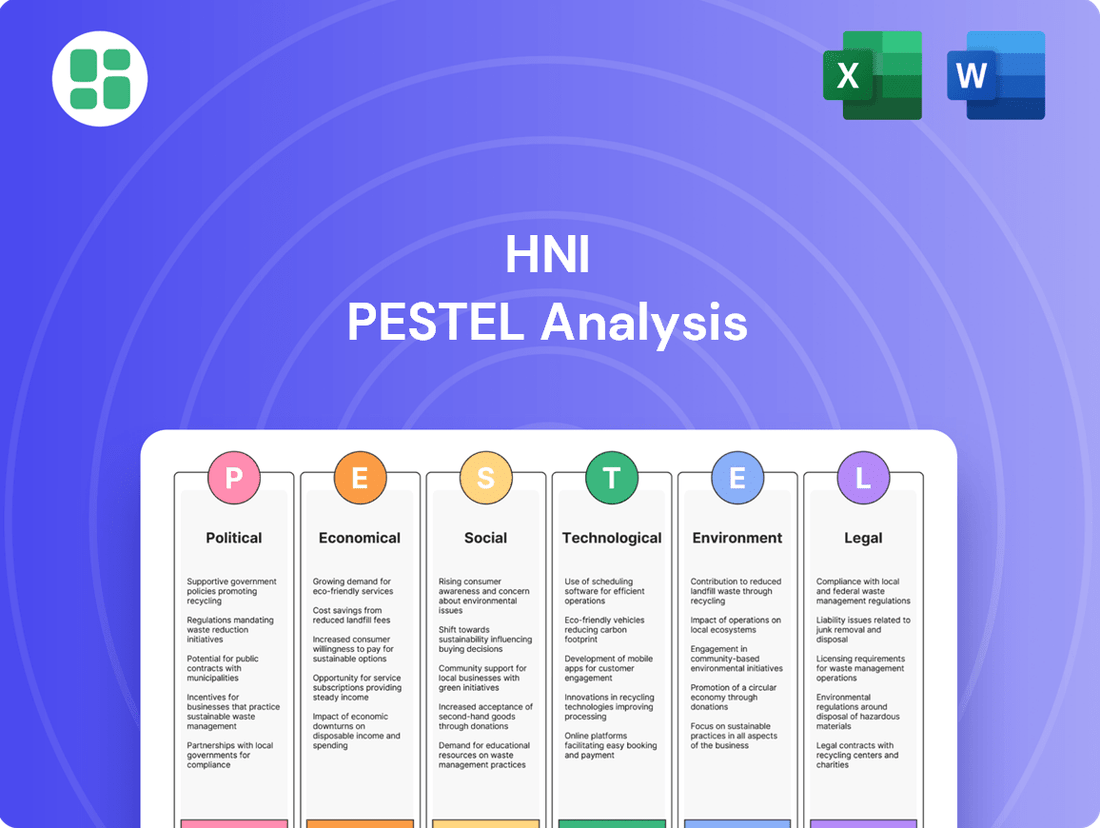

HNI PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HNI Bundle

Unlock the strategic advantages HNI holds by understanding the political, economic, social, technological, environmental, and legal forces at play. Our comprehensive PESTLE analysis provides the crucial external intelligence you need to anticipate market shifts and capitalize on opportunities. Download the full report to gain actionable insights and refine your own strategic planning.

Political factors

Changes in trade policies, such as tariffs on imported raw materials like steel and wood, directly influence HNI Corporation's production costs and market competitiveness. For instance, the U.S. imposed tariffs on steel and aluminum in 2018, which could affect HNI's input expenses for office furniture manufacturing.

Given HNI's significant presence in North America, trade agreements and potential disputes among the U.S., Canada, and Mexico are crucial. The United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA, aims to reshape regional trade dynamics and could impact HNI's supply chain and pricing strategies for both office and hearth products.

These evolving trade landscapes can necessitate adjustments in sourcing strategies, potentially leading HNI to explore more domestic suppliers or diversify its international procurement to mitigate the impact of tariffs and trade barriers, ultimately affecting the final price point of its products.

Government spending on infrastructure, including commercial and public sector buildings, directly fuels demand for workplace furnishings. For instance, the U.S. government's commitment to upgrading federal buildings and investing in new public facilities, as seen in the Biden administration's infrastructure plans, creates significant opportunities for companies like HNI. These projects often involve substantial office fit-outs, translating to increased sales for furniture manufacturers.

Fluctuations in government budgets and evolving infrastructure priorities present both opportunities and challenges. A robust infrastructure spending bill can unlock substantial market potential, while budget cuts or a shift in focus away from building projects can dampen demand. The Bipartisan Infrastructure Law, enacted in 2021, allocated over $1 trillion for infrastructure improvements, with a portion expected to benefit commercial and public office spaces through 2025 and beyond.

Federal and state-level initiatives to modernize public workspaces are particularly impactful. As governments aim to create more efficient and modern work environments for their employees, the demand for contemporary office furniture, ergonomic solutions, and collaborative space designs rises. This trend is evident in the ongoing efforts by various state governments to update their administrative buildings and create more functional workspaces, directly benefiting HNI's product lines.

The regulatory environment significantly shapes manufacturing operations for companies like HNI. In 2024, the U.S. manufacturing sector continued to navigate a complex web of federal and state regulations covering everything from workplace safety to emissions. For instance, Occupational Safety and Health Administration (OSHA) standards, which dictate safety protocols, can influence the capital expenditures required for equipment upgrades and employee training, directly impacting HNI's operational costs.

Environmental compliance, particularly concerning air and water quality, presents another critical factor. As of early 2025, the Environmental Protection Agency (EPA) continues to enforce regulations that may necessitate investments in pollution control technologies. Failure to comply can lead to substantial fines, as seen in past enforcement actions against manufacturers, making adherence a strategic imperative for HNI.

Navigating the diverse state-level regulatory frameworks across North America, where HNI operates, adds another layer of complexity. Each state may have unique labor laws, zoning requirements, and environmental permits. For example, California's stringent environmental regulations often differ from those in Texas, requiring HNI to tailor its compliance strategies and potentially its production processes to meet varying standards, impacting overall efficiency and cost.

Political Stability and Business Confidence

Political stability in North America is a cornerstone for business confidence, directly impacting HNI Corporation's (HNI) outlook. A predictable and effective government fosters an environment where companies feel secure enough to invest in new commercial spaces, a key market for HNI's office furniture and related products. This stability also translates to consumer confidence, encouraging individuals to make significant investments like purchasing new homes, which benefits HNI's residential building products segment.

In 2024, North America generally maintained a relatively stable political landscape, though regional variations exist. For instance, the US experienced ongoing policy debates and an election cycle, which can introduce short-term uncertainty. However, the underlying institutional framework has historically provided a degree of resilience. This stability is crucial for HNI, as prolonged political volatility can lead businesses to postpone capital expenditures and consumers to delay home purchases, directly dampening demand for HNI's offerings.

- Political Stability Index: North America, as a region, typically scores high on global political stability indices, though specific country rankings can fluctuate.

- Government Effectiveness: The perceived effectiveness of government in implementing policies and managing the economy influences business investment decisions.

- Consumer Confidence and Housing Market: Political stability is a significant driver of consumer confidence, which directly correlates with demand in the residential housing market, a sector HNI serves.

- Business Investment: Uncertainty stemming from political shifts can lead to a slowdown in business investment, impacting the commercial real estate sector and HNI's office furniture sales.

Incentives for Green Building and Energy Efficiency

Government incentives, like tax credits for energy-efficient upgrades, are increasingly shaping the building sector. For instance, the Inflation Reduction Act of 2022 in the United States offers significant tax credits for homeowners and businesses investing in energy-efficient improvements, including those that enhance heating and cooling systems, potentially boosting demand for HNI's energy-saving hearth products.

Policies that mandate or encourage green building certifications, such as LEED or BREEAM, directly influence material and product selection. As of 2024, a growing number of commercial projects are targeting LEED certification, creating a market advantage for manufacturers like HNI that can demonstrate the environmental performance and sustainability of their office furniture and hearth products.

Initiatives focused on reducing the carbon footprint of buildings are also gaining traction globally. Many municipalities are setting ambitious carbon reduction targets for new construction and renovations. This trend supports the market for products that contribute to lower embodied carbon and operational energy savings, aligning with HNI's sustainable product offerings.

- Tax Credits: The US federal residential clean energy tax credit, for example, can cover a portion of the cost for qualifying energy-efficient home improvements, directly impacting consumer purchasing decisions for hearth products.

- Green Building Standards: LEED-certified buildings often specify products with low VOC emissions and recycled content, areas where HNI has focused its sustainability efforts for office furniture.

- Carbon Reduction Goals: Many cities are implementing building codes that require new commercial buildings to meet specific energy performance benchmarks, indirectly favoring manufacturers of energy-efficient components.

Political stability in North America is crucial for HNI's business, influencing investment in commercial spaces and consumer confidence for housing. While generally stable, the 2024 election cycle in the US introduced some short-term uncertainty.

Government spending on infrastructure, particularly on public buildings, directly drives demand for HNI's workplace furnishings. The Bipartisan Infrastructure Law, with over $1 trillion allocated through 2025, presents significant opportunities for companies like HNI in upgrading federal and public facilities.

Trade policies, including tariffs and regional agreements like USMCA, directly impact HNI's production costs and supply chain. Navigating these evolving trade landscapes requires strategic adjustments in sourcing to mitigate risks and maintain competitiveness.

Regulatory environments, from workplace safety standards by OSHA to EPA emissions controls, necessitate ongoing capital expenditures and compliance efforts. State-level variations in labor and environmental laws also add complexity to HNI's operational strategies across North America.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the HNI, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The HNI PESTLE Analysis offers a streamlined, visually organized overview of external factors, alleviating the pain point of sifting through complex data during strategic discussions.

Economic factors

North America's economic health, measured by GDP growth, significantly impacts spending on furniture and building products. A strong economy fuels commercial development and residential construction, boosting demand for HNI's products. For instance, in Q1 2024, the U.S. GDP grew at an annualized rate of 1.3%, indicating moderate economic expansion that supports consumer and business spending.

Conversely, economic slowdowns can curb capital expenditure and delay home renovations, directly affecting HNI's revenue streams. A projected U.S. GDP growth of 2.1% for 2024 suggests continued, albeit moderate, demand, but any significant deceleration could pose challenges.

The commercial real estate market is showing signs of stabilization, with projections for cautious optimism in 2025. This is a critical factor for HNI, as an up-cycle in office spaces, anticipated for 2025, directly influences demand for their workplace furnishings. For instance, commercial construction spending in the US reached an annualized rate of $270.5 billion in April 2024, indicating a foundational level of activity.

While the residential construction sector faced challenges in 2024, particularly impacting building products, a return to growth is expected in 2025. Single-family housing is predicted to see moderate growth, a positive sign for hearth products. However, multifamily construction is anticipated to decline, a trend that could temper overall residential demand.

Interest rates play a crucial role in influencing HNI's operational costs and investment decisions. For instance, a business looking to expand its office space or undertake new construction projects in 2024 would face higher borrowing costs due to elevated interest rates. Conversely, the anticipation of potential interest rate cuts by the Federal Reserve in mid-2025 could stimulate investment and consumer spending, potentially benefiting HNI's market.

Inflation directly impacts HNI's bottom line by increasing expenses for raw materials, labor, and transportation. If inflation remains at a projected 3.2% for 2024, as some forecasts suggest, HNI must implement strategies to mitigate the erosion of its profit margins. Managing these cost pressures effectively will be key to maintaining profitability in the current economic climate.

Raw Material Costs and Supply Chain Volatility

Fluctuations in the prices of key raw materials such as steel and lumber, alongside persistent supply chain disruptions, directly influence HNI's production expenses. While certain material costs, like steel, experienced year-over-year decreases in 2024, they generally remain higher than pre-pandemic figures. Projections suggest moderate price increases for materials like lumber in 2025.

HNI is actively managing economic uncertainties stemming from tariff volatility and increasing inflation expectations. These factors create a challenging environment for cost management and pricing strategies.

- Steel prices: Declined year-over-year in 2024 but remain above pre-pandemic levels.

- Lumber prices: Expected to see moderate increases in 2025.

- Supply Chain: Ongoing disruptions continue to impact material availability and cost.

- Economic Factors: Tariff uncertainty and rising inflation expectations contribute to volatility.

Consumer Spending and Disposable Income

Consumer confidence and disposable income are pivotal for the residential building products market, especially for items like hearth products that represent discretionary spending. Higher disposable income directly translates into increased consumer willingness to invest in home enhancements and premium goods.

Economic forecasts for 2025 suggest a positive trajectory for consumer spending, which is a key engine for overall economic growth. This trend is expected to bolster demand for residential building products.

- Consumer Confidence: The Conference Board Consumer Confidence Index stood at 102.0 in May 2024, indicating a generally positive outlook, though slightly down from April's 104.0.

- Disposable Income Growth: Real disposable personal income increased at an annual rate of 2.1% in the first quarter of 2024, according to the Bureau of Economic Analysis.

- Projected Spending: Analysts anticipate continued growth in consumer spending through 2025, driven by factors like a stable labor market and potential wage increases.

- Impact on Home Improvement: This sustained consumer spending power is projected to fuel demand for home improvement projects, including the purchase of decorative and functional building products.

Economic factors significantly shape HNI's performance, with GDP growth directly influencing demand for both residential and commercial building products. While moderate GDP growth was observed in early 2024, projections for the remainder of the year and into 2025 suggest continued, though potentially uneven, market expansion.

Interest rate trends and inflation levels are critical for managing operational costs and investment decisions. Anticipated interest rate adjustments in mid-2025 could stimulate spending, while persistent inflation necessitates careful cost management to protect profit margins.

Fluctuations in raw material prices, such as steel and lumber, alongside ongoing supply chain challenges, directly impact HNI's production expenses. While some material costs saw year-over-year declines in 2024, they remain elevated compared to pre-pandemic levels, with moderate increases anticipated for lumber in 2025.

Consumer confidence and disposable income are vital drivers for the residential segment, particularly for discretionary items. Positive consumer sentiment and income growth observed in early 2024 are expected to continue, supporting demand for home enhancements through 2025.

| Economic Indicator | Value/Projection | Period | Impact on HNI |

|---|---|---|---|

| US GDP Growth | 1.3% (annualized) | Q1 2024 | Supports consumer and business spending. |

| US GDP Growth Projection | 2.1% | 2024 | Indicates continued moderate demand. |

| Interest Rates | Elevated, potential cuts anticipated | Mid-2025 | Affects borrowing costs and investment decisions. |

| Inflation Projection | 3.2% | 2024 | Increases raw material, labor, and transportation costs. |

| Steel Prices | Year-over-year decline, above pre-pandemic | 2024 | Impacts production expenses. |

| Lumber Prices | Moderate increases expected | 2025 | Impacts production expenses. |

| Consumer Confidence Index | 102.0 | May 2024 | Generally positive outlook for discretionary spending. |

| Real Disposable Personal Income Growth | 2.1% (annual rate) | Q1 2024 | Boosts willingness for home enhancements. |

Preview Before You Purchase

HNI PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive HNI PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting HNI Corporation. It provides a thorough strategic overview for informed decision-making.

Sociological factors

The shift to hybrid work is profoundly altering office design, with a growing preference for collaborative zones over individual cubicles. This trend directly impacts furniture manufacturers like HNI, necessitating a pivot towards adaptable, multi-functional pieces that support hot-desking and spontaneous team interactions.

By 2024, it's estimated that over 40% of the global workforce will be engaged in hybrid work arrangements, a significant increase from pre-pandemic levels. HNI's strategic response involves developing furniture solutions that facilitate seamless transitions between focused work and team-based activities, often incorporating integrated technology for enhanced connectivity.

The modern workplace is increasingly prioritizing employee well-being, with a significant trend towards wellness-centric office environments. This shift is directly fueling demand for ergonomic furniture, dedicated quiet zones, relaxation areas, and biophilic design elements that incorporate nature. For instance, a 2024 survey indicated that 70% of employees believe a comfortable workspace positively impacts their productivity.

HNI can effectively leverage this sociological factor by expanding its product lines to directly address these employee comfort and health needs. Offering a wider range of certified ergonomic chairs, adjustable desks, and acoustically optimized partitions can position HNI as a key partner for businesses investing in their workforce's physical and mental health, thereby boosting employee retention and overall output.

Demographic shifts are significantly reshaping the housing market, directly impacting demand for building products. For instance, an aging housing stock, with a substantial portion of homes now over 20 years old, creates a growing need for renovations and upgrades. This presents a considerable opportunity for segments like hearth products, as homeowners look to modernize and improve their living spaces.

The sustained high cost of homeownership continues to be a major driver for rental demand, particularly for apartments. This trend influences commercial building activity, as developers respond to the need for more multi-family housing units. In 2024, the U.S. median home price remained elevated, hovering around $420,000, further solidifying apartment living as an attractive option for many.

Sustainability and Ethical Consumption Preferences

Consumers and businesses are increasingly prioritizing sustainability and ethical production, a trend that significantly impacts purchasing decisions. This growing consciousness fuels demand for products crafted from recycled materials, sustainably sourced resources, and those demonstrating a reduced environmental impact.

For instance, a 2024 survey indicated that 73% of global consumers are willing to change their consumption habits to reduce their environmental impact. This highlights a substantial market opportunity for companies aligning with these values.

HNI's demonstrated commitment to sustainability and transparent reporting directly addresses this evolving consumer preference. By highlighting their efforts in areas like responsible sourcing and reduced emissions, HNI can effectively attract and retain this valuable market segment.

- Growing Consumer Demand: 73% of global consumers in 2024 reported willingness to alter consumption habits for environmental benefit.

- Material Preferences: Increased demand for products made from recycled content and sustainably sourced materials.

- Ethical Sourcing Focus: Consumers are scrutinizing supply chains for ethical labor practices and environmental stewardship.

- Brand Reputation Impact: Companies with strong sustainability credentials often experience enhanced brand loyalty and market share.

Lifestyle Changes and Home as a Hub

The lines between work and home are increasingly blurred, transforming residences into multifaceted hubs. This shift fuels demand for integrated home office solutions, with the global home office furniture market projected to reach $38.8 billion by 2027, growing at a CAGR of 5.1% from 2022. Consumers are investing in functional yet stylish setups that accommodate both professional and personal needs.

This trend also elevates the importance of hearth products, not just for warmth but for creating a comfortable and inviting atmosphere. The hospitality sector is capitalizing on this, with many hotels incorporating fireplaces and sophisticated hearth designs to enhance guest experiences. This reflects a broader societal desire for enhanced residential comfort and ambiance.

- Home Office Growth: The demand for dedicated home office spaces is a significant driver, impacting furniture and technology sales.

- Ambiance Demand: Hearth products are increasingly sought after for their role in creating cozy and aesthetically pleasing living environments.

- Hospitality Integration: The hospitality industry's adoption of hearth features signals a broader consumer appreciation for these elements.

Sociological factors highlight a growing emphasis on employee well-being, driving demand for ergonomic and health-conscious office environments. Furthermore, evolving work-life integration fuels the desire for adaptable home office setups and enhanced residential comfort, impacting furniture and hearth product markets.

Technological factors

The increasing adoption of smart office technologies and IoT integration is reshaping how businesses operate and design their workspaces. This trend presents a significant opportunity for HNI to innovate within its product lines.

By embedding sensors and connectivity into office furniture, HNI can offer solutions that monitor space utilization, manage lighting and climate control, and provide seamless device integration. For instance, smart desks could automatically adjust height based on user presence or time of day, optimizing comfort and energy use.

In 2024, the global smart office market was valued at approximately $35.6 billion, with projections indicating substantial growth. Companies are increasingly investing in these technologies to boost employee productivity and achieve greater energy efficiency, aligning with sustainability goals.

HNI's ability to develop and market 'smart' furniture solutions that cater to these evolving demands could lead to enhanced customer value, improved operational efficiency within client organizations, and a stronger competitive position in the evolving office furniture market.

The adoption of advanced manufacturing techniques, particularly automation and robotics, is significantly boosting production efficiency for companies like HNI. By integrating these technologies, HNI can expect reduced labor costs and enhanced product quality, directly impacting their bottom line. For instance, the global industrial robotics market was valued at approximately USD 50 billion in 2023 and is projected to grow substantially, indicating a strong industry trend towards automation.

Investments in automation enable faster production cycles and greater customization capabilities, allowing HNI to respond more effectively to market demands. This technological shift also provides a strategic advantage in overcoming labor shortages prevalent in sectors like construction and manufacturing, ensuring a more consistent and reliable output.

The growing trend of consumers buying office furniture and hearth products online means HNI must have strong e-commerce operations. This includes investing in easy-to-use websites and virtual showrooms to connect with more customers and adapt to how people prefer to shop.

In 2024, the global e-commerce market for home furnishings was projected to reach over $160 billion, highlighting the significant opportunity for companies like HNI to leverage digital platforms. By enhancing their online presence and distribution, HNI can tap into this expanding market and meet changing customer expectations.

Material Innovation and Product Development

Ongoing research and development in material science is a significant technological driver for companies like HNI. Innovations in lightweight composites, recycled plastics, and advanced wood alternatives are paving the way for more sustainable, durable, and cost-effective hearth products. For instance, the global advanced composites market was valued at approximately $110 billion in 2023 and is projected to grow substantially, indicating a strong demand for these materials.

Furthermore, advancements in hearth product technology are focusing on enhanced energy efficiency and cleaner burning processes. This includes developments in combustion systems and heat exchange mechanisms. By 2025, it's anticipated that the market for energy-efficient home appliances will see continued expansion, driven by both consumer demand and regulatory pushes toward sustainability.

These material and technological innovations directly impact product development by enabling:

- Development of lighter, stronger, and more aesthetically versatile hearth products.

- Improved energy efficiency, leading to lower operating costs for consumers and reduced environmental impact.

- Integration of smart technologies for enhanced user experience and control.

- Utilization of recycled and renewable materials, aligning with growing consumer preferences for eco-friendly products.

AI and Data Analytics in Design and Operations

Artificial Intelligence (AI) and advanced data analytics are revolutionizing how businesses like HNI operate. These technologies enable predictive demand forecasting and streamline supply chain management, leading to greater efficiency. For instance, AI-powered tools can analyze vast datasets to anticipate customer needs, potentially reducing inventory holding costs by an estimated 15-20% in the coming years.

Beyond operational efficiencies, AI is key to personalizing product design and enhancing customer service. By understanding individual preferences through data, HNI can tailor offerings, boosting customer satisfaction and loyalty. In 2024, companies leveraging AI for customer interaction reported an average increase of 10% in customer retention rates.

Furthermore, AI integration into smart office solutions offers significant advantages. These systems can optimize space utilization, leading to potential cost savings on real estate and utilities. Early adopters of smart office technology in 2024 saw an average improvement of 12% in energy efficiency within their facilities.

- AI-driven demand forecasting can reduce excess inventory by up to 20%.

- Personalized customer experiences powered by AI can boost retention by 10%.

- Smart office solutions can improve energy efficiency by an average of 12%.

- Data analytics in product design allows for faster iteration cycles and market responsiveness.

The integration of AI and advanced analytics offers significant operational advantages for HNI, enabling more accurate demand forecasting and optimized supply chain management. For example, AI tools can potentially reduce inventory holding costs by 15-20% by anticipating customer needs more effectively.

AI also facilitates personalized product design and enhances customer service, with companies using AI for customer interaction reporting a 10% increase in customer retention rates in 2024. Furthermore, smart office technologies powered by AI can improve facility energy efficiency by an average of 12%.

| Technology | Impact on HNI | 2024/2025 Data Point |

| AI & Data Analytics | Improved forecasting, supply chain efficiency, personalized customer experience | AI-driven customer interaction increased retention by 10% in 2024. |

| Smart Office Tech | Optimized space utilization, enhanced energy efficiency | Smart office adoption led to 12% average energy efficiency improvement. |

| E-commerce Platforms | Expanded market reach, improved customer shopping experience | Global home furnishings e-commerce projected over $160 billion in 2024. |

Legal factors

HNI must navigate a complex web of product safety and quality regulations across its diverse product lines. For office furniture, this includes standards related to flammability, stability, and durability, ensuring products are safe for everyday use in various environments. Failure to meet these can result in costly recalls, as seen in the furniture industry where recalls, often driven by safety concerns, can cost millions.

Similarly, HNI's hearth products are subject to strict codes concerning emissions and installation safety. For instance, the U.S. Environmental Protection Agency (EPA) sets emission standards for wood-burning appliances, with ongoing reviews and potential tightening of these regulations impacting manufacturing processes. Non-compliance not only poses safety risks to consumers but also carries significant legal liabilities and can severely damage brand reputation, impacting market access and consumer trust.

HNI, with its workforce of roughly 7,700 individuals, must meticulously adhere to labor laws. This includes staying compliant with wage and hour rules, upholding workplace safety standards like those enforced by OSHA, and maintaining strict non-discrimination policies. Failure to comply can lead to significant financial penalties and reputational damage.

Evolving labor regulations directly influence HNI's operational expenditures and human resource strategies. For instance, shifts in minimum wage laws or new safety mandates can necessitate budget adjustments and policy overhauls, impacting overall profitability.

The company's distinct 'member-owner culture' introduces a layer of complexity to its employment regulations. This unique structure suggests specific internal governance frameworks that must align with employee rights and responsibilities, potentially differing from traditional corporate models.

Protecting its intellectual property is paramount for HNI's sustained competitive edge. This includes safeguarding unique designs, proprietary manufacturing techniques, and established brand names through robust patent, trademark, and copyright registrations. HNI must also actively monitor for and pursue legal recourse against any infringement of its intellectual assets.

Conversely, HNI is obligated to meticulously ensure its product offerings and operational methods do not violate the intellectual property rights of other entities. This diligence is essential to avoid costly litigation and maintain market integrity. For instance, in 2024, the global intellectual property litigation market saw significant activity, underscoring the importance of such compliance.

Environmental Compliance and Emissions Standards

HNI's manufacturing, particularly for hearth products, faces stringent environmental regulations like EPA standards for emissions from stoves and fireplaces. These rules govern air quality and waste disposal, directly impacting product development and operational costs.

The push for stricter emissions standards, especially in 2024 and 2025, necessitates innovation in cleaner-burning technologies for hearths. Failure to meet these evolving standards can result in significant fines and jeopardize operating licenses, underscoring the critical need for ongoing compliance efforts.

- Emissions Standards: EPA regulations set limits on particulate matter and other pollutants from residential wood heaters.

- Compliance Costs: Manufacturers must invest in research and development for compliant products, potentially increasing production expenses.

- Market Access: Non-compliance can restrict market access, as many regions and retailers require proof of adherence to environmental standards.

Data Privacy and Cybersecurity Laws

As HNI increasingly integrates digital solutions like e-commerce and smart office technology, adherence to data privacy legislation, such as the California Consumer Privacy Act (CCPA), and cybersecurity mandates is paramount. These regulations are evolving, with many jurisdictions strengthening their data protection frameworks. For instance, in 2024, the global cybersecurity market was projected to reach over $200 billion, highlighting the increasing focus on data security.

Maintaining robust cybersecurity measures is crucial for safeguarding sensitive customer and proprietary company information. Failure to comply can result in significant legal penalties and reputational damage. HNI must ensure transparent data handling practices, especially for its smart products, to build and retain customer trust in an era of heightened data awareness.

- CCPA Compliance: Ensuring all data collection and usage aligns with the CCPA's consumer rights regarding personal information.

- Cybersecurity Investment: Allocating resources to advanced security infrastructure and threat detection to protect against breaches.

- Smart Product Transparency: Clearly communicating data collection and usage policies for all connected devices and services.

- Regulatory Monitoring: Staying abreast of new and updated data privacy and cybersecurity laws globally, which saw a 15% increase in enforcement actions in 2024.

HNI must adhere to a growing body of product safety and environmental regulations, impacting design and manufacturing. For instance, evolving EPA emissions standards for hearth products, with potential tightening in 2024-2025, require investment in cleaner technologies. Failure to comply can lead to fines and market restrictions.

Labor laws, including wage, hour, and workplace safety standards, are critical for HNI's approximately 7,700 employees. Non-compliance can result in significant penalties and reputational harm, particularly given the company's unique member-owner culture which may necessitate specific internal governance alignments.

Intellectual property protection and non-infringement are paramount. HNI must safeguard its designs and trademarks while ensuring its products do not violate others' IP rights, a growing concern as global IP litigation saw substantial activity in 2024.

Data privacy and cybersecurity are increasingly important, especially with HNI's digital integration. Compliance with regulations like CCPA is essential, as demonstrated by the global cybersecurity market projected to exceed $200 billion in 2024, with a 15% increase in enforcement actions observed in the same year.

Environmental factors

The intensifying focus on sustainability and the circular economy is compelling HNI to prioritize product design for durability, recyclability, and the use of recycled or renewable materials. This shift directly influences HNI's operational strategies and product development pipeline.

HNI's commitment to sustainability is evident in its initiatives, such as the installation of new solar power systems. For example, in 2023, HNI completed a significant solar project at its Orrville, Ohio facility, generating approximately 3.5 million kilowatt-hours of clean energy annually, reducing its carbon footprint by over 2,500 metric tons.

These efforts extend to waste reduction and enhanced material efficiency across its manufacturing processes. HNI is also actively exploring product take-back programs to further integrate circular economy principles, aiming to minimize landfill waste and maximize resource utilization.

HNI's significant reliance on wood and other natural resources for its furniture and home décor products means that responsible sourcing is crucial. This directly addresses concerns about deforestation and unsustainable harvesting practices, which could impact future supply and brand image.

To counter these risks and appeal to environmentally conscious consumers, HNI can leverage certifications like FSC (Forest Stewardship Council). In 2024, the demand for certified sustainable wood products continued to grow, with FSC-certified timber sales showing a steady increase year-over-year.

Looking ahead to 2025, the market anticipates moderate price increases for timber due to projected shortages in certain regions. This underscores the importance of securing stable, sustainable supply chains and potentially exploring alternative materials.

HNI is actively working to reduce its energy consumption and carbon footprint. The company's commitment is evident in its investment in renewable energy, such as the solar installation at its Orrville, Ohio facility, which is expected to generate approximately 2.7 million kilowatt-hours of electricity annually. This initiative directly addresses the environmental factor of energy usage in manufacturing.

Furthermore, HNI is focusing on developing energy-efficient hearth products. This strategy aligns with market demand for sustainable solutions and contributes to reducing the overall carbon footprint associated with product use. By promoting energy-efficient designs, HNI can gain a competitive edge and appeal to environmentally conscious consumers.

Regulatory pressures, like the U.S. Securities and Exchange Commission's (SEC) proposed climate disclosure rules, are also driving companies like HNI to enhance their reporting on greenhouse gas (GHG) emissions. As of 2023, many companies are increasing their transparency regarding Scope 1 and Scope 2 emissions, with a growing focus on Scope 3 as well, pushing for tangible reductions in their environmental impact.

Waste Management and Pollution Control

Effective waste management is paramount for HNI, impacting both operational costs and its environmental footprint. Reducing manufacturing waste, for instance, can lead to significant material savings. In 2024, many industries are focusing on circular economy principles to minimize waste, with some reporting up to a 15% reduction in landfill waste through better sorting and recycling programs.

Responsible disposal of hazardous materials is non-negotiable, requiring adherence to strict regulations to prevent environmental contamination. Failure to comply can result in hefty fines and reputational damage. For example, in 2023, the EPA levied millions in penalties for improper hazardous waste handling.

Minimizing air and water pollution is also critical. HNI must invest in advanced filtration and treatment technologies. By 2025, stricter emissions standards are expected globally, pushing companies to adopt cleaner production processes. Companies that proactively invest in pollution control often see improved efficiency and reduced long-term compliance costs.

- Waste Reduction: Aiming for a 10-20% decrease in manufacturing waste by 2025 through process optimization.

- Hazardous Material Management: Ensuring 100% compliance with all local and international hazardous waste disposal regulations.

- Pollution Control Investment: Allocating a specific budget for upgrading air and water pollution control systems, potentially seeing a 5% reduction in emissions.

- Public Image: Maintaining a positive corporate image by transparently reporting on environmental performance and sustainability initiatives.

Climate Change Adaptation and Resilience

The escalating frequency and intensity of extreme weather events, a direct consequence of climate change, pose significant threats to HNI's global operations. These disruptions can severely impact supply chains, from the sourcing of raw materials like wood and textiles to the timely delivery of finished furniture. For instance, increased flooding in Southeast Asia, a key manufacturing hub for many furniture companies, could lead to production delays and increased transportation costs.

Building resilience into HNI's operational framework is therefore paramount. This involves a proactive approach to identifying and mitigating climate-related risks, such as investing in more robust logistics and diversifying sourcing locations to reduce reliance on climate-vulnerable regions. Companies are increasingly embedding climate risk assessments into their core strategic planning processes, recognizing that adaptation is not just an environmental imperative but a business necessity.

In 2024, many companies are allocating substantial capital towards climate adaptation strategies. For example, a significant portion of corporate sustainability budgets are now directed towards supply chain resilience initiatives. Furthermore, financial institutions are increasingly factoring climate risk into their lending and investment decisions, potentially impacting HNI's cost of capital if adaptation measures are not adequately addressed.

- Supply Chain Vulnerability: Extreme weather events can disrupt raw material sourcing and manufacturing processes.

- Operational Adaptation: HNI must adapt its manufacturing and distribution networks to withstand potential climate-related disruptions.

- Strategic Integration: Climate risk is becoming a central component of long-term business strategy and planning.

- Investment in Resilience: Companies are increasing investments in supply chain resilience, with a growing focus on climate adaptation measures.

HNI's environmental strategy is increasingly shaped by consumer demand for sustainable products and regulatory pressures on emissions. The company's investment in solar power, like the Orrville, Ohio facility's 3.5 million kWh annual generation, demonstrates a commitment to reducing its carbon footprint. By 2025, HNI aims for a 10-20% reduction in manufacturing waste, aligning with circular economy principles.

The company's reliance on wood necessitates responsible sourcing, with FSC-certified timber sales showing steady growth. Anticipated timber price increases in 2025 due to regional shortages highlight the need for supply chain resilience and material diversification. HNI is also focusing on energy-efficient hearth products to meet market demand for sustainable solutions.

Climate change poses risks to HNI's global operations, impacting supply chains and logistics. Proactive adaptation strategies, including supply chain diversification and climate risk assessments, are becoming critical for business continuity and cost of capital management. Companies are channeling substantial capital into climate adaptation, with financial institutions increasingly factoring climate risk into investment decisions.

| Environmental Focus | HNI Initiatives/Data | 2024/2025 Outlook |

|---|---|---|

| Renewable Energy | Orrville, OH solar project: 3.5 million kWh annually | Continued investment in clean energy generation |

| Waste Reduction | Target: 10-20% decrease in manufacturing waste by 2025 | Focus on circular economy principles and process optimization |

| Sustainable Sourcing | Growing demand for FSC-certified wood products | Potential timber price increases due to regional shortages |

| Energy Efficiency | Development of energy-efficient hearth products | Meeting consumer demand for sustainable, lower-emission products |

| Climate Resilience | Integrating climate risk into strategic planning | Increased capital allocation towards supply chain adaptation |

PESTLE Analysis Data Sources

Our HNI PESTLE Analysis is meticulously constructed using a blend of publicly available government data, reports from reputable international organizations, and in-depth industry-specific research. This ensures that every aspect, from political stability to technological advancements, is grounded in robust and current information.