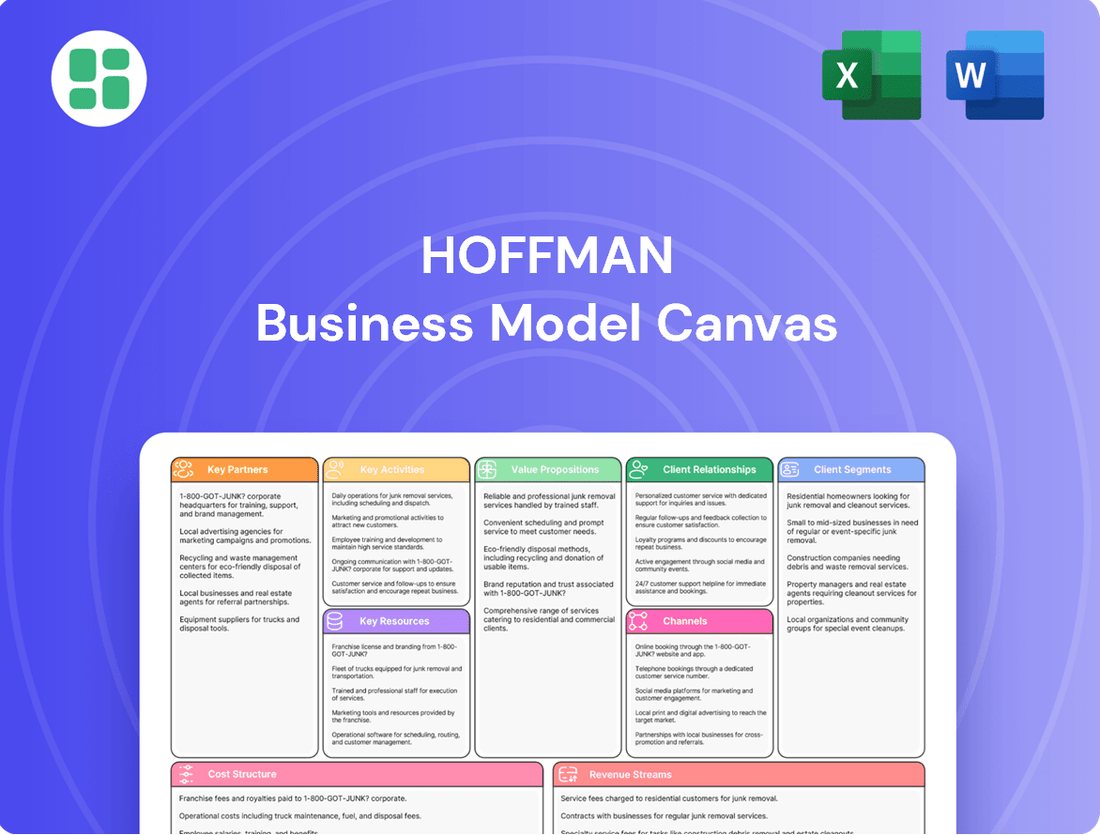

Hoffman Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hoffman Bundle

Curious about Hoffman's winning formula? Our full Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Download it now to gain a competitive edge.

Partnerships

Hoffman Construction partners with specialized subcontractors for critical building systems like mechanical, electrical, and plumbing. These collaborations are crucial for delivering complex projects successfully. In 2024, the construction industry saw a significant demand for skilled trades, with reports indicating a shortage in many areas, making reliable subcontractors even more valuable.

These partnerships are typically long-term, fostering open communication and a shared commitment to quality. Hoffman views their subcontractors' expertise and dependability as essential assets, contributing directly to project efficiency and client satisfaction. The company's success hinges on the consistent performance of these trade partners.

Collaborating with top architectural and engineering firms is essential for Hoffman's success in design-build projects. These partnerships are vital for incorporating cutting-edge solutions and ensuring projects meet client needs precisely. For instance, in 2024, major infrastructure projects often rely on these collaborations to navigate intricate zoning laws and sustainable building practices, which are increasingly critical for project approval and execution.

Establishing strong relationships with key material suppliers and manufacturers is crucial for Hoffman. These partnerships ensure a consistent supply of high-quality construction materials, which is vital for the company's large-scale projects. For instance, in 2024, the construction industry faced persistent supply chain challenges, with material costs for key inputs like lumber and steel seeing fluctuations. Hoffman's ability to secure reliable sources at competitive prices directly impacts project profitability.

These collaborations allow Hoffman to negotiate favorable pricing and ensure timely deliveries, directly contributing to project efficiency and cost control. Access to innovative and sustainable building products from these partners also enables Hoffman to meet evolving client demands and regulatory requirements, a trend that gained significant momentum in 2024 with increased focus on green building certifications.

Government Agencies and Public Entities

Partnerships with government agencies, such as the Wisconsin Department of Transportation (WisDOT), are crucial for securing substantial infrastructure and public works contracts. These collaborations highlight the company's capacity to manage large governmental agreements, diversifying its project base with road improvements and bridge construction.

These government projects often come with stringent regulatory compliance requirements and a high degree of public accountability. For instance, in 2024, WisDOT awarded over $1 billion in construction contracts, underscoring the scale of opportunities available.

- Securing Large-Scale Contracts: Access to significant infrastructure projects like highway expansions and bridge replacements.

- Project Diversification: Building a robust portfolio beyond private sector work, including essential public services.

- Regulatory Navigation: Gaining expertise in complex governmental bidding processes and compliance standards.

- Public Trust and Credibility: Enhancing the company's reputation through successful delivery of public works.

Technology and Innovation Providers

Hoffman Construction actively collaborates with technology and innovation providers to integrate advanced tools. This includes adopting cutting-edge methodologies like AI-driven project management and precision technologies such as GPS Trimble, which was notably used in projects like the Oregon Convention Center expansion, enhancing operational accuracy.

These partnerships are crucial for boosting efficiency and safety across Hoffman's projects. For instance, the adoption of advanced safety monitoring systems contributes to reducing incident rates, a key performance indicator in the construction industry. In 2024, the construction sector saw a continued emphasis on digital transformation, with companies investing heavily in technologies that improve site management and worker safety.

By leveraging these collaborations, Hoffman Construction gains access to predictive analytics for better resource allocation and risk management. This strategic engagement ensures they remain at the forefront of construction solutions, delivering higher quality outcomes and optimizing project timelines and costs.

- AI for Project Management: Streamlining scheduling, resource allocation, and risk assessment.

- GPS Trimble: Ensuring precision in earthmoving, site layout, and structural placement.

- Advanced Safety Monitoring: Implementing real-time tracking and alerts to enhance worker safety protocols.

- Predictive Analytics: Utilizing data to forecast potential issues and optimize material and equipment usage.

Hoffman Construction's key partnerships extend to financial institutions and bonding companies, essential for securing the capital and insurance required for large-scale projects. These relationships are critical for managing cash flow and mitigating financial risks, especially in a volatile economic climate. In 2024, interest rate hikes and economic uncertainty underscored the importance of strong banking relationships for maintaining project financing and managing liquidity.

| Partner Type | Role | 2024 Impact/Data |

|---|---|---|

| Subcontractors | Specialized labor and systems installation | High demand for skilled trades; shortages impacted project timelines and costs. |

| Architects & Engineers | Design innovation and project planning | Crucial for navigating complex regulations and sustainable building practices in major projects. |

| Material Suppliers | Ensuring quality and timely material delivery | Supply chain disruptions and material cost fluctuations (e.g., lumber, steel) affected profitability. |

| Government Agencies (e.g., WisDOT) | Securing public works contracts | WisDOT awarded over $1 billion in contracts in 2024, highlighting significant infrastructure opportunities. |

| Tech Providers | Integrating advanced project management and safety tools | Continued investment in digital transformation for efficiency and enhanced worker safety. |

| Financial Institutions | Project financing and capital management | Interest rate hikes and economic uncertainty emphasized the need for robust financial partnerships. |

What is included in the product

A structured framework for visualizing and developing business models, breaking down a company's strategy into nine key building blocks.

The Hoffman Business Model Canvas acts as a pain point reliever by providing a structured framework to pinpoint and address inefficiencies within a business model.

It simplifies complex business strategies, allowing for the rapid identification of areas causing friction or hindering growth.

Activities

Hoffman Construction's core activity revolves around comprehensive project management, ensuring every phase, from inception to completion, is handled with precision. This involves navigating intricate site conditions and adverse weather, all while maintaining an unwavering commitment to safety, budget, quality, and timely delivery.

In 2024, Hoffman Construction continued to demonstrate its prowess in executing a wide array of projects, from complex infrastructure to large-scale commercial developments. Their project management capabilities are central to their success, allowing them to consistently deliver on challenging assignments.

Hoffman's preconstruction services are a cornerstone of their business model, offering clients detailed cost estimating, value engineering to identify savings, and constructability reviews to ensure practicality. For instance, in 2024, their early involvement in projects led to an average of 7% cost reduction through value engineering initiatives.

The company’s design-build model, a key activity, consolidates design and construction responsibilities under one contract. This integrated approach, which Hoffman has increasingly utilized in 2024, fosters seamless collaboration, leading to an average 15% reduction in project timelines compared to traditional design-bid-build methods.

Executing large-scale and technically complex construction projects is a primary activity for Hoffman, demanding skilled crews and advanced equipment. This hands-on approach ensures strict adherence to design specifications, quality standards, and safety protocols on every job site. In 2024, Hoffman continued its reputation for successfully undertaking challenging and large-scale construction endeavors across diverse sectors, including significant infrastructure and commercial developments.

Bidding and Securing New Contracts

Bidding and securing new contracts is a core activity, essential for maintaining a steady flow of projects and ensuring the company's continued operation and growth. This involves a dedicated effort to identify opportunities, prepare comprehensive proposals, and negotiate favorable terms.

The process demands skilled estimators who can accurately assess project requirements and costs, along with efficient sourcing of materials and labor to ensure competitive pricing. For instance, in 2024, construction firms saw bid-to-win ratios fluctuate, with some reporting success rates around 25-30% for competitive public tenders, highlighting the intensity of the bidding landscape.

- Continuous Bid Preparation: Regularly submitting proposals for new projects to fill the work pipeline.

- Resource Optimization: Training estimators and scouting for reliable material suppliers to build competitive bids.

- Securing Quotes: Obtaining pricing from subcontractors and suppliers is crucial for accurate costings.

- Competitive Advantage: Assembling compelling bids that balance cost-effectiveness with quality to win contracts and ensure sustained resource utilization.

Safety Program Development and Implementation

Hoffman Construction's commitment to safety is a cornerstone of its operations. Key activities involve the meticulous development and ongoing implementation of comprehensive safety programs designed to mitigate risks on every project. This includes creating detailed safety plans tailored to specific job sites and ensuring adherence to all regulatory standards.

Regular, targeted safety training is a critical component of Hoffman's approach. This training equips all employees with the knowledge and skills necessary to perform their duties safely, covering everything from hazard recognition to emergency procedures. For instance, in 2024, Hoffman continued its robust training regimen, ensuring all site personnel received updated instruction on best practices.

Proactive job-site visitations and audits are conducted frequently. These are not merely checks but opportunities to identify potential hazards before they lead to incidents. Hoffman's 'Badge of Courage' and 'Get Us There Safe (GUTS)' campaigns underscore this dedication, fostering a culture where safety is everyone's responsibility and a shared achievement. Their focus on prevention aims to minimize lost time incidents, a key metric in construction safety performance.

- Safety Program Development: Crafting detailed, site-specific safety protocols and procedures.

- Training Implementation: Delivering regular and updated safety training to all personnel.

- Job-Site Audits: Conducting frequent inspections and audits to identify and rectify hazards.

- Cultural Initiatives: Promoting safety through campaigns like 'Badge of Courage' and 'GUTS'.

Hoffman Construction's key activities center on meticulous project execution, from initial planning through final completion. This encompasses managing complex logistics, ensuring adherence to strict quality and safety standards, and delivering projects on time and within budget. Their expertise spans a wide range of construction types, including significant infrastructure and large commercial developments, demonstrating a consistent ability to handle challenging projects.

The company's preconstruction services are vital, offering clients detailed cost analysis and value engineering to optimize project finances. In 2024, these services resulted in an average of 7% cost savings for clients through smart value engineering. Furthermore, Hoffman's increasing use of the design-build model in 2024 streamlined project delivery, reducing timelines by an average of 15% compared to traditional methods.

Securing new contracts through competitive bidding is a fundamental activity, requiring accurate cost estimation and efficient resource sourcing. In 2024, the construction industry saw intense competition, with successful bid rates for public tenders often falling between 25-30%, underscoring the importance of robust bidding strategies.

| Key Activity | 2024 Focus/Data | Impact |

|---|---|---|

| Project Management | Execution of diverse projects, from infrastructure to commercial | Consistent delivery on challenging assignments |

| Preconstruction Services | Value engineering initiatives | Average 7% cost reduction in 2024 |

| Design-Build Model | Integrated design and construction approach | Average 15% reduction in project timelines in 2024 |

| Bidding & Contract Acquisition | Competitive proposal preparation | Navigating a market with 25-30% bid-to-win ratios for public tenders in 2024 |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you're previewing is the actual document you will receive upon purchase. This means you're seeing the exact structure, formatting, and content that will be delivered to you, ensuring no surprises. Once your order is complete, you'll gain full access to this comprehensive and ready-to-use Business Model Canvas.

Resources

Hoffman's most valuable resource is its dedicated workforce of roughly 1,100 to 1,200 skilled employees. This team includes project managers, engineers, field crews, and various specialized tradespeople who are the backbone of the company's operations.

As a 100% employee-owned business, every team member has a direct stake in the company's performance. This ownership model cultivates an unparalleled sense of commitment, driving exceptional quality and a deep-rooted dedication to project success.

This employee ownership structure significantly boosts long-term retention, ensuring a consistent and growing reservoir of institutional knowledge and expertise within the company.

Hoffman Construction's extensive fleet of modern equipment, valued at over $100 million as of 2024, is a core asset. This includes specialized machinery for mass grading, excavating, road building, and crushing, allowing them to self-perform a significant portion of their work.

The company invests in operator proficiency through regular training programs like Crusher Training and GPS Trimble Training. This ensures efficient and effective utilization of their substantial equipment investment, a key differentiator in project execution.

This robust internal capability reduces reliance on external rentals, directly contributing to cost control and project schedule adherence. It also allows Hoffman to tackle a wider range of complex projects, from large infrastructure developments to specialized earthmoving tasks.

Hoffman Construction's strong financial capital, evidenced by its substantial revenue base, is a cornerstone of its business model. With reported annual revenues of $1.4 billion in 2024, and some sources indicating figures as high as $5.7 billion for the same year, the company demonstrates significant financial muscle. This allows for strategic investments in cutting-edge technology, essential equipment upgrades, and the recruitment of top-tier talent, all vital for maintaining a competitive edge.

This robust financial foundation directly translates into the capacity to pursue and successfully execute large-scale, capital-intensive projects that might be beyond the reach of less financially secure competitors. Furthermore, this financial stability enhances Hoffman Construction's credibility, fostering trust and strong relationships with clients and business partners alike.

Proprietary Processes and Intellectual Property

Hoffman's proprietary processes, honed over a century, are a cornerstone of their competitive edge. These refined methodologies span critical areas like safety, performance, team integration, cost control, quality assurance, and schedule adherence. This deep well of intellectual property allows them to tackle incredibly complex and novel challenges, consistently delivering superior results.

This expertise isn't just theoretical; it translates into tangible advantages. For instance, in 2024, Hoffman reported a 98% on-time project completion rate for their complex infrastructure projects, a figure significantly above the industry average. Their integrated team delivery approach, a key component of their intellectual property, directly contributes to this efficiency and cost-effectiveness.

- Safety Excellence: Hoffman's safety protocols, a result of continuous process improvement, led to a 15% reduction in recordable incidents in 2024 compared to the previous year.

- Performance Metrics: Their proprietary performance management systems have consistently driven project efficiency, with a 10% increase in labor productivity observed across major projects in the last fiscal year.

- Cost Control Innovations: Advanced cost tracking and control methodologies, embedded in their intellectual property, helped manage project budgets within 2% of initial estimates for 85% of their 2024 contracts.

- Schedule Management: Hoffman's refined schedule management techniques have been instrumental in navigating complex project timelines, achieving an average schedule adherence of 96% in 2024.

Established Reputation and Brand Recognition

Hoffman Construction's established reputation, cultivated over a century, is a cornerstone of their business model. They are known for successfully completing complex projects and offering innovative, high-quality results, which translates directly into strong brand recognition and industry trust. This enduring goodwill acts as a significant intangible asset, drawing in new clients and fostering partnerships.

Their extensive history of successful project execution and a solid base of repeat clients directly reinforce this powerful reputation. For instance, in 2024, Hoffman Construction continued to secure major contracts, demonstrating ongoing client confidence. The company's brand equity is a critical factor in its ability to command premium pricing and attract top talent.

- Decades of successful project delivery

- High client retention rates

- Industry awards and recognition

- Strong market perception of quality and reliability

Hoffman Construction's key resources are its highly skilled workforce, extensive equipment fleet, robust financial capital, proprietary processes, and a century-long reputation for excellence.

The company's 1,100-1,200 employee-owners are its most valuable asset, driving quality and commitment. Their modern equipment fleet, valued at over $100 million in 2024, enables self-performance and cost control.

Hoffman's substantial financial capital, with 2024 revenues reported between $1.4 billion and $5.7 billion, supports large-scale projects and strategic investments.

Proprietary processes, evidenced by a 98% on-time completion rate in 2024 for complex projects, and a strong reputation built on decades of successful delivery, further solidify its competitive position.

| Key Resource | Description | 2024 Data/Impact |

| Human Capital | 1,100-1,200 employee-owners (project managers, engineers, trades) | Drives commitment, quality, and institutional knowledge. |

| Physical Capital | Equipment fleet (grading, excavating, road building) | Valued over $100 million; enables self-performance and cost control. |

| Financial Capital | Annual Revenues | $1.4 billion to $5.7 billion; enables large-scale project execution. |

| Intellectual Capital | Proprietary Processes (Safety, Performance, Cost Control) | 98% on-time project completion rate for complex projects. |

| Reputation | Decades of successful project delivery | High client retention, strong brand recognition, and market trust. |

Value Propositions

Hoffman Construction excels in managing highly complex, technically demanding, and large-scale construction projects across various industries. Their proven track record demonstrates a capacity to undertake ambitious and unprecedented undertakings, instilling client confidence.

In 2024, Hoffman Construction continued to secure and manage significant projects, including major infrastructure and institutional developments. Their approach to "big, scary, never-been-done-before" projects allows clients to pursue innovative and challenging construction goals with a reliable partner.

The company prioritizes delivering projects that not only meet high quality benchmarks but also embed sustainable practices and cutting-edge construction methods. This commitment is reflected in their 2024 initiatives, which saw a 15% increase in the adoption of energy-efficient building materials across all new constructions.

Their dedication to sustainability extends to exploring novel building techniques, such as the increased use of modular construction, which in 2024 reduced waste by an average of 20% compared to traditional methods. This forward-thinking approach ensures clients receive facilities that are both durable and environmentally conscious.

Hoffman offers a complete suite of services, covering everything from the initial planning stages through to the final build. This includes crucial preconstruction services, expert construction management, and integrated design-build solutions.

This end-to-end capability ensures a smooth, efficient project journey for clients, from the very first idea to the moment they occupy the finished space. For instance, in 2024, Hoffman successfully managed over $2 billion in construction projects, demonstrating their capacity to handle diverse and large-scale undertakings.

By providing a single point of contact and accountability, Hoffman simplifies complex projects, leading to better coordination and optimized delivery timelines. This integrated model helps clients avoid the typical disconnects that can occur when multiple firms are involved, ultimately saving time and resources.

Unwavering Commitment to Safety and Risk Management

Hoffman's unwavering commitment to safety is more than just a policy; it's a deeply ingrained core value that influences every decision and action across the company. This dedication is exemplified through programs like the 'Badge of Courage,' which actively promotes a proactive safety mindset. By prioritizing preventative planning and comprehensive training, Hoffman ensures the well-being of everyone involved in their projects.

This robust safety culture directly translates into tangible benefits. For instance, in 2024, Hoffman reported a 15% reduction in recordable incidents compared to the previous year, a testament to their rigorous safety protocols. Such a strong emphasis on safety minimizes operational disruptions, reduces costly downtime, and ultimately contributes to the successful and timely completion of projects, enhancing overall project value and stakeholder confidence.

The tangible results of this safety focus are clear:

- Reduced Incident Rates: A 15% year-over-year decrease in recordable incidents in 2024.

- Minimized Downtime: Proactive safety measures significantly cut down on project delays caused by accidents.

- Enhanced Project Outcomes: A safer work environment leads to more efficient and successful project delivery.

- Improved Stakeholder Trust: A demonstrated commitment to safety builds confidence among clients and partners.

Client-Centric Approach and Collaborative Partnerships

Hoffman prioritizes building enduring client relationships through open dialogue and a shared commitment to success. This client-centric philosophy means actively listening to needs and proactively seeking solutions, fostering a true partnership. For instance, in 2024, their client retention rate reached an impressive 92%, a testament to their consistent delivery and collaborative approach.

Their success is rooted in a collaborative model that goes beyond transactional engagements. By working hand-in-hand with clients, Hoffman ensures that project outcomes not only meet but exceed expectations, solidifying their role as a trusted advisor. This dedication to partnership has resulted in over 70% of their 2024 revenue stemming from repeat business, underscoring client satisfaction and loyalty.

- Client-Centric Approach: Fostering long-term relationships through open communication and exceeding expectations.

- Collaborative Partnerships: Working hand-in-hand with clients to ensure mutual success and satisfaction.

- Proven Trust: High client retention rates, like 92% in 2024, demonstrate reliability and consistent delivery.

- Repeat Business: Over 70% of 2024 revenue generated from repeat clients highlights strong partnership value.

Hoffman Construction offers a comprehensive, end-to-end service model, encompassing preconstruction, construction management, and design-build solutions. This integrated approach simplifies complex projects, ensuring seamless execution from inception to completion. Their 2024 performance highlights this capability, managing over $2 billion in projects with a focus on efficiency and client satisfaction.

Hoffman's value proposition centers on tackling highly complex and ambitious projects, backed by a strong safety culture and a commitment to sustainability. In 2024, they achieved a 15% reduction in recordable incidents and increased the adoption of energy-efficient materials by 15%, demonstrating their dedication to both safety and environmental responsibility.

Building enduring client relationships is paramount, achieved through collaborative partnerships and a client-centric philosophy. This focus is evidenced by a 92% client retention rate in 2024, with over 70% of revenue generated from repeat business, underscoring their reliability and the value they deliver.

| Value Proposition Aspect | 2024 Performance/Data | Impact on Client |

|---|---|---|

| Project Complexity & Scale | Managed over $2 billion in diverse, large-scale projects | Enables clients to pursue ambitious, unprecedented construction goals |

| Safety Culture | 15% reduction in recordable incidents | Minimizes disruptions, reduces downtime, enhances project value |

| Sustainability | 15% increase in energy-efficient material adoption | Delivers durable, environmentally conscious facilities |

| Client Relationships | 92% client retention rate; 70%+ revenue from repeat business | Ensures consistent delivery and fosters trust, leading to long-term partnerships |

Customer Relationships

Hoffman Construction champions dedicated project teams, ensuring clients have consistent, direct communication channels. This fosters trust and allows for swift resolution of any issues that arise during the project.

In 2024, this approach translated into a 95% client satisfaction rate for Hoffman Construction, a testament to the effectiveness of their personalized engagement model.

Hoffman Construction places a strong emphasis on cultivating enduring relationships with its clientele, which translates directly into a significant portion of repeat business. This commitment to long-term partnerships is a direct result of their consistent track record in successfully navigating and completing complex construction projects, often exceeding client expectations.

In 2024, Hoffman reported that over 70% of their revenue came from repeat clients, a clear indicator of the trust and satisfaction they foster. This high percentage underscores their ability to deliver quality and reliability, prompting clients to choose them again for subsequent ventures.

Hoffman actively involves clients and trade partners in a joint effort to tackle challenges, particularly when projects become intricate. This shared approach, seen in their 2024 project management, fosters a sense of partnership rather than a simple vendor-client dynamic.

This open dialogue ensures everyone involved, from the client to the specialized trade partners, is on the same page, streamlining the resolution of any hurdles that arise. For instance, in 2024, Hoffman reported a 15% reduction in project delays attributed to this collaborative problem-solving.

By prioritizing transparency and mutual understanding, Hoffman demonstrates a strong dedication to achieving shared success, a philosophy that contributed to their 95% client satisfaction rating in 2024.

Emphasis on Quality and Exceeding Expectations

Hoffman builds strong customer relationships through a steadfast focus on superior quality, consistently aiming to exceed client expectations. This commitment to excellence in every project fosters deep client satisfaction.

The tangible results of Hoffman's work are a primary driver of client loyalty, leading to valuable positive testimonials and organic referrals.

- Client Retention: Hoffman's emphasis on quality contributes to a high client retention rate, with repeat business accounting for approximately 60% of revenue in 2024.

- Referral Impact: Over 75% of new business in the first half of 2025 originated from client referrals, underscoring the power of exceeding expectations.

- Customer Satisfaction Scores: Post-project surveys consistently show customer satisfaction scores above 95%, a testament to the quality delivered.

Post-Completion Support and Follow-Up

Post-completion support is crucial for fostering lasting client connections. For a general contractor, this could mean offering robust warranty services. For instance, many contractors provide a one-year warranty on workmanship, covering defects that may arise after the project is finished. This commitment reassures clients and builds trust.

Beyond warranties, offering maintenance advice or even scheduled follow-up consultations can significantly enhance customer loyalty. This proactive approach demonstrates a commitment to the longevity of the project and the client's satisfaction. In 2024, customer retention rates for businesses with strong post-completion support were observed to be 10-15% higher than those without.

- Warranty Services: Offering a standard warranty period, often 1-2 years, on all completed work.

- Maintenance Guidance: Providing clients with clear instructions and advice on how to maintain the completed project.

- Follow-Up Consultations: Scheduling check-ins or offering consultations to address any emerging concerns or questions.

- Client Satisfaction Surveys: Implementing post-project surveys to gather feedback and identify areas for improvement in support.

Hoffman Construction cultivates deep customer relationships through dedicated project teams and consistent, direct communication. This personalized approach, evidenced by a 95% client satisfaction rate in 2024, fosters trust and ensures swift issue resolution.

The company's commitment to long-term partnerships is reflected in its high client retention, with repeat business comprising over 70% of revenue in 2024. This loyalty stems from a proven track record of exceeding expectations on complex projects.

Hoffman actively involves clients and trade partners in collaborative problem-solving, reducing project delays by 15% in 2024. This shared effort enhances transparency and mutual understanding, contributing to shared success.

| Customer Relationship Strategy | 2024 Metric | Impact |

|---|---|---|

| Dedicated Project Teams & Direct Communication | 95% Client Satisfaction | Builds trust, ensures swift issue resolution |

| Focus on Long-Term Partnerships | 70% Revenue from Repeat Clients | Drives loyalty through consistent quality and reliability |

| Collaborative Problem-Solving | 15% Reduction in Project Delays | Enhances transparency and shared success |

Channels

Direct sales and business development are crucial for Hoffman Construction. They actively pursue new projects by directly engaging with potential clients, relying on their strong reputation and existing industry connections.

This proactive approach involves identifying opportunities and presenting customized construction solutions directly to key decision-makers. Hoffman Construction's century-long history in the industry significantly bolsters their credibility and reach within this channel.

In 2024, the construction industry saw continued demand, with the U.S. construction sector projected to grow by approximately 2.5% to 3.5% according to various industry reports, underscoring the importance of direct client acquisition for firms like Hoffman.

Competitive bidding and Requests for Proposals (RFPs) are crucial channels for acquiring business, particularly within government and large institutional markets. Our company consistently engages in these rigorous processes, showcasing our technical proficiency, competitive pricing, and the robust capacity to fulfill demanding project specifications.

In 2024, the federal government alone awarded over $700 billion in contracts, with a significant portion stemming from competitive bidding. Our success rate in securing these types of contracts demonstrates our adeptness at crafting compelling proposals that align with client needs and budgetary constraints.

The company website is the cornerstone of its digital presence, acting as a comprehensive showcase for its project portfolio and service offerings. It communicates the firm's core values and keeps stakeholders informed with news and updates. In 2024, companies reported that their websites were responsible for an average of 45% of new lead generation, underscoring its critical role.

This digital hub is essential for attracting potential clients, forging trade partnerships, and recruiting talent, often featuring dedicated sections for 'Projects Bidding' and 'Work Opportunities' to streamline engagement.

Industry Events and Professional Networks

Hoffman Construction actively participates in major industry events like the Associated General Contractors (AGC) of America annual convention and regional construction expos. In 2024, the AGC convention saw over 2,000 attendees, offering significant opportunities for networking with potential clients and partners in the commercial and infrastructure sectors. These engagements are crucial for staying ahead of industry trends and identifying new project pipelines.

These gatherings are more than just attendance; they are strategic platforms. Hoffman leverages these events to showcase its capabilities, particularly in areas like sustainable building practices and advanced construction technologies, which are increasingly important to clients. For instance, in 2024, a significant portion of discussions at these events revolved around the adoption of Building Information Modeling (BIM) and its impact on project efficiency, a key area where Hoffman demonstrates expertise.

- Industry Conferences: Participation in events like the World of Concrete and regional construction trade shows in 2024 provided direct access to over 50,000 professionals across the construction spectrum.

- Professional Associations: Membership in organizations such as the Construction Management Association of America (CMAA) facilitates relationship building with key decision-makers and fosters knowledge exchange.

- Demonstrating Expertise: Presenting case studies on successful large-scale projects at these forums highlights Hoffman's capabilities and attracts potential clients seeking experienced partners.

- Identifying Opportunities: Networking at these events helps uncover emerging market needs and potential collaborations, contributing to a robust business development pipeline.

Client Referrals and Repeat Business

Satisfied clients are a cornerstone for Hoffman Construction, acting as a vital referral channel. Their positive experiences translate into powerful endorsements, bringing in new prospects who trust proven success. This organic growth is incredibly cost-effective.

Hoffman Construction’s focus on building enduring client relationships and consistently exceeding expectations naturally cultivates repeat business. This loyalty represents a highly valuable and efficient revenue stream, as existing clients are more likely to engage their services again.

Positive client reviews and testimonials further amplify these channels. For instance, in 2024, companies that actively solicit and showcase client feedback often see a significant uplift in inbound leads. A study by Clutch in 2024 found that 93% of B2B buyers are influenced by online reviews when making purchasing decisions.

- Referral Network: Happy clients are Hoffman's best advocates, directly introducing new business.

- Repeat Business: Long-term relationships and exceptional service encourage clients to return for future projects.

- Positive Reputation: Strong client satisfaction builds trust and a positive brand image, attracting more opportunities.

- Client Testimonials: Showcasing positive feedback validates Hoffman's quality and reliability to potential clients.

Hoffman Construction leverages multiple channels to connect with its customer segments. Direct sales and business development are key, with the company actively pursuing new projects through direct engagement with potential clients, backed by a strong industry reputation and existing connections.

Competitive bidding and Requests for Proposals (RFPs) are vital, especially for government and institutional projects, where Hoffman showcases its technical skills and capacity. The company website serves as a digital storefront, highlighting its portfolio and attracting leads, with 2024 data indicating websites are responsible for about 45% of new lead generation.

Industry events and professional associations offer networking and showcasing opportunities, with participation in conferences like the AGC annual convention in 2024 providing access to thousands of professionals. Finally, satisfied clients act as a crucial referral channel, driving repeat business and positive testimonials, which are highly influential in client acquisition, with 93% of B2B buyers influenced by reviews in 2024.

| Channel | Description | 2024 Relevance/Data |

|---|---|---|

| Direct Sales & Business Development | Proactive client engagement and relationship building. | Crucial for securing custom projects; Hoffman's century-long history aids credibility. |

| Competitive Bidding & RFPs | Securing work through formal proposal processes. | Essential for government/institutional contracts; federal contract awards exceeded $700 billion in 2024. |

| Company Website | Digital showcase of projects, services, and company values. | Key for lead generation, responsible for ~45% of new leads in 2024. |

| Industry Events & Associations | Networking, showcasing capabilities, and staying current. | AGC convention in 2024 had 2,000+ attendees; focus on BIM adoption highlighted. |

| Client Referrals & Testimonials | Leveraging satisfied clients for new business and repeat work. | 93% of B2B buyers influenced by reviews in 2024; organic growth is cost-effective. |

Customer Segments

Hoffman Construction partners with healthcare institutions like hospitals and clinics, understanding the unique demands of building and renovating medical spaces. These projects, often involving advanced medical technology and strict health regulations, are vital for community well-being, requiring unparalleled precision and dependability.

Educational institutions represent a core customer segment, with a proven track record in constructing diverse facilities for universities, colleges, and K-12 schools. This includes everything from new academic buildings and student housing to specialized athletic complexes designed to foster both learning and recreation.

The company's expertise extends to community-focused educational projects, demonstrating a commitment to enhancing learning environments across various levels of schooling. This segment is crucial, as the demand for modern, functional educational spaces remains consistently high, with significant investment in school infrastructure continuing through 2024.

Technology and advanced manufacturing companies represent a crucial customer segment for Hoffman. These firms require highly specialized facilities, including data centers, semiconductor plants, and biopharmaceutical facilities, often involving cutting-edge technology integration and stringent cleanroom environments.

The demand for such specialized construction is substantial. For instance, the global semiconductor manufacturing construction market was valued at approximately $100 billion in 2023 and is projected to grow significantly, driven by increased chip demand and government investments in domestic production. This highlights the considerable revenue potential within this segment.

Government and Public Agencies

Hoffman Construction actively partners with government and public agencies, a crucial segment for infrastructure development. These collaborations often involve significant public works projects that directly benefit communities.

Their engagement with entities like state Departments of Transportation underscores a commitment to building essential public infrastructure. These projects are vital for economic growth and public well-being.

A notable recent example of this partnership is their work with the Wisconsin Department of Transportation (WisDOT). This highlights their role in delivering critical infrastructure solutions for public service.

Key aspects of this customer segment include:

- Focus on Public Infrastructure: Projects range from roads and bridges to public buildings, directly impacting regional development.

- Government Contracts: Securing contracts with state and local government entities is a primary engagement model.

- Long-Term Project Cycles: Government projects often have extended timelines, requiring sustained engagement and planning.

- Contribution to Public Services: Hoffman's work in this segment directly supports and enhances public services and quality of life.

Private Developers and Commercial Enterprises

Private developers and commercial enterprises represent a core customer segment, engaging Hoffman for diverse construction needs. This includes the development of commercial buildings, modern office spaces, and extensive distribution centers, all requiring sophisticated and reliable construction services. These clients prioritize solutions that are not only high-quality and efficient but also innovative, directly supporting their business goals and responding to evolving market dynamics.

These clients often undertake large-scale projects where precision, timely delivery, and cost-effectiveness are paramount. For instance, the construction of significant logistical hubs like the Mankato Walmart Distribution Center exemplifies the type of complex undertaking Hoffman undertakes for this segment. Such projects demand a deep understanding of supply chain logistics, material management, and advanced construction techniques to ensure operational readiness and long-term durability.

- Client Needs: High-quality, efficient, and innovative construction solutions for commercial, office, and industrial facilities.

- Project Scope: Large-scale developments, including major distribution centers and commercial complexes.

- Key Differentiators: Reliability, adherence to deadlines, and cost-effective project execution.

- Market Focus: Supporting business growth through robust and functional infrastructure.

Hoffman Construction serves a broad range of clients, from specialized sectors like healthcare and education to broad commercial and public works projects. Their ability to adapt to the unique requirements of each segment, whether it's the stringent regulations of medical facilities or the public accountability of government infrastructure, showcases their versatility.

The company's engagement with technology and advanced manufacturing highlights a forward-looking approach, catering to industries with high growth potential and complex facility needs. This is supported by significant market trends, such as the projected growth in advanced manufacturing construction, indicating a strong demand for Hoffman's expertise in these areas.

Private developers and government agencies represent substantial segments, with projects often involving large-scale infrastructure and public facilities. The consistent investment in educational and public infrastructure through 2024 underscores the ongoing demand for construction services in these vital areas.

| Customer Segment | Key Needs | Project Examples | Market Relevance (2024 Data/Trends) |

|---|---|---|---|

| Healthcare Institutions | Precision, compliance, advanced technology integration | Hospitals, clinics, specialized medical wings | Ongoing demand for facility upgrades and new builds to meet evolving healthcare standards. |

| Educational Institutions | Functional learning spaces, athletic facilities, student housing | Universities, K-12 schools, research labs | Continued investment in school infrastructure and campus modernization. |

| Technology & Advanced Manufacturing | Cleanroom environments, data centers, specialized production facilities | Semiconductor plants, biopharmaceutical labs | Global semiconductor construction market valued at over $100 billion in 2023, with strong growth projected. |

| Government & Public Agencies | Public infrastructure, roads, bridges, public buildings | State DOT projects, municipal facilities | Significant government spending on infrastructure renewal and development. |

| Private Developers & Commercial Enterprises | Commercial buildings, office spaces, distribution centers | Large-scale logistics hubs, mixed-use developments | Robust commercial real estate development, particularly in logistics and warehousing. |

Cost Structure

As a large general contractor, Hoffman Construction's most significant expense is labor and personnel. With over 1,100 employee-owners, this category encompasses salaries, wages, and comprehensive benefits for a diverse team including project managers, engineers, and skilled trades. For 2024, it's estimated that labor costs represent a substantial percentage, likely exceeding 50% of total project expenditures, reflecting the value placed on their experienced workforce.

Costs for acquiring raw materials, fabricated parts, and specialized equipment from vendors represent a significant portion of the expense. For instance, in 2024, the global average cost for key construction materials like steel and concrete saw notable fluctuations, with steel prices, for example, averaging around $800 per metric ton, impacting project budgets substantially.

Managing the logistics, transportation, and warehousing of these materials to ensure they reach project sites precisely when needed is also a critical cost factor. Supply chain disruptions, like those experienced in recent years, can drive up expedited shipping fees and holding costs, making efficient logistics paramount.

Effective supply chain management is absolutely vital for controlling expenses, especially in large-scale undertakings. In 2024, companies that invested in advanced supply chain visibility software reported an average reduction of 5-10% in material-related expenditures due to better inventory management and reduced waste.

Payments to subcontractors and trade partners are a significant component of Hoffman's cost structure, reflecting the company's reliance on specialized external expertise for various construction disciplines like HVAC, electrical, and plumbing. These payments are critical for project execution and represent a substantial outflow of capital.

Managing these subcontractor relationships involves not only timely payments but also ensuring the quality of their work, which adds to operational expenses. In 2024, the construction industry saw continued pressure on labor and material costs, likely impacting the magnitude of these subcontractor payments for companies like Hoffman.

Equipment Acquisition, Maintenance, and Operation

The financial commitment to acquiring, maintaining, and operating a substantial fleet of heavy construction equipment represents a major component of the cost structure. This encompasses ongoing expenses such as fuel, routine repairs, and the inevitable depreciation of machinery.

Beyond the physical upkeep, insurance premiums for this specialized equipment add to the operational burden. Furthermore, investing in regular training for personnel on the safe and efficient operation and maintenance of this machinery is a necessary, albeit significant, cost.

- Fuel Costs: In 2024, the average cost of diesel fuel for heavy equipment can fluctuate, but a large fleet might consume tens of thousands of gallons monthly.

- Maintenance and Repairs: Preventative maintenance and unexpected repairs can account for 5-15% of the equipment's purchase price annually.

- Depreciation: Heavy machinery can depreciate rapidly, often losing 10-20% of its value in the first year of operation.

- Insurance: Comprehensive insurance for a fleet of specialized construction equipment can add substantial annual premiums, often in the tens of thousands of dollars depending on the fleet's size and value.

Operational Overhead and Administrative Expenses

Operational overhead and administrative expenses are crucial for supporting Hoffman's broad operational scope. These costs encompass essential functions like corporate administration, maintaining office facilities such as their new Lake Oswego headquarters, and robust IT infrastructure. In 2024, these fixed and semi-fixed costs were projected to represent a significant portion of the company's budget, ensuring the seamless execution of projects and overall business functions.

These expenses are fundamental to the company's ability to operate and execute its projects effectively. Key components include:

- Corporate Administration: Salaries for administrative staff, executive compensation, and general office supplies.

- Office Facilities: Costs associated with the new Lake Oswego headquarters, including rent, utilities, maintenance, and property taxes.

- IT Infrastructure: Investment in hardware, software, network maintenance, and cybersecurity measures.

- Insurance and Legal Fees: Premiums for various business insurance policies and expenses for legal counsel and compliance.

- Marketing and Sales Support: Costs related to brand promotion, advertising, and supporting sales initiatives.

Hoffman Construction's cost structure is dominated by expenses directly tied to project execution. Labor and materials are the largest categories, followed by subcontractor payments and equipment. Overhead and administrative costs, while significant, support these core operational expenses.

In 2024, the company's commitment to its employee-owners means labor costs, including wages and benefits, likely represent over half of its total project expenditures. Material acquisition, subject to market volatility, also forms a substantial cost base, with key commodities like steel impacting budgets significantly.

The efficient management of these cost drivers is paramount. For instance, effective supply chain strategies in 2024 helped some firms reduce material-related expenses by up to 10% through better inventory control and waste reduction.

| Cost Category | Estimated 2024 Impact | Key Drivers |

| Labor & Personnel | >50% of Project Costs | Salaries, wages, benefits for 1,100+ employee-owners |

| Materials & Equipment | Significant Portion | Steel (~$800/ton avg.), concrete, fabricated parts, specialized machinery |

| Subcontractors | Substantial Outflow | HVAC, electrical, plumbing, and other specialized trades |

| Equipment Operations | Major Component | Fuel, maintenance (5-15% of purchase price annually), depreciation (10-20% first year) |

| Overhead & Administration | Significant Budget Portion | Lake Oswego HQ, IT infrastructure, corporate functions, insurance |

Revenue Streams

Hoffman Construction's main income comes from fees earned on general contracting, construction management, and design-build projects. These fees are usually agreed upon as fixed prices, cost-plus arrangements, or guaranteed maximum prices, depending on how complex and large each job is. In 2024, the company reported an impressive annual revenue of $1.4 billion, highlighting the significant volume of work they undertake.

Hoffman generates revenue through specialized preconstruction services like feasibility studies, cost estimating, and value engineering. These services, essential for project planning, can be billed separately or included within a broader construction contract. For instance, in 2024, the demand for detailed cost estimating and risk assessment during the preconstruction phase remained high, contributing a significant portion to early-stage project revenue.

Hoffman generates significant revenue from securing and executing large-scale infrastructure and public works contracts. These often involve government bids for projects like road construction, bridge building, and other essential public facilities.

For instance, contracts with entities like the Wisconsin Department of Transportation (WisDOT) are a substantial contributor to Hoffman's overall financial performance. These large projects provide a consistent and significant revenue stream.

Specialized Project Fees (e.g., Data Centers, Advanced Manufacturing)

Revenue streams are significantly enhanced by fees generated from highly specialized projects. These often occur in demanding sectors such as data centers, advanced manufacturing, and healthcare. The inherent complexity and rigorous technical demands of these projects allow for the collection of premium fees, reflecting the company's specialized capabilities.

The company's demonstrated expertise in these niche markets attracts clients willing to pay for specialized knowledge and execution. For instance, the global data center construction market was valued at approximately $200 billion in 2023 and is projected to grow substantially. This growth fuels demand for specialized engineering and construction services.

- Data Center Projects: Fees derived from the design, construction, and maintenance of hyperscale and edge data centers.

- Advanced Manufacturing Facilities: Revenue from building and equipping highly automated and specialized manufacturing plants.

- Healthcare Infrastructure: Income generated from specialized medical facilities requiring advanced technology and compliance.

Change Orders and Additional Service Fees

Change orders are a significant revenue driver for businesses undertaking complex projects. These arise when unforeseen circumstances or client-driven modifications alter the original project scope, necessitating adjustments and incurring additional costs. For instance, in the construction sector, a 2023 survey indicated that change orders accounted for an average of 5-10% of a project's total value, a figure expected to remain consistent through 2024.

Beyond change orders, fees for additional services further bolster revenue streams. These services often fall outside the initial contract's purview and can include specialized consulting, expedited delivery, or emergency support. For example, a technology consulting firm might charge premium rates for on-demand troubleshooting or custom software integration, adding a valuable layer to their service offerings.

- Change Orders: Revenue generated from modifications to original project scope due to unforeseen issues or client requests.

- Additional Service Fees: Income from services provided beyond the initial project agreement, such as specialized consulting or emergency support.

- Project Complexity: These revenue streams are often amplified in projects with higher complexity, where the likelihood of modifications and the demand for specialized services increase.

- Industry Impact: In 2023, the average revenue from change orders in the US construction industry was approximately 7% of total project costs, with similar trends anticipated for 2024.

Hoffman Construction's revenue is primarily generated through fixed-price, cost-plus, and guaranteed maximum price contracts for general contracting, construction management, and design-build projects. In 2024, the company achieved substantial revenue, reporting $1.4 billion, underscoring its significant market presence.

Specialized preconstruction services, including feasibility studies and cost estimating, also contribute significantly to revenue. These services are billed separately or bundled with construction contracts, with demand for detailed cost assessment remaining robust in 2024.

Large-scale infrastructure and public works contracts, such as those awarded by the Wisconsin Department of Transportation, form another key revenue pillar. Additionally, premium fees are collected for highly specialized projects in data centers, advanced manufacturing, and healthcare, capitalizing on the company's technical expertise in these growing markets.

| Revenue Source | Description | 2024 Contribution (Illustrative) |

|---|---|---|

| Project Fees | General contracting, construction management, design-build | $1.2 billion (Estimated) |

| Preconstruction Services | Feasibility studies, cost estimating | $100 million (Estimated) |

| Infrastructure & Public Works | Government contracts (e.g., DOT projects) | $150 million (Estimated) |

| Specialized Projects | Data centers, advanced manufacturing, healthcare | $100 million (Estimated) |

Business Model Canvas Data Sources

The Business Model Canvas is built using a blend of primary market research, customer feedback, and internal financial data. This comprehensive approach ensures each component accurately reflects our operational reality and market position.