HMS Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HMS Bundle

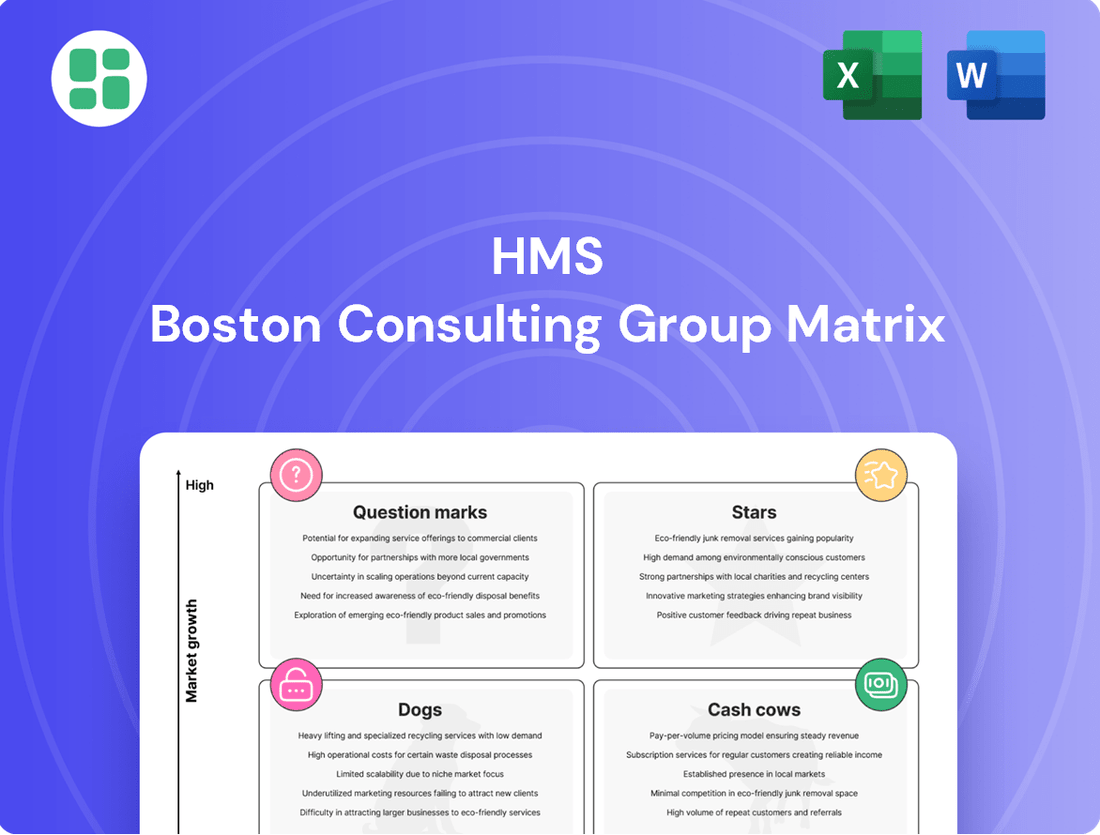

The BCG Matrix is a powerful tool that helps businesses categorize their products or business units based on market share and market growth. Understanding where your offerings fall—as Stars, Cash Cows, Dogs, or Question Marks—is crucial for informed strategic decisions. This glimpse into the BCG Matrix is just the beginning of unlocking your company's full potential.

To truly leverage the BCG Matrix for your business, you need the complete breakdown. Purchase the full version to gain detailed quadrant analysis, actionable insights, and a clear roadmap for resource allocation and future investment. Don't just understand the concepts; implement them for tangible growth.

Stars

HMS Networks' advanced IIoT edge gateways are positioned strongly in the market, benefiting from the surge in Industry 4.0 adoption. These devices are crucial for real-time data processing and analytics directly at the network's edge, a capability highly sought after by businesses aiming for greater efficiency and reduced latency. Their significant market share in this expanding sector underscores their importance in enabling localized intelligence and minimizing reliance on cloud infrastructure.

HMS Networks' private 5G and wireless industrial solutions are a prime example of a Stars category within the BCG matrix. The industrial sector's growing interest in private 5G for enhanced connectivity and mobility fuels this segment's high-growth potential. These solutions are crucial for enabling low-latency communication and flexible network deployments essential for smart factories and automated logistics.

As operational technology (OT) and information technology (IT) environments increasingly merge, the need for strong cybersecurity solutions specifically designed for industrial communication is soaring. HMS Networks is well-positioned in this rapidly growing and vital sector, with their solutions for securing this convergence capturing significant market share.

HMS Networks' ability to bridge the gap between OT and IT security makes them a crucial player in safeguarding industrial operations. The global industrial cybersecurity market was valued at approximately $16.5 billion in 2023 and is projected to reach over $30 billion by 2028, demonstrating the immense growth opportunity HMS Networks is tapping into.

Solutions for Autonomous Mobile Robots (AMRs)

The market for autonomous mobile robots (AMRs) and automated guided vehicles (AGVs) in manufacturing and logistics is experiencing significant expansion, creating a robust demand for specialized communication modules. HMS Networks' embedded communication solutions are well-positioned to meet this need, facilitating dependable and efficient data exchange for these mobile platforms. This sector is expected to see continued growth as automation becomes increasingly integral to industrial operations.

HMS Networks' offerings in the AMR and AGV space are designed to ensure seamless connectivity, which is crucial for the efficient operation of these robots. For instance, the company provides robust industrial communication technologies that enable real-time data transfer, essential for navigation, task management, and integration with broader warehouse management systems. This focus on reliable communication underpins the growing adoption of AMRs in dynamic industrial environments.

- Market Growth: The global AMR market was valued at approximately $3.5 billion in 2023 and is projected to reach over $10 billion by 2028, growing at a compound annual growth rate (CAGR) of around 23%.

- Demand Drivers: Increased demand for warehouse automation, e-commerce growth, and the need for operational efficiency are key factors fueling AMR adoption.

- HMS Networks' Role: HMS provides essential communication hardware and protocols that enable AMRs to connect to various industrial networks, ensuring interoperability and data integrity.

- Future Outlook: Continued advancements in AI and robotics, coupled with ongoing investments in smart factory initiatives, will further drive the demand for advanced AMR solutions and their underlying communication infrastructure.

Cloud-Native Industrial Data Platforms

Cloud-Native Industrial Data Platforms are positioned as Stars in the BCG Matrix, reflecting their strong market growth and significant market share. These platforms are crucial for digital transformation, enabling effortless data flow between industrial equipment and cloud analytics. Their design caters to the increasing demands of Industrial Internet of Things (IIoT) applications, offering scalability and adaptability.

The success of these platforms is evident in their substantial market penetration. For instance, the IIoT platform market was valued at approximately $27.7 billion in 2023 and is projected to reach $120.1 billion by 2030, growing at a CAGR of 23.4% during this period. This rapid expansion highlights the strong demand for cloud-native solutions that can handle vast amounts of industrial data.

- High Market Share: Cloud-native platforms have captured a significant portion of the industrial data management market due to their advanced capabilities.

- Rapid Growth: The IIoT platform sector, where these solutions operate, is experiencing robust growth, driven by the increasing adoption of digital technologies in manufacturing and other industries.

- Strategic Alliances: Collaborations with major cloud providers like AWS, Azure, and Google Cloud are key differentiators, enhancing their reach and service offerings.

- Scalability and Flexibility: Their cloud-native architecture allows businesses to scale their data operations up or down easily, adapting to changing needs and reducing infrastructure costs.

Stars in the BCG matrix represent business units or product lines that have a high market share in a high-growth industry. For HMS Networks, their advanced IIoT edge gateways and private 5G solutions exemplify this category. These offerings are capitalizing on the burgeoning Industry 4.0 and smart factory trends, which are experiencing significant expansion.

The demand for localized data processing and low-latency communication is a key driver for these Star products. The global IIoT market, a direct beneficiary of these technologies, was valued at approximately $27.7 billion in 2023 and is projected for substantial growth. HMS Networks' strong position in these high-growth segments indicates their potential for continued revenue generation and market leadership.

Their success in areas like private 5G and industrial cybersecurity, with the latter market expected to exceed $30 billion by 2028, further solidifies their Star status. These are areas where HMS Networks not only possesses significant market share but also operates within sectors experiencing rapid technological adoption and investment.

The company’s focus on enabling seamless connectivity for autonomous mobile robots (AMRs) also places them in a Star position. With the AMR market projected to grow from $3.5 billion in 2023 to over $10 billion by 2028, HMS Networks is well-positioned to benefit from this expanding automation landscape.

| Product/Solution Area | Market Growth | HMS Networks' Position | Key Drivers |

| IIoT Edge Gateways | High (Industry 4.0 adoption) | High Market Share | Real-time data processing, reduced latency |

| Private 5G & Wireless Industrial | High (Industrial connectivity needs) | High Market Share | Low-latency communication, network flexibility |

| Industrial Cybersecurity | High (OT/IT convergence) | Significant Market Share | Securing industrial operations, data protection |

| AMR/AGV Communication | High (Automation expansion) | Strong Market Presence | Dependable data exchange for mobile platforms |

What is included in the product

Strategic guidance on investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

Clear visual mapping of business units to identify underperformers and resource allocation needs.

Cash Cows

HMS Networks' established Industrial Ethernet connectivity, particularly in PROFINET and EtherNet/IP, acts as a strong cash cow. These protocols are the backbone of modern factory automation, with EtherNet/IP and PROFINET together accounting for a substantial portion of new industrial network connections, often exceeding 70% in many regions.

While the Industrial Ethernet market is mature, HMS Networks' dominant market share in these established protocols ensures a steady and significant cash flow. This is achieved with minimal incremental investment, as the need for robust and reliable industrial networking continues unabated, supporting consistent revenue generation.

HMS Networks' legacy fieldbus to Ethernet gateways are classic cash cows. Their broad range of gateways, enabling older systems like PROFIBUS to connect with newer Industrial Ethernet networks, consistently brings in steady income. Even though fieldbus usage is decreasing, a large number of existing installations still need these conversion tools to stay operational.

These products command a significant market share within a niche that isn't growing much but is essential. This strong position in a low-growth market ensures reliable profits for HMS Networks. For instance, in 2024, the demand for these gateways remained robust, supporting the installed base of automation equipment that relies on these communication bridges.

HMS Networks' Ewon remote access solutions are a prime example of a cash cow within their product portfolio, as per the Boston Consulting Group (BCG) matrix. These established offerings are a staple for machine builders and system integrators, facilitating global equipment monitoring and troubleshooting. Their market is mature, boasting a significant installed base that translates into consistent, recurring revenue streams from subscriptions and ongoing support services.

The strategy for Ewon centers on maximizing profitability by maintaining customer loyalty and ensuring peak operational efficiency. In 2024, HMS Networks reported that their Industrial IoT & Connectivity segment, which prominently features Ewon, continued to be a strong contributor to overall revenue. This segment benefits from the predictable, high-margin nature of its recurring revenue model, underscoring its cash cow status.

Basic Embedded Communication Modules (Anybus)

The Anybus range of embedded communication modules from HMS Networks represents a classic Cash Cow within the BCG matrix. These modules are essential for basic connectivity in a vast array of industrial devices, solidifying their position as foundational products for the company.

Anybus benefits from a commanding market share within a mature, albeit low-growth, component market. This strong market position, coupled with consistent demand, translates into reliable sales and robust profit margins, a hallmark of a Cash Cow.

- Market Share: High in a mature, low-growth segment.

- Revenue Generation: Steady and predictable due to widespread adoption.

- Profitability: Strong profit margins driven by established technology and economies of scale.

- Strategic Role: Provides consistent cash flow to fund investments in other business areas.

Maintenance and Support Services for Core Products

Maintenance and support services for core products represent a classic Cash Cow for companies with established market dominance in essential industrial hardware and software. This segment, characterized by consistent revenue streams from ongoing technical support, software updates, and essential maintenance for widely deployed solutions, thrives on high market share. While the growth rate for these services is typically low, their profitability is exceptionally high due to established infrastructure and minimal incremental investment requirements. For instance, in 2024, companies in the industrial automation sector often report that their legacy product support divisions, despite minimal new feature development, contribute a significant portion of their operating profit, often exceeding 30%.

These services are crucial for customer retention, ensuring that clients continue to rely on the company's ecosystem. The low investment needed to maintain these operations, coupled with the recurring nature of the revenue, makes them highly attractive. This allows companies to reallocate capital to more dynamic areas of their business. In 2024, the global market for industrial software maintenance and support was estimated to be worth over $50 billion, with a substantial portion of that attributed to established players in areas like manufacturing execution systems (MES) and industrial control systems (ICS).

- Consistent Revenue Generation: Ongoing support and updates for core industrial products provide a predictable income stream.

- High Profitability: Despite low growth, this segment boasts high profit margins due to minimal new investment needs.

- Customer Retention: Essential services ensure client satisfaction and loyalty, reducing churn.

- Capital Reallocation: Profits from Cash Cows can fund innovation and growth in other business units.

HMS Networks' Industrial Ethernet connectivity, particularly PROFINET and EtherNet/IP, serves as a robust cash cow. These protocols are fundamental to modern factory automation, with their combined share of new industrial network connections frequently surpassing 70% in various regions. This mature market, dominated by HMS Networks, generates consistent cash flow with minimal additional investment, reflecting the ongoing demand for reliable industrial networking solutions.

The company's legacy fieldbus to Ethernet gateways also function as classic cash cows. These products, enabling older systems like PROFIBUS to interface with newer Industrial Ethernet networks, continue to provide steady income. Despite the decline in fieldbus usage, a significant installed base necessitates these conversion tools for continued operation, ensuring reliable profits in a niche market.

HMS Networks' Ewon remote access solutions are a prime example of a cash cow. These established offerings are vital for machine builders and system integrators, supporting global equipment monitoring and troubleshooting. The mature market and substantial installed base translate into predictable, recurring revenue from subscriptions and support services, a characteristic of a cash cow.

The Anybus range of embedded communication modules exemplifies a classic Cash Cow. These modules are critical for basic connectivity across a wide spectrum of industrial devices, establishing them as foundational products. Anybus benefits from a high market share in a mature, low-growth component market, ensuring consistent sales and strong profit margins.

| Product Category | BCG Matrix Classification | Key Characteristics | 2024 Relevance |

| Industrial Ethernet Connectivity (PROFINET, EtherNet/IP) | Cash Cow | High market share, mature market, steady cash flow, low investment | Continued dominance in factory automation, exceeding 70% of new connections in many areas. |

| Legacy Fieldbus to Ethernet Gateways | Cash Cow | Essential for installed base, niche but stable demand, reliable profits | Robust demand supporting automation equipment relying on communication bridges. |

| Ewon Remote Access Solutions | Cash Cow | Mature market, recurring revenue (subscriptions/support), high profitability | Strong contributor to Industrial IoT & Connectivity segment revenue, predictable high-margin model. |

| Anybus Embedded Communication Modules | Cash Cow | High market share, mature component market, consistent sales, strong margins | Foundational products for industrial devices, ensuring reliable sales and robust profit margins. |

Delivered as Shown

HMS BCG Matrix

The preview you are currently viewing is the exact, unwatermarked HMS BCG Matrix document you will receive upon purchase. This comprehensive analysis tool is ready for immediate integration into your strategic planning, offering clear visual representations of your business portfolio. You'll gain access to the fully formatted report, designed for professional presentation and actionable insights, without any demo content or hidden surprises.

Dogs

Products built for older, proprietary fieldbus protocols are seeing a sharp drop in new installations as open standards take over. HMS Networks' market share in this declining area is likely very small and shrinking further.

These legacy solutions typically bring in very little revenue and demand a disproportionate amount of support. They represent prime candidates for divestment or a planned end-of-life strategy as the industry moves toward more modern, interoperable systems.

Niche Analog-to-Digital Converters for Legacy Systems represent a classic example of a Dogs category in the BCG matrix. These specialized converters are designed for outdated, non-networked analog control systems commonly found in older industrial settings. The market for these products is experiencing a significant decline as industries increasingly adopt modern, digital, and networked solutions.

HMS Networks' presence in this shrinking segment is likely characterized by a low market share. The growth potential and profitability of these legacy converters are minimal, making them a drain on resources that could be more effectively deployed in high-growth areas. For instance, while specific 2024 market share data for this niche is not publicly available, the broader trend of industrial automation moving away from analog systems is well-documented, with investments in IoT and digital twins accelerating.

Several IoT platform pilot projects, particularly those focused on niche industrial automation modules, have shown minimal market traction. For instance, a 2023 initiative targeting predictive maintenance in small-scale manufacturing saw less than 5% of pilot participants proceed to full-scale deployment due to integration complexities and a lack of clear ROI. These represent significant sunk costs without a path to market leadership.

Discontinued Product Line Inventory

Discontinued product line inventory, often categorized as Dogs in the BCG Matrix, represents assets that are no longer actively marketed or supported. Managing this inventory involves strategies focused on liquidation to recover capital, even if at a reduced value. For instance, in 2024, many electronics manufacturers faced challenges with legacy device inventory, with some reporting write-downs of up to 20% on unsold units from previous years.

These liquidation efforts are typically characterized by low growth and low profitability. The primary objective is to minimize the financial drag associated with storage, obsolescence, and management costs. Companies often resort to clearance sales, bulk disposals, or selling to liquidators to move this stock. For example, a major apparel retailer in 2024 implemented aggressive end-of-season sales, offering discounts up to 70% on discontinued lines to clear warehouse space.

The strategic aim for Dogs is to divest remaining assets and reallocate resources to more promising product categories. This often involves writing off unrecoverable inventory to improve balance sheet health. By 2025, it's projected that companies will increasingly adopt digital platforms for liquidating such inventory, aiming for faster turnover and reduced holding expenses.

- Low Growth & Profitability: Discontinued lines offer minimal revenue potential, often resulting in losses after accounting for holding costs.

- Inventory Liquidation Strategies: Tactics include deep discounts, bulk sales to third-party liquidators, or donation for tax benefits.

- Capital Recovery Focus: The goal is to convert stagnant inventory into cash, however small the amount, to free up working capital.

- Divestment and Resource Reallocation: The ultimate objective is to exit these product categories entirely and invest in higher-potential business units.

Highly Commoditized Basic Connectivity Cables/Accessories

Highly commoditized basic connectivity cables and accessories represent a segment where differentiation is minimal, leading to intense price competition. Companies operating here, like HMS Networks might, often struggle with slim profit margins due to the sheer number of manufacturers vying for market share. For instance, the global market for electronic components, including cables, is projected to reach hundreds of billions of dollars, but the basic cable segment within this is highly fragmented and price-sensitive.

These products are often considered cash traps within a business portfolio, as reinvestment yields little return due to the lack of pricing power and high volume requirements. HMS Networks' market share in such a commoditized space would likely be very small. The strategy here typically involves minimizing efforts and resources, shifting focus towards higher-value, more differentiated offerings to improve overall profitability and growth.

- Low Market Share: In highly commoditized markets, achieving significant market share is challenging due to numerous competitors.

- Slim Profit Margins: Intense price competition directly erodes profit margins on basic connectivity cables and accessories.

- Cash Trap Potential: High volume, low margin sales can tie up capital without generating substantial returns.

- Strategic Focus: Minimizing investment and prioritizing higher-value product lines is a common strategy for managing such segments.

Dogs in the BCG matrix represent products or business units with low market share in a low-growth industry. These are typically cash drains, offering minimal returns and requiring significant resources for maintenance. For instance, legacy fieldbus products in industrial automation, while still existing, are in a declining market with limited growth prospects.

HMS Networks, like many industrial technology companies, likely has some offerings that fall into the Dog category. These might include older product lines that haven't kept pace with market evolution or highly commoditized basic components where competition is fierce and margins are thin. For example, a 2024 analysis of the industrial connectivity market indicated a continued shift towards IP-based solutions, leaving older proprietary protocols with shrinking demand.

The strategic approach for Dogs is usually divestment or a managed decline. The goal is to minimize losses and free up capital and resources to invest in more promising areas of the business, such as Stars or Question Marks. A 2023 report on portfolio management highlighted that companies successfully divesting underperforming assets often saw improved profitability and increased investment capacity for innovation.

Consider the example of basic analog-to-digital converters for legacy industrial systems. While niche, the overall market for these is contracting as digital and networked solutions become standard. HMS Networks' share in such a segment would likely be small, with minimal growth and profitability, making it a prime candidate for a wind-down strategy to optimize resource allocation.

| Product Category | Market Growth | Market Share | Profitability | Strategic Recommendation |

| Legacy Fieldbus Products | Low (Declining) | Low | Low | Divest/End-of-Life |

| Commoditized Connectivity Cables | Low | Low | Very Low | Minimize Investment/Focus on Differentiation |

| Analog-to-Digital Converters (Legacy) | Very Low (Declining) | Very Low | Very Low | Divest/Phase Out |

Question Marks

Single Pair Ethernet (SPE) solutions represent a significant opportunity for HMS Networks, fitting squarely into the Stars category of the BCG Matrix. This emerging technology promises substantial cost and space efficiencies in industrial settings by enabling Ethernet communication over a single twisted pair cable.

The market for SPE is experiencing rapid growth, with projections indicating a compound annual growth rate (CAGR) of over 20% in the coming years, driven by the increasing demand for industrial automation and IIoT connectivity. HMS Networks, as an early mover, has a chance to establish a strong foothold.

Significant investment in research and development, alongside dedicated market education efforts, will be critical for HMS Networks to solidify its position and capture a leading market share before competitors fully enter the space. This proactive approach is essential to capitalize on the high-growth potential.

AI-Driven Predictive Maintenance Software fits into the Question Marks category of the BCG Matrix. This new software leverages AI to anticipate industrial machinery failures, a market experiencing significant growth. For instance, the global AI in industrial automation market was valued at approximately $2.5 billion in 2023 and is projected to reach over $11 billion by 2028, exhibiting a compound annual growth rate of over 30%.

HMS Networks is entering this burgeoning market with a low existing market share, necessitating substantial investment. Significant capital will be directed towards acquiring AI expertise, integrating diverse data streams, and refining the platform's capabilities. This strategic investment is crucial to transform the software from a Question Mark into a potential market leader, or Star, in the coming years.

HMS Networks is developing new offerings centered on optimizing energy use and promoting eco-friendly practices within industrial automation. These solutions directly support global environmental objectives, tapping into a sector experiencing rapid expansion due to regulatory mandates and corporate sustainability commitments.

The market for green automation and energy management is characterized by high growth potential, fueled by increasing environmental regulations and a strong corporate push towards sustainability. HMS Networks' involvement in this area positions them to capitalize on these trends, though they are likely in the initial phases of establishing market presence.

To effectively compete and gain significant market share in this burgeoning field, HMS Networks will need to dedicate substantial resources to developing specialized solutions and forging key strategic alliances. This proactive approach is crucial for navigating the competitive landscape and solidifying their position in the green automation sector.

Advanced Human-Machine Interface (HMI) with AR/VR Integration

Developing advanced Human-Machine Interfaces (HMIs) with Augmented Reality (AR) and Virtual Reality (VR) integration represents a significant push into the future of industrial operations. This technology aims to revolutionize operator interaction, offering immersive experiences for training, diagnostics, and remote assistance. While the potential for enhanced efficiency and safety is immense, the current market penetration for these sophisticated HMIs remains nascent.

The market for AR/VR in industrial applications is projected for substantial growth, with some forecasts suggesting it could reach tens of billions of dollars by the late 2020s. However, widespread adoption is still hindered by factors such as high implementation costs and the need for robust infrastructure. For a company like HMS Networks, this segment would likely be categorized as a 'Question Mark' within the BCG matrix, indicating high potential but requiring significant investment to establish a strong market position.

- Market Potential: The industrial AR/VR market is anticipated to grow significantly, potentially reaching over $30 billion globally by 2027, driven by sectors like manufacturing and logistics.

- Current Adoption: Despite the growth projections, actual market adoption of advanced AR/VR HMIs remains relatively low, with many industries still in the pilot or early adoption phases.

- HMS Networks Position: HMS Networks' current market share in this specific advanced HMI segment would likely be minimal, reflecting its status as an emerging technology.

- Strategic Imperative: Substantial research and development (R&D) investment, coupled with a strong focus on user experience (UX) and demonstrating clear ROI, are crucial for proving market viability and capturing future growth.

New Geographic Market Expansion (e.g., South America/Africa)

Expanding into new geographic markets like South America and Africa presents a significant opportunity for HMS Networks, aligning with the 'Question Marks' quadrant of the BCG Matrix due to high growth potential but low current market share. These regions, such as Brazil and Nigeria, are experiencing robust economic growth, with Sub-Saharan Africa's GDP projected to grow by 3.1% in 2024, according to the World Bank. HMS Networks must invest heavily in building local sales infrastructure, adapting products to specific market needs, and navigating diverse regulatory environments to gain traction against established local players.

Strategic initiatives will focus on establishing strong distribution partnerships and localized marketing campaigns to penetrate these markets effectively. For instance, understanding the specific connectivity demands in rapidly urbanizing areas of South America, where mobile data usage is soaring, will be critical. The initial investment in market entry, including setting up local support and sales teams, will be substantial, reflecting the high risk and high reward nature of these emerging economies. By 2024, the African digital economy is expected to contribute significantly to GDP, highlighting the potential for companies like HMS Networks that can offer relevant solutions.

- Market Entry Strategy: Focus on phased entry, prioritizing key urban centers with high digital adoption rates in countries like Colombia or Kenya.

- Localization Efforts: Tailor product features and pricing to meet the specific economic conditions and user preferences in target South American and African nations.

- Partnership Development: Forge alliances with local telecommunication providers and system integrators to leverage existing networks and market knowledge.

- Investment Allocation: Direct significant capital towards building a robust local sales force and establishing reliable customer support channels to overcome initial market share challenges.

The AI-Driven Predictive Maintenance Software is a prime example of a Question Mark for HMS Networks. It operates in a high-growth market, but the company currently holds a minimal market share.

Significant investment in R&D, talent acquisition, and platform refinement is necessary to elevate this offering from a Question Mark to a potential market leader.

The success of this software hinges on HMS Networks' ability to effectively leverage AI capabilities and demonstrate tangible value to industrial clients in a competitive landscape.

| Category | Product/Service | Market Growth | Market Share | Strategic Focus |

|---|---|---|---|---|

| Question Mark | AI-Driven Predictive Maintenance Software | High (30%+ CAGR projected) | Low (Emerging product) | Investment in R&D, AI expertise, market penetration |

| Question Mark | Advanced AR/VR HMIs | High (Tens of billions by late 2020s) | Low (Nascent adoption) | Substantial R&D, UX focus, ROI demonstration |

| Question Mark | Expansion into South America & Africa | High (Robust economic growth) | Low (New market entry) | Building local infrastructure, partnerships, localization |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of internal financial data, comprehensive market research, and competitive analysis to provide a clear strategic overview.