HMS SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HMS Bundle

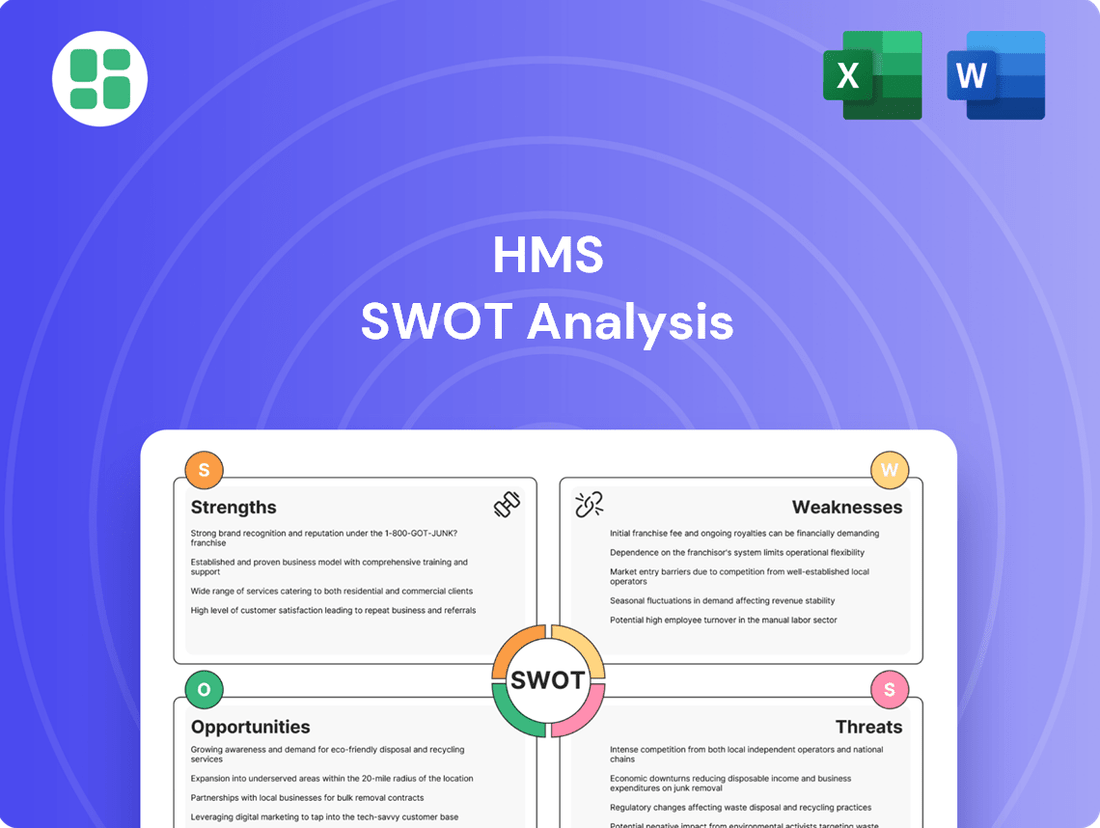

Curious about the HMS's competitive edge and potential hurdles? Our comprehensive SWOT analysis dives deep into its internal strengths, weaknesses, market opportunities, and threats. Don't miss out on the crucial details that inform strategic decision-making.

Unlock the full strategic picture of HMS with our in-depth SWOT analysis. This report provides actionable insights and a clear roadmap for navigating its market landscape. Invest in understanding the complete story to drive informed growth.

Strengths

HMS Networks commands a leading position in the Industrial ICT and IIoT sectors, demonstrating significant market influence. Their core strength lies in facilitating seamless communication and data exchange between industrial machines and systems, a critical component for advanced automation and remote operational oversight. This expertise allows them to effectively cater to a worldwide customer base.

HMS Networks boasts a diverse and ever-growing product lineup, covering essential industrial connectivity needs. Their offerings span gateways, remote access solutions, and embedded communication modules, serving a wide array of industrial sectors.

Strategic acquisitions have been a key driver in expanding this portfolio. For instance, the integration of Red Lion Controls and PEAK-System Technik has brought industrial Ethernet switches, panel meters, and operator panels into the HMS fold. These additions also bolster their presence in automotive communication standards.

This broadened product suite enables HMS to present more comprehensive solutions to their clients. By offering a wider range of integrated products, they can effectively tap into new customer segments and address more complex industrial challenges.

HMS Networks boasts a formidable global sales and support infrastructure, featuring over 20 strategically located sales offices. This extensive network is further amplified by a vast array of distributors and partners, ensuring broad market penetration and accessibility.

The strategic acquisition of Red Lion Controls in 2018 significantly bolstered HMS Networks' presence in the North American market, a key growth region. This move effectively complemented their established strengths in Europe, creating a more balanced and robust global footprint.

This widespread network is crucial for delivering localized support and efficient distribution channels. It directly translates to enhanced customer reach and a superior service experience, a critical differentiator in the competitive industrial communication landscape.

Strategic Acquisition-Driven Growth

HMS Networks demonstrates a strong capacity for strategic growth through acquisitions. The company successfully integrated Red Lion Controls in 2023, followed by the acquisition of PEAK-System in 2024. These moves have been instrumental in broadening their product portfolio, entering new technological domains, and expanding their global reach, thereby solidifying their market standing.

This consistent strategy of acquiring complementary businesses fuels HMS Networks' expansion and enhances their competitive edge. For example, the PEAK-System acquisition specifically bolstered their offerings in the automotive diagnostics sector, a key growth area. Such targeted acquisitions allow HMS to quickly gain market share and technological expertise.

- Proven Acquisition Strategy: Successful integration of Red Lion Controls (2023) and PEAK-System (2024).

- Market Consolidation and Expansion: Acquisitions consolidate product lines and open new geographical markets.

- Technological Advancement: Strategic purchases enhance capabilities in emerging technology areas.

- Strengthened Market Position: M&A activities contribute directly to a more robust competitive advantage.

Alignment with Industrial Digitalization Trends

HMS Networks' core business is exceptionally well-positioned to benefit from the ongoing global shift towards Industry 4.0 and the Industrial Internet of Things (IIoT). This alignment is a significant strength, as it places the company at the forefront of a rapidly expanding market driven by the need for smarter, more connected industrial operations. The increasing adoption of digital technologies in manufacturing and automation directly fuels demand for HMS's solutions.

A key indicator of this strength is the market dominance of Industrial Ethernet. In 2024, Industrial Ethernet represented a substantial 76% of all new industrial network installations. HMS's focus on this technology means they are deeply embedded in the infrastructure of modern industrial digitalization, ready to capture market share as this trend continues to accelerate.

This strategic positioning allows HMS to capitalize on several key growth areas:

- Growing demand for connected industrial systems: As more factories and industrial facilities embrace automation and data exchange, the need for reliable and efficient communication solutions like those offered by HMS increases.

- Expansion of IIoT applications: The proliferation of IIoT devices and platforms creates a greater requirement for interoperability and data management, areas where HMS's expertise in industrial networking is crucial.

- Industry 4.0 adoption: The broader adoption of Industry 4.0 principles, focusing on intelligent manufacturing, predictive maintenance, and optimized supply chains, inherently relies on robust industrial communication networks.

HMS Networks' strategic acquisitions, such as the integration of Red Lion Controls in 2023 and PEAK-System Technik in 2024, have significantly broadened its product portfolio and expanded its market reach. This approach has allowed HMS to consolidate product lines and enter new technological domains, particularly strengthening its position in automotive communication standards and industrial diagnostics.

The company's deep alignment with the Industry 4.0 and IIoT megatrends represents a core strength, placing it at the forefront of a rapidly growing market. With Industrial Ethernet dominating new installations, accounting for 76% in 2024, HMS is well-positioned to benefit from the increasing demand for connected industrial systems and IIoT applications.

HMS Networks possesses a robust global sales and support infrastructure, with over 20 sales offices and a wide network of distributors and partners. This extensive reach ensures broad market penetration and localized customer support, a critical factor for success in the competitive industrial communication landscape.

Their proven expertise in facilitating seamless communication and data exchange between industrial machines is fundamental to advanced automation and remote operational oversight. This core competency addresses a critical need for efficient data flow in modern industrial environments.

What is included in the product

Analyzes HMS’s competitive position through key internal and external factors.

Simplifies complex strategic discussions by offering a clear, actionable framework for identifying and addressing critical business challenges.

Weaknesses

HMS Networks' reliance on the industrial sector makes it susceptible to economic cycles. When industrial markets slow down, so does investment in new automation and connectivity solutions, directly impacting HMS. For instance, the company noted in its 2024 performance that a more challenging economic climate led to a slight deceleration in new node installations, highlighting this vulnerability.

HMS has encountered difficulties in consistently growing its sales organically. In the second quarter of 2025, organic sales actually saw a decline of 5%.

This slowdown was partly due to unfavorable currency movements and some operational hiccups stemming from the integration of new businesses following recent acquisitions, particularly concerning the ERP system implementation.

The company's ongoing challenge is to ensure that its organic sales performance remains robust, even as it pursues growth through acquisitions.

While acquisitions fuel growth, integrating companies like Red Lion and PEAK-System introduces substantial operational hurdles. These can include significant restructuring expenses and temporary disruptions, such as delayed invoicing stemming from ERP system overhauls.

For example, the integration of Red Lion in 2023 involved significant upfront costs and a period of adjustment that impacted short-term operational efficiency. Similarly, PEAK-System's onboarding in early 2024 presented challenges in harmonizing IT infrastructure and business processes.

Successfully merging these entities is paramount to unlocking their full potential and achieving the intended strategic advantages from these expansion efforts.

Exposure to Geopolitical and Trade Policies

HMS Networks faces significant headwinds from evolving geopolitical and trade policies. For instance, in Q2 2025, the company reported that tariffs directly impacted its gross margin. This exposure is amplified by the fact that roughly 15% of HMS Networks' sales are exports from the EU to North America, a segment particularly susceptible to shifts in trade agreements and potential disputes.

These international trade dynamics can have a tangible effect on HMS Networks' financial performance. The imposition of tariffs, or even the threat of them, can increase the cost of goods sold and reduce the company's profitability. Furthermore, escalating trade tensions could disrupt supply chains and lead to increased operational costs, directly impacting the company's bottom line.

- Tariff Impact: Q2 2025 results showed tariffs negatively affecting gross margin.

- Export Vulnerability: Around 15% of sales are EU to North America exports, a sensitive trade corridor.

- Profitability Risk: Changing tariff structures and trade disputes pose a direct threat to profit margins.

- Cost Structure Volatility: Geopolitical shifts can lead to unpredictable changes in operational costs.

Slow Adoption of 5G in Industrial Automation

Despite 5G's promise for industrial communication, its adoption in automation is lagging. This slow uptake is largely attributed to the intricate nature of managing new infrastructure, the significant upfront investment required, and the ongoing challenge of making real-time cellular chip performance economically viable for widespread industrial use.

While HMS Networks provides robust wireless solutions, the broader industry's hesitant embrace of 5G directly impacts the potential for accelerated growth in this cutting-edge connectivity segment. For instance, a 2024 report indicated that only about 15% of industrial facilities had deployed 5G for critical operations, highlighting the gradual transition.

- Infrastructure Complexity: Integrating 5G networks into existing industrial setups presents significant technical hurdles.

- High Implementation Costs: The capital expenditure for 5G deployment remains a major barrier for many businesses.

- Affordable Real-Time Performance: Achieving consistent, low-latency performance at a cost-effective price point for cellular chips is still developing.

HMS Networks' reliance on the industrial sector exposes it to economic downturns, as seen in Q2 2025 when a challenging economic climate slightly decelerated new node installations. The company also faced a 5% decline in organic sales in Q2 2025, partly due to currency fluctuations and integration issues from acquisitions like Red Lion and PEAK-System, which caused operational disruptions and increased restructuring expenses.

Geopolitical shifts and trade policies present a significant weakness, with Q2 2025 results showing tariffs negatively impacting gross margins, especially for its 15% of sales exported from the EU to North America. Furthermore, the slow adoption of 5G in industrial automation, due to infrastructure complexity, high implementation costs, and the challenge of cost-effective real-time cellular chip performance, limits growth potential in this area, with only about 15% of industrial facilities using 5G for critical operations in 2024.

| Weakness Category | Specific Issue | Impact/Data Point | Date/Period |

|---|---|---|---|

| Economic Sensitivity | Reliance on Industrial Sector | Slight deceleration in new node installations | 2024 |

| Sales Performance | Organic Sales Decline | -5% decline in organic sales | Q2 2025 |

| Integration Challenges | Acquisition Integration Issues | Operational disruptions, restructuring expenses | Ongoing (e.g., Red Lion 2023, PEAK-System 2024) |

| Geopolitical/Trade Exposure | Tariff Impact on Margins | Negative impact on gross margin | Q2 2025 |

| Technology Adoption | Slow 5G Uptake in Industry | Limited growth in wireless solutions segment | ~15% industrial 5G adoption (2024) |

Preview the Actual Deliverable

HMS SWOT Analysis

You are viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

This is the same HMS SWOT analysis document included in your download. The full content is unlocked after payment.

The file shown below is not a sample—it’s the real HMS SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The Industrial Internet of Things (IIoT) and Industry 4.0 sectors are experiencing explosive growth. Analysts project the global IIoT market to surge, with some estimates reaching over $200 billion by 2026, and even higher projections in the trillions for the broader Industry 4.0 ecosystem. This significant expansion is fueled by manufacturers’ increasing reliance on connected systems for enhanced efficiency and data-driven decision-making.

This macro trend presents a massive and growing opportunity for HMS Networks. Their expertise in industrial communication and data exchange solutions directly addresses the core needs of this evolving landscape. As more factories embrace automation and connectivity, the demand for robust and reliable networking solutions, like those offered by HMS, will continue to escalate, allowing them to capture a greater market share.

The increasing interconnectedness of industrial systems, often referred to as Industry 4.0, has dramatically heightened the need for robust cybersecurity. This trend fuels a rapidly expanding market for specialized IoT security solutions designed to protect critical infrastructure.

HMS Networks has strategically positioned itself to capitalize on this trend with the introduction of its Anybus Defender product line, offering industrial security appliances. This proactive response demonstrates HMS's commitment to addressing the evolving security landscape.

The escalating demand for secure industrial networks presents a substantial opportunity for HMS to broaden its portfolio and solidify its position as a vital provider of cybersecurity for industrial operations. For instance, the global industrial cybersecurity market was valued at approximately USD 16.5 billion in 2023 and is projected to reach USD 34.6 billion by 2028, growing at a CAGR of 15.8% during this period.

The manufacturing sector's ongoing embrace of smart factories and advanced automation creates a significant opportunity for HMS. This trend is driving a strong demand for robust and integrated communication solutions that can handle the complexities of connected devices and real-time data exchange. For instance, the global Industrial Internet of Things (IIoT) market, a key enabler of smart factories, was projected to reach over $115 billion in 2024, highlighting the scale of this digital shift.

Industries are actively investing in upgrading their operational systems to boost productivity and streamline processes. This upgrade cycle involves implementing solutions for enhanced data visibility and control, directly aligning with HMS's core offerings. By providing the necessary communication infrastructure, HMS can tap into this market as companies seek to optimize their manufacturing floors through technologies like predictive maintenance and AI-driven quality control.

HMS's established expertise in industrial communication positions it well to capitalize on this digital transformation. The company can offer solutions that enable seamless data flow between machines, systems, and people, facilitating the creation of more efficient and responsive manufacturing environments. This allows HMS to expand its reach by supporting a growing number of manufacturers in their journey towards Industry 4.0, a movement expected to add trillions to the global economy by 2030.

Geographic and Vertical Market Expansion

HMS can leverage its existing technological strengths to tap into burgeoning markets. The Asia Pacific region, for instance, is anticipated to see significant growth in industrial IoT adoption, with some projections indicating it will be the fastest-growing market globally. This presents a substantial opportunity for HMS to extend its reach beyond its current strongholds in Europe and North America.

Furthermore, HMS has avenues for deeper penetration within specific, high-growth industrial sectors. Verticals like pharmaceuticals and logistics management are increasingly prioritizing digital solutions for compliance and real-time operational visibility. For example, the global pharmaceutical logistics market is expected to grow substantially, driven by the need for secure and temperature-controlled supply chains, a segment where HMS's offerings could be highly valuable.

- Geographic Expansion: Target high-growth regions such as Asia Pacific, where industrial IoT is projected for rapid expansion.

- Vertical Market Deepening: Increase penetration in sectors like pharmaceuticals and logistics, addressing specific needs for digital compliance and real-time tracking.

- Market Growth Drivers: Capitalize on the increasing demand for digital transformation and operational efficiency across various industries.

- Regional IoT Market Growth: Asia Pacific's industrial IoT market is expected to be the fastest-growing globally, presenting a key opportunity.

Leveraging Emerging Technologies like AI and Edge Computing

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into Industrial Internet of Things (IIoT) systems, coupled with the rise of edge computing, presents a substantial opportunity for HMS. These technologies are transforming industrial operations by enabling sophisticated predictive maintenance, allowing for the analysis of vast datasets in real-time, and driving significant improvements in operational efficiency. For instance, the global AI in IIoT market was projected to reach USD 21.5 billion by 2025, indicating a strong growth trajectory.

HMS can capitalize on this trend by innovating its product portfolio to embed AI and edge computing capabilities. This strategic move would allow the company to offer more intelligent, responsive, and value-added solutions to its clientele. Such advancements could translate into enhanced asset performance management and more streamlined supply chains for customers. The adoption of edge computing, in particular, is expected to grow rapidly, with the global edge computing market size anticipated to reach over USD 200 billion by 2026, underscoring the demand for localized data processing.

Key opportunities arising from these technological advancements include:

- Enhanced Predictive Maintenance: AI algorithms can analyze sensor data from industrial equipment to predict failures before they occur, reducing downtime and maintenance costs. Studies suggest predictive maintenance can reduce maintenance costs by up to 30% and prevent 70% of equipment failures.

- Real-time Data Processing and Optimization: Edge computing allows for immediate data analysis at the source, enabling faster decision-making and dynamic adjustments to optimize production processes. This can lead to improved throughput and resource utilization.

- Development of Smarter Products: Incorporating AI and edge capabilities into HMS's offerings can create a competitive advantage by delivering more sophisticated and data-driven solutions that directly address customer needs for greater automation and insight.

- New Service Revenue Streams: Offering AI-powered analytics and managed services based on these technologies can open up new avenues for recurring revenue and deeper customer engagement.

The ongoing digital transformation across industries presents a significant tailwind for HMS Networks. As factories worldwide embrace Industry 4.0 principles, the demand for robust industrial communication and connectivity solutions, HMS's core competency, is set to surge. This trend is further amplified by the increasing adoption of smart manufacturing technologies, driving a need for seamless data exchange and integration.

HMS is well-positioned to capitalize on the growing need for cybersecurity in industrial environments. The company's Anybus Defender product line directly addresses the escalating threat landscape, offering essential protection for critical infrastructure. The industrial cybersecurity market itself is experiencing robust growth, projected to expand significantly in the coming years, creating a fertile ground for HMS's security-focused offerings.

The company can also leverage its technological expertise to expand into new geographic markets and deepen its presence in high-growth industrial verticals. Regions like Asia Pacific are demonstrating rapid adoption of industrial IoT, offering substantial opportunities for market share expansion. Furthermore, sectors such as pharmaceuticals and logistics are increasingly seeking digital solutions for compliance and real-time tracking, areas where HMS's capabilities can provide significant value.

The convergence of AI, ML, and edge computing within IIoT systems opens avenues for HMS to develop more intelligent and value-added solutions. By integrating these advanced technologies, HMS can enhance its product portfolio, offering capabilities like predictive maintenance and real-time data optimization. This strategic evolution can lead to new service revenue streams and a stronger competitive position in the evolving industrial landscape.

| Opportunity Area | Market Driver | HMS Relevance | Projected Growth/Impact |

|---|---|---|---|

| Industry 4.0 & IIoT Expansion | Digital transformation in manufacturing | Core business in industrial communication | Global IIoT market projected to exceed $200 billion by 2026 |

| Industrial Cybersecurity | Increasing cyber threats to critical infrastructure | Anybus Defender product line | Industrial cybersecurity market to reach $34.6 billion by 2028 (15.8% CAGR) |

| Geographic & Vertical Expansion | Demand for digital solutions in emerging markets and specific sectors | Leveraging existing technology for new markets | Asia Pacific fastest-growing industrial IoT market; Pharma/Logistics demand for tracking |

| AI, ML & Edge Computing Integration | Need for advanced analytics and real-time processing | Enhancing product portfolio with intelligent capabilities | AI in IIoT market projected at $21.5 billion by 2025; Edge computing market over $200 billion by 2026 |

Threats

The industrial communication market is a battleground, with giants like Siemens and Cisco Systems vying for dominance alongside specialized firms. This intense rivalry puts constant pressure on pricing and necessitates significant investment in research and development for HMS. For instance, in 2023, the industrial automation market, a key sector for industrial communication, was valued at approximately $132 billion and is projected to grow, indicating robust competition.

To navigate this crowded space, HMS Networks faces the challenge of differentiating its products and services effectively. Failing to innovate or offer unique value propositions could erode market share. The need for continuous improvement is paramount; companies in this sector often spend a substantial portion of their revenue on R&D to maintain a competitive edge, with some major players investing upwards of 5% of their sales.

Global economic uncertainties, including persistent inflation and the lingering effects of supply chain disruptions experienced through 2024, contribute to higher capital costs. This makes it more expensive for businesses to invest in new projects or expand operations, potentially dampening demand for HMS Networks' solutions.

Geopolitical tensions, such as ongoing conflicts and trade disputes, create an unpredictable market environment. This instability can lead to delayed project timelines and a general cautiousness among industrial clients, directly impacting order intake and sales volumes for HMS Networks, as seen in fluctuations during 2024.

A sustained economic slowdown or escalating geopolitical instability presents a significant threat to HMS Networks' future growth prospects. These macro factors can reduce overall industrial investment, directly affecting the company's ability to secure new business and maintain sales momentum.

HMS Networks' reliance on global supply chains for electronic components and manufacturing presents a significant threat. Past events, like the semiconductor shortages that affected various industries in 2021-2022, demonstrated the vulnerability of these extended networks. Future disruptions from geopolitical tensions or unforeseen events could lead to production delays and elevated costs for HMS, impacting their ability to meet market demand.

Rapid Technological Obsolescence

The rapid pace of innovation in industrial communication and the Industrial Internet of Things (IIoT) presents a significant threat. Existing technologies can become outdated quickly, demanding continuous investment in research and development from HMS Networks to maintain competitiveness. For instance, the evolution of wireless standards like Wi-Fi 7, expected to see broader industrial adoption by 2025, could render older communication solutions less efficient.

Failure to adapt swiftly to new industry standards or emerging technologies could result in a decline in market relevance for HMS Networks. This necessitates proactive monitoring of technological shifts and a willingness to pivot product development strategies. The increasing demand for edge computing capabilities, for example, requires ongoing R&D to ensure HMS solutions can seamlessly integrate and support these distributed processing needs.

HMS Networks must allocate substantial resources to R&D to ensure its product portfolio remains current and competitive in this dynamic environment. This includes staying ahead of advancements in areas such as cybersecurity for IIoT, which is crucial given the increasing sophistication of cyber threats. By 2024, the global IIoT cybersecurity market was projected to reach over $30 billion, highlighting the critical nature of this investment.

Key areas of concern include:

- Rapid evolution of IIoT protocols: New communication standards emerge frequently, requiring constant updates to HMS products.

- Advancements in edge computing: The shift towards processing data closer to the source necessitates new hardware and software capabilities.

- Increasing cybersecurity demands: Robust security features are paramount as industrial systems become more connected and vulnerable.

- Competition from agile tech startups: Smaller, specialized firms can quickly develop niche solutions, challenging established players.

Increasing Cybersecurity

The escalating sophistication of cyberattacks presents a major threat to HMS. While cybersecurity itself is an opportunity, the increasing frequency of attacks on industrial control systems and critical infrastructure means that a breach involving HMS products or customer systems could result in substantial financial losses and operational disruptions for clients. This necessitates ongoing investment in product security and robust incident response capabilities.

The financial implications of a cyberattack are significant. For instance, the average cost of a data breach in the industrial sector reached $4.73 million in 2023, according to IBM's Cost of a Data Breach Report. A successful attack on HMS could lead to:

- Severe financial penalties and recovery costs.

- Extended operational downtime for customers relying on HMS systems.

- Irreparable reputational damage, impacting future sales and partnerships.

Intense competition from established players like Siemens and Cisco, alongside nimble startups, pressures HMS Networks on pricing and demands continuous R&D investment. The industrial automation market, valued at approximately $132 billion in 2023, exemplifies this competitive landscape, requiring HMS to constantly innovate to maintain market share.

Global economic headwinds, including persistent inflation and lingering supply chain issues through 2024, increase capital costs and can dampen demand for industrial communication solutions. Geopolitical instability further exacerbates this, leading to project delays and cautious client spending, impacting HMS's order intake.

Technological obsolescence is a constant threat, with rapid advancements in IIoT protocols and edge computing requiring significant and ongoing R&D investment from HMS. For example, the expected broader industrial adoption of Wi-Fi 7 by 2025 could challenge older communication standards, necessitating proactive adaptation.

The escalating sophistication of cyberattacks poses a severe risk, as breaches in industrial systems can lead to substantial financial losses and operational disruptions for clients. IBM's 2023 Cost of a Data Breach Report indicated an average cost of $4.73 million in the industrial sector, highlighting the critical need for robust cybersecurity in HMS's offerings.

SWOT Analysis Data Sources

This HMS SWOT analysis is built upon a robust foundation of data, drawing from internal financial reports, comprehensive market intelligence, and expert industry forecasts to provide a well-rounded and actionable assessment.