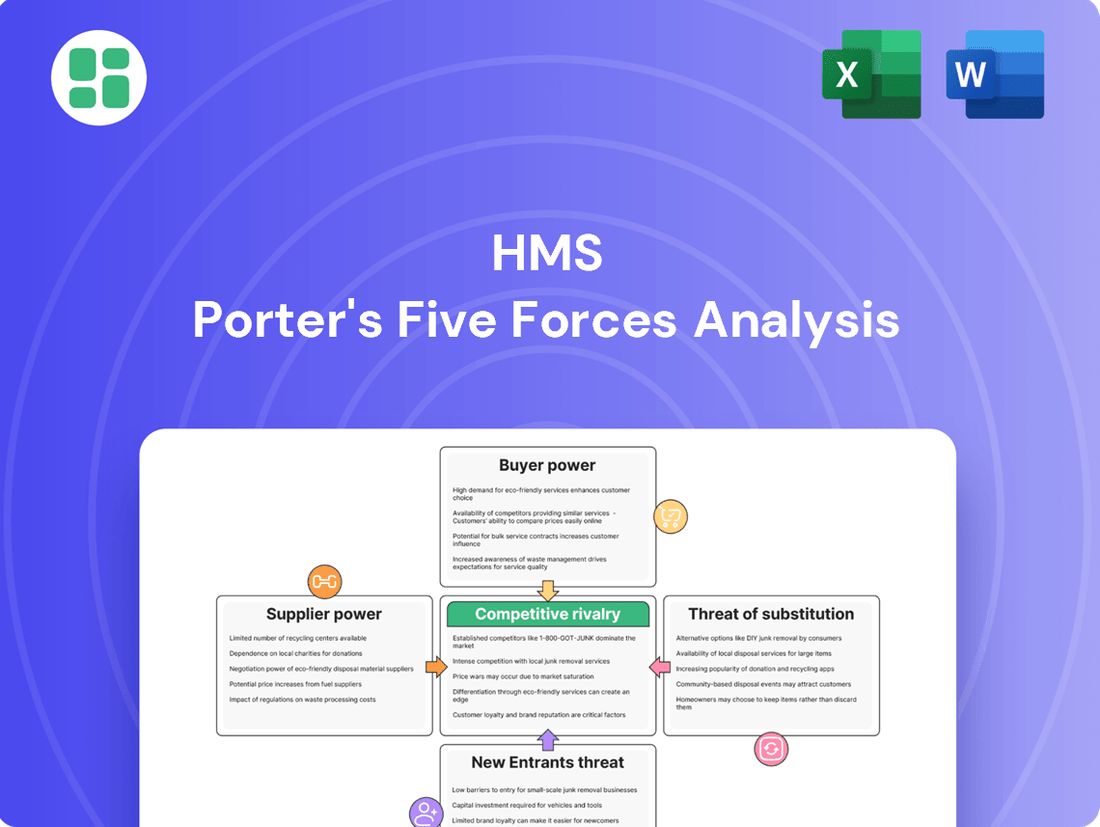

HMS Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HMS Bundle

HMS's competitive landscape is shaped by powerful forces, from the intense rivalry among existing players to the ever-present threat of new entrants. Understanding these dynamics is crucial for any business operating within or looking to enter this market.

The complete report reveals the real forces shaping HMS’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

HMS Networks, a key player in industrial communication, faces significant bargaining power from its semiconductor and component suppliers. This is due to the often concentrated nature of this market, where a few manufacturers dominate the supply of critical, specialized components necessary for HMS's advanced solutions.

The global electronic component supply chain experienced considerable strain in recent years, with shortages and price hikes impacting many tech firms. For instance, lead times for certain microcontrollers and advanced sensors, crucial for HMS's products, extended significantly, affecting production schedules and increasing costs. This reliance on a limited supplier base grants these manufacturers considerable leverage in setting terms and prices.

When suppliers offer highly specialized industrial communication protocols or embedded technologies, their bargaining power can significantly increase. This is because these niche offerings are often not readily available from multiple sources. For instance, if HMS Networks relies on a particular patented technology for its industrial communication solutions, finding an alternative could be challenging and costly.

The unique nature of these specialized technologies can lead to substantial switching costs for HMS Networks. If a supplier provides a critical component or protocol that is deeply integrated into HMS’s product lines, moving to a different supplier would likely involve significant redesign, re-certification, and potential disruption to existing customer deployments. In 2023, the industrial automation market saw continued growth, with a particular emphasis on specialized connectivity solutions, underscoring the importance of these niche suppliers.

Fluctuations in raw material costs, particularly for rare earth elements and metals vital for electronic components, directly impact HMS Networks' cost of goods. For instance, the price of neodymium, a key rare earth element, saw significant volatility in 2024, with some reports indicating price increases of over 20% in certain periods due to supply chain disruptions.

Suppliers can leverage these rising material costs to increase their prices to HMS Networks. This pressure on HMS's margins is significant if they cannot pass these increases on to their customers, especially given the competitive landscape in the industrial communication sector.

Geopolitical events, such as trade disputes or resource nationalism in key mining regions, can further amplify these raw material cost pressures. Such instability creates uncertainty and can lead to sudden price spikes, challenging HMS Networks' cost management strategies.

Supplier Concentration for Specific Modules or Solutions

When a few suppliers control essential modules or software for HMS Networks, they gain significant leverage over pricing and delivery. This concentration means HMS has fewer alternatives if a key supplier increases costs or faces production issues.

For instance, if a critical communication protocol software is only available from one or two specialized firms, those firms can dictate terms. HMS Networks' strategy to counter this includes broadening its supplier network and bringing more expertise in-house. The acquisition of PEAK-System Technik GmbH in 2023, for example, aimed to bolster their capabilities in embedded systems and diagnostics, potentially reducing reliance on external providers for certain solutions.

- Supplier Concentration: High if critical components are sourced from a few vendors.

- Impact on HMS: Potential for increased costs and disrupted delivery schedules.

- Mitigation Strategies: Diversifying suppliers and in-house capability development.

- Example: Acquisition of PEAK-System Technik GmbH to integrate expertise.

Importance of Supplier's Technology to HMS's Product Portfolio

For suppliers whose technology is deeply integrated into HMS Networks' core product lines, such as their Anybus, Ewon, or Ixxat brands, their bargaining power is significantly elevated.

The complexity and cost associated with integrating new technologies mean that switching suppliers for these critical components can be a lengthy and expensive undertaking, providing incumbent suppliers with considerable leverage. This is especially true for suppliers providing foundational communication protocols and hardware that are essential to HMS's product functionality.

- Supplier Technology Integration: Suppliers of critical technologies like those powering HMS's Anybus, Ewon, and Ixxat product families hold strong bargaining power due to deep integration.

- Switching Costs: The high cost and time required to integrate new technologies into existing product lines create significant switching costs, reinforcing supplier leverage.

- Foundational Components: Suppliers of essential communication protocols and hardware components possess elevated bargaining power as these are fundamental to HMS's offerings.

The bargaining power of suppliers for HMS Networks is substantial, primarily driven by the concentration within the semiconductor and component markets. When suppliers offer highly specialized or patented technologies, their leverage increases significantly due to limited alternatives and high switching costs for HMS. For instance, the industrial automation sector's reliance on specific, integrated communication modules means suppliers of these niche products can command higher prices and dictate terms, impacting HMS's cost structure and production timelines.

The global semiconductor shortage, which persisted through much of 2023 and into early 2024, highlighted the vulnerability of companies like HMS Networks to supplier power. Extended lead times and price increases for critical components, such as advanced microcontrollers and specialized sensors, directly affected HMS's operational efficiency and profitability. This situation underscores the strategic importance of managing supplier relationships and diversifying sourcing to mitigate risks associated with concentrated supply chains.

| Factor | Impact on HMS Networks | Example/Data Point (2023-2024) |

|---|---|---|

| Supplier Concentration | Increased costs, potential supply disruptions | Few dominant suppliers for advanced industrial communication chips. |

| Specialized Technology | High switching costs, limited alternatives | Proprietary communication protocols or embedded software. |

| Raw Material Volatility | Pressure on margins, increased cost of goods | Neodymium price increases of over 20% in certain periods of 2024. |

| Integration Depth | Elevated supplier leverage | Components deeply embedded in Anybus, Ewon, Ixxat product lines. |

What is included in the product

This analysis dissects the competitive forces impacting HMS, evaluating supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry.

Effortlessly visualize competitive intensity with a dynamic, interactive dashboard that highlights key threats and opportunities.

Customers Bargaining Power

HMS Networks' diverse customer base, spanning manufacturing, automotive, energy, and building automation, significantly dilutes the bargaining power of any single customer. This broad reach across industrial sectors means no one industry segment holds overwhelming sway over HMS's pricing or terms.

While this diversification is a strength, a notable slowdown in a key sector like automotive, which represented a substantial portion of industrial automation investments in 2024, could still impact overall demand for HMS's solutions.

HMS Networks' connectivity solutions are often indispensable for customers' core operations, facilitating automation, remote management, and crucial data exchange. This makes them a vital component for achieving smarter manufacturing and boosting operational efficiency, especially as Industry 4.0 and the Industrial Internet of Things (IIoT) become more prevalent. For instance, in 2023, the industrial automation market, where HMS operates, saw significant growth, underscoring the essential nature of these technologies for businesses.

Large industrial clients of HMS, particularly those with significant in-house technical capabilities, can leverage their expertise to integrate components from multiple suppliers or even develop proprietary solutions. This reduces their reliance on a single vendor like HMS, potentially impacting pricing negotiations. For instance, a major manufacturing firm might opt to combine open-source industrial IoT platforms with specialized hardware from a competitor, thereby reducing their dependence on HMS's integrated offerings.

The widespread adoption of standardized industrial communication protocols, such as OPC UA, while fostering interoperability, simultaneously empowers customers to mix and match solutions from various providers. This ease of integration means a customer could potentially source a control system from one vendor and a data analytics platform from another, bypassing a fully integrated HMS solution. This scenario can exert downward pressure on HMS's pricing and necessitate a competitive feature set to retain market share.

Price Sensitivity and Volume-Based Purchasing

For significant purchasers, such as major machine builders or system integrators, price is often a critical consideration. These entities frequently aim for cost efficiencies through large-scale procurement and can use their substantial order volumes to secure more advantageous pricing and contract conditions. In 2023, the industrial communication sector saw continued price pressure, with some reports indicating average price increases for certain components being kept below 5% due to intense competition and customer negotiation leverage.

HMS Networks addresses this by employing a dual approach: direct sales channels cater to large clients requiring tailored solutions and pricing, while an extensive network of distributors and partners ensures accessibility and competitive pricing for a broader customer base. This strategy allows HMS to effectively manage varying customer demands and price sensitivities across different market segments.

- Price Sensitivity: Large-volume buyers, like machine builders, often prioritize cost savings and can exert significant influence on pricing through their purchasing power.

- Economies of Scale: These customers seek to benefit from lower per-unit costs associated with bulk orders, driving negotiations for favorable terms.

- HMS Networks' Strategy: The company balances direct sales for key accounts with a broad distributor network to manage diverse customer price expectations.

- Market Dynamics: In 2023, the industrial communication market experienced price pressures, with component price hikes generally moderated by customer negotiation and competitive forces.

Switching Costs for Customers

Once HMS's communication modules or gateways are integrated into a customer's industrial systems, the cost and effort involved in switching to a competitor's solution can be substantial. This often necessitates significant system redesign, extensive reprogramming, and comprehensive retraining of personnel, effectively creating customer lock-in. For instance, in the industrial automation sector, a typical integration project for a new communication protocol could involve months of engineering work and significant capital expenditure, making a switch to a rival solution economically prohibitive for many clients.

This inherent customer lock-in directly strengthens HMS's bargaining position, as the perceived risk and expense of changing suppliers deter customers from seeking alternatives. However, this advantage is not static; continued innovation from HMS is crucial to maintain and enhance this competitive moat. The company's ongoing investment in R&D, aiming for seamless integration and superior performance, directly contributes to higher switching costs for its existing customer base.

The bargaining power of customers is thus moderated by these switching costs. While customers may seek better pricing or terms, the operational disruption and financial outlay required to change providers often outweigh the potential benefits. This dynamic is particularly evident in industries where system reliability and long-term operational efficiency are paramount, such as manufacturing and utilities.

- High Integration Costs: Switching HMS's industrial communication hardware can involve significant expenses for system redesign and reprogramming.

- Operational Disruption: Customers face potential downtime and productivity losses during the transition to a new vendor.

- Training Requirements: New systems necessitate retraining staff, adding to the overall cost and complexity of switching.

- Customer Lock-in: These factors create a strong incentive for customers to remain with HMS, reducing their bargaining power.

The bargaining power of customers for HMS Networks is generally moderate, influenced by factors like price sensitivity and switching costs. While large buyers can negotiate for better terms, the deep integration of HMS solutions into customer operations creates significant switching barriers. This lock-in effect limits customers' ability to easily shift to competitors, thereby reducing their overall leverage.

| Factor | Impact on Customer Bargaining Power | HMS Networks' Mitigation Strategy |

|---|---|---|

| Price Sensitivity | High for large-volume buyers; moderate for smaller clients. | Dual sales channels (direct for key accounts, distributors for broader reach) to manage price expectations. |

| Switching Costs | Substantial due to integration complexity, reprogramming, and retraining. | Focus on R&D for seamless integration and superior performance to enhance customer lock-in. |

| Product Differentiation | Limited by standardization of protocols like OPC UA. | Emphasis on unique features, reliability, and comprehensive support to maintain competitive advantage. |

| Customer Concentration | Diluted by a diverse customer base across multiple industrial sectors. | Broad market penetration reduces reliance on any single customer or industry segment. |

Full Version Awaits

HMS Porter's Five Forces Analysis

This preview showcases the complete HMS Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. You're looking at the actual document, meaning the detailed insights into threat of new entrants, bargaining power of buyers and suppliers, threat of substitute products, and intensity of rivalry are precisely what you'll receive. Once your purchase is complete, you'll gain instant access to this professionally formatted and ready-to-use analysis.

Rivalry Among Competitors

The industrial automation landscape is dominated by formidable global giants such as Siemens, Rockwell Automation, Schneider Electric, and ABB. These established players boast extensive portfolios that encompass a wide array of automation solutions, often integrating communication technologies seamlessly within their broader product ecosystems.

This integration presents a significant competitive challenge for specialized companies like HMS Networks. For instance, Siemens' extensive offerings in factory automation, including their SIMATIC controllers and SINUMERIK CNC systems, often come bundled with their proprietary communication protocols and solutions, creating a strong pull for customers already invested in their ecosystem. Similarly, Rockwell Automation's Connected Enterprise strategy emphasizes the integration of its Allen-Bradley control systems with its industrial communication products, solidifying its market position.

HMS Networks, while a specialized leader in protocol conversion and IIoT connectivity, thrives by concentrating on its core expertise. Their strategy involves providing interoperability solutions that bridge the communication gaps between diverse automation systems, including those from these larger competitors. This focus allows HMS to offer flexibility and choice to end-users, enabling them to integrate best-of-breed components from various vendors, thereby carving out a distinct competitive niche.

The industrial IoT and automation market is booming, fueled by widespread digital transformation and Industry 4.0 adoption. This expansion, with the global industrial IoT market expected to hit USD 847.0 billion by 2033, creates fertile ground for all participants but simultaneously escalates rivalry as firms aggressively pursue market share.

HMS Networks leverages its proprietary, patented technology and a diverse portfolio of brands, including Anybus, Red Lion, Ewon, and Ixxat, to stand out. This product differentiation is key in a market where rivals are constantly vying for attention.

The pace of innovation is relentless, with HMS Networks needing to continuously advance its offerings in industrial communication protocols, remote access, and embedded solutions. For instance, the demand for integrated advanced analytics and AI capabilities within industrial networks is a significant driver of this innovation cycle.

In 2023, HMS Networks reported net sales of SEK 7,304 million, highlighting the scale of operations and the investment required to maintain a competitive edge through R&D. This financial performance underscores the importance of staying ahead in product development.

Acquisition Activities and Market Consolidation

The industrial communication sector is experiencing a significant wave of consolidation, driven by strategic acquisitions. HMS Networks, a key player, has actively participated in this trend. For instance, their acquisition of PEAK-System Technik GmbH in 2021 bolstered their automotive diagnostics capabilities, while the earlier acquisition of Red Lion Controls in 2018 significantly expanded their industrial automation and visualization portfolio.

These consolidations directly reshape the competitive rivalry. By integrating acquired technologies and market access, companies like HMS Networks can enhance their product offerings and customer reach. This can lead to a more concentrated market where fewer, larger entities possess greater market share and influence, potentially intensifying competition for smaller, independent players.

The ongoing M&A activity indicates a dynamic market where strategic mergers and acquisitions are not just growth strategies but essential tools for maintaining and improving competitive positioning. This trend suggests that market leadership in industrial communications is increasingly defined by the ability to strategically integrate complementary businesses and technologies.

Global Reach and Local Presence

HMS Networks boasts a significant global footprint, evidenced by its presence in over 20 sales offices and an extensive network of distributors and partners. This widespread reach enables them to cater to a diverse international clientele.

The competitive landscape in this sector necessitates a robust global presence coupled with the agility to adapt to local market nuances. These include variations in communication standards and distinct customer preferences across different regions.

- Global Sales Offices: Over 20 as of early 2024.

- Distribution Network: Extensive partnerships facilitating worldwide service.

- Adaptability: Crucial for navigating regional communication standards and customer needs.

Competitive rivalry in industrial automation is intense, with giants like Siemens and Rockwell Automation offering integrated solutions that challenge specialized players. HMS Networks differentiates itself through its focus on interoperability, enabling diverse system integration. The market's rapid growth, projected to reach USD 847.0 billion by 2033, fuels this competition as firms vie for market share.

HMS Networks actively manages this rivalry through strategic acquisitions, such as the 2021 acquisition of PEAK-System Technik GmbH, to enhance its portfolio and market reach. This ongoing consolidation reshapes the competitive landscape, favoring companies that can effectively integrate new technologies and businesses.

The company's global presence, with over 20 sales offices and a broad distribution network, is crucial for navigating regional differences in communication standards and customer preferences, allowing it to compete effectively worldwide.

| Competitor | Key Offerings | HMS Networks' Strategy |

|---|---|---|

| Siemens | Integrated factory automation, proprietary communication protocols | Interoperability solutions, bridging diverse systems |

| Rockwell Automation | Connected Enterprise strategy, Allen-Bradley control systems | Focus on protocol conversion and IIoT connectivity |

| ABB | Broad automation solutions, integrated communication | Leveraging proprietary technology and diverse brands (Anybus, Red Lion) |

SSubstitutes Threaten

The threat of substitutes for HMS Networks' industrial communication solutions is significant, particularly from evolving Industrial Ethernet standards and emerging wireless technologies like 5G. While HMS provides robust solutions across many protocols, the market's continuous shift towards faster, more integrated communication methods means new technologies could bypass traditional offerings.

The transition to Industrial Ethernet is a prime example; it has already captured a substantial portion of new industrial automation installations, demonstrating how readily the market adopts superior alternatives. This ongoing migration highlights the potential for newer, more advanced protocols to emerge as viable substitutes, impacting demand for existing solutions.

Large manufacturers, particularly in sectors like automotive or aerospace, may develop their own proprietary communication systems. For instance, by 2024, it's estimated that over 60% of new vehicles incorporate some level of in-house developed connectivity software, reducing reliance on third-party solutions.

This internal development can be a significant substitute threat if these systems offer substantial cost savings or unique customization benefits that external vendors cannot match. However, the high cost and specialized expertise required for robust industrial communication solutions often make this a less viable substitute for many companies.

The growing trend of cloud-based and software-defined networking (SDN) solutions presents a significant threat of substitutes for hardware-centric communication modules. As industrial environments increasingly embrace cloud computing for data exchange and remote management, these platforms can offer alternative functionalities. For instance, cloud service providers are expanding their offerings in data storage and compute power for Industrial Internet of Things (IIoT) applications, potentially reducing the reliance on specialized hardware.

Basic Connectivity Solutions vs. Advanced IIoT Offerings

For basic industrial connectivity needs, simpler, lower-cost hardware and software can act as substitutes for HMS's advanced IIoT solutions. These alternatives might be sufficient for less demanding applications where real-time data and complex automation are not critical. For instance, basic network switches or less sophisticated data loggers could fulfill minimal communication requirements at a fraction of the cost.

However, the increasing demand for sophisticated capabilities like predictive maintenance, real-time performance monitoring, and intricate automation is a key factor limiting the threat of substitutes. As industries push for greater efficiency and data-driven decision-making, the need for robust, reliable, and specialized communication infrastructure, like that offered by HMS, becomes paramount. This trend is evidenced by the projected growth in the Industrial Internet of Things (IIoT) market, which was estimated to reach over $210 billion in 2024, indicating a strong preference for advanced solutions.

- Limited Applicability of Basic Solutions: Simpler connectivity options often lack the bandwidth, security features, and integration capabilities required for modern industrial operations.

- Growing IIoT Adoption: The global IIoT market is expanding rapidly, with forecasts suggesting continued strong growth, driven by the need for advanced functionalities.

- Cost vs. Value Proposition: While lower-cost substitutes exist, they often fail to deliver the long-term value and operational improvements that HMS's advanced solutions provide.

- Industry 4.0 Imperatives: The drive towards Industry 4.0 necessitates sophisticated connectivity, making basic substitutes increasingly irrelevant for competitive industries.

Cybersecurity Concerns Leading to Isolated Systems

Heightened cybersecurity concerns, particularly within industrial operational technology (OT) environments, are a significant threat of substitutes for companies like HMS Networks. These worries can drive a preference for air-gapped or highly isolated systems, effectively reducing the need for the interconnected solutions that HMS specializes in. For instance, a 2024 report indicated that 45% of industrial organizations experienced at least one cybersecurity incident impacting operations, fueling this cautious approach.

While HMS provides robust security features within its products, a strong market sentiment favoring complete disconnection due to fear of breaches could limit the adoption of their otherwise beneficial connected offerings. This is especially true as the perceived risk of cyberattacks on critical infrastructure continues to grow, with some sectors actively investing in legacy, non-networked equipment as a perceived safeguard.

However, it's important to note that the overarching industry trend, despite these concerns, is still towards increased connectivity and data utilization. The potential benefits of real-time monitoring, predictive maintenance, and optimized operations offered by connected systems often outweigh the perceived risks for many forward-thinking organizations. For example, the Industrial Internet of Things (IIoT) market is projected to reach $1.1 trillion by 2028, demonstrating this persistent drive for connectivity.

- Cybersecurity Incidents: 45% of industrial organizations reported operational cybersecurity incidents in 2024.

- Market Trend: The IIoT market is expected to reach $1.1 trillion by 2028, indicating a strong push for connectivity.

- Risk Mitigation: Some companies are opting for isolated systems as a direct response to cybersecurity fears.

The threat of substitutes for HMS Networks' industrial communication solutions is driven by the continuous evolution of communication technologies and alternative approaches to connectivity. As industrial environments demand greater efficiency and data integration, new technologies can emerge as viable alternatives that may bypass traditional hardware-centric offerings.

Industrial Ethernet standards have already captured significant market share, demonstrating the willingness of industries to adopt superior communication methods. Furthermore, the rise of wireless technologies and the increasing capability of cloud-based and software-defined networking solutions present ongoing challenges. For instance, the global IIoT market was projected to exceed $210 billion in 2024, highlighting a strong demand for advanced, often integrated, communication capabilities that could potentially replace standalone hardware modules.

While simpler, lower-cost hardware can serve as a substitute for less demanding applications, the growing need for sophisticated functionalities like predictive maintenance and real-time monitoring often favors more advanced solutions. However, heightened cybersecurity concerns can also drive a preference for isolated systems, reducing the need for interconnected solutions. In 2024, 45% of industrial organizations reported operational cybersecurity incidents, fueling this trend towards isolation in some sectors.

| Substitute Type | Description | Impact on HMS | Market Trend/Data (2024) |

|---|---|---|---|

| Industrial Ethernet | Faster, more integrated communication protocols replacing older serial methods. | Captures new installations, potentially reducing demand for legacy HMS solutions. | Significant adoption in new industrial automation projects. |

| Wireless Technologies (e.g., 5G) | Emerging technologies offering high bandwidth and low latency. | Can offer alternative connectivity, potentially bypassing traditional wired solutions. | Increasing investment and deployment in industrial settings. |

| Cloud-based/SDN Solutions | Software-defined networking and cloud platforms for data exchange and management. | Can offer alternative functionalities, reducing reliance on specialized hardware. | IIoT market projected to exceed $210 billion in 2024, indicating strong growth in connected solutions. |

| Proprietary Systems | In-house developed communication systems by large manufacturers. | Reduces reliance on third-party vendors if cost savings or customization benefits are significant. | Over 60% of new vehicles in 2024 incorporated some in-house connectivity software. |

| Isolated/Air-gapped Systems | Systems disconnected from external networks due to cybersecurity fears. | Limits adoption of interconnected solutions offered by HMS. | 45% of industrial organizations experienced operational cybersecurity incidents in 2024. |

Entrants Threaten

The threat of new entrants into the industrial communication and IIoT market is significantly mitigated by the high capital investment required for research and development and manufacturing. Developing advanced hardware and sophisticated software for these specialized applications demands substantial upfront funding.

For instance, a new player would need to match the R&D expenditure of established firms. HMS Networks, a leading company in this space, consistently invests a significant portion of its revenue back into innovation, with their 2023 R&D expenses amounting to approximately SEK 300 million (around $28 million USD).

This level of ongoing investment creates a substantial barrier, as new entrants must not only develop competitive products but also sustain continuous innovation to keep pace with market leaders. The sheer scale of capital needed for cutting-edge technology and efficient production lines makes it challenging for newcomers to gain a foothold and compete effectively against well-funded incumbents.

The industrial communication sector presents a formidable barrier to new entrants due to the sheer complexity and fragmentation of its standards and protocols. Companies like HMS Networks have spent decades building expertise in navigating and integrating with diverse systems such as EtherNet/IP, PROFINET, and Modbus. This deep-seated knowledge and established compatibility are not easily replicated, making it difficult for newcomers to offer competitive solutions that seamlessly connect with existing industrial infrastructure.

HMS Networks has cultivated deep-seated relationships with key players in the industrial automation sector, including manufacturers, machine builders, and system integrators worldwide. This extensive network, coupled with a strong brand reputation built on its Anybus, Ewon, and Red Lion product lines, presents a significant barrier to new entrants.

For instance, in 2023, HMS Networks reported a revenue of SEK 2,590 million, demonstrating its substantial market presence and the financial strength backing its established customer base. Newcomers would find it incredibly challenging to replicate this level of trust and market penetration quickly, as acquiring and retaining customers in this specialized industry often hinges on long-standing partnerships and proven reliability.

Regulatory Hurdles and Certification Requirements

The industrial communication device sector faces substantial barriers due to stringent regulatory compliance and mandatory certifications. For instance, devices operating in hazardous environments must often meet ATEX directives in Europe or NEC standards in North America, requiring rigorous testing and validation.

These certifications are not only time-consuming but also represent a significant upfront investment for new companies, potentially costing tens of thousands of dollars per product line. For example, achieving UL certification for electrical safety can take several months and involve substantial fees.

This complex web of regional and industry-specific requirements, including those for cybersecurity and electromagnetic compatibility (EMC), effectively deters many potential new entrants. The need to secure multiple approvals, such as CE marking for the European market and FCC certification for the US, adds layers of complexity and expense, limiting the ease with which new players can enter the market.

- Regulatory Compliance: Industrial communication devices must adhere to safety, interoperability, and performance standards specific to regions and industries.

- Certification Costs: Obtaining necessary certifications like ATEX, NEC, UL, CE, and FCC can incur significant expenses and lengthy approval processes.

- Market Entry Barriers: The complexity and cost associated with navigating these regulatory hurdles act as a substantial deterrent for new companies entering the industrial communication device market.

Talent Acquisition and Specialized Expertise

The niche nature of industrial communication and IIoT demands highly specialized engineering talent. New entrants face significant hurdles in attracting and retaining individuals with expertise in embedded systems, network protocols, and industrial automation. This specialized workforce is already in high demand, making recruitment a considerable challenge.

The competition for skilled IIoT engineers is fierce. For instance, in 2024, the demand for cybersecurity professionals within the industrial sector, a key component of IIoT security, continued to outstrip supply. Reports indicated a global shortage of over 3 million cybersecurity professionals, with industrial control systems (ICS) security being a particularly critical gap.

- Talent Scarcity: The limited pool of engineers with deep knowledge in areas like OPC UA, MQTT, and industrial network security presents a barrier to entry.

- High Recruitment Costs: Companies in 2024 reported average recruitment costs for specialized tech roles, including IIoT engineers, exceeding $5,000 per hire, often with extended time-to-hire periods.

- Retention Challenges: Established players often offer competitive compensation and career development opportunities, making it difficult for new entrants to retain top talent once acquired.

The threat of new entrants in the industrial communication and IIoT market is significantly constrained by substantial capital requirements for R&D and manufacturing, alongside the complexity of existing standards and protocols. Established companies like HMS Networks have built deep relationships and strong brand reputations over decades, making it difficult for newcomers to replicate their market penetration and customer trust. Furthermore, stringent regulatory compliance and mandatory certifications, which are both costly and time-consuming, act as significant deterrents.

The demand for specialized engineering talent in areas like embedded systems and industrial automation further erects a barrier. For instance, in 2024, the shortage of cybersecurity professionals in the industrial sector remained a critical issue, with reports indicating a global deficit of over 3 million such professionals. This scarcity drives up recruitment costs, with average hiring expenses for specialized tech roles exceeding $5,000 per hire in 2024, and makes talent retention a challenge for new entrants.

| Barrier Type | Description | Example/Data Point |

| Capital Requirements | High R&D and manufacturing investment | HMS Networks' 2023 R&D expenditure was approximately SEK 300 million (~$28 million USD). |

| Technical Complexity & Standards | Navigating diverse protocols (e.g., EtherNet/IP, PROFINET) | Decades of expertise required to ensure seamless integration with existing infrastructure. |

| Customer Relationships & Brand Reputation | Established trust and market penetration | HMS Networks' 2023 revenue of SEK 2,590 million reflects significant market presence and customer loyalty. |

| Regulatory Compliance & Certifications | Meeting regional and industry-specific standards (ATEX, NEC, UL, CE, FCC) | Certification processes can cost tens of thousands of dollars per product line and take months. |

| Talent Scarcity | Demand for specialized IIoT engineers | In 2024, a global shortage of over 3 million cybersecurity professionals impacted industrial control systems security. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of robust data, including company annual reports, industry-specific market research, and government economic indicators, to provide a comprehensive understanding of competitive dynamics.