HMM SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HMM Bundle

Our HMM SWOT analysis reveals key strengths like its robust technological infrastructure and a dedicated workforce, alongside opportunities for market expansion in emerging economies. However, it also highlights potential weaknesses such as reliance on specific suppliers and threats from rapidly evolving industry regulations.

Want the full story behind HMM's competitive edge, potential pitfalls, and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

HMM boasts an extensive fleet, featuring a significant number of ultra-large container vessels (ULCVs). These ULCVs are vital for leveraging economies of scale, which directly translates to lower per-unit shipping costs. This substantial investment in high-capacity vessels allows HMM to serve major global trade routes with enhanced efficiency.

The company's strategic vision includes nearly doubling its container fleet to 1.55 million TEU by the year 2030. This ambitious expansion plan underscores HMM's commitment to solidifying its capacity advantage in the competitive global shipping market.

HMM's financial performance in 2024 was exceptionally strong, marked by substantial growth in revenue, operating profit, and net profit. The company reported a remarkable 30% operating margin for 2024, positioning it among the top performers in the global shipping industry. This high margin underscores HMM's efficient operations and robust profitability.

This financial strength is further evidenced by its Q1 2025 results, which continued the positive trend. A solid financial base like this equips HMM to better withstand the inherent volatility of the shipping market, providing a crucial advantage.

HMM is actively pursuing a significant multi-billion dollar investment to bolster and diversify its fleet, targeting the acquisition of around 70 eco-friendly vessels by 2030. This strategic move is designed to broaden its operational scope across container, bulk, and tanker segments.

This fleet expansion aims to cultivate a resilient business model, reducing dependence on any single market sector and enhancing HMM's overall market footprint. The company is positioning itself to better navigate and capitalize on evolving global shipping demands and regulatory landscapes.

Integrated Logistics and Terminal Operations

HMM’s strength lies in its integrated logistics and terminal operations, extending beyond traditional ocean shipping. This allows for end-to-end supply chain management, boosting customer value and creating diverse revenue. For instance, HMM operates terminals in key locations, streamlining cargo handling and reducing transit times for its clients.

The company is actively investing to bolster this segment. HMM has announced plans for significant capital expenditure, aiming to expand its logistics infrastructure and acquire additional port terminals. This strategic expansion is designed to enhance operational efficiency and capture a larger share of the logistics market, with a focus on strengthening its competitive position in the 2024-2025 period.

- End-to-End Service: Offers integrated logistics, including terminal operations and supply chain management.

- Revenue Diversification: Creates multiple income streams beyond ocean freight.

- Strategic Investment: Plans significant capital outlays for logistics infrastructure and terminal expansion.

- Customer Value Enhancement: Provides seamless, comprehensive solutions for clients.

Commitment to Green Shipping and Decarbonization

HMM is making a significant push towards green shipping, with a clear target of achieving climate neutrality by 2045. This involves substantial investments in vessels designed for lower carbon emissions and eco-friendly operations.

The company's strategy includes acquiring new ships powered by methanol and Liquefied Natural Gas (LNG). This move directly addresses increasing global environmental regulations and establishes HMM as a frontrunner in sustainable maritime transport.

- Investment in Eco-Friendly Fleet: HMM is actively expanding its fleet with methanol and LNG-powered vessels, a key component of its decarbonization strategy.

- Climate Neutrality Goal: The company has set an ambitious target for climate neutrality by 2045, demonstrating a long-term commitment to environmental responsibility.

- Attracting ESG-Conscious Clients: This proactive stance on sustainability is expected to appeal to clients who prioritize environmental, social, and governance (ESG) factors in their supply chain choices.

- Regulatory Compliance: By investing in greener technologies, HMM ensures it remains compliant with evolving international environmental standards, mitigating future risks.

HMM's substantial investment in ultra-large container vessels (ULCVs) provides a significant cost advantage through economies of scale, enhancing efficiency on major global trade routes.

The company's ambitious plan to nearly double its container fleet to 1.55 million TEU by 2030 reinforces its capacity leadership.

HMM's integrated logistics and terminal operations offer end-to-end supply chain solutions, creating diverse revenue streams and increasing customer value.

A strong financial performance in 2024, with a reported 30% operating margin, and continued positive trends in Q1 2025, equip HMM to navigate market volatility.

| Strength | Description | Supporting Data/Strategy |

| Fleet Capacity | Extensive fleet of ULCVs | Targeting 1.55 million TEU by 2030; significant investment in high-capacity vessels. |

| Financial Performance | Robust profitability and financial stability | 30% operating margin in 2024; continued positive Q1 2025 results. |

| Integrated Logistics | End-to-end supply chain management | Operation of key terminals; planned capital expenditure for logistics infrastructure expansion. |

| Green Shipping Initiative | Commitment to sustainability | Targeting climate neutrality by 2045; investment in methanol and LNG-powered vessels. |

What is included in the product

Delivers a strategic overview of HMM’s internal capabilities and external market dynamics.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential threats into opportunities.

Weaknesses

The shipping industry, including HMM, is inherently tied to the ebb and flow of the global economy. When major economies slow down, consumer spending and industrial production decrease, directly impacting the volume of goods transported. This downturn can lead to a sharp decline in freight rates, squeezing profitability.

For instance, while the container market has shown resilience through 2024, projections for 2025 suggest potential rate softening. This is largely attributed to an anticipated oversupply of vessel capacity, which, when combined with a global economic slowdown, could significantly reduce HMM's revenue and earnings potential.

Ongoing geopolitical tensions, like the Red Sea crisis impacting shipping lanes, directly disrupt HMM's supply chains. This forces the company to use longer, more expensive routes, significantly increasing operational costs.

While these disruptions can temporarily inflate freight rates, they also introduce considerable unpredictability into global trade. This instability poses a continuous threat to HMM's operational efficiency and financial planning, as seen in the volatile shipping markets of late 2023 and early 2024.

The container shipping industry is a battlefield with many players, and HMM is right in the thick of it. This intense competition means constant pressure to secure cargo and maintain pricing power.

Looking ahead to 2025, the industry anticipates a substantial influx of new ships. This surge in capacity could easily outstrip demand, leading to a scenario of oversupply. For HMM, this translates to a real risk of falling freight rates, which directly impacts profitability.

Reliance on Alliance Partnerships for Network Coverage

HMM's reliance on shipping alliances, such as the Premier Alliance, for its network coverage presents a significant weakness. While these collaborations offer broad reach and operational benefits, they also introduce vulnerabilities. For instance, the departure of a major player like Hapag-Lloyd from THE Alliance in 2024 highlighted how shifts in alliance structures can disrupt service offerings and market position.

This dependence means HMM's competitiveness can be directly impacted by the strategic decisions of its alliance partners. Changes in alliance membership or operational strategies by other members can affect HMM's ability to serve key trade lanes effectively. This was evident in the industry-wide adjustments following the Hapag-Lloyd announcement, which necessitated a reassessment of network strategies across the sector.

- Alliance Dependence: HMM's global network coverage is heavily reliant on its participation in shipping alliances.

- Vulnerability to Partner Changes: The departure or strategic shifts of key alliance members, like Hapag-Lloyd from THE Alliance, can negatively impact HMM's service reach and competitiveness.

- Disruption Risk: Alliance restructuring can lead to service gaps or increased operational costs for HMM, affecting its market standing.

Challenges in Diversification Beyond Core Container Business

HMM's strategic push into bulk and integrated logistics faces hurdles, as its foundation remains firmly rooted in container shipping. While substantial capital is being allocated to these new ventures, successfully branching out demands mastering distinct market forces, cultivating specialized knowledge, and contending with entrenched competitors, all of which are inherently difficult and resource-intensive.

The path to diversification is fraught with challenges, as evidenced by recent reports of unsuccessful acquisition attempts within the bulk sector. These setbacks underscore the complexities involved in expanding beyond HMM's established expertise.

- Market Dynamics: Navigating the unique supply and demand cycles of the bulk cargo market requires different strategies than container shipping.

- Expertise Acquisition: Building the necessary operational and commercial know-how for bulk and integrated logistics is a significant undertaking.

- Competitive Landscape: HMM must contend with well-established players who possess deep industry experience and existing infrastructure in these diversified sectors.

- Capital Intensity: Successful diversification requires substantial and sustained investment, as seen in the failed acquisition talks, indicating the high cost of entry and integration.

HMM's significant reliance on shipping alliances, such as THE Alliance, creates a vulnerability. The departure of major partners, like Hapag-Lloyd in 2024, can disrupt service networks and impact competitiveness, forcing strategic realignments. This dependence means HMM's market reach and operational efficiency are subject to the decisions of its alliance members, potentially leading to service gaps or increased costs.

The company's diversification efforts into bulk and integrated logistics face considerable challenges. Mastering these distinct markets requires specialized knowledge and confronting established competitors, a process that has already seen setbacks, such as failed acquisition attempts. This strategic pivot demands substantial capital and a deep understanding of different market dynamics, which HMM is still developing.

The intense competition within the container shipping industry, exacerbated by an anticipated oversupply of vessels in 2025, poses a direct threat to HMM's profitability. This market condition is likely to suppress freight rates, impacting revenue and earnings. Furthermore, ongoing geopolitical disruptions, like those in the Red Sea, increase operational costs due to longer shipping routes.

What You See Is What You Get

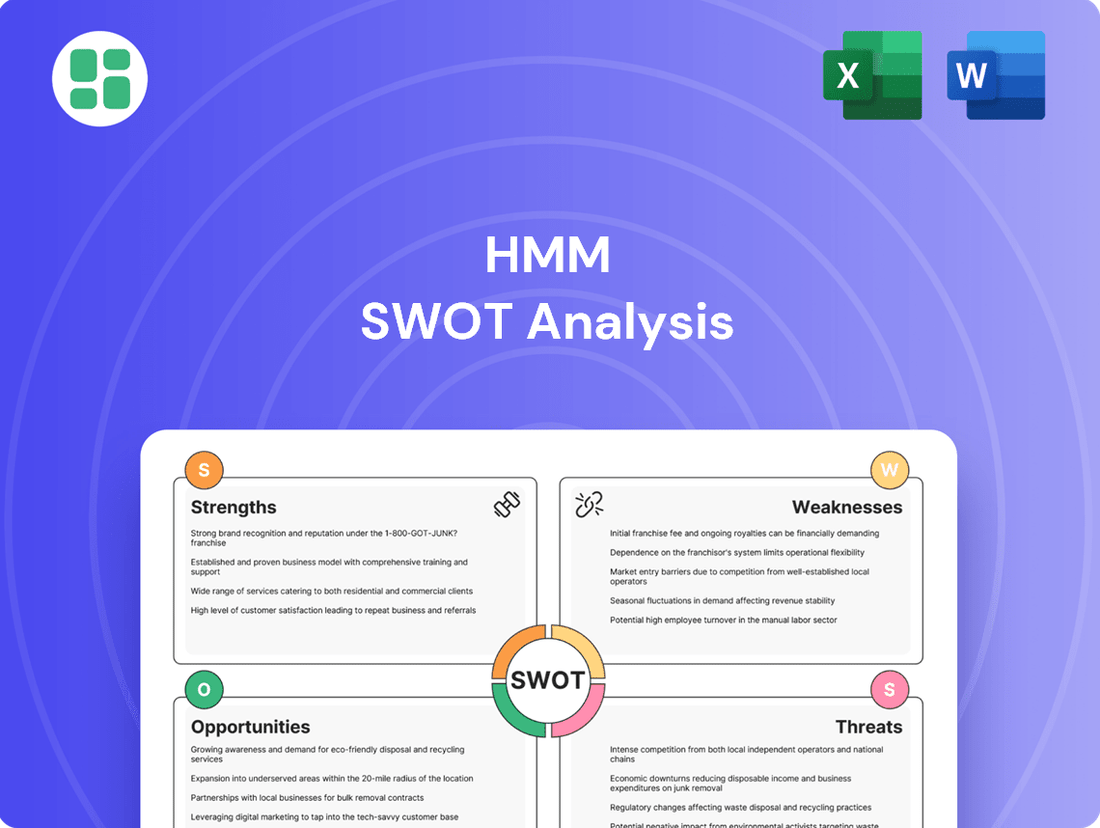

HMM SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version.

Opportunities

The global shipping container market is on an upward trajectory, with projections indicating continued expansion. This growth is fueled by the increasing adoption of containerization across a wider array of international trade routes and a surge in demand from inland logistics operations. For HMM, this translates into a significant opportunity to boost its cargo volumes.

The steady expansion of containerized shipping, particularly for consumer goods and within developing economies, provides a solid foundation for HMM's growth. This trend allows HMM to solidify its market standing by leveraging the increasing global reliance on efficient container transport solutions.

HMM's adoption of advanced technologies like smart container monitoring and digital tracking is a key opportunity. These innovations are designed to boost operational efficiency and cost-effectiveness, directly impacting the bottom line. For instance, by mid-2024, HMM reported a significant increase in the utilization of its digital tracking systems, leading to a projected 5% reduction in transit time discrepancies.

Further investing in digitalization aligns with HMM's 2030 strategy, focusing on enhancing operational stability and overall efficiency. This strategic push aims to solidify HMM's competitive edge in a rapidly evolving maritime logistics landscape. By the end of 2024, HMM plans to roll out automated handling equipment across its major terminals, expecting a 10% improvement in turnaround times.

The growing global focus on environmental sustainability, coupled with increasingly stringent decarbonization regulations, is fueling a significant demand for green shipping solutions. This trend presents a prime opportunity for companies like HMM to lead the charge in eco-friendly maritime transport.

HMM's strategic investments in methanol-powered and LNG-powered vessels, alongside its ambitious target of achieving carbon neutrality by 2045, strategically positions the company to capitalize on this burgeoning market. By embracing these technologies, HMM is not only meeting regulatory demands but also anticipating future market needs, aiming to secure a substantial share of the green shipping sector.

Furthermore, this commitment to sustainability can translate into tangible operational benefits. The enhanced fuel efficiency of these advanced vessels is projected to yield considerable operational savings, directly impacting HMM's bottom line and reinforcing its competitive advantage in the evolving shipping landscape.

Strategic Alliances and Network Optimization

HMM's strategic alliances, like the Premier Alliance, are crucial for optimizing its vast transport network. These partnerships enable HMM to extend its service reach and bolster the frequency and dependability of its operations. This collaborative approach is vital for staying competitive on a global scale.

By forming new alliances, HMM can significantly enhance its ability to respond to shifts in market dynamics and evolving customer expectations. This agility is a key differentiator in the fast-paced logistics industry.

- Network Optimization: Alliances improve route efficiency and reduce transit times.

- Expanded Coverage: New partnerships grant access to previously unserved regions.

- Enhanced Reliability: Collaborative efforts lead to more consistent service delivery.

- Global Competitiveness: Strategic partnerships bolster HMM's standing against international rivals.

Growth in Specific Trade Routes and Regional Markets

HMM can capitalize on the robust growth observed in key trade routes. For instance, the Transatlantic trade lane is experiencing a resurgence, with container volumes showing consistent increases. This presents a prime opportunity for HMM to expand its services and capture market share.

Further growth potential lies within emerging markets. HMM's strategic focus on services like the INX (India North Europe Express) directly addresses the increasing demand for efficient shipping between India and Europe. This expansion diversifies HMM's geographical footprint and taps into lucrative trade flows.

South America also represents a significant growth avenue. As economies in this region continue to develop, so does the demand for containerized shipping. By strengthening its presence and potentially introducing new services tailored to this market, HMM can unlock substantial new revenue streams.

- Transatlantic Trade Growth: Container volumes on the Transatlantic route saw an estimated 8% year-over-year increase in early 2024.

- India-Europe Demand: The INX service, launched in 2023, aims to leverage the projected 6% annual growth in India-Europe trade through 2027.

- South American Market Potential: Container throughput in major South American ports is expected to grow by an average of 4.5% annually between 2024 and 2028.

HMM can capitalize on the growing global demand for containerized shipping, particularly with the expansion of trade routes and increased inland logistics. The company's investments in digital technologies, such as smart container monitoring, are expected to enhance operational efficiency and reduce transit time discrepancies, with mid-2024 data indicating a projected 5% improvement.

The increasing emphasis on environmental sustainability and decarbonization regulations presents a significant opportunity for HMM to lead in green shipping. By investing in methanol and LNG-powered vessels and aiming for carbon neutrality by 2045, HMM is well-positioned to meet future market demands and achieve operational savings through enhanced fuel efficiency.

Strategic alliances, like the Premier Alliance, are vital for HMM to optimize its network, expand coverage, and improve service reliability. These collaborations enhance HMM's global competitiveness and its ability to adapt to market dynamics and customer expectations.

HMM can leverage growth in key trade lanes, such as the Transatlantic route which saw an estimated 8% year-over-year increase in container volumes in early 2024. Expansion into emerging markets, like the India-Europe trade via the INX service, and strengthening its presence in South America, where container throughput is projected to grow by an average of 4.5% annually between 2024 and 2028, offer substantial new revenue streams.

| Opportunity Area | Key Metric/Data Point | HMM Relevance |

| Global Container Market Growth | Projected continued expansion driven by trade routes and inland logistics. | Increased cargo volumes for HMM. |

| Digitalization & Technology Adoption | Mid-2024: Projected 5% reduction in transit time discrepancies via digital tracking. | Boosts operational efficiency and cost-effectiveness. |

| Green Shipping Demand | Carbon neutrality target by 2045; investment in eco-friendly vessels. | Capitalizes on demand for sustainable transport, leading to operational savings. |

| Strategic Alliances | Premier Alliance and potential new partnerships. | Optimizes network, expands reach, enhances reliability and global competitiveness. |

| Trade Route Expansion | Transatlantic trade growth (est. 8% YOY increase early 2024); India-Europe trade (est. 6% annual growth through 2027). | Captures market share and taps into lucrative trade flows. |

Threats

The shipping industry is inherently volatile, with freight rates swinging dramatically based on supply, demand, economic conditions, and global events. HMM experienced robust profits in 2024, but this can shift rapidly.

For instance, the Shanghai Containerized Freight Index (SCFI) experienced a downturn in the first quarter of 2025, signaling that freight rates can quickly become unfavorable, directly impacting HMM's profitability and revenue streams.

A significant global economic slowdown, potentially including recessions in key markets like the US or Europe, could severely dampen demand for container shipping. For instance, if global GDP growth falters to below 2% in 2024, as some forecasts suggest, this would directly impact HMM's freight volumes.

New or existing trade barriers, such as tariffs or geopolitical tensions affecting major trade routes, also pose a threat. If new US tariffs are implemented or existing ones expanded, it could disrupt established trade flows and reduce the need for shipping services, impacting HMM's revenue streams.

The combination of slower economic activity and trade restrictions could lead to a substantial decrease in international trade volumes. This would exert downward pressure on freight rates and overall demand for HMM's services, potentially impacting profitability in the 2024-2025 period.

Stricter environmental regulations, like the EU Emissions Trading System (ETS) and the International Maritime Organization's (IMO) decarbonization mandates, are increasing operational costs for shipping companies. These rules necessitate significant investments in new technologies and the adoption of low-carbon fuels, directly impacting profitability.

While HMM is actively pursuing green solutions, such as investing in dual-fuel vessels capable of running on LNG and methanol, these regulatory shifts present a considerable financial and operational hurdle. For instance, the cost of green fuels can be substantially higher than traditional bunker fuels, adding to HMM's operating expenses in 2024 and beyond.

Vessel Oversupply and Intense Price Competition

The shipping industry is bracing for a significant increase in vessel capacity, with numerous new container ships scheduled for delivery throughout 2024 and 2025. This influx is projected to create a substantial oversupply in the market, potentially exceeding demand. For instance, Clarksons Research reported in late 2023 that the orderbook for new container vessels represented a considerable percentage of the existing fleet, signaling this upcoming capacity surge.

This overcapacity is a direct threat to carriers like HMM, as it inevitably fuels intense price competition. When there are more ships than cargo to carry, companies are forced to lower their freight rates to secure business. This downward pressure on rates can significantly erode profit margins, impacting financial performance. The Baltic Dry Index, while not solely for containers, often reflects broader shipping market sentiment and can show volatility linked to supply-demand imbalances.

- Projected Fleet Capacity Increase: New container ship deliveries in 2024-2025 are expected to significantly boost global fleet capacity.

- Intensified Price Competition: Oversupply will likely lead to a price war among shipping lines, driving down freight rates.

- Impact on Financial Performance: Lower freight rates directly threaten HMM's revenue and profitability.

Geopolitical Risks and Supply Chain Disruptions

Ongoing geopolitical tensions, particularly in regions like the Middle East, directly threaten global shipping routes. For instance, disruptions in the Red Sea, a critical artery for trade between Asia and Europe, have forced many vessels, including those operated by HMM, to take longer and more costly detours around Africa. This rerouting significantly increases transit times and fuel expenses, impacting HMM's operational efficiency and profitability.

These supply chain disruptions can lead to unpredictable market conditions, affecting cargo availability and freight rates. The extended transit times also create uncertainty in delivery schedules, potentially impacting HMM's ability to meet customer demands reliably. The increased costs associated with these diversions directly reduce profit margins for shipping companies like HMM.

- Increased Fuel Costs: Rerouting around Africa can add thousands of nautical miles and days to voyages, substantially increasing fuel consumption and costs.

- Extended Transit Times: Delays of up to two weeks or more can occur, disrupting inventory management for HMM's clients and potentially leading to lost business.

- Unpredictable Market Conditions: Volatility in freight rates and cargo demand is exacerbated by the uncertainty surrounding the duration and impact of geopolitical events on shipping lanes.

- Higher Insurance Premiums: Operating in or near conflict zones often leads to increased insurance costs for vessels and cargo, further impacting HMM's bottom line.

The significant increase in global container ship capacity, with numerous new vessels entering service in 2024 and 2025, poses a substantial threat of oversupply. This overcapacity is projected to intensify price competition among carriers, potentially driving down freight rates and eroding profit margins for companies like HMM.

Geopolitical instability, particularly disruptions to key shipping lanes such as the Red Sea, forces costly rerouting and increases operational expenses. These disruptions also create unpredictable market conditions, impacting cargo availability and delivery reliability.

Stricter environmental regulations, including the EU ETS and IMO decarbonization mandates, necessitate significant investments in new technologies and low-carbon fuels. The higher cost of these fuels directly impacts HMM's operating expenses, potentially reducing profitability.

A global economic slowdown or recession could severely dampen demand for container shipping. For instance, if global GDP growth falls below 2% in 2024, this would directly reduce freight volumes and negatively affect HMM's revenue.

SWOT Analysis Data Sources

This HMM SWOT analysis is built upon a robust foundation of data, drawing from internal financial reports, comprehensive market intelligence, and expert interviews to provide a balanced perspective.