HITT Contracting Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HITT Contracting Bundle

HITT Contracting operates in a dynamic construction landscape, facing significant pressures from buyer power and the threat of new entrants. Understanding these forces is crucial for navigating its competitive environment.

The complete Porter's Five Forces Analysis unpacks the intricate web of competition, supplier leverage, and substitute products affecting HITT Contracting. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The commercial construction sector, including firms like HITT Contracting, grapples with substantial price swings for essential materials such as steel, lumber, and concrete. Projections indicate a potential 3-8% increase in these costs in early 2025, largely driven by rising energy prices.

This inherent volatility in material expenses directly influences project budgeting and scheduling, thereby bolstering the bargaining power of suppliers. This leverage is particularly pronounced when dealing with specialized or custom-ordered construction components.

Ongoing global supply chain disruptions, fueled by geopolitical events and logistical hurdles, significantly impact material availability and delivery timelines for construction projects. This situation amplifies the bargaining power of suppliers who can ensure consistent and timely provision of critical components, especially for specialized equipment like data center cooling systems.

For instance, in 2024, the construction industry continued to grapple with lead times for HVAC equipment extending by as much as 30-40% compared to pre-pandemic levels, directly increasing supplier leverage for these essential items.

The construction sector, including companies like HITT Contracting, faces a significant challenge with the scarcity of skilled labor. This shortage, exacerbated by an aging workforce and a lack of new entrants, directly boosts the bargaining power of labor suppliers, such as trade unions and specialized subcontractors.

This dynamic is reflected in rising labor costs, with average hourly earnings in construction increasing by 4.4% in 2024. Such cost pressures, coupled with the potential for project delays due to insufficient skilled workers, further solidify the leverage of those available skilled professionals.

Supplier Consolidation and Specialization

As construction increasingly relies on advanced technologies and specialized components, suppliers offering these niche solutions can wield greater bargaining power. This is particularly evident in sectors like data center construction, where the demand for high-capacity cooling systems and specialized structural reinforcements concentrates demand among a limited number of manufacturers.

This trend towards supplier specialization can lead to fewer viable alternatives for contractors like HITT Contracting. For example, the market for advanced building information modeling (BIM) software or prefabricated modular components often features a handful of dominant players. In 2024, the global BIM software market was valued at approximately $7.3 billion, with a significant portion driven by specialized functionalities essential for complex projects.

- Niche Technology Dependence: Increased reliance on specialized construction technologies, such as advanced façade systems or smart building integrations, can consolidate supplier options.

- Limited Alternative Suppliers: As technologies become more sophisticated, the pool of qualified suppliers capable of meeting stringent performance and quality standards shrinks.

- Data Center Example: The growing demand for data centers, a sector HITT Contracting is active in, necessitates specialized HVAC and structural components, often sourced from a concentrated group of manufacturers, thereby increasing their leverage.

Importance of Supplier Relationships

HITT Contracting's proactive approach to fostering robust, enduring partnerships with its subcontractors and suppliers significantly dampens the bargaining power of suppliers. This strategy ensures more favorable terms and greater reliability, which is essential in the construction industry where material and labor availability can fluctuate.

By cultivating these strong relationships, HITT can often secure preferential treatment and better pricing. For instance, in 2024, the construction sector experienced ongoing supply chain challenges, making supplier loyalty a valuable asset. Companies that invested in these partnerships were better positioned to navigate material shortages and price volatility.

Furthermore, HITT employs strategic purchasing tactics to further neutralize supplier leverage. This includes diversifying its supplier base to avoid over-reliance on any single entity and engaging in advanced procurement strategies. Locking in prices for key materials or purchasing in bulk ahead of anticipated demand spikes are critical methods to guarantee supply and manage cost escalations, especially when commodity prices are on the rise.

- Supplier Diversification: HITT actively seeks multiple sources for critical materials and services to prevent any single supplier from dictating terms.

- Long-Term Contracts: Establishing multi-year agreements with key suppliers helps to stabilize pricing and ensure consistent supply, a strategy particularly beneficial in volatile market conditions seen in 2024.

- Strategic Partnerships: Building collaborative relationships allows for shared forecasting and planning, leading to more efficient inventory management and cost savings for both HITT and its suppliers.

- Advance Purchasing: When market indicators suggest price increases or potential shortages, HITT may opt to purchase materials in advance, securing current pricing and availability.

The bargaining power of suppliers in the construction sector, impacting firms like HITT Contracting, is significant due to material cost volatility and supply chain disruptions. In 2024, lead times for HVAC equipment, for example, extended by up to 40%, increasing supplier leverage for these critical items.

The scarcity of skilled labor further empowers labor suppliers, with average hourly earnings in construction rising by 4.4% in 2024, directly impacting project costs and timelines.

A growing reliance on specialized technologies, such as advanced BIM software valued at approximately $7.3 billion globally in 2024, concentrates market power among a few dominant suppliers, limiting contractor options.

| Factor | Impact on Supplier Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Material Price Volatility | Increases supplier leverage | Potential 3-8% increase in early 2025 for steel, lumber, concrete |

| Supply Chain Disruptions | Amplifies supplier power for timely delivery | HVAC lead times extended by 30-40% |

| Skilled Labor Shortage | Boosts bargaining power of labor suppliers | 4.4% increase in construction hourly earnings |

| Niche Technology Dependence | Consolidates supplier options, increasing leverage | BIM software market valued at $7.3 billion |

What is included in the product

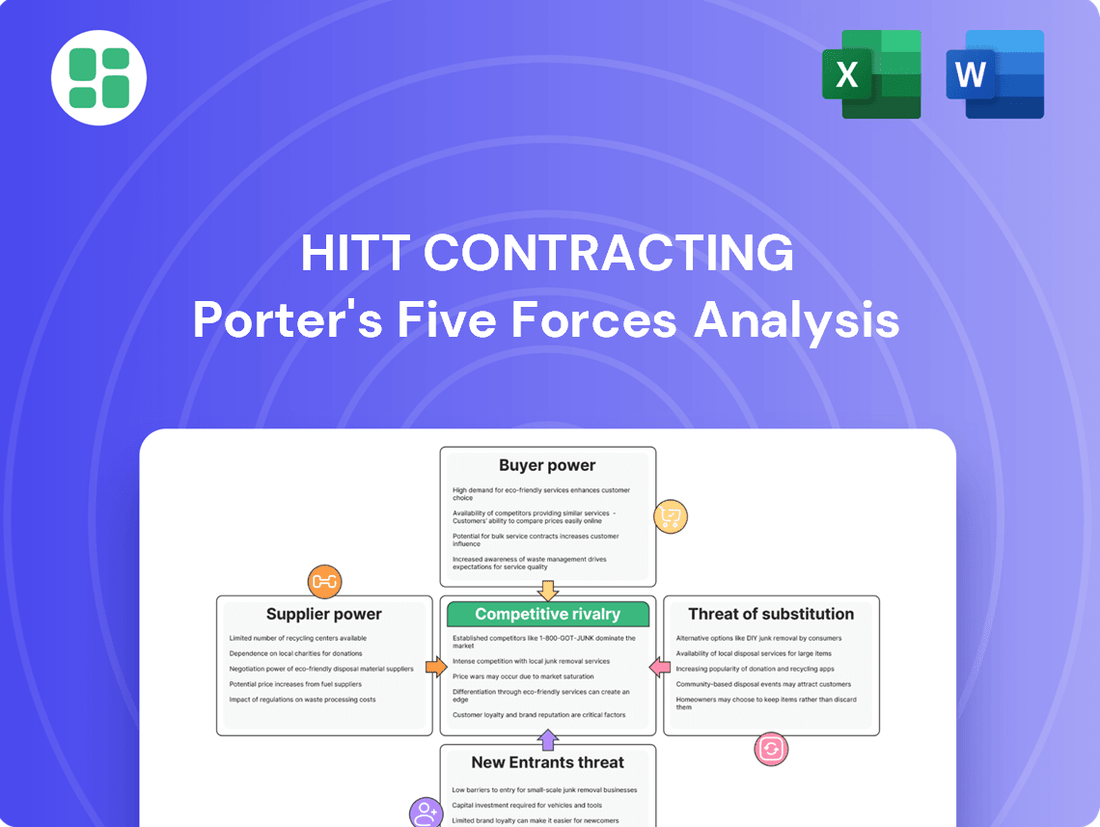

This analysis meticulously examines the five forces shaping HITT Contracting's competitive environment, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly visualize competitive pressures with a dynamic, interactive Porter's Five Forces model, enabling HITT Contracting to proactively address market challenges.

Customers Bargaining Power

HITT Contracting's clients are often large, sophisticated entities like major corporations or institutions, especially in sectors such as technology and healthcare. These clients are accustomed to managing substantial investments and possess intricate procurement knowledge.

Because HITT Contracting handles large-scale, complex projects, these clients wield considerable bargaining power. They can leverage the significant financial commitment involved to negotiate for competitive pricing, favorable contract terms, and exceptionally high-quality outcomes.

HITT Contracting's business model is built on fostering enduring client relationships, which significantly mitigates the bargaining power of customers. By prioritizing strategic alignment and mutual growth, HITT cultivates trust and repeat business, reducing the likelihood of purely transactional, price-driven negotiations.

This emphasis on long-term partnerships transforms the customer dynamic from one of direct power to one of collaborative engagement. For instance, in 2024, HITT reported that over 70% of its revenue came from repeat clients, a testament to the success of this relationship-focused strategy.

Clients in commercial construction are increasingly vocal about their desire for cutting-edge solutions, eco-friendly methods, and designs that conserve energy. This trend pressures contractors, including HITT Contracting, to embrace new technologies and green building standards.

This heightened client demand for innovation and sustainability gives customers significant leverage. They can use these preferences to shape project requirements and potentially negotiate for additional services or better pricing, impacting contractor margins.

For instance, the U.S. Green Building Council reported that in 2023, over 30% of all new commercial construction projects pursued LEED certification, a clear indicator of client demand for sustainable practices.

Market Demand Fluctuations by Sector

The bargaining power of customers is significantly influenced by sector-specific demand. For instance, the booming demand for warehousing and data centers, fueled by e-commerce and AI advancements, presents a more favorable environment for contractors like HITT Contracting. In 2024, the industrial and logistics construction sector continued to see robust activity, with reports indicating a substantial pipeline of new projects. This increased demand can, to some extent, temper the immediate leverage of individual clients.

Conversely, shifts like the sustained trend towards remote work have dampened demand for traditional office spaces. This can empower clients in the commercial office sector, giving them more negotiating power. While large, repeat clients across all sectors will always retain considerable influence due to the volume of business they represent, the overall market sentiment within a specific sector plays a crucial role in the customer's bargaining strength.

- Sectoral Demand Impact: E-commerce and AI growth bolster demand for warehousing and data centers, potentially reducing customer leverage in these segments.

- Remote Work Effects: Declining demand for traditional office spaces due to remote work trends increases customer bargaining power in that sector.

- Client Size Matters: While sector trends shift leverage, major clients consistently hold significant influence due to their substantial business volume.

- Market Dynamics: In 2024, the industrial construction sector showed resilience, contrasting with potential slowdowns in office construction, directly affecting customer power.

Public Sector and Regulatory Influence

The public sector's substantial spending significantly shapes the construction industry, and its standardized bidding processes and stringent regulatory demands can heavily influence contract stipulations. For instance, in 2023, government spending on infrastructure projects in the United States reached approximately $270 billion, demonstrating the immense leverage government clients possess.

Compliance with evolving environmental regulations and building codes, which are often mandated by public bodies, can introduce additional costs. Clients, particularly in the public sector, may expect contractors like HITT Contracting to absorb or minimize these expenses, directly impacting profit margins.

- Government spending on infrastructure in the US was around $270 billion in 2023.

- Public sector clients often dictate standardized bidding and strict regulatory requirements.

- Increased compliance costs for environmental and building codes can be passed to contractors.

- This regulatory environment empowers public sector customers to negotiate more favorable terms.

The bargaining power of customers for HITT Contracting is substantial, particularly with large, sophisticated clients in sectors like technology and healthcare. These clients, accustomed to significant investments, can leverage the sheer volume of business to negotiate favorable pricing and terms. For example, HITT Contracting reported in 2024 that over 70% of its revenue stemmed from repeat clients, highlighting their ability to retain business through strong relationships, which can temper direct price negotiations.

Furthermore, evolving client demands for sustainability and innovation, such as the pursuit of LEED certification which over 30% of new commercial construction projects sought in 2023, grant customers additional leverage. They can influence project specifications and potentially negotiate for better terms based on these preferences. Sectoral demand also plays a role; robust activity in industrial construction in 2024, driven by e-commerce and AI, may offer contractors some buffer against intense customer negotiation, while a weaker office construction market due to remote work trends empowers clients in that segment.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Context |

|---|---|---|

| Client Sophistication & Volume | High | Over 70% of HITT's 2024 revenue from repeat clients. Large clients have significant negotiation leverage. |

| Demand for Innovation/Sustainability | Moderate to High | Over 30% of new commercial projects pursued LEED in 2023. Clients can use these preferences to negotiate. |

| Sectoral Demand Dynamics | Varies by Sector | Robust industrial construction in 2024 vs. potential office sector weakness due to remote work. |

| Public Sector Requirements | High | US government infrastructure spending approx. $270 billion in 2023. Standardized bidding and regulations empower public clients. |

Full Version Awaits

HITT Contracting Porter's Five Forces Analysis

This preview showcases the complete HITT Contracting Porter's Five Forces analysis, offering a detailed examination of competitive forces within the construction industry. You're looking at the actual document, meaning the insightful analysis of threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and intensity of rivalry that you see here is precisely what you will receive instantly after purchase.

Rivalry Among Competitors

HITT Contracting faces significant competitive rivalry in the national construction market. As the #10 top general contractor in the U.S. in 2025, with $8.7 billion in 2024 revenue, HITT competes directly with other industry giants. Major players such as Turner, Bechtel, and Kiewit vie for the same large-scale projects, intensifying the battle for market share and project acquisition.

The construction industry, including companies like HITT Contracting, faces significant competitive rivalry stemming from the persistent shortage of skilled labor. This scarcity compels contractors to vie not just for lucrative projects but also for qualified professionals, driving up labor expenses and potentially impacting project delivery schedules.

HITT Contracting's competitive rivalry is significantly shaped by its strategic focus on high-demand sectors. By specializing in areas like telecommunications/data centers, healthcare, and hospitality, HITT has carved out a strong market position. For instance, its #1 ranking in telecommunications/data centers highlights how deep expertise in a specific, growing segment can be a powerful differentiator.

Technological Adoption as a Competitive Differentiator

The commercial construction sector is seeing a significant surge in technological adoption, with Building Information Modeling (BIM), artificial intelligence (AI), robotics, and 3D printing becoming increasingly vital. These advancements are key to boosting efficiency, cutting expenses, and improving on-site safety. Companies that proactively integrate these innovations position themselves for a distinct advantage.

HITT Contracting, for instance, leverages its commitment to technological integration to differentiate itself. By investing in and skillfully implementing these cutting-edge tools, HITT enhances project delivery, offering clients greater efficiency and superior quality outcomes. This focus on innovation directly impacts their competitive standing in a market where technological prowess is a growing differentiator.

- BIM adoption is projected to reach 70% globally by 2025, a significant increase from previous years, driving better collaboration and fewer errors.

- AI in construction is expected to grow substantially, with applications in project management and risk assessment showing particular promise for cost savings, potentially up to 10-15% on projects.

- Robotics are increasingly being deployed for tasks like bricklaying and demolition, aiming to improve speed and worker safety, with the global construction robotics market expected to reach $2.6 billion by 2027.

Pricing Pressures and Project Delays

Competitive rivalry in the construction sector, particularly for firms like HITT Contracting, is intensified by significant pricing pressures. These pressures are often exacerbated by volatile material costs and broader economic inflation, as seen in the persistent inflation rates throughout 2023 and into early 2024, impacting project bids and overall profitability.

Furthermore, the threat of project delays, frequently stemming from complications in securing project financing or unexpected economic downturns, adds another layer of complexity. For instance, rising interest rates in 2023 made financing more expensive, potentially delaying or stalling new construction starts. Contractors must therefore balance aggressive bidding with robust risk management strategies to ensure project viability and maintain healthy margins.

- Pricing Pressures: Fluctuating material costs and inflation directly impact bid competitiveness.

- Project Delays: Financing complications and economic uncertainty can lead to stalled projects.

- Profitability Focus: Contractors must manage costs and mitigate risks to maintain healthy profit margins.

- Competitive Landscape: Intense rivalry necessitates efficient operations and strategic pricing.

HITT Contracting operates within a fiercely competitive national construction market, facing off against major players like Turner, Bechtel, and Kiewit. This intense rivalry is further amplified by a persistent shortage of skilled labor, driving up costs and creating a battle for talent in addition to projects.

Technological adoption, including BIM and AI, is a key differentiator, with BIM adoption projected to reach 70% globally by 2025. Companies that effectively integrate these innovations gain a significant edge, enhancing efficiency and project quality. HITT's specialization in high-demand sectors like data centers, where it holds a #1 ranking, also sharpens its competitive stance.

| Competitor | 2024 Revenue (Est.) | Key Specializations |

|---|---|---|

| HITT Contracting | $8.7 billion | Data Centers, Healthcare, Hospitality |

| Turner Construction | $14.5 billion (2023) | Healthcare, Aviation, Sports |

| Bechtel | $30.0 billion (2023) | Infrastructure, Energy, Government |

| Kiewit | $18.5 billion (2023) | Infrastructure, Power, Oil & Gas |

SSubstitutes Threaten

Modular and prefabricated construction methods are increasingly challenging traditional building approaches. These methods can slash project timelines by as much as 50% and significantly reduce on-site labor requirements, offering a compelling alternative for developers. The efficiency and cost savings, projected to reach 20-30% in some projects by 2024, make them a serious threat to conventional construction.

The rise of advanced materials, such as self-healing concrete and graphene, alongside the growing adoption of 3D printing in construction, poses a significant threat of substitution for traditional methods. These innovations can streamline building processes and enhance material performance, potentially reducing reliance on conventional construction techniques and labor.

For instance, 3D printed concrete structures can be erected faster and with less waste compared to traditional methods, impacting project timelines and costs. In 2023, the global 3D printing construction market was valued at approximately $1.5 billion and is projected to grow substantially, indicating a clear shift towards alternative building solutions.

Clients increasingly consider renovating or adaptively reusing existing buildings instead of new construction, particularly in markets with slower demand for new builds or a strong focus on sustainability. This trend is evident as the construction industry faces evolving client priorities.

For instance, the U.S. Green Building Council reported a significant increase in LEED-certified renovations and adaptive reuse projects, highlighting a market shift. HITT Contracting effectively addresses this threat by offering a comprehensive suite of services that includes interior fit-outs and renovation projects, thereby catering to both new construction and refurbishment demands.

Digital Twin and Virtual Construction

The rise of digital twin and virtual construction technologies presents a significant threat of substitution for traditional construction methods by HITT Contracting. These advanced tools enable highly detailed simulations and optimizations of building performance, potentially lessening the reliance on physical mock-ups or extensive on-site modifications. For instance, the global digital twin market was projected to reach $12.9 billion in 2023 and is expected to grow substantially, indicating increasing adoption.

Clients can leverage these virtual environments to explore design alternatives and refine specifications before physical construction commences. This virtual iteration can reduce the need for costly changes during the actual building phase, thereby impacting the scope and traditional execution of construction projects. By 2024, the adoption of BIM (Building Information Modeling), a key enabler of digital twins, is widespread, with many projects mandating its use.

- Virtual Prototyping: Clients can virtually test and validate building designs, reducing the need for physical prototypes.

- Simulation-Driven Optimization: Digital twins allow for the simulation of various performance scenarios, leading to optimized designs that might bypass traditional construction steps.

- Reduced On-Site Adjustments: Enhanced virtual planning minimizes errors and the need for costly rework on-site, a core service in traditional contracting.

- Client Empowerment: Clients gain greater control and understanding of the construction process virtually, potentially altering their engagement with traditional contracting models.

Non-Construction Solutions to Space Needs

The threat of substitutes for traditional construction services is growing, particularly from non-construction solutions that address space needs. For instance, companies are increasingly looking at optimizing their current physical footprint. In 2024, the adoption of smart building technologies, which enhance space utilization through data analytics and automation, is a prime example of this trend. These systems can make existing spaces more efficient, potentially delaying or eliminating the need for new construction.

Furthermore, shifts in business models, such as the sustained rise of remote and hybrid work arrangements, directly impact the demand for commercial office space. A significant portion of the workforce continues to operate remotely, reducing the overall requirement for physical office square footage. This trend was particularly pronounced in 2024, with many companies re-evaluating their real estate portfolios and opting for smaller, more flexible workspaces or entirely remote operations, thereby lessening the demand for new construction projects.

- Smart Building Technology Adoption: Increased investment in IoT and AI for building management, aiming to improve space utilization efficiency by up to 20% in some commercial properties.

- Remote Work Trends: In 2024, an estimated 30% of the global workforce maintained a hybrid or fully remote work status, impacting commercial real estate demand.

- Flexible Office Solutions: Growth in co-working spaces and flexible lease agreements offers alternatives to traditional long-term construction commitments for businesses needing space.

The threat of substitutes for traditional construction methods is significant, driven by innovations like modular construction, advanced materials, and 3D printing. These alternatives offer faster timelines and cost savings, with modular construction potentially reducing project duration by up to 50% and cost by 20-30% by 2024. The growing adoption of digital twins and virtual construction further enhances design optimization and reduces on-site modifications, impacting traditional project execution.

Furthermore, adaptive reuse of existing buildings and the rise of smart building technologies that optimize space utilization present non-construction alternatives. The sustained trend of remote and hybrid work arrangements in 2024, with an estimated 30% of the global workforce operating remotely, directly reduces demand for new commercial office construction. Flexible office solutions and co-working spaces also offer alternatives to traditional building commitments.

Entrants Threaten

Entering the national commercial construction market, especially to go head-to-head with established players like HITT Contracting, demands a significant upfront investment. Think about the costs for state-of-the-art equipment, cutting-edge technology, and building a solid operational framework. These initial outlays create a substantial barrier for newcomers.

The sheer size of projects HITT handles presents another hurdle. With HITT reporting an impressive $8.7 billion in revenue for 2024, their capacity to take on massive undertakings means new entrants struggle to even bid on these large-scale opportunities, let alone win them. This scale requirement effectively locks out smaller, less capitalized competitors.

The construction industry, including sectors where HITT Contracting operates, faces a pronounced shortage of skilled labor. This scarcity makes it exceptionally difficult for new companies to enter the market and build a competent team. For instance, in 2024, the Associated General Contractors of America reported that a significant majority of construction firms struggled to find qualified workers, a trend that directly hinders new entrants.

HITT Contracting's 85-year legacy has cultivated deeply ingrained client relationships and a sterling reputation for quality. This extensive history fosters unwavering trust, a significant barrier for newcomers. New entrants struggle to replicate this established credibility, finding it challenging to secure major projects or build a dependable network of clients and partners.

Complex Regulatory Environment and Compliance Costs

The commercial construction sector, including companies like HITT Contracting, grapples with a complex and constantly changing web of regulations. These rules cover everything from worker safety and environmental protection to intricate building codes. For instance, in 2024, the Occupational Safety and Health Administration (OSHA) continued to enforce strict safety standards, with penalties for violations potentially reaching tens of thousands of dollars per incident.

New businesses entering this market face substantial compliance costs. They must invest heavily in understanding and adhering to these legal frameworks. This includes obtaining various permits, ensuring materials meet specific standards, and implementing rigorous safety protocols. A 2023 report indicated that compliance costs can represent as much as 5-10% of a project's total budget for smaller firms.

- Regulatory Hurdles: Navigating evolving safety, environmental, and building codes presents a significant barrier to entry.

- High Compliance Costs: New entrants must allocate substantial capital to meet regulatory requirements, impacting initial profitability.

- Legal Framework Complexity: Understanding and adhering to intricate legal and permitting processes requires specialized knowledge and resources.

- Enforcement and Penalties: Non-compliance can lead to severe financial penalties, further deterring new market participants.

Access to Supply Chains and Subcontractor Networks

Established players in the construction sector, including HITT Contracting, have cultivated deep-rooted relationships with suppliers and subcontractors over many years. These existing networks are vital for ensuring consistent material availability and securing specialized labor, which are crucial for maintaining project timelines and quality. For instance, in 2024, the construction industry continued to grapple with supply chain disruptions, making these established relationships even more valuable for firms like HITT that could rely on their trusted partners.

New entrants face a significant hurdle in replicating these established supply chain and subcontractor networks. Building trust and securing preferential terms from suppliers and subcontractors, especially during times of high demand or material scarcity, requires considerable time and proven performance. Without these established connections, new firms may experience higher material costs and longer lead times, impacting their competitiveness.

The difficulty in accessing reliable and cost-effective supply chains and subcontractor networks acts as a substantial barrier. For example, in 2024, the cost of key construction materials like lumber and steel saw significant fluctuations, underscoring the advantage of firms with pre-existing, favorable supply agreements. New companies would struggle to match these terms, potentially facing:

- Higher material procurement costs

- Limited access to specialized subcontractors

- Increased project delivery risks due to unreliable supply

- Challenges in negotiating favorable payment terms

The threat of new entrants for HITT Contracting is moderate. While the industry requires significant capital for equipment and technology, and skilled labor shortages persist, established relationships and regulatory complexity pose substantial barriers. New companies struggle to match the scale, reputation, and established supply chains of firms like HITT.

HITT's substantial revenue of $8.7 billion in 2024 highlights its market dominance, making it difficult for new entrants to compete on project size. The scarcity of skilled labor, as noted by the Associated General Contractors of America in 2024, further complicates new company formation. Additionally, navigating stringent regulations, such as OSHA's safety standards, incurs high compliance costs for newcomers, potentially reaching 5-10% of a project's budget as reported in 2023.

Established supply chain relationships are critical, especially with material costs fluctuating in 2024. New firms face challenges in securing favorable terms for materials like lumber and steel, leading to higher procurement costs and increased project risks. These factors collectively limit the ease with which new competitors can effectively enter and challenge established players like HITT Contracting.

| Barrier | Impact on New Entrants | HITT Contracting Advantage |

|---|---|---|

| Capital Investment | High initial costs for equipment and technology | Established financial resources and economies of scale |

| Skilled Labor Shortage | Difficulty in building a competent workforce | Stronger recruitment and retention capabilities |

| Client Relationships & Reputation | Challenging to build trust and secure projects | 85-year legacy fostering deep client loyalty |

| Regulatory Compliance | Significant costs and complexity in adhering to codes | Experienced legal and compliance teams |

| Supply Chain & Subcontractor Networks | Higher material costs and unreliable access | Long-standing, trusted supplier and subcontractor relationships |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for HITT Contracting is built upon a foundation of reliable data, including industry-specific market research reports, HITT's publicly available financial statements and annual reports, and insights from construction trade publications.