HNI SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HNI Bundle

HNI's current market position is defined by its robust brand recognition and diversified product portfolio, but also faces challenges from evolving consumer preferences and increasing competition. Understanding these dynamics is crucial for any strategic investor or business planner.

Want the full story behind HNI's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

HNI Corporation's strength lies in its diversified product portfolio, spanning both Workplace Furnishings and Residential Building Products. This dual focus acts as a significant risk mitigator, preventing over-reliance on any single market. The company's ability to navigate varied economic conditions is a testament to this strategy, demonstrating resilience and consistent growth.

This diversification proved beneficial in early 2025, with the Residential Building Products segment reporting a solid 7.1% rise in net sales for the first quarter. This growth, largely driven by the remodel-retrofit market, effectively cushioned any minor fluctuations experienced in other business areas, showcasing the inherent stability this broad product offering provides.

HNI holds a commanding presence in North America, securing top market share in both office furniture and hearth products. This dual leadership is built on a robust brand reputation and deeply entrenched distribution channels, enabling efficient service across varied customer segments and reinforcing its competitive edge. The company's strategic emphasis on delivering value-oriented products coupled with personalized customer care underpins this market dominance.

HNI's dedication to sustainability and corporate responsibility is a significant strength, evidenced by its consistent recognition, including being named one of America's Most Responsible Companies for six consecutive years. This commitment translates into tangible goals, such as reducing Scope 1 and 2 greenhouse gas emissions and achieving zero waste to landfill.

These environmental initiatives directly appeal to a growing segment of consumers who prioritize eco-friendly brands, thereby bolstering HNI's brand reputation and market appeal. The company's focus on using sustainable materials further reinforces this positive image, differentiating it in the competitive landscape.

Strategic Acquisitions and Synergy Realization

HNI's strategic acquisition of Kimball International (KII) in 2023 has proven to be a significant boon, bolstering financial performance and exceeding initial synergy expectations. The company now anticipates realizing $50 million in synergies, a substantial increase from the original projection, highlighting effective integration and value creation.

This acquisition, coupled with the operational ramp-up at HNI's Mexico facility, provides a clear pathway to enhanced earnings growth through 2026. The combined impact of these initiatives positions HNI for sustained financial improvement and offers strong visibility into future profitability.

- Kimball International Acquisition: Contributed significantly to HNI's financial performance in 2023.

- Synergy Realization: Expected synergies now total $50 million, doubling the initial estimate.

- Growth Visibility: The KII acquisition and Mexico facility ramp-up provide elevated earnings growth visibility through 2026.

Robust Financial Performance and Shareholder Returns

HNI's financial performance remains a significant strength, with the company projecting double-digit non-GAAP earnings per share (EPS) growth for 2025. This builds upon a strong 2024, where HNI achieved record EPS.

The company's robust financial health is further underscored by its consistently strong balance sheet and healthy operating cash flow generation.

HNI is committed to returning value to its shareholders. This is evident through its consistent dividend payments and active share repurchase programs, demonstrating financial discipline and a focus on enhancing shareholder wealth.

- Double-digit non-GAAP EPS growth projected for 2025.

- Achieved record EPS in 2024.

- Maintains a strong balance sheet and healthy operating cash flow.

- Consistently returns value to shareholders via dividends and buybacks.

HNI's diversified business model, encompassing both workplace furnishings and residential building products, provides significant resilience. This strategic approach proved advantageous in early 2025, with the residential segment seeing a 7.1% net sales increase in Q1, demonstrating the stability offered by this broad market exposure.

The company commands leading market shares in North America for office furniture and hearth products, a position built on strong brand equity and extensive distribution networks. This dual leadership highlights HNI's ability to effectively serve diverse customer bases and maintain a competitive advantage.

HNI's commitment to sustainability is a notable strength, recognized by its consecutive inclusion as one of America's Most Responsible Companies. This focus on environmental initiatives, including emissions reduction and waste diversion, resonates with increasingly eco-conscious consumers.

The strategic acquisition of Kimball International in 2023 has significantly boosted HNI's financial performance, with anticipated synergies now reaching $50 million, exceeding initial projections. This integration, alongside operational enhancements at its Mexico facility, positions HNI for sustained earnings growth through 2026.

Financial strength is a key attribute, with HNI projecting double-digit non-GAAP EPS growth for 2025, following a record EPS year in 2024. The company maintains a robust balance sheet and healthy operating cash flow, complemented by a consistent strategy of returning value to shareholders through dividends and share repurchases.

| Metric | 2024 (Actual) | 2025 (Projected) | YOY Growth (Projected) |

| Non-GAAP EPS | Record Value | Double-digit Growth | 10%+ |

| Kimball International Synergies | Contributing Factor | $50 Million Realized | N/A |

| Residential Building Products Net Sales (Q1 2025) | N/A | 7.1% Increase | N/A |

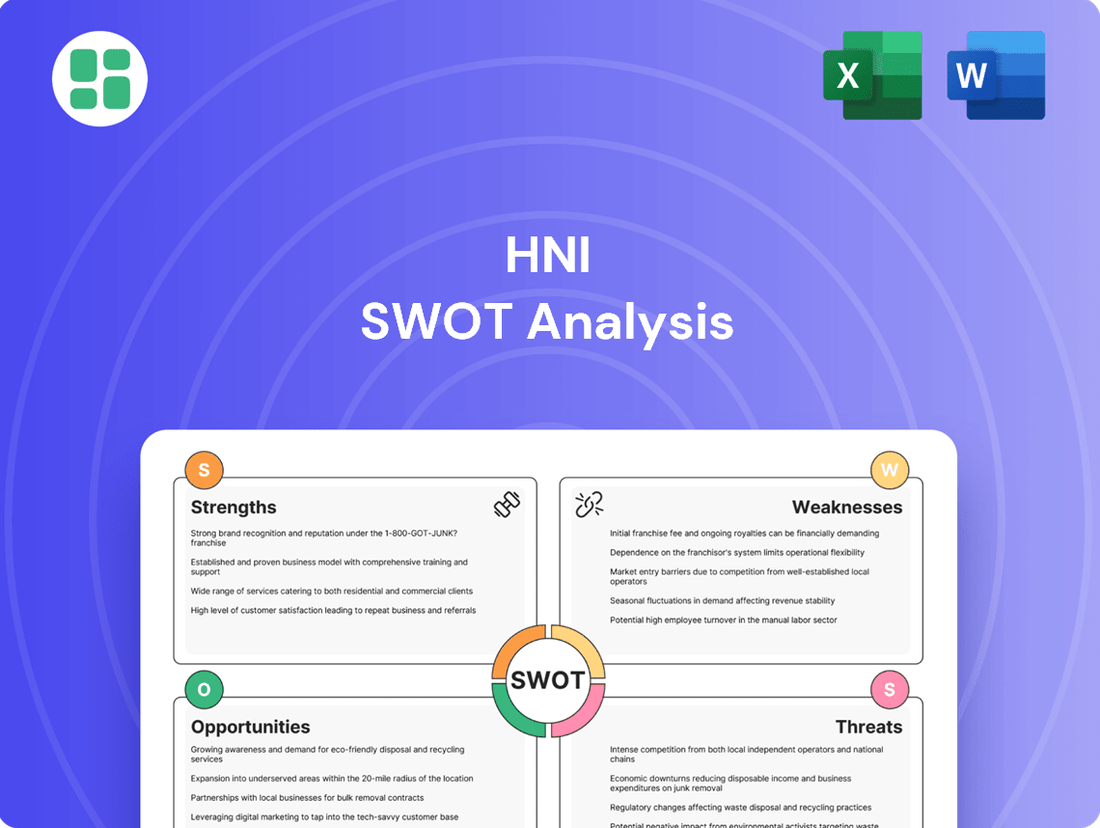

What is included in the product

Analyzes HNI’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical business challenges, transforming potential weaknesses into strategic advantages.

Weaknesses

HNI's significant reliance on the North American market, while providing a strong established base, also presents a key weakness. This concentration means the company is particularly vulnerable to regional economic slowdowns or shifts in consumer spending within this primary territory. In 2023, for instance, North America accounted for approximately 85% of HNI's total net sales, highlighting the extent of this geographical dependency.

HNI's Workplace Furnishings and Residential Building Products segments are quite sensitive to the ups and downs of the construction and real estate markets. When commercial real estate development slows or residential building permits drop, it directly affects how much office furniture and hearth products people buy.

For instance, during periods of economic uncertainty or when interest rates climb, as seen with the Federal Reserve's rate hikes in 2023 and continued concerns in early 2024, demand for these products can significantly decrease. This cyclical nature means HNI's revenue can be volatile, tied closely to broader economic health and consumer confidence in housing and office spaces.

HNI faces significant headwinds due to intense competition in both its office furniture and hearth product segments. In the office furniture market, it contends with giants like Steelcase and MillerKnoll, who have substantial brand recognition and established distribution networks. This crowded landscape, with numerous other manufacturers vying for market share, puts considerable pressure on HNI's pricing strategies and can limit its ability to expand profit margins.

Potential Supply Chain Vulnerabilities

As a manufacturer, HNI faces inherent risks tied to the fluctuating costs of raw materials and potential disruptions within its supply chain. Geopolitical events that impact international trade also pose a threat to its operations and sourcing.

For instance, tariff-related pressures have been identified as a significant challenge. HNI has indicated an expectation to mitigate the majority of these impacts, suggesting proactive strategies are in place to manage these external pressures.

- Raw Material Volatility: Fluctuations in commodity prices for steel, wood, and other key inputs can directly impact HNI's cost of goods sold.

- Supply Chain Disruptions: Events such as natural disasters, labor shortages, or transportation issues can delay production and increase logistics costs.

- Geopolitical Risks: Trade disputes, sanctions, or political instability in regions where HNI sources materials or sells products can create uncertainty and affect profitability.

Impact of Evolving Work Models on Office Furniture Demand

The persistent rise of remote and hybrid work arrangements presents a notable weakness for traditional office furniture demand. While companies might invest in home office setups, a shrinking corporate footprint directly impacts the volume of new office furniture orders. For instance, a 2024 report indicated that approximately 30% of companies plan to reduce their office space in the coming year, a trend that directly affects furniture manufacturers like HNI.

This shift necessitates a pivot towards more adaptable and modular furniture solutions, a market segment where HNI might face increased competition from specialized providers. The demand for large, fixed workstation setups is likely to decline, requiring a strategic reorientation of product offerings. By late 2024, surveys showed a significant portion of employees (over 40%) preferring at least two days of remote work per week, underscoring this evolving preference.

- Reduced Corporate Footprints: Companies downsizing office spaces directly curtails demand for traditional office furniture.

- Shift to Home Offices: While this creates a new market, it's fragmented and may not offset large-scale corporate orders.

- Demand for Flexibility: Traditional, fixed furniture designs may become less desirable compared to adaptable, modular solutions.

- Competitive Landscape: Specialized home office furniture providers could gain market share, challenging established players.

HNI's significant reliance on the North American market, accounting for approximately 85% of net sales in 2023, makes it vulnerable to regional economic downturns. Its workplace furnishings and residential building products segments are highly sensitive to the cyclical nature of the construction and real estate markets, with demand impacted by factors like interest rate hikes seen in 2023 and early 2024.

Intense competition from established players like Steelcase and MillerKnoll in office furniture, alongside numerous hearth product manufacturers, pressures HNI's pricing and profit margins. The company also faces risks from volatile raw material costs and supply chain disruptions, with tariffs identified as a specific challenge that HNI aims to mitigate.

The growing trend of remote and hybrid work arrangements, with around 30% of companies planning office space reductions in 2024 and over 40% of employees preferring remote work by late 2024, directly reduces demand for traditional office furniture. This necessitates a strategic shift towards more flexible and modular solutions, a market segment where HNI may encounter increased competition from specialized providers.

What You See Is What You Get

HNI SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine preview of the entire report, ensuring you know exactly what you're getting. Once purchased, the complete, detailed analysis is yours to download.

Opportunities

The shift towards hybrid and flexible work models is a significant opportunity. HNI can leverage this by developing innovative furniture solutions that cater to both traditional office environments and home workspaces, focusing on ergonomics and adaptability. For instance, the demand for home office furniture saw a substantial surge, with U.S. online sales of home office desks and chairs increasing by over 100% in early 2024 compared to pre-pandemic levels, indicating a sustained market for these products.

The residential remodel and retrofit market presents a significant opportunity for growth. As the existing housing stock ages, homeowners are increasingly investing in renovations to improve energy efficiency and update aesthetics. This trend is a key driver for the residential building products segment, particularly for hearth products that enhance both comfort and visual appeal.

In 2024, the US home improvement market was projected to reach approximately $485 billion, with remodeling and renovations accounting for a substantial portion. This sustained demand for upgrades, driven by factors like aging infrastructure and a desire for modern amenities, directly benefits companies offering specialized products for these projects.

Strategic acquisitions offer HNI significant opportunities to expand its market share and diversify its product portfolio. The successful acquisition of Kimball International in 2023, for instance, demonstrates HNI's capability in integrating new businesses and leveraging their strengths. This strategic move is expected to contribute to HNI's growth trajectory by broadening its customer base and enhancing its competitive positioning within the industry.

HNI's recent definitive agreement to acquire Steelcase for approximately $2.2 billion, expected to close in the first half of 2025, underscores this commitment to growth through consolidation. This substantial transaction is poised to significantly enhance HNI's customer reach and unlock considerable operational synergies, further solidifying its market leadership pending regulatory approvals.

Technological Advancements and Smart Products

Integrating smart technology into HNI's product lines, such as adjustable height desks with integrated charging or AI-powered ergonomic chairs, offers a compelling opportunity. This aligns with growing consumer demand for connected, efficient, and aesthetically pleasing home and office environments. For instance, the smart home market, which includes connected appliances and furniture, was projected to reach over $100 billion in 2024, showcasing a strong consumer appetite for such innovations.

Similarly, enhancing hearth products with features like energy efficiency, remote control, and smart home integration can tap into a market segment prioritizing both comfort and technological convenience. The global smart fireplace market is experiencing steady growth, driven by advancements in design and functionality, with an estimated market size of approximately $2.5 billion in 2023, expected to grow further.

- Enhanced User Experience: Smart features in office furniture can boost productivity and well-being.

- Energy Efficiency: Modern hearth products can offer significant energy savings, appealing to eco-conscious consumers.

- Market Differentiation: Innovative smart products can set HNI apart from competitors.

- Premium Pricing Potential: Technologically advanced products often command higher price points.

Increasing Demand for Sustainable and Eco-Friendly Products

The rising tide of environmental awareness presents a significant opportunity for HNI. As consumers and businesses increasingly prioritize sustainability, HNI's existing commitment to eco-friendly practices can serve as a powerful differentiator. This growing segment of the market is actively seeking out products with a lower environmental impact.

HNI can capitalize on this trend by further developing and marketing its range of products crafted from recycled, renewable, and low-emission materials. This strategic focus allows HNI to tap into a burgeoning market segment that values environmental responsibility. For instance, a recent report indicates that the global market for sustainable products is projected to reach $150 billion by 2027, growing at a compound annual growth rate of over 9%.

- Market Growth: The global market for sustainable products is experiencing robust growth, offering substantial revenue potential.

- Consumer Preference: A significant and growing portion of consumers are actively seeking out and willing to pay a premium for eco-friendly goods.

- Competitive Edge: HNI's established sustainability initiatives can be leveraged to gain a competitive advantage over less environmentally conscious competitors.

- Product Innovation: Opportunities exist to innovate and expand product lines using recycled, renewable, and low-emitting materials.

HNI can capitalize on the evolving workplace by offering adaptable furniture solutions for hybrid and remote setups, aligning with a market where U.S. online sales of home office furniture saw over a 100% increase in early 2024. The company is also well-positioned to benefit from the robust residential remodel market, projected to reach approximately $485 billion in the U.S. for 2024, by providing products that enhance home spaces. Strategic acquisitions, like the pending $2.2 billion deal for Steelcase, are set to expand HNI's reach and product offerings, demonstrating a clear growth strategy. Furthermore, integrating smart technology into their product lines, mirroring the over $100 billion projected size of the smart home market in 2024, presents an opportunity for innovation and premium pricing.

| Opportunity Area | Market Trend/Data Point | HNI Relevance |

| Hybrid Workspaces | U.S. online home office furniture sales increased >100% in early 2024. | Develop adaptable furniture for home and office. |

| Residential Remodeling | U.S. home improvement market projected at $485 billion for 2024. | Supply products for home renovations and upgrades. |

| Strategic Acquisitions | Pending $2.2 billion acquisition of Steelcase. | Expand market share and diversify product portfolio. |

| Smart Technology Integration | Smart home market projected >$100 billion in 2024. | Incorporate smart features into furniture for enhanced user experience. |

Threats

Broad economic slowdowns, characterized by high inflation and rising interest rates, pose a significant threat to HNI. These conditions can lead to reduced corporate capital expenditures on office furnishings, directly impacting HNI's commercial segment. For instance, a persistent inflation rate above 3% in 2024, coupled with interest rate hikes by the Federal Reserve, could dampen demand for new office build-outs and renovations.

Similarly, consumer spending on home building products, crucial for HNI's residential segment, is likely to contract. As mortgage rates climbed in late 2023 and early 2024, affordability for new homes decreased, translating to lower demand for furniture and building materials. This slowdown in residential construction and renovation directly affects HNI's sales volumes and overall profitability.

The office furniture and hearth product sectors are intensely competitive, which can force HNI to lower prices, potentially shrinking profit margins. Companies like Steelcase and Herman Miller in office furniture, and brands such as Travis Industries in hearth products, are constantly vying for market share. This rivalry means HNI must remain agile to avoid losing ground.

Competitors might employ aggressive pricing tactics or launch new, disruptive products that could threaten HNI's established market standing. For instance, the rise of direct-to-consumer office furniture brands has already altered market dynamics, forcing established players to adapt their strategies. HNI needs to monitor these shifts closely to maintain its competitive edge.

Emerging trends like furniture-as-a-service and direct-to-consumer (DTC) models pose a significant threat to HNI's established manufacturing and distribution networks. For instance, the global furniture rental market is projected to reach $12.7 billion by 2028, indicating a shift in consumer preference away from outright ownership. HNI must proactively integrate these evolving business models to remain competitive and relevant in the face of such disruptive forces.

Fluctuations in Raw Material Costs and Supply Chain Instability

Volatility in the cost of essential raw materials like wood and metal directly impacts HNI's manufacturing expenses. For instance, lumber prices saw significant swings in 2023 and early 2024, with benchmarks like the CME Random Lengths framing lumber futures experiencing periods of sharp increases and subsequent declines, directly affecting furniture production costs. This unpredictability, coupled with ongoing global supply chain challenges, such as shipping delays and port congestion, can escalate production costs and hinder HNI's capacity to deliver products on time, potentially squeezing profit margins and affecting product availability for consumers.

These supply chain disruptions can lead to increased lead times for components and finished goods. For example, the automotive industry, a sector that relies heavily on similar raw materials and complex supply chains, experienced production losses totaling billions in 2023 due to component shortages. While not directly HNI, this illustrates the broader economic impact of such instability. For HNI, this translates to higher freight costs and the potential need to hold more inventory, tying up capital and increasing operational risk.

- Rising Material Costs: Fluctuations in commodity prices for wood, metals, and fabrics directly increase HNI's cost of goods sold.

- Supply Chain Disruptions: Geopolitical events, natural disasters, and transportation bottlenecks can delay critical component deliveries, impacting production schedules.

- Increased Logistics Expenses: Higher shipping rates and fuel surcharges add to the overall cost of bringing raw materials in and finished goods out.

- Inventory Management Challenges: Uncertainty in supply chains may force HNI to hold larger raw material inventories, increasing storage costs and the risk of obsolescence.

Regulatory Changes and Environmental Compliance Costs

Stricter environmental regulations, especially regarding emissions from hearth products or the sourcing of materials for furniture, pose a significant threat. These changes could drive up compliance costs for HNI, potentially requiring substantial investments in updated manufacturing techniques or entirely new product concepts. For instance, evolving emissions standards for wood-burning fireplaces, a key product category for HNI, could necessitate costly retrofitting or redesigns to meet new benchmarks by 2025.

While HNI's existing sustainability initiatives are beneficial, the continuous evolution of environmental laws presents an ongoing challenge. Companies must remain agile and prepared to adapt to new mandates. The cost of compliance, including potential research and development for greener materials or cleaner production methods, could impact profitability if not managed proactively. For example, anticipated regulations in the European Union concerning material traceability and recycled content could affect HNI's global supply chain and product development pipeline.

- Increased Capital Expenditure: Anticipated investments in pollution control equipment or process modifications to meet stricter 2025 emissions standards could range from millions to tens of millions of dollars, impacting free cash flow.

- Supply Chain Disruptions: New material sourcing regulations might limit available suppliers or increase raw material costs, potentially affecting production schedules and margins.

- Product Redesign Costs: Adapting existing product lines to comply with new environmental performance criteria could require significant R&D and retooling expenses.

Intensifying competition from both established rivals and agile direct-to-consumer brands presents a significant threat to HNI's market share and pricing power. For instance, the office furniture segment saw players like Steelcase and Herman Miller actively innovating in 2023 and 2024, while new DTC entrants gained traction, potentially pressuring HNI's margins.

The company faces substantial risks from economic downturns, including high inflation and rising interest rates, which could curb consumer and commercial spending on its core products. A continued trend of elevated mortgage rates, as seen through late 2023 into 2024, directly impacts residential construction and renovation demand, a key revenue driver for HNI.

Supply chain volatility and rising material costs for key inputs like lumber and metals continue to pose a threat, impacting production expenses and delivery timelines. For example, lumber prices experienced notable fluctuations in 2023 and early 2024, directly influencing HNI's cost of goods sold.

Emerging business models such as furniture-as-a-service and the expansion of DTC channels challenge HNI's traditional manufacturing and distribution networks. The global furniture rental market's projected growth to $12.7 billion by 2028 highlights a potential shift in consumer preference away from outright ownership.

| Threat Category | Specific Risk | Potential Impact on HNI | Illustrative Data Point (2023-2024) |

| Economic Slowdown | Reduced consumer spending on residential furnishings due to high mortgage rates | Lower sales volumes and profitability in the residential segment | Mortgage rates averaging above 6.5% in late 2023/early 2024 |

| Competitive Landscape | Aggressive pricing by competitors in office furniture | Erosion of profit margins | Increased promotional activity observed from major office furniture manufacturers |

| Supply Chain Disruptions | Volatility in lumber prices impacting production costs | Higher cost of goods sold, potential margin compression | Random Lengths framing lumber futures saw significant price swings in 2023-2024 |

| Evolving Business Models | Growth of furniture-as-a-service impacting traditional sales | Potential loss of market share if not adapted to | Furniture rental market projected to reach $12.7 billion by 2028 |

SWOT Analysis Data Sources

This HNI SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market intelligence, and expert industry forecasts, ensuring a data-driven and accurate strategic assessment.