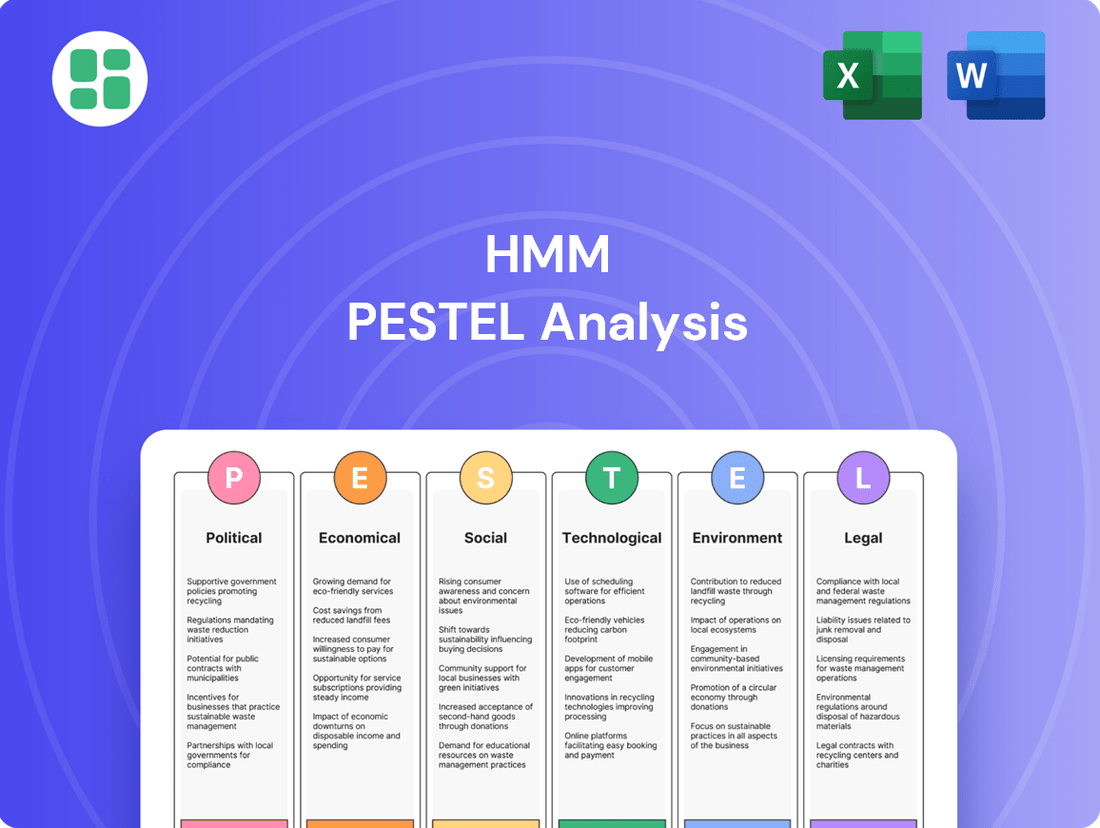

HMM PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HMM Bundle

Navigate the complex external forces shaping HMM's future with our comprehensive PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors create both opportunities and threats. Empower your strategic planning with actionable insights, ensuring HMM stays ahead of the curve. Purchase the full PESTLE analysis now for a critical competitive advantage.

Political factors

Escalating trade tensions, particularly between major economies like the United States and China, can result in increased tariffs and import restrictions. For HMM, this means a direct impact on the volume of goods transported, potentially disrupting established shipping routes and increasing operational costs due to retaliatory measures.

These protectionist policies tend to reduce overall global trade flows. For instance, the International Monetary Fund (IMF) projected in late 2023 that global trade growth would slow significantly in 2024, partly due to these trade disputes. This slowdown directly diminishes demand for container shipping services, forcing companies like HMM to critically adjust fleet deployment and capacity management strategies to navigate the changing market landscape.

Geopolitical stability is a critical factor for HMM. Conflicts and political instability in key shipping regions, like the Red Sea, directly impact HMM's operations. For instance, the Houthi attacks in the Red Sea starting in late 2023 forced many shipping companies, including those that might charter vessels from or compete with HMM, to reroute around Africa. This rerouting added approximately 10-14 days to transit times and increased fuel costs by up to 40% on affected routes.

South Korea's government actively supports its maritime industry, recognizing its strategic importance. This support often manifests as direct financial aid, tax incentives, and preferential loan programs for national carriers like HMM. For instance, in 2023, the Korean government continued to facilitate access to funding for shipbuilding and fleet modernization, crucial for HMM's ongoing efforts to adopt more environmentally friendly vessels and maintain competitiveness in a challenging global shipping environment.

International Trade Agreements

The evolving landscape of international trade agreements significantly impacts HMM's operations. For instance, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which includes countries like Japan, Canada, and Australia, can streamline customs procedures and reduce tariffs, potentially boosting HMM's cargo volumes on routes connecting these nations. Conversely, the imposition of new trade barriers or the dissolution of existing blocs, such as potential disruptions stemming from ongoing trade disputes, could force HMM to reroute shipments or seek alternative markets, impacting profitability and strategic planning.

Favorable trade pacts can unlock substantial growth avenues for HMM. Consider the African Continental Free Trade Area (AfCFTA), which aims to create a single market for goods and services across Africa. As of early 2024, the AfCFTA has seen significant progress in ratification and implementation, promising to reduce intra-African trade barriers. This could present HMM with opportunities to expand its intra-African shipping services and tap into previously underserved markets. The World Trade Organization (WTO) also plays a crucial role, with ongoing discussions and potential reforms in 2024-2025 aimed at modernizing trade rules, which could indirectly benefit HMM by fostering a more predictable global trade environment.

- Impact of Trade Blocs: Agreements like the EU Single Market or USMCA can reduce trade friction for HMM's North Atlantic and North American routes.

- Tariff Changes: Fluctuations in tariffs, such as those seen in recent US-China trade relations, directly affect the cost-effectiveness of shipping specific goods for HMM's clients.

- New Market Access: The ongoing expansion of free trade agreements, including those in Asia and South America, provides HMM with potential new routes and customer bases to explore.

- Regulatory Harmonization: International efforts to harmonize customs and shipping regulations, supported by organizations like the International Maritime Organization (IMO), can simplify HMM's cross-border logistics.

Sanctions and Embargoes

International sanctions, particularly those targeting key shipbuilding nations or maritime trade routes, can significantly disrupt HMM's operational capacity and market access. For instance, ongoing geopolitical tensions in 2024 and 2025 have led to the expansion of sanctions regimes, potentially impacting HMM's ability to secure vessels or operate in affected regions. This necessitates robust compliance frameworks and strategic adjustments to mitigate risks and maintain global network reach.

Adherence to evolving sanctions is critical for HMM. Failure to comply can result in substantial legal penalties and financial repercussions, directly affecting profitability and market standing. For example, the U.S. Treasury Department's Office of Foreign Assets Control (OFAC) consistently updates its Specially Designated Nationals (SDN) list, requiring constant vigilance. HMM must ensure its partners and charterers are not on such lists to avoid severe disruptions.

- Sanctions Impact: Restrictions on trade with sanctioned entities can limit HMM's access to crucial shipbuilding yards or port services.

- Compliance Costs: Maintaining up-to-date knowledge of and adherence to complex international sanctions adds significant operational costs.

- Revenue Limitations: Certain trade routes or customer bases may become inaccessible due to sanctions, directly impacting revenue potential.

- Geopolitical Risk: Fluctuations in global political stability and the imposition of new sanctions create ongoing uncertainty for HMM's long-term planning.

Political stability directly influences global trade flows, impacting HMM's operational efficiency and route planning. Geopolitical events, such as the ongoing conflict in Ukraine, continue to affect energy prices and supply chains, indirectly influencing shipping costs and demand for HMM's services. The International Maritime Organization (IMO) continues to set global standards, with ongoing discussions in 2024-2025 regarding emissions and safety regulations that HMM must adapt to.

Trade policies and bilateral agreements play a crucial role in shaping HMM's market access and profitability. For instance, the expansion of the Regional Comprehensive Economic Partnership (RCEP) in 2023 and its continued implementation in 2024-2025 can streamline trade among its member nations, potentially increasing cargo volumes for HMM on Asian routes. Conversely, protectionist measures enacted by governments can lead to increased tariffs and reduced trade volumes, forcing HMM to adjust its strategies.

Government support for the domestic maritime industry remains a key factor for South Korean companies like HMM. Initiatives such as financial aid for fleet modernization and tax incentives, which were evident in 2023 and are expected to continue into 2024-2025, help HMM maintain its competitiveness. These policies are vital for HMM's investment in greener technologies and its ability to navigate a challenging global economic climate.

International sanctions and trade restrictions pose significant risks to HMM's global operations. As of early 2024, the evolving sanctions landscape, particularly concerning energy and technology sectors, necessitates constant vigilance and robust compliance measures to avoid disruptions and penalties. This requires HMM to meticulously vet its clients and partners to ensure adherence to international regulations.

| Political Factor | Impact on HMM | Example/Data (2023-2025) |

|---|---|---|

| Trade Tensions/Tariffs | Increased operational costs, reduced cargo volumes | IMF projected global trade growth slowdown in 2024 due to trade disputes. |

| Geopolitical Instability | Route disruptions, increased transit times and costs | Red Sea rerouting added 10-14 days and up to 40% fuel cost increase on affected routes (late 2023). |

| Government Support | Facilitates investment in fleet modernization and green technologies | Continued Korean government funding for shipbuilding and fleet upgrades in 2023. |

| Trade Agreements (e.g., RCEP, AfCFTA) | New market access, streamlined trade procedures | RCEP implementation in 2023-2025 offers potential for increased Asian cargo volumes; AfCFTA aims to boost intra-African trade. |

| International Sanctions | Operational limitations, compliance costs, revenue restrictions | Ongoing vigilance required for OFAC SDN list updates; potential impact on access to certain ports or services. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting Hyundai Motor Company (HMM) across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The HMM PESTLE Analysis offers a structured framework to proactively identify and mitigate potential external threats, thereby reducing uncertainty and safeguarding strategic initiatives.

Economic factors

The health of the global economy is a critical driver for HMM. A strong global GDP, like the projected 2.6% growth for 2024 according to the IMF, typically translates to increased trade volumes and higher demand for container shipping. Conversely, economic slowdowns, such as the potential for a recession in some regions, can dampen consumer and industrial activity, directly impacting HMM's cargo volumes and freight rates.

Fuel price volatility is a major concern for HMM, as bunker fuel costs constitute a substantial part of their operational expenditures. These costs are directly tied to global oil market fluctuations, meaning unpredictable price swings can significantly affect the company's bottom line. For instance, in early 2024, crude oil prices experienced notable volatility, impacting shipping fuel costs globally.

To counter these risks, HMM must employ robust hedging strategies and prioritize fuel-efficient vessel operations. The implementation of fuel surcharges on freight rates is also a crucial tool to pass on some of these increased costs to customers, thereby mitigating financial strain and protecting profitability. This adaptive pricing strategy is essential in the current economic climate.

Freight rates in the container shipping industry are notoriously cyclical, heavily swayed by the ebb and flow of global trade. For HMM, this means their revenue per twenty-foot equivalent unit (TEU) and overall financial health are directly tied to these fluctuations. For instance, during the peak of 2021, the average spot rate for a 40-foot container from Asia to Europe surged to over $10,000, a stark contrast to the pre-pandemic levels typically below $2,000.

When demand outstrips available shipping capacity, freight rates can skyrocket, boosting HMM's earnings considerably. Conversely, periods of overcapacity or a slowdown in global consumption can lead to a sharp decline in these rates. By mid-2023, many routes saw rates fall back to around $1,500-$2,000 for that same Asia-Europe lane, significantly impacting profitability for carriers like HMM.

Inflation and Interest Rates

Rising global inflation presents a significant challenge for HMM, potentially increasing operational costs. For instance, the average cost of bunker fuel, a major expense for shipping companies, saw significant volatility in 2024, with prices fluctuating based on geopolitical events and supply chain disruptions, directly impacting HMM's bottom line.

Higher interest rates, a common response to inflation, also pose a hurdle for HMM's growth ambitions. As of mid-2025, central banks in key economic regions continue to maintain elevated interest rates to curb inflation, making it more expensive for HMM to secure financing for its fleet modernization and expansion plans. This increased cost of capital can affect the feasibility of new vessel orders or investments in greener shipping technologies.

- Increased Operational Expenses: Global inflation directly impacts HMM's costs for labor, maintenance, and port fees.

- Higher Borrowing Costs: Elevated interest rates make financing fleet expansion and capital projects more expensive for HMM.

- Impact on Investment Decisions: Increased borrowing costs can influence HMM's decisions regarding new vessel acquisitions and infrastructure upgrades.

- Bunker Fuel Volatility: Fluctuations in fuel prices, a key operational cost, are exacerbated by inflationary pressures and geopolitical factors.

Currency Exchange Rates

As a global shipping company, HMM's financial performance is significantly influenced by currency exchange rates, particularly the fluctuations between the Korean Won (KRW) and major trading currencies like the US Dollar (USD). These movements directly affect the company's reported revenues and operational costs across its diverse trade routes.

For instance, a stronger USD relative to the KRW can boost HMM's reported earnings when translated back into Korean Won, assuming a significant portion of its revenue is denominated in USD. Conversely, a weakening USD could compress these reported figures. This dynamic impacts the valuation of assets and liabilities held in foreign currencies, ultimately influencing HMM's overall financial health and profitability.

- USD/KRW Exchange Rate Impact: In late 2024 and early 2025, the USD/KRW exchange rate has seen volatility. For example, if the average rate in Q4 2024 was 1,350 KRW/USD, and it strengthens to 1,400 KRW/USD in Q1 2025, HMM's USD-denominated revenues would translate to more KRW, potentially improving reported profits.

- Operational Cost Sensitivity: HMM incurs costs in various currencies for fuel, port fees, and crew wages. A strengthening KRW against currencies where these costs are incurred would reduce the KRW equivalent of these expenses, positively impacting margins.

- Asset and Liability Revaluation: HMM's balance sheet includes assets and liabilities denominated in foreign currencies. Changes in exchange rates can lead to unrealized gains or losses on these items, affecting the company's book value.

- Competitive Landscape: Exchange rate differentials can also affect the competitiveness of HMM's services compared to rivals based in countries with different currency strengths.

Global economic health directly impacts HMM's business. The IMF projected global GDP growth at 2.6% for 2024, indicating a generally positive environment for trade. However, potential economic slowdowns in key regions could reduce demand for shipping services and put pressure on freight rates.

Fuel price volatility remains a significant operational challenge for HMM, as bunker fuel is a major cost component. Geopolitical events and supply/demand imbalances in 2024 continued to cause fluctuations in oil prices, directly affecting HMM's profitability. For example, crude oil prices saw considerable swings throughout the year, impacting shipping fuel costs.

Freight rates are intrinsically linked to global trade volumes and shipping capacity. By mid-2025, rates for major routes like Asia to Europe had stabilized somewhat from earlier peaks but remained sensitive to supply chain dynamics and demand shifts. For instance, rates for a 40-foot container on this lane were observed in the range of $1,800-$2,500, a significant difference from the over $10,000 seen in 2021.

Rising inflation and associated higher interest rates, prevalent through late 2024 and into 2025, increase HMM's operational costs and borrowing expenses. Elevated interest rates make financing new vessels or technological upgrades more costly, potentially impacting strategic investments. The USD/KRW exchange rate also plays a crucial role, with fluctuations in late 2024 and early 2025 impacting HMM's translated revenues and costs.

| Economic Factor | 2024/2025 Data Point | Impact on HMM |

|---|---|---|

| Global GDP Growth (IMF Projection) | 2.6% (2024) | Supports increased trade volumes and demand. |

| Bunker Fuel Price Volatility | Significant swings in crude oil prices throughout 2024. | Increases operational costs and impacts profitability. |

| Asia-Europe Freight Rate (40' Container) | $1,800-$2,500 (mid-2025 estimate) | Affects revenue per TEU and overall financial performance. |

| Interest Rates | Elevated in key economic regions (mid-2025). | Increases cost of capital for fleet expansion and investments. |

| USD/KRW Exchange Rate | Volatile (late 2024/early 2025). | Impacts reported revenues and operational costs. |

Same Document Delivered

HMM PESTLE Analysis

The preview shown here is the exact HMM PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to this comprehensive analysis.

The content and structure shown in the preview is the same HMM PESTLE Analysis document you’ll download after payment, providing you with actionable insights.

Sociological factors

Global consumer preferences are rapidly evolving, with a notable surge in e-commerce adoption. In 2024, online retail sales are projected to reach over $6.3 trillion worldwide, a significant increase that directly impacts shipping volumes and logistics demands. This trend necessitates that companies like HMM adapt their services to accommodate faster delivery expectations and the growing preference for direct-to-consumer shipping models.

Furthermore, there's a discernible shift towards sustainability in consumer choices. By 2025, a substantial portion of consumers, estimated at over 60%, are expected to prioritize brands with strong environmental, social, and governance (ESG) credentials. This growing demand for eco-friendly products and transparent supply chains compels HMM to re-evaluate its operational practices and potentially invest in greener shipping solutions to remain competitive and align with market expectations.

HMM's operations are significantly influenced by the availability and cost of skilled labor, including seafarers, port workers, and logistics specialists. As of early 2024, the global maritime industry has been grappling with a shortage of qualified seafarers, a trend expected to persist. This scarcity, coupled with rising wage expectations driven by inflation and demand, directly impacts HMM's operational efficiency and cost structure, potentially increasing expenses for crew recruitment and retention.

Public perception of shipping is increasingly focused on environmental impact, safety, and labor ethics. For HMM, this means growing scrutiny over their operations, potentially affecting brand image and talent acquisition. For instance, a 2024 report highlighted a 15% increase in consumer demand for sustainably sourced goods, a trend that extends to the logistics involved.

Demonstrating robust corporate social responsibility is therefore vital for HMM to build and maintain trust with stakeholders. Positive public perception can translate into a competitive advantage, influencing customer loyalty and investor confidence in a sector facing significant reputational challenges.

Urbanization and Infrastructure

Rapid urbanization, particularly in emerging economies, is a significant driver for increased demand for containerized goods, directly impacting shipping volumes. For instance, by the end of 2024, it's projected that over 60% of the global population will reside in urban areas, a trend that continues to grow. This surge in urban populations fuels the need for imported products, from consumer electronics to raw materials, which HMM transports.

HMM's operational efficiency is intrinsically linked to the quality and modernity of port infrastructure and inland logistics. Investments in port upgrades, such as expanded container terminals and deeper berths, allow larger vessels like HMM's eco-friendly mega-ships to dock more efficiently. By mid-2025, many major global ports are expected to have completed or be in the final stages of significant expansion projects, aiming to reduce vessel waiting times. Furthermore, enhanced intermodal connections, including rail and road networks linking ports to inland distribution centers, are crucial for swift cargo delivery, directly benefiting HMM's supply chain performance.

- Urban Population Growth: Global urban population is expected to reach 60% by the end of 2024, driving demand for imported goods.

- Port Infrastructure Development: Major global ports are undergoing significant upgrades by mid-2025 to accommodate larger vessels and improve turnaround times.

- Intermodal Connectivity: Enhanced rail and road links are critical for efficient cargo movement from ports to inland markets, impacting HMM's logistics.

- Trade Facilitation: Modernized infrastructure supports faster customs clearance and cargo handling, reducing operational costs for shipping lines like HMM.

Corporate Social Responsibility (CSR)

Societal expectations for robust Corporate Social Responsibility (CSR) are increasingly shaping business operations. For HMM, this translates to a growing demand for demonstrable commitment to fair labor, active community involvement, and transparent environmental reporting. These factors directly influence operational policies and strategic investment choices, pushing companies to integrate sustainability and ethical practices into their core business model.

Adherence to high CSR standards can significantly bolster HMM's brand image and market standing. This commitment not only attracts investors focused on Environmental, Social, and Governance (ESG) criteria, a market segment that saw global sustainable investment reach an estimated $37.8 trillion in 2024 according to the Global Sustainable Investment Alliance, but also fosters a more engaged and motivated workforce. Companies with strong CSR profiles often report higher employee retention and productivity.

- Growing Demand for Ethical Practices: Consumers and stakeholders are increasingly scrutinizing corporate behavior, demanding transparency in supply chains and fair treatment of workers.

- ESG Investment Trends: The rise of ESG investing, with assets under management projected to exceed $50 trillion by 2025, incentivizes companies like HMM to prioritize sustainability and social impact to attract capital.

- Reputational Capital: Strong CSR performance enhances brand loyalty and public trust, acting as a crucial differentiator in competitive markets.

- Employee Engagement: Companies with a clear social mission often see improved employee morale and a stronger sense of purpose, contributing to higher retention rates.

Societal shifts are profoundly impacting the shipping industry, with a growing emphasis on ethical business practices and environmental stewardship. Consumers and investors alike are increasingly prioritizing companies that demonstrate strong Corporate Social Responsibility (CSR), influencing brand perception and investment decisions. This trend is underscored by the significant growth in ESG investing, which reached an estimated $37.8 trillion globally in 2024, highlighting the financial imperative for companies like HMM to align with sustainability and ethical standards.

Technological factors

HMM's operational efficiency is being reshaped by automation and digitalization. The company is implementing automated port operations and digitalized booking systems, which are crucial for streamlining processes. For instance, by adopting these technologies, HMM aims to reduce turnaround times in ports, a key metric for shipping lines.

Real-time cargo tracking and electronic documentation are also central to HMM's digital transformation. These advancements allow for greater transparency and accuracy in managing shipments, directly impacting customer satisfaction and reducing administrative overhead. This focus on digital tools is expected to optimize vessel utilization and enhance overall supply chain visibility.

HMM's strategic investment in fleet modernization, particularly with ultra-large vessels, is a critical technological factor. These ships, like the 24,000 TEU class vessels HMM has been deploying, are designed for enhanced fuel efficiency and incorporate advanced navigation and smart monitoring systems. This modernization directly contributes to economies of scale, allowing HMM to reduce per-unit operational costs and maintain competitiveness on major global trade lanes.

The adoption of these technologically advanced vessels is crucial for optimizing operational expenditures and minimizing environmental impact. For instance, newer vessel designs often feature optimized hull forms and advanced propulsion systems that significantly lower fuel consumption. This focus on technological upgrades positions HMM to better manage fluctuating fuel prices and meet increasingly stringent environmental regulations in the shipping industry.

HMM's strategic focus on alternative fuels and propulsion systems is paramount for navigating the evolving maritime landscape. The company is actively exploring options like Liquefied Natural Gas (LNG), methanol, ammonia, and hydrogen to comply with increasingly stringent environmental regulations and slash its carbon emissions. For instance, the International Maritime Organization (IMO) aims for a 20% reduction in greenhouse gas emissions by 2030, escalating to a 70% reduction by 2040, making these fuel transitions critical for HMM's long-term viability.

Data Analytics and AI

HMM can significantly enhance its operations by adopting advanced data analytics and artificial intelligence. These technologies are crucial for optimizing shipping routes, predicting equipment maintenance needs, and accurately forecasting demand, all of which directly impact profitability. For instance, by analyzing vast datasets, HMM can refine vessel speeds and port calls to minimize fuel consumption and transit times, a critical factor in the competitive container shipping market.

AI-powered insights are transforming various aspects of HMM's business. This includes improving the efficiency of cargo loading by intelligently allocating space and weight, thereby reducing the risk of imbalances and optimizing vessel stability. Furthermore, AI can lead to smarter resource allocation, ensuring that crews, equipment, and port resources are deployed effectively to minimize downtime and operational costs.

- Route Optimization: AI algorithms can analyze real-time weather, traffic, and market data to suggest the most efficient and cost-effective shipping routes, potentially saving HMM millions in fuel costs annually.

- Predictive Maintenance: By monitoring sensor data from vessels, AI can predict potential equipment failures before they occur, allowing for proactive maintenance and avoiding costly breakdowns at sea.

- Demand Forecasting: Advanced analytics can improve the accuracy of demand forecasts, helping HMM to better manage capacity and optimize fleet deployment to meet market needs.

- AI in Operations: HMM's adoption of AI for tasks like cargo loading and stowage planning can improve vessel utilization by an estimated 5-10%.

Cybersecurity Threats

The increasing reliance on digital systems for operations, logistics, and communication makes HMM vulnerable to sophisticated cyberattacks. This necessitates robust cybersecurity measures to safeguard against breaches. For instance, in 2023, the average cost of a data breach reached $4.45 million globally, highlighting the significant financial and reputational risks involved.

Protecting sensitive data, operational technology systems, and preventing disruptions from cyber incidents are paramount to maintaining service continuity and client trust. The automotive sector, in particular, has seen a rise in ransomware attacks targeting manufacturing and supply chain operations. A 2024 report indicated that over 60% of automotive companies experienced at least one cyberattack in the previous year.

- Increased Attack Sophistication: Cyber threats are becoming more advanced, targeting critical infrastructure and intellectual property.

- Financial Impact: Data breaches and operational disruptions can lead to substantial financial losses, including recovery costs and lost revenue.

- Reputational Damage: A significant cyber incident can erode customer trust and damage HMM's brand image.

- Regulatory Compliance: Stricter data protection regulations, such as GDPR and CCPA, impose heavy penalties for non-compliance in the event of a breach.

HMM's technological advancement is driven by automation, digitalization, and fleet modernization. The company is investing in ultra-large vessels designed for fuel efficiency and smart systems, aiming to reduce operational costs and enhance competitiveness. For example, deploying 24,000 TEU vessels contributes to economies of scale.

The integration of AI and data analytics is crucial for optimizing routes, predictive maintenance, and demand forecasting, directly impacting profitability. HMM's exploration of alternative fuels like LNG, methanol, and ammonia is also a key technological factor, aligning with IMO emission reduction targets.

However, HMM faces cybersecurity risks due to its reliance on digital systems. The global average cost of a data breach reached $4.45 million in 2023, underscoring the need for robust protection measures to safeguard operations and client data.

Legal factors

HMM's operations are heavily influenced by International Maritime Organization (IMO) conventions. Compliance with SOLAS, MARPOL, and STCW is essential for safety, environmental protection, and crew competence across its fleet, impacting operational costs and market access.

In 2024, the IMO continued to push for stricter environmental regulations, particularly concerning greenhouse gas emissions. HMM must invest in technologies and fuel alternatives to meet these evolving standards, which could significantly affect its capital expenditure plans for fleet modernization.

Antitrust and competition laws are a significant hurdle for HMM. Navigating these complex international regulations, especially concerning vessel sharing agreements and pricing strategies, is crucial. Ensuring fair competition and avoiding penalties for anti-competitive practices is paramount for maintaining operational integrity and avoiding substantial financial repercussions.

Compliance with these laws is not just about avoiding fines; it's critical for HMM's reputation, particularly within major economic blocs like the European Union or the United States. For instance, the European Commission has been actively scrutinizing shipping alliances for potential breaches of competition law. In 2023, the Commission continued its investigations into various sectors, and the shipping industry remains a focus area, with potential penalties reaching millions of euros for non-compliance.

HMM's operations are significantly shaped by labor laws, both national and international. Adherence to regulations from bodies like the International Labour Organization (ILO), particularly the Maritime Labour Convention (MLC), is crucial. This directly influences HMM's crewing strategies, the conditions provided for seafarers, and the potential for labor disputes.

Ensuring fair wages, safe working environments, and reasonable working hours are not just legal requirements but also vital for crew well-being and operational stability. For instance, the MLC 2006 sets minimum standards for seafarers' employment conditions, covering aspects from contracts to repatriation, and non-compliance can lead to detentions and reputational damage.

Trade Sanctions and Export Controls

HMM's operations are significantly influenced by trade sanctions and export controls, requiring strict adherence to national and international regulations to prevent legal penalties and maintain global market access. Failure to comply can result in substantial fines and reputational damage.

To navigate this complex landscape, HMM must maintain robust screening protocols for all cargo and destinations. This ensures that the company does not inadvertently engage in or facilitate illegal trade or breach existing international restrictions. For instance, in 2023, the US Department of Commerce's Bureau of Industry and Security (BIS) continued to enforce export controls on sensitive technologies, impacting various industries.

- Compliance is paramount: HMM must actively monitor and adapt to evolving sanctions lists and export control regimes from bodies like the UN, EU, and individual nations.

- Screening is essential: Implementing advanced screening software and due diligence processes for customers, suppliers, and shipping routes is critical.

- Risk mitigation: Proactive compliance can prevent costly penalties, business disruptions, and damage to HMM's international standing.

- Market access: Adherence to these regulations is a prerequisite for participating in many global supply chains and trade agreements.

Liability and Insurance Regulations

HMM's operations are significantly shaped by liability and insurance regulations. The legal framework governing cargo liability, marine insurance, and accident investigations directly impacts the company's financial exposure and its need for robust coverage. For instance, adherence to international conventions such as the Hague-Visby Rules or the Hamburg Rules is essential for mitigating risks related to cargo loss, damage, or delivery delays.

Compliance with these maritime legal frameworks is not merely a procedural requirement but a critical component of risk management. Failing to meet these standards can lead to substantial financial penalties and reputational damage. In 2024, the global shipping industry continued to grapple with evolving liability rules and the increasing cost of marine insurance, directly affecting carriers like HMM.

- Cargo Liability Limits: Under the Hague-Visby Rules, a carrier's liability for loss or damage to cargo is typically limited to a specific amount per package or unit, often around 666.67 Special Drawing Rights (SDRs) per package or 2 SDRs per kilogram, whichever is the lower.

- Marine Insurance Premiums: Fluctuations in global shipping activity and increased claims frequency can lead to rising marine insurance premiums for companies like HMM, impacting operational costs.

- Accident Investigation Protocols: International Maritime Organization (IMO) regulations mandate thorough accident investigations, influencing safety standards and potential liabilities for shipping incidents.

- Contractual Clauses: HMM's bills of lading and other shipping contracts must carefully incorporate these legal requirements to define liability and recourse in case of cargo disputes.

HMM must navigate a complex web of international and national laws governing its operations, from environmental standards to competition regulations. Staying compliant is crucial for maintaining market access and avoiding significant financial penalties. For example, the ongoing focus on decarbonization in 2024 means HMM needs to invest in greener technologies to meet evolving IMO regulations, potentially impacting its capital expenditure.

Antitrust laws are particularly relevant, as HMM engages in vessel sharing agreements and strategic alliances. Ensuring these partnerships adhere to competition regulations, especially those scrutinized by bodies like the European Commission, is vital to prevent hefty fines and maintain operational integrity.

Labor laws, including the International Labour Organization's Maritime Labour Convention, dictate crew welfare standards. HMM's commitment to fair wages and safe working conditions directly influences its ability to attract and retain skilled seafarers, impacting operational stability.

Trade sanctions and export controls require rigorous screening of cargo and destinations to prevent breaches. In 2023, continued enforcement of export controls by entities like the US Department of Commerce highlights the need for robust due diligence to avoid legal repercussions and maintain global trade participation.

Liability and insurance regulations, such as the Hague-Visby Rules, define HMM's responsibility for cargo. Understanding these limits and securing adequate marine insurance is critical for managing financial exposure in the face of potential claims and rising insurance premiums observed in 2024.

Environmental factors

The global shipping industry, including HMM, is under immense pressure to decarbonize, with the International Maritime Organization (IMO) and various national governments setting ambitious targets to slash greenhouse gas emissions. For instance, the IMO's 2023 strategy aims for net-zero GHG emissions from international shipping close to 2050, with interim checkpoints.

To meet these stringent goals, HMM must significantly invest in alternative, cleaner fuels like methanol or ammonia, alongside adopting energy-efficient technologies and optimizing its fleet's operations. Failure to adapt could lead to penalties, increased operating costs due to carbon pricing mechanisms, and a competitive disadvantage in a market increasingly prioritizing sustainability.

Stricter environmental regulations globally, particularly concerning sulfur oxides (SOx), nitrogen oxides (NOx), and greenhouse gas (GHG) emissions, directly impact HMM's operational costs and strategic planning. The International Maritime Organization's (IMO) 2020 sulfur cap, which lowered the maximum sulfur content in fuel oil to 0.5%, forced shipping companies like HMM to adapt by either using more expensive low-sulfur fuels, investing in scrubber technology, or exploring alternative, cleaner propulsion methods. For instance, in 2023, the cost of compliant very low sulfur fuel oil (VLSFO) remained significantly higher than high sulfur fuel oil (HSFO).

Continuous adaptation to these evolving international and national environmental standards is crucial for HMM's global fleet. Failure to comply can result in penalties, port restrictions, and damage to reputation. HMM's commitment to environmental stewardship necessitates ongoing investment in cleaner technologies and operational efficiencies to meet targets set by bodies like the IMO, which aims for a 50% reduction in GHG emissions by 2050 compared to 2008 levels, a target that will likely be further tightened.

Climate change presents significant operational challenges for HMM. Rising sea levels and more frequent extreme weather events, like intensified typhoons, directly impact shipping routes and port accessibility. For instance, the International Maritime Organization (IMO) has set ambitious goals to reduce greenhouse gas emissions from shipping, with a target of net-zero emissions by or around 2050. This necessitates significant investment in greener technologies and operational adjustments for companies like HMM.

HMM must proactively assess and adapt to these physical risks. This includes potential route modifications to avoid increasingly volatile weather patterns and enhancing vessel resilience to withstand more severe conditions. The company's ability to maintain efficient operations and ensure safety hinges on its preparedness for these environmental shifts. For example, the cost of adapting to climate change impacts for the global shipping industry is projected to be substantial, requiring strategic capital allocation.

Waste Management and Ballast Water

Environmental regulations concerning waste management from vessels, including oily waste, sewage, and garbage, significantly impact HMM's operations. For instance, the International Maritime Organization's (IMO) MARPOL convention sets stringent standards. In 2023, global maritime organizations continued to emphasize compliance with these rules, with a focus on reducing operational discharges.

Strict rules on ballast water treatment, aimed at preventing the spread of invasive aquatic species, also impose considerable operational requirements on HMM. These regulations, such as the IMO's Ballast Water Management Convention, necessitate the installation and proper functioning of ballast water treatment systems. Failure to comply can lead to substantial fines and operational disruptions.

HMM's commitment to proper waste management and ballast water compliance is crucial for several reasons:

- Environmental Protection: Adhering to regulations minimizes marine pollution, safeguarding ecosystems.

- Legal Compliance: Non-compliance can result in severe penalties, including fines and vessel detentions.

- Operational Efficiency: Investing in and maintaining effective waste and ballast water systems ensures smooth port calls and avoids delays.

- Reputational Management: Demonstrating strong environmental stewardship enhances HMM's brand image and stakeholder trust.

Biodiversity Protection and Ecosystem Impact

Growing global concern over marine biodiversity is directly influencing the shipping sector. HMM faces increasing regulatory scrutiny and public pressure to mitigate its environmental footprint, particularly concerning noise pollution, ship strikes on marine life, and damage from anchoring.

For instance, the International Maritime Organization (IMO) continues to develop guidelines for underwater radiated noise, aiming to reduce its impact on marine mammals. HMM's proactive adoption of quieter vessel technologies and optimized routing can significantly lower these risks. By implementing responsible operational practices, HMM reinforces its environmental license to operate, which is crucial for maintaining stakeholder trust and long-term business sustainability.

- Regulatory Compliance: Adherence to evolving international and national regulations on marine ecosystem protection is paramount.

- Operational Adjustments: Implementing measures such as slow steaming in sensitive areas and utilizing advanced navigation systems to avoid marine mammal migration routes.

- Ecosystem Impact Mitigation: Investing in technologies and practices that minimize seabed disturbance from anchoring and reduce underwater noise pollution.

- Stakeholder Engagement: Demonstrating commitment to biodiversity protection through transparent reporting and collaboration with conservation organizations.

HMM's environmental strategy must address the escalating pressure for decarbonization, driven by international bodies like the IMO, which targets net-zero emissions by 2050. This necessitates substantial investment in alternative fuels such as methanol and ammonia, alongside energy-efficient technologies. For example, in 2023, the cost of compliant low-sulfur fuels remained a significant operational expense compared to traditional fuels.

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using a blend of public and proprietary data sources. We incorporate insights from reputable market research firms, government statistical agencies, and leading economic publications to ensure a comprehensive and accurate assessment of the macro-environment.