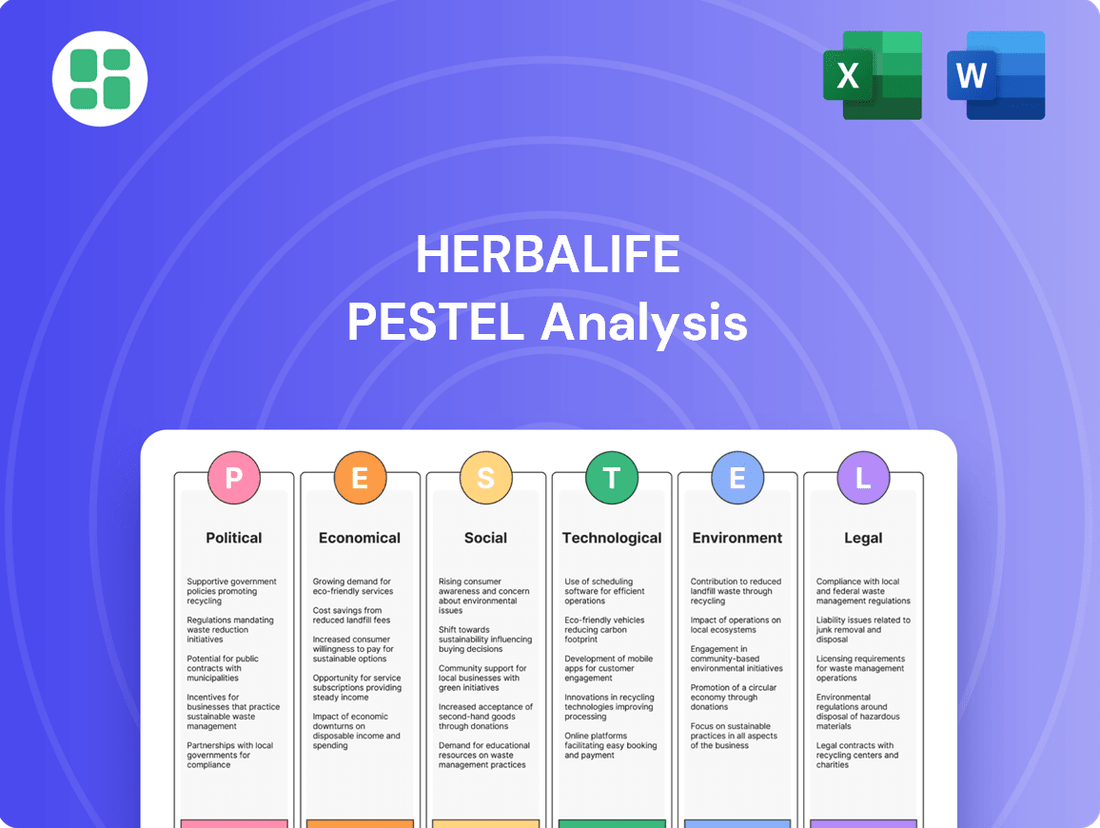

Herbalife PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Herbalife Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Herbalife's trajectory. This comprehensive PESTLE analysis provides the strategic intelligence you need to anticipate challenges and capitalize on opportunities. Download the full version now to gain a decisive advantage.

Political factors

Government bodies, especially in the United States, are increasing their focus on multi-level marketing (MLM) companies. The Federal Trade Commission (FTC) proposed new rules in 2024 that could substantially alter MLM operations, emphasizing clearer disclosures about recruitment and income. This heightened oversight is designed to safeguard consumers from misleading tactics and verify the authenticity of direct selling ventures.

The Federal Trade Commission's (FTC) proposed new Earnings Claims Rule, slated for 2025, directly targets multi-level marketing (MLM) companies by aiming to prohibit misleading income representations. This significant regulatory shift mandates that any earnings claims made by these companies must be supported by clear, documented evidence.

Furthermore, the rule requires companies to provide substantiation for their claims upon request, a move designed to increase transparency and accountability. It also places strict limitations on broad statements about high earnings, insisting on robust disclaimers to prevent consumer deception.

The Federal Trade Commission (FTC) is contemplating extending its Business Opportunity Rule to multi-level marketing (MLM) companies. This move could significantly impact how companies like Herbalife operate by introducing new compliance measures.

Key proposed changes include mandatory income disclosures for potential recruits before they sign up, a mandatory seven-day cooling-off period before enrollment, and the requirement for clear, documented information on average earnings, associated risks, and overall costs. These regulations, if implemented, would fundamentally reshape the recruitment and onboarding processes within the MLM industry.

For instance, the FTC's existing Business Opportunity Rule already requires sellers to provide a detailed disclosure document, and applying this to MLMs would bring greater transparency. In 2023, the FTC reported a significant number of consumer complaints related to deceptive practices in pyramid schemes and MLMs, highlighting the need for stricter oversight.

Lobbying and Policy Influence

Herbalife actively engages in lobbying to shape government policies, a common practice for companies in the health and wellness sector. These efforts are vital for managing regulatory complexities and championing the direct selling model.

In 2024, Herbalife Nutrition reported significant investment in lobbying, with total expenditures reaching $600,000. This financial commitment underscores the company's focus on influencing legislative and regulatory outcomes.

- Policy Advocacy: Herbalife's lobbying aims to advocate for favorable regulations within the direct selling and nutritional supplement industries.

- Industry Representation: The company's lobbying activities serve to represent the interests of the broader direct selling sector.

- 2024 Expenditures: Herbalife Nutrition spent $600,000 on lobbying efforts during 2024.

International Regulatory Compliance

Herbalife's global expansion, like that of other multi-level marketing (MLM) firms, requires navigating a complex web of international regulatory compliance. This means adhering to varying laws in each country of operation, which can significantly impact business models and growth strategies.

Looking ahead to 2024 and 2025, a key trend is the anticipated tightening of compliance requirements for MLMs worldwide. This includes greater scrutiny on income disclosure statements, the structure of compensation plans, and the accuracy of product claims. For instance, some European nations have already implemented stricter rules on pyramid schemes, impacting how MLMs can operate.

Companies like Herbalife must remain agile and adapt to these often volatile local regulations to ensure continued operation and resilience. Failure to comply can lead to substantial fines, operational disruptions, and reputational damage. For example, in 2023, several countries reviewed their MLM regulations, signaling a trend towards increased oversight.

- Global Regulatory Landscape: MLMs operate in over 100 countries, each with unique legal frameworks governing direct selling and compensation structures.

- Stricter Compliance Trends: Expect increased demands for transparency in earnings claims and product efficacy by 2025, mirroring trends seen in the financial services sector.

- Adaptability is Key: Companies must invest in robust legal and compliance teams to monitor and respond to evolving regulations, such as those concerning data privacy and consumer protection.

Heightened regulatory scrutiny on multi-level marketing (MLM) operations is a significant political factor. The U.S. Federal Trade Commission (FTC) proposed new rules in 2024, with potential implementation by 2025, that could drastically alter MLM business models by demanding clearer income and recruitment disclosures. This increased oversight aims to protect consumers from deceptive practices, a move supported by a high volume of consumer complaints reported in 2023 concerning pyramid schemes and MLMs.

Herbalife's active engagement in lobbying, evidenced by its $600,000 expenditure in 2024, highlights its commitment to influencing legislative and regulatory outcomes favorable to the direct selling industry. This policy advocacy is crucial for navigating the complex global regulatory landscape where varying laws in over 100 operating countries necessitate constant adaptation to maintain compliance and operational resilience.

The anticipated tightening of global MLM compliance requirements by 2025, particularly regarding earnings claims and product efficacy, mirrors trends in other sectors like financial services. Companies must invest in robust legal and compliance frameworks to address evolving regulations on data privacy and consumer protection, ensuring they can adapt to potential disruptions and maintain their market presence.

| Regulatory Body | Key Action | Year | Impact on MLMs |

| U.S. FTC | Proposed Earnings Claims Rule | 2024 (Anticipated 2025) | Prohibits misleading income representations; requires substantiated claims. |

| U.S. FTC | Considering extending Business Opportunity Rule | Ongoing | Mandatory disclosures, cooling-off periods, clearer earnings information. |

| Global | Trend towards stricter compliance | 2023-2025 | Increased scrutiny on compensation, product claims, and transparency. |

What is included in the product

This PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Herbalife, providing a comprehensive understanding of its external operating landscape.

It offers actionable insights for strategic decision-making by identifying key trends and potential disruptions across these critical macro-environmental factors.

A Herbalife PESTLE analysis serves as a pain point reliever by offering a clear, summarized version of external factors for easy referencing during meetings or presentations, ensuring stakeholders are aligned on market dynamics.

Economic factors

Global economic conditions significantly shape Herbalife's financial trajectory, particularly concerning foreign currency fluctuations and the discretionary spending power of consumers. These external forces can directly impact sales volumes and profitability.

For instance, in the second quarter of 2025, Herbalife experienced a 1.7% year-over-year decrease in net sales. A notable contributor to this decline was the impact of unfavorable foreign exchange rates, a common challenge for companies with international operations.

Despite the top-line sales dip, Herbalife demonstrated enhanced operational efficiency by reporting a substantial increase in net income for Q2 2025. This suggests effective cost management and improved profitability even amidst economic headwinds.

Consumer spending on health and wellness remains a robust driver for companies like Herbalife. The global dietary supplement market is projected for substantial expansion, anticipated to hit $688.9 billion by 2032.

Despite economic headwinds, consumers are prioritizing their well-being, with the median monthly expenditure on supplements holding steady at $50 in 2024. This consistent investment underscores a strong consumer commitment to personal health, directly benefiting the demand for Herbalife's product offerings.

Herbalife's financial performance in the second quarter of 2025 showcased a significant improvement in profitability. Net income soared by an impressive 946.8%, reaching $49.2 million. This substantial increase occurred despite a modest 1.7% dip in revenue during the same period.

The company's management expressed optimism by raising its full-year adjusted EBITDA guidance. This upward revision suggests a strong belief in the effectiveness of ongoing strategic initiatives and disciplined cost management practices. The focus on enhancing profitability, even with minor revenue fluctuations, underscores a commitment to operational efficiency.

Market Dynamics in Direct Selling

The direct selling industry is navigating significant shifts, with some multi-level marketing (MLM) companies exploring affiliate marketing to address regulatory scrutiny and growing consumer distrust. For instance, in 2023, reports indicated a noticeable increase in direct selling firms experimenting with affiliate-style compensation structures, moving away from traditional recruitment-heavy models.

While Herbalife continues to operate with its established MLM framework, this broader industry movement highlights the imperative for direct selling businesses to adapt. Companies must remain agile, ensuring transparency and evolving their compensation and marketing strategies to maintain relevance and consumer confidence in the face of changing market dynamics.

Key adaptations observed in the direct selling sector include:

- Increased adoption of digital marketing tools and social commerce platforms.

- Greater emphasis on product-centric sales rather than recruitment-driven growth.

- Diversification of sales channels beyond traditional person-to-person interactions.

- Focus on enhancing transparency in compensation plans and business operations.

Investment in Strategic Initiatives

Herbalife is actively investing in strategic initiatives to fuel its future expansion, with a particular focus on digital transformation and the development of innovative new products. This forward-looking approach is designed to meet the dynamic needs of consumers and maintain a competitive edge in the global market.

The company's commitment to growth is underscored by recent key acquisitions. In 2024, Herbalife announced the acquisition of assets from Pruvit and Link Biosciences. These moves are strategically aimed at bolstering its product portfolio and advancing its technological capabilities, positioning the company for sustained success.

These investments are not merely operational upgrades; they represent critical pillars for Herbalife's long-term growth trajectory. By enhancing its product offerings and embracing digital advancements, the company is proactively adapting to evolving consumer preferences and market trends, ensuring its relevance and profitability in the years to come.

- Digital Transformation: Enhancing online platforms and data analytics for improved customer engagement and operational efficiency.

- Product Development: Investing in R&D for new nutritional supplements and wellness products, responding to health trends.

- Strategic Acquisitions: Integrating Pruvit and Link Biosciences assets to expand product lines and technological infrastructure.

- Market Adaptation: Proactively responding to changing consumer demands for personalized nutrition and digital-first experiences.

Global economic conditions continue to influence Herbalife, with foreign exchange rates and consumer spending power remaining key factors. Despite a 1.7% year-over-year net sales decrease in Q2 2025, attributed partly to unfavorable currency movements, the company achieved a remarkable 946.8% surge in net income, reaching $49.2 million, showcasing strong cost management.

The health and wellness sector remains a resilient market, with the global dietary supplement market projected to reach $688.9 billion by 2032. Consumers are prioritizing well-being, with median monthly supplement expenditure holding steady at $50 in 2024, supporting demand for Herbalife's products.

Herbalife raised its full-year adjusted EBITDA guidance, signaling confidence in its strategic initiatives and operational efficiency despite minor revenue fluctuations.

The direct selling industry is adapting, with some MLMs exploring affiliate marketing to address regulatory scrutiny. Herbalife's continued focus on digital transformation and strategic acquisitions, such as Pruvit and Link Biosciences in 2024, aims to bolster its product portfolio and technological capabilities for future growth.

What You See Is What You Get

Herbalife PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Herbalife PESTLE analysis covers the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed overview for strategic planning.

Sociological factors

Consumers in 2025 are deeply invested in proactive self-care, seeking personalized health solutions rather than just addressing illness. This shift means a growing demand for products that support overall well-being and preventative health measures. For instance, a recent survey indicated that 70% of consumers aged 25-55 are actively seeking out supplements and dietary changes to boost their immune systems and energy levels, a trend that directly benefits companies like Herbalife.

Wellness trends for 2025 are strongly characterized by personalization, sustainability, and a holistic view of health. This includes a preference for functional foods and advanced supplements tailored to individual needs, reflecting a desire for both efficacy and ethical sourcing. The global wellness market is projected to reach $7 trillion by 2025, with personalized nutrition alone expected to be a significant contributor, underscoring the alignment of these consumer priorities with Herbalife's core business model.

There's a noticeable surge in consumer interest for highly specific nutritional supplements. This includes a growing preference for plant-based alternatives, supplements aimed at improving brain health, and products designed to support metabolic functions and women's well-being. This trend reflects a desire for personalized health solutions.

Consumers are actively looking for targeted products addressing individual health concerns, such as beauty-enhancing supplements and those focused on mental wellness and stress reduction. Herbalife's strategic product development, exemplified by launches like MultiBurn, directly aligns with and aims to capitalize on these evolving consumer demands for specialized nutrition.

Public perception of multi-level marketing (MLM) remains a complex sociological factor. Ongoing consumer skepticism, fueled by past controversies and regulatory scrutiny over earnings claims, persists. For instance, the U.S. Federal Trade Commission (FTC) continues to monitor and take action against deceptive MLM practices, emphasizing the importance of earnings disclosures.

Social media platforms have amplified both the visibility of success stories and the scrutiny of MLM operations. While aspirational narratives can draw new participants, they also necessitate greater transparency regarding the realities of income potential. This dual nature of social media underscores the need for companies like Herbalife to proactively manage their public image and ensure accurate representation of business opportunities.

Herbalife actively works to counter negative perceptions by focusing on product quality, scientific backing, and robust distributor support systems. Their emphasis on product efficacy and providing training and resources aims to build trust and differentiate their model from less reputable schemes. This approach is crucial in navigating the sociological landscape where trust and transparency are paramount for sustained growth.

Influence of Social Media on Wellness Trends

Social media platforms like TikTok, Instagram, and Facebook are now central to how companies like Herbalife market their products and find new distributors. In 2024, it's estimated that over 4.9 billion people globally use social media, making it an unparalleled channel for reaching potential customers and recruits. This digital ecosystem allows for direct engagement, showcasing product benefits through live demonstrations and user testimonials, which significantly shapes consumer perception and adoption of health and wellness trends.

The rise of social selling is a critical sociological factor. It empowers individuals to build their networks and promote products directly, fostering a sense of community and trust. For instance, influencer marketing on platforms like Instagram saw a 47% increase in engagement in 2023, demonstrating its effectiveness in driving consumer interest. This shift means that brand loyalty is increasingly built through authentic online interactions and relatable content, directly impacting sales and recruitment strategies.

This digital influence directly shapes consumer awareness and engagement with health and wellness products. By 2025, projections suggest that social commerce sales will reach $2.1 trillion globally. This highlights how deeply ingrained social media is in purchasing decisions, particularly within the wellness sector where personal experiences and visual appeal are paramount. Companies must leverage these platforms effectively to stay competitive and resonate with evolving consumer behaviors.

Demographic Shifts and Wellness Engagement

Younger generations, especially Gen Z and millennials, are increasingly focused on health and well-being. This translates into higher spending on wellness products and services compared to older demographics. For instance, a 2024 report indicated that over 60% of Gen Z consumers actively seek out health-focused brands.

This demographic trend significantly shapes the fitness, nutrition, and beauty markets. Companies like Herbalife, which provide products and business models centered around these areas, are well-positioned to capitalize on this growing demand. The global wellness market is projected to reach $7.0 trillion by 2025, with younger consumers being a key driver.

- Gen Z and Millennial Wellness Spending: These groups prioritize proactive health measures and are willing to invest in solutions that support their lifestyle.

- Market Growth Drivers: The increasing awareness of preventative healthcare and the desire for personalized nutrition fuels demand for companies like Herbalife.

- Herbalife's Opportunity: The company's product portfolio and direct-selling model align with the preferences of these younger, health-conscious consumers.

Sociological factors significantly influence consumer behavior and market dynamics for companies like Herbalife. The increasing emphasis on personalized health and wellness, particularly among younger demographics like Gen Z and millennials, presents a substantial opportunity. These groups actively seek out brands that align with their proactive health goals and are willing to invest in tailored nutrition solutions.

The pervasive influence of social media continues to shape purchasing decisions and brand perception. Platforms serve as both a source of aspirational content and a space for critical evaluation of business models, including multi-level marketing (MLM). Companies must navigate this landscape by fostering transparency and showcasing genuine product benefits to build trust and engagement.

Public perception of MLMs remains a critical sociological element. While aspirational narratives can attract new participants, persistent consumer skepticism, often fueled by past controversies and regulatory oversight, necessitates a strong focus on ethical practices and clear earnings disclosures. Herbalife's efforts to emphasize product quality and scientific backing are vital in counteracting negative sentiment.

The global wellness market's projected growth to $7 trillion by 2025, with personalized nutrition as a key driver, underscores the alignment of consumer trends with Herbalife's offerings. The increasing demand for functional foods, plant-based alternatives, and supplements targeting specific health concerns, such as cognitive function and metabolic health, further validates this alignment.

| Sociological Factor | Impact on Herbalife | Supporting Data (2024-2025 Projections) |

|---|---|---|

| Personalized Wellness Demand | Increased demand for tailored nutrition and health solutions. | 70% of consumers aged 25-55 actively seeking personalized health solutions. |

| Social Media Influence | Drives brand awareness, engagement, and potential recruitment. | Over 4.9 billion global social media users in 2024; social commerce sales projected to reach $2.1 trillion by 2025. |

| Gen Z/Millennial Health Focus | Higher spending on wellness products and services from younger demographics. | Over 60% of Gen Z consumers actively seek health-focused brands (2024). |

| MLM Perception | Requires transparency and focus on product efficacy to build trust. | Ongoing FTC monitoring of MLM practices emphasizes the need for clear earnings disclosures. |

Technological factors

Herbalife is actively incorporating AI into its service delivery, notably with platforms like the Pro2col app. This app is designed to create customized wellness plans by analyzing user biometric data.

The beta phase of Pro2col, which began in Q2 2025, saw participation from over 7,000 distributors. This initiative underscores Herbalife's move towards a more data-driven approach in the wellness sector.

The core aim of these AI-powered tools is to offer highly personalized nutrition guidance and sophisticated health monitoring capabilities to users.

Herbalife is significantly boosting its digital toolkit for independent distributors. This includes investing in advanced platforms designed to streamline sales processes, simplify recruitment efforts, and enhance customer relationship management. For instance, in 2024, the company continued to roll out its enhanced distributor portal, which aims to provide real-time sales data and personalized marketing support, directly impacting distributor productivity.

These technological upgrades are crucial for Herbalife's global expansion strategy. By making the business model more accessible and effective through user-friendly digital tools, the company empowers its vast network of independent distributors worldwide. This digital enhancement is particularly important for emerging markets, where mobile-first solutions are key to reaching new customers and recruits, contributing to the company's projected revenue growth in these regions.

MLM companies like Herbalife are increasingly embracing e-commerce, with digital sales channels becoming paramount. By 2024, global e-commerce sales are projected to exceed $6 trillion, a significant portion of which is driven by direct selling models that leverage online platforms for product distribution and independent distributor recruitment.

Social selling, particularly on platforms like TikTok and Instagram, is a critical technological factor. Herbalife distributors are utilizing these channels for live product demonstrations and customer testimonials, directly engaging with a broader, digitally native audience. This approach bypasses traditional retail, fostering community and driving sales through authentic, peer-to-peer recommendations.

Data Analytics for Business Insights

Herbalife is increasingly leveraging data analytics to understand customer behavior and deliver tailored supplement suggestions. This focus on data allows for more effective marketing and product development.

The Protocol app exemplifies this strategy, integrating AI and real-time data analytics. This creates a more engaging user experience, fostering continued product engagement and boosting customer loyalty.

- Personalized Recommendations: Data analytics enables Herbalife to offer highly personalized product recommendations based on individual user data.

- Enhanced User Engagement: The Protocol app's AI-driven features aim to keep users actively involved with the platform and Herbalife products.

- Customer Lifetime Value: By fostering loyalty through personalized experiences, Herbalife seeks to increase the long-term value of each customer.

- Data-Driven Product Development: Insights gleaned from user data can inform future product innovations and improvements.

Automation for Operational Efficiency

Technological advancements are significantly boosting automation within Herbalife's operations. This includes sophisticated tools for lead generation, streamlined sales processes, and automated customer engagement platforms. For instance, AI-powered chatbots can handle routine customer inquiries, freeing up distributors.

This increased automation directly supports business objectives by enhancing efficiency and improving overall customer satisfaction. By automating repetitive tasks, distributors can dedicate more time to crucial activities such as team training and personalized customer support, which are vital for network growth.

The impact of automation is substantial. In 2024, companies in the direct selling industry reported an average efficiency gain of 15-20% through automation tools. This allows for faster onboarding of new distributors and more responsive customer service, ultimately driving sales and retention.

Key areas of automation impacting Herbalife include:

- Automated Lead Generation: Utilizing digital marketing tools and AI to identify and qualify potential customers and distributors.

- Streamlined Sales Processes: Implementing e-commerce platforms and CRM systems for efficient order processing and sales tracking.

- Enhanced Customer Interaction: Deploying chatbots and personalized communication systems for immediate customer support and engagement.

- Data Analytics for Insights: Leveraging automated data analysis to understand market trends and distributor performance.

Herbalife's integration of AI, exemplified by the Pro2col app, signifies a major technological shift, personalizing wellness plans through biometric data analysis. The beta phase of Pro2col in Q2 2025 involved over 7,000 distributors, highlighting a move towards data-driven wellness strategies.

The company is also enhancing its digital toolkit for distributors, with an updated portal in 2024 offering real-time sales data and marketing support to boost productivity. This digital focus is critical for global expansion, particularly in emerging markets where mobile-first solutions are key.

E-commerce and social selling are paramount, with global e-commerce sales projected to surpass $6 trillion by 2024. Distributors leverage platforms like TikTok and Instagram for live demonstrations, fostering direct engagement with a digitally native audience.

Data analytics enables personalized product recommendations and informs product development, with the Protocol app using AI and real-time data for enhanced user engagement and customer loyalty.

Legal factors

The Federal Trade Commission (FTC) is intensifying its scrutiny of Multi-Level Marketing (MLM) operations, with new rules proposed for 2024 and set to be finalized in 2025. These stricter regulations are designed to bolster transparency and safeguard consumers by dictating how MLMs recruit, advertise their products, and crucially, disclose income potential to participants. This regulatory shift could significantly impact how companies like Herbalife operate and communicate their business opportunities.

New proposals from the Federal Trade Commission (FTC) are set to significantly alter how Multi-Level Marketing (MLM) companies, including those in the herbal supplement sector, operate. These proposals mandate that MLMs must provide clear, mandatory income disclosures to potential recruits before any recruitment takes place. This aims to give individuals a realistic understanding of earning potential, moving away from potentially misleading representations.

Furthermore, MLMs will be required to substantiate all earnings claims with concrete, documented evidence. This means companies can no longer make generalized or anecdotal claims about income without verifiable proof, a crucial step in preventing deceptive practices. For instance, if a company claims distributors can earn $1,000 a month, they will need to present data showing a significant percentage of their distributors actually achieve this.

The FTC's focus on income disclosure and substantiation is a direct response to concerns about the low average earnings of many MLM participants. In 2023, for example, reports indicated that a substantial majority of MLM distributors earned very little, often less than minimum wage when accounting for expenses. These new regulations, expected to be finalized in 2024 or early 2025, are designed to protect consumers by ensuring transparency and accountability in earnings representations within the industry.

Regulators are keenly focused on differentiating legitimate multi-level marketing (MLM) structures from illegal pyramid schemes. This scrutiny is crucial for consumer protection and market integrity.

The Federal Trade Commission (FTC) has reinforced its business guidance, clarifying that primary revenue generation must stem from actual retail sales of products or services, not from recruitment fees or investments made by new participants. This distinction is paramount in preventing deceptive earnings claims.

For instance, in 2023, the FTC continued to pursue enforcement actions against companies that failed to meet these retail sales requirements, underscoring the ongoing legal challenges for MLMs to demonstrate a sustainable business model rooted in product distribution rather than recruitment.

Consumer Protection and Product Claims

MLM companies like Herbalife face stringent consumer protection laws that govern product safety and the truthfulness of their claims. Failure to comply can lead to significant penalties and reputational damage.

Proposed regulations aim to prevent MLMs from misrepresenting the business opportunity as a traditional employment path. They also mandate that companies must back up all product claims with robust substantiation records, which need to be retained for an extended period, potentially several years.

- Accurate Product Claims: Companies must ensure all marketing materials accurately reflect product benefits and efficacy.

- Substantiation Records: Maintaining detailed records to prove product claims is crucial for compliance.

- Opportunity Misrepresentation: Prohibiting the portrayal of MLM participation as a guaranteed employment situation is a key regulatory focus.

- Consumer Trust: Adherence to these legal factors is vital for maintaining consumer trust and brand integrity.

Litigation and Regulatory Settlements

Herbalife has faced significant legal challenges, including a notable $200 million settlement with the U.S. Federal Trade Commission (FTC) in 2016 to resolve claims of deceptive marketing practices. Additionally, the company incurred a $123 million penalty in 2020 related to bribery of Chinese officials, highlighting past instances of non-compliance.

These historical settlements underscore a persistent legal risk for Herbalife. The evolving regulatory landscape, particularly concerning direct selling and pyramid scheme allegations, necessitates continuous investment in robust compliance programs to mitigate the potential for future litigation and associated financial penalties.

- FTC Settlement (2016): $200 million.

- China Bribery Penalty (2020): $123 million.

- Ongoing Regulatory Scrutiny: Increased focus on direct selling business models globally.

- Compliance Investment: Essential for avoiding future legal entanglements and reputational damage.

The evolving regulatory landscape for Multi-Level Marketing (MLM) operations, particularly concerning income disclosure and substantiation of claims, presents a significant legal factor for companies like Herbalife. Stricter rules proposed by the FTC in 2024 and expected in 2025 mandate clear income disclosures to potential recruits and require verifiable proof for all earnings claims. This is a direct response to concerns about low average earnings among MLM participants, with data from 2023 showing many distributors earning below minimum wage after expenses.

Companies must demonstrate that their primary revenue comes from retail sales, not recruitment, to avoid being classified as illegal pyramid schemes. Herbalife's history includes a $200 million FTC settlement in 2016 for deceptive marketing and a $123 million penalty in 2020 for bribery in China, underscoring the critical need for ongoing compliance investment to navigate these legal complexities and protect against future litigation and reputational harm.

Environmental factors

Consumers are increasingly scrutinizing the environmental and social footprint of their purchases, leading to a surge in demand for sustainable and ethically produced nutritional supplements. This trend favors companies that utilize eco-friendly packaging, source ingredients responsibly, and maintain transparent supply chains. For instance, a 2024 Nielsen report indicated that 73% of global consumers would change their purchasing habits to reduce their environmental impact.

Herbalife, operating as a major player in the global nutrition sector, faces pressure to align its operations with these growing consumer expectations. This means adapting to preferences for recycled materials in packaging and ensuring fair labor practices throughout its sourcing and manufacturing processes. By demonstrating commitment to these values, Herbalife can enhance brand loyalty and market position.

The creation of synthetic vitamins and supplements often involves petrochemicals and energy-intensive manufacturing, leaving a significant environmental mark. This reliance on fossil fuels contributes to greenhouse gas emissions throughout the production chain.

The dietary supplement sector generates substantial plastic waste, with estimates suggesting millions of new plastic bottles are added to landfills each year. For companies like Herbalife, this underscores the critical importance of evaluating and mitigating their manufacturing and packaging-related environmental impacts.

The push for eco-friendly packaging is a significant environmental factor for companies like Herbalife. The dietary supplement packaging market is expected to hit $21.5 billion by 2035, with sustainability at its core. This means a growing demand for packaging made from recycled or compostable materials, as well as a focus on reducing waste through right-sized designs.

Herbalife's own sustainability efforts align with this trend. The company emphasizes transparent policies and reports on its environmental impact, signaling a commitment to responsible packaging practices. This focus on reducing waste and using sustainable materials is becoming increasingly important for consumer perception and regulatory compliance.

Supply Chain Transparency and Responsible Sourcing

Consumers increasingly demand to know where their products come from, pushing brands to be more open about their supply chains. This focus on transparency often goes hand-in-hand with a commitment to sustainability, with certifications like Fair Trade and Organic gaining significant traction as indicators of ethical and environmentally conscious practices. For instance, in 2024, the global market for certified organic food and beverages was projected to reach over $300 billion, highlighting consumer willingness to support such standards.

Herbalife, with its extensive global network of ingredient sourcing and manufacturing, must navigate these evolving consumer expectations. Ensuring ethical labor practices and environmentally sound sourcing of raw materials is paramount to maintaining brand reputation and consumer trust. The company's commitment to responsible sourcing is crucial for its long-term viability in a market that increasingly values corporate social responsibility.

- Growing Consumer Demand: A 2024 survey indicated that over 70% of consumers consider supply chain transparency when making purchasing decisions.

- Rise of Certifications: The market for Fair Trade certified products saw a 15% year-over-year growth in 2024, demonstrating consumer preference for ethically sourced goods.

- Environmental Impact: Companies focusing on sustainable sourcing reported an average 10% increase in customer loyalty in 2024.

- Herbalife's Responsibility: As a global distributor, Herbalife faces scrutiny regarding its sourcing practices, impacting its brand image and market position.

Corporate Social Responsibility (CSR) Initiatives

Herbalife's commitment to sustainability is evident in its stated goals to reduce operational emissions and waste, alongside prioritizing community health and safety. These efforts are detailed in their ESG reports, showcasing their dedication to responsible business practices that benefit stakeholders.

The company's focus on environmental stewardship is a key component of its CSR strategy. For instance, Herbalife has set targets for reducing its carbon footprint, aiming for a specific percentage reduction in Scope 1 and Scope 2 emissions by 2030. This aligns with broader global efforts to combat climate change.

- Sustainability Goals: Herbalife aims to reduce its environmental impact through operational efficiencies and waste reduction programs.

- ESG Reporting: The company regularly publishes ESG reports, providing transparency on its environmental, social, and governance performance.

- Community Focus: Initiatives often include programs that support the health and well-being of the communities in which Herbalife operates.

- Emissions Reduction: Specific targets are in place for decreasing greenhouse gas emissions across its operations.

Growing consumer awareness around environmental impact is a significant driver in the nutrition sector, with 73% of global consumers in 2024 indicating a willingness to alter purchasing habits for sustainability. This translates to increased demand for products with eco-friendly packaging and transparent, responsible sourcing practices.

The dietary supplement packaging market is projected to reach $21.5 billion by 2035, with sustainability as a core focus, emphasizing recycled materials and waste reduction. Herbalife's own sustainability reports highlight efforts in responsible packaging and waste reduction, aligning with these consumer and market trends.

The environmental footprint of supplement production, from petrochemical reliance in synthetic vitamin creation to significant plastic waste from packaging, presents a challenge. Companies like Herbalife are increasingly scrutinized for their manufacturing and packaging's environmental impact, making sustainable practices crucial for brand reputation.

Consumer demand for supply chain transparency, with over 70% considering it in purchasing decisions in 2024, extends to ethical and environmental sourcing. The 15% year-over-year growth in the Fair Trade certified products market in 2024 underscores this preference, impacting companies like Herbalife's brand image and market positioning.

| Environmental Factor | Consumer Trend (2024 Data) | Market Impact | Herbalife's Position |

| Sustainable Packaging | 73% consumers willing to change habits for environmental impact | Dietary supplement packaging market to reach $21.5B by 2035 | Focus on recycled materials and waste reduction |

| Ethical Sourcing | 70% consumers consider supply chain transparency | Fair Trade market grew 15% YoY in 2024 | Emphasis on responsible sourcing and transparency |

| Carbon Footprint | Increasing demand for reduced operational emissions | Global push for climate change mitigation | Targets for Scope 1 & 2 emission reduction by 2030 |

PESTLE Analysis Data Sources

Our Herbalife PESTLE Analysis is built on a robust foundation of data from reputable sources including government reports, economic indicators from institutions like the IMF and World Bank, and up-to-date industry research. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Herbalife.