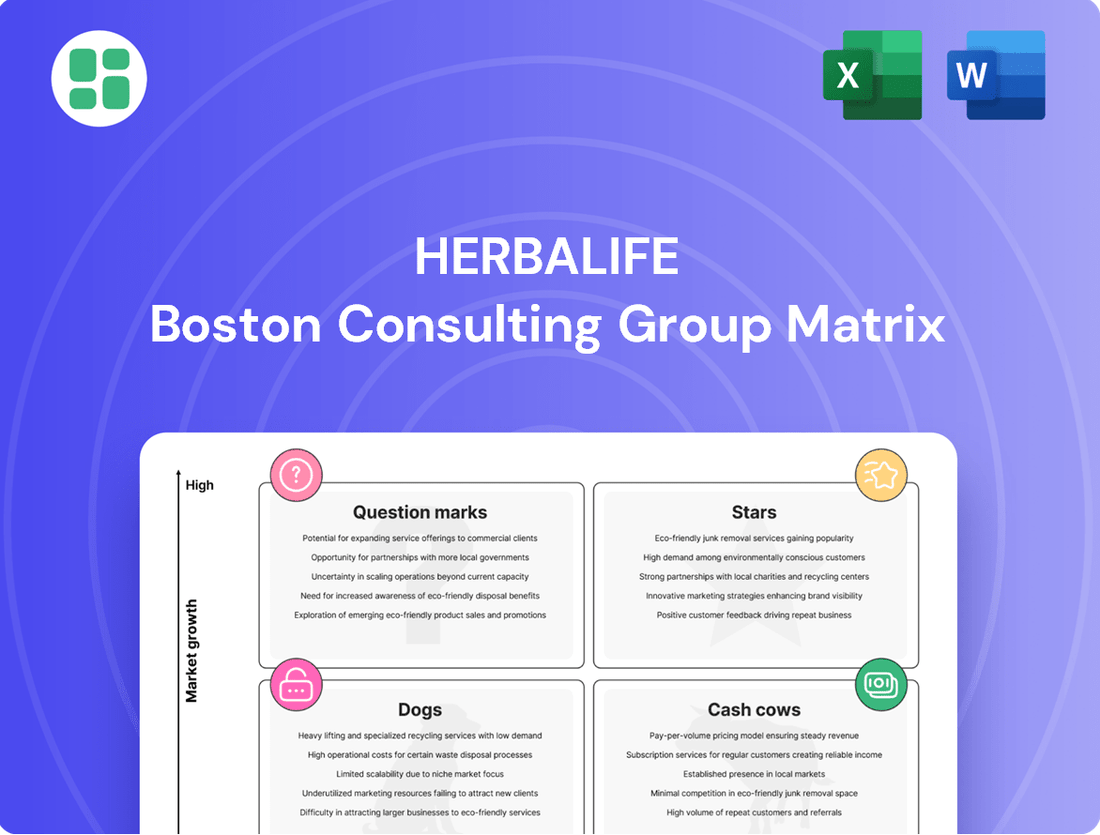

Herbalife Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Herbalife Bundle

Curious about Herbalife's product portfolio performance? Our BCG Matrix analysis reveals which products are driving growth, which are stable earners, and which might be lagging. Understand their market share and growth potential at a glance.

Unlock the full strategic picture by purchasing the complete Herbalife BCG Matrix. Gain detailed quadrant placements, actionable insights for each product category, and a clear roadmap for optimizing your investment and resource allocation.

Don't miss out on critical strategic intelligence. The full BCG Matrix provides the in-depth analysis you need to make informed decisions about Herbalife's product lines, ensuring you capitalize on opportunities and mitigate risks effectively.

Stars

Herbalife's July 2025 launch of MultiBurn™ signals a strategic move into the high-growth weight management sector. This new supplement leverages clinically studied botanical extracts, aiming for a significant market impact by offering a non-pharmaceutical solution.

The introduction of MultiBurn™ underscores Herbalife's commitment to innovation, catering to contemporary consumer preferences for natural and effective weight management tools. This launch is expected to bolster their product portfolio in a segment experiencing robust expansion.

Herbalife's strategic pivot towards personalized nutrition is clearly demonstrated by the beta launch of its Pro2col digital platform and the early 2025 acquisition of Link BioSciences. This move positions them to capitalize on a high-growth market by using biometrics and AI to craft bespoke supplement regimens.

This focus on tailored health solutions aims to significantly boost customer engagement and lifetime value. For instance, the global personalized nutrition market was valued at approximately $11.4 billion in 2023 and is projected to reach $35.5 billion by 2030, growing at a CAGR of 17.6%.

These technology-driven advancements are crucial for Herbalife to secure future market leadership in an increasingly health-conscious world. By integrating data and AI, they are creating a more sticky customer experience.

Latin America is truly shining for Herbalife, showing impressive strength. In the second quarter of 2025, the region saw a solid 9% growth in sales when measured in local currency. This consistent upward trend in both volume and sales highlights Herbalife's strong footing in this dynamic market.

What’s particularly exciting is the surge in new distributors joining Herbalife in Latin America, which jumped by a significant 16%. This robust expansion in the sales force points to a healthy and growing network, reinforcing the region's status as a key performer and a star in Herbalife's global operations.

Herbalife24 Sports Nutrition Expansion

Herbalife24 Sports Nutrition Expansion is a key growth driver for Herbalife, poised to capture increasing market share in the rapidly expanding global sports nutrition sector. This strategic focus leverages the strong demand for performance-enhancing products, positioning Herbalife24 as a potential market leader.

The global sports nutrition market is projected to reach approximately $82.5 billion by 2028, growing at a compound annual growth rate (CAGR) of 8.9% from 2021 to 2028. Herbalife's investment in product innovation and geographic reach for its Herbalife24 line directly targets this lucrative market.

- Market Growth: The sports nutrition market is experiencing robust expansion, driven by increasing health consciousness and demand for specialized dietary supplements.

- Herbalife24 Focus: The Herbalife24 product line is central to the company's strategy to capitalize on this growth through targeted product development and market penetration.

- Expansion Strategy: Both portfolio expansion, introducing new formulations and product types, and geographic expansion into emerging markets are critical components of this growth plan.

- Investment Rationale: Significant investment in this category is justified by the high growth potential and Herbalife's aim to establish a dominant position in the sports nutrition segment.

Award-Winning Product Innovations

Herbalife's commitment to innovation is evident in its award-winning product launches. The F1 Shake Mix Café Latte, introduced in 2024, secured the prestigious Product of the Year 2025 award in Indonesia. This recognition highlights its exceptional consumer appeal, driven by its appealing flavor and robust nutritional content.

This success underscores Herbalife's ability to innovate within its established product categories, translating into significant market traction. The Café Latte variant quickly resonated with consumers, solidifying its position as a popular choice and contributing to a high market share within a rapidly expanding regional market segment.

- Product Innovation: F1 Shake Mix Café Latte, launched in 2024.

- Award Recognition: Product of the Year 2025 in Indonesia.

- Market Impact: Rapid consumer adoption and favorite status due to flavor and nutrition.

- Strategic Significance: Demonstrates strong market acceptance and innovation in a core product line, boosting market share in a growing regional segment.

Herbalife's F1 Shake Mix Café Latte, launched in 2024, won Product of the Year 2025 in Indonesia. This award highlights its strong consumer appeal, driven by its flavor and nutritional profile. The product's rapid adoption demonstrates Herbalife's innovation in core categories, boosting market share in a growing regional segment.

What is included in the product

The Herbalife BCG Matrix analyzes its product portfolio by categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

The Herbalife BCG Matrix offers a clear, one-page overview, relieving the pain of complex business unit analysis.

This export-ready design simplifies PowerPoint integration, easing the burden of presentation preparation.

Cash Cows

Herbalife's Core Weight Management Shakes, notably the Formula 1 line with its popular French Vanilla and Dutch Chocolate options, remain powerful cash cows for the company. These foundational products consistently generate significant revenue, underscoring their enduring appeal and market penetration.

The weight management sector, where Formula 1 plays a pivotal role, was a powerhouse in 2023, accounting for more than 55% of Herbalife's overall revenue. This substantial contribution highlights the product's dominance and consistent consumer demand.

These shakes are prime examples of cash cows because they generate robust cash flow with minimal need for extensive promotional spending. Their established market presence and strong brand recognition mean they require less investment to maintain their high sales volume.

Herbalife's established global distributor network functions as a classic Cash Cow within the BCG Matrix. This extensive network of independent distributors worldwide provides a stable and reliable channel for product distribution and sales, consistently generating income. For instance, in 2023, Herbalife reported net sales of $3.05 billion, a significant portion of which is directly attributable to this established network.

This mature network, cultivated over decades, demands minimal new investment to sustain its operations, especially when contrasted with the cost of building entirely new distribution channels. It represents a core asset that underpins a steady and predictable revenue stream for the company, allowing for capital allocation to other strategic areas.

Foundational Daily Nutrition Supplements, like Herbalife's core vitamin and mineral offerings, are firmly positioned as Cash Cows. These products are the bedrock of consistent revenue, tapping into the enduring demand for basic wellness. In 2024, the global dietary supplements market was valued at over $170 billion, a testament to the stable and predictable nature of this segment, which Herbalife leverages effectively.

Mature Market Operations (e.g., North America)

Mature markets like North America represent Herbalife's established stronghold, offering a substantial and reliable revenue stream. While growth might not be explosive, these regions benefit from deep customer loyalty and extensive market penetration, ensuring consistent profitability.

Herbalife's operations in North America, for instance, have historically been a bedrock of its financial performance. In 2024, despite evolving consumer preferences and increased competition, these established markets continued to contribute significantly to the company's overall sales volume, demonstrating resilience.

- Stable Revenue Base: North America provides a consistent and predictable income source, crucial for overall financial stability.

- Deep Market Penetration: Years of operation have resulted in widespread brand recognition and a substantial customer base.

- Focus on Efficiency: Strategies in these mature markets emphasize optimizing existing operations and maintaining market share rather than pursuing rapid expansion.

- Loyal Customer Segment: A core group of long-term distributors and customers ensures ongoing demand and sales.

Efficient Global Supply Chain

Herbalife's efficient global supply chain is a significant driver of its Cash Cow status. The company consistently invests in streamlining its operations, which is crucial for its worldwide reach. This focus on efficiency directly translates into reduced operational costs and improved product availability, bolstering profit margins.

This operational excellence is key to Herbalife's ability to generate substantial cash. By ensuring products reach consumers reliably and cost-effectively across its extensive distribution network, the supply chain underpins the high profitability characteristic of a Cash Cow.

- Supply Chain Investment: Herbalife's ongoing commitment to supply chain optimization supports its global expansion strategy.

- Cost Reduction: Operational efficiencies achieved through supply chain management contribute to higher profit margins.

- Product Accessibility: An efficient supply chain ensures consistent product availability for Herbalife's distributors and customers worldwide.

- Profitability Driver: The supply chain's effectiveness is a critical factor in generating the strong cash flows associated with a Cash Cow business unit.

Herbalife's core weight management shakes, like Formula 1, are prime cash cows due to their consistent high sales and minimal investment needs. These products, which formed over 55% of revenue in 2023, generate substantial cash flow, requiring less promotional spending due to their established brand loyalty.

The company's extensive global distributor network is another cash cow, providing a stable sales channel. This mature network, responsible for a significant portion of Herbalife's $3.05 billion in net sales in 2023, requires little new investment to maintain its reliable income stream.

Foundational daily nutrition supplements also act as cash cows, tapping into the stable global dietary supplements market, valued at over $170 billion in 2024. These products offer consistent revenue, leveraging the enduring demand for basic wellness products.

Mature markets, particularly North America, represent established cash cows for Herbalife. Despite evolving preferences, these regions maintained significant sales contributions in 2024 due to deep customer loyalty and market penetration, ensuring consistent profitability.

| Product Category | BCG Matrix Status | Key Financial Indicator | Supporting Data Point |

| Weight Management Shakes (e.g., Formula 1) | Cash Cow | High Revenue Contribution | Accounted for >55% of 2023 revenue |

| Global Distributor Network | Cash Cow | Stable Sales Channel | Contributed to $3.05 billion net sales in 2023 |

| Foundational Daily Nutrition Supplements | Cash Cow | Consistent Market Demand | Leverages >$170 billion global supplements market (2024) |

| North America Market | Cash Cow | Reliable Profitability | Maintained significant sales contribution in 2024 |

What You See Is What You Get

Herbalife BCG Matrix

The Herbalife BCG Matrix preview you are viewing is the identical, fully prepared document you will receive upon purchase. This means no watermarks, no altered content, and no demo versions – just the complete, professionally formatted analysis ready for your strategic decision-making. You can be confident that the insights and structure presented here are precisely what you’ll gain access to immediately after completing your transaction, allowing for seamless integration into your business planning.

Dogs

Herbalife's performance in regions like China and EMEA has been a point of concern. In recent quarters, these markets have shown flat or even declining sales and volume figures. For example, Herbalife's China segment reported a revenue decline of 13% year-over-year in the first quarter of 2024, highlighting a challenging environment.

This trend suggests a combination of low market share and limited growth prospects within these geographical areas. Such underperforming markets can become cash traps, demanding ongoing investment but yielding minimal returns, potentially impacting overall profitability.

Consequently, these underperforming regional markets may warrant a strategic review. Options could include significant restructuring, a focused turnaround effort, or even divestiture to reallocate resources to more promising growth areas within Herbalife's portfolio.

Certain legacy Herbalife product lines, particularly those with formulations that haven't been refreshed to align with current wellness trends, are likely categorized as Dogs. For instance, older meal replacement shakes that don't incorporate newer ingredients like adaptogens or specialized protein blends may face declining consumer interest. These products often represent a shrinking portion of overall sales, potentially contributing to a reduced market share in a dynamic nutritional supplement industry.

Herbalife's weight management products, a core segment, face significant pressure from emerging competitors, particularly those offering GLP-1 drugs. These new pharmaceutical solutions provide a distinct mechanism for weight loss, potentially drawing consumers away from traditional nutritional supplements and meal replacements. For instance, the global obesity drug market, including GLP-1s, was projected to reach over $20 billion by 2023 and is expected to grow substantially in the coming years, indicating a significant shift in consumer preference towards medical interventions.

Stagnant Niche Personal Care Items

Stagnant niche personal care items within Herbalife's portfolio, if any exist, would likely represent products with minimal market traction. These could be items that haven't resonated with consumers or face overwhelming competition from established brands. For example, a hypothetical niche anti-aging serum that saw initial interest but failed to capture significant market share might fit this description. In 2024, the personal care market continues to be highly competitive, with innovation and effective marketing crucial for success.

Such products often exhibit low sales volumes and limited growth potential, acting as resource drains rather than profit generators. They consume marketing budgets and operational resources without yielding substantial returns. In the broader personal care industry, the average growth rate for niche segments can vary, but those failing to adapt or differentiate often see single-digit or even negative growth.

- Low Market Share: Products with a minimal percentage of their niche market's sales.

- Limited Growth Prospects: Future sales increases are projected to be negligible or declining.

- Resource Consumption: These items may require ongoing investment in inventory, marketing, or research without commensurate returns.

- High Competition: Facing numerous similar offerings from other brands, making differentiation difficult.

Shrinking Distributor Bases in Specific Localities

While Herbalife's overall distributor growth might be positive, certain local or regional markets are showing a concerning trend of declining active distributors. This shrinkage in the sales force directly impacts product sales and the company's ability to reach customers in those specific areas. These are essentially low-growth, low-share segments that can become resource drains.

For instance, in some European markets, Herbalife has seen a noticeable dip in distributor numbers in the past year. Reports from 2024 indicate that in specific countries within the EU, the active distributor base has contracted by as much as 5-8% year-over-year, contrasting with more robust growth in other regions.

- Shrinking Distributor Bases: Certain local or regional markets within Herbalife's network are experiencing a persistent decline in active distributors.

- Impact on Sales and Reach: This erosion of the sales force directly hinders product sales and limits market penetration in affected areas.

- Resource Drain: These segments represent low-growth, low-share areas that can consume resources without generating proportional returns.

- 2024 Data Point: In 2024, specific European markets saw an average contraction of 5-8% in their active distributor base, highlighting localized challenges.

Products categorized as Dogs in Herbalife's BCG Matrix are those with low market share and low growth potential. These items often represent legacy products or those in saturated markets where competition is fierce and consumer interest is waning. For example, older formulations of nutritional supplements that haven't been updated with current ingredient trends or consumer preferences could fall into this category.

These "Dogs" can become resource drains, requiring marketing and operational support without generating significant returns. In 2024, the challenge for companies like Herbalife is to identify these underperformers and make strategic decisions, such as discontinuation or minimal investment, to free up resources for more promising growth areas.

The decline in active distributors in certain European markets, with some areas seeing a 5-8% contraction in 2024, exemplifies a "Dog" scenario at a regional level. This reduced sales force directly impacts sales volume and market penetration, indicating a low-share, low-growth segment that consumes resources.

Furthermore, the intense competition from GLP-1 drugs in the weight management sector, a market projected to exceed $20 billion by 2023, highlights how established product categories can become "Dogs" if they fail to innovate or adapt to significant market shifts.

| Product Category Example | Market Share | Growth Potential | 2024 Performance Indicator |

| Legacy Meal Replacement Shakes | Low | Low | Declining sales volume due to newer formulations |

| Niche Personal Care Items | Very Low | Negligible | Minimal market traction, high competition |

| Certain European Markets (Distributors) | Low | Low | 5-8% contraction in active distributors (2024) |

| Weight Management (Traditional) | Decreasing | Stagnant/Declining | Pressure from GLP-1 drugs; market shift |

Question Marks

Herbalife's recent acquisitions of Pro2col Health and Link BioSciences in early 2025 significantly bolster its personalized nutrition segment. These ventures, focusing on digital wellness, represent high-potential growth areas, though their current market share within Herbalife's broader offerings is minimal.

These new technologies are positioned as question marks in the BCG matrix, demanding significant investment to cultivate their market presence and technological capabilities. The goal is to transition them into future Stars by driving adoption and innovation in the rapidly evolving personalized health landscape.

Herbalife's introduction of high-end, premium product lines, like its healthy lifespan offerings, signals a strategic move into expanding, albeit potentially crowded, market niches. These specialized products currently represent a small fraction of Herbalife's overall market presence.

Significant investment in marketing and comprehensive distributor training is essential to drive broader consumer acceptance and sales growth for these premium items. For instance, the company might allocate substantial resources to highlight the science behind these advanced formulations, aiming to capture a discerning customer base.

Herbalife's expansion into untapped emerging markets represents its 'Question Marks' in the BCG Matrix. These are regions with high growth potential but currently low market share, demanding substantial investment to establish distributor networks and brand awareness. For instance, Herbalife has been actively exploring opportunities in parts of Southeast Asia and Africa, areas showing robust demographic growth and increasing disposable incomes.

These new market entries are inherently risky, as success hinges on effectively replicating their direct-selling model in diverse cultural and regulatory landscapes. The upfront costs for training, logistics, and marketing can be considerable, with the payoff uncertain in the short term. By 2024, the company continued to focus on strategic pilot programs in these nascent territories, aiming to build a foundation for future growth.

Digital Sales and Engagement Platforms (Early Rollouts)

Herbalife's early-stage digital sales and engagement platforms represent a strategic investment in future growth. These platforms, rolled out globally to distributors, aim to streamline sales processes and improve recruitment effectiveness. While still in their nascent adoption phases, their potential to reshape market dynamics is significant, though their immediate impact on overall market share remains modest. Ongoing investment is crucial for their development and optimization.

- Early Adoption: Global rollout of new digital tools for distributors is in its initial stages, focusing on enhancing sales and recruitment.

- Limited Current Impact: The immediate effect on Herbalife's overall market share is currently limited, reflecting the early adoption phase.

- Future Growth Potential: These platforms are designed to drive future growth by increasing distributor efficiency and engagement.

- Continuous Investment: Sustained investment and refinement are necessary to maximize the effectiveness of these digital initiatives.

Subscription Model for New Products

Herbalife's recent foray into a subscription model for products like MultiBurn in the U.S. aims to secure consistent revenue streams within an expanding market. This strategy is designed to foster customer loyalty and predictable sales.

While initial adoption rates for this subscription service have shown promise, its ultimate success, ability to scale effectively, and capacity to gain substantial market share remain under observation. The company is actively monitoring key performance indicators to gauge its long-term viability.

- Recurring Revenue Capture: The subscription model directly targets recurring revenue, a desirable trait for stable financial growth.

- Market Growth Potential: The subscription e-commerce market in the U.S. has seen significant expansion, offering a fertile ground for this strategy. In 2023, subscription e-commerce sales in the U.S. were estimated to be over $100 billion.

- Early Adoption Indicators: Positive early uptake suggests customer interest and a potential for this model to become a significant contributor to sales.

- Scalability and Market Share: The true test lies in how well the model scales across Herbalife's product portfolio and its ability to capture a larger slice of the competitive wellness market.

Herbalife's emerging digital platforms and subscription services represent key question marks. These initiatives require substantial investment to gain traction and build market share, with their long-term success still being evaluated.

The company's expansion into new geographic markets also falls into the question mark category, demanding significant upfront capital for establishing operations and brand recognition in regions with high growth potential but currently low penetration.

These ventures are considered question marks because they have the potential to become stars but also carry the risk of not achieving significant market share, necessitating careful monitoring and strategic resource allocation.

Herbalife's investment in personalized nutrition technologies, such as its early 2025 acquisitions, are question marks needing further development to solidify their market position.

| Initiative | Market Potential | Current Market Share | Investment Needed | Outlook |

|---|---|---|---|---|

| Digital Sales Platforms | High | Low | Significant | Potential Star |

| Subscription Services (e.g., MultiBurn) | Growing | Emerging | Moderate | Potential Star |

| Emerging Market Expansion | High | Low | Substantial | Potential Star |

| Personalized Nutrition Tech | High | Minimal | Significant | Potential Star |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market research, including sales data, consumer behavior analysis, and competitive landscape reports, to accurately position Herbalife's products.