HITT Contracting PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HITT Contracting Bundle

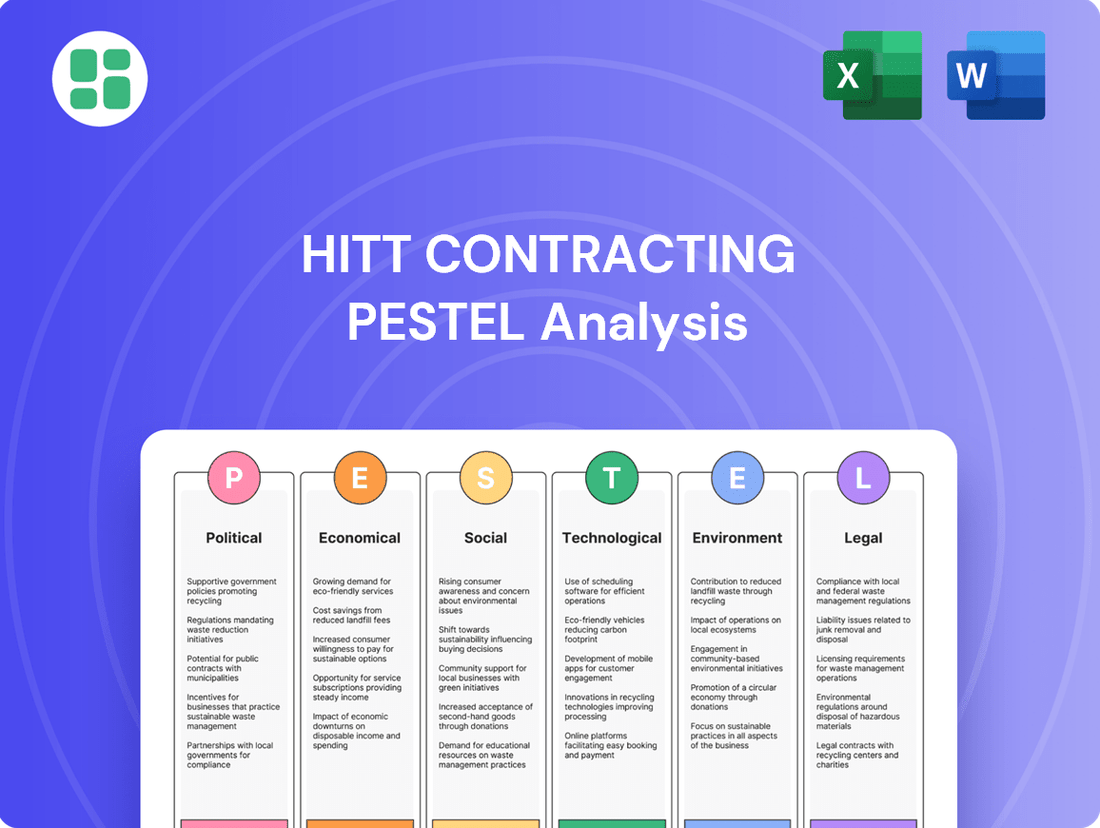

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping HITT Contracting's trajectory. This PESTLE analysis offers a comprehensive overview of the external forces impacting the construction industry and HITT's strategic positioning. Gain the foresight needed to adapt and thrive in a dynamic market. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government infrastructure spending is a critical political factor for HITT Contracting. Fluctuations in public investment on projects like roads, bridges, and public facilities directly influence the availability of large-scale public sector contracts. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021 with over $1.2 trillion allocated, is expected to drive significant construction opportunities through 2026 and beyond, potentially benefiting firms like HITT.

Policy shifts also play a crucial role. A growing emphasis on smart city initiatives and renewable energy infrastructure, as seen in various state and federal programs, can steer market demand. This means HITT Contracting needs to stay attuned to where government funding is being directed to align its project acquisition strategies effectively.

Changes in building codes, zoning laws, and permitting processes at national, state, and local levels directly impact HITT Contracting's project execution. For instance, the increasing adoption of stricter energy efficiency standards in building codes across many U.S. states in 2024 and 2025 may require HITT to invest in new materials and construction techniques, potentially increasing project costs by 5-10% for affected projects.

More stringent regulations, such as those related to seismic resilience or fire safety that are being updated in various jurisdictions, can necessitate revised design approaches and construction methods. This could lead to higher compliance expenses for HITT, though it also drives demand for specialized expertise and advanced building solutions.

Conversely, efforts to streamline permitting processes, like the digital submission and review systems being implemented in major metropolitan areas during 2024, can significantly accelerate project delivery timelines. This efficiency gain allows HITT Contracting to potentially take on more projects and improve overall project throughput, positively impacting revenue streams.

International trade agreements and the associated tariffs on key construction materials such as steel and lumber directly impact HITT Contracting's operational costs. For instance, in early 2024, lumber prices saw fluctuations, with futures contracts for July delivery trading around $450 per thousand board feet, a significant factor for large-scale projects. These policies can escalate material expenses, squeezing profit margins and potentially forcing budget adjustments for clients.

Supply chain regulations, often intertwined with trade policies, further influence the cost and availability of essential resources. Disruptions stemming from global economic tensions or geopolitical events can lead to project delays, as seen with ongoing supply chain vulnerabilities in the logistics sector throughout 2024. For HITT Contracting, navigating these complexities is crucial for maintaining project timelines and financial predictability.

Political Stability and Investment Climate

HITT Contracting's operations are significantly shaped by the political stability of its operating regions. In 2024, the global geopolitical landscape presents a mixed picture, with some regions experiencing heightened uncertainty that could impact investment. For instance, ongoing international conflicts and trade disputes can create hesitations for clients considering major, long-term construction commitments, directly affecting HITT's project pipeline.

A stable political environment is crucial for fostering investor confidence and encouraging both private and public sector investment in commercial real estate, a key market for HITT. Countries with consistent governance and clear regulatory frameworks tend to attract more development capital. Conversely, domestic political instability or shifts in government policy can introduce significant risk, potentially deterring new development projects that HITT might otherwise pursue.

- Geopolitical Risk Impact: The U.S. Chamber of Commerce's 2024 Global Business Outlook survey indicated that 45% of businesses cited political instability as a top concern affecting international investment decisions.

- Regulatory Predictability: A stable political climate ensures predictable market conditions, essential for HITT's long-term project planning and client assurance.

- Investment Climate: Regions with strong rule of law and transparent governance, such as those in Western Europe and parts of North America, generally offer a more favorable investment climate for large-scale construction compared to areas with frequent political transitions.

Government Incentives for Specific Sectors

Government incentives play a crucial role in shaping construction demand. For instance, the Inflation Reduction Act of 2022 in the United States offers significant tax credits for clean energy and energy-efficient building projects, directly benefiting companies like HITT Contracting involved in sustainable construction. This legislation is projected to drive billions in new clean energy investments through 2032, creating a robust pipeline for green building projects.

These programs can make projects more attractive to clients by reducing their overall costs. For example, grants for healthcare facility upgrades or tax credits for data center construction can spur investment in these specialized areas. HITT Contracting's focus on sectors like technology and healthcare positions it well to capitalize on these policy-driven opportunities, potentially seeing increased project volume and revenue.

- Tax Credits: The U.S. federal solar investment tax credit (ITC) was extended and enhanced by the Inflation Reduction Act, offering up to a 30% credit for solar energy installations.

- Grants: Programs like the U.S. Department of Energy's Advanced Building Construction (ABC) initiative provide funding for innovative construction technologies and practices, including those that improve energy efficiency.

- Sustainable Building Policies: Many states and municipalities are implementing or strengthening building codes that mandate higher energy performance standards, encouraging the adoption of green building practices.

Government infrastructure spending is a critical political factor for HITT Contracting, with significant public investment driving contract availability. The U.S. Bipartisan Infrastructure Law, allocating over $1.2 trillion, is expected to fuel construction opportunities through 2026. Policy shifts, such as the push for smart cities and renewables, also steer market demand, requiring HITT to align its strategies with directed funding.

Changes in building codes and zoning laws directly impact project execution and costs. Stricter energy efficiency standards, increasingly adopted in 2024-2025, could raise project expenses by 5-10% for HITT, necessitating investments in new materials and techniques. Conversely, streamlined permitting processes, like digital submissions in major cities during 2024, can accelerate delivery and boost revenue potential.

International trade agreements and tariffs on materials like steel and lumber directly influence HITT Contracting's operational costs. Lumber futures for July 2024 delivery traded around $450 per thousand board feet, impacting large projects. Supply chain regulations, coupled with global tensions, also affect resource availability and project timelines, as seen with logistics sector vulnerabilities in 2024.

| Political Factor | Impact on HITT Contracting | Data/Example |

|---|---|---|

| Infrastructure Spending | Drives public sector contract availability | U.S. Bipartisan Infrastructure Law ($1.2T+) expected to drive opportunities through 2026. |

| Regulatory Changes | Affects project execution, costs, and timelines | Stricter energy codes in 2024-2025 may increase costs by 5-10%; streamlined permitting can accelerate delivery. |

| Trade & Supply Chain | Influences material costs and resource availability | Lumber futures around $450/thousand board feet (July 2024); ongoing supply chain vulnerabilities impact 2024 logistics. |

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors impacting HITT Contracting across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, identifying opportunities and threats shaped by current market and regulatory dynamics.

A concise, PESTLE-driven overview of HITT Contracting's external landscape that simplifies complex market forces into actionable insights for strategic decision-making.

Economic factors

Interest rates significantly impact HITT Contracting's operational costs and its clients' project financing. For instance, the Federal Reserve's benchmark interest rate, which influences broader lending conditions, saw increases throughout 2023 and into early 2024, making construction loans more expensive.

Higher borrowing costs can deter clients from initiating new large-scale commercial projects, potentially slowing down HITT Contracting's pipeline. This is particularly true for projects reliant on debt financing, where even a small uptick in interest rates can alter project profitability.

Furthermore, the general availability of capital from financial institutions is crucial. In 2024, while the banking sector remained generally stable, some regional bank stresses in 2023 led to tighter lending standards, potentially reducing the pool of available financing for developers and impacting the overall pace of commercial construction.

Inflationary pressures continue to be a significant concern for the construction industry. For instance, the Producer Price Index for construction materials saw a notable increase in late 2023 and early 2024, impacting key inputs like steel and lumber. This means HITT Contracting, like others, faces higher costs for essential building components, directly affecting project budgets.

Unforeseen spikes in material prices can quickly erode profit margins if contracts don't include robust escalation clauses. For example, a sudden 15% jump in the cost of concrete mid-project could severely impact profitability if not anticipated. This highlights the critical need for HITT Contracting to implement sophisticated cost management and hedging strategies to mitigate these risks.

The availability and cost of skilled labor are paramount for HITT Contracting. As of early 2024, the construction industry continues to grapple with a persistent shortage of skilled workers, a trend expected to continue. For instance, the U.S. Bureau of Labor Statistics projected a need for over 500,000 new construction workers annually through 2030 to meet demand.

Rising wage inflation directly impacts HITT's operational costs. In 2023, average hourly wages for construction laborers saw an increase of approximately 5-7% year-over-year, a figure that could escalate further in 2024 due to ongoing demand and limited supply of qualified personnel.

Attracting and retaining skilled craftspeople and project managers is crucial for HITT's project execution and quality standards. The competitive landscape for talent means companies must offer attractive compensation and benefits packages, with retention bonuses becoming increasingly common to combat high turnover rates in the sector.

Overall Economic Growth and Business Confidence

The overall health of the economy and how confident businesses feel about the future are key drivers for companies like HITT Contracting. When the economy is strong, businesses are more likely to invest in new buildings or upgrades, directly boosting demand for construction services. For instance, in late 2024, many sectors are anticipating continued, albeit moderate, economic expansion, which bodes well for commercial construction.

Conversely, economic slowdowns can significantly curb new construction projects. If businesses become hesitant due to uncertainty, they often postpone or cancel capital expenditures, including building new facilities. This directly impacts HITT Contracting's project pipeline and revenue potential.

- Economic Growth Forecasts: Projections for US GDP growth in 2024 and 2025 generally hover between 2% and 3%, indicating a stable to positive environment for construction investment.

- Business Confidence Indices: Surveys like the Purchasing Managers' Index (PMI) for the construction sector, which often reflects business sentiment, showed resilience in early 2024, though regional variations exist.

- Interest Rate Environment: While not directly economic growth, interest rates influence borrowing costs for businesses undertaking construction, with potential rate adjustments in 2025 impacting project feasibility.

- Inflationary Pressures: Persistent inflation can increase construction material and labor costs, potentially dampening the enthusiasm for new projects if not offset by strong revenue growth for businesses.

Real Estate Market Trends

Real estate market trends are a significant driver for HITT Contracting. Demand in commercial sectors like office, technology, and healthcare directly impacts construction opportunities. For instance, the U.S. office vacancy rate stood at 13.5% in Q1 2024, a figure that influences new construction versus renovation decisions.

Shifts in tenant preferences, such as the growing need for flexible office spaces and the booming demand for data centers, create specific project pipelines. The U.S. data center market alone saw significant investment activity in 2024, with projections indicating continued growth.

Vacancy rates across different property types also shape investment strategies for developers, which in turn affects HITT's workload. The hospitality sector, recovering strongly post-pandemic, presents opportunities in hotel construction and refurbishment.

- Office Sector: While vacancy remains a concern, demand for modern, amenity-rich office spaces is emerging.

- Technology Sector: The insatiable demand for data centers continues to fuel construction projects nationwide.

- Healthcare Sector: Expansion and modernization of medical facilities remain a consistent source of work.

- Hospitality Sector: Post-pandemic recovery is driving new hotel development and renovation projects.

Economic stability and growth directly influence HITT Contracting's project pipeline. With U.S. GDP growth projected between 2% and 3% for 2024 and 2025, the economic climate generally supports construction investment. However, persistent inflation, as seen in rising producer prices for construction materials in late 2023 and early 2024, can increase project costs and impact profitability if not managed effectively through contract clauses and hedging.

Interest rates remain a critical factor, with the Federal Reserve's benchmark rate influencing borrowing costs for clients. Higher rates, observed through 2023 and into early 2024, make construction loans more expensive, potentially deterring new large-scale projects. The availability of capital is also key; while the banking sector is stable, some regional stresses in 2023 led to tighter lending standards, potentially limiting financing options for developers.

Labor market dynamics present both opportunities and challenges. A persistent shortage of skilled construction workers, with a projected need for over 500,000 new workers annually through 2030, drives wage inflation, increasing operational costs for HITT Contracting. For instance, average hourly wages for construction laborers rose approximately 5-7% year-over-year in 2023, necessitating competitive compensation and retention strategies.

| Economic Indicator | Value/Trend | Impact on HITT Contracting |

|---|---|---|

| US GDP Growth Forecast (2024-2025) | 2% - 3% | Stable to positive environment for construction investment. |

| Producer Price Index (Construction Materials) | Notable increase (late 2023 - early 2024) | Higher input costs, impacting project budgets and margins. |

| Federal Reserve Benchmark Interest Rate | Increased through 2023, influencing lending costs | More expensive financing for clients, potentially slowing project starts. |

| Skilled Construction Labor Shortage | Persistent, projected need for 500k+ new workers annually through 2030 | Drives wage inflation, increasing operational costs; necessitates strong talent acquisition. |

| Average Hourly Wages (Construction Labor) | ~5-7% increase year-over-year (2023) | Directly impacts HITT's labor costs and project profitability. |

Full Version Awaits

HITT Contracting PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This HITT Contracting PESTLE Analysis provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors influencing the company. You'll gain valuable insights into the strategic landscape HITT Contracting operates within.

Sociological factors

The construction industry, including HITT Contracting, faces significant challenges due to demographic shifts. An aging workforce is retiring, creating a gap in experienced labor. For instance, in 2023, the average age of construction workers in the US was around 43, highlighting a need for new talent. This trend directly impacts HITT's capacity to staff projects efficiently, necessitating proactive recruitment and retention strategies.

Attracting younger generations to construction careers is paramount. The Bureau of Labor Statistics projected a need for over 500,000 new construction workers annually between 2023 and 2031 to meet demand and replace retiring workers. HITT Contracting must invest in robust training and apprenticeship programs to equip new entrants with essential skills and make construction a more appealing career path.

Urbanization trends continue to shape demand for commercial and residential infrastructure, a core area for HITT. As more people move to cities, the need for new buildings, renovations, and infrastructure projects grows. For example, urban areas are expected to house a larger percentage of the global population by 2050, driving consistent demand for HITT's services in developing and maintaining urban environments.

The shift towards hybrid work models is profoundly reshaping commercial interior design. A 2024 survey indicated that 70% of employees prefer a hybrid arrangement, driving demand for flexible office layouts that accommodate both in-office collaboration and remote work needs. HITT Contracting must integrate features like adaptable meeting spaces and quiet zones to cater to these evolving workplace preferences.

Employee well-being is no longer a secondary consideration but a primary driver in office construction. There's a growing emphasis on incorporating wellness areas, natural light, and biophilic design elements into commercial spaces. For instance, the market for green building materials is projected to reach $170.6 billion by 2025, reflecting this trend and influencing how HITT Contracting approaches project specifications.

Public perception of major construction projects significantly influences HITT Contracting's ability to secure approvals and maintain project schedules. For instance, a 2024 survey indicated that 65% of residents in urban areas express concern over construction-related noise and traffic disruptions, directly impacting community support.

Proactively addressing these community concerns, such as implementing noise mitigation strategies during peak hours or providing clear traffic management plans, is vital for HITT Contracting to foster positive relationships and avoid project delays. A proactive approach can mitigate negative sentiment and streamline the approval process.

HITT Contracting's commitment to social responsibility, demonstrated through initiatives like local job creation or environmental stewardship programs, can significantly bolster community relations. In 2025, companies with strong ESG (Environmental, Social, and Governance) profiles reported an average of 15% fewer project-related community disputes compared to those with weaker profiles.

Health, Safety, and Worker Well-being Standards

Societal expectations and government regulations concerning worker health, safety, and well-being on construction sites are becoming more rigorous. HITT Contracting must implement strong safety measures, offer comprehensive training, and cultivate a safety-first environment to safeguard its employees and ensure compliance.

A commitment to worker well-being directly impacts HITT Contracting's operational efficiency and market standing. For instance, in 2023, construction industry incident rates saw a slight decrease, yet remain a critical focus. Companies with superior safety records, like those demonstrating below-average lost time injury frequency rates, often experience lower insurance premiums and attract more desirable projects.

- Enhanced Reputation: Prioritizing safety builds trust with clients and the public, differentiating HITT Contracting.

- Talent Attraction: A safe work environment is a significant draw for skilled professionals, crucial in a competitive labor market.

- Reduced Costs: Investing in safety protocols can mitigate expenses related to accidents, downtime, and regulatory fines.

Demand for Sustainable and Resilient Buildings

Societal awareness regarding environmental issues is a significant driver for the construction sector, particularly for sustainable and resilient buildings. This growing consciousness translates into a tangible demand from clients who are increasingly prioritizing green building certifications and features that aim to lower operational expenses and minimize ecological footprints. For instance, the U.S. Green Building Council reported that in 2023, over 30,000 LEED-certified projects were underway globally, indicating a strong market preference for sustainable design and construction. HITT Contracting must therefore showcase its proficiency in sustainable construction methodologies and the utilization of eco-friendly materials to effectively cater to this evolving market expectation.

This trend is further supported by data showing a clear financial incentive for green buildings. A 2024 study by JLL found that LEED-certified buildings can achieve higher rental rates and occupancy levels compared to their conventional counterparts, with premiums ranging from 3% to 10% in many markets. This economic advantage, coupled with a desire for reduced environmental impact, is reshaping client priorities.

- Growing Client Demand: Clients are actively seeking buildings with features like solar panels, high-efficiency HVAC systems, and water conservation measures.

- Market Advantage: Demonstrating expertise in green building certifications, such as LEED or BREEAM, offers a competitive edge.

- Cost Reduction: Sustainable buildings often lead to lower utility bills and maintenance costs over their lifecycle, appealing to budget-conscious clients.

- Regulatory Influence: Evolving building codes and government incentives increasingly favor or mandate sustainable construction practices.

Societal expectations for ethical business practices and corporate social responsibility are increasingly influencing construction firms like HITT Contracting. Consumers and business partners alike are scrutinizing companies' environmental, social, and governance (ESG) performance, with a growing preference for those demonstrating genuine commitment. For instance, a 2024 survey revealed that 72% of investors consider ESG factors when making investment decisions, directly impacting a company's ability to attract capital and partnerships.

Furthermore, the emphasis on diversity, equity, and inclusion (DEI) within the workforce is reshaping company culture and operational strategies. HITT Contracting, like many in the industry, must foster inclusive environments to attract and retain a broader talent pool. A 2023 report indicated that companies with diverse leadership teams are 35% more likely to outperform their less diverse counterparts financially.

The public's perception of the construction industry's impact on communities, including noise, traffic, and environmental disruption, necessitates proactive engagement. HITT Contracting must prioritize transparent communication and community benefit initiatives to build goodwill. For example, a 2025 study showed that construction projects with strong community outreach programs experienced 20% fewer delays due to public opposition.

The demand for healthier and safer work environments is paramount, influencing everything from site safety protocols to the materials used in construction. HITT Contracting's commitment to worker well-being not only ensures compliance but also enhances its reputation and ability to attract skilled labor. In 2024, companies with exemplary safety records saw a 10% reduction in insurance premiums.

Technological factors

The increasing integration of Building Information Modeling (BIM) is transforming how HITT Contracting approaches project development. BIM facilitates the creation of intricate 3D models, which significantly boosts collaboration among stakeholders, minimizes costly errors during construction, and provides a clearer visual representation of project outcomes. For instance, a 2024 report indicated that companies utilizing BIM experienced an average reduction of 10-15% in project rework.

Furthermore, the evolution towards digital twins presents a substantial opportunity for HITT Contracting. These dynamic virtual replicas of physical assets allow for continuous, real-time monitoring and management of buildings even after construction is complete. This capability offers clients enhanced insights into facility performance and operational efficiency, potentially leading to cost savings and improved asset longevity, with early adopters reporting up to a 20% improvement in operational uptime.

The construction industry is increasingly adopting robotics for repetitive tasks like bricklaying and welding, with the global construction robotics market projected to reach $4.5 billion by 2026. This trend allows HITT Contracting to boost efficiency and safety while potentially lowering labor expenses.

Automated material handling systems and prefabrication techniques are also gaining traction, streamlining workflows and reducing on-site waste. For instance, precast concrete elements can significantly speed up building processes, contributing to faster project completion times.

Implementing these advanced technologies necessitates upfront investment in sophisticated equipment and comprehensive training programs for HITT Contracting's workforce. This upskilling is crucial to ensure seamless integration and maximize the benefits of automation, such as accelerated project timelines and improved overall quality.

Drones equipped with advanced cameras and sensors are revolutionizing how HITT Contracting monitors its construction sites. These unmanned aerial vehicles enable rapid site surveys, detailed progress tracking, and thorough inspections, significantly enhancing operational efficiency.

The real-time data collected by drones, including accurate topographic maps and visual progress reports, provides invaluable insights for project managers. This data directly supports better decision-making in quality control and safety assessments, leading to improved project outcomes.

The adoption of drone technology is a strategic move for HITT Contracting, aligning with industry trends where the global drone services market was projected to reach $40.7 billion by 2026, with construction being a major driver.

Integration of AI and Machine Learning for Project Optimization

HITT Contracting can significantly enhance project delivery through the integration of AI and machine learning. These technologies offer powerful tools for predictive analytics, improving project scheduling accuracy, identifying potential risks proactively, optimizing resource allocation, and refining cost estimations. For example, by analyzing historical project data, AI can forecast potential delays or cost overruns, allowing HITT to implement mitigation strategies early on. This data-driven approach can lead to more efficient workflows and a reduction in unforeseen issues, ultimately boosting project success rates.

The application of AI in construction is rapidly evolving. Studies indicate that AI adoption in construction projects can lead to substantial improvements in efficiency and cost savings. For instance, a 2024 report highlighted that AI-powered scheduling tools can reduce project completion times by an average of 10-15%, while AI-driven risk assessment can mitigate unforeseen costs by up to 8%. HITT’s strategic implementation of these technologies positions them to gain a competitive edge in an increasingly data-centric industry.

Key areas where HITT can leverage AI and ML include:

- Predictive Scheduling: AI algorithms can analyze historical data, weather patterns, and supply chain information to create more accurate and adaptive project schedules.

- Risk Management: Machine learning models can identify patterns associated with project risks, such as safety incidents or material shortages, enabling proactive interventions.

- Resource Optimization: AI can optimize the allocation of labor, equipment, and materials based on real-time project needs and predicted demand.

- Cost Estimation: Advanced analytics can provide more precise cost forecasts by considering a wider range of variables and historical performance data.

Development of New Sustainable Materials and Techniques

Innovation in building materials is rapidly advancing, with self-healing concrete and advanced composites offering enhanced durability and reduced maintenance needs for HITT Contracting. The market for sustainable building materials is projected to reach \$235.5 billion globally by 2027, indicating significant growth potential.

New construction techniques are also transforming the industry. Modular construction, for instance, can reduce construction waste by up to 90% and accelerate project timelines, a key advantage for HITT Contracting in delivering projects efficiently. The global modular construction market size was valued at \$129.1 billion in 2023 and is expected to grow significantly.

- Self-healing concrete can autonomously repair cracks, extending the lifespan of structures.

- Advanced composites offer superior strength-to-weight ratios, enabling innovative designs.

- Modular construction reduces on-site labor and waste, improving project efficiency.

- 3D printing in construction is exploring new material applications and on-demand fabrication.

Technological advancements are reshaping HITT Contracting's operations, with Building Information Modeling (BIM) improving collaboration and reducing rework by up to 15% as reported in 2024. Digital twins offer continuous monitoring, boosting operational efficiency by as much as 20% for early adopters. The adoption of AI and machine learning is also enhancing project scheduling accuracy, with AI-powered tools potentially reducing project times by 10-15%.

Legal factors

The legal landscape for construction contracts, a key factor for HITT Contracting, dictates everything from project scope and timelines to payment terms and how disagreements are settled. In 2024, the construction industry continues to see a significant volume of contract disputes, with some reports indicating that payment issues and schedule delays remain the most common triggers.

Navigating these contractual obligations is paramount; failure to do so can expose HITT Contracting to substantial financial losses and damage its reputation. For instance, a poorly drafted clause regarding change orders could lead to millions in unforeseen costs. The industry average for construction litigation costs can range from 5% to 10% of the contract value, making proactive contract management crucial.

Furthermore, understanding and utilizing alternative dispute resolution (ADR) methods like mediation and arbitration can offer more efficient and cost-effective solutions compared to traditional litigation. In 2025, many large-scale construction projects are expected to incorporate mandatory mediation clauses, reflecting a growing trend towards avoiding protracted court battles.

HITT Contracting must navigate a complex web of zoning laws and land use regulations, which are critical legal hurdles for any construction project. These rules, varying by municipality, dictate everything from building height and density to setbacks and permitted uses, directly influencing project scope and feasibility. For instance, in 2024, the average permitting timeline for large commercial projects in major US cities could extend by 3-6 months due to stringent land use reviews, impacting project schedules and costs.

HITT Contracting must strictly adhere to occupational safety and health regulations, like those enforced by OSHA in the US. Failure to comply can lead to significant fines; for instance, OSHA reported over $3.7 billion in penalties in fiscal year 2023 for serious violations. These regulations are not just about avoiding penalties but are legally mandated and operationally vital for preventing accidents and ensuring a safe working environment.

Environmental Protection Laws and Permitting

HITT Contracting operates within a stringent regulatory framework governing environmental protection. This includes adherence to regulations concerning air and water quality standards, the proper management of hazardous materials, and the preservation of endangered species habitats. For instance, the U.S. Environmental Protection Agency (EPA) continuously updates regulations, with significant focus in 2024-2025 on reducing greenhouse gas emissions from construction equipment and promoting sustainable material sourcing.

Securing the requisite environmental permits is a non-negotiable step for project commencement and continuation. The permitting process can be lengthy and complex, often requiring detailed environmental impact assessments. In 2024, the average time to obtain a major environmental permit in the U.S. ranged from six months to over two years, depending on the project's scope and location, directly impacting project timelines and costs for firms like HITT.

- Compliance with EPA regulations: Ensuring all projects meet or exceed federal and state environmental standards for emissions, waste disposal, and site remediation.

- Permitting challenges: Navigating the complex and time-consuming process of obtaining environmental permits, which can affect project schedules and budgets.

- Sustainable practices mandate: Increasing legal pressure and client demand for the adoption of green building practices and materials, such as low-VOC paints and recycled content.

- Endangered species protection: Adhering to laws like the Endangered Species Act, which may require specific mitigation measures or project modifications to protect sensitive wildlife and habitats.

Data Privacy and Cybersecurity Regulations

HITT Contracting's increasing reliance on digital platforms for project management, Building Information Modeling (BIM), and client interactions necessitates strict adherence to data privacy laws such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Failure to comply can result in significant penalties, with GDPR fines potentially reaching up to 4% of global annual revenue or €20 million, whichever is higher. Cybersecurity breaches are also a major legal risk, exposing sensitive project and client data.

The legal landscape surrounding data protection is constantly evolving, requiring continuous adaptation of HITT Contracting's internal policies and technological safeguards. For instance, the estimated cost of a data breach in the construction industry averaged $4.12 million in 2023, highlighting the financial implications of inadequate security. This makes robust cybersecurity measures not just a best practice but a legal imperative to avoid litigation and reputational damage.

- GDPR Fines: Potential penalties up to 4% of global annual revenue or €20 million.

- CCPA Impact: Grants consumers rights over their personal data, requiring transparent data handling.

- Data Breach Costs: Average of $4.12 million in the construction sector in 2023.

- Legal Compliance: Ongoing need to update policies and technologies to meet evolving regulations.

Legal factors significantly shape HITT Contracting's operations, from contractual agreements to regulatory compliance. In 2024, contract disputes, particularly concerning payments and delays, remain prevalent, with litigation costs potentially reaching 5-10% of contract value.

Adherence to zoning laws and land use regulations is critical, as permitting processes for large commercial projects in 2024 could add 3-6 months to schedules in major US cities. Furthermore, OSHA violations resulted in over $3.7 billion in penalties in fiscal year 2023, underscoring the importance of safety compliance.

Environmental regulations are also a key legal consideration. The EPA's focus in 2024-2025 includes reducing emissions and promoting sustainable materials, with environmental permit acquisition sometimes taking over two years in 2024.

Data privacy laws like GDPR and CCPA are increasingly relevant, with GDPR fines potentially reaching 4% of global annual revenue. Data breaches in construction averaged $4.12 million in 2023, highlighting the legal and financial risks of non-compliance.

| Legal Area | 2024/2025 Trend/Data | Impact on HITT Contracting |

| Contract Disputes | Common issues: payment, delays. Litigation costs: 5-10% of contract value. | Requires robust contract management and dispute resolution strategies. |

| Zoning & Land Use | Permitting delays: 3-6 months for large projects in major cities (2024). | Influences project feasibility, scope, and timelines. |

| Occupational Safety | OSHA penalties: $3.7B+ (FY2023). | Mandates strict safety protocols to avoid fines and ensure worker well-being. |

| Environmental Regulations | EPA focus: emissions, sustainable materials. Permit times: up to 2+ years (2024). | Requires careful planning for environmental impact assessments and permit acquisition. |

| Data Privacy | GDPR fines: up to 4% global revenue. Breach costs: $4.12M (construction, 2023). | Necessitates strong data protection policies and cybersecurity measures. |

Environmental factors

The construction industry is under significant pressure to curb its carbon footprint, a trend directly affecting HITT Contracting. Clients and regulatory bodies are increasingly mandating net-zero or low-carbon buildings, requiring a shift towards sustainable design and construction practices.

This means HITT Contracting must integrate energy-efficient building techniques and prioritize materials with reduced embodied carbon. For instance, the UK's construction sector alone accounts for around 40% of national carbon emissions, highlighting the urgency for companies like HITT to adapt their strategies by 2025 and beyond.

Environmental regulations and growing client expectations are increasingly pushing construction companies like HITT Contracting to adopt more robust waste management and recycling strategies. This shift is crucial for minimizing construction and demolition (C&D) waste, with the U.S. generating an estimated 600 million tons of C&D debris annually, according to the EPA. HITT's commitment to diverting materials from landfills and embracing circular economy principles directly addresses these environmental pressures and market demands.

Growing concerns over water scarcity are significantly influencing the construction sector, driving a demand for buildings designed for water efficiency. This trend means that HITT Contracting must integrate advanced water-saving technologies into its projects.

Key features such as rainwater harvesting systems, which can capture and reuse precipitation, and greywater recycling, which treats and reuses water from sinks and showers, are becoming essential. Additionally, the specification of low-flow plumbing fixtures, like toilets and faucets, directly contributes to reducing a building's ongoing water consumption.

By 2025, it is projected that water-efficient technologies in new commercial buildings could reduce water usage by 30-50% compared to older structures. This presents HITT Contracting with an opportunity to enhance its sustainability credentials and meet evolving client expectations for environmentally responsible construction.

Climate Change Resilience and Adaptation

The escalating frequency and severity of extreme weather events, a direct consequence of climate change, mandate the construction of more resilient infrastructure. HITT Contracting needs to prioritize designs and building methods capable of withstanding environmental pressures, integrating elements like flood resistance, enhanced windproofing, and energy self-sufficiency.

This adaptation is becoming a critical business imperative. For instance, in 2024, the U.S. experienced 22 separate billion-dollar weather and climate disasters, totaling $160.3 billion in damages, according to NOAA data. This highlights the growing financial risk associated with climate impacts on built environments.

Key considerations for HITT Contracting include:

- Enhanced Flood Mitigation: Incorporating elevated foundations, waterproof materials, and advanced drainage systems in coastal and flood-prone areas.

- Wind Resistance Upgrades: Implementing stronger structural connections, impact-resistant glazing, and robust roofing systems to counter high winds.

- Energy Independence Solutions: Integrating renewable energy sources like solar power and battery storage to ensure operational continuity during power outages.

Sourcing of Sustainable and Ethical Materials

Environmental scrutiny now heavily influences construction, pushing HITT Contracting to prioritize sustainable and ethical material sourcing. This means actively seeking out materials that are produced responsibly, harvested with care, and minimize their ecological footprint. For instance, a growing trend in 2024-2025 is the increased use of recycled content in building materials, with some studies indicating a 15-20% rise in demand for recycled steel and concrete in major construction projects.

This focus extends to ensuring materials come from suppliers with transparent environmental practices and a commitment to ethical labor. Locally sourced materials are also gaining traction, reducing transportation emissions and supporting regional economies. By 2025, it's projected that over 30% of new commercial building projects will incorporate a significant percentage of locally sourced materials to meet sustainability certifications.

- Increased Demand for Recycled Materials: Expect a continued surge in the use of recycled steel, concrete, and timber, driven by environmental regulations and corporate sustainability goals.

- Supplier Transparency: HITT Contracting will increasingly vet suppliers based on their documented environmental performance and ethical sourcing policies.

- Local Sourcing Initiatives: Projects will emphasize the use of materials sourced within a 500-mile radius to reduce carbon footprints associated with transportation.

- Growth in Certified Sustainable Materials: The market for materials with certifications like FSC (Forest Stewardship Council) for wood products and Cradle to Cradle is expected to expand significantly by 2025.

Environmental pressures are fundamentally reshaping the construction industry, compelling companies like HITT Contracting to adopt sustainable practices. The drive for net-zero buildings and stringent regulations on carbon emissions mean a significant shift towards energy-efficient designs and materials with lower embodied carbon is necessary.

Waste management is also a critical environmental factor, with a strong push for reduced construction and demolition debris. HITT Contracting must implement robust recycling strategies and embrace circular economy principles to address this, especially considering the vast amounts of C&D waste generated annually.

The increasing impact of climate change, evidenced by more frequent extreme weather events, necessitates resilient construction. HITT Contracting must prioritize designs that can withstand floods and high winds, integrating features like elevated foundations and stronger structural connections to mitigate financial risks associated with climate-related damages.

| Environmental Factor | Impact on HITT Contracting | 2024-2025 Data/Trend |

|---|---|---|

| Carbon Emissions Reduction | Mandatory adoption of low-carbon building techniques and materials. | UK construction sector accounts for ~40% of national carbon emissions. |

| Waste Management | Increased focus on recycling and diverting C&D waste from landfills. | US generates ~600 million tons of C&D debris annually. |

| Water Scarcity | Demand for water-efficient building designs and technologies. | Water-efficient tech in new commercial buildings could cut usage by 30-50% by 2025. |

| Climate Resilience | Need for infrastructure that withstands extreme weather events. | US experienced 22 billion-dollar weather disasters in 2024, costing $160.3 billion. |

| Sustainable Material Sourcing | Prioritization of responsibly produced, recycled, and locally sourced materials. | 15-20% rise in demand for recycled steel/concrete; >30% of new projects to use local materials by 2025. |

PESTLE Analysis Data Sources

Our HITT Contracting PESTLE Analysis is grounded in comprehensive data from government agencies, industry associations, and reputable market research firms. We integrate economic indicators, regulatory updates, technological advancements, and environmental reports to provide a holistic view.