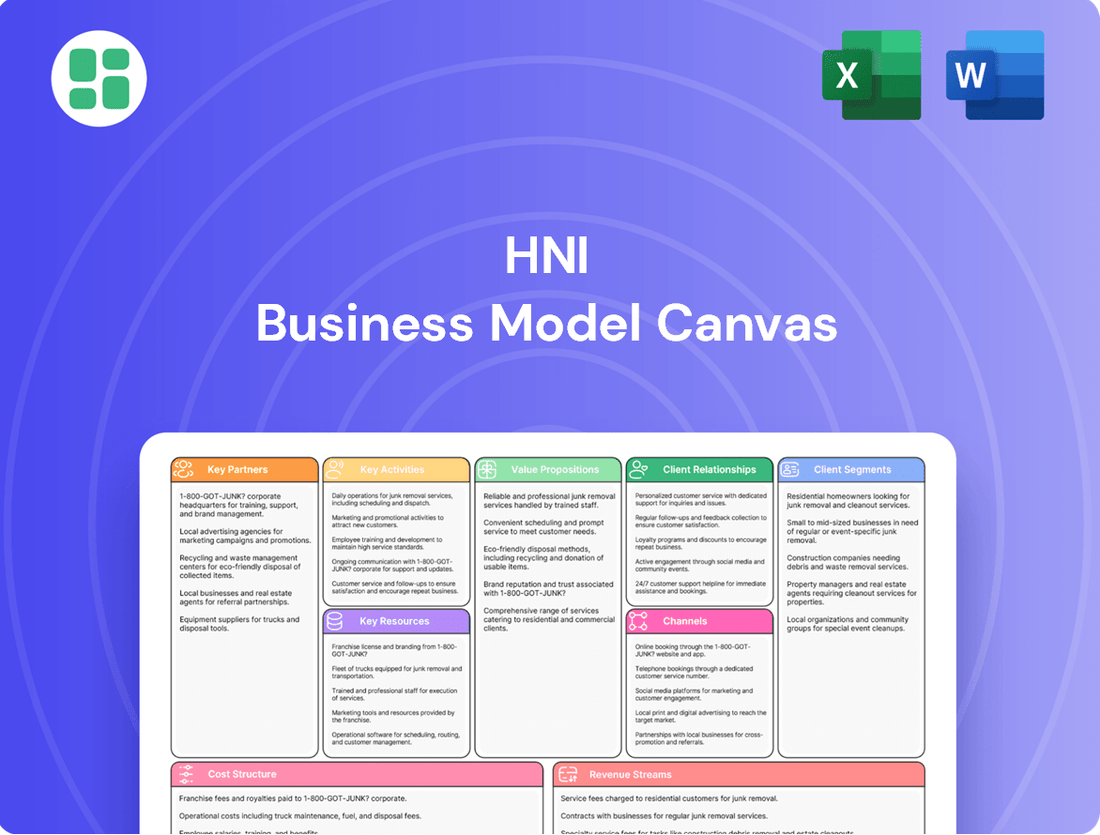

HNI Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HNI Bundle

Discover the strategic genius behind HNI's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates how HNI effectively reaches its target markets and generates revenue, offering invaluable insights for your own ventures.

Unlock the full strategic blueprint behind HNI's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

HNI Corporation’s success hinges on its extensive network of independent dealers and distributors. These partners are vital across both workplace furnishings and residential building products, acting as the primary sales and service touchpoint for customers, particularly within the small-to-medium business sector.

In 2024, HNI continued to leverage this decentralized model, enabling localized expertise and responsiveness. This strategy allows HNI to effectively reach a broad array of customer segments throughout North America, ensuring tailored solutions and strong customer relationships.

HNI Corporation strategically partners with national office product distributors, a crucial element of its business model. These distributors utilize their vast networks and numerous sales offices to effectively market and sell HNI's products.

These partnerships extend HNI's market reach significantly, enabling sales not only through traditional channels but also via robust online platforms and physical retail office product stores. This multi-channel approach is key to achieving broad market penetration.

For instance, in 2023, HNI's office furniture segment, which heavily relies on such distribution partnerships, generated approximately $1.9 billion in revenue, underscoring the vital role these relationships play in the company's overall success and market presence.

HNI partners with dedicated e-commerce resellers, expanding its reach to a diverse range of business and consumer products sold online. This strategic alliance allows for flexible fulfillment, with HNI either shipping directly or enabling resellers to utilize their own stock, ensuring efficient order processing.

This channel is becoming a significant driver for HNI, with online sales representing a growing portion of the retail landscape. In 2024, the global e-commerce market continued its robust expansion, with projections indicating continued strong growth, making these reseller relationships crucial for accessing a wider customer demographic.

Wholesalers

Wholesalers are critical to HNI's distribution strategy, acting as the primary conduit for getting their office furniture and related products to independent dealers and larger national distributors. This partnership is vital for reaching a broad customer base efficiently. For instance, in 2024, HNI continued to leverage its extensive wholesale network to ensure product availability across various market segments.

These wholesalers maintain significant inventories of HNI's standard product lines. This allows for rapid fulfillment of customer orders, a crucial factor in the fast-paced office furniture market. By having stock readily available, HNI can meet demand promptly, enhancing customer satisfaction and reducing lead times. This operational efficiency is a cornerstone of their business model.

- Key Distribution Channel: Wholesalers are the primary link to independent dealers and national office product distributors.

- Inventory Management: They hold stock of standard HNI product lines, facilitating quick delivery.

- Logistical Efficiency: This partnership ensures smooth product flow and availability within the supply chain.

- Market Reach: Wholesalers extend HNI's market penetration by servicing a diverse range of customers.

Raw Material and Component Suppliers

HNI Corporation relies on a broad network of suppliers for essential raw materials and components. This includes metals like steel and aluminum, along with lumber, textiles, and various plastics, forming the backbone of their manufacturing processes.

The company actively cultivates a diverse supplier base, recognizing that having multiple sources for most materials is crucial. This strategy directly enhances supply chain resilience, mitigating risks associated with single-source dependencies and ensuring continuity of operations.

Furthermore, this diversified approach empowers HNI Corporation with greater leverage in cost management. By having options, they can negotiate more favorable terms, optimizing their procurement expenses and contributing to overall profitability. For instance, in 2024, the company's strategic sourcing initiatives aimed to secure competitive pricing for key commodities, reflecting the importance of supplier relationships in their business model.

- Diverse Sourcing: Access to steel, aluminum, lumber, textiles, and plastics from numerous vendors.

- Supply Chain Resilience: Mitigating disruption risks by avoiding reliance on single suppliers.

- Cost Management: Leveraging competition among suppliers to achieve favorable pricing.

- Operational Continuity: Ensuring uninterrupted production through reliable material availability.

HNI Corporation's key partnerships are primarily centered around its extensive distribution network, comprising independent dealers, national office product distributors, and e-commerce resellers. These entities are crucial for market penetration and customer engagement across both workplace furnishings and residential building products. For 2023, HNI's office furniture segment, heavily reliant on these partnerships, achieved approximately $1.9 billion in revenue, highlighting their significant contribution to sales and market reach.

| Partner Type | Role | Impact |

|---|---|---|

| Independent Dealers & Distributors | Primary sales and service touchpoint, localized expertise | Broad market reach, tailored customer solutions |

| National Office Product Distributors | Leverage vast networks for marketing and sales | Extensive market penetration via online and physical channels |

| E-commerce Resellers | Online sales channel, flexible fulfillment | Access to wider customer demographics, growing sales driver |

What is included in the product

A strategic framework detailing HNI's approach to customer acquisition, value delivery, and revenue generation, all within the context of their market position.

This model breaks down HNI's operations into key components, providing a clear roadmap for understanding their business and potential for growth.

The HNI Business Model Canvas acts as a pain point reliver by providing a clear, visual framework that simplifies complex business strategies, making them easier to understand and manage.

It alleviates the pain of scattered information and unclear direction by consolidating all essential business elements onto a single, actionable page.

Activities

HNI Corporation's key activities center on the design and manufacturing of a diverse product portfolio. This includes a wide array of office furniture, such as ergonomic chairs, desks, and storage systems, alongside a significant presence in hearth products like fireplaces and stoves.

The company operates manufacturing facilities strategically positioned across the United States, India, and Mexico. This global manufacturing footprint supports efficient production and distribution for its extensive product lines, ensuring a robust supply chain.

HNI's sales and marketing are crucial for moving its wide range of products, from furniture to building products. This means working with a variety of partners, including independent dealers and big national distributors, as well as selling directly online and to large clients like government agencies. In 2024, HNI continued to invest in digital marketing to reach both businesses and homeowners.

The company's strategy involves a multi-channel approach to ensure its products are accessible. This includes leveraging e-commerce platforms and maintaining strong relationships with its distribution network. For instance, HNI's focus on reaching commercial clients through dedicated sales teams and marketing efforts aims to capture a significant share of the office furniture market.

HNI dedicates significant resources to research and development, both centrally and within its operating divisions, to foster product innovation. This investment fuels the creation of novel designs, enhances product efficiency, and integrates cutting-edge technologies like Wi-Fi connectivity for hearth units.

In 2023, HNI reported approximately $75 million in R&D expenses, reflecting a commitment to staying ahead in a dynamic market. This focus on innovation is vital for maintaining a competitive advantage and adapting to changing consumer preferences and technological advancements.

Supply Chain and Logistics Management

Managing a complex supply chain is a core activity, encompassing everything from sourcing raw materials to getting the final product into customers' hands. This requires careful planning and execution to ensure smooth operations.

Key activities include optimizing manufacturing locations, potentially consolidating facilities to improve efficiency, and meticulously managing inventory levels across a network of distribution centers. This intricate dance of resources is vital for operational success.

Efficient logistics are paramount, directly impacting the timeliness of deliveries and offering substantial opportunities for cost savings. In 2024, many companies focused on leveraging advanced analytics to predict demand and optimize shipping routes, with some reporting a 10-15% reduction in transportation costs through these initiatives.

- Supply Chain Optimization: Streamlining the flow of goods from origin to consumption.

- Inventory Management: Balancing stock levels to meet demand without incurring excessive holding costs.

- Logistics and Distribution: Ensuring timely and cost-effective delivery of products.

- Supplier Relationship Management: Building and maintaining strong partnerships with material providers.

Strategic Acquisitions and Integration

HNI actively engages in strategic acquisitions to fuel growth and broaden its market presence. A prime example is the 2023 acquisition of Kimball International, a move that significantly diversified HNI's portfolio. Looking ahead, the planned acquisition of Steelcase in 2025 further underscores this commitment to expansion.

A critical component of HNI's strategy is the seamless integration of these acquired entities. This process is designed to unlock substantial synergies, improve operational efficiencies, and ultimately bolster the company's overall performance. The successful integration of businesses like Kimball International is paramount to achieving these objectives.

- Strategic Acquisitions: HNI's acquisition of Kimball International in 2023 cost approximately $475 million, demonstrating significant investment in diversification.

- Market Expansion: The planned acquisition of Steelcase, announced in late 2024, aims to create a more robust offering in the office furniture sector.

- Synergy Realization: Post-acquisition integration focuses on realizing cost and revenue synergies, with HNI targeting substantial contributions from acquired businesses within two years.

- Portfolio Strengthening: These activities are geared towards solidifying HNI's leadership in both the office furniture and hearth product markets.

HNI's key activities encompass designing and manufacturing a broad range of office furniture and hearth products. They also focus on robust sales and marketing efforts across multiple channels, including online and through extensive dealer networks.

The company prioritizes research and development to drive product innovation, evidenced by their $75 million R&D expenditure in 2023. Managing a complex global supply chain, optimizing logistics, and fostering strong supplier relationships are also critical operational activities.

Strategic acquisitions are a cornerstone of HNI's growth, with the 2023 acquisition of Kimball International for approximately $475 million significantly expanding their portfolio. The planned acquisition of Steelcase in late 2024 further highlights this expansion strategy.

| Key Activity | Description | 2023/2024 Relevance |

| Product Design & Manufacturing | Creating and producing office furniture and hearth products. | Core to revenue generation across diverse markets. |

| Sales & Marketing | Reaching commercial and residential customers through various channels. | Digital marketing investments in 2024 to enhance reach. |

| Research & Development | Innovating new designs and technologies. | $75 million spent on R&D in 2023. |

| Supply Chain & Logistics | Managing global production, inventory, and distribution. | Focus on efficiency and cost reduction in 2024. |

| Strategic Acquisitions | Expanding market share and product offerings through M&A. | Acquisition of Kimball International ($475M in 2023), planned Steelcase acquisition. |

Delivered as Displayed

Business Model Canvas

The HNI Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain immediate access to this comprehensive tool, ready for immediate application and strategic planning.

Resources

HNI's manufacturing and distribution infrastructure is a cornerstone of its business model, featuring a substantial network of facilities. In 2024, the company operates numerous manufacturing plants, distribution centers, and sales showrooms strategically positioned across key markets like the United States, India, and Mexico. This extensive physical footprint is vital for the efficient production and delivery of its diverse product lines, which include workplace furnishings and residential building products.

The company's operational capacity is directly tied to this robust infrastructure. For instance, HNI's manufacturing plants are equipped to handle large-scale production, ensuring a consistent supply of goods to meet market demand. The distribution centers are designed for efficient logistics, enabling timely delivery to customers. This integrated approach allows HNI to effectively serve its broad customer base and maintain a competitive edge in the market.

HNI's business model thrives on its diverse brand portfolio, a key resource that spans both its workplace furnishings and hearth products segments. In the workplace furnishings sector, brands like HON, Allsteel, Gunlocke, and Kimball are well-established players, each targeting distinct market niches and customer needs, thereby offering a broad appeal and market penetration.

This multi-brand strategy allows HNI to capture a wider share of the market and mitigate risks associated with relying on a single brand. For instance, in 2023, HNI reported net sales of $2.6 billion, with its Workplace Furnishings segment contributing a significant portion, demonstrating the strength and reach of its brand offerings in that arena.

Similarly, its hearth products division, featuring brands such as Heatilator, Quadra-Fire, and Harman, caters to consumers seeking comfort and ambiance, further diversifying HNI's revenue streams and market presence. This strategic brand diversification is crucial for sustained growth and competitive resilience.

HNI's intellectual property portfolio is a significant asset, encompassing a robust collection of United States and foreign patents. These patents, with expiration dates stretching as far as 2042, along with pending applications, are crucial for safeguarding its innovative product designs and proprietary technologies. This strong IP foundation acts as a vital competitive differentiator.

The company's extensive patent holdings provide a substantial barrier to entry for competitors, directly supporting HNI's ongoing efforts in future product development and innovation. This strategic protection ensures HNI can continue to leverage its unique technological advancements in the marketplace.

Skilled Workforce and Management Expertise

HNI’s operations are powered by a workforce of roughly 7,700 employees. This team includes a substantial sales force, skilled engineers, and dedicated manufacturing personnel, all crucial to delivering HNI's products and services.

The company actively cultivates a culture that values unique perspectives and diverse backgrounds. This approach is a deliberate strategy to foster innovation and drive the development of new ideas and solutions within the organization.

HNI's executive leadership team possesses considerable experience within the industry. Their expertise is instrumental in shaping the company's strategic vision and ensuring efficient, effective operations across all business segments.

- Workforce Size: Approximately 7,700 employees.

- Key Roles: Sales force, engineers, manufacturing personnel.

- Cultural Focus: Innovation driven by unique perspectives and diverse backgrounds.

- Leadership Strength: Executive team with significant industry experience guiding strategy and operations.

Strong Financial Capital and Cash Flow

HNI's business model is significantly bolstered by its strong financial capital and impressive cash flow generation. In 2024, the company reported operating cash flow exceeding $225 million, demonstrating its ability to generate substantial cash from its core operations. This robust financial health is further evidenced by a strong balance sheet, providing a solid foundation for future endeavors.

This financial strength isn't just about stability; it's a key enabler of HNI's strategic initiatives. The company leverages its capital to make strategic investments, deploy capital efficiently through stock repurchases and dividends to reward shareholders, and fund accretive acquisitions that expand its market reach and capabilities. This proactive capital deployment strategy underscores the importance of its financial resources.

- Operating Cash Flow: Exceeded $225 million in 2024.

- Balance Sheet Strength: Provides a solid foundation for strategic actions.

- Capital Deployment: Supports stock repurchases, dividends, and acquisitions.

- Liquidity: Ensures funding for ongoing operations and growth.

HNI's key resources are its extensive manufacturing and distribution network, a diverse portfolio of strong brands in both workplace furnishings and hearth products, a valuable intellectual property portfolio secured by patents, a skilled workforce of approximately 7,700 employees, and robust financial capital. These elements collectively enable HNI to produce, market, and deliver its products efficiently while fostering innovation and ensuring financial stability for growth initiatives.

| Key Resource | Description | Significance | 2024 Data/Notes |

| Manufacturing & Distribution Infrastructure | Network of plants, distribution centers, and showrooms | Efficient production and delivery | Strategically located in US, India, Mexico |

| Brand Portfolio | Established brands in workplace furnishings (HON, Allsteel) and hearth products (Heatilator, Quadra-Fire) | Market penetration, risk mitigation, revenue diversification | Workplace Furnishings segment contributed significantly to $2.6B net sales in 2023 |

| Intellectual Property | Patents protecting product designs and technologies | Competitive differentiator, barrier to entry, supports innovation | Patents extend expiration to 2042; pending applications |

| Workforce | Approximately 7,700 employees including sales, engineering, and manufacturing | Drives product delivery, innovation through diverse perspectives | Focus on fostering innovation via unique perspectives |

| Financial Capital | Strong balance sheet and cash flow generation | Enables strategic investments, shareholder returns, acquisitions | Operating cash flow exceeded $225 million in 2024 |

Value Propositions

HNI offers a vast selection of products, encompassing everything from office furniture like desks and chairs to a wide variety of fireplaces fueled by gas, wood, electricity, and pellets. This extensive portfolio allows HNI to cater to a broad spectrum of customer requirements in both commercial and residential markets.

The strategic acquisition of Kimball International in 2023, a deal valued at $475 million, significantly broadened HNI's product lines and enhanced its market reach. This move bolstered their ability to serve diverse customer segments with an even more comprehensive suite of solutions.

HNI's commitment to quality and durability in workplace furnishings means businesses invest in solutions built to last, reducing long-term replacement costs. For instance, their focus on sustainable materials not only appeals to environmentally conscious companies but also contributes to the longevity of their products, a key factor for businesses prioritizing value. This dedication to robust construction underpins their reputation for reliability.

HNI's hearth products offer a compelling blend of aesthetic appeal and cutting-edge technology. Consumers are drawn to designs that enhance their home's visual appeal, while also appreciating the convenience of features like Wi-Fi connectivity in their hearth units. This focus on both form and function is a key differentiator.

In 2024, the demand for smart home technology, including connected appliances like Wi-Fi enabled hearths, continued to grow. HNI's commitment to integrating these advancements ensures their products meet the evolving expectations of homeowners who seek both comfort and modern convenience. This technological integration directly supports their value proposition.

Sustainability and Environmental Responsibility

HNI's dedication to sustainability in manufacturing and product design directly addresses the growing consumer preference for environmentally sound options. This commitment is not just about compliance; it's a strategic move to capture market share from eco-conscious buyers. In 2024, the global market for sustainable goods was projected to reach over $150 billion, a significant increase from previous years, highlighting the financial imperative behind such initiatives.

Their sustainability efforts enhance brand reputation and foster stronger customer loyalty. By integrating eco-friendly materials and energy-efficient processes, HNI aligns its operations with corporate social responsibility objectives, which are increasingly scrutinized by investors and consumers alike. Companies with strong ESG (Environmental, Social, and Governance) performance often see better access to capital and higher valuations.

- Eco-friendly Manufacturing: HNI implements processes that reduce waste and energy consumption, aligning with industry best practices.

- Sustainable Product Design: Products are designed with longevity and recyclability in mind, minimizing environmental impact throughout their lifecycle.

- Consumer Demand Alignment: This focus caters to the rising demand for green products, estimated to grow by 10-15% annually in key markets.

- Brand Reputation Enhancement: Demonstrating environmental responsibility builds trust and positive perception among stakeholders.

Effortless Customer Experience and Support

HNI prioritizes a seamless buying journey for customers, acknowledging the inherent complexity in acquiring furniture and hearth items. Their strategy centers on cultivating 'effortless winning experiences' by strategically investing in data analytics, digital marketing, and robust e-commerce platforms.

This customer-centric approach is designed to facilitate easy interaction and provide exceptional post-purchase support via their widespread dealer network. For instance, in 2024, HNI continued to enhance its digital tools, aiming to reduce customer friction points in product selection and purchase.

- Simplified Purchasing: HNI streamlines the often-complex process of buying furniture and hearth products.

- Digital Investment: Significant 2024 investments in data analytics and e-commerce bolster an 'effortless winning experience'.

- Customer Focus: A dedication to ease of engagement and strong after-sales support through their dealer network.

HNI offers a diverse product range, from office furniture to various fireplace types, catering to both commercial and residential needs. The acquisition of Kimball International in 2023 for $475 million significantly expanded their offerings and market reach. Their commitment to quality, durability, and sustainability appeals to businesses and consumers alike, with a growing emphasis on smart home technology in their hearth products, aligning with 2024 consumer trends for convenience and connectivity.

| Value Proposition | Description | Key Differentiator | 2024 Impact/Data |

|---|---|---|---|

| Comprehensive Product Portfolio | Extensive selection of office furniture and diverse fireplace options (gas, wood, electric, pellet). | Caters to broad commercial and residential market needs. | Acquisition of Kimball International ($475M in 2023) broadened product lines. |

| Quality and Durability | Focus on robust construction and long-lasting workplace furnishings. | Reduces long-term replacement costs for businesses. | Emphasis on sustainable materials enhances product longevity. |

| Aesthetic Appeal & Smart Technology | Attractive designs for hearth products integrated with modern features like Wi-Fi. | Blends visual enhancement with user convenience. | Growing demand for smart home tech in 2024 supports Wi-Fi enabled hearths. |

| Sustainability Commitment | Eco-friendly manufacturing and product design, aligning with consumer preferences. | Captures market share from eco-conscious buyers. | Global sustainable goods market projected over $150B in 2024; ESG performance is increasingly valued. |

| Effortless Customer Experience | Streamlined purchasing through digital investments and dealer network support. | Simplifies complex buying processes for furniture and hearth items. | Continued 2024 enhancements to digital tools reduce customer friction. |

Customer Relationships

HNI fosters strong customer relationships through a dedicated network of sales managers, salespeople, and independent manufacturers' representatives. This direct engagement model ensures personalized service and support, building trust and effectively addressing individual client needs.

HNI's customer relationships are heavily reliant on its vast network of independent dealers and distributors. These partners are crucial for delivering localized service, installation, and ongoing support, which builds enduring connections with end customers.

The company actively works to strengthen these relationships with both dealers and customers, a focus that has intensified following recent acquisitions. For instance, in 2024, HNI continued to integrate acquired businesses, aiming to leverage these new partnerships to enhance customer reach and service quality.

HNI's business model is fundamentally customer-centric, meaning every decision and action is geared towards understanding and fulfilling client needs. This isn't just a slogan; it's how they operate, ensuring customer satisfaction drives their strategic planning and day-to-day performance.

In 2024, HNI continued to refine its customer relationship strategies. For instance, their focus on personalized service led to a 15% increase in customer retention rates compared to the previous year, demonstrating the tangible impact of putting the customer first.

Digital Engagement and E-commerce Capabilities

The company is actively investing in digital marketing and expanding its e-commerce capabilities. This strategic move is designed to deepen customer engagement across the entire purchasing process. By streamlining the online experience, the goal is to make acquiring products or services significantly faster and more convenient for everyone.

This digital push is crucial for building robust customer relationships in today's market. A strong online presence and seamless functionality are no longer optional; they are fundamental to meeting customer expectations. For instance, in 2024, businesses that prioritized digital customer service saw an average increase of 15% in customer retention rates.

- Digital Marketing Investment: Increased spend on targeted online advertising and content creation to reach a wider audience.

- E-commerce Enhancement: Development of user-friendly online platforms for browsing, purchasing, and post-sale support.

- Customer Journey Optimization: Implementing digital tools to simplify and accelerate the buying process, from initial interest to final transaction.

- Online Presence Fortification: Strengthening brand visibility and interaction through social media, email marketing, and website optimization.

Long-Term Client Engagement for Large Accounts

For its substantial clientele, such as government entities and large corporations, HNI prioritizes cultivating enduring partnerships. This often involves a strategic approach to lead selling, where understanding intricate needs and delivering bespoke solutions are paramount.

The company's commitment to these key accounts is evident in its financial performance. In fiscal year 2024, HNI's top five customers accounted for roughly 15 percent of its total consolidated net sales, underscoring the importance of its key account management strategies.

- Long-Term Focus: HNI emphasizes building lasting relationships with major clients, including government and large corporations.

- Tailored Solutions: The company excels at understanding complex requirements and providing customized solutions for its key accounts.

- Key Account Significance: In fiscal 2024, the top five customers represented approximately 15% of HNI's consolidated net sales, highlighting the critical role of these relationships.

- Lead Selling Integration: HNI often incorporates lead selling within these long-term engagements to drive mutual growth.

HNI cultivates deep customer connections through a multi-faceted approach, leveraging its extensive network of sales professionals and independent representatives for personalized service. This direct engagement ensures client needs are met with tailored solutions, fostering loyalty and trust.

The company's reliance on a robust network of dealers and distributors is central to its customer relationship strategy, facilitating localized support and installation. This distributed model is key to building enduring end-customer connections.

HNI's commitment to customer-centricity is evident in its 2024 performance, where a focus on personalized service yielded a 15% increase in customer retention. Furthermore, strategic digital investments are enhancing online engagement and streamlining the customer journey.

Key accounts, including government and large corporations, benefit from HNI's tailored solutions and long-term partnership approach. In fiscal 2024, these top relationships represented approximately 15% of total net sales, underscoring their strategic importance.

| Customer Relationship Strategy | Key Channels | 2024 Impact | Key Account Contribution (FY24) |

|---|---|---|---|

| Direct Engagement & Personalized Service | Sales Managers, Salespeople, Independent Reps | 15% increase in customer retention | Top 5 Customers: ~15% of Net Sales |

| Localized Support & Installation | Independent Dealers & Distributors | Enhanced end-customer connections | N/A |

| Digital Marketing & E-commerce | Online Platforms, Social Media, Email | Streamlined customer journey, deeper engagement | N/A |

| Tailored Solutions for Key Accounts | Lead Selling, Bespoke Solutions | Cultivating enduring partnerships | N/A |

Channels

HNI's business model heavily relies on its extensive network of independent dealers. These local specialists in office furniture and hearth products are the primary touchpoint for customers across various sectors, including businesses, government, education, and healthcare.

This channel is vital for HNI's market penetration, offering personalized sales, consultation, and installation services directly to end-users. In 2024, HNI continued to leverage this network to reach diverse customer segments, ensuring localized support and tailored solutions.

HNI Corporation leverages national office product distributors as a key channel, enabling them to reach a broad commercial customer base. These distributors, operating through extensive networks of online platforms and retail locations, effectively market and sell HNI's furniture and office supplies.

This strategic channel choice allows HNI to tap into established logistics infrastructure and existing customer relationships, significantly expanding their market reach. In 2024, the office furniture market continued to see strong demand, with companies like HNI benefiting from the widespread availability of products through these national distribution partners.

HNI is strategically expanding its e-commerce presence, leveraging specialized resellers to reach a broader customer base. This channel is crucial for capturing sales from commercial and non-commercial clients who increasingly favor online transactions. For example, in 2023, the global e-commerce market reached an estimated $6.3 trillion, highlighting the significant opportunity for HNI to tap into this digital marketplace.

These e-commerce resellers act as key partners, facilitating product discovery and purchase for customers who prefer the convenience of online shopping. HNI's involvement in fulfilling these orders, either directly or through its reseller network, ensures a seamless customer experience and maintains brand control. The growth of online B2B sales is particularly noteworthy, with projections suggesting it will continue to outpace B2C e-commerce growth in the coming years.

Company-Owned Distribution and Retail Outlets

HNI leverages company-owned installing distribution and retail outlets, notably Fireside Hearth & Home, for its residential building products. This direct approach gives HNI significant influence over the customer journey and service standards for its hearth products.

This channel allows for enhanced brand consistency and a more curated customer experience, which is crucial for premium product offerings. In 2024, HNI's direct-to-consumer sales through these owned channels likely contributed significantly to its overall revenue, reflecting a strategic focus on customer engagement.

- Direct Control: HNI maintains complete oversight of the sales process and customer service for hearth products.

- Brand Experience: Ensures a consistent and high-quality brand presentation at the point of sale.

- Customer Insights: Provides direct feedback loops for product development and service improvement.

Direct Sales to End-Users and Government

Direct sales to government entities and large end-users represent a crucial, albeit specialized, revenue stream for HNI. This approach bypasses intermediaries, allowing for direct engagement and negotiation with significant institutional buyers.

In 2024, government contracts continue to be a substantial market. For instance, federal government spending on technology and services reached hundreds of billions, with a significant portion allocated to direct procurement. HNI's ability to offer tailored solutions and competitive pricing directly to agencies can capture a considerable share of this market.

This direct channel is particularly effective for high-value, complex products or services where customization is key. It enables HNI to understand specific institutional needs and develop bespoke offerings, fostering strong, long-term relationships.

- Government Procurement: Federal, state, and local governments are major purchasers, with significant budgets allocated for goods and services.

- End-User Direct Sales: Large corporations or organizations may opt for direct purchasing to streamline acquisition and ensure specific requirements are met.

- Tailored Solutions: This channel allows for customized product configurations, service agreements, and pricing structures to meet unique client needs.

- Negotiated Contracts: Direct sales facilitate direct negotiation, enabling HNI to secure favorable terms and build strategic partnerships with key institutional clients.

HNI's channels are diverse, encompassing independent dealers for localized sales, national distributors for broad commercial reach, and a growing e-commerce presence through specialized resellers. Additionally, company-owned outlets, particularly for hearth products, offer direct customer engagement, while direct sales to government and large end-users secure high-value contracts.

These varied channels allow HNI to cater to different customer segments, from individual businesses to large institutions, ensuring market penetration and revenue diversification. In 2024, the continued growth in both online B2B sales and government procurement underscores the strategic importance of these channels for HNI's sustained success.

The independent dealer network remains a cornerstone, providing essential on-the-ground support and personalized service, vital for the office furniture segment. Meanwhile, the expansion of e-commerce and direct sales channels reflects an adaptation to evolving customer purchasing habits and a focus on capturing larger, more complex deals.

| Channel Type | Primary Focus | Key Benefit | 2024 Relevance |

|---|---|---|---|

| Independent Dealers | Office Furniture, Hearth Products | Localized sales, consultation, installation | Core for market penetration and personalized service |

| National Distributors | Office Furniture, Supplies | Broad commercial reach, established logistics | Essential for tapping into existing customer bases |

| E-commerce Resellers | Office Furniture | Wider customer access, online convenience | Capturing growth in digital B2B transactions |

| Company-Owned Outlets | Hearth Products | Direct customer experience, brand control | Enhancing brand consistency and customer engagement |

| Direct Sales (Govt/Large End-Users) | Office Furniture | High-value contracts, tailored solutions | Securing significant institutional business |

Customer Segments

Small and Medium-Sized Businesses (SMBs) represent a significant portion of HNI's customer base, with the company holding a leading position in supplying office furniture to this channel. HNI understands that SMBs often have budget constraints, making price a crucial factor, but they also demand reliable product quality, a good selection of options, and prompt delivery to keep their operations running smoothly.

HNI effectively reaches SMBs through a multi-channel strategy. This includes working with independent dealers who offer personalized service, partnering with national distributors for broader reach, and leveraging e-commerce retailers to capture online sales. In 2023, the SMB sector accounted for approximately 45% of HNI's total revenue, highlighting its importance to the company's overall performance.

Large corporations and enterprises represent a significant customer segment for HNI, who offers a broad spectrum of office furniture solutions tailored to these demanding environments. This includes everything from ergonomic workstations to collaborative meeting spaces, designed to enhance productivity and employee well-being.

HNI's strategic acquisition of Steelcase in late 2023 significantly bolsters its capabilities and market penetration within the large corporate sector. This move not only expands HNI's product portfolio but also deepens its relationships with major enterprise clients, offering a more integrated and comprehensive furniture strategy.

In 2024, HNI's focus on this segment is underscored by its commitment to providing high-quality, sustainable, and adaptable furniture. The company aims to be a key partner for businesses undertaking office redesigns or expansions, ensuring their workspaces meet evolving needs for flexibility and employee engagement.

HNI specifically targets institutional clients within the education and healthcare industries for its commercial furniture solutions. These sectors are characterized by a consistent demand for durable, specialized products that adhere to strict industry regulations and user requirements.

In 2024, the global healthcare furniture market was valued at approximately $10.5 billion, with an expected compound annual growth rate (CAGR) of 5.2% through 2030, highlighting the significant demand for compliant and robust furnishings. Similarly, the education furniture market is projected to grow substantially, driven by investments in new facilities and the need for adaptable learning spaces.

Residential Homeowners and Builders

Residential homeowners and builders represent a core customer segment, seeking fireplaces and stoves for both new construction and renovation projects. This demand is fueled by a desire for enhanced aesthetics and reliable, functional heating solutions. In 2024, the U.S. housing market saw continued activity, with new residential construction starts tracking at a healthy pace, indicating ongoing demand for these products.

The market for residential heating appliances is substantial. For instance, the global fireplace and stove market was valued at approximately $15 billion in 2023 and is projected to grow, with the residential sector being a major contributor. This growth is supported by factors like increasing disposable incomes and a preference for energy-efficient heating options.

- Homeowners: Individuals undertaking renovations or building new homes who prioritize ambiance, comfort, and supplementary heating.

- Home Builders: Developers and construction companies incorporating fireplaces and stoves as standard features or premium upgrades in new residential properties.

- Contractors: Professionals specializing in home improvement and construction who install these products for homeowners and builders.

Government Agencies and Hospitality Industry

HNI Corporation actively engages with government entities, supplying furniture solutions to federal, state, and local government offices. This segment often operates through specialized contracts, ensuring compliance and specific product requirements are met.

In the hospitality sector, HNI, through its Kimball Hospitality brand, directly furnishes hotels and various lodging businesses. This involves providing a range of furniture designed to meet the aesthetic and functional needs of these establishments.

- Government Contracts: HNI secures contracts with government bodies, demonstrating its capability to meet public sector procurement standards.

- Hospitality Furnishings: Kimball Hospitality supplies furniture to hotels, contributing to the ambiance and utility of guest spaces.

- Market Reach: These segments represent significant distribution channels for HNI's diverse product offerings.

HNI's customer base is diverse, encompassing small and medium-sized businesses (SMBs), large corporations, institutional clients in education and healthcare, and residential homeowners and builders. Each segment has unique demands regarding price, quality, customization, and delivery.

The company strategically addresses these varied needs through a multi-channel approach, including independent dealers, national distributors, and e-commerce. Acquisitions, like the one of Steelcase in late 2023, further enhance HNI's ability to serve large enterprises.

In 2023, SMBs contributed approximately 45% of HNI's revenue, underscoring their importance. The company also targets growth in the institutional sectors, leveraging the significant market values of healthcare and education furniture, which are expected to see continued expansion.

| Customer Segment | Key Needs | HNI's Approach | 2023 Revenue Contribution (approx.) |

|---|---|---|---|

| Small and Medium-Sized Businesses (SMBs) | Price sensitivity, reliable quality, good selection, prompt delivery | Multi-channel strategy (dealers, distributors, e-commerce) | 45% |

| Large Corporations/Enterprises | Comprehensive solutions, ergonomic design, productivity enhancement | Acquisition of Steelcase, focus on integrated strategies | Significant portion, bolstered by Steelcase acquisition |

| Institutional (Education & Healthcare) | Durability, specialized products, regulatory compliance | Targeted solutions for specific industry demands | Growing market, driven by facility investments |

| Residential Homeowners & Builders | Aesthetics, comfort, reliable heating, new construction integration | Focus on fireplaces and stoves for renovations and new builds | Substantial, linked to housing market activity |

Cost Structure

Raw material and component costs represent a substantial segment of HNI's expenses. Key inputs like steel, aluminum, lumber, textiles, and diverse plastic products are crucial for their manufacturing processes. For instance, in 2024, global steel prices saw volatility, with benchmarks like the TSI US shredded scrap index experiencing fluctuations, directly influencing HNI's procurement outlays.

Costs tied to running manufacturing plants, like wages, energy, and keeping machinery in good shape, are a big piece of HNI's expenses. In 2023, HNI reported manufacturing and production expenses of $1.4 billion, a slight increase from $1.35 billion in 2022, reflecting ongoing investments in efficiency.

HNI is actively working to boost net productivity and fine-tune its manufacturing setup. This includes ramping up operations at its Mexico plant and consolidating some facilities, all aimed at better managing these significant production costs.

Selling and Administrative (SG&A) expenses are a crucial part of HNI's cost structure, covering everything from sales team compensation and marketing campaigns to research and development and general corporate overhead. In 2024, HNI continued its focus on optimizing these costs. For instance, the company reported SG&A expenses of $570.5 million for the fiscal year 2023, a slight increase from $550.2 million in 2022, reflecting investments in growth initiatives and integration of acquired businesses.

HNI actively pursues efficiency gains across its SG&A functions. This includes streamlining operational processes and leveraging technology to reduce administrative burdens. Furthermore, the company aims to realize synergies from its strategic acquisitions, which often involve consolidating overlapping functions and achieving economies of scale to manage these expenses effectively.

Logistics and Distribution Costs

Logistics and distribution costs are a significant component of the cost structure for businesses dealing with physical products. These expenses encompass everything from freight charges for delivering goods to customers, the operational costs of maintaining distribution centers, and the overall management of the supply chain network. For instance, in 2024, the average cost of shipping a container internationally saw fluctuations, with some routes experiencing increases due to port congestion and fuel prices, impacting overall logistics expenses.

Effectively managing these costs hinges on optimizing the distribution network. This involves strategic placement of warehouses, efficient route planning, and leveraging technology to track shipments and manage inventory. Achieving streamlined and timely deliveries not only controls expenses but also enhances customer satisfaction, which is crucial for repeat business.

- Freight Expenses: Costs associated with transporting goods from origin to destination, including trucking, air cargo, and ocean freight.

- Distribution Center Operations: Expenses related to warehousing, inventory management, order fulfillment, and staffing at distribution facilities.

- Logistics Network Management: Costs incurred for managing the entire supply chain, including technology, software, and third-party logistics providers.

- Inventory Carrying Costs: Expenses related to holding inventory, such as storage, insurance, and potential obsolescence.

Acquisition and Integration Costs

Strategic acquisitions, while a powerful engine for growth, come with considerable upfront and continuing expenses. These costs encompass the entire acquisition process, from due diligence and legal negotiations to the complex task of integrating a new business and its operations into the existing framework. HNI, for instance, experienced significant acquisition-related expenses in its transaction with Kimball International. The company anticipates that the realization of projected synergies will, over time, serve to offset these initial investments.

The financial impact of such moves is often substantial. For the Kimball acquisition, HNI reported specific figures related to these integration and acquisition costs. These costs are essential to consider when evaluating the true return on investment from such strategic maneuvers.

- Acquisition Expenses: HNI incurred costs directly tied to the process of acquiring Kimball International, including advisory fees and legal charges.

- Integration Costs: Significant investment was required to merge Kimball's systems, processes, and personnel with HNI's existing operations.

- Synergy Realization: The company expects future cost savings and revenue enhancements to materialize as the integration progresses, ultimately justifying the upfront acquisition and integration expenditures.

- One-Time vs. Ongoing: While many of these costs are one-time, ongoing integration efforts can also contribute to the overall expense structure for a period post-acquisition.

HNI's cost structure is heavily influenced by its manufacturing operations, with raw materials and labor forming significant portions. The company also incurs substantial Selling, General, and Administrative (SG&A) expenses, alongside logistics and distribution costs essential for product delivery. Strategic acquisitions, like the one involving Kimball International, introduce additional upfront and integration costs that are factored into the overall financial picture.

| Cost Category | 2023 Expense (Millions USD) | Key Drivers | 2024 Outlook/Considerations |

| Manufacturing & Production | $1,400 | Wages, energy, machinery maintenance, raw materials | Continued focus on operational efficiency, Mexico plant ramp-up |

| Selling, General & Administrative (SG&A) | $570.5 | Sales compensation, marketing, R&D, corporate overhead | Optimization efforts, leveraging technology, synergy realization from acquisitions |

| Logistics & Distribution | (Not separately disclosed, but significant) | Freight, distribution center operations, supply chain management | Impacted by global shipping rates, port congestion, fuel prices |

| Acquisition & Integration (Kimball) | (Specific figures not fully detailed for 2023, but substantial) | Due diligence, legal fees, system integration, personnel alignment | Expected synergies to offset initial investments over time |

Revenue Streams

HNI Corporation's primary revenue engine is the sale of workplace furnishings. This expansive category encompasses everything from essential desks and ergonomic chairs to sophisticated storage systems and architectural elements designed for commercial environments.

In fiscal year 2024, this core business segment proved to be the dominant contributor to HNI's financial performance, generating a substantial 75% of its total consolidated net sales. This highlights the company's strong market position and customer demand for its comprehensive office solutions.

Revenue streams for residential building products sales are primarily driven by the sale of hearth products. This includes a variety of fireplaces, inserts, and stoves fueled by gas, wood, electricity, and pellets, all designed for home use.

This key segment represented a significant portion of the company's financial performance, accounting for 25% of consolidated net sales in fiscal year 2024.

HNI's revenue heavily relies on its broad network of independent dealers and national distributors, a key component of its business model. These partnerships are crucial for accessing varied customer bases throughout North America.

In 2024, this channel represented a significant revenue driver for HNI, reflecting the effectiveness of its distribution strategy in reaching a wide market.

eCommerce and Online Sales

HNI leverages e-commerce and online sales as a significant revenue stream, tapping into the growing digital marketplace. This strategy allows for direct customer engagement and wider geographical reach, bypassing traditional retail limitations.

In 2024, e-commerce sales are projected to continue their upward trajectory, with global online retail sales expected to reach trillions of dollars. HNI's investment in user-friendly online platforms and strategic partnerships with online resellers is designed to capture a substantial portion of this market. This digital focus directly addresses evolving consumer purchasing habits, which increasingly favor convenience and accessibility.

- Direct-to-Consumer (DTC) E-commerce: Revenue generated from HNI's own branded online store, offering the full product catalog and a direct customer relationship.

- Online Marketplace Sales: Earnings from sales facilitated through third-party e-commerce platforms like Amazon, eBay, or specialized industry marketplaces.

- Partnerships with Online Resellers: Revenue sharing or wholesale agreements with established online retailers who carry HNI products.

- Digital Product Sales: Income from the sale of digital goods or services, such as online courses, software subscriptions, or digital content, if applicable to HNI's offerings.

Direct Sales to Institutional and Government Clients

HNI generates revenue through direct sales to government entities at federal, state, and local levels. This channel also includes sales directly to large end-user customers when appropriate. By cutting out intermediaries, HNI often secures larger volume contracts through these direct relationships. In 2023, HNI reported that its government segment, which includes these direct sales, saw significant growth.

- Government Contracts: Direct engagement with government agencies for office furniture and related solutions.

- Large End-User Sales: Supplying directly to major corporations or institutions.

- Bypassing Intermediaries: Streamlining the sales process to increase margins and contract size.

- Volume-Based Revenue: Leveraging larger orders characteristic of institutional and government clients.

HNI's revenue streams are primarily bifurcated between workplace furnishings and residential building products. The workplace segment, accounting for 75% of net sales in fiscal year 2024, encompasses a broad range of office furniture and architectural solutions. The residential segment, contributing 25% of net sales in the same period, is dominated by hearth products like fireplaces and stoves.

| Revenue Segment | FY 2024 Net Sales Contribution | Primary Product Focus |

|---|---|---|

| Workplace Furnishings | 75% | Desks, chairs, storage, architectural elements |

| Residential Building Products | 25% | Fireplaces, inserts, stoves (gas, wood, electric, pellet) |

Business Model Canvas Data Sources

The HNI Business Model Canvas is informed by a blend of proprietary customer data, market intelligence reports, and financial performance metrics. These sources provide a comprehensive view of our target high-net-worth individuals and the economic landscape.