Herbalife Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Herbalife Bundle

Herbalife faces moderate threats from new entrants and substitutes, with intense rivalry among existing direct selling companies. Buyer power is somewhat diffused due to the network marketing model, but distributors can exert influence. Supplier power is generally low, as ingredients are widely available.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Herbalife’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Herbalife's reliance on a limited number of suppliers for specialized raw ingredients, manufacturing, and packaging significantly impacts its bargaining power. When few suppliers can provide critical components, their ability to dictate terms and prices escalates.

This concentration means these suppliers can exert considerable pressure, potentially driving up Herbalife's input costs. For instance, if a key botanical extract or a unique packaging material is sourced from only one or two global providers, Herbalife has less leverage to negotiate favorable terms, directly affecting its profit margins.

The switching costs for Herbalife are a significant factor in the bargaining power of its suppliers. If Herbalife faces substantial expenses or operational disruptions when changing ingredient or packaging suppliers, current suppliers gain leverage. For instance, if a new supplier requires extensive product re-testing, new manufacturing line setups, or incurs penalties on existing long-term contracts, Herbalife's ability to negotiate lower prices or better terms is diminished.

The uniqueness of inputs significantly impacts supplier bargaining power. When suppliers offer proprietary or highly differentiated ingredients, especially those with strong scientific backing or exclusive sourcing, their leverage increases. Herbalife's commitment to science-based nutrition suggests that its unique product formulations may depend on specific suppliers for key ingredients, potentially giving those suppliers more influence.

Threat of Forward Integration

If suppliers can credibly threaten to move into the health and wellness product space themselves, their leverage over Herbalife grows significantly. This forward integration by suppliers would mean they no longer need Herbalife's distribution or manufacturing capabilities, effectively cutting out the middleman. For instance, a major ingredient supplier for Herbalife's nutritional supplements could decide to launch its own branded line of products, directly competing with Herbalife.

This threat is particularly potent if suppliers possess strong brand recognition or established distribution networks. Consider the scenario where a key supplier of specialized botanical extracts, which are crucial for many of Herbalife's products, also has a robust direct-to-consumer sales channel. In 2023, the global health and wellness market was valued at approximately $5.8 trillion, indicating a substantial market that suppliers might find attractive to enter directly.

- Supplier Capability: Suppliers with existing manufacturing, marketing, and distribution infrastructure are better positioned for forward integration.

- Market Attractiveness: High-growth segments within the health and wellness industry, like personalized nutrition or sports supplements, can incentivize supplier integration.

- Cost of Entry: Lower barriers to entry for suppliers in specific product categories reduce the perceived risk of forward integration.

- Competitive Landscape: A fragmented market with numerous players can make it easier for a well-resourced supplier to establish a foothold.

Volume of Purchases

Herbalife's substantial global presence and the sheer volume of its purchases for key ingredients and manufacturing services typically grant it considerable bargaining power with its suppliers. This scale allows Herbalife to negotiate more favorable terms due to the significant revenue stream it represents for many suppliers.

However, this leverage can be diminished if a particular supplier caters to a broad base of other large, similarly sized clients. In such scenarios, the supplier's reliance on any single customer, even a large one like Herbalife, is reduced, thereby lessening Herbalife's ability to dictate terms.

- Herbalife's Global Scale: Operates in over 90 countries, indicating a vast network of suppliers and significant purchasing volumes.

- Negotiating Leverage: Large purchase orders can lead to better pricing and preferential treatment from suppliers.

- Supplier Diversification: The impact of Herbalife's purchasing volume is moderated if suppliers have numerous other major customers.

When suppliers are concentrated, offering unique or highly specialized inputs, their bargaining power over Herbalife increases. This is particularly true if these suppliers have the capability and incentive to integrate forward into Herbalife's market, potentially becoming direct competitors. While Herbalife's large scale generally provides leverage, this can be diluted if its suppliers also serve numerous other major clients, reducing their dependence on any single customer.

| Factor | Impact on Herbalife | Example/Data Point |

|---|---|---|

| Supplier Concentration | Increases supplier power | Few suppliers for specialized ingredients like unique botanical extracts. |

| Input Uniqueness | Increases supplier power | Proprietary ingredients with scientific backing. |

| Forward Integration Threat | Increases supplier power | Suppliers entering the health and wellness market (valued at $5.8 trillion in 2023). |

| Herbalife's Scale | Decreases supplier power | Operates in over 90 countries, implying large purchase volumes. |

| Supplier Diversification | Increases supplier power | Supplier serving many large clients reduces reliance on Herbalife. |

What is included in the product

Herbalife's Porter's Five Forces Analysis reveals the intense competition from direct selling rivals and traditional retailers, the significant bargaining power of its distributors, and the low threat of new entrants due to established brand loyalty and distribution networks.

Instantly identify and mitigate competitive threats with a dynamic, interactive Porter's Five Forces model for Herbalife, allowing for rapid strategic adjustments.

Customers Bargaining Power

Herbalife's primary direct customers are its independent distributors, and the costs they incur to switch to a competitor are significant. These sunk costs include investments in training programs, building a sales network, and holding existing product inventory. For instance, a distributor who has invested heavily in Herbalife's tiered training and certification programs and has a well-established downline network faces substantial hurdles to replicate this elsewhere. These switching costs effectively reduce the individual bargaining power of these distributors.

End consumers today have an abundance of choices when it comes to health and wellness products. They can easily find similar items through traditional retail stores, online marketplaces like Amazon, and even from other direct selling companies, all offering comparable nutritional supplements and weight management solutions.

This widespread availability of alternatives directly fuels the bargaining power of these customers. With so many options readily accessible, consumers can readily switch to a competitor if they perceive better value, lower prices, or a more convenient purchasing experience from Herbalife's distributors.

For instance, the global health and wellness market was valued at approximately $1.5 trillion in 2023 and is projected to grow, indicating a highly competitive landscape where consumers have significant leverage. This competitive pressure means Herbalife must consistently offer compelling product value and a superior customer experience to retain its customer base.

Distributors and consumers are quite sensitive to price, and this directly influences their power to negotiate with Herbalife. If Herbalife's prices are too high, especially when similar products are easily found elsewhere, sales can suffer. This price pressure can also push distributors to explore alternative product lines.

For instance, in 2023, the global direct selling industry, which includes companies like Herbalife, generated over $170 billion in revenue. However, increased competition and economic pressures mean that price remains a critical factor for both end consumers and the independent distributors who sell these products.

Information Availability

The internet and social media have dramatically increased information availability for consumers and potential Herbalife distributors. This readily accessible data covers product effectiveness, competitor offerings, and the nuances of the multi-level marketing (MLM) structure.

This transparency significantly empowers customers, allowing them to make more informed purchasing and business opportunity decisions. For instance, online reviews and detailed product comparisons are now commonplace, influencing purchasing behavior across many industries, including nutrition and wellness.

Consider the sheer volume of information: In 2024, billions of web pages are dedicated to product reviews and business opportunity discussions. This accessibility means that potential distributors can easily research Herbalife's compensation plan and compare it to other direct selling companies, directly impacting their decision to join or not.

- Increased Transparency: Online platforms offer detailed insights into product ingredients, scientific backing, and user testimonials.

- Competitive Landscape: Consumers can effortlessly compare Herbalife products and pricing with numerous other health and wellness brands available in 2024.

- MLM Scrutiny: The structure and financial viability of MLM business models are widely discussed and analyzed online, providing potential distributors with extensive background information.

- Informed Decision-Making: Greater information availability empowers consumers and potential distributors to make choices based on comprehensive research rather than solely on marketing.

Low Distributor Profitability

When Herbalife distributors find it difficult to earn a decent living from selling products, their collective frustration can translate into a significant increase in their bargaining power as customers. This low distributor profitability, a recurring theme in network marketing, can lead to high turnover rates.

For instance, if a large percentage of distributors are not meeting income expectations, they are more likely to seek alternative income streams or switch to competing products. This indirect customer bargaining power arises from their potential to leave the network, forcing Herbalife to consider their needs and improve the distributor compensation model to retain them.

- Low Distributor Profitability: Distributors often face challenges in generating substantial income.

- High Churn Rates: Dissatisfied distributors are prone to leaving the network.

- Indirect Customer Bargaining Power: High churn indirectly empowers distributors to demand better terms.

- Impact on Herbalife: Forces the company to address compensation and support structures.

The bargaining power of Herbalife's end consumers is amplified by the sheer volume of readily available health and wellness alternatives. In 2024, the global wellness market continues its expansion, with numerous brands offering comparable nutritional supplements and weight management solutions through various channels, from online retailers to brick-and-mortar stores. This competitive environment allows consumers to easily switch if they find better pricing or value elsewhere, putting pressure on Herbalife to maintain its product appeal and pricing strategy.

| Factor | Description | Impact on Herbalife |

|---|---|---|

| Availability of Substitutes | Consumers have access to a vast array of similar health and wellness products from competitors. | Increased pressure to differentiate on price, quality, and brand loyalty. |

| Price Sensitivity | Both end consumers and distributors are highly aware of pricing and readily compare options. | Limits Herbalife's pricing flexibility and necessitates competitive cost structures. |

| Information Transparency | The internet provides extensive product reviews, competitor analysis, and MLM structure discussions. | Empowers consumers and potential distributors to make informed decisions, demanding greater value and transparency. |

| Low Distributor Profitability | When distributors struggle to earn, their collective dissatisfaction can increase their bargaining power. | Can lead to distributor attrition, forcing Herbalife to improve compensation and support to retain its sales force. |

Preview the Actual Deliverable

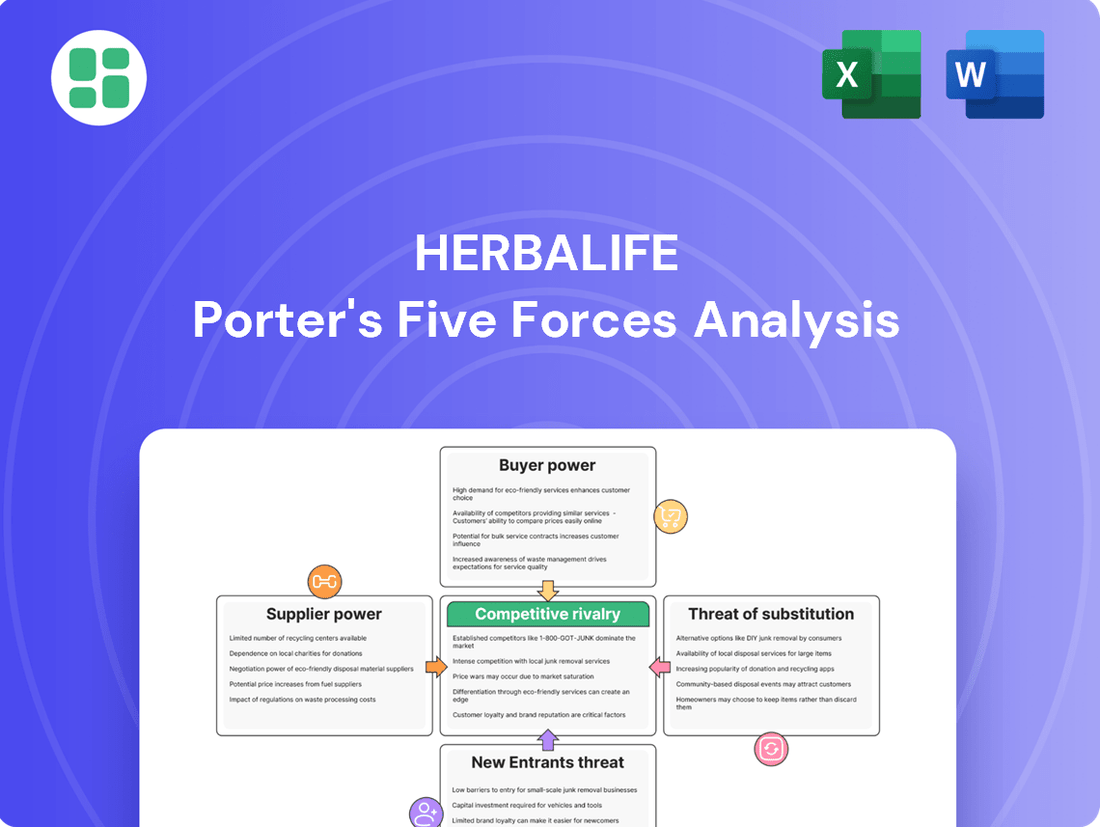

Herbalife Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis of Herbalife, detailing the competitive landscape through the lens of threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors. The document you see here is exactly what you’ll be able to download after payment, providing an in-depth strategic evaluation of Herbalife's industry position. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, ready for your strategic planning needs.

Rivalry Among Competitors

The health and wellness sector, particularly the segments for dietary supplements and weight management, is incredibly crowded. Herbalife contends with a vast array of global and local companies, making it a highly fragmented market.

Competition for Herbalife is fierce, coming from other multi-level marketing (MLM) businesses that operate on similar models, established traditional retail brands with strong distribution networks, and increasingly, direct-to-consumer online sellers.

In 2024, the global dietary supplements market alone was valued at over $170 billion, showcasing the sheer scale and the number of participants vying for market share, with many offering comparable products to Herbalife's.

The health and wellness sector, encompassing dietary supplements, is experiencing robust growth, with the global market projected to reach approximately $327.4 billion by 2028, according to Statista. This expansion, coupled with the inherent nature of multi-level marketing (MLM) business models, fuels intense competition. While the overall industry is expanding, the sheer number of players, including Herbalife, creates a crowded landscape where individual company growth can be significantly constrained by the competitive pressures.

Herbalife's product differentiation faces a tough landscape. While their offerings are science-backed, many competitors provide similar nutritional and weight-management solutions. This necessitates substantial investment in research and development to create unique formulations. For instance, products like MultiBurn™ aim to set them apart, but the overall market sees a degree of product similarity.

Exit Barriers

High fixed costs in manufacturing, distribution, and marketing for companies like Herbalife create significant hurdles for exiting the market. These substantial investments mean that shutting down operations is often a costly endeavor, encouraging firms to persevere even when facing difficulties.

The health and wellness sector, where Herbalife operates, is characterized by these substantial upfront and ongoing expenses. For instance, maintaining an extensive network of independent distributors, as Herbalife does, requires continuous investment in training, events, and motivational programs. Furthermore, brand building through global marketing campaigns and product development also represents significant fixed costs.

- High Fixed Costs: Significant capital is tied up in manufacturing facilities, global supply chains, and extensive marketing efforts.

- Distribution Network Investment: Building and sustaining a large, independent distributor network involves ongoing costs for training, events, and support.

- Brand Equity and Marketing: Continuous investment in advertising and brand promotion is crucial, creating a barrier to exit if these investments are not recouped.

- Incentive to Compete: The high exit barriers compel companies to remain in the market and compete intensely, rather than incur substantial losses by leaving.

Regulatory Scrutiny on MLM Model

The multi-level marketing (MLM) structure employed by companies like Herbalife attracts significant regulatory attention. This scrutiny, particularly concerning compensation plans and recruitment practices, can create a competitive disadvantage if not managed proactively. For instance, in 2023, several MLM companies faced investigations or settlements related to these concerns, impacting their operational freedom and market perception.

This regulatory environment directly influences competitive rivalry by forcing companies to invest in compliance and potentially alter their business models. Companies that can navigate these complexities effectively, perhaps by demonstrating clearer product sales over recruitment incentives, may gain a competitive edge. The ongoing debate around the legality and ethics of MLM models means that compliance is not just a legal requirement but a strategic imperative in 2024.

- Regulatory Investigations: MLM models are frequently subject to investigations by consumer protection agencies globally, impacting operational continuity.

- Compliance Costs: Adhering to evolving regulations requires significant investment in legal counsel, auditing, and potentially restructuring compensation plans.

- Reputational Risk: Negative regulatory findings can severely damage a company's brand image, deterring both distributors and consumers.

- Market Access: In some jurisdictions, strict regulations can limit or even prohibit certain MLM practices, affecting market reach and growth potential.

The competitive rivalry in the health and wellness sector, especially for Herbalife, is intense due to a fragmented market with numerous global and local players. This crowded landscape, valued at over $170 billion for dietary supplements in 2024, means companies like Herbalife face constant pressure from other MLMs, traditional retailers, and online sellers offering similar products.

Product differentiation is a significant challenge, as many competitors offer comparable nutritional and weight-management solutions. This necessitates ongoing investment in research and development to create unique formulations, as seen with products like Herbalife's MultiBurn™. The industry's growth, projected to reach approximately $327.4 billion by 2028, further fuels this competitive environment.

The multi-level marketing model itself attracts considerable regulatory scrutiny, creating a competitive disadvantage if not managed proactively. Companies facing investigations or settlements for compensation plan or recruitment practices, as occurred with several MLMs in 2023, must invest heavily in compliance and may see their market perception and operational freedom impacted.

| Competitor Type | Key Characteristics | Impact on Herbalife |

|---|---|---|

| Other MLMs | Similar business model, distributor networks | Direct competition for distributors and customers, price wars |

| Traditional Retailers | Established brands, strong distribution, physical presence | Brand loyalty, accessibility, broader product ranges |

| Direct-to-Consumer (Online) | Agile, lower overhead, targeted marketing | Price competition, convenience, niche market appeal |

| Emerging Brands | Innovative products, niche focus, digital-native | Disruption, shifting consumer preferences |

SSubstitutes Threaten

Consumers seeking health and wellness have a wide array of substitutes beyond Herbalife's offerings. Traditional approaches like balanced diets and regular exercise remain primary alternatives. In 2024, the market for weight-loss solutions saw significant growth, with pharmaceutical options like GLP-1 agonists gaining substantial traction, impacting the demand for nutritional supplements.

Furthermore, the accessibility of generic or store-brand supplements presents a cost-effective substitute for consumers. Herbalife itself acknowledges this competitive landscape by developing products designed to complement the use of GLP-1 medications, indicating a strategic response to evolving consumer health trends and the availability of alternative solutions.

The threat of substitutes is a significant concern for Herbalife, particularly when consumers perceive a better price-performance trade-off elsewhere. For instance, many consumers might find generic vitamins or simply focusing on a balanced, whole-foods diet to be a more cost-effective way to achieve their health and wellness goals compared to Herbalife's specialized supplements and meal replacement products. In 2024, the global vitamin and dietary supplement market was valued at over $170 billion, indicating a vast array of accessible alternatives.

Consumers are increasingly favoring plant-based, clean-label, and sustainable nutrition options, a trend that presents a significant threat of substitution for traditional offerings like Herbalife's. This shift means that products perceived as more natural or environmentally friendly can easily replace existing choices. For instance, the global plant-based food market was projected to reach $74.2 billion in 2025, indicating a substantial and growing consumer demand for these alternatives.

Accessibility of Information and DIY Solutions

The proliferation of readily accessible health and wellness information online presents a significant threat of substitutes for Herbalife. Consumers can easily find free workout routines, detailed dietary plans, and extensive nutritional guidance through websites, blogs, and social media platforms. This empowers individuals to create their own health regimens, bypassing the need for structured, paid programs like those offered by Herbalife.

This DIY trend is fueled by the sheer volume of free content. For instance, in 2024, platforms like YouTube hosted billions of hours of fitness and nutrition content, with many channels boasting millions of subscribers dedicated to healthy living advice. This readily available, often expert-driven, information directly competes with Herbalife’s core offering.

The accessibility of these substitutes is further amplified by the increasing sophistication of health and fitness apps. Many of these apps, some offering advanced tracking and personalized advice for free or a nominal fee, provide a comprehensive alternative to traditional direct-selling nutritional programs. Consider the growth in the digital health market, which was projected to reach over $600 billion globally by 2027, indicating a strong consumer shift towards accessible digital health solutions.

- Information Abundance: Billions of hours of free fitness and nutrition content available online.

- DIY Empowerment: Consumers readily create personalized health plans without external programs.

- App Competition: Sophisticated health apps offer tracking and advice at low or no cost.

- Market Shift: Growing digital health market signals consumer preference for accessible online solutions.

Reputational Impact of MLM Model

The negative perception of multi-level marketing (MLM) can significantly impact Herbalife by driving consumers to alternative distribution channels. For instance, a 2023 survey indicated that 45% of consumers express skepticism towards MLM business models, preferring direct-to-consumer (DTC) or traditional retail channels for health and wellness products.

This skepticism acts as a potent substitute. Consumers wary of the MLM structure, perhaps due to past controversies or a lack of transparency, will actively seek out non-MLM health and wellness brands. These brands, even if offering comparable products, become substitutes not just at the product level, but at the entire purchasing experience level.

Consider the rise of subscription box services and online wellness platforms. These models offer convenience and a perceived transparency that contrasts sharply with the often-complex commission structures of MLMs. For example, companies like HelloFresh or Goop have capitalized on consumer desire for curated, easily accessible wellness solutions, directly challenging Herbalife's established distribution method.

The threat is amplified when these substitutes offer competitive pricing and perceived higher quality, irrespective of Herbalife's product efficacy.

- Consumer Skepticism: A significant portion of the market actively avoids MLM products due to trust concerns.

- Alternative Channels: Direct-to-consumer (DTC) and traditional retail offer more appealing purchasing experiences.

- Brand Perception: Negative MLM associations can overshadow product quality, pushing consumers to non-MLM competitors.

- Market Trends: The growth of subscription services and online wellness platforms provides direct substitutes for Herbalife's distribution model.

The threat of substitutes for Herbalife is substantial, encompassing everything from basic lifestyle changes to cutting-edge pharmaceutical interventions. Consumers can opt for balanced diets and exercise, or increasingly, turn to weight-loss drugs like GLP-1 agonists, which saw considerable market growth in 2024. Even generic supplements offer a more budget-friendly alternative to Herbalife's specialized products.

The digital landscape further empowers consumers with a wealth of free health information and personalized fitness plans, directly competing with Herbalife's structured programs. Health and fitness apps, many offering advanced tracking for minimal cost, also present a compelling substitute. By 2024, platforms like YouTube hosted billions of hours of free fitness content, illustrating the sheer volume of accessible alternatives.

Consumer skepticism towards multi-level marketing (MLM) models also drives demand towards direct-to-consumer (DTC) and traditional retail channels. This preference for transparency and simpler purchasing experiences means brands offering comparable wellness solutions through these alternative models pose a significant threat. The global digital health market, projected to exceed $600 billion by 2027, highlights this shift towards accessible, often online, wellness solutions.

| Substitute Category | Examples | 2024 Market Insight |

| Lifestyle Changes | Balanced Diet, Regular Exercise | Core health practices remain primary alternatives. |

| Pharmaceuticals | GLP-1 Agonists (e.g., Ozempic, Wegovy) | Significant market growth in 2024 for weight-loss medications. |

| Generic Supplements | Store-brand vitamins, minerals | Cost-effective alternatives to specialized nutritional products. |

| Digital Health & Apps | Fitness apps, online nutrition plans | Global digital health market projected over $600 billion by 2027. |

| Alternative Distribution Models | DTC brands, subscription boxes | Capitalize on consumer preference for transparency and convenience. |

Entrants Threaten

While a small direct-selling venture can indeed launch with modest capital, establishing a global multi-level marketing (MLM) powerhouse akin to Herbalife demands significant financial resources. This includes hefty investments in research and development for product innovation, setting up and maintaining robust manufacturing facilities, and building an extensive, well-supported international distributor network. For instance, companies in the direct selling industry often report substantial upfront costs for inventory, marketing materials, and technology platforms to support their sales force.

Established brands like Herbalife benefit from existing brand recognition and a loyal customer and distributor base, making it difficult for newcomers to gain traction. For instance, Herbalife reported approximately 2.3 million active distributors globally as of the end of 2023, highlighting the scale of its established network.

New entrants face the significant challenge of building trust and replicating such extensive network effects, which are crucial for direct selling models. This deep-rooted loyalty and the inherent advantages of a large, existing sales force create a substantial barrier to entry for potential competitors aiming to disrupt the market.

The multi-level marketing (MLM) sector, which Herbalife operates within, faces significant regulatory scrutiny globally. New entrants must contend with evolving rules regarding compensation structures and marketing claims, often facing allegations of being pyramid schemes. For instance, in 2023, the U.S. Federal Trade Commission continued its focus on deceptive marketing practices in direct selling, a key area for MLMs.

Distribution Channel Complexity

The complexity of establishing a global multi-level marketing (MLM) distribution network presents a significant barrier. New entrants must invest heavily in recruiting, training, and managing a vast number of independent distributors. This process is not only resource-intensive but also requires sophisticated logistical and motivational strategies to maintain an effective sales force.

Managing a multi-tiered compensation structure adds another layer of difficulty. Designing and administering a fair and motivating pay plan that incentivizes distributors across various levels is a complex undertaking. For instance, Herbalife's compensation plan, which involves commissions, bonuses, and royalty overrides, requires robust administrative systems and careful financial planning to ensure profitability and compliance.

The sheer scale and intricate nature of these operational requirements deter many potential competitors. Building a comparable MLM infrastructure from scratch is a monumental task, often requiring years of development and substantial capital. In 2023, Herbalife reported net sales of $5.06 billion, illustrating the scale of operations required to compete effectively in this market.

- Global Reach Challenge: New entrants face the daunting task of replicating Herbalife's extensive global network of independent distributors, which spans over 90 countries.

- Recruitment and Retention Costs: The ongoing expense and effort associated with attracting, training, and retaining a large, decentralized sales force are substantial deterrents.

- Compensation Plan Complexity: Designing and managing a multi-level compensation structure that is both compliant and motivating requires specialized expertise and significant administrative overhead.

Access to Raw Materials and Specialized Expertise

New companies entering the herbal supplement market can struggle to obtain consistent, high-quality raw materials. For instance, sourcing specific botanical ingredients with guaranteed purity and potency often requires established relationships with suppliers, which newcomers lack. This can lead to inconsistent product quality, a significant barrier to building brand trust.

Furthermore, attracting top-tier scientific and nutritional talent is a considerable hurdle. Companies like Herbalife invest heavily in research and development, employing experts to validate product claims and innovate formulations. In 2023, the global dietary supplements market was valued at approximately $172.3 billion, indicating intense competition for skilled professionals in this rapidly growing sector.

- Securing high-quality raw materials: New entrants may find it difficult to establish reliable supply chains for specialized botanical ingredients, impacting product consistency.

- Attracting specialized expertise: The need for skilled nutritionists and scientists to develop credible products creates a talent acquisition challenge for emerging companies.

- R&D investment: Significant capital is required for research and development to ensure product efficacy and regulatory compliance, a barrier for smaller players.

- Brand credibility: Without established scientific backing and quality control, new entrants face an uphill battle in building consumer trust in the competitive health and wellness space.

The threat of new entrants into Herbalife's market is generally considered moderate to low. While the direct selling model might seem accessible, the significant capital required for global operations, extensive product development, and building a vast distributor network presents a substantial barrier. For instance, establishing a global presence similar to Herbalife's, which operates in over 90 countries, demands immense financial and logistical capabilities that are difficult for newcomers to replicate quickly.

Brand loyalty and the network effect are powerful deterrents. Herbalife's established reputation and the large, active base of approximately 2.3 million distributors as of the end of 2023 make it challenging for new companies to gain market share. Replicating this scale of trust and the inherent advantages of a deeply entrenched sales force is a significant hurdle.

Regulatory scrutiny within the multi-level marketing (MLM) sector also acts as a barrier. New entrants must navigate complex rules regarding compensation and marketing claims, with ongoing oversight from bodies like the U.S. Federal Trade Commission, which in 2023 continued to focus on deceptive practices in direct selling. This regulatory landscape requires significant legal and compliance resources.

The complexity of managing a multi-tiered compensation structure, like Herbalife's, which includes commissions, bonuses, and royalty overrides, demands robust administrative systems and careful financial planning. Designing and administering a fair and motivating pay plan requires specialized expertise and significant overhead, further deterring potential entrants.

| Barrier to Entry | Description | Impact on New Entrants |

| Capital Requirements | Significant investment needed for global infrastructure, R&D, and marketing. | High barrier due to substantial upfront costs. |

| Brand Recognition & Network Effects | Established reputation and large distributor base. | Difficult for new entrants to gain traction and build trust. |

| Regulatory Compliance | Navigating complex MLM regulations and scrutiny. | Requires significant legal and compliance resources. |

| Supply Chain & Talent Acquisition | Securing high-quality raw materials and specialized scientific talent. | Challenges in product consistency and credibility. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Herbalife is built upon a foundation of comprehensive data, including their annual financial reports, investor presentations, and publicly available SEC filings. We also incorporate industry-specific market research reports and news from reputable business publications to capture current market dynamics and competitive pressures.