HNI Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HNI Bundle

HNI's competitive landscape is shaped by several powerful forces, from the bargaining power of its buyers to the looming threat of new entrants. Understanding these dynamics is crucial for navigating the office furniture and building products industries.

The complete report reveals the real forces shaping HNI’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

HNI Corporation, a major player in office furniture and hearth products, sources essential materials like steel, wood, fabrics, plastics, and electronic components. The strength of suppliers hinges on market concentration and the uniqueness of their offerings. For instance, if a single supplier controls a vital part, HNI might face increased costs due to that supplier's leverage.

The bargaining power of suppliers for HNI is significantly influenced by the switching costs involved. If HNI faces substantial expenses or operational disruptions when changing suppliers, such as the need for new machinery or extensive product redesign, existing suppliers gain considerable leverage. For instance, if a key component supplier for HNI's office furniture requires significant retooling of its own production lines to accommodate a new HNI design, that supplier's bargaining power increases.

Conversely, when switching costs are low, HNI can more easily explore alternative suppliers, thereby diminishing supplier power. Imagine if HNI sources a standard office supply item like pens; if multiple suppliers offer comparable products with minimal integration effort, HNI can readily shift its business, limiting any single supplier's ability to dictate terms. In 2024, the global supply chain disruptions highlighted how critical these switching costs are; companies that could pivot to new suppliers quickly were better positioned, demonstrating the direct link between switching ease and supplier leverage.

The availability of substitute inputs significantly dampens the bargaining power of HNI's suppliers. If HNI can easily switch to alternative raw materials or components, suppliers of its current inputs have less room to dictate terms. For instance, if HNI's furniture manufacturing relies on specific wood types, but readily available composite materials or recycled plastics can be used, the power of traditional wood suppliers diminishes.

Importance of HNI to Suppliers

The significance of HNI (High Net Worth Individuals) as a customer heavily influences its suppliers' bargaining power. If HNI constitutes a substantial part of a supplier's overall income, that supplier is likely to be more accommodating with terms and less likely to push for price hikes, valuing the continued business relationship.

For suppliers that are smaller or cater to niche markets, HNI's patronage can be particularly vital. This dependence can shift the balance, giving HNI more leverage in negotiations.

- Supplier Revenue Dependence: If HNI accounts for a significant percentage of a supplier's annual revenue, the supplier's ability to dictate terms diminishes. For instance, if a key supplier to HNI reported that 30% of its 2024 revenue came from HNI clients, it would be highly motivated to maintain that relationship.

- Niche Market Reliance: For specialized service providers or luxury goods manufacturers, HNI clients may represent the majority of their customer base. A bespoke automotive supplier, for example, might find 70% of its sales in 2024 were to HNI customers, making it very sensitive to HNI demands.

- Strategic Importance: Beyond direct revenue, supplying to HNI can also offer suppliers prestige and access to a high-profile client network, further increasing HNI's leverage.

Forward Integration Threat by Suppliers

The threat of suppliers forward integrating, meaning they could begin producing office furniture or hearth products themselves, is a key factor in assessing their bargaining power. This potential move by suppliers to compete directly with HNI Corporation would significantly bolster their leverage in negotiations.

However, for HNI’s core industries, this threat is generally considered low. Establishing a manufacturing operation, building a recognized brand, and creating a robust distribution network requires substantial capital investment, making it a high barrier to entry for most suppliers looking to compete with established players like HNI.

Despite the generally low threat, suppliers’ potential for forward integration can still influence pricing and supply terms. For instance, if a key supplier demonstrates the capacity and willingness to move into manufacturing, HNI might face pressure on input costs or contract conditions.

- Supplier Forward Integration Threat: Suppliers moving into direct competition with HNI by manufacturing office furniture or hearth products themselves.

- Impact on Bargaining Power: A credible threat of forward integration significantly increases supplier leverage.

- Industry Barriers: High capital requirements, brand building, and distribution network needs generally limit this threat in HNI's sectors.

- Influence on Terms: Even a low-probability threat can affect HNI's pricing and supply agreements.

The bargaining power of suppliers for HNI Corporation is influenced by several factors, including the concentration of suppliers, the uniqueness of their products, and the switching costs for HNI. When suppliers are few and their offerings are specialized, their power increases, potentially leading to higher input costs for HNI. For instance, in 2024, many industries experienced supply chain volatility, where specialized component suppliers held significant leverage due to limited alternatives.

HNI's reliance on specific suppliers also plays a crucial role. If HNI represents a substantial portion of a supplier's revenue, the supplier is more likely to offer favorable terms to retain HNI's business. Conversely, if HNI can easily switch to alternative suppliers for materials like standard plastics or basic wood, supplier power is reduced. The threat of suppliers forward integrating into HNI's business is generally low due to high capital and brand-building barriers, but even a perceived threat can influence negotiations.

| Factor | Impact on HNI | Example (2024 Context) |

|---|---|---|

| Supplier Concentration | High power for few suppliers | A single dominant steel supplier for office furniture frames |

| Switching Costs | High costs increase supplier leverage | HNI needing custom machinery for a new fabric supplier |

| Customer Dependence (HNI's share of supplier revenue) | Low dependence by supplier increases HNI's leverage | If HNI is 5% of a supplier's 2024 revenue, the supplier has less power |

| Forward Integration Threat | Low threat in HNI's core sectors | Suppliers lack capital for large-scale furniture manufacturing |

What is included in the product

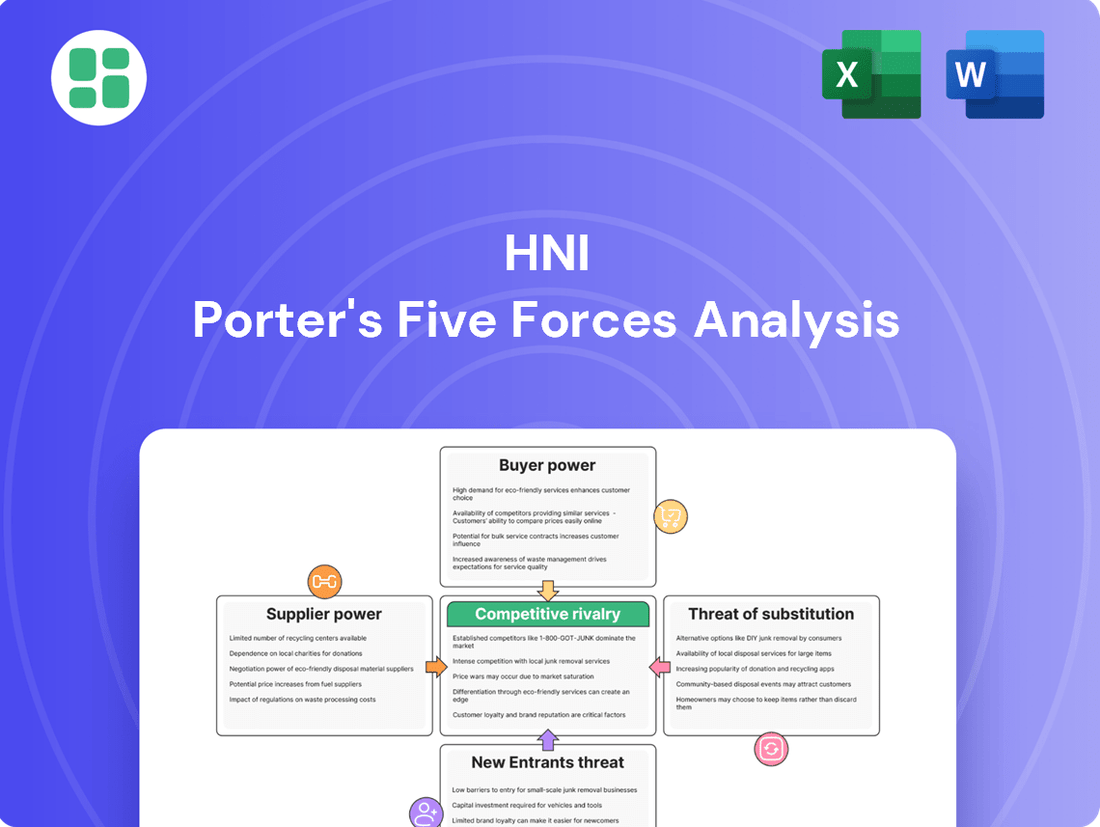

This analysis dissects the competitive landscape for HNI by examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Instantly identify and quantify competitive pressures, alleviating the pain of strategic uncertainty.

Customers Bargaining Power

HNI's customer base is diverse, encompassing large commercial clients, government agencies, and individual residential consumers, often reached through extensive dealer and distributor networks. This broad reach means that while individual customers might have limited power, the concentration and purchasing volume of certain segments can significantly shift the balance.

For instance, major commercial clients or government contracts, representing substantial order volumes, can leverage their scale to negotiate more favorable pricing and terms. This is a common dynamic in industries where large, repeat orders are crucial for revenue generation, allowing these powerful customers to exert considerable influence on HNI's profitability and operational flexibility.

The ease with which HNI's customers can switch to a competitor's offerings significantly influences their bargaining power. In the office furniture sector, switching can involve considerable effort, including new installation logistics and potential compatibility problems with existing setups, or even the forfeiture of current warranties.

For hearth products, however, the barriers to switching are often much lower. This is particularly true for customers undertaking new installations or simply replacing an existing unit, which directly enhances their leverage when negotiating prices or terms with HNI.

Customers' price sensitivity directly impacts their bargaining power. In highly competitive sectors, like the office furniture market where HNI operates, a wide array of alternatives means customers are often very attuned to price differences. This can force manufacturers to compete more on cost, potentially squeezing profit margins.

Consider the residential hearth products segment. Consumers in this market frequently engage in price comparisons across different brands and even alternative heating solutions. For instance, a homeowner might weigh the cost of a gas fireplace against electric options or even traditional heating systems. This comparison shopping behavior amplifies customer bargaining power, as they can readily shift to a lower-priced competitor if HNI's pricing is perceived as too high.

Availability of Substitutes for Customers

The availability of substitutes significantly strengthens customer bargaining power for HNI Corporation. When customers have numerous alternatives, they are less reliant on HNI's specific products and can more easily switch if prices increase or quality declines. This forces HNI to remain competitive.

For HNI's office furniture segment, the rise of flexible co-working spaces and the continued prevalence of remote work arrangements offer viable alternatives to traditional office setups. This means businesses can opt for shared office solutions or equip home offices instead of purchasing large quantities of HNI's furniture. In 2024, the flexible workspace market continued its expansion, with reports indicating a steady demand for co-working solutions globally.

Similarly, in the hearth products sector, customers have a wide array of alternative heating solutions. Options such as energy-efficient heat pumps, modern central heating systems, and even electric fireplaces provide comparable comfort and functionality to HNI's wood and gas fireplaces and stoves. The increasing adoption of heat pump technology, driven by energy efficiency goals, presents a strong substitute.

- Substitutes for Office Furniture: Co-working spaces, remote work setups, and shared office solutions reduce reliance on HNI's traditional office furniture.

- Substitutes for Hearth Products: Heat pumps, central heating systems, and electric heaters offer alternative comfort and heating capabilities.

- Market Trends: The growing flexible workspace market and the increasing adoption of energy-efficient heating technologies like heat pumps in 2024 underscore the competitive landscape.

Customer Information and Product Differentiation

Customers today are incredibly well-informed, with easy access to competitor pricing, product features, and independent quality reviews. This readily available information significantly enhances their bargaining power. For instance, in the financial services sector, comparison websites and financial aggregators allow individuals to easily benchmark HNI's offerings against rivals, potentially driving down prices or demanding more favorable terms, especially for standardized products.

HNI, like many companies, navigates this by offering a diverse portfolio and focusing on value and superior customer service. However, the digital landscape means that even for less differentiated products, customers can leverage detailed online comparisons to negotiate better deals. This dynamic means that maintaining a clear competitive edge through unique product features or exceptional service becomes crucial to mitigating customer bargaining power.

Consider the impact of online reviews. A 2024 survey indicated that over 80% of consumers read online reviews before making a purchase decision. For HNI, positive reviews highlighting unique value propositions can strengthen their position, while negative feedback on comparable products can embolden customers to demand concessions.

- Informed Customers: Access to competitor pricing and product reviews grants customers increased leverage.

- Product Differentiation: HNI's ability to differentiate its offerings directly impacts customer bargaining power.

- Digital Transparency: Online comparison tools empower customers to seek better deals, particularly for less unique products.

- Customer Service Emphasis: While differentiation is key, strong customer service can offset some of the price-driven bargaining power.

The bargaining power of HNI's customers is a significant factor, influenced by the availability of substitutes and the customers' own price sensitivity. For instance, the office furniture market, where HNI operates, saw continued demand for flexible workspace solutions in 2024, providing customers with alternatives to traditional furniture purchases. Similarly, in the hearth products sector, energy-efficient heat pumps and central heating systems offer viable substitutes, increasing customer leverage.

Informed customers, armed with easy access to competitor pricing and product reviews, also wield considerable power. A 2024 survey revealed that over 80% of consumers consult online reviews before purchasing. This transparency empowers customers to negotiate better terms, especially for less differentiated products, making product differentiation and strong customer service crucial for HNI to mitigate this influence.

| Segment | Key Customer Bargaining Power Drivers | 2024 Market Trend Impact |

|---|---|---|

| Office Furniture | Availability of substitutes (co-working spaces, remote work setups), customer price sensitivity | Continued growth in flexible workspaces reduced reliance on traditional office furniture. |

| Hearth Products | Availability of substitutes (heat pumps, central heating), customer price sensitivity, ease of switching | Increased adoption of energy-efficient heating technologies strengthened customer alternatives. |

Same Document Delivered

HNI Porter's Five Forces Analysis

This preview showcases the complete HNI Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises. You'll gain instant access to this ready-to-use strategic tool, empowering you with actionable insights for your business decisions.

Rivalry Among Competitors

The office furniture and hearth products sectors are populated by a substantial and varied group of competitors. In office furniture, giants like Steelcase and MillerKnoll compete alongside numerous smaller, specialized firms. Similarly, the hearth products market features a mix of large national brands and many regional and local manufacturers, all vying for customer attention and sales.

The growth rate of the office furniture and hearth product markets significantly impacts how fiercely companies compete. For office furniture, a steady growth trajectory is anticipated, fueled by the ongoing adoption of hybrid work arrangements and a heightened focus on ergonomic solutions.

Similarly, the hearth product market is experiencing growth, partly due to increasing consumer interest in energy-efficient heating options. However, within these broader markets, slower growth in specific niches can intensify competition as businesses vie more aggressively for the available customer base.

HNI positions itself by highlighting value, quality, and customer service, but the extent to which its products truly stand out from competitors can be a key factor. If HNI's offerings are perceived as similar to those of rivals, the industry can become more prone to price-based competition.

In 2024, the furniture industry, where HNI operates, saw varying degrees of product differentiation. While some companies focus on unique designs or specialized features, a significant portion of the market still operates on more standardized product lines. This can lead to intense price wars, especially when customers don't perceive a substantial difference between brands.

Furthermore, switching costs for customers in the furniture sector are generally low. This means that if a customer is not particularly loyal or satisfied, they can easily opt for a competitor's product without incurring significant financial or time penalties. This ease of switching amplifies competitive rivalry.

Exit Barriers

High exit barriers can trap competitors in an industry, forcing them to continue competing even when unprofitable. This often leads to sustained, aggressive rivalry, especially when market conditions are challenging. For instance, in the semiconductor industry, the massive investment in specialized manufacturing equipment, often costing billions, creates significant exit barriers. Companies that have invested heavily in these assets are unlikely to abandon them easily, even if current market demand is low, leading to intense price competition.

Consider the airline industry. The substantial cost of aircraft, long-term leases, and the need to maintain a network of routes can make exiting extremely difficult. This often results in carriers continuing operations, even at low profitability, to avoid massive write-offs. In 2023, several airlines continued to operate routes with historically low load factors, a testament to these high exit barriers, as the cost of grounding planes and breaking leases was prohibitive.

These barriers can manifest in several ways:

- Specialized Assets: Investments in unique machinery or technology that have little resale value elsewhere.

- Long-Term Contracts: Commitments to suppliers, customers, or employees that are costly to break.

- Employee Severance Costs: Significant payouts required for laying off a large workforce.

- Government or Regulatory Restrictions: Rules that impede the closure or sale of businesses in certain sectors.

Strategic Stakes and Acquisitions

The strategic importance of the office furniture industry for major players, coupled with the potential for significant acquisitions, intensifies competitive rivalry. Companies actively seek to expand their market share and product offerings through strategic moves.

HNI Corporation's agreement to acquire Kimball International for approximately $475 million in early 2024 exemplifies this trend. This acquisition aims to bolster HNI's position in the mid-tier office furniture market and expand its distribution channels, directly impacting the competitive landscape.

- Acquisition Activity: HNI's acquisition of Kimball International for $475 million in 2024 signals a consolidation trend.

- Market Share Focus: Companies are driven to acquire others to gain market share and broaden their product portfolios.

- Synergy Pursuit: The pursuit of operational and financial synergies through M&A further fuels competitive intensity.

- Concentrated Landscape: Such strategic moves lead to a more concentrated industry, potentially increasing rivalry among larger entities.

Competitive rivalry within HNI's operating sectors is significant due to a large number of diverse competitors, ranging from industry giants to smaller, specialized firms. This rivalry is further fueled by low switching costs for customers and a strategic emphasis on market share through acquisitions, as seen with HNI's $475 million purchase of Kimball International in 2024. The furniture industry, in particular, can experience intense price competition when product differentiation is minimal, a common scenario in 2024.

| Competitor Type | Example Companies (Office Furniture) | Example Companies (Hearth Products) | Impact on Rivalry |

|---|---|---|---|

| Large, Established Players | Steelcase, MillerKnoll | HNI Corporation (various brands), Lennox International | Drive innovation and market share battles. |

| Specialized/Niche Firms | Herman Miller (specific lines), smaller design studios | Regional fireplace installers, custom hearth builders | Target specific customer needs, can lead to localized competition. |

| Regional/Local Manufacturers | Various smaller office furniture makers | Local hearth and stone companies | Compete on price and local service, especially in less consolidated markets. |

SSubstitutes Threaten

The increasing adoption of remote and hybrid work models presents a significant threat of substitution for HNI's Workplace Furnishings segment. Companies are re-evaluating their need for extensive traditional office furniture as employees spend more time working from home or in flexible co-working spaces. This shift directly impacts the demand for HNI's core products.

In 2024, a substantial portion of the workforce continued to embrace flexible work arrangements. For instance, reports indicated that over 50% of companies offered some form of hybrid work, and a significant percentage of employees expressed a preference for remote work options. This trend directly reduces the volume of new office furniture purchases companies would typically make for centralized, in-person workspaces.

In the Residential Building Products segment, the threat of substitutes for traditional fireplaces and stoves is significant. Modern, energy-efficient alternatives like heat pumps and advanced central heating systems are increasingly popular. For instance, the global heat pump market was valued at approximately $70 billion in 2023 and is projected to grow substantially, indicating a clear shift towards these alternatives.

These substitutes often provide compelling advantages over traditional options. Many homeowners are drawn to lower operating costs and enhanced environmental benefits, such as reduced carbon emissions. The adoption of smart thermostats also plays a role, allowing for more precise and efficient temperature control, further diminishing reliance on older heating methods.

The relative cost and performance of substitutes are critical. If alternative heating solutions, like electric furnaces or even improved insulation coupled with existing systems, offer comparable or better performance at a lower price point, customers will consider switching away from traditional hearth products. For instance, advancements in energy efficiency for electric heating systems in 2024 have made them increasingly competitive, potentially eroding the market share of wood-burning fireplaces if cost savings are significant.

Customer Willingness to Adopt Substitutes

Customer willingness to embrace new technologies or different ways of working significantly influences the threat posed by substitutes. For instance, the increasing acceptance of remote work tools directly challenges traditional office supply providers. This shift is often driven by factors like enhanced convenience and changing lifestyle preferences.

HNI, a major player in office furniture and related products, needs to be keenly aware of these evolving customer behaviors. As more individuals and businesses opt for flexible work arrangements, the demand for traditional office setups may decline, making substitutes more appealing. For example, a 2024 survey indicated that 62% of U.S. workers prefer a hybrid work model, highlighting a substantial shift away from full-time office presence.

The adoption of substitutes is also fueled by growing environmental consciousness and a desire for more efficient living. This can manifest in the demand for energy-efficient home systems or products that support sustainable lifestyles. HNI's product development and marketing strategies must therefore align with these broader societal trends to remain competitive.

- Remote Work Adoption: In 2024, an estimated 31% of the global workforce worked remotely at least part-time, a significant increase from pre-pandemic levels.

- Sustainability Focus: Consumer surveys in early 2025 show that over 70% of respondents consider sustainability when making purchasing decisions for home goods.

- Technological Integration: The market for smart home devices, which often substitute for traditional appliances and systems, is projected to grow by 15% annually through 2026.

- HNI's Response: HNI's investment in ergonomic and adaptable furniture solutions designed for hybrid work environments directly addresses this evolving customer willingness to adopt new work models.

Lifecycle Extension of Existing Products

The ability to extend the lifecycle of existing office furniture through refurbishment, repair, or the addition of ergonomic accessories presents a significant threat of substitutes for new HNI products. This trend means customers can achieve desired functionality and comfort without a full new purchase.

Companies are increasingly prioritizing sustainable and cost-effective solutions. For instance, opting for remanufactured furniture or upgrading specific components rather than replacing entire workstations directly competes with HNI's new product sales. This focus on circular economy principles can divert revenue from new product lines.

- Refurbishment Market Growth: The global office furniture refurbishment market is projected to see substantial growth, with some reports indicating an average annual growth rate of 5-7% leading up to 2025, suggesting a growing preference for extending the life of existing assets.

- Cost Savings: Refurbishing or upgrading can offer significant cost savings, with estimates suggesting businesses can save 30-50% compared to purchasing new furniture of similar quality.

- Sustainability Initiatives: Corporate sustainability goals are a key driver, with many organizations actively seeking to reduce their environmental footprint by reusing and recycling office furniture, further bolstering the substitute threat.

The threat of substitutes for HNI's products is multifaceted, stemming from evolving work models, technological advancements, and a growing emphasis on sustainability and cost-effectiveness. For HNI's Workplace Furnishings, the rise of remote and hybrid work directly reduces the need for traditional office setups, with over 50% of companies offering hybrid arrangements in 2024. Similarly, in Residential Building Products, energy-efficient alternatives like heat pumps, a market valued at approximately $70 billion in 2023, are increasingly replacing traditional fireplaces and stoves due to lower operating costs and environmental benefits. Furthermore, the option to refurbish or upgrade existing office furniture, a market growing at 5-7% annually, presents a cost-effective and sustainable substitute for new purchases, with potential savings of 30-50%.

| Substitute Category | Key Driver | 2024/2025 Data Point | Impact on HNI |

|---|---|---|---|

| Remote/Hybrid Work Models | Employee preference, cost savings for companies | 62% of US workers prefer hybrid work (2024) | Reduced demand for traditional office furniture |

| Energy-Efficient Home Heating | Lower operating costs, environmental concerns | Global heat pump market ~$70 billion (2023) | Substitution for fireplaces/stoves |

| Furniture Refurbishment/Upgrades | Cost savings, sustainability initiatives | Market growth of 5-7% annually (pre-2025) | Reduced sales of new furniture |

Entrants Threaten

The office furniture and hearth products sectors demand significant upfront capital for manufacturing plants, specialized equipment, and robust distribution systems. For instance, establishing a modern office furniture production line can easily run into millions of dollars, a substantial barrier for newcomers.

Existing companies, including HNI, leverage economies of scale, meaning they can produce goods more cheaply per unit due to higher production volumes. This advantage extends to bulk purchasing of raw materials and more efficient marketing campaigns, making it exceedingly challenging for new entrants to match their cost competitiveness without a massive initial investment.

In 2023, the global office furniture market was valued at over $70 billion, with significant consolidation and established players dominating. This indicates that the capital required to gain meaningful market share is substantial, and new entrants would face intense price pressure from incumbents benefiting from scale.

HNI Corporation enjoys a significant advantage due to its deeply entrenched brand loyalty and a robust, multi-layered distribution network. This network includes a vast number of dealers, distributors, and direct sales forces that have been cultivated over years, ensuring broad market reach across North America.

For any new company entering the office furniture and building products markets, replicating HNI's established distribution capabilities presents a formidable challenge. Building brand recognition and trust to match HNI's reputation would require substantial investment and time, making it difficult for newcomers to effectively compete for diverse customer segments.

In 2024, HNI's strong brand equity, built through consistent quality and marketing, acts as a significant barrier. For instance, their Herman Miller brand, acquired in 2021, further solidified their position in high-end office furniture, a segment where brand perception is paramount.

Securing reliable and cost-effective access to essential raw materials like wood, steel, and fabrics, along with managing intricate supply chains, presents a substantial hurdle for new companies entering the furniture industry. HNI Corporation, for instance, benefits from deeply entrenched relationships with its suppliers and a well-established logistics network. These established advantages are incredibly difficult for emerging competitors to quickly match.

Regulatory Barriers and Certifications

The office furniture and hearth product industries face substantial regulatory hurdles. For instance, office furniture, particularly items designed for ergonomics and sustainability, must often meet stringent safety and environmental certifications. Similarly, hearth products are heavily regulated concerning safety features and emissions standards, as evidenced by the EPA's requirements for wood-burning appliances.

New companies entering these markets must invest heavily in research, development, and testing to ensure their products comply with these complex regulations. This can include obtaining certifications like GREENGUARD for indoor air quality in office furniture or meeting specific safety standards for gas fireplaces. The financial and time commitments required for compliance can significantly deter potential new entrants, thereby reducing the threat of new competition.

Consider the following specific examples of regulatory impacts:

- Office Furniture: Compliance with standards such as ANSI/BIFMA X5.1 for general-purpose office chairs can add 5-10% to product development costs.

- Hearth Products: Meeting EPA emission standards for wood heaters, which became more stringent in 2020, required manufacturers to invest in new combustion technologies, impacting capital expenditure.

- Sustainable Materials: Certifications like FSC (Forest Stewardship Council) for wood sourcing add a layer of compliance and cost for furniture manufacturers aiming for eco-friendly claims.

Intellectual Property and Proprietary Technology

HNI's robust intellectual property portfolio, especially concerning its hearth products and ergonomic office furniture, acts as a significant deterrent to new entrants. The company's consistent investment in research and development, evidenced by its patent filings, creates a technological moat. For instance, HNI's commitment to innovation in areas like advanced combustion technology for fireplaces or unique ergonomic adjustment mechanisms for office chairs means that newcomers must either invest heavily in their own R&D to replicate these features or face licensing fees, directly increasing their startup costs and time to market.

Proprietary manufacturing processes and unique design elements further solidify HNI's competitive position. These elements are not easily replicated and require substantial expertise and capital investment to develop. A new competitor attempting to enter the market would need to overcome the challenge of either developing entirely new, competitive technologies or acquiring licenses for HNI's existing intellectual property, both of which present substantial financial and operational hurdles.

The threat of new entrants is thus mitigated by the high barriers to entry created by HNI's intellectual property. For example, HNI's investment in R&D for its office furniture division, which saw significant product development in the years leading up to 2025, has resulted in a range of patented ergonomic features. These innovations require extensive testing and validation, making it difficult for new companies to quickly match HNI's product quality and functionality without considerable upfront investment.

Key aspects of HNI's intellectual property that deter new entrants include:

- Patented hearth technologies: Innovations in efficiency and safety for fireplaces and inserts.

- Ergonomic design patents: Unique adjustment mechanisms and support systems in office seating.

- Proprietary manufacturing techniques: Advanced methods for material processing and assembly.

- Ongoing R&D investment: Continuous development of new features and materials, as seen in their 2024 product line enhancements.

The threat of new entrants for HNI Corporation is significantly low due to substantial capital requirements for manufacturing and distribution, coupled with strong brand loyalty and established networks that are difficult and costly to replicate.

High upfront investment in plants, equipment, and robust distribution systems, alongside economies of scale enjoyed by incumbents, creates a formidable barrier. For instance, HNI's 2023 market position in the over $70 billion global office furniture market highlights the scale needed to compete effectively.

Regulatory compliance, particularly for safety and environmental standards in both office furniture and hearth products, necessitates significant investment in R&D and testing, further deterring newcomers. Meeting EPA emission standards for wood heaters, for example, requires advanced combustion technologies.

HNI's intellectual property, including patented hearth technologies and ergonomic designs, along with ongoing R&D investments, creates a technological moat, demanding substantial upfront investment or licensing fees from potential entrants to match product quality and functionality.

| Barrier Type | Description | Impact on New Entrants | HNI's Advantage | Example/Data |

|---|---|---|---|---|

| Capital Requirements | High cost of manufacturing facilities and specialized equipment. | Significant upfront investment needed. | Leverages existing infrastructure and scale. | Establishing a modern office furniture production line can cost millions. |

| Brand Loyalty & Distribution | Established customer trust and extensive dealer networks. | Difficult to gain market access and build recognition. | Multi-layered network cultivated over years. | HNI's Herman Miller brand acquired in 2021 solidified high-end market position. |

| Intellectual Property (IP) | Patented technologies and proprietary processes. | Requires heavy R&D investment or licensing fees. | Technological moat from continuous R&D. | Patented ergonomic features in office seating; ongoing R&D for 2024 product lines. |

| Regulatory Compliance | Meeting safety and environmental certifications. | Adds significant costs and time to market entry. | Existing compliance infrastructure and expertise. | ANSI/BIFMA X5.1 compliance can add 5-10% to product development costs for office chairs. |

Porter's Five Forces Analysis Data Sources

Our analysis leverages data from industry-specific market research reports, financial statements of key players, and government regulatory filings to provide a comprehensive view of competitive forces.