifying material sourcing to include more local and renewable options can enhance supply chain resilience against disruptions and price volatility.

Emissions and Carbon Footprint Reduction

The construction sector's substantial contribution to global energy-related CO2 emissions, estimated at around 39% by the World Green Building Council, places immense pressure on the industry to decarbonize. This environmental factor is driving innovation and adoption of more sustainable practices.

Key initiatives to reduce emissions and carbon footprints are gaining traction. These include the widespread use of low-carbon concrete alternatives, the integration of electric and hybrid construction machinery, and the increased adoption of prefabricated construction methods, all aimed at minimizing onsite emissions and overall environmental impact.

- Construction's CO2 Impact: The built environment accounts for approximately 39% of global energy-related CO2 emissions.

- Decarbonization Drivers: Regulatory pressures and growing investor demand for ESG (Environmental, Social, and Governance) compliance are pushing for greener construction.

- Low-Carbon Innovations: The development and adoption of materials like geopolymer concrete and supplementary cementitious materials (SCMs) are critical for reducing embodied carbon.

- Machinery Electrification: Companies are investing in electric excavators and other zero-emission equipment, with significant market growth projected in the coming years.

Environmental factors are increasingly shaping the construction industry, pushing for greener practices and materials. The demand for sustainable building is booming, with the U.S. Green Building Council reporting over 7.3 billion square feet of LEED-certified space in 2023. Extreme weather events, like the over a dozen billion-dollar disasters in the U.S. in 2024, are also compelling the industry to build more resilient structures, driving innovation in materials and design.

The construction sector’s significant contribution to global CO2 emissions, around 39%, is a major driver for decarbonization efforts. This is leading to the adoption of low-carbon concrete, electric machinery, and prefabricated methods. The circular economy is also gaining traction, with the global construction waste management market projected to reach $150 billion by 2024, emphasizing material reuse and recycling.

| Environmental Factor | Impact on Construction | Key Data/Trend (2023-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Demand for resilient and weather-resistant building | Over a dozen billion-dollar weather disasters in the US in 2024; Global market for green building materials projected over $300 billion by 2025. |

| Sustainability & Green Building | Growth in eco-friendly materials and practices | Over 7.3 billion sq ft LEED certified in the US (2023); Global sustainable building materials market valued over $250 billion (2023). |

| Waste Reduction & Circular Economy | Focus on material reuse, recycling, and reduced landfill impact | Global construction waste management market projected at $150 billion (2024); UK aiming for 70% construction waste recycling by 2025. |

| Carbon Emissions & Decarbonization | Pressure to reduce the industry's carbon footprint | Construction accounts for ~39% of global energy-related CO2 emissions; Growth in low-carbon concrete and electric construction machinery. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is informed by a comprehensive blend of official government publications, reputable academic research, and leading industry-specific data providers. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental landscape.