HITT Contracting Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HITT Contracting Bundle

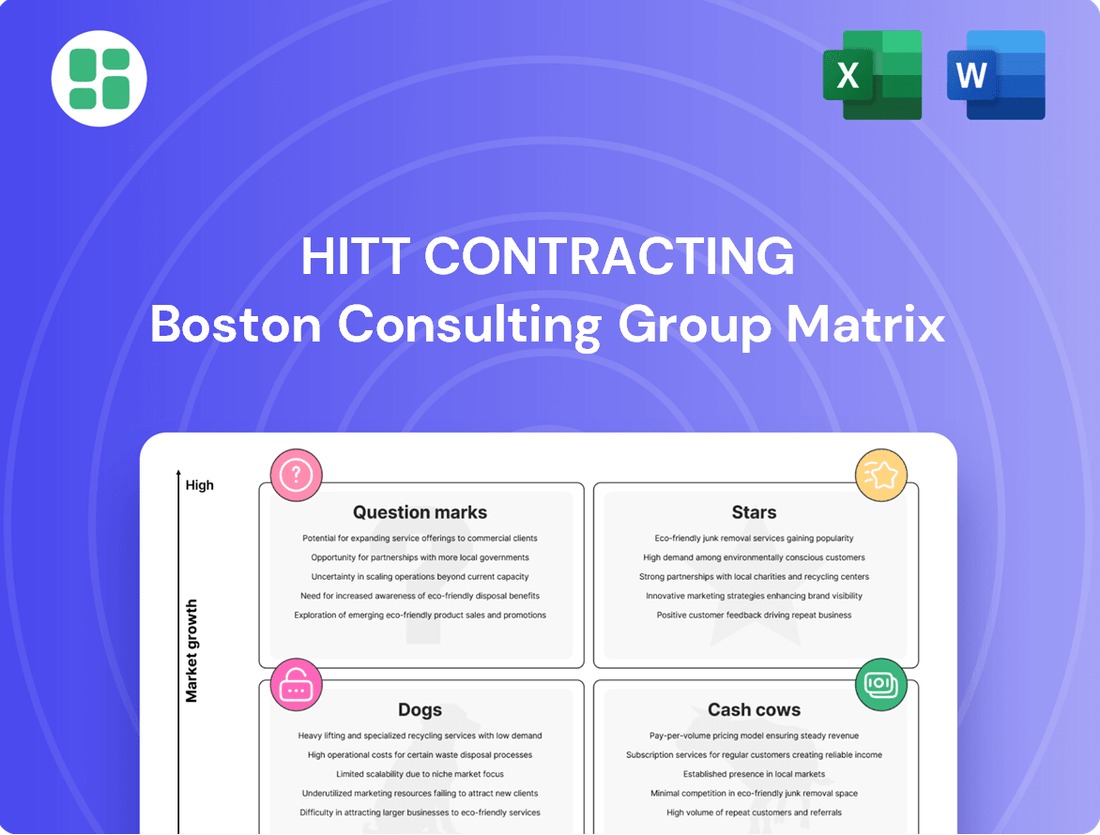

Curious about HITT Contracting's strategic product positioning? This glimpse into their BCG Matrix reveals how their offerings stack up in the market. To truly unlock actionable insights and understand which ventures are poised for growth, which are steady earners, and which might need a second look, you need the full picture.

Dive deeper into HITT Contracting's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

HITT Contracting stands out as a premier force in mission-critical and data center construction, securing the top spot as the #1 Telecommunications / Data Center Contractor on ENR's 2025 rankings. This achievement underscores their significant market presence in a sector fueled by the ever-growing global need for enhanced data storage and processing capabilities.

The mission-critical and data center construction market is a high-growth area, with demand projected to continue its upward trajectory. HITT's specialized focus and extensive experience in executing complex, large-scale data center projects have positioned them as a leader, capturing a substantial market share in this dynamic and expanding field.

The life sciences sector is experiencing robust growth, driven by ongoing innovation and a substantial need for specialized research and development facilities. This expansion is reflected in market projections, with the global life sciences construction market expected to reach over $200 billion by 2028, showcasing a significant opportunity.

HITT Contracting has proactively cultivated a strong position within this dynamic market, boasting senior leadership with deep expertise in managing complex life science projects. Their commitment to understanding the unique demands of these environments is a key differentiator.

HITT’s demonstrated capability to successfully deliver intricate, highly regulated facilities, such as advanced laboratories and biopharmaceutical manufacturing plants, solidifies their significant market share. This expertise is crucial in a sector where precision and compliance are paramount, ensuring they capture a substantial portion of this expanding construction segment.

As technology companies continue their rapid expansion, the demand for advanced campus build-outs that seamlessly blend office, research and development, and specialized facilities is soaring. HITT Contracting's proven track record in large-scale commercial construction, coupled with their client-centric approach focused on fostering growth, positions them squarely within this high-demand, high-growth sector.

HITT's capacity to execute complex, forward-thinking designs for leading technology firms underscores their dominance in this market. For instance, in 2024, the technology sector continued to be a major driver of commercial real estate development, with significant investments in new and expanded campuses to accommodate evolving work environments and innovation hubs.

Sustainable & Net-Zero Construction

The demand for sustainable and net-zero buildings is surging, driven by stricter environmental mandates and corporate commitments to Environmental, Social, and Governance (ESG) principles. This trend is creating a lucrative, high-growth market segment. For instance, the global green building market was valued at approximately $310.7 billion in 2023 and is projected to reach $776.1 billion by 2030, growing at a compound annual growth rate (CAGR) of 14.1% during this period.

HITT Contracting is strategically positioned to capitalize on this expansion. Their dedication to sustainability is evident in their net-zero-ready headquarters and their dedicated R&D lab focused on advancing green building techniques. This forward-thinking strategy enables HITT to secure a significant portion of projects from clients prioritizing environmental responsibility.

- Market Growth: The global green building market is experiencing robust growth, with projections indicating a significant increase in value by 2030.

- Driving Factors: Environmental regulations and corporate ESG goals are primary catalysts for the expansion of sustainable construction.

- HITT's Position: HITT's investment in net-zero-ready infrastructure and green building R&D places them as a frontrunner in this expanding sector.

- Competitive Advantage: This proactive stance allows HITT to effectively target and serve the growing demand for eco-conscious construction projects.

Healthcare Construction (Strategic Acquisitions)

HITT Contracting's strategic acquisition of Central Consulting & Contracting significantly bolsters its presence in healthcare construction. This move, particularly impactful in the New York metropolitan area, enhances HITT's market share and specialized expertise in a rapidly expanding sector. Central's established client base and HITT's extensive resources create a powerful synergy for tackling complex medical facility projects.

The healthcare construction market is experiencing robust growth, driven by an aging population and advancements in medical technology. For instance, the U.S. healthcare construction market was valued at approximately $50 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 4.5% through 2030. This acquisition positions HITT to capitalize on this trend.

- Enhanced Market Share: The integration of Central Consulting & Contracting immediately expands HITT's footprint in the lucrative healthcare sector.

- Expanded Expertise: HITT gains specialized knowledge and a proven track record in complex medical facility development.

- Synergistic Growth: Combining HITT's national capabilities with Central's regional strength allows for efficient scaling and client service.

- Addressing Demand: The acquisition directly addresses the increasing demand for state-of-the-art healthcare infrastructure.

HITT Contracting's leadership in data centers, life sciences, technology, green buildings, and healthcare positions them as Stars in the BCG Matrix. These sectors represent high-growth markets where HITT demonstrates strong competitive advantages through specialization, innovation, and strategic acquisitions.

Their #1 ranking in Telecommunications/Data Centers by ENR in 2025, coupled with significant investments in green building R&D and the strategic acquisition in healthcare, highlights their dominance. These areas are characterized by substantial market growth and HITT's ability to capture significant market share, indicating strong future potential and current success.

The company's proactive approach in these segments, from advanced lab construction to net-zero facilities, showcases their ability to meet evolving industry demands. This strategic focus on high-growth, high-potential areas solidifies HITT's status as Stars, poised for continued expansion and market leadership.

HITT's expertise in complex, regulated environments like life sciences and healthcare, alongside their capacity for large-scale tech campus build-outs, further reinforces their Star status. These are sectors with ongoing demand, driven by demographic shifts and technological advancements, where HITT has clearly established a leading position.

| Sector | HITT's Position | Market Growth Driver | Key HITT Strength | 2024 Data Point/Projection |

|---|---|---|---|---|

| Data Centers | Star | Increased data demand | #1 Contractor (ENR 2025) | Continued high investment in data infrastructure |

| Life Sciences | Star | Innovation in R&D | Expertise in complex facilities | Global market projected over $200B by 2028 |

| Technology | Star | Corporate expansion | Large-scale campus execution | Tech sector driving significant commercial development |

| Green Buildings | Star | ESG mandates | Net-zero R&D, sustainable practices | Global green building market valued ~$310.7B in 2023 |

| Healthcare | Star | Aging population, tech advancements | Acquisition of Central Consulting & Contracting | U.S. healthcare construction market ~$50B in 2023 |

What is included in the product

Highlights which units to invest in, hold, or divest for HITT Contracting's diverse construction services.

HITT Contracting's BCG Matrix offers a clear, one-page overview of their business units, relieving the pain of strategic ambiguity.

Cash Cows

General Commercial Interior Fit-outs are HITT Contracting's established Cash Cows. This segment operates in a mature, stable market where HITT holds a significant, long-standing market share.

The consistent demand, particularly from a high percentage of repeat clients, ensures a substantial and reliable cash flow for the company. For instance, in 2024, HITT reported strong performance in its commercial interiors division, contributing significantly to overall revenue stability.

Maintaining HITT's dominant position in this core business requires minimal promotional investment due to its strong reputation for quality and efficient project execution.

HITT Contracting's traditional corporate base building construction is a cornerstone of their business, representing a mature market segment. This area, while not experiencing rapid expansion, consistently generates substantial revenue due to HITT's extensive experience and established reputation.

In 2024, the U.S. non-residential construction market, which includes corporate base building, saw steady activity, with reports indicating a continued demand for office and mixed-use developments. HITT's deep expertise in this sector allows them to secure a significant share of these projects, contributing reliably to their financial health.

This segment acts as a financial anchor for HITT, providing a stable platform from which they can invest in and grow other areas of their business. The predictable cash flow from these projects underpins the company's overall stability and capacity for future endeavors.

HITT Contracting's Routine Renovation & Service Work division functions as a classic Cash Cow within the BCG framework. The company leverages its strong, long-term client relationships, which translate into consistent demand for ongoing renovation projects and essential service work. This steady stream of business from loyal customers provides a predictable and reliable cash flow.

While these individual renovation and service jobs might be smaller in scope compared to HITT's large-scale new construction, their sheer volume and recurring nature are key. For instance, HITT reported a robust backlog of over $10 billion in late 2023, a significant portion of which is attributed to repeat business and ongoing client needs. This high volume ensures a stable revenue base.

These services are generally characterized by higher profit margins and require less intensive new business development efforts. This efficiency allows HITT to generate substantial profits with relatively lower investment. The predictable nature of this revenue stream supports overall company stability and funding for other strategic initiatives.

Established Government Sector Projects

HITT Contracting's established government sector projects function as classic cash cows within their BCG matrix. While the government sector may not exhibit explosive growth, it offers a remarkably stable and predictable stream of work. This stability is crucial for consistent revenue generation.

These long-term government engagements, once secured, translate into reliable payment cycles, directly fueling HITT's cash flow. Their demonstrated expertise in navigating complex government procurement procedures provides a distinct competitive edge, ensuring they can consistently win these dependable projects.

- Stable Revenue: Government contracts provide a predictable revenue base, minimizing market volatility.

- Long-Term Engagements: Projects often span several years, ensuring sustained cash inflow.

- Competitive Advantage: HITT's experience in government bidding secures a steady pipeline of work.

- Financial Stability: These projects contribute significantly to the company's overall financial health and operational funding.

Hospitality Sector Renovations

Hospitality sector renovations are a classic example of a cash cow for HITT Contracting. This market is mature, meaning demand is stable and predictable, but it consistently requires updates to stay appealing. Think about hotels needing to refresh their look or upgrade amenities to attract guests. HITT's deep roots and existing partnerships in this industry mean they have a steady stream of these renovation projects coming their way.

This segment is vital for HITT's cash flow. It generates reliable revenue without demanding substantial investment in new markets or groundbreaking innovation. For instance, in 2024, the U.S. hotel construction pipeline included over 1,000 projects, many of which involve significant renovations. HITT's ability to secure a portion of this work provides consistent earnings.

- Mature Market Demand: The hospitality sector consistently needs renovations to maintain competitiveness, ensuring a steady project pipeline.

- HITT's Established Position: Strong industry presence and relationships allow HITT to secure a reliable share of renovation projects.

- Consistent Revenue Generation: This segment provides predictable cash flow, contributing significantly to HITT's overall financial stability.

- Low Investment Needs: Unlike star or question mark segments, renovations require less capital for market penetration or development.

HITT Contracting’s established presence in the General Commercial Interior Fit-outs segment firmly places it as a Cash Cow. This area benefits from a mature market with consistent demand, particularly from a high percentage of repeat clients, ensuring a substantial and reliable cash flow. For instance, in 2024, HITT reported strong performance in its commercial interiors division, contributing significantly to overall revenue stability.

Maintaining HITT's dominant position in this core business requires minimal promotional investment due to its strong reputation for quality and efficient project execution. This segment acts as a financial anchor, providing a stable platform for investment in other business areas.

HITT Contracting's traditional corporate base building construction is a cornerstone of their business, representing a mature market segment. This area, while not experiencing rapid expansion, consistently generates substantial revenue due to HITT's extensive experience and established reputation. In 2024, the U.S. non-residential construction market saw steady activity, with HITT's deep expertise allowing them to secure a significant share of these projects, contributing reliably to their financial health.

The Routine Renovation & Service Work division also functions as a classic Cash Cow. HITT leverages strong, long-term client relationships for consistent demand, providing a predictable and reliable cash flow. While individual jobs may be smaller, their volume and recurring nature are key. For example, HITT reported a robust backlog of over $10 billion in late 2023, with a significant portion from repeat business, ensuring a stable revenue base with higher profit margins and lower investment needs.

| Segment | Market Growth | Market Share | Cash Flow | Investment Needs |

| General Commercial Interior Fit-outs | Low | High | High | Low |

| Corporate Base Building | Low | High | High | Low |

| Routine Renovation & Service Work | Low | High | High | Low |

Delivered as Shown

HITT Contracting BCG Matrix

The HITT Contracting BCG Matrix you are previewing is the identical, fully-formatted document you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises – just a professionally designed, analysis-ready report ready for immediate strategic application.

What you see here is the definitive HITT Contracting BCG Matrix report that will be delivered to you after completing your purchase. This comprehensive document has been meticulously crafted to provide clear, actionable insights, ensuring you receive the exact same strategic tool for your business planning needs.

Rest assured, the HITT Contracting BCG Matrix previewed on this page is the actual, final document you will download. It’s designed for professional use and is ready for immediate integration into your strategic discussions and decision-making processes.

The HITT Contracting BCG Matrix you are currently viewing is the precise file that will be yours after purchase. This means you can confidently assess its value, knowing the complete, unwatermarked, and professionally formatted report will be instantly accessible for your use.

Dogs

Small-scale, commoditized retail fit-outs represent a Dogs category for a contractor like HITT Contracting. These projects, often characterized by intense price competition and low profit margins, do not align with HITT's expertise in larger, more complex construction endeavors. For instance, the retail construction sector in 2024 saw continued pressure on margins, with many smaller fit-out projects offering minimal differentiation and strategic value.

Geographic markets with limited strategic investment represent areas where HITT Contracting might have minimal or isolated project engagements. These are typically new regions where the company hasn't yet committed significant long-term resources or built a robust local presence.

Without a critical mass of projects or well-established client networks in these markets, HITT likely experiences low market share. These ventures can end up consuming disproportionate resources compared to the returns they generate, hindering overall efficiency.

For example, in 2024, HITT Contracting's presence in certain emerging international markets might show only a handful of projects, perhaps contributing less than 1% to their overall revenue. These isolated engagements often struggle to gain momentum and can divert attention from more established, profitable regions.

Outdated niche building systems installation would likely be classified as Dogs within HITT Contracting's BCG Matrix. These services operate in a market with diminishing demand as clients increasingly favor modern, more efficient building technologies.

For instance, consider the market for pneumatic tube systems in healthcare facilities, a once-dominant niche. While some legacy systems remain, new installations are rare as digital communication and automated delivery systems have largely replaced them. HITT's market share in such a declining segment would likely be low, reflecting the shrinking client base.

Investing further in these outdated systems would offer poor returns. The 2024 construction landscape shows a strong preference for smart building technology and sustainable materials, with the global smart buildings market projected to reach $115.16 billion by 2024, according to Mordor Intelligence. This highlights the limited upside for HITT in focusing on obsolete building systems.

Ad-hoc, Non-Strategic Subcontracting Work

Ad-hoc, non-strategic subcontracting work for HITT Contracting falls into the Dogs category of the BCG Matrix. This involves taking on intermittent projects that don't fit the company's core strategy as a full-service general contractor in high-value sectors.

These types of engagements often serve to fill capacity gaps rather than build long-term client relationships or generate substantial profits. They typically represent a low market share within a highly fragmented industry segment.

- Low Market Share: These projects typically secure only a small portion of business within their niche.

- Low Growth Potential: The nature of the work offers limited opportunities for expansion or strategic development.

- Limited Profitability: Margins are often slim, with a focus on immediate revenue rather than long-term value.

- Resource Drain: Can divert resources from more strategically important and profitable ventures.

Very Low-Margin, Basic Facility Maintenance Contracts

Very low-margin, basic facility maintenance contracts represent a potential Dogs category for HITT Contracting. These are typically commoditized services, lacking integration with HITT's core construction and renovation capabilities. In 2024, the general facility maintenance market saw profit margins often hovering between 2-5%, a stark contrast to the higher margins found in specialized construction.

These contracts often require significant operational overhead without leveraging HITT's advanced project management or specialized construction expertise. For example, routine HVAC servicing or landscaping, while necessary, does not utilize the complex logistics and skilled labor that HITT excels at. This can lead to a situation where resources are tied up in low-return activities.

The strategic upside for HITT in pursuing these basic maintenance contracts is minimal. They do not typically lead to larger, more profitable projects, nor do they significantly enhance HITT's brand reputation in specialized construction. Data from industry reports in late 2024 indicated that companies focusing solely on basic maintenance often struggled with scalability and profitability compared to integrated service providers.

- Low Profitability: Margins typically range from 2-5% in the general facility maintenance sector.

- Resource Drain: These contracts consume resources without leveraging specialized expertise.

- Limited Strategic Value: They offer little opportunity for upselling or integration into larger projects.

- Commoditization Risk: The services are easily replicable by numerous smaller competitors.

Small-scale, commoditized retail fit-outs are a prime example of Dogs for HITT Contracting. These projects, characterized by intense price competition and low profit margins, do not align with HITT's core strengths in larger, complex construction. In 2024, the retail construction sector continued to face margin pressures, with many smaller fit-out projects offering minimal differentiation and strategic value.

Outdated niche building systems, such as pneumatic tube systems, also fall into the Dogs category. Demand for these services is diminishing as clients increasingly adopt modern, efficient building technologies, leading to a shrinking client base and limited upside for HITT. The global smart buildings market's projected growth to $115.16 billion by 2024 underscores the limited future for obsolete systems.

Ad-hoc, non-strategic subcontracting work represents another Dog. These intermittent projects don't fit HITT's core strategy as a full-service general contractor and typically offer low profitability and limited growth potential, potentially diverting resources from more strategic ventures.

Basic facility maintenance contracts, with their very low margins and commoditized nature, are also classified as Dogs. These services consume resources without leveraging HITT's specialized expertise and offer minimal strategic value, as indicated by industry reports in late 2024 showing lower profitability for companies focused solely on basic maintenance.

| BCG Category | HITT Contracting Example | Market Characteristics | HITT's Position | Strategic Implication |

|---|---|---|---|---|

| Dogs | Small Retail Fit-outs | Low margins, high competition, low differentiation | Low market share, minimal strategic alignment | Resource drain, low ROI |

| Dogs | Outdated Building Systems Installation | Diminishing demand, replaced by new technologies | Low market share, shrinking client base | Limited future growth, focus on legacy assets |

| Dogs | Ad-hoc Subcontracting | Fragmented market, capacity filling | Low market share, no long-term relationships | Resource diversion, minimal profitability |

| Dogs | Basic Facility Maintenance | Commoditized services, low profit margins (2-5% in 2024) | Low market share, no leverage of specialized expertise | Limited strategic value, commoditization risk |

Question Marks

HITT Contracting's investment in advanced robotics and automation, exemplified by their Virginia Tech research lab, positions this segment as a Question Mark on the BCG matrix. While the construction industry is seeing significant growth in robotics adoption, HITT's current market penetration in offering these as client-facing services is likely nascent.

The global construction robotics market was valued at approximately $2.5 billion in 2023 and is projected to reach over $7.5 billion by 2030, indicating a high-growth trajectory. This rapid expansion presents a substantial opportunity for HITT, but the uncertainty lies in the speed and breadth of client adoption and HITT's ability to scale these specialized services effectively.

The modular and prefabricated construction sector is experiencing robust growth, driven by the need for faster project delivery, reduced waste, and improved cost control. In 2024, the global modular construction market was valued at approximately $100 billion and is projected to reach over $150 billion by 2028, showcasing a significant upward trend.

HITT Contracting's involvement in specialized modular and prefabricated solutions likely positions them in a "Question Mark" category within the BCG Matrix. While this segment offers high growth potential, HITT's current market share is probably nascent, necessitating strategic investment to capture a meaningful position.

To move this offering from a Question Mark to a Star, HITT would need to significantly invest in research, development, and market penetration for these advanced modular solutions. This could involve expanding capabilities in design, manufacturing, and logistics to offer more integrated and comprehensive off-site construction services.

HITT Contracting's investment in AI-driven project optimization and predictive analytics falls into the question mark category of the BCG matrix. While their research and development actively explores these technologies, aiming to enhance construction management and mitigate project risks, their current market share in providing these as standalone, client-facing services is minimal. This positions it as a high-growth potential area but also a speculative venture for HITT.

Expansion into Specific Emerging Manufacturing Niches

HITT Contracting's strategic consideration of expansion into specific emerging manufacturing niches, such as advanced battery gigafactories or specialized semiconductor fabrication plants for nascent technologies, positions these as potential Question Marks within a BCG matrix framework. These sectors exhibit substantial growth potential, but HITT's current market penetration and established expertise in these highly specialized sub-segments may be limited. This necessitates considerable investment in developing specialized capabilities, securing necessary certifications, and cultivating relationships with key players in these evolving industries.

The global market for electric vehicle batteries alone was projected to reach over $300 billion by 2027, highlighting the immense growth trajectory of such niches. Similarly, the semiconductor industry, particularly for advanced chips used in AI and quantum computing, is experiencing unprecedented demand. For HITT, entering these areas would require a focused approach:

- Targeted Investment: Allocating capital towards acquiring specialized equipment and training personnel for cleanroom environments and advanced manufacturing processes.

- Partnership Development: Collaborating with technology providers and established players in these emerging sectors to gain market access and build credibility.

- Risk Mitigation: Developing strategies to navigate the inherent technological and market uncertainties associated with nascent industries.

- Capability Building: Focusing on developing a deep understanding of the unique construction requirements and regulatory landscapes of these specialized manufacturing environments.

Highly Specialized Public-Private Partnerships (P3s) in New Sectors

HITT Contracting is exploring highly specialized Public-Private Partnerships (P3s) in emerging sectors, aiming for significant growth. These ventures, while offering substantial scale, present a steep learning curve and intense competition, meaning HITT's initial market share in these new P3 niches will likely be low. Success will demand considerable investment in resources and expertise.

These new P3 frontiers represent potential "Question Marks" in a BCG-like matrix for HITT. The strategy involves actively seeking these opportunities, understanding that the initial investment in market development and project acquisition will be high. For instance, in 2024, the global P3 market saw continued expansion, with a notable increase in infrastructure projects beyond traditional transportation, including areas like advanced manufacturing facilities and specialized research centers.

- High Growth Potential: Sectors like advanced healthcare infrastructure and sustainable energy facilities are seeing increased P3 adoption.

- Low Initial Market Share: Entering novel P3 domains means competing against established players or pioneering new models, leading to a smaller initial foothold.

- Significant Resource Allocation: Securing these complex deals requires dedicated teams for market analysis, legal structuring, and financial modeling.

- Strategic Investment: HITT's approach is to build expertise and market presence in these specialized areas for long-term competitive advantage.

HITT Contracting's ventures into highly specialized manufacturing niches, such as advanced battery gigafactories and semiconductor fabrication plants, are positioned as Question Marks. These areas offer substantial growth, but HITT's current market share is likely minimal, requiring significant investment to build expertise and gain traction.

The global electric vehicle battery market alone was projected to exceed $300 billion by 2027, underscoring the immense growth potential in these specialized sectors. HITT's strategy involves targeted investment in equipment and training, alongside strategic partnerships to navigate these nascent industries.

Similarly, HITT's exploration of specialized Public-Private Partnerships (P3s) in emerging sectors also falls into the Question Mark category. While these P3s offer significant scale, they come with a steep learning curve and intense competition, suggesting a low initial market share for HITT in these new domains.

The global P3 market in 2024 showed increased activity in areas beyond traditional transportation, including advanced manufacturing and research centers, indicating evolving opportunities. HITT's approach here is to build expertise and market presence in these specialized areas for long-term advantage.

| HITT Contracting Venture | BCG Category | Market Growth Potential | Current Market Share | Strategic Focus |

| Advanced Robotics & Automation | Question Mark | High | Nascent | R&D, Client Adoption |

| Modular & Prefabricated Construction | Question Mark | High | Nascent | Capability Expansion |

| AI-Driven Project Optimization | Question Mark | High | Minimal | R&D, Service Offering |

| Specialized Manufacturing Niches (e.g., Gigafactories) | Question Mark | Very High | Limited | Targeted Investment, Partnerships |

| Specialized Public-Private Partnerships (P3s) | Question Mark | High | Low | Market Development, Expertise |

BCG Matrix Data Sources

Our HITT Contracting BCG Matrix is informed by a comprehensive blend of internal financial data, project performance metrics, and external market research, ensuring a robust and actionable strategic overview.