Herbalife SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Herbalife Bundle

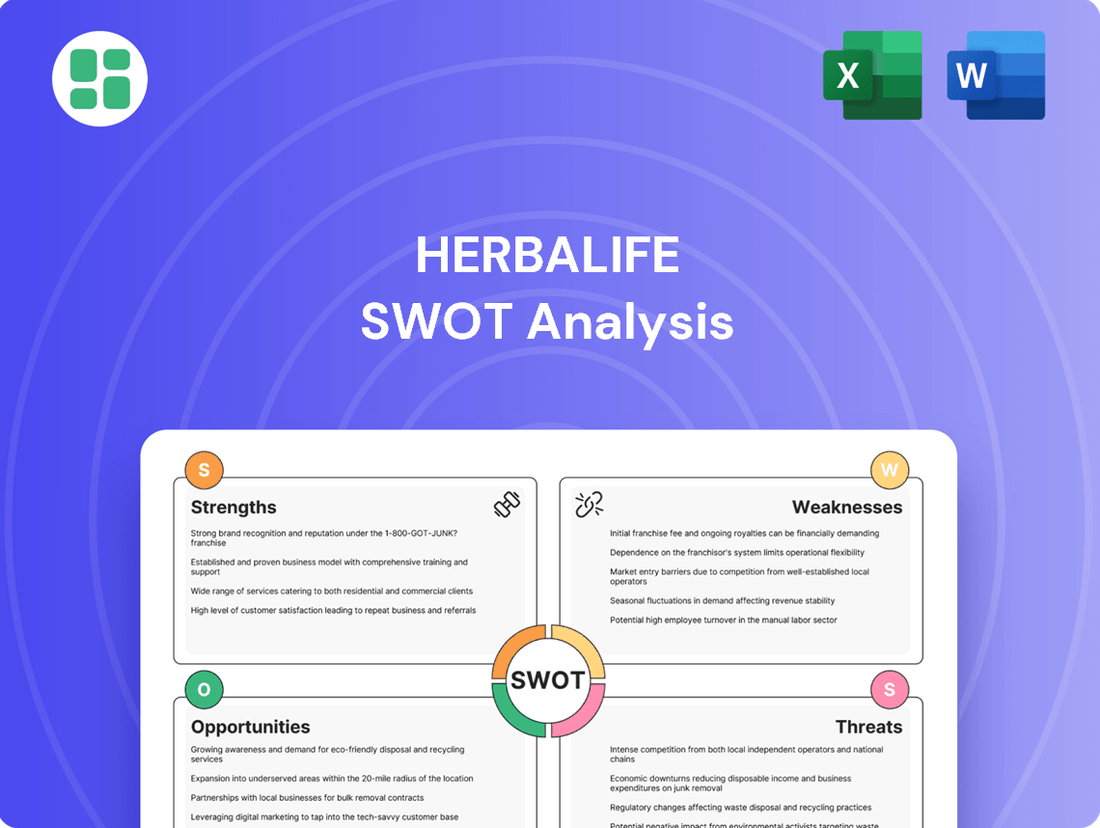

Herbalife's SWOT analysis reveals a strong brand recognition and a vast global network, but also highlights challenges like regulatory scrutiny and reliance on direct selling models. Understanding these dynamics is crucial for anyone looking to invest or compete in the wellness industry.

Want the full story behind Herbalife’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Herbalife's strength lies in its expansive global distribution network, reaching over 90 countries through independent distributors. This vast reach facilitates deep market penetration and supports a direct-to-consumer sales approach, minimizing traditional retail costs and cultivating strong customer connections. In 2023, Herbalife reported net sales of $3.05 billion, underscoring the efficacy of this widespread distribution model.

Herbalife boasts a diverse product portfolio encompassing dietary supplements, weight management aids, sports nutrition, and personal care items. This wide array of science-backed offerings addresses a spectrum of health and wellness needs, aligning with shifting consumer demands for options like plant-based and customized nutrition. For instance, in 2023, the company continued to emphasize its nutrition and weight management segments, which historically represent the largest portions of its revenue.

Herbalife boasts significant brand recognition and a deeply ingrained customer loyalty built over decades. This strong brand equity translates into trust and consistent repeat business, a crucial advantage in the competitive wellness sector.

Globally, Herbalife is recognized as a leading brand, particularly for weight management solutions and health shakes. This established market position, reinforced by its long operational history, provides a solid foundation for continued sales and customer engagement, with the company reporting net sales of $3.4 billion for the full year 2023.

Direct-to-Consumer Engagement

Herbalife's direct-to-consumer (DTC) model is a significant strength, leveraging its network of independent distributors. These distributors act as personal coaches, building strong relationships and fostering community. This direct engagement allows for highly personalized product recommendations and a more intimate customer experience, which is crucial for retention.

This approach translates into tangible results. For instance, in the first quarter of 2024, Herbalife reported a 1.7% increase in net sales to $1.34 billion, demonstrating the continued effectiveness of its distributor-led sales strategy. The emphasis on personalized support and community building is a key driver of customer loyalty in the competitive wellness market.

Key aspects of this DTC engagement include:

- Personalized Coaching: Distributors offer tailored advice and support, enhancing the customer journey.

- Community Building: The model fosters a sense of belonging and shared experience among customers.

- Customer Loyalty: Direct relationships and personalized service lead to higher retention rates.

- Brand Advocacy: Satisfied customers often become brand advocates, further driving sales.

Income Opportunity for Distributors

Herbalife's compensation plan offers a compelling income opportunity, allowing distributors to earn by selling products and building their own sales teams. This flexible model appeals to a wide range of individuals looking for entrepreneurial pursuits.

The company consistently attracts new members to its global sales force. For instance, in 2023, Herbalife reported a notable increase in new distributor recruitment, underscoring the model's enduring appeal and the perceived potential for financial growth among its participants.

- Flexible Income Generation: Distributors can earn through direct product sales and by sponsoring new members, creating multiple revenue streams.

- Global Reach and Recruitment: Herbalife's established international presence facilitates widespread recruitment, with significant growth in new distributors observed annually.

- Entrepreneurial Appeal: The business model empowers individuals to be their own bosses, setting their own hours and building a business at their own pace.

- Incentives and Recognition: The compensation structure often includes incentives, bonuses, and recognition programs that further motivate distributors and encourage performance.

Herbalife's extensive global distribution network, operating in over 90 countries through independent distributors, is a cornerstone of its success. This expansive reach allows for deep market penetration and a cost-effective direct-to-consumer sales model, fostering strong customer relationships. The company's net sales reached $3.05 billion in 2023, a testament to the effectiveness of this widespread model.

The company offers a broad product range, including supplements, weight management, sports nutrition, and personal care items. This diverse, science-backed portfolio caters to evolving consumer preferences for options like plant-based and personalized nutrition, with weight management and nutrition segments remaining key revenue drivers in 2023.

Herbalife benefits from significant brand recognition and high customer loyalty, cultivated over many years. This strong brand equity builds trust and encourages repeat purchases, a vital advantage in the competitive wellness industry.

Herbalife's direct-to-consumer model, powered by its independent distributors, emphasizes personalized coaching and community building. This direct engagement fosters strong customer relationships, leading to higher retention rates. In the first quarter of 2024, net sales increased by 1.7% to $1.34 billion, highlighting the ongoing effectiveness of this distributor-led strategy.

The compensation plan provides a strong incentive for distributors, offering income opportunities through sales and team building. This flexible model attracts individuals seeking entrepreneurial ventures, with notable growth in new distributor recruitment observed in 2023.

| Strength | Description | Supporting Data |

| Global Distribution Network | Vast reach across 90+ countries via independent distributors. | Net sales of $3.05 billion in 2023. |

| Diverse Product Portfolio | Wide range of science-backed health and wellness products. | Continued emphasis on nutrition and weight management in 2023. |

| Brand Recognition & Loyalty | Strong, established brand with high customer retention. | Consistent repeat business in the competitive wellness sector. |

| Direct-to-Consumer Model | Leverages distributors for personalized coaching and community. | 1.7% net sales increase to $1.34 billion in Q1 2024. |

| Attractive Compensation Plan | Offers income potential through sales and team building. | Notable increase in new distributor recruitment in 2023. |

What is included in the product

Delivers a strategic overview of Herbalife’s internal and external business factors, highlighting its brand recognition and distribution network while acknowledging regulatory scrutiny and competitive pressures.

Identifies key vulnerabilities and competitive threats, enabling proactive risk mitigation and strategic adjustments.

Weaknesses

Herbalife's reliance on its multi-level marketing (MLM) structure presents a significant weakness. This model frequently attracts intense regulatory scrutiny and faces negative public perception, often being equated with pyramid schemes. For instance, in 2023, Herbalife settled with the U.S. Federal Trade Commission (FTC) for $123 million, agreeing to revise its business practices to ensure it was not operating as a pyramid scheme.

The multi-level marketing structure, while offering opportunities, often sees a high turnover of distributors. Many individuals join with the expectation of substantial earnings but find it challenging to achieve consistent income or build a lasting business, leading them to leave the program.

This constant churn means Herbalife must continually invest in recruiting new members and providing them with training and support. For instance, in 2023, the company's global distributor count saw fluctuations, underscoring the ongoing need for robust recruitment strategies to counteract attrition.

Herbalife has grappled with persistent negative public perception stemming from its multi-level marketing model, leading to numerous legal challenges. For instance, in 2016, the company settled with the U.S. Federal Trade Commission (FTC) for $200 million and agreed to significant business practice changes to resolve allegations of deceptive earnings claims. This historical scrutiny continues to cast a shadow, impacting its ability to attract new distributors and retain customers who may be wary of the company's past legal entanglements.

Product Pricing and Accessibility

Herbalife's product pricing can be a significant hurdle, often appearing higher than comparable items found in traditional retail environments. This premium pricing strategy might deter budget-conscious shoppers, potentially hindering broader market adoption, especially among those new to the brand or seeking more economical health solutions.

The direct selling model, while fostering personal customer relationships, doesn't always translate into competitive pricing or the instant availability that consumers expect from brick-and-mortar stores or e-commerce giants. For instance, while Herbalife reported net sales of $1.46 billion in the first quarter of 2024, its direct-to-consumer model means pricing is set by distributors, leading to variations and potentially higher perceived costs compared to mass-market alternatives.

- Perceived High Cost: Competitors often offer similar nutritional products at lower price points, impacting Herbalife's appeal to price-sensitive demographics.

- Direct Selling Price Inflexibility: Unlike traditional retail, pricing is influenced by distributor markups, potentially increasing the final cost to the consumer.

- Accessibility Challenges: The reliance on distributors can mean less immediate product availability compared to readily accessible retail channels.

Dependence on Distributor Effectiveness and Ethics

Herbalife's reliance on its independent distributors presents a significant weakness. The quality of customer interaction, product representation, and adherence to ethical guidelines can vary greatly from one distributor to another. This inconsistency can directly affect the company's brand perception and customer trust.

Misconduct or misrepresentation by distributors can lead to serious regulatory scrutiny and damage Herbalife's reputation. For instance, in 2023, the company continued to face scrutiny regarding its business practices, a common challenge for direct-selling models. This necessitates substantial investment in comprehensive training and continuous monitoring to ensure compliance and maintain brand integrity.

- Variable Distributor Performance: The effectiveness of sales and customer engagement is directly tied to the skills and ethics of individual distributors, leading to inconsistent customer experiences.

- Reputational Risk: Distributor misconduct, such as making unsubstantiated claims or engaging in unethical sales tactics, can severely damage Herbalife's brand image and lead to public backlash.

- Regulatory Compliance Challenges: Ensuring thousands of independent distributors adhere to all relevant consumer protection laws and marketing regulations is a complex and ongoing task, with potential for fines and legal action.

- Brand Dilution: Inconsistent product messaging and service quality across a vast network of distributors can dilute the overall brand message and weaken its market position.

Herbalife's dependence on its multi-level marketing (MLM) structure continues to be a significant weakness, attracting ongoing regulatory scrutiny and negative public perception. The company settled with the U.S. Federal Trade Commission (FTC) in 2023 for $123 million, necessitating revisions to its business practices to avoid being classified as a pyramid scheme.

The MLM model often experiences high distributor turnover, as many individuals struggle to achieve consistent income, leading to a constant need for recruitment and training. For example, in Q1 2024, Herbalife's net sales were $1.46 billion, but the direct selling model means pricing is set by distributors, potentially increasing costs compared to mass-market alternatives.

The performance and ethical conduct of independent distributors can vary widely, impacting customer experience and brand trust. Distributor misconduct, such as making unsubstantiated claims, poses a reputational risk, as seen in past FTC settlements like the $200 million agreement in 2016. Ensuring compliance across a vast network remains a complex challenge.

Herbalife's product pricing is often perceived as high compared to similar items in traditional retail, potentially deterring price-sensitive consumers. This direct-selling approach can also lead to less immediate product availability than consumers expect from readily accessible retail channels.

Same Document Delivered

Herbalife SWOT Analysis

This is the same Herbalife SWOT analysis document included in your download. The full content is unlocked after payment, providing a comprehensive overview of the company's strategic position.

Opportunities

Herbalife has a substantial opportunity to expand into emerging markets, which are experiencing rapid growth. Regions like Southeast Asia, Africa, and Latin America are showing increased internet penetration and a growing middle class, creating a fertile ground for new distributor recruitment and customer acquisition. For instance, in 2024, the global direct selling market, which includes companies like Herbalife, was projected to continue its upward trajectory, with emerging economies being key drivers of this growth.

Herbalife can significantly expand its market presence and operational efficiency by embracing digital transformation. Leveraging advanced platforms and AI tools can improve product accessibility and streamline how distributors manage their businesses, ultimately enhancing customer interaction.

Focusing on mobile-first strategies and social selling, alongside automated support systems, is crucial for boosting efficiency and driving sales growth. For instance, in 2023, Herbalife reported that its digital engagement initiatives contributed to a noticeable increase in distributor activity and customer retention rates.

Herbalife can capitalize on its opportunity for product innovation by developing specialized offerings in booming sectors such as plant-based nutrition and personalized wellness. For instance, the global plant-based food market was valued at approximately $22.9 billion in 2023 and is projected to grow significantly, offering a ripe area for new product lines.

Introducing subscription models for its existing and new products presents a strategic avenue to foster customer loyalty and generate predictable, recurring revenue. Companies that effectively implement subscription services often see increased customer lifetime value, with some subscription businesses reporting retention rates upwards of 70% after the first year.

Capitalizing on Health and Wellness Trends

The global health and wellness market is experiencing robust growth, with preventative care and active nutrition products seeing particularly strong demand. This trend offers a significant opportunity for Herbalife to expand its market reach by further integrating these principles into its product development and marketing strategies. For instance, the global wellness market was valued at approximately $5.6 trillion in 2023 and is projected to reach $8.5 trillion by 2027, indicating a substantial runway for growth. Herbalife can capitalize on this by emphasizing sustainable sourcing and ethical ingredient practices, appealing to an increasingly discerning and health-conscious consumer base.

Herbalife is well-positioned to benefit from the increasing consumer focus on holistic well-being. The company's existing product portfolio, centered around nutrition and weight management, directly addresses key segments of the health and wellness industry.

- Growing Demand: The global health and wellness sector is expanding rapidly, driven by increased consumer awareness of preventative care and active lifestyles.

- Product Alignment: Herbalife's core offerings in nutrition and weight management align perfectly with these burgeoning market trends.

- Ethical Sourcing: Emphasizing sustainable and ethically sourced ingredients can further attract and retain a health-conscious demographic.

- Market Expansion: This trend provides a clear avenue for Herbalife to broaden its customer base and enhance brand loyalty.

Enhanced Distributor Support and Training

Herbalife has a significant opportunity to bolster its distributor network by investing in advanced training and support systems. Imagine equipping distributors with cutting-edge tools like virtual reality simulations for product demonstrations or AI-powered coaching to refine their sales techniques. This kind of investment, seen in the broader direct selling industry which saw global retail sales reach an estimated $197.8 billion in 2023 according to the World Federation of Direct Selling Associations, could dramatically boost distributor retention and overall sales effectiveness.

By enhancing community-building efforts and offering data-driven insights, Herbalife can empower its independent distributors to achieve greater success. This includes providing them with personalized performance analytics and strategies tailored to their specific markets. For instance, equipping distributors with real-time market trend data can help them adapt their product offerings and marketing messages more effectively, mirroring the data-centric approaches that drive success in other sales-focused industries.

- Invest in advanced training: Explore virtual reality and AI-powered coaching for enhanced distributor skills.

- Boost retention and productivity: Improved training directly correlates with higher distributor engagement and sales performance.

- Strengthen community: Foster a supportive network through enhanced communication and shared success strategies.

- Leverage data insights: Provide distributors with actionable data to optimize their sales efforts and market approach.

Herbalife can tap into the growing demand for personalized nutrition and wellness solutions. The company's ability to offer tailored product recommendations based on individual health goals and preferences presents a significant growth opportunity. For example, the global personalized nutrition market was estimated to be worth $16.4 billion in 2023 and is projected to expand considerably in the coming years.

Expanding its digital footprint and leveraging data analytics can further enhance customer engagement and operational efficiency. By optimizing its online platforms and utilizing AI-driven insights, Herbalife can better understand consumer needs and deliver more targeted marketing campaigns. In 2023, companies that invested in digital transformation saw an average increase of 15% in customer retention.

The company has a prime opportunity to innovate its product portfolio, focusing on emerging health trends like plant-based diets and functional foods. The plant-based food market alone was valued at approximately $22.9 billion in 2023, signaling strong consumer interest. Introducing new, science-backed products in these areas can attract a wider customer base and solidify its market position.

Furthermore, strengthening its distributor network through enhanced training and digital tools offers a clear path to increased sales and market penetration. Investing in advanced sales enablement technologies can empower distributors, leading to greater productivity and loyalty. The direct selling industry's global retail sales reached an estimated $197.8 billion in 2023, highlighting the potential of a well-supported distributor force.

Threats

Herbalife navigates a landscape of intense regulatory scrutiny, with its multi-level marketing (MLM) model and income claims frequently under review globally. For instance, the U.S. Federal Trade Commission (FTC) has previously investigated and imposed consent orders on similar companies, and proposed new rules could further tighten oversight. Should new regulations be enacted or existing ones enforced more stringently, Herbalife might face substantial operational adjustments and increased compliance costs, potentially affecting its core business strategies.

Negative media and social media campaigns pose a significant threat to Herbalife. The swift dissemination of critical content regarding multi-level marketing (MLM) structures and historical issues can rapidly tarnish the brand's reputation, undermining both consumer and distributor confidence. This erosion of trust directly impacts sales volume and the ability to attract new distributors, as seen in past instances where negative press led to noticeable dips in recruitment numbers.

Herbalife contends with fierce competition from multiple fronts. Beyond rival direct selling firms, it faces pressure from major retailers like Walmart and Amazon, which offer comparable health and wellness products. These established players often leverage economies of scale for competitive pricing, directly impacting Herbalife's market position and its ability to attract new distributors by offering potentially more lucrative or stable income streams.

Economic Downturns and Discretionary Spending

Global economic slowdowns pose a significant threat to Herbalife. As economies contract, consumers tend to cut back on non-essential purchases, and premium nutritional supplements often fall into this category. This directly impacts sales volumes, particularly for higher-priced product lines.

Furthermore, periods of economic instability can diminish the appeal of the direct selling business model. Potential distributors might be less inclined to join or remain active when job security is uncertain or when their own personal finances are strained, creating hurdles for recruitment and retention efforts.

- Reduced Discretionary Spending: In 2024, global consumer confidence indexes in many major markets showed volatility, suggesting a cautious spending environment that could impact discretionary purchases like Herbalife products. For instance, the Conference Board Consumer Confidence Index experienced fluctuations throughout the year, reflecting economic anxieties.

- Impact on Entrepreneurial Opportunity: Economic uncertainty can lead to a decline in new distributor sign-ups. In 2024, reports from various direct selling associations indicated slower growth rates in distributor numbers compared to previous years, a trend often linked to broader economic conditions.

- Potential for Lower Average Order Value: Even loyal customers may reduce their purchase frequency or opt for lower-priced alternatives during economic downturns, leading to a decrease in the average order value per customer.

Changing Consumer Preferences and Demographics

Shifting consumer preferences present a significant challenge for Herbalife. There's a growing demand for transparency in ingredients and sourcing, with many consumers seeking clean label and non-GMO products. This could make Herbalife's complex product formulations and multi-level marketing (MLM) structure less appealing to a segment of the market that prefers simpler, more direct business models.

Younger generations, particularly Gen Z, are also influencing market trends. They often prioritize sustainability and expect brands to communicate digitally and authentically. Herbalife's reliance on traditional sales methods and its established product lines may need substantial updates to resonate with these digitally native consumers who are increasingly vocal about environmental and social responsibility.

For example, a 2024 survey indicated that over 60% of Gen Z consumers consider a brand's sustainability practices when making purchasing decisions. Furthermore, the preference for "clean label" products, meaning fewer artificial ingredients and simpler ingredient lists, continues to gain traction across all age groups, impacting the nutritional supplement market significantly.

- Transparency Demand: Consumers increasingly scrutinize ingredient lists and sourcing practices.

- Dietary Philosophies: Growth in clean eating, non-GMO, and plant-based trends requires product adaptation.

- Gen Z Influence: Younger consumers prioritize sustainability and digital-first brand interactions.

- Model Simplicity: A preference for less complex business models could challenge Herbalife's MLM structure.

The evolving regulatory landscape presents a persistent threat to Herbalife's operational model. Increased scrutiny of multi-level marketing (MLM) practices, particularly concerning income claims and distributor compensation, could lead to stricter enforcement actions or new legislation. For instance, ongoing discussions around consumer protection in direct selling could result in compliance burdens that impact profitability. Potential changes in how MLM businesses are classified or regulated globally could necessitate significant adjustments to Herbalife's core strategies and revenue streams.

Negative publicity and social media sentiment continue to be a significant risk. Past controversies and ongoing criticisms of the MLM model can quickly erode brand trust and deter both consumers and potential distributors. In 2024, social media platforms saw continued discussions and critiques of direct selling, impacting brand perception. This can lead to decreased sales and recruitment challenges, as seen in periods where negative sentiment correlated with lower distributor acquisition rates.

Intense competition from both direct selling rivals and traditional retail channels poses a substantial threat. Companies like Amway and Nu Skin, along with major retailers such as Amazon and Walmart, offer similar health and wellness products, often at competitive price points. This broad competitive set can dilute market share and make it harder for Herbalife to attract and retain distributors, especially when alternative income opportunities are perceived as more stable or lucrative.

Economic downturns and reduced consumer discretionary spending directly impact sales. During periods of economic uncertainty, consumers often cut back on non-essential purchases, including premium supplements. For example, in late 2024, many regions experienced inflationary pressures which led to cautious consumer spending. This can result in lower sales volumes and a decrease in the average order value per customer, affecting overall revenue.

Shifting consumer preferences towards transparency, clean ingredients, and sustainability present a challenge. Consumers, particularly younger demographics like Gen Z, increasingly favor brands with clear ingredient sourcing and ethical practices. A 2024 Nielsen report indicated that over 55% of consumers are willing to pay more for products from sustainable brands. Herbalife's product formulations and business model may need to adapt to meet these evolving demands.

SWOT Analysis Data Sources

This Herbalife SWOT analysis is built upon a foundation of robust data, including publicly available financial statements, comprehensive market research reports, and expert industry commentary to ensure a well-rounded and accurate assessment.