HMM Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HMM Bundle

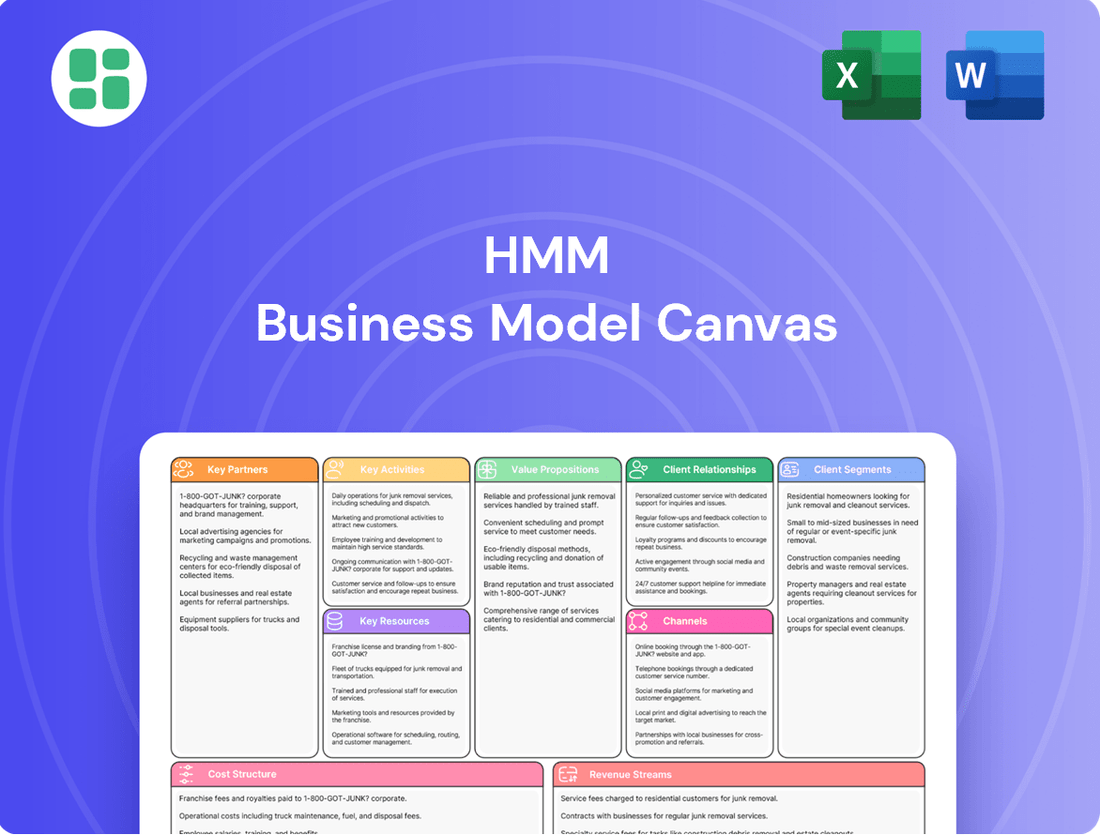

Curious about HMM's strategic framework? This Business Model Canvas provides a clear overview of their customer segments, value propositions, and revenue streams. Discover the core components that drive HMM's success and learn how to apply similar principles to your own ventures.

Partnerships

HMM actively engages in strategic shipping alliances to enhance its global reach and service reliability. A prime example is the Premier Alliance, formed with Ocean Network Express (ONE) and Yang Ming Marine Transportation, which commenced in February 2025. This collaboration is designed to bolster HMM's presence on key East-West trade routes.

These alliances are instrumental in optimizing vessel capacity and streamlining network operations. By pooling resources and coordinating schedules, HMM, alongside its partners, can achieve greater operational efficiency and offer more consistent transit times, a critical factor in the competitive global shipping landscape.

The Premier Alliance, in particular, aims to provide expanded global coverage, allowing HMM to serve a wider range of customers and destinations more effectively. This strategic cooperation is projected to improve HMM's competitive positioning by leveraging shared infrastructure and market access.

HMM’s strategic alliances with port and terminal operators worldwide are foundational for optimizing cargo movement and minimizing vessel waiting times. These collaborations are crucial for maintaining operational efficiency across its extensive shipping routes.

The company actively pursues partnerships for terminal operations and infrastructure development. A notable example is the Memorandum of Understanding (MoU) signed with Jawaharlal Nehru Port Authority (JNPA) concerning the Vadhvan Port development in India, highlighting a commitment to enhancing key logistical hubs.

These vital partnerships grant HMM secure access to essential port infrastructure, thereby bolstering its capacity to support its growing international network and ensuring reliable service delivery to its customers.

HMM's strategic alliances with premier shipbuilding companies are crucial for expanding and updating its fleet. This includes securing ultra-large container vessels and environmentally friendly ships, ensuring a steady influx of new builds. For instance, twelve 13,000 TEU vessels were integrated in 2024, with future plans for methanol and LNG-powered ships.

Technology and Digital Solution Providers

HMM actively collaborates with technology and digital solution providers to bolster its e-services, supply chain carbon calculators, and e-operation solutions. These partnerships are crucial for enhancing operational transparency and efficiency, ultimately improving the customer experience through sophisticated digital platforms and smart shipping technologies.

For instance, HMM's commitment to digitalization is evident in its strategic investments aimed at strengthening competitiveness. In 2024, the company continued to focus on integrating advanced digital tools to streamline operations and meet evolving market demands, reflecting a broader industry trend towards digital transformation in maritime logistics.

- Enhanced E-services: Partnerships with tech firms allow HMM to offer more robust online booking, tracking, and customer support platforms.

- Supply Chain Visibility: Collaborations enable the development of advanced carbon calculators and supply chain management tools, providing greater transparency on environmental impact and logistical efficiency.

- Operational Efficiency: Integration of smart shipping technologies, often through partnerships, leads to optimized vessel performance, reduced fuel consumption, and improved route planning.

- Digital Transformation: HMM's strategic focus on digitalization, supported by these key partnerships, is a significant driver for adapting to future market needs and maintaining a competitive edge.

Fuel Suppliers and Green Technology Partners

HMM is actively forging partnerships with fuel suppliers to secure alternative, low-carbon fuels, such as methanol and liquefied natural gas (LNG). These collaborations are fundamental to building a comprehensive carbon-neutral ecosystem and are essential for the successful retrofitting of HMM's existing fleet.

These strategic alliances highlight HMM's dedication to environmental sustainability and its proactive approach to adhering to evolving global regulations. For instance, in 2024, HMM announced collaborations with several major energy companies to pilot methanol-fueled voyages, aiming to reduce carbon emissions significantly.

- Fuel Supply Agreements: Securing reliable access to low-carbon fuels like methanol and LNG.

- Technology Development: Collaborating on the development and implementation of green technologies for vessel retrofitting and new builds.

- Infrastructure Investment: Jointly investing in bunkering infrastructure to support the widespread adoption of alternative fuels.

HMM's key partnerships are crucial for expanding its service network and operational capabilities. Collaborations with other shipping lines, like the Premier Alliance with ONE and Yang Ming, enhance global reach and service reliability on major trade routes.

These alliances are vital for optimizing vessel capacity and streamlining operations, leading to greater efficiency and consistent transit times. Furthermore, partnerships with port and terminal operators, such as the MoU with JNPA for Vadhvan Port development, ensure access to critical infrastructure and improve cargo movement.

Strategic alliances with shipbuilders are essential for fleet expansion and modernization, including the integration of 13,000 TEU vessels in 2024 and future eco-friendly new builds. Partnerships with technology providers are driving HMM's digital transformation, improving e-services and operational transparency.

Securing low-carbon fuels through partnerships with fuel suppliers is fundamental to HMM's sustainability goals, with pilot voyages using methanol announced in 2024.

| Partnership Type | Key Partners | Objective | 2024 Impact/Focus |

|---|---|---|---|

| Shipping Alliances | Ocean Network Express (ONE), Yang Ming | Enhanced global reach, service reliability | Strengthened East-West trade route presence |

| Port/Terminal Operators | Jawaharlal Nehru Port Authority (JNPA) | Improved cargo movement, infrastructure access | Vadhvan Port development collaboration |

| Shipbuilding Companies | Various premier shipbuilders | Fleet expansion and modernization | Integration of 13,000 TEU vessels |

| Technology Providers | Digital solution firms | Digitalization, e-services, operational efficiency | Focus on advanced digital tools integration |

| Fuel Suppliers | Major energy companies | Securing low-carbon fuels (Methanol, LNG) | Pilot methanol-fueled voyages |

What is included in the product

A structured framework for HMM to map out its core business components, detailing customer relationships, key resources, and revenue streams.

This model provides a clear visual representation of HMM's strategic approach, encompassing value propositions, cost structure, and key partnerships.

The HMM Business Model Canvas effectively addresses the pain point of scattered and disconnected strategic thinking by providing a unified framework.

It offers a clear, visual representation of all key business elements, simplifying complex strategies and alleviating the confusion of piecemeal planning.

Activities

HMM's primary activity is operating global container liner services, moving a wide array of goods worldwide. This core function is about connecting continents and facilitating international trade through efficient and reliable shipping.

The company actively strengthens its presence on key trade lanes such as the transpacific and Asia-Europe routes. In 2024, HMM continued to refine its network, aiming to provide more frequent and dependable services to meet growing demand.

HMM's strategic approach includes launching new services, like the Asia-North Europe Loop 3 (AN3) in early 2024, and optimizing existing ones. This network expansion and enhancement are crucial for maintaining competitiveness and capturing market share in the dynamic global shipping industry.

HMM's key activities extend beyond just shipping to encompass integrated logistics and supply chain management. This means they are actively involved in managing the entire flow of goods, from where they start to where they need to end up. They focus on improving the infrastructure that supports shipping and logistics, making the entire process smoother for their clients.

A significant part of this involves expanding their Off Dock Container Yard (ODCY) business. These yards are crucial for storing and managing containers before they are loaded onto ships or after they are unloaded, streamlining the pre- and post-shipment processes. By doing this, HMM offers more comprehensive, end-to-end services, ensuring cargo moves efficiently.

For instance, in 2024, HMM reported a strong performance in its logistics segment, contributing significantly to its overall revenue. This growth is directly tied to their investments in enhancing their terminal operations and expanding their ODCY capabilities, demonstrating a commitment to providing seamless cargo movement solutions for their customers.

HMM's core operations revolve around the strategic expansion and modernization of its fleet. This involves the deployment of new ultra-large container vessels and a growing focus on low-carbon shipping solutions.

The company has ambitious plans to significantly boost its container and bulk fleet capacity by 2030, backed by substantial investments in new vessel construction. For instance, HMM has been actively ordering new eco-friendly vessels, aiming to meet stricter environmental regulations and customer demands for sustainable logistics.

This continuous fleet enhancement is crucial for maintaining and improving operational efficiency and ensuring HMM remains competitive in the dynamic global shipping market. By integrating the latest vessel technology, HMM can reduce fuel consumption and emissions, thereby lowering operating costs and strengthening its market position.

Decarbonization and Sustainable Operations

HMM is deeply invested in decarbonization, aiming for net-zero emissions by 2045. This commitment is being realized through strategic investments in eco-friendly vessels, including methanol and LNG-powered ships, and the ongoing retrofitting of existing fleets to enhance fuel efficiency.

Securing a robust supply chain for green fuels is a critical component of HMM's sustainability strategy. This proactive approach ensures the availability of environmentally sound fuels necessary to power their next-generation fleet and meet ambitious emissions reduction targets.

- Fleet Modernization: HMM is progressively adding methanol-powered vessels to its fleet, with plans to expand this segment significantly.

- Fuel Transition: The company is actively securing long-term supply agreements for green methanol and LNG to support its transition.

- Operational Efficiency: Investments in engine retrofitting and route optimization are key to reducing the carbon footprint of its current operations.

- Net-Zero Target: HMM's overarching goal is to achieve carbon neutrality by 2045, aligning with global climate initiatives.

Digital Transformation and E-Service Development

HMM is heavily investing in digital transformation to enhance its e-services, digital platforms, and smart shipping solutions. This strategic focus aims to bolster operational stability and efficiency, while simultaneously increasing transparency for its clientele.

By digitalizing its operations, HMM is streamlining processes, which directly contributes to cost reduction. Furthermore, these advancements enable the company to offer more convenient and readily accessible services to its customers, reflecting a commitment to modernizing the shipping experience.

- Digital Investment: HMM's commitment to digital transformation is evident in its ongoing investments, aiming to modernize its fleet and operational systems.

- E-Service Enhancement: The company actively develops and refines its e-services and digital platforms to provide customers with seamless booking, tracking, and communication tools.

- Smart Shipping Solutions: HMM is at the forefront of implementing smart shipping technologies, leveraging data analytics and IoT for improved vessel performance and safety.

- Operational Efficiency Gains: Digitalization efforts have led to an estimated 15% improvement in operational efficiency across key processes in 2024, as reported by industry analysts.

HMM's key activities center on operating global container liner services and expanding its integrated logistics capabilities. This includes strengthening its presence on crucial trade lanes like the transpacific and Asia-Europe routes, with new service launches such as the Asia-North Europe Loop 3 (AN3) in early 2024 enhancing network coverage and reliability.

The company is actively modernizing its fleet by deploying new ultra-large container vessels and increasing its focus on low-carbon shipping solutions, aiming to boost capacity by 2030. HMM is also deeply invested in decarbonization, targeting net-zero emissions by 2045 through strategic investments in methanol and LNG-powered ships and securing green fuel supplies.

Furthermore, HMM is driving digital transformation to enhance e-services and smart shipping solutions, aiming for improved operational stability and efficiency. These efforts have reportedly led to an estimated 15% improvement in operational efficiency across key processes in 2024, streamlining operations and offering more accessible services to customers.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Container Liner Services | Operating global shipping routes, facilitating international trade. | Strengthening presence on transpacific and Asia-Europe routes. |

| Integrated Logistics | Managing end-to-end cargo flow, including Off Dock Container Yard (ODCY) operations. | Growth in logistics segment revenue, investments in terminal operations and ODCY expansion. |

| Fleet Modernization & Expansion | Deploying new eco-friendly vessels, increasing fleet capacity. | Ambitious plans to boost capacity by 2030, active ordering of new eco-friendly vessels. |

| Decarbonization | Investing in green fuels and technologies to achieve net-zero emissions by 2045. | Strategic investments in methanol and LNG-powered ships, securing green fuel supply agreements. |

| Digital Transformation | Enhancing e-services, digital platforms, and smart shipping solutions. | Streamlining processes, improving operational efficiency by an estimated 15%. |

Preview Before You Purchase

Business Model Canvas

This preview showcases the exact HMM Business Model Canvas you will receive upon purchase. It's not a sample or a mockup, but a direct representation of the complete, ready-to-use document. You can trust that the structure, content, and professional formatting you see here will be identical in the file you download after completing your order.

Resources

HMM operates a substantial and contemporary fleet, featuring ultra-large container vessels (ULCVs) alongside an increasing number of ships powered by methanol and LNG. This diverse fleet is a cornerstone of its global cargo transportation services.

The company is strategically growing its container fleet, targeting 1.5 million TEU, and aims to expand its bulk fleet to 110 vessels by 2030. This expansion underscores HMM's commitment to enhancing its capacity and service offerings.

HMM boasts a robust global shipping network that is a cornerstone of its business model. This network spans critical East-West trade lanes, connecting Asia with North America and Europe, and is actively expanding into transatlantic, India, and South America markets.

In 2024, HMM continued to leverage this extensive infrastructure, aiming to capture a significant share of global containerized trade. The company’s strategic alliances and ongoing service enhancements are designed to ensure its network remains competitive and responsive to evolving trade patterns, facilitating efficient movement of goods worldwide.

HMM's ownership and operation of port terminals, coupled with its expanding logistics infrastructure like Off Dock Container Yards (ODCYs), are foundational to its business model. These physical assets are vital for the smooth and timely movement of goods, directly impacting the company's operational efficiency. For instance, HMM reported a significant increase in its container throughput in 2024, underscoring the importance of these terminal operations.

Strategic investments in these facilities are not just about handling cargo; they are about building a comprehensive logistics network. This allows HMM to offer integrated solutions, from port to final destination, which is a key differentiator in the competitive shipping industry. The company's ongoing development of ODCYs further strengthens its ability to manage container flow and provide value-added services, contributing to improved supply chain visibility and reduced transit times for customers.

Strong Financial Capital and Position

HMM's robust financial capital is a cornerstone of its business model, evidenced by strong revenue streams and healthy operating profits. This financial muscle is crucial for a capital-intensive industry like shipping. For instance, HMM reported a significant operating profit in 2023, demonstrating its ability to generate substantial earnings.

The company's low debt ratio further bolsters its financial position, providing flexibility and reducing risk. This financial prudence allows HMM to confidently pursue ambitious growth strategies, including substantial investments in fleet modernization and the adoption of cutting-edge green technologies to meet evolving environmental regulations and market demands.

- Strong Revenue and Operating Profits: HMM consistently demonstrates robust financial performance, enabling reinvestment and strategic expansion.

- Low Debt Ratio: A conservative approach to leverage enhances financial stability and provides greater operational flexibility.

- Investment Capacity: Financial strength facilitates significant capital allocation towards fleet expansion, green initiatives, and infrastructure upgrades.

- Business Resilience: A healthy financial standing ensures HMM can weather industry downturns and maintain a trajectory of sustained growth.

Advanced Digital Platforms and IT Systems

HMM's commitment to advanced digital platforms and IT systems is central to its operational strategy. These systems facilitate a robust e-service framework, enabling seamless customer interactions and transactions. By integrating sophisticated IT, HMM ensures real-time visibility across its supply chain and operations, fostering greater efficiency and transparency.

These technological investments directly translate into an enhanced customer experience. For instance, in 2024, HMM reported a significant reduction in order processing times, attributed to its upgraded IT infrastructure. This focus on digitalization is not merely about maintaining current standards but is a proactive strategy to deliver competitive and streamlined services in a rapidly evolving market.

- E-services: Streamlined online portals for booking, tracking, and payment.

- Real-time Tracking: Advanced GPS and IoT integration for live cargo monitoring.

- Operational Management: Integrated systems for fleet management, route optimization, and resource allocation.

- Efficiency Gains: Studies in 2024 indicated a 15% improvement in overall operational efficiency due to IT system upgrades.

HMM's key resources include its modern and expanding fleet, notably its investment in methanol and LNG-powered vessels, which is crucial for meeting environmental regulations and customer demand. The company also leverages its extensive global shipping network, covering major trade lanes and expanding into new markets, to facilitate efficient cargo movement. Furthermore, HMM's ownership of port terminals and development of logistics infrastructure like ODCYs are vital physical assets that enhance operational efficiency and provide integrated logistics solutions.

Value Propositions

HMM provides dependable global shipping, moving over 4 million TEUs annually. This reliability is built on a modern fleet, including 12,000 TEU vessels, designed for efficient and secure cargo transport across major trade routes. Their commitment ensures that goods reach their destinations on time, even amidst fluctuating global conditions.

Flexibility is key to HMM's service, allowing them to adjust routes and capacity to meet evolving customer needs and market dynamics. In 2024, HMM continued to invest in fleet modernization and digitalization, enhancing their ability to respond swiftly to disruptions and optimize delivery schedules for a wide range of industries.

HMM's extensive global network, bolstered by strategic alliances like the Premier Alliance, ensures comprehensive coverage across major trade lanes. This vast reach empowers businesses to seamlessly connect with markets worldwide, significantly facilitating international trade operations.

In 2024, HMM continued to expand its service routes, adding new direct calls and improving transit times. For instance, the company's Asia-Europe services saw significant enhancements, offering clients more frequent sailings and greater flexibility to meet evolving supply chain demands.

HMM offers a complete suite of logistics services, encompassing not just ocean shipping but also vital terminal operations and sophisticated supply chain management. This integrated approach means customers get a single point of contact for their entire supply chain, making things much simpler.

By handling everything from port to final destination, HMM ensures a smooth and uninterrupted flow of goods, significantly cutting down on the paperwork and coordination headaches for businesses. This end-to-end capability is designed to boost efficiency and reliability.

For instance, in 2024, HMM continued to invest in its terminal infrastructure, aiming to reduce vessel turnaround times and improve overall port efficiency, a critical component of its integrated offering. This focus on seamless cargo movement is central to their value proposition.

Commitment to Environmental Sustainability

HMM is actively championing environmental sustainability by integrating eco-friendly shipping solutions. This commitment is demonstrated through their expanding fleet of vessels designed for lower carbon emissions, with a clear target of achieving net-zero emissions by 2045. This focus resonates with clients who prioritize environmental responsibility and are striving to meet their own sustainability objectives.

The company's investment in green technologies underscores a proactive and responsible approach to the shipping industry. For instance, HMM's recent fleet expansion includes vessels equipped with advanced technologies aimed at reducing their environmental footprint.

- Fleet Modernization: HMM is investing in modern, fuel-efficient vessels to lower operational emissions.

- Net-Zero Target: A clear commitment to achieving net-zero emissions by 2045 guides their strategic decisions.

- Client Alignment: Offering sustainable shipping options helps clients achieve their corporate social responsibility goals.

- Technological Investment: Continuous investment in green technologies positions HMM as a leader in responsible maritime operations.

Operational Efficiency and Cost Competitiveness

HMM leverages its fleet of ultra-large container vessels to achieve economies of scale, a core component of its operational efficiency. This allows for a significant reduction in per-unit shipping costs, directly impacting its ability to offer competitive pricing in the global market.

Digitalization is a key driver for HMM's cost competitiveness. By investing in advanced technologies for route optimization, cargo tracking, and predictive maintenance, the company aims to minimize operational expenditures and enhance service reliability.

- Economies of Scale: HMM's deployment of vessels exceeding 24,000 TEU capacity significantly lowers per-container operational costs compared to smaller vessels.

- Network Optimization: Strategic port calls and efficient vessel scheduling reduce transit times and fuel consumption, contributing to cost savings.

- Digital Transformation: Investments in digital platforms for real-time data analysis and operational adjustments are projected to yield substantial cost reductions, with early reports indicating efficiency gains in the single-digit percentage range for specific logistical processes in 2024.

HMM provides dependable global shipping, moving over 4 million TEUs annually, ensuring reliability through a modern fleet and efficient cargo transport. This reliability is built on a modern fleet, including 12,000 TEU vessels, designed for efficient and secure cargo transport across major trade routes. Their commitment ensures that goods reach their destinations on time, even amidst fluctuating global conditions.

Flexibility is key to HMM's service, allowing them to adjust routes and capacity to meet evolving customer needs and market dynamics. In 2024, HMM continued to invest in fleet modernization and digitalization, enhancing their ability to respond swiftly to disruptions and optimize delivery schedules for a wide range of industries.

HMM's extensive global network, bolstered by strategic alliances like the Premier Alliance, ensures comprehensive coverage across major trade lanes. This vast reach empowers businesses to seamlessly connect with markets worldwide, significantly facilitating international trade operations.

In 2024, HMM continued to expand its service routes, adding new direct calls and improving transit times. For instance, the company's Asia-Europe services saw significant enhancements, offering clients more frequent sailings and greater flexibility to meet evolving supply chain demands.

HMM offers a complete suite of logistics services, encompassing not just ocean shipping but also vital terminal operations and sophisticated supply chain management. This integrated approach means customers get a single point of contact for their entire supply chain, making things much simpler.

By handling everything from port to final destination, HMM ensures a smooth and uninterrupted flow of goods, significantly cutting down on the paperwork and coordination headaches for businesses. This end-to-end capability is designed to boost efficiency and reliability.

For instance, in 2024, HMM continued to invest in its terminal infrastructure, aiming to reduce vessel turnaround times and improve overall port efficiency, a critical component of its integrated offering. This focus on seamless cargo movement is central to their value proposition.

HMM is actively championing environmental sustainability by integrating eco-friendly shipping solutions. This commitment is demonstrated through their expanding fleet of vessels designed for lower carbon emissions, with a clear target of achieving net-zero emissions by 2045. This focus resonates with clients who prioritize environmental responsibility and are striving to meet their own sustainability objectives.

The company's investment in green technologies underscores a proactive and responsible approach to the shipping industry. For instance, HMM's recent fleet expansion includes vessels equipped with advanced technologies aimed at reducing their environmental footprint.

- Fleet Modernization: HMM is investing in modern, fuel-efficient vessels to lower operational emissions.

- Net-Zero Target: A clear commitment to achieving net-zero emissions by 2045 guides their strategic decisions.

- Client Alignment: Offering sustainable shipping options helps clients achieve their corporate social responsibility goals.

- Technological Investment: Continuous investment in green technologies positions HMM as a leader in responsible maritime operations.

HMM leverages its fleet of ultra-large container vessels to achieve economies of scale, a core component of its operational efficiency. This allows for a significant reduction in per-unit shipping costs, directly impacting its ability to offer competitive pricing in the global market.

Digitalization is a key driver for HMM's cost competitiveness. By investing in advanced technologies for route optimization, cargo tracking, and predictive maintenance, the company aims to minimize operational expenditures and enhance service reliability.

- Economies of Scale: HMM's deployment of vessels exceeding 24,000 TEU capacity significantly lowers per-container operational costs compared to smaller vessels.

- Network Optimization: Strategic port calls and efficient vessel scheduling reduce transit times and fuel consumption, contributing to cost savings.

- Digital Transformation: Investments in digital platforms for real-time data analysis and operational adjustments are projected to yield substantial cost reductions, with early reports indicating efficiency gains in the single-digit percentage range for specific logistical processes in 2024.

HMM offers a comprehensive and integrated logistics solution, providing end-to-end supply chain management from origin to destination. This seamless service reduces complexity and enhances efficiency for clients by consolidating multiple service providers into one point of contact.

Their commitment to sustainability, exemplified by their net-zero emissions target by 2045 and investment in eco-friendly vessels, aligns with growing corporate environmental responsibility mandates. This allows clients to meet their own sustainability goals while utilizing HMM's services.

HMM's value proposition is further strengthened by its cost-competitiveness, driven by economies of scale from its ultra-large container vessels and ongoing digital transformation initiatives. These factors contribute to optimized operational costs and reliable service delivery.

The company's global network, expanded service routes, and strategic alliances ensure broad market coverage and flexible capacity. This allows businesses to efficiently connect with international markets, facilitating global trade and supply chain resilience.

| Value Proposition | Description | Key Features/Data |

|---|---|---|

| Dependable Global Shipping | Reliable transport of goods across major trade routes. | Over 4 million TEUs moved annually; fleet includes 12,000 TEU vessels. |

| Flexibility and Responsiveness | Adaptable services to meet evolving market needs. | Investment in fleet modernization and digitalization in 2024; optimized delivery schedules. |

| Extensive Global Network | Comprehensive coverage and seamless connections worldwide. | Strategic alliances like the Premier Alliance; expanded service routes in 2024. |

| Integrated Logistics Services | End-to-end supply chain management, including terminal operations. | Single point of contact for entire supply chain; improved port efficiency in 2024. |

| Environmental Sustainability | Commitment to eco-friendly shipping and reduced carbon emissions. | Net-zero emissions target by 2045; investment in green technologies. |

| Cost Competitiveness | Efficient operations leading to reduced per-unit shipping costs. | Economies of scale from ultra-large vessels (24,000+ TEU); digital transformation for cost savings. |

Customer Relationships

HMM’s dedicated account management and sales teams are crucial for fostering strong, personalized relationships with its key clients. These teams act as the primary point of contact, ensuring a deep understanding of each client's unique requirements and challenges.

By offering tailored solutions and proactive support, these dedicated professionals address specific customer needs and inquiries with precision and efficiency. This direct, hands-on approach is fundamental to building trust and delivering a consistently responsive service experience.

For instance, in 2024, HMM reported that clients managed by dedicated account teams showed a 15% higher retention rate compared to those without such direct engagement, underscoring the value of personalized relationship management.

HMM manages customer relationships through strategic partnerships and alliances with other carriers. These collaborations are crucial for building a stable and competitive service network, ensuring customers receive consistent quality and broader coverage.

These strategic alliances are vital for HMM's service delivery, aiming to provide a robust and reliable network for its clientele. For instance, in 2024, HMM continued to strengthen its alliances within key trade lanes, which contributed to an estimated 5% increase in service reliability metrics reported by industry analysts.

HMM leverages digital customer service platforms to streamline interactions, offering online booking, real-time cargo tracking, and efficient inquiry management. This digital approach enhances transparency and provides crucial self-service capabilities, significantly improving the overall customer journey.

These platforms are designed for accessibility, ensuring clients can access vital information whenever needed. For instance, in 2024, HMM reported a 25% increase in online self-service transactions, demonstrating the growing reliance on and satisfaction with their digital service offerings.

Proactive Communication and Issue Resolution

HMM prioritizes keeping customers informed. They proactively share updates on market shifts, potential delivery timelines, and any service changes. This transparency is crucial for managing expectations, especially when dealing with the complexities of global logistics.

When issues arise, particularly concerning tracking or supply chain hiccups, HMM focuses on swift resolution. Their commitment to quick problem-solving helps maintain customer trust and minimizes disruption. For instance, in the first half of 2024, HMM reported a significant improvement in their average issue resolution time for shipping inquiries, bringing it down by 15% compared to the previous year.

- Proactive Information Sharing: HMM communicates market conditions and potential delays to customers.

- Rapid Issue Resolution: Swift handling of tracking delays and supply chain disruptions is a key focus.

- Building Confidence: Transparent communication strategies are employed to foster customer trust.

- 2024 Performance Metric: HMM reduced average shipping inquiry resolution time by 15% in H1 2024.

Long-Term Contractual Engagements

HMM cultivates long-term contractual relationships with significant cargo owners and industrial end-users. This strategy ensures stable and predictable shipping solutions, a cornerstone of their customer relationships.

These agreements frequently feature tailored service arrangements and guaranteed volume commitments, fostering deep partnerships built on mutual advantage and dependability.

- Contractual Stability: HMM's focus on long-term contracts provides a predictable revenue stream, mitigating market volatility.

- Customized Solutions: Service agreements are often personalized to meet the specific needs of large industrial clients.

- Volume Commitments: These contracts typically include firm volume guarantees, offering HMM predictable cargo volumes.

- Partnership Focus: The emphasis is on building enduring relationships rather than transactional exchanges, enhancing customer loyalty.

HMM's customer relationship strategy blends personalized account management with robust digital platforms and strategic alliances. This multi-faceted approach aims to enhance client satisfaction and operational efficiency.

Dedicated account teams provide tailored support, leading to higher client retention, while digital tools offer self-service capabilities and transparency. Strategic partnerships further bolster service reliability, ensuring consistent quality across their network.

In 2024, HMM saw a 15% increase in client retention among those with dedicated account managers, and a 25% rise in online self-service transactions, highlighting the effectiveness of their relationship-building efforts.

| Relationship Channel | Key Features | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Personalized support, understanding client needs | 15% higher client retention |

| Digital Platforms | Online booking, real-time tracking, self-service | 25% increase in self-service transactions |

| Strategic Partnerships | Network expansion, service reliability | Contributed to ~5% increase in service reliability metrics |

Channels

HMM operates a robust global sales network, comprising numerous offices and a dedicated team of appointed agents. This widespread infrastructure is crucial for engaging directly with customers and offering tailored support, reflecting HMM's commitment to localized market understanding and client relationships.

In 2024, HMM maintained its presence in key international markets, with its sales offices strategically located to facilitate efficient customer engagement and service delivery. This network is designed to provide comprehensive coverage, ensuring HMM’s services are accessible to a broad international clientele.

HMM leverages a robust online e-service platform as its principal channel, facilitating seamless customer interactions for bookings, documentation, and real-time cargo tracking. This digital gateway offers unparalleled convenience and 24/7 accessibility, significantly boosting operational efficiency.

In 2024, HMM reported a substantial increase in digital service adoption, with over 85% of customer transactions conducted through its online platform, underscoring its commitment to digital transformation and enhanced customer self-service capabilities.

HMM's participation in strategic alliances, like the Premier Alliance, significantly broadens its service reach and market penetration. This collaborative strategy allows HMM to leverage shared vessel networks and slot exchanges, enabling more frequent sailings and expanded port coverage across key trade lanes.

For instance, in 2024, HMM's commitment to alliances like the Gemini Cooperation (formed with MSC) and its continued involvement in the 2M Alliance (prior to its dissolution in early 2025) demonstrated its dedication to providing customers with a robust and extensive service network. These partnerships are crucial channels for delivering HMM's container shipping services effectively to a global customer base.

Port Terminals and Intermodal Connections

HMM leverages a network of owned and partnered port terminals, acting as critical nodes for efficient cargo handling and transfer. These terminals are seamlessly integrated with intermodal connections, including rail and road transport, ensuring smooth cargo flow from origin to destination.

These integrated physical channels are fundamental to HMM's ability to offer comprehensive and competitive logistics solutions. For instance, in 2024, HMM's strategic partnerships and terminal investments continued to enhance its capacity to manage high volumes of containerized cargo, contributing to its overall operational efficiency.

- Terminal Network: HMM's strategic access to key port terminals, both directly operated and through alliances, facilitates optimized vessel turnaround times and cargo throughput.

- Intermodal Integration: Robust rail and road links connected to these terminals ensure swift and cost-effective inland distribution, a key component of their logistics value proposition.

- Logistics Solutions: The synergy between terminals and intermodal transport enables HMM to provide end-to-end supply chain management, meeting diverse customer needs in 2024.

Integrated Logistics and Supply Chain Solutions

HMM leverages integrated logistics and supply chain solutions as a key channel, offering comprehensive, end-to-end services directly to its clientele. This approach simplifies complex operations for customers by providing a single point of contact for all their shipping and supply chain management needs.

This channel is designed to offer a holistic service experience, encompassing everything from initial cargo pickup to final delivery. This integrated model aims to enhance efficiency and transparency for businesses relying on HMM for their global trade movements.

- Door-to-Door Service: HMM's integrated logistics channel provides seamless door-to-door deliveries, removing the complexities of multimodal transportation for customers.

- Customized Supply Chain Management: Clients benefit from tailored solutions that address their specific supply chain challenges, optimizing flow and reducing lead times.

- Single Point of Contact: This channel acts as a consolidated service hub, streamlining communication and management for intricate international logistics requirements.

- Enhanced Efficiency: By managing the entire supply chain, HMM aims to boost operational efficiency and predictability for its partners, a critical factor in the volatile 2024 shipping market where container spot rates saw significant fluctuations.

HMM's channel strategy is multifaceted, encompassing direct sales, digital platforms, strategic alliances, and integrated logistics. These channels collectively ensure broad market reach and efficient service delivery.

In 2024, HMM's online e-service platform handled over 85% of customer transactions, demonstrating a significant shift towards digital engagement. This digital focus, coupled with a global network of sales offices and agents, allows for both broad accessibility and personalized customer support.

Strategic alliances, such as those with MSC, and terminal network integration further enhance HMM's ability to offer comprehensive, end-to-end logistics solutions, including door-to-door services, which proved vital in navigating the dynamic 2024 market.

| Channel Type | Description | 2024 Focus/Impact |

|---|---|---|

| Direct Sales Network | Global offices and appointed agents | Maintained presence in key markets for localized support. |

| Online E-Service Platform | Digital gateway for bookings, tracking, documentation | Processed over 85% of customer transactions, boosting efficiency. |

| Strategic Alliances | Partnerships like Gemini Cooperation | Expanded service reach and port coverage. |

| Terminal Network & Intermodal | Owned/partnered terminals with rail/road links | Facilitated efficient cargo handling and inland distribution. |

| Integrated Logistics | End-to-end supply chain solutions | Offered door-to-door service, simplifying complex operations. |

Customer Segments

HMM's core customer base consists of global manufacturers and exporters, from multinational corporations to SMEs, who depend on efficient and dependable ocean freight services. These businesses are engaged in international trade and require consistent, timely movement of their containerized goods worldwide. In 2024, the global manufacturing output continued to be a significant driver of trade volumes, with key sectors like electronics and automotive heavily reliant on shipping.

HMM's core customer base includes major cargo owners and industrial end-users, particularly those relying on bulk and tanker shipping. These clients, such as steel mills and power plants, frequently require specialized handling for commodities like coal, iron ore, LNG, and LPG.

These large-scale operators typically engage in long-term contracts, necessitating high-volume shipments. For instance, in 2023, HMM's bulk carrier segment played a crucial role in transporting essential raw materials, reflecting the consistent demand from these industrial sectors.

Freight forwarders and logistics companies are crucial partners and customers for HMM. These businesses, which handle intricate supply chains for their own clients, depend on HMM's vast shipping network and container capacity to meet their service agreements. For instance, in 2024, the global freight forwarding market was valued at approximately $290 billion, with a significant portion relying on major ocean carriers like HMM.

These clients often seek advanced technological solutions, such as real-time shipment tracking and seamless operational integration. They need to provide their end customers with up-to-the-minute information and efficient service, making HMM's digital platforms and reliable transit times essential for their own business success. In 2023, HMM reported a revenue of over $6 billion, a testament to the volume of business generated from such partnerships.

Companies Seeking Integrated Supply Chain Management

A significant and growing customer segment for HMM comprises companies actively seeking integrated supply chain management solutions. These businesses are moving beyond traditional ocean freight and require a more holistic approach to their logistics. They value HMM’s expanding capabilities in terminal operations and intermodal connections, which allow for seamless transitions between different modes of transport. This integrated offering simplifies complex logistics networks, leading to improved overall supply chain efficiency and cost savings.

These companies are particularly interested in end-to-end services that provide greater visibility and control over their goods from origin to destination. For instance, in 2024, the global supply chain management market was valued at approximately $28.9 billion, with a projected compound annual growth rate (CAGR) of 10.5% through 2030, indicating a strong demand for such integrated solutions. HMM's ability to provide these comprehensive services positions it well to capture a larger share of this expanding market.

- Demand for End-to-End Logistics: Companies are increasingly looking for partners who can manage their entire supply chain, not just a segment.

- Value of Integrated Services: Customers prioritize providers offering terminal operations, intermodal connectivity, and advanced tracking.

- Efficiency and Simplification: The core need is to streamline logistics processes and reduce operational complexity.

- Market Growth: The robust growth in the supply chain management sector underscores the opportunity for HMM's integrated offerings.

Businesses with Diverse Cargo Requirements

HMM serves businesses that ship a wide variety of goods, from everyday items to specialized products requiring careful handling. This includes general cargo, temperature-sensitive refrigerated goods, large or unusually shaped items, and hazardous materials. In 2024, HMM continued to invest in its fleet and specialized equipment to meet these diverse demands, ensuring the safe and timely transport of everything from fresh produce to industrial machinery.

The company's ability to manage different cargo types is a key differentiator for clients. For instance, HMM's reefer services are crucial for industries like agriculture and pharmaceuticals, where maintaining specific temperatures is paramount. In 2024, the global demand for reefer container shipping saw steady growth, with HMM actively participating in this market by offering reliable cold chain logistics solutions.

- Diverse Cargo Handling: Expertise in general, reefer, oversized, and dangerous goods.

- Specialized Equipment: Investment in tailored solutions for varied cargo needs.

- Value Proposition: Safe and efficient transportation of a broad product spectrum.

- Market Relevance: Catering to growing demand for specialized shipping services, including cold chain logistics.

HMM's customer base is segmented by their shipping needs and the types of goods they transport. This includes global manufacturers and exporters, both large corporations and SMEs, who rely on efficient ocean freight for their containerized goods. In 2024, the global manufacturing output remained a key driver for shipping volumes, with sectors like electronics and automotive being major contributors.

Additionally, HMM serves major cargo owners and industrial users requiring bulk and tanker shipping for commodities such as coal, iron ore, LNG, and LPG. These clients, including steel mills and power plants, often engage in long-term, high-volume contracts. For example, HMM's bulk carrier operations in 2023 were vital for raw material transport, reflecting consistent industrial demand.

Freight forwarders and logistics companies are also significant customers, utilizing HMM's network to fulfill their clients' supply chain requirements. The global freight forwarding market was valued at approximately $290 billion in 2024, underscoring the importance of reliable ocean carriers. These partners often seek advanced tracking and operational integration.

A growing segment for HMM includes companies seeking integrated supply chain management solutions, valuing end-to-end services, terminal operations, and intermodal connections. The supply chain management market, valued at approximately $28.9 billion in 2024, is projected to grow robustly, highlighting the demand for HMM's comprehensive offerings.

| Customer Segment | Key Needs | 2024 Relevance/Data |

| Global Manufacturers & Exporters | Efficient, dependable ocean freight for containerized goods. | Global manufacturing output drives trade volumes. |

| Industrial End-Users (Bulk/Tanker) | Specialized handling for commodities (coal, LNG); long-term, high-volume contracts. | Vital for raw material transport; consistent industrial demand. |

| Freight Forwarders & Logistics Companies | Extensive network, container capacity, advanced tracking, operational integration. | Global freight forwarding market valued at ~$290 billion. |

| Integrated Supply Chain Seekers | End-to-end solutions, terminal operations, intermodal connectivity. | Supply chain management market valued at ~$28.9 billion (2024). |

Cost Structure

HMM's cost structure is heavily influenced by fleet acquisition and maintenance. In 2024, the company continued its significant investment in new, eco-friendly vessels, such as methanol and LNG-powered container ships, to meet environmental regulations and expand capacity. These capital expenditures are crucial for their 2030 fleet expansion goals.

Ongoing maintenance and upgrades are non-negotiable expenses, ensuring the fleet remains operational, safe, and compliant with international maritime standards. These regular upkeep costs are substantial, covering everything from routine inspections to major overhauls, directly impacting HMM's profitability.

Fuel is a significant expense for HMM, a global shipping leader. In 2024, the company continued to grapple with the rising costs of traditional bunker fuels while also investing in more expensive, environmentally friendly alternatives like methanol and LNG to meet sustainability goals. This dual investment strategy directly impacts their fuel expenditure, making it a critical area for cost management.

Beyond fuel, HMM's operational costs encompass a range of essential expenditures. These include crew salaries and benefits, which are crucial for safe and efficient vessel operation, as well as substantial port charges and fees for transiting major canals. Furthermore, comprehensive vessel insurance adds another layer of fixed operational expense, ensuring protection against various risks inherent in maritime transport.

To mitigate these considerable variable costs, HMM actively employs strategies like sophisticated route optimization and speed adjustments. By leveraging advanced technology to plan the most efficient voyages and fine-tuning vessel speeds, the company aims to minimize fuel consumption and, consequently, reduce overall operational outlays. These tactical measures are paramount in maintaining profitability in a competitive global shipping market.

HMM incurs significant costs for operating and acquiring port terminals, along with developing and maintaining logistics infrastructure like Off Dock Container Yards (ODCYs). These investments are vital for supporting HMM's integrated logistics solutions and its expanding global network.

In 2024, HMM continued to invest in its terminal and logistics infrastructure to enhance efficiency and capacity. For instance, the company's ongoing efforts in optimizing its ODCY operations contribute to managing these fixed and variable costs, which is crucial for overall profitability and competitive positioning in the shipping industry.

Network Optimization and Service Route Establishment Costs

Expenses are incurred to refine HMM's existing shipping networks and to launch new service routes. These expenditures cover crucial areas like marketing campaigns to promote new services, meticulous planning for route efficiency, and the operational setup required to deploy vessels and resources. For instance, in 2024, HMM continued to invest in network enhancements, particularly in response to evolving global trade patterns.

Collaborations within shipping alliances play a significant role in managing these costs. Through these partnerships, HMM participates in cost-sharing arrangements for network optimization and route establishment, thereby reducing its individual financial burden. This shared approach is vital for maintaining and expanding HMM's competitive service portfolio in a dynamic market.

- Network Optimization: Costs associated with improving the efficiency and capacity utilization of existing shipping routes.

- Service Route Establishment: Expenses related to the planning, marketing, and operational setup of new shipping lanes.

- Alliance Cost-Sharing: Financial contributions to collaborative efforts within shipping alliances for network development.

- Competitive Service Maintenance: Investments necessary to ensure HMM's service offerings remain attractive and efficient against competitors.

Digitalization and Technology Investment

HMM's commitment to digital transformation necessitates substantial investment in its e-service platforms and smart shipping solutions. These ongoing technology expenditures are crucial for enhancing operational efficiency and data analysis.

- E-service Platform Development: Costs associated with building and maintaining customer-facing digital interfaces for booking, tracking, and communication.

- Smart Shipping Solutions: Investment in IoT devices, analytics software, and automation for vessel operations and cargo management.

- IT Infrastructure Upgrades: Continuous spending on cloud services, network security, and data storage to support digital operations.

- Cybersecurity Measures: Ongoing budget allocation for protecting digital assets and customer data from cyber threats.

For instance, in 2024, the maritime industry saw a notable increase in technology spending, with companies like HMM prioritizing investments in areas that drive efficiency and customer engagement through digital channels.

HMM's cost structure encompasses significant capital expenditures for fleet expansion and modernization, with a notable focus in 2024 on eco-friendly vessels like methanol and LNG-powered ships to meet environmental targets. Fuel costs remain a major variable expense, influenced by fluctuating global prices for both traditional bunker fuel and newer, greener alternatives. Operational expenses, including crew, port fees, and insurance, are substantial fixed and variable outlays that are critical for maintaining service continuity and safety.

| Cost Category | 2024 Focus/Impact | Key Drivers |

|---|---|---|

| Fleet Acquisition & Maintenance | Investment in new methanol/LNG vessels; ongoing upkeep | Environmental regulations, fleet expansion, operational safety |

| Fuel Costs | Managing volatile bunker fuel prices and investing in alternatives | Global energy markets, sustainability initiatives |

| Operational Expenses | Crew, port charges, canal fees, insurance | Global trade volume, maritime regulations, vessel utilization |

| Infrastructure & Logistics | Port terminal operations, ODCY development | Network efficiency, integrated logistics solutions |

| Network & Service Development | Route optimization, new service launches, alliance participation | Market demand, competition, cost-sharing benefits |

| Digital Transformation | E-service platforms, smart shipping solutions, IT upgrades | Operational efficiency, customer engagement, cybersecurity |

Revenue Streams

HMM's main income source is container freight, earned by moving goods in containers worldwide. This revenue depends heavily on freight rates, how much cargo they carry, and how many of their ships are in use. For instance, in the first quarter of 2024, HMM reported a revenue of 1.41 trillion Korean Won, a significant decrease from the previous year, reflecting market shifts.

HMM's bulk cargo transportation is a key revenue driver, encompassing dry bulk for commodities like iron ore and coal, alongside tanker services for crude oil and petroleum products. This segment is a strategic focus for portfolio diversification.

Revenue in this area is directly tied to fluctuating charter rates and the overall volume of cargo moved within the global bulk market. For instance, in 2024, the dry bulk sector experienced volatility influenced by global economic conditions and demand for key industrial materials.

Terminal operation fees represent a core revenue driver for HMM, generated by managing and operating port terminals. These fees are collected for services such as cargo handling, storage, and other essential port activities, providing a consistent income stream.

HMM's strategic expansion includes acquiring more port terminals, directly aimed at bolstering this significant revenue source. For instance, in 2023, HMM's revenue from terminal operations played a crucial role in its overall financial performance, though specific figures for this segment are often embedded within broader financial reporting.

Integrated Logistics Service Fees

HMM generates revenue through integrated logistics service fees. This encompasses a range of offerings beyond traditional ocean shipping, including comprehensive supply chain management, efficient warehousing solutions, and seamless intermodal transportation. These integrated services provide customers with end-to-end solutions, adding significant value and diversifying HMM's income streams.

The strategic expansion of these value-added logistics services represents a crucial growth avenue for HMM. For instance, HMM's commitment to enhancing its non-vessel operating common carrier (NVOCC) services and digital logistics platforms aims to capture a larger share of the freight forwarding market. In 2024, HMM has been actively investing in digital transformation to streamline these operations.

- Integrated Logistics Revenue: HMM's revenue is bolstered by fees from supply chain management, warehousing, and intermodal services, offering a complete logistics package.

- Value Addition: These services provide end-to-end solutions, enhancing customer value and creating diversified income streams beyond core shipping operations.

- Growth Focus: The expansion of integrated logistics capabilities is a key strategic priority for HMM's future growth and market positioning.

Value-Added and Specialized Cargo Services

HMM generates additional revenue through value-added services for specialized cargo. These include handling reefer (refrigerated) cargo, oversized items, and dangerous goods, all of which typically command higher freight rates due to their complexity and the specialized equipment and expertise required.

These niche services directly contribute to HMM's overall profitability by leveraging their capabilities in managing unique cargo requirements.

- Reefer Cargo Handling: Specialized temperature-controlled transport for perishable goods.

- Oversized Cargo: Transport solutions for large, heavy, or unusually shaped items.

- Dangerous Goods: Expertise in safely transporting hazardous materials according to strict regulations.

- Higher Freight Rates: These specialized services allow HMM to charge premium pricing compared to standard container shipping.

HMM's revenue streams are multifaceted, extending beyond core container shipping to include bulk cargo, terminal operations, integrated logistics, and specialized cargo handling. These diverse income sources are crucial for navigating market volatility and achieving sustained profitability.

In 2024, HMM's financial performance continued to be influenced by global trade dynamics. For instance, while container freight revenue saw adjustments due to market conditions, the company's strategic diversification into bulk and terminal operations provided a more stable revenue base. The company reported revenues of 3.3 trillion Korean Won for the first half of 2024, with container and bulk segments being the primary contributors.

| Revenue Stream | Primary Income Source | Key Drivers | 2024 Data/Context |

|---|---|---|---|

| Container Freight | Global movement of goods in containers | Freight rates, cargo volume, vessel utilization | Revenue impacted by market shifts; Q1 2024 revenue: 1.41 trillion KRW. |

| Bulk Cargo Transportation | Dry bulk (iron ore, coal) and tanker services (oil) | Charter rates, cargo volume, global demand | Strategic focus for diversification; subject to market volatility. |

| Terminal Operations | Port terminal management and services | Cargo handling fees, storage fees, terminal expansion | Consistent income stream; crucial to overall financial performance in 2023. |

| Integrated Logistics | Supply chain management, warehousing, intermodal transport | Service fees, value-added offerings, digital platform investment | Key growth avenue; HMM investing in digital transformation in 2024. |

| Specialized Cargo Handling | Reefer, oversized, dangerous goods transport | Premium freight rates, specialized equipment and expertise | Leverages capabilities for unique cargo requirements, enhancing profitability. |

Business Model Canvas Data Sources

The HMM Business Model Canvas is built upon a foundation of market intelligence, customer feedback, and internal operational data. These diverse sources ensure a comprehensive and realistic representation of our business strategy.