HITT Contracting SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HITT Contracting Bundle

HITT Contracting's impressive track record and strong industry reputation are clear strengths, but understanding their potential vulnerabilities and the competitive landscape is crucial for informed decisions.

Want to delve deeper into HITT's strategic advantages, potential threats, and untapped opportunities? Purchase the complete SWOT analysis to unlock a professionally crafted report, packed with actionable insights and financial context, perfect for investors and industry strategists.

Strengths

HITT Contracting boasts a formidable national presence, recognized as the #10 Top General Contractor in the U.S. by Engineering News-Record (ENR) in 2025. This esteemed ranking is a testament to their substantial $8.7 billion in construction revenue generated in 2024.

Operating across nearly every state, HITT's extensive national footprint enables them to engage in a wide array of projects, significantly expanding their market reach and diversifying their revenue streams. This broad operational capacity also serves to mitigate risks tied to dependence on any single geographic market.

HITT Contracting demonstrates significant strength through its diverse sector expertise and comprehensive service offerings. The company adeptly handles everything from base building and interior fit-outs to complex renovation projects across various industries. This broad reach, including a top ranking (#1) in Telecommunications/Data Center Contracting as of 2024, allows HITT to navigate economic fluctuations by not relying on a single market segment.

HITT Contracting's dedication to cultivating enduring client relationships and a strong reputation for quality is a significant strength. Their high repeat client rate, often exceeding industry averages, demonstrates a deep-seated trust built on consistent delivery of exceptional building experiences.

Commitment to Innovation and Sustainability

HITT Contracting demonstrates a strong commitment to innovation and sustainability, actively integrating these principles into their operations and project execution. This forward-thinking approach is exemplified by their new net-zero-ready headquarters, which broke ground in January 2025 and will feature advanced elements like a research lab, solar canopy, wind turbines, and 3D printing capabilities. Their pursuit of LEED Platinum certification and carbon neutrality underscores a proactive strategy to meet the increasing market demand for environmentally responsible construction.

Robust Workforce and Leadership Development

HITT Contracting boasts a significant strength in its robust workforce and leadership development, employing over 1,800 dedicated team members across the nation. This extensive team is a key asset, especially considering industry-wide labor challenges. The company's consistent recognition in various 'Best Places to Work' lists underscores its success in attracting and retaining talent.

The company's strategic approach to succession planning and the consistent promotion of internal leaders from within its ranks ensures a stable and experienced management structure. This focus on nurturing talent from the ground up is a critical differentiator, contributing to operational continuity and experienced decision-making.

- Nationwide Team: Over 1,800 employees contribute to HITT's operational capacity.

- Talent Recognition: Multiple 'Best Places to Work' accolades highlight a strong employee value proposition.

- Leadership Pipeline: Strategic succession planning and organic promotions foster experienced leadership.

HITT Contracting's extensive national reach, evidenced by its #10 ranking among U.S. General Contractors with $8.7 billion in 2024 revenue, allows for broad market engagement and risk diversification.

The company's diverse sector expertise, particularly its #1 position in Telecommunications/Data Center Contracting in 2024, provides resilience against market downturns by reducing reliance on any single industry.

HITT's strong client relationships, reflected in a high repeat client rate, underscore a reputation for quality and consistent project delivery, fostering long-term partnerships.

A commitment to innovation and sustainability is a key strength, highlighted by their net-zero-ready headquarters project initiated in January 2025, incorporating advanced green technologies and aiming for LEED Platinum certification.

HITT's robust workforce of over 1,800 employees, coupled with multiple 'Best Places to Work' recognitions and a strong internal leadership pipeline, provides a stable and skilled operational foundation.

| Metric | 2024 Data | 2025 Projection/Status |

|---|---|---|

| ENR Top General Contractor Ranking | #10 | #10 (as of 2025) |

| 2024 Construction Revenue | $8.7 billion | N/A |

| Telecommunications/Data Center Contracting Ranking | #1 (as of 2024) | N/A |

| Employee Count | Over 1,800 | N/A |

| Headquarters Project Status | Broke ground January 2025 | Under construction |

What is included in the product

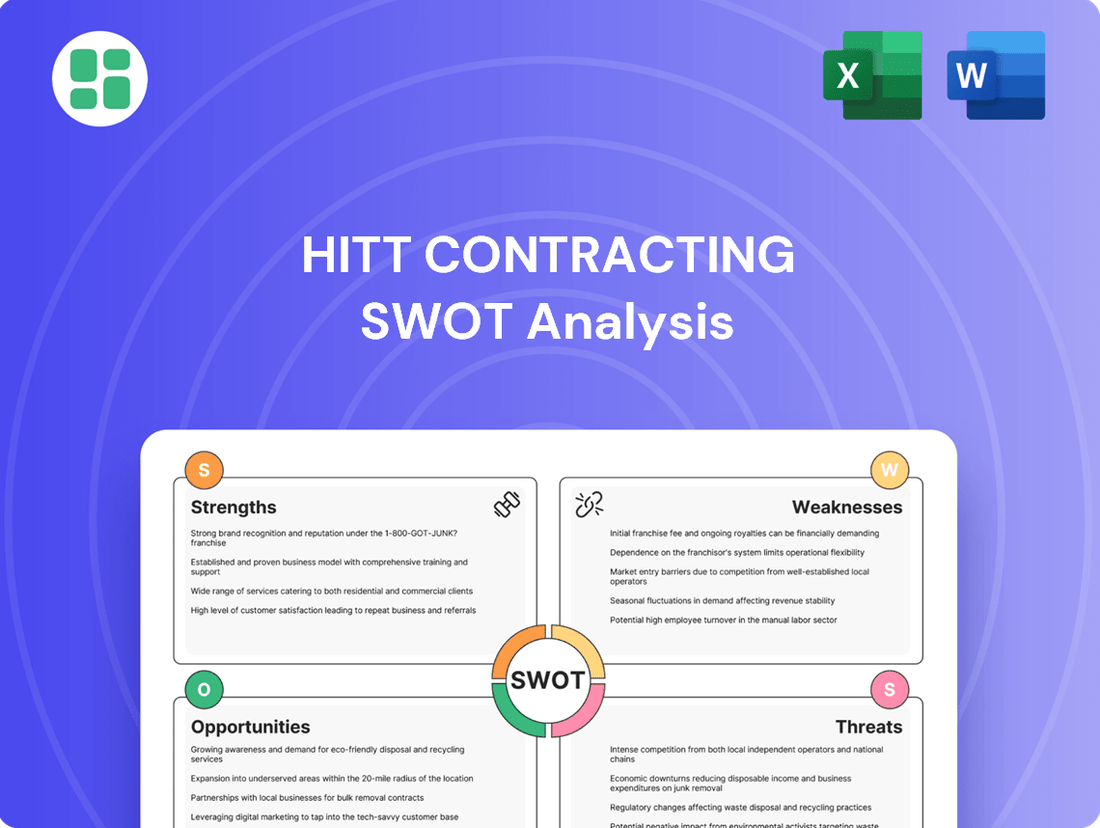

Delivers a strategic overview of HITT Contracting’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats to inform strategic decision-making.

Offers a clear, actionable SWOT framework to identify and address HITT Contracting's strategic challenges and opportunities.

Weaknesses

While HITT Contracting operates across various sectors, a significant slowdown in key areas such as commercial workplaces, technology, or hospitality could directly affect project pipelines and overall revenue. The commercial construction sector is projected for more moderate growth in 2025, with specific segments like office and retail experiencing headwinds.

A sustained economic contraction or a reduction in corporate investment in new construction and interior renovations presents a risk of fewer large-scale project opportunities for HITT. For instance, if corporate spending on office fit-outs declines by an estimated 5-7% in 2025 due to economic uncertainty, HITT's backlog in this segment could be impacted.

HITT Contracting, like many general contractors, faces significant risks due to its reliance on subcontractors for specialized work. In 2024, the construction industry saw a notable increase in subcontractor insolvencies, with some reports indicating a rise of over 15% compared to the previous year, directly impacting project timelines and budgets for prime contractors.

The financial health and operational capabilities of these third-party providers are critical; any failure on their part, such as bankruptcy or simply poor execution, can directly translate into project delays, increased costs, and potential legal entanglements for HITT. This dependence necessitates rigorous due diligence and ongoing monitoring.

Maintaining consistent quality and ensuring the financial stability of a broad subcontractor base across a national footprint presents a considerable operational challenge, requiring substantial resources for vetting and oversight to mitigate these inherent weaknesses.

HITT Contracting, like many in the commercial construction sector, faces significant headwinds from escalating material and labor expenses. Throughout 2024 and into early 2025, the industry has seen continued volatility in prices for essential inputs such as steel, lumber, and concrete. These inflationary pressures directly impact project profitability, necessitating robust cost management and accurate bidding to avoid margin erosion, especially on fixed-price contracts.

The persistent rise in wages for skilled construction labor further compounds these cost challenges. If these input costs aren't effectively mitigated through smart procurement and operational efficiencies, it can diminish the financial appeal of new construction projects for clients. This potential slowdown in client investment could create a more competitive and less predictable market for companies like HITT.

Challenges in Workforce Recruitment and Retention

Despite HITT Contracting's efforts to foster a positive workplace, the construction sector is grappling with a significant and ongoing labor deficit. Projections indicate a need for hundreds of thousands more skilled workers by 2025, driven by an aging demographic and a shortfall in new entrants to the trades.

This industry-wide scarcity poses a direct challenge for HITT, potentially hindering its ability to secure qualified personnel for its diverse projects. The competition for talent could escalate, impacting project timelines and driving up labor expenses as the company strives to attract and keep its workforce.

- The U.S. construction industry requires an estimated 546,000 additional workers in 2023 alone to meet demand, according to Associated Builders and Contractors (ABC).

- The average age of a skilled tradesperson in the U.S. is 55, highlighting the impending retirement wave.

- Labor costs in construction saw an increase of 5.1% year-over-year as of Q4 2023, according to the Bureau of Labor Statistics.

Operational Complexities of National Scale Projects

HITT Contracting faces significant operational hurdles managing projects nationwide. Navigating diverse state-specific regulations, varying permitting requirements, and distinct regional labor markets across numerous states presents a complex logistical challenge. This broad geographic footprint means coordinating consistent quality, safety protocols, and project schedules across all operations requires robust systems and constant oversight.

The sheer scale of national operations exposes HITT to a wider array of economic fluctuations and localized competitive pressures. For instance, a downturn in a specific regional housing market or increased competition from local contractors in a particular state could impact project pipelines and profitability differently than in other areas. In 2024, the construction industry experienced varying regional growth rates, with some areas seeing robust activity while others faced slowdowns, directly affecting large national players.

- Regulatory Variance: HITT must comply with over 50 different sets of state and local building codes and permitting processes.

- Labor Market Dynamics: Managing a national workforce requires adapting to diverse wage scales, skill availability, and union regulations across different regions.

- Economic Sensitivity: Performance can be uneven, with strong growth in some markets offset by weaker conditions in others, impacting overall company performance metrics.

HITT Contracting's reliance on subcontractors creates a significant weakness, as the financial stability and operational execution of these third parties directly impact project timelines and budgets. The construction industry has seen an increase in subcontractor insolvencies, with reports indicating a rise of over 15% in 2024, directly affecting prime contractors like HITT. Maintaining consistent quality and financial oversight across a broad national subcontractor base demands substantial resources and rigorous vetting processes to mitigate these inherent risks.

Escalating material and labor costs present another substantial challenge. Throughout 2024 and into early 2025, the construction sector has experienced continued price volatility for key inputs like steel and lumber, alongside a persistent rise in skilled labor wages, with average construction labor costs increasing by 5.1% year-over-year as of Q4 2023. These inflationary pressures directly impact project profitability, especially on fixed-price contracts, necessitating robust cost management and accurate bidding to avoid margin erosion.

The construction industry faces a significant and ongoing labor deficit, with projections indicating a need for hundreds of thousands more skilled workers by 2025 due to an aging workforce and a shortfall in new entrants. This scarcity can hinder HITT's ability to secure qualified personnel, potentially impacting project timelines and driving up labor expenses as competition for talent escalates.

Managing nationwide operations introduces considerable complexity, requiring HITT to navigate diverse state-specific regulations, varying permitting requirements, and distinct regional labor markets. This broad geographic footprint necessitates robust systems and constant oversight to coordinate consistent quality, safety protocols, and project schedules across all operations, while also exposing the company to uneven economic fluctuations and localized competitive pressures.

| Weakness | Impact | Supporting Data (2024/2025 Projections/Trends) |

|---|---|---|

| Subcontractor Dependence | Project delays, budget overruns, quality issues | 15% increase in subcontractor insolvencies in 2024 |

| Rising Material & Labor Costs | Reduced profit margins, potential project slowdowns | 5.1% YoY increase in construction labor costs (Q4 2023); continued price volatility in steel/lumber |

| Skilled Labor Shortage | Project delays, increased labor expenses, difficulty staffing projects | Need for hundreds of thousands of skilled workers by 2025 |

| National Operational Complexity | Logistical challenges, inconsistent quality risk, uneven market performance | Navigating 50+ state/local building codes; varying regional economic growth rates |

What You See Is What You Get

HITT Contracting SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive document outlines HITT Contracting's Strengths, Weaknesses, Opportunities, and Threats, providing actionable insights for strategic planning. You'll receive the complete, professionally formatted analysis ready for immediate use.

Opportunities

The construction industry is seeing a significant boom in data center and healthcare projects, a trend expected to continue strongly into 2025. This surge is fueled by the ever-increasing demand for digital infrastructure and advanced medical facilities.

HITT Contracting is particularly well-positioned to benefit from this growth. The company holds the top spot in telecommunications and data center contracting, demonstrating deep expertise. Furthermore, their recent acquisition of a healthcare construction firm significantly bolsters their capabilities in this vital sector.

By leveraging their established track record and expanding their specialized services in these high-demand areas, HITT can unlock substantial revenue opportunities. Their strategic focus on these growth segments allows them to capture a larger share of the projected 2025 commercial construction market.

The commercial construction sector is rapidly embracing technologies like AI, VDC, and prefabrication. HITT's dedicated research lab and use of tools such as HyperWall and 3D printing showcase a forward-thinking approach to innovation.

By further integrating and developing these advanced technologies, HITT can unlock significant gains in operational efficiency and cost reduction. This strategic adoption also promises to enhance site safety and pave the way for novel service expansions, solidifying its market position.

The construction industry is seeing a significant surge in demand for sustainable practices and materials, driven by both consumer preference and increasing government regulations. This shift towards green building and net-zero energy projects presents a substantial opportunity for companies like HITT Contracting.

HITT's proactive stance, including its commitment to carbon neutrality by 2023 and its LEED Platinum and net-zero target for its new headquarters, positions it favorably to capitalize on this growing market. By showcasing its expertise in sustainable construction, HITT can attract clients who prioritize environmental responsibility, thereby gaining a competitive edge.

Strategic Acquisitions and Partnerships

HITT Contracting's acquisition of Central Consulting & Contracting in March 2025 exemplifies a potent strategy for growth, bolstering its capabilities in the healthcare sector and expanding its footprint into the New York tri-state area. This move underscores the value of acquiring specialized expertise and market access.

Further strategic acquisitions and partnerships present a significant opportunity for HITT to accelerate market entry, integrate niche skill sets, and broaden its service portfolio. For instance, acquiring a firm with established sustainable building practices could position HITT favorably in a market increasingly prioritizing green construction.

- Market Expansion: Target firms in underrepresented geographic regions to broaden HITT's national presence.

- Service Diversification: Acquire companies with expertise in emerging construction technologies or specialized sectors like data centers or advanced manufacturing.

- Talent Acquisition: Partner with or acquire firms known for their skilled workforce and innovative project management approaches.

- Synergistic Growth: Seek collaborations that offer complementary services, enabling bundled offerings and enhanced client value.

Infrastructure and Public Sector Investment

Government investments, particularly through initiatives like the Infrastructure Investment and Jobs Act (IIJA), are projected to sustain robust growth in nonresidential infrastructure. This includes significant opportunities in transportation networks, manufacturing facilities, and utility upgrades. For example, the IIJA allocated $1.2 trillion, with $550 billion in new federal spending, aiming to revitalize American infrastructure through 2026.

The increasing volume of public sector bids presents a stable and predictable pipeline of work. HITT Contracting's established national footprint and proven track record with complex, large-scale projects position it favorably to secure these publicly funded contracts. These projects often come with extended timelines, offering considerable long-term stability and revenue predictability.

- Increased government spending on infrastructure: The IIJA is a key driver, with substantial funds earmarked for transportation and utility projects through 2026.

- Growing public sector project pipeline: A rising number of bids from government entities offers a consistent source of potential work.

- HITT's strategic advantage: The company's national presence and expertise in large-scale construction align well with the demands of public infrastructure projects.

HITT Contracting is poised to capitalize on the surging demand for data center and healthcare construction, sectors projected for continued strong growth through 2025. Their leading position in telecommunications contracting and recent healthcare firm acquisition provide a solid foundation for capturing significant market share.

The company's commitment to technological advancement, evidenced by its research lab and adoption of tools like HyperWall, offers opportunities for enhanced efficiency and cost savings. This focus on innovation also opens doors for new service offerings, further solidifying their competitive edge.

HITT's proactive approach to sustainability, including carbon neutrality goals and LEED certifications, aligns with increasing market preference and regulatory shifts toward green building. This positions them to attract environmentally conscious clients and secure a greater share of sustainable projects.

Strategic acquisitions, such as the March 2025 purchase of Central Consulting & Contracting, are key to expanding HITT's healthcare capabilities and geographical reach. Further targeted acquisitions can accelerate market entry and integrate specialized expertise, driving synergistic growth.

Government infrastructure spending, bolstered by initiatives like the IIJA, presents a stable and predictable revenue stream. HITT's national presence and experience with large-scale projects make them well-suited to secure these publicly funded contracts, ensuring long-term project pipelines.

| Opportunity Area | Key Drivers | HITT's Advantage | Projected Impact (2024-2025) |

|---|---|---|---|

| Data Center & Healthcare Construction | Digital infrastructure demand, advanced medical facilities | Top telecommunications contractor, healthcare acquisition | Significant revenue growth potential |

| Technological Integration | AI, VDC, prefabrication adoption | Research lab, HyperWall, 3D printing | Improved efficiency, cost reduction, new services |

| Sustainable Building | Consumer preference, government regulations | Carbon neutrality commitment, LEED/net-zero focus | Competitive edge, increased client acquisition |

| Strategic Acquisitions | Market expansion, niche skill integration | Acquisition of Central Consulting & Contracting | Accelerated growth, broadened service portfolio |

| Government Infrastructure Spending | IIJA funding, infrastructure revitalization | National footprint, large-scale project experience | Stable, predictable revenue pipeline |

Threats

While the commercial construction sector anticipates a positive trajectory in 2025, a noticeable deceleration in growth is projected, alongside persistent economic uncertainties. This environment presents a significant threat to HITT Contracting, as a slowdown could directly impact project pipelines and revenue streams.

Interest rate volatility poses a substantial risk, with potential increases in borrowing costs for clients. For instance, if benchmark rates continue their upward trend, as seen with the Federal Reserve's stance on inflation in late 2024, clients may postpone or entirely cancel planned commercial developments, thereby dampening demand for HITT's services.

A severe economic downturn could further exacerbate these challenges by curtailing investment in commercial properties. Such a scenario, potentially triggered by global economic headwinds or domestic policy shifts, would inevitably reduce the overall market size and HITT Contracting's opportunities for securing new contracts.

The commercial construction sector is inherently competitive, with numerous companies actively pursuing project opportunities. As market growth is projected to moderate in 2025, this competitive landscape is expected to intensify, potentially driving down prices and impacting contractor profit margins.

HITT Contracting, like its peers, faces the risk of increased pricing pressures. This could stem from new market entrants or established competitors adopting more aggressive pricing tactics, which may challenge HITT's existing market share and overall profitability.

Ongoing geopolitical tensions and extreme weather events continue to create significant supply chain challenges, impacting the availability and cost of essential construction materials. These disruptions directly affect project timelines and budgets, posing a threat to HITT Contracting's operational efficiency and profitability.

For instance, the average price of lumber, a critical component in many construction projects, saw significant fluctuations in 2024, with some reports indicating increases of over 15% in certain periods compared to the previous year due to supply constraints. Similarly, steel prices have remained volatile, influenced by global demand and production issues, potentially increasing HITT's material acquisition costs.

Regulatory Changes and Increased Scrutiny

HITT Contracting must contend with a dynamic regulatory environment. Evolving environmental standards, updated building codes, and heightened safety compliance requirements present ongoing challenges. For a national firm, managing diverse state and local regulations adds significant complexity and expense.

Non-compliance carries substantial risks, including hefty fines, project stoppages, and damage to HITT's reputation, especially when operating in sectors with stringent oversight like healthcare. For instance, the Environmental Protection Agency (EPA) continues to refine regulations impacting construction materials and waste disposal, with new guidelines expected to be fully implemented by late 2024, potentially increasing material costs.

- Increased Compliance Costs: Adapting to new environmental and safety regulations can add an estimated 3-5% to project budgets.

- Potential for Fines: Violations of building codes or safety standards can result in penalties averaging tens of thousands of dollars per infraction.

- Reputational Risk: Public perception of safety and environmental responsibility is crucial, with negative incidents potentially impacting future contract bids.

- Project Delays: Regulatory hurdles or failed inspections can lead to significant project timeline extensions, impacting profitability.

Talent Shortages and Rising Labor Costs

The construction industry continues to grapple with a significant skilled labor shortage, a trend that is expected to persist and potentially worsen. This scarcity is largely due to an aging workforce retiring and a lack of new entrants filling skilled trade roles. For HITT Contracting, this translates directly into increased labor costs as competition for qualified workers intensifies.

These rising labor expenses can directly impact HITT's profitability and project timelines. For instance, the U.S. Bureau of Labor Statistics projected in 2023 that employment in construction would grow 4.9% by 2032, adding about 247,600 jobs, but many of these roles require specialized skills that are in short supply. This means HITT may face challenges securing enough skilled personnel, potentially leading to project delays and increased operational expenditures.

- Persistent Skilled Labor Gap: An aging workforce and insufficient new talent entering skilled trades create ongoing hiring challenges.

- Increased Labor Costs: Competition for scarce skilled labor drives up wages and benefits, impacting project budgets.

- Project Delays: Inability to secure adequate skilled labor can lead to slower project completion times.

- Impact on Profitability: Higher labor expenses and potential project delays can squeeze profit margins for HITT Contracting.

The construction sector faces headwinds from moderating growth in 2025 and ongoing economic uncertainty, directly impacting HITT Contracting's project pipeline and revenue. Interest rate volatility, as indicated by the Federal Reserve's stance on inflation in late 2024, could increase client borrowing costs, leading to project postponements or cancellations. A severe economic downturn would further contract the market, reducing opportunities for new contracts.

Intensified competition in a moderating market is a significant threat, potentially driving down prices and squeezing profit margins for HITT Contracting. Geopolitical tensions and extreme weather events continue to disrupt supply chains, affecting material availability and costs. For example, lumber prices saw increases of over 15% in certain 2024 periods due to supply constraints, and steel prices remain volatile, impacting acquisition costs.

Navigating a dynamic regulatory environment, including evolving environmental standards and building codes, presents ongoing challenges. Non-compliance risks hefty fines, project stoppages, and reputational damage, especially with new EPA guidelines impacting construction materials expected by late 2024. The persistent skilled labor shortage, with an aging workforce and few new entrants, drives up labor costs and can cause project delays.

| Threat Category | Specific Risk | Potential Impact on HITT Contracting | Relevant Data/Trend (2024-2025) |

|---|---|---|---|

| Economic Slowdown | Moderating market growth, economic uncertainty | Reduced project pipeline, lower revenue | Projected deceleration in commercial construction growth for 2025 |

| Financial Market Volatility | Rising interest rates | Client project postponement/cancellation, increased borrowing costs | Federal Reserve's continued focus on inflation control into late 2024 |

| Competitive Landscape | Intensified competition, pricing pressure | Reduced profit margins, potential loss of market share | Expected increase in competitive bidding as market growth moderates |

| Supply Chain Disruptions | Material availability and cost fluctuations | Project delays, increased operational costs | Lumber price increases of over 15% in parts of 2024; volatile steel prices |

| Regulatory Environment | Evolving environmental and safety standards, code updates | Increased compliance costs, potential fines, project delays | New EPA guidelines impacting materials expected by late 2024; potential 3-5% budget increase for compliance |

| Labor Market | Skilled labor shortage, rising wages | Increased labor costs, project delays, impact on profitability | U.S. Bureau of Labor Statistics projection: 4.9% job growth by 2032, but skills gap persists |

SWOT Analysis Data Sources

This HITT Contracting SWOT analysis is built upon a robust foundation of data, including their most recent financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded view of HITT's operational and market positioning.