HMM Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HMM Bundle

HMM's competitive landscape is shaped by powerful forces, from the intense rivalry among existing players to the bargaining power of its customers. Understanding these dynamics is crucial for navigating the shipping industry.

The complete report reveals the real forces shaping HMM’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of shipbuilders is a considerable factor for HMM, primarily because constructing new vessels involves immense capital outlays and requires highly specialized manufacturing capabilities. This inherent barrier to entry means fewer shipyards can undertake such projects, giving them leverage.

HMM's strategic fleet expansion, which includes a significant investment in eco-friendly vessels like methanol-powered and LNG-powered ships, underscores its dependence on a limited pool of capable shipbuilders. These advanced vessels demand specific expertise and infrastructure, further concentrating power among a select group of suppliers.

The extended lead times associated with new vessel construction, often spanning several years from order to delivery, also bolster the shipbuilders' negotiating position. This extended timeline means HMM must commit resources and plan far in advance, making it more challenging to switch suppliers or delay orders without substantial penalties.

Fuel suppliers wield significant influence over shipping companies like HMM, with fuel costs often representing as much as 50% of total operating expenses. This substantial portion means that even minor fluctuations in fuel prices can have a dramatic impact on HMM's bottom line.

Geopolitical events and ongoing supply chain disruptions in 2024 have demonstrated the volatility of fuel prices, directly affecting HMM's profitability. For instance, disruptions in major oil-producing regions can quickly escalate shipping costs, squeezing margins.

Furthermore, the global maritime industry's transition to lower-carbon and alternative fuels, such as LNG and methanol, introduces a new layer of supplier power. The nascent nature of these fuel supply chains means they can be more expensive and less established, giving suppliers of these newer fuels considerable leverage over HMM.

Port and terminal operators hold significant sway, particularly where congestion is high, as they manage the essential infrastructure for cargo handling. This control allows them to influence turnaround times and costs for shipping companies.

Global port congestion remained a notable challenge throughout 2024, with projections indicating its persistence into 2025. For companies like HMM, this translates directly into higher operational expenses, driven by delays and various surcharges levied by these operators.

Supplier Power 4

The bargaining power of suppliers in the maritime industry, particularly for technology providers, is on the rise. As companies like HMM invest heavily in digitalization and automation to boost operational efficiency, their reliance on specialized technology suppliers for real-time tracking, AI platforms, and other smart solutions increases. This dependency grants these tech providers greater leverage.

HMM's strategic focus on enhancing operational efficiency through digital transformation means it's increasingly dependent on suppliers who can deliver cutting-edge solutions. This includes providers of advanced navigation systems, predictive maintenance software, and AI-powered logistics management tools. The demand for such technologies is projected to grow significantly, with the global maritime digitalization market expected to see substantial investment through 2025 and into the future.

- Increasing reliance on specialized tech: HMM's push for digitalization makes it more dependent on suppliers of advanced maritime technology.

- Growing market for maritime tech: Significant investments are anticipated in maritime digitization through 2025 and beyond, strengthening supplier positions.

- Supplier leverage: Providers of real-time tracking, AI platforms, and automation solutions gain power due to HMM's need for these capabilities.

Supplier Power 5

The bargaining power of suppliers is a significant factor for HMM, particularly for providers of specialized equipment like large cranes and container boxes. As HMM continues to expand its fleet and focus on operational efficiency, the demand for these critical components will likely increase. This puts considerable leverage in the hands of the limited number of specialized manufacturers capable of producing such equipment.

HMM's strategic plans, including a substantial investment in container boxes to match its growing fleet capacity, directly highlight this supplier power. For instance, in 2023, the global container shipping market saw fluctuating prices for new containers due to supply chain disruptions and demand shifts. Manufacturers of these specialized assets can therefore influence HMM's procurement costs and timelines, impacting the company's ability to scale its operations effectively.

- Specialized Equipment Dependency: HMM relies on a concentrated group of suppliers for essential assets like cranes and container boxes.

- Demand Influence on Costs: As HMM's fleet grows, its demand for these components can drive up prices from specialized manufacturers.

- Strategic Investments Highlight Need: HMM's planned investment in container boxes underscores the critical role suppliers play in fleet expansion.

- Market Volatility Impact: Fluctuations in the market for shipping equipment, as seen in 2023, can amplify supplier bargaining power.

The bargaining power of suppliers for HMM is substantial, particularly for specialized components and services. This power stems from the capital-intensive nature of shipbuilding, the specialized expertise required for eco-friendly vessels, and the extended lead times for new constructions, all of which concentrate influence among a limited number of capable providers.

Fuel suppliers also exert significant leverage, with fuel costs representing a major operational expense, often around 50% of total costs. Volatility in fuel prices, exacerbated by geopolitical events and supply chain disruptions in 2024, directly impacts HMM's profitability, while the industry's shift to alternative fuels like LNG and methanol further strengthens the hand of emerging fuel suppliers due to their less established supply chains.

Technology providers are increasingly influential as HMM invests in digitalization and automation. The growing demand for advanced maritime technology, including AI and real-time tracking, grants these specialized suppliers greater negotiating power, with significant market growth projected through 2025.

Suppliers of essential equipment like large cranes and container boxes also hold considerable sway. HMM's fleet expansion and focus on operational efficiency mean increased demand for these critical items, which are produced by a concentrated group of manufacturers, influencing procurement costs and timelines.

| Supplier Category | Key Factors Influencing Power | Impact on HMM |

|---|---|---|

| Shipbuilders | High capital, specialized skills, long lead times | Limited choice, potential for higher costs and longer delivery schedules |

| Fuel Suppliers | Fuel cost as % of operations, price volatility, alternative fuel transition | Direct impact on profitability, increased costs for new fuel types |

| Technology Providers | Digitalization trend, demand for AI/automation, specialized solutions | Increased reliance, potential for higher software/hardware costs |

| Equipment Manufacturers (Cranes, Containers) | Concentrated market, demand from fleet expansion | Influence on procurement costs and availability of essential assets |

What is included in the product

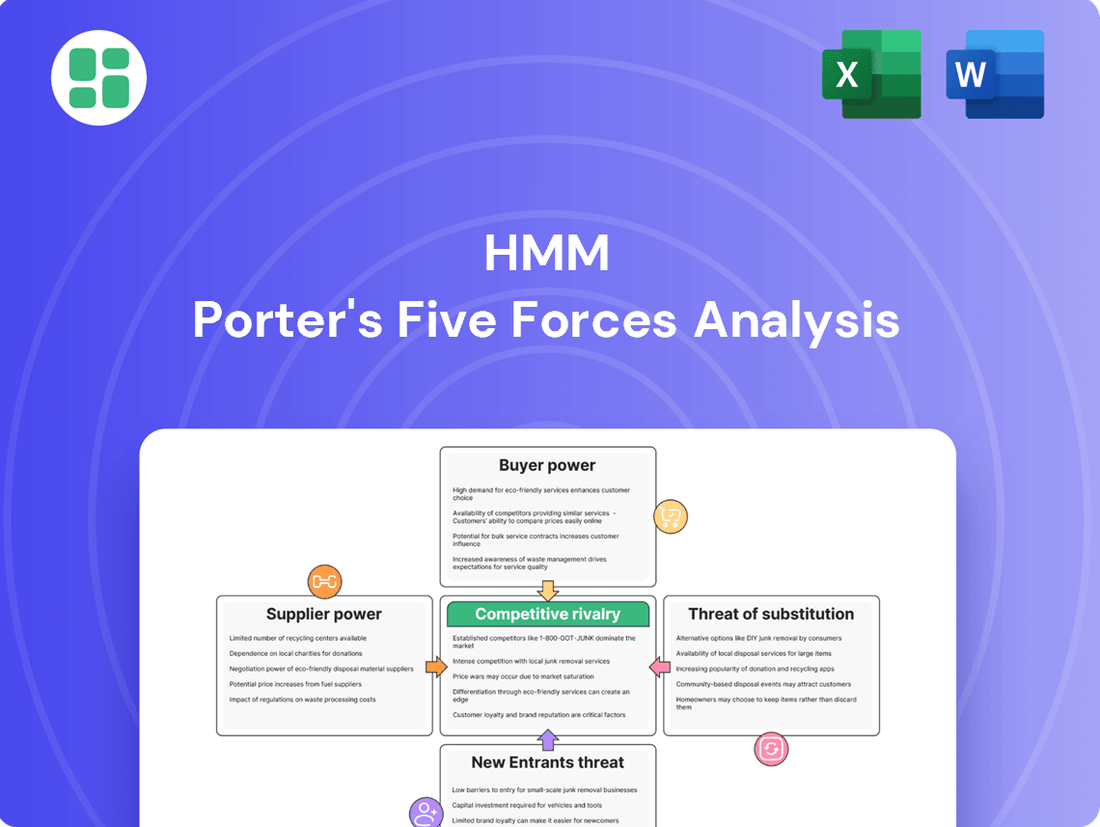

HMM's Porter's Five Forces analysis dissects the competitive intensity within the shipping industry, evaluating the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players to understand HMM's strategic positioning.

Instantly identify and address competitive threats with a structured framework, turning market uncertainty into strategic clarity.

Customers Bargaining Power

Large global shippers and freight forwarders wield significant bargaining power in the container shipping sector. This is primarily due to the sheer volume of cargo they consistently move, often leading them to demand competitive pricing and highly reliable service. Their leverage is amplified by the industry's ongoing concerns about overcapacity, which can make carriers more amenable to customer demands.

The ability of these major players to easily switch between shipping lines or to negotiate favorable long-term contracts directly translates into downward pressure on freight rates. For instance, in 2024, reports indicated that the largest global logistics companies were able to secure significantly lower per-container rates compared to smaller, less volume-driven shippers, reflecting their enhanced negotiation capabilities.

Customers in the container shipping industry, including HMM's clients, possess significant bargaining power due to the presence of numerous large global carriers. Competitors like MSC, Maersk, CMA CGM, and COSCO offer extensive networks, providing customers with ample choices and the ability to negotiate favorable rates and service agreements. This competitive landscape directly impacts HMM's pricing and service offerings.

The formation of strategic alliances, such as HMM's Premier Alliance, is a direct response to this customer bargaining power. These alliances aim to consolidate resources and create more robust, reliable, and cost-effective service networks. For instance, by leveraging combined capacity and expanded routes, HMM and its partners can present a more compelling value proposition to shippers, mitigating some of the pressure from highly price-sensitive customers.

Customers, particularly large shippers, wield significant bargaining power when they can easily switch between carriers or when their purchase volume represents a substantial portion of a carrier's business. In 2024, the ongoing focus on supply chain resilience and visibility has amplified this. Customers are actively seeking shipping partners that offer robust real-time tracking and can demonstrate a capacity to mitigate disruptions, such as those experienced due to geopolitical events like the Red Sea crisis.

This heightened demand for reliability and integrated logistics solutions naturally shifts leverage towards carriers that can consistently deliver on these expectations. For instance, major ocean carriers that invested in advanced tracking technology and diversified their routes to circumvent bottlenecks in 2023 and early 2024 found themselves in a stronger negotiating position with clients prioritizing dependable delivery over solely cost.

Bargaining Power 4

The bargaining power of customers in the maritime shipping industry is significantly shaped by freight rate volatility. Geopolitical events and vessel overcapacity are key drivers of this fluctuation. For instance, the Red Sea crisis in late 2023 and early 2024 led to increased shipping times and surcharges, temporarily strengthening the position of carriers. However, this dynamic can quickly reverse.

Looking ahead, the market anticipates a substantial influx of new vessel deliveries, particularly in 2025. Industry analysts projected that the global containership fleet capacity could grow by approximately 8% in 2024, with further expansion expected in 2025. This potential oversupply of shipping capacity is likely to tilt the scales back towards customers, or shippers, as supply begins to outpace demand.

Customers can strategically leverage these market shifts. During periods of high freight rates, shippers may face increased costs and reduced negotiation leverage. Conversely, when capacity expands and rates decline, customers gain more power to negotiate favorable terms, secure lower prices, and potentially demand higher service levels.

- Freight Rate Volatility: Fluctuations driven by geopolitical events and vessel supply/demand balances directly impact customer power.

- Impact of New Vessel Deliveries: Anticipated fleet expansion in 2025 could lead to overcapacity, enhancing shipper bargaining power.

- Strategic Customer Action: Customers can benefit by timing their shipping needs or contract negotiations during periods of increased capacity and lower rates.

- Market Data: Projections suggest an approximate 8% increase in containership fleet capacity in 2024, with continued growth into 2025, signaling a potential shift in market power.

Bargaining Power 5

The bargaining power of customers for HMM is influenced by evolving global trade dynamics. The increasing trend towards near-shoring and friend-shoring could significantly alter traditional long-haul trade routes. This shift may reduce customer dependence on ultra-large container vessels, a core offering of HMM.

HMM, as a global container liner service provider, faces potential challenges if customers increasingly opt for regional logistics solutions. For instance, a significant shift of manufacturing from Asia to Mexico or Eastern Europe could lead some of HMM's clients to seek carriers with more localized networks, thereby diminishing their reliance on major intercontinental shipping lines.

- Customer Dependence: Shifts in manufacturing locations, such as the move towards near-shoring, can reduce customer reliance on large, global carriers like HMM.

- Regional Logistics: Customers may find regional logistics providers more suitable for their altered supply chains, impacting demand for HMM's intercontinental services.

- Trade Lane Impact: Changes in trade lanes due to friend-shoring could offer customers alternative, potentially more cost-effective, shipping options.

Customers in the container shipping sector, including HMM's clients, possess considerable bargaining power. This stems from the availability of numerous large global carriers, such as MSC, Maersk, and CMA CGM, offering extensive networks and competitive pricing. The ability for customers to switch carriers or negotiate favorable long-term contracts directly pressures freight rates downwards.

The market anticipates a significant increase in vessel capacity, with projections indicating an approximate 8% growth in the global containership fleet in 2024 and further expansion into 2025. This potential oversupply is likely to further empower customers, giving them more leverage to negotiate better terms and prices.

Customer bargaining power is also influenced by supply chain shifts like near-shoring and friend-shoring. These trends can reduce reliance on traditional long-haul routes and large global carriers, potentially leading customers to seek more regional logistics solutions. For example, a shift in manufacturing could see clients favoring carriers with more localized networks, diminishing their dependence on intercontinental services.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Observation (2024-2025) |

|---|---|---|

| Carrier Competition | High | Numerous global carriers (MSC, Maersk, CMA CGM) offer extensive networks, increasing customer choice. |

| Fleet Capacity Growth | Increasing | Projected ~8% fleet capacity increase in 2024, with continued growth in 2025, suggesting potential oversupply. |

| Trade Route Shifts (Near-shoring) | Potentially Increasing | Manufacturing shifts may reduce reliance on intercontinental shipping, favoring regional solutions. |

| Customer Volume | High | Large shippers moving significant cargo volumes can negotiate lower per-container rates. |

Preview Before You Purchase

HMM Porter's Five Forces Analysis

This preview showcases the comprehensive HMM Porter's Five Forces Analysis you will receive immediately after purchase. The document displayed here is the exact, fully formatted report, providing an in-depth examination of competitive forces within HMM's industry. You are looking at the actual document, ensuring no surprises or placeholder content, and it will be ready for your immediate use upon completing your purchase.

Rivalry Among Competitors

Competitive rivalry in the global container shipping sector is intense, largely due to the industry's oligopolistic nature. A handful of dominant carriers, including MSC, Maersk, CMA CGM, COSCO, Hapag-Lloyd, and HMM, dictate much of the market's direction. This concentration often sparks aggressive price competition and puts downward pressure on freight rates.

HMM, as the eighth-largest liner globally according to Alphaliner data, actively participates in this competitive landscape. The company's strategies are shaped by the need to maintain market share and profitability amidst the pricing pressures exerted by its larger rivals. This dynamic environment necessitates constant adaptation and efficiency improvements.

The global container shipping industry is grappling with significant overcapacity, a situation poised to worsen in 2025 as numerous new vessels are scheduled for delivery. This influx of capacity means there are more ships than cargo to carry, which naturally drives down the prices for shipping services, known as freight rates.

This intense competition, fueled by excess ships, directly pressures companies like HMM. When freight rates fall, the revenue generated per voyage decreases, impacting profitability. For instance, the average spot freight rates on major East-West trade lanes saw considerable drops throughout 2023 and into early 2024, with some routes experiencing declines of over 50% compared to their 2022 peaks, illustrating the direct impact of overcapacity on pricing power.

The shipping industry is characterized by intense competition, with major players forming strategic alliances to enhance network efficiency and service portfolios. HMM's participation in the recently established Premier Alliance, alongside Ocean Network Express (ONE) and Yang Ming, effective February 2025, is a prime example. This collaboration is designed to ensure consistent and competitive service delivery on crucial East-West trade routes, a direct response to significant alliance realignments occurring across the global shipping landscape.

Competitive Rivalry 4

Geopolitical events and supply chain disruptions, like the Red Sea crisis and ongoing port congestion, inject significant volatility into the shipping industry. These disruptions can temporarily inflate freight rates, offering a short-term revenue boost for carriers. However, they also serve as a critical test of a carrier's operational agility, route management capabilities, and commitment to schedule reliability. This resilience directly impacts customer trust and, consequently, market share.

The ability to navigate these challenges effectively creates a distinct competitive advantage. For instance, carriers that can reroute efficiently and maintain consistent service levels during disruptions are likely to retain and attract customers. In 2024, the impact of these events on major shipping lines, such as Maersk and MSC, highlighted the importance of robust contingency planning and flexible fleet management. Reports from early 2024 indicated that while some carriers saw increased spot rates due to diversions, others focused on maintaining long-term customer relationships through dependable service, showcasing differing strategic responses to the same pressures.

- Increased Volatility: Geopolitical events and supply chain issues create unpredictable market conditions.

- Operational Resilience: Carriers are judged by their ability to adapt routes and maintain schedules amidst disruptions.

- Customer Perception: Reliability during crises directly influences customer loyalty and market share.

- Strategic Differentiation: Responses to disruptions can highlight a carrier's competitive strengths or weaknesses.

Competitive Rivalry 5

Competitive rivalry within the shipping industry is intensifying, pushing companies like HMM to differentiate beyond basic freight services. The focus is shifting towards value-added offerings such as superior service quality, comprehensive integrated logistics solutions, and a strong commitment to sustainability. This strategic pivot is crucial in a market where basic shipping capacity can often be seen as a commodity.

HMM is actively pursuing these differentiation strategies. The company is expanding its integrated logistics solutions, which aim to provide end-to-end supply chain management for its clients. Furthermore, HMM is making significant investments in eco-friendly vessels, a move that not only addresses growing environmental concerns but also positions the company favorably with a segment of the market increasingly prioritizing sustainability. Their ambition to achieve carbon neutrality by 2045 underscores this commitment.

- Service Quality: Enhancing customer experience and reliability to build loyalty.

- Integrated Logistics: Offering a broader suite of supply chain services beyond mere transportation.

- Sustainability Initiatives: Investing in greener technologies and operations to meet environmental regulations and market demand for eco-conscious partners.

- Fleet Modernization: HMM's investment in new, fuel-efficient vessels, such as the acquisition of 12 large LNG-powered container ships completed in 2021, exemplifies this strategy.

Competitive rivalry in the container shipping sector is fierce, driven by overcapacity and aggressive pricing. Companies like HMM must differentiate themselves through service quality and integrated logistics to maintain market share. The ongoing influx of new vessels, projected to exacerbate capacity issues in 2025, intensifies this pressure, forcing carriers to innovate and adapt constantly.

| Metric | HMM (2024 Estimate) | Industry Average (2024 Estimate) | Notes |

| Market Share (Global) | ~2.5% | Varies by carrier | Based on Alphaliner data, placing HMM as the 8th largest. |

| Freight Rate Trends (East-West) | Declining | Declining | Spot rates saw significant drops in 2023-early 2024. |

| Fleet Capacity Growth | Investing in new vessels | Significant growth expected | Overcapacity is a major competitive factor. |

SSubstitutes Threaten

Air freight stands as a significant substitute for ocean shipping, particularly for time-sensitive and high-value goods. Its primary advantage is speed, with air cargo offering considerably faster transit times. For instance, in 2024, air cargo can deliver goods across continents in days, whereas ocean shipping can take weeks.

While air freight is substantially more expensive than ocean shipping, its speed makes it a viable alternative when delivery urgency outweighs cost considerations. This is especially true when ocean shipping routes experience significant delays or disruptions, as was seen in various global supply chain issues throughout 2023 and into 2024, pushing some businesses towards air freight despite the higher price point.

Rail transport, especially for long-haul routes like the Asia-Europe land bridge, poses a significant threat of substitution to ocean shipping. It offers a compelling middle ground, balancing speed with cost-effectiveness for certain cargo movements.

For businesses needing faster transit than sea freight but finding air cargo too expensive, rail emerges as a viable alternative. In 2024, the growth of intermodal rail services continues to challenge traditional shipping lanes, particularly for time-sensitive goods.

Road transport can act as a substitute for sea freight, particularly for shorter distances or when integrated into multimodal logistics. For instance, in 2024, the increasing efficiency and cost-competitiveness of trucking for regional distribution in Europe might divert some cargo that would otherwise use short-sea shipping routes, impacting the volume for maritime carriers.

Threat of Substitutes 4

The growing trend of near-shoring and friend-shoring presents a significant threat to HMM's core business. Companies are increasingly relocating manufacturing closer to their primary markets, a shift that directly reduces the reliance on long-haul international container shipping. This strategic move towards more localized supply chains could diminish the overall demand for global ocean transportation services, which form the backbone of HMM's operations.

For instance, the World Trade Organization reported in 2024 that while global trade volume is projected to grow, the composition of trade is evolving. Services trade is expanding at a faster pace than goods trade, partly due to digitalization and the increasing prevalence of localized production models. This suggests a potential long-term structural change that could impact the volume of physical goods requiring ocean freight.

- Near-shoring and Friend-shoring: Companies are reconfiguring supply chains to reduce geopolitical risks and transportation costs by bringing production closer to home or to allied nations.

- Impact on Container Shipping: A more localized manufacturing base means fewer goods will need to traverse vast distances across oceans, directly impacting the volume of cargo handled by shipping lines like HMM.

- Shifting Trade Patterns: The rise of digital services and localized production could lead to a structural decline in the demand for traditional, long-distance goods transportation.

- HMM's Core Business Vulnerability: HMM's reliance on extensive global ocean routes makes it particularly susceptible to these shifts in manufacturing and trade dynamics.

Threat of Substitutes 5

The threat of substitutes for traditional shipping methods, particularly ocean freight, is currently low but shows potential for growth. While direct, large-scale substitutes are not yet prevalent, emerging technologies could alter the landscape.

Innovations in cargo transport, such as advanced drone technology for specialized, high-value, or time-sensitive cargo, represent a nascent but developing substitute. Similarly, advancements in highly efficient overland routes, potentially leveraging hyperloop or improved rail networks, could offer alternative solutions for certain types of goods. However, widespread adoption of these technologies for bulk cargo remains a distant prospect, with significant infrastructure and cost hurdles to overcome.

For instance, while drone delivery is expanding for last-mile logistics, its capacity for intercontinental freight is severely limited. In 2024, the global drone logistics market is projected to reach billions, but this primarily addresses smaller-scale, localized delivery needs rather than direct competition with container shipping for global trade. The capital investment required for widespread adoption of new, large-scale transport technologies means that traditional shipping is likely to remain dominant for the foreseeable future.

- Nascent Technologies: Advanced drone technology and hyper-efficient overland routes are emerging as potential future substitutes.

- Limited Current Impact: These technologies are currently constrained by capacity and infrastructure, posing a low threat to established shipping in 2024.

- Market Growth: The global drone logistics market's expansion in 2024 is focused on last-mile delivery, not large-scale freight substitution.

- High Capital Barriers: Significant investment is needed for new transport infrastructure, maintaining the current dominance of traditional shipping.

The threat of substitutes for ocean freight, while currently moderate, is influenced by evolving logistics and global trade patterns. Air freight offers speed for time-sensitive goods, with 2024 data showing its continued use despite higher costs.

Rail and road transport also serve as substitutes, especially for shorter distances or when integrated into multimodal solutions, impacting regional shipping volumes. The growing trend of near-shoring in 2024 further reduces reliance on long-haul container shipping, potentially diminishing demand for services like those offered by HMM.

Emerging technologies like advanced drones and hyper-efficient overland routes present a nascent threat, though their impact on bulk cargo remains limited in 2024 due to capacity and infrastructure constraints.

Companies are reconfiguring supply chains, leading to shifts in trade patterns that could structurally impact demand for traditional ocean freight.

| Substitute | Key Advantage | 2024 Relevance |

|---|---|---|

| Air Freight | Speed | Viable for time-sensitive, high-value goods; higher cost. |

| Rail Transport | Speed-Cost Balance | Growing as a middle ground for certain long-haul routes. |

| Road Transport | Flexibility, Short-Haul | Impacts regional distribution and short-sea shipping. |

| Near-shoring/Friend-shoring | Reduced Lead Times, Risk | Directly reduces demand for long-haul container shipping. |

| Emerging Tech (Drones, etc.) | Niche Speed | Limited capacity for bulk; significant infrastructure hurdles. |

Entrants Threaten

The threat of new entrants in the container shipping industry is significantly low due to the immense capital requirements. Building a fleet of ultra-large container vessels, securing port access, and establishing a global logistics network demands billions of dollars. For instance, HMM's own strategic plans include substantial investments in fleet modernization and infrastructure development, creating a formidable financial hurdle for any aspiring competitor.

The threat of new entrants in the container shipping industry, particularly for a major player like HMM, is generally considered moderate to low. Established carriers benefit significantly from economies of scale. For instance, HMM operates a substantial fleet, allowing for more efficient vessel utilization and lower per-unit operating costs. In 2024, the average vessel size in the global container fleet continued to grow, with many new builds exceeding 20,000 TEU capacity, a scale that is incredibly capital-intensive for newcomers to replicate.

New companies entering the market would face immense challenges in matching these cost advantages. Building or acquiring a fleet of comparable size requires billions of dollars in investment, a hurdle that deters most potential entrants. Furthermore, securing port slots, negotiating favorable bunker fuel contracts, and establishing a global network of agents and logistics partners are complex and costly endeavors that take years to develop, making it difficult to compete effectively on price against incumbents like HMM.

The threat of new entrants in the container shipping industry, particularly for a player like HMM, is significantly mitigated by the immense capital requirements and the necessity of establishing extensive global networks. Building a fleet capable of competing on major trade lanes demands billions of dollars in investment. For instance, a single large container ship can cost upwards of $200 million, and a new entrant would need dozens to be competitive.

HMM's strategic advantage is further bolstered by its participation in the Premier Alliance, which encompasses critical East-West trade routes. These established routes and the associated strategic alliances are incredibly difficult and time-consuming for newcomers to replicate. Access to key ports, favorable slot charters, and reciprocal agreements are built over years, creating substantial barriers to entry that deter potential competitors from quickly challenging established players.

Threat of New Entrants 4

The threat of new entrants in the maritime industry is significantly dampened by escalating regulatory hurdles and increasing environmental compliance costs. New regulations from the International Maritime Organization (IMO) and the European Union, like the EU Emissions Trading System (ETS) and FuelEU Maritime, impose stringent requirements on emissions and the adoption of greener fuels. These mandates translate into substantial upfront operational and investment expenses that any new player must absorb immediately.

These compliance costs create a formidable barrier. For instance, the cost of retrofitting vessels or investing in new, compliant technologies can run into millions of dollars per ship. This financial commitment, coupled with the ongoing expenses of navigating complex environmental reporting and carbon pricing mechanisms, makes it exceedingly difficult for newcomers to compete on a level playing field with established companies that have already made or are in the process of making these necessary investments.

- Regulatory Complexity: Navigating the evolving landscape of IMO and EU environmental regulations presents a steep learning curve and significant compliance overhead for new entrants.

- Capital Investment: The need for substantial capital to invest in greener technologies and comply with emissions standards, such as those mandated by FuelEU Maritime, acts as a major deterrent.

- Operational Costs: Increased operational expenses related to carbon pricing under the EU ETS and the procurement of alternative fuels create immediate cost disadvantages for new companies.

- Established Infrastructure: Existing players often benefit from established relationships with suppliers of compliant fuels and have already amortized initial investments in greener technologies, further widening the gap.

Threat of New Entrants 5

The threat of new entrants for HMM, a major South Korean container shipping company, is relatively low due to significant established barriers. HMM has cultivated strong brand recognition and deep customer relationships over many years in the global container liner services and integrated logistics sector.

These established connections and the company's reputation make it difficult for newcomers to gain traction. Furthermore, HMM's sophisticated and integrated logistics capabilities, honed through years of operation, represent a substantial hurdle for any potential competitor looking to enter the market.

For instance, the capital required to build a comparable fleet and establish a global network is immense. New entrants would also struggle to replicate HMM's existing market share and the trust it has built with its clientele, which is crucial in the high-stakes world of international shipping.

- High Capital Investment: Establishing a global shipping fleet and infrastructure requires billions of dollars, a significant deterrent for new players.

- Brand Loyalty and Customer Relationships: HMM's long-standing presence has fostered strong customer loyalty, making it hard for new entrants to attract business.

- Integrated Logistics Capabilities: HMM's comprehensive logistics solutions, from port to final delivery, are complex to replicate and offer a competitive advantage.

- Regulatory Hurdles and Compliance: Navigating international shipping regulations and compliance standards demands expertise and resources that new companies may lack.

The threat of new entrants in the container shipping industry, impacting companies like HMM, remains low due to substantial capital requirements and established networks. Building a competitive fleet and global logistics infrastructure demands billions, a barrier that deters most newcomers. For instance, the cost of a single ultra-large container vessel can exceed $200 million, and a new entrant would need dozens to compete effectively.

Furthermore, navigating complex regulatory environments, including evolving environmental standards from bodies like the IMO and EU, adds significant cost and expertise requirements. Compliance with measures like the EU Emissions Trading System (ETS) and FuelEU Maritime necessitates substantial investment in greener technologies and fuels, creating an immediate disadvantage for new players who haven't yet amortized these costs.

Established players like HMM benefit from existing economies of scale, strong customer relationships, and integrated logistics capabilities that are difficult and time-consuming to replicate. These factors, combined with the immense financial and regulatory hurdles, significantly limit the threat of new entrants in this capital-intensive sector.

| Barrier Type | Description | Example Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building a modern container fleet and global infrastructure costs billions. | A new entrant needs over $2 billion for a fleet of 10 large vessels. |

| Economies of Scale | Larger carriers have lower per-unit operating costs. | HMM's large fleet allows for more efficient vessel utilization and fuel purchasing. |

| Regulatory Compliance | Meeting stringent environmental regulations (e.g., EU ETS, FuelEU Maritime) requires significant investment. | New entrants face immediate costs for compliant technologies and fuels. |

| Brand & Relationships | Established companies have strong customer loyalty and market presence. | Newcomers struggle to attract business from clients accustomed to HMM's services. |

Porter's Five Forces Analysis Data Sources

Our HMM Porter's Five Forces analysis is built upon a robust foundation of data, including detailed company financial statements, market research reports from leading firms, and insights from industry expert interviews. This multi-faceted approach ensures a comprehensive understanding of competitive dynamics.