Hengyi Petrochemical PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hengyi Petrochemical Bundle

Navigate the complex external forces impacting Hengyi Petrochemical with our expert-crafted PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both challenges and opportunities for the company. This comprehensive report is your key to unlocking strategic foresight and making informed decisions. Download the full version now to gain a critical competitive edge.

Political factors

Government industrial policies significantly shape Hengyi Petrochemical's trajectory, especially within China's strategic push for self-sufficiency in advanced materials. For instance, China's 14th Five-Year Plan (2021-2025) emphasizes high-quality development in the petrochemical sector, potentially favoring domestic players like Hengyi with incentives for technological upgrades and green initiatives. This focus could unlock new investment opportunities in specialized chemicals and advanced fibers.

In Brunei, Hengyi's operations are also influenced by the nation's economic diversification strategy, which aims to maximize value from its oil and gas resources. Government support for downstream processing, as seen with the Pulau Muara Besar refinery and petrochemical complex, provides a stable operational environment and potential for expansion. However, any shifts in Brunei's resource management policies could impact feedstock availability and operational costs.

Hengyi Petrochemical's global operations are significantly influenced by international trade relations and tariff policies. For instance, the ongoing trade dynamics between major economies can impact the cost of imported crude oil, a key raw material, and the competitiveness of its refined products in export markets. Trade disputes, such as those seen in recent years, can lead to retaliatory tariffs, directly affecting Hengyi's export volumes and profit margins on products sold internationally.

Geopolitical stability in key crude oil-producing regions, particularly the Middle East, is crucial for Hengyi Petrochemical's raw material security. Any political unrest or international conflict in these areas could directly impact oil supply chains, leading to price volatility and potential shortages. For instance, the ongoing tensions in Eastern Europe in 2024 continued to highlight the vulnerability of global energy markets to political instability.

Furthermore, the economic and political stability of major consumer markets, such as China and Southeast Asia, directly influences demand for Hengyi's refined petrochemical products. Economic downturns or trade disputes in these regions, often stemming from political decisions, can significantly dampen consumer spending and industrial activity, impacting Hengyi's sales volumes and profitability.

Regulatory Environment

Hengyi Petrochemical navigates a complex web of national and international regulations. Changes in environmental protection laws, particularly concerning emissions and waste management, directly impact its operational costs and require ongoing investment in cleaner technologies. For instance, China's increasingly stringent environmental standards, reinforced by initiatives like the "Blue Sky Protection Campaign," push companies like Hengyi to upgrade their facilities to meet stricter pollution control requirements.

New or tightened regulations on industrial operations, including safety standards and production quotas, can necessitate significant operational adjustments. These can range from modifying production processes to investing in advanced monitoring systems, thereby increasing compliance expenses. The global push for decarbonization also presents a regulatory challenge, potentially influencing future investment decisions and the long-term viability of certain petrochemical products.

- Environmental Compliance Costs: Hengyi must allocate substantial capital to meet evolving environmental standards, impacting its profitability.

- Safety Regulations: Adherence to strict safety protocols is paramount, with potential penalties for non-compliance affecting operational continuity.

- International Trade Policies: Shifting trade agreements and tariffs can influence the cost of raw materials and the accessibility of international markets for Hengyi's products.

- Carbon Emission Targets: Future regulations on carbon emissions could necessitate significant shifts in Hengyi's energy sourcing and production methods.

International Cooperation and Investment Policies

Hengyi Petrochemical's international expansion, especially its significant investments in Brunei, is heavily shaped by bilateral and multilateral investment treaties and policies that encourage foreign direct investment (FDI). These agreements can streamline regulatory processes and offer protections, thereby facilitating Hengyi's cross-border operations and large-scale project development. Government-to-government relations play a crucial role; positive diplomatic ties can smooth the path for investment, while strained relations can introduce significant hurdles.

For instance, China's Belt and Road Initiative (BRI) has fostered an environment conducive to such large-scale projects, with numerous infrastructure and investment agreements signed between China and participating nations, including Brunei. These frameworks aim to enhance economic ties and reduce investment risks. As of early 2024, China's outward FDI continued to show resilience, with significant flows into Southeast Asia, underscoring the supportive policy environment for companies like Hengyi.

- Bilateral Investment Treaties (BITs): These treaties offer legal protections for foreign investors, such as guarantees against expropriation without compensation and provisions for fair and equitable treatment, which are vital for long-term, capital-intensive projects like Hengyi's Brunei complex.

- FDI Promotion Policies: Many countries, including those in Southeast Asia, actively offer incentives like tax holidays, duty exemptions, and streamlined approval processes to attract foreign investment, directly benefiting Hengyi's project viability and expansion.

- Government-to-Government Relations: The strength of diplomatic ties between China and host countries directly impacts the ease of doing business, influencing regulatory approvals, land acquisition, and overall project security for Hengyi's international ventures.

- Multilateral Frameworks: Participation in regional economic blocs and trade agreements can further reduce trade barriers and harmonize investment regulations, creating a more predictable and favorable operating environment for Hengyi's global operations.

Government industrial policies in China, like the 14th Five-Year Plan, prioritize petrochemical self-sufficiency and technological advancement, creating opportunities for Hengyi. Brunei's economic diversification strategy supports downstream processing, benefiting Hengyi's refinery operations. Geopolitical stability in oil-producing regions and consumer markets directly impacts Hengyi's raw material security and product demand, with global energy markets showing continued vulnerability to political events in 2024.

What is included in the product

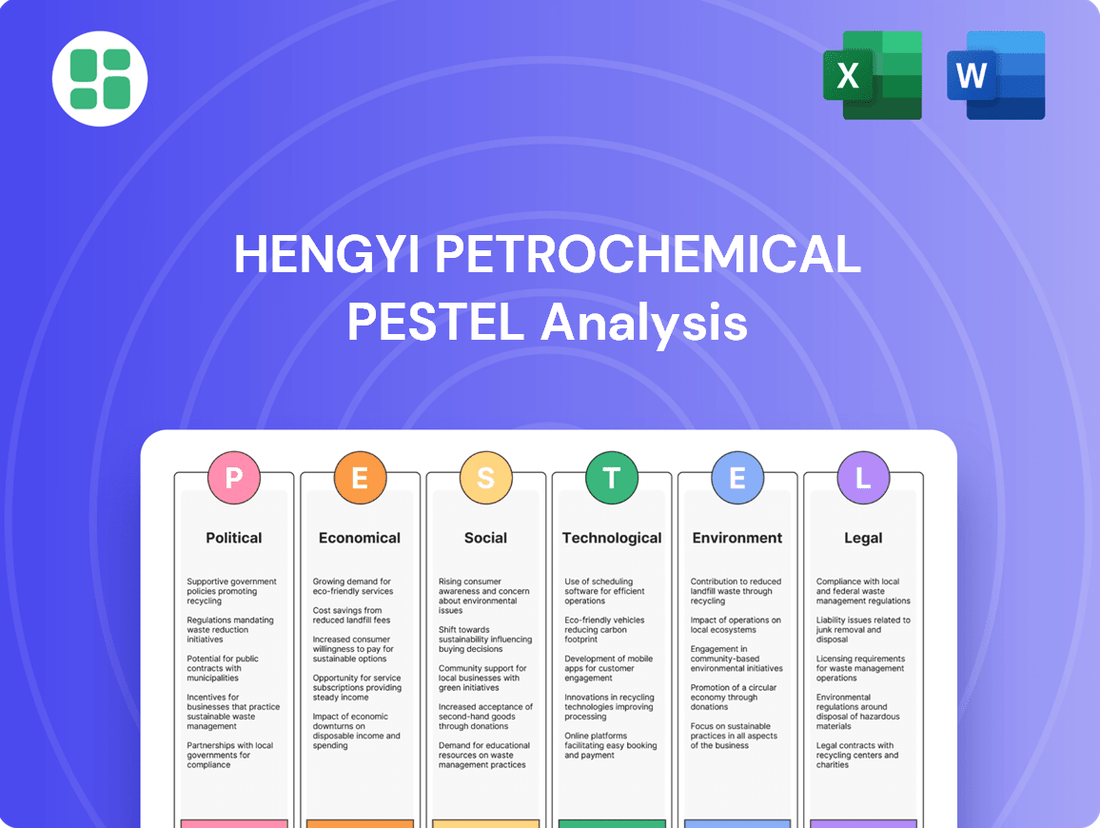

This PESTLE analysis comprehensively examines the political, economic, social, technological, environmental, and legal factors influencing Hengyi Petrochemical, offering strategic insights for navigating its operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors affecting Hengyi Petrochemical.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the PESTLE factors impacting Hengyi Petrochemical.

Economic factors

Global crude oil price volatility significantly impacts Hengyi Petrochemical, as its production relies heavily on oil derivatives. Fluctuations in oil prices directly affect raw material costs, which can compress profit margins if not managed effectively. For instance, during periods of high oil prices, Hengyi's input costs rise, potentially forcing adjustments to production planning and pricing strategies to maintain competitiveness.

In 2024, crude oil prices have experienced notable swings, with Brent crude averaging around $83 per barrel in the first half of the year, up from an average of $77 per barrel in the latter half of 2023. This volatility creates challenges for Hengyi in forecasting expenses and setting stable product prices. The company must employ robust risk management strategies, such as hedging, to mitigate the financial impact of these price movements on its operations and profitability.

The overall health of the global economy significantly impacts Hengyi Petrochemical's demand. A robust global economy, especially in major textile-consuming regions like Asia and Europe, translates to higher consumer spending and thus increased demand for Hengyi's PTA and polyester fibers. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from 2023, suggesting a moderately supportive environment for demand.

Economic slowdowns, conversely, can lead to reduced consumer purchasing power, directly affecting order volumes for Hengyi's products. A downturn in key markets could see a decrease in textile production and sales, creating challenges for Hengyi. For example, if major economies experience a recession, the demand for discretionary goods like apparel, which rely on polyester fibers, would likely contract.

Conversely, economic booms present significant market opportunities for Hengyi. Increased disposable income and consumer confidence during periods of economic expansion fuel demand for a wide range of goods, including those produced by Hengyi's downstream industries. This growth can lead to higher production volumes and improved profitability for the company.

Exchange rate fluctuations significantly impact Hengyi Petrochemical's financial performance. A stronger Chinese Yuan (CNY) can reduce the cost of imported raw materials like crude oil, which Hengyi procures internationally. Conversely, a weaker Yuan can boost export revenues from international sales, making Hengyi's products more competitive abroad. For instance, during periods of Yuan depreciation, Hengyi's overseas earnings translate into more Yuan, potentially improving its bottom line. In 2023, the Yuan experienced volatility against major currencies, directly influencing the cost of goods sold and the value of foreign currency-denominated profits.

Inflation and Interest Rates

Rising inflation directly impacts Hengyi Petrochemical's operational expenses. For instance, global energy prices, a key input for petrochemical production, saw significant volatility in 2024. This surge in raw material and energy costs can compress profit margins if not passed on to consumers. Labor and logistics costs also tend to climb with inflation, further pressuring operational efficiency.

Higher interest rates, a common response to inflation, present a dual challenge for Hengyi. Increased borrowing costs can make financing new capital expenditures, such as plant expansions or technological upgrades, more expensive. This can potentially slow down investment in future growth. Furthermore, existing debt becomes costlier to service, impacting the company's overall financial health and potentially affecting its ability to pursue strategic acquisitions or R&D initiatives.

- Impact on Operational Costs: Global inflation in 2024 led to an estimated 8-12% increase in energy and raw material costs for the petrochemical sector, directly affecting Hengyi's input expenses.

- Borrowing Costs: Central bank policy shifts in 2024 saw benchmark interest rates rise by 0.50% to 1.00% in many major economies, increasing the cost of capital for companies like Hengyi.

- Investment Decisions: Higher interest rates can deter new project financing, potentially delaying Hengyi's planned capacity expansions or diversification projects by 1-2 years.

- Financial Health: Increased debt servicing costs due to higher interest rates could reduce Hengyi's net profit by an estimated 3-5% in the short to medium term.

Supply Chain Disruptions and Logistics Costs

Global supply chain bottlenecks and elevated logistics costs present a significant challenge for Hengyi Petrochemical. These disruptions directly impact its capacity to secure essential raw materials and efficiently deliver finished goods to market. For instance, the average cost of shipping a 40-foot container from Asia to Europe saw substantial increases throughout 2024, reaching peaks that significantly eroded profit margins for many industries, including petrochemicals.

Such operational hurdles translate into higher expenses for Hengyi, affecting its overall cost structure. Delivery timelines can also become unpredictable, potentially leading to missed sales opportunities and strained customer relationships. The ongoing volatility in freight rates, influenced by factors like port congestion and fuel prices, means Hengyi must continually adapt its logistics strategies to mitigate these impacts.

- Increased Operational Expenses: Higher shipping rates and the need for expedited logistics solutions directly inflate Hengyi's cost of goods sold.

- Delivery Timeline Volatility: Port delays and container shortages can extend lead times, impacting Hengyi's ability to meet customer demand consistently.

- Raw Material Procurement Challenges: Disruptions in the global movement of crude oil and other feedstocks can lead to price spikes and availability issues for Hengyi.

Economic instability, characterized by fluctuating crude oil prices and global inflation, directly impacts Hengyi Petrochemical's profitability by increasing raw material and energy costs. For example, Brent crude averaged around $83 per barrel in the first half of 2024, a rise from late 2023, impacting input expenses. Higher interest rates, a response to inflation, also increase borrowing costs, potentially slowing investment in growth initiatives and making debt servicing more expensive.

| Economic Factor | 2024 Impact on Hengyi Petrochemical | Data Point/Example |

|---|---|---|

| Crude Oil Price Volatility | Increased input costs, potential margin compression | Brent crude averaged ~$83/barrel (H1 2024) |

| Global Economic Growth | Demand for PTA and polyester fibers influenced by consumer spending | IMF projected 3.2% global growth in 2024 |

| Inflation | Higher operational expenses (energy, raw materials, labor) | Estimated 8-12% increase in energy/raw material costs for petrochemicals in 2024 |

| Interest Rates | Increased borrowing costs, higher debt servicing expenses | Benchmark rates rose 0.50%-1.00% in major economies in 2024 |

Preview Before You Purchase

Hengyi Petrochemical PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hengyi Petrochemical delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain valuable insights into the external forces shaping Hengyi Petrochemical's landscape, enabling informed strategic planning and risk assessment.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of each PESTLE element, offering a thorough understanding of the opportunities and challenges Hengyi Petrochemical faces in the global market.

Sociological factors

Consumers are increasingly prioritizing sustainability, a trend significantly impacting the textile and apparel sectors. This heightened awareness translates into a demand for products made with eco-friendly materials and ethical production processes. For instance, a 2024 survey indicated that 68% of consumers consider sustainability when making purchasing decisions, up from 57% in 2022.

This growing consumer preference directly pressures companies like Hengyi Petrochemical to adapt. The company faces the challenge of integrating greener production methods, such as reducing water usage and chemical emissions, and exploring the development of recycled or bio-based materials. Failure to align with these evolving consumer values could lead to a decline in market demand and a competitive disadvantage.

Hengyi Petrochemical's operations in China are significantly influenced by labor availability and costs, shaped by ongoing demographic shifts and urbanization. As China's population ages and the rural-to-urban migration continues, the pool of readily available young, unskilled labor is shrinking. This dynamic can lead to increased competition for workers, potentially driving up wages and impacting production costs. For instance, in 2024, China's manufacturing sector has seen wage increases, particularly in skilled trades, which could affect Hengyi's operational expenses.

Societal expectations for worker health and safety in industrial settings are increasingly stringent, driven by a heightened awareness of occupational risks and a demand for corporate accountability. This evolving landscape places significant pressure on companies like Hengyi Petrochemical to adhere to and often exceed minimum regulatory requirements.

The implementation of robust safety protocols directly influences Hengyi's operational procedures, requiring substantial investment in safety equipment, regular maintenance, and comprehensive risk assessments. For instance, in 2023, the global chemical industry saw a notable increase in compliance spending, with companies allocating an average of 15% of their operational budget to safety initiatives to mitigate incidents and meet evolving standards.

These enhanced safety measures necessitate rigorous training programs for all employees, from frontline workers to management, ensuring a thorough understanding of emergency procedures and hazard prevention. Furthermore, Hengyi's commitment to health and safety significantly shapes its public image, fostering trust among stakeholders and potentially attracting talent that prioritizes ethical and responsible employers.

Community Relations and CSR Expectations

Hengyi Petrochemical's success is deeply intertwined with its community relations and the fulfillment of Corporate Social Responsibility (CSR) expectations. Maintaining positive relationships with local communities where it operates is paramount for its social license to operate. This involves proactive engagement, addressing local concerns, and contributing to community well-being.

Meeting broader CSR expectations is no longer optional but a critical business imperative. Hengyi's commitment to environmental stewardship, ethical labor practices, and transparent operations significantly influences public perception and stakeholder trust. For instance, in 2024, many petrochemical companies increased their investment in local environmental protection initiatives, with Hengyi likely following suit to maintain goodwill.

Philanthropic activities and community development programs further solidify Hengyi's standing. These efforts can range from supporting local education and healthcare to investing in infrastructure projects. Such initiatives not only benefit the communities but also enhance Hengyi's reputation as a responsible corporate citizen, mitigating potential operational disruptions.

- Community Engagement: Hengyi actively participates in local dialogue, addressing environmental and social concerns raised by residents near its facilities.

- Environmental Stewardship: Investments in advanced pollution control technologies and sustainable practices are crucial for maintaining community trust and regulatory compliance.

- Philanthropic Contributions: Support for local education and healthcare initiatives demonstrates a commitment to the long-term well-being of the communities where Hengyi operates.

- Social License to Operate: Positive community relations and strong CSR performance are essential for securing and maintaining the implicit permission from the community to conduct business.

Changing Lifestyles and Textile Demand

Evolving global lifestyles significantly impact textile demand, influencing Hengyi Petrochemical's polyester fiber sales. The rising popularity of athleisure and performance wear, driven by health and wellness trends, creates new market opportunities. For instance, the global sportswear market was valued at approximately $196 billion in 2023 and is projected to grow, directly benefiting producers of polyester fibers used in these garments.

Shifts in consumer preferences towards sustainable and recycled materials also play a crucial role. As consumers become more environmentally conscious, demand for recycled polyester (rPET) fibers is increasing. Hengyi Petrochemical's ability to adapt to these trends, perhaps by increasing its production of rPET, will be key to capturing market share.

- Athleisure Growth: The increasing adoption of casual, comfortable clothing for everyday wear boosts demand for polyester's versatility and durability.

- Technical Textiles: Expansion in sectors like automotive, medical, and industrial applications for textiles, which often utilize specialized polyester fibers, contributes to sustained demand.

- Sustainability Focus: Growing consumer and regulatory pressure for eco-friendly materials is driving innovation in recycled polyester production.

Societal expectations regarding corporate responsibility, particularly concerning environmental impact and worker welfare, are intensifying. This translates into increased scrutiny of Hengyi Petrochemical's operational practices and supply chain. For example, a 2024 report by the Global Corporate Accountability Initiative highlighted that 75% of investors now consider ESG (Environmental, Social, and Governance) factors as material to financial performance, influencing investment decisions and corporate valuations.

Hengyi's commitment to ethical labor standards, fair wages, and safe working conditions is crucial for maintaining its social license to operate and attracting a skilled workforce. A 2023 survey of manufacturing employees revealed that 60% would prioritize working for a company with strong ethical and safety records, even if it meant a slightly lower salary, underscoring the growing importance of these factors in talent acquisition and retention.

The company must also navigate evolving consumer preferences for sustainable products and transparent sourcing. A 2024 consumer survey indicated that 70% of respondents are willing to pay a premium for products that are demonstrably environmentally friendly and ethically produced, directly impacting demand for petrochemical-derived materials if sustainability is not adequately addressed.

Community relations remain a cornerstone of Hengyi's social standing. Proactive engagement with local communities, addressing concerns about pollution and resource usage, and contributing to local development are vital for operational continuity and stakeholder trust. In 2023, companies with strong community engagement strategies reported 10% fewer operational disruptions compared to those with weaker ties, demonstrating the tangible benefits of positive social relations.

Technological factors

Continuous innovation in petrochemical refining is a significant technological factor for Hengyi Petrochemical. Advancements in areas like catalytic cracking and advanced distillation can directly boost production efficiency, leading to higher yields of key products such as Purified Terephthalic Acid (PTA). For instance, the adoption of next-generation catalysts can reduce energy consumption per ton of PTA produced, a critical cost driver.

These technological upgrades also play a crucial role in waste reduction and environmental compliance. By implementing more sophisticated separation and purification techniques, Hengyi can minimize by-product formation and improve the overall sustainability of its operations. This not only lowers operational costs but also strengthens its competitive edge in a market increasingly focused on eco-friendly production methods.

In 2024, the global petrochemical industry saw significant investment in R&D for process optimization. Companies that successfully integrate these cutting-edge production methods are better positioned to navigate market volatility and maintain profitability. Hengyi's ability to leverage these technological advancements will be a key determinant of its long-term success and market leadership.

The petrochemical industry, including companies like Hengyi Petrochemical, faces evolving technological landscapes driven by new material development. The emergence of advanced synthetic fibers and bio-based alternatives presents both a challenge and an opportunity. For instance, the increasing interest in sustainable textiles could impact demand for traditional polyester, a core product for Hengyi.

To maintain market relevance and explore diversification, significant investment in research and development is crucial. Companies must actively explore and integrate innovative materials that offer enhanced performance or sustainability profiles. This proactive approach is essential for Hengyi to adapt to changing consumer preferences and regulatory environments, potentially leading to new product lines and market segments.

Hengyi Petrochemical is increasingly integrating automation and digitalization across its operations. This includes advanced process control systems in its refining and chemical production facilities, aiming to optimize yields and reduce energy consumption. For example, by 2024, many leading petrochemical firms have reported efficiency gains of 5-10% through AI-driven predictive maintenance, minimizing costly downtime.

Digitalization is also transforming Hengyi's supply chain and logistics. Real-time tracking and data analytics enhance inventory management and transportation efficiency, leading to lower operational costs and improved delivery times. By 2025, the adoption of digital twin technology in complex manufacturing environments is expected to further boost operational control and quality assurance, a trend Hengyi is likely to embrace.

Sustainable Production Technologies

Hengyi Petrochemical is increasingly focusing on sustainable production technologies to minimize its environmental impact. Innovations like carbon capture, utilization, and storage (CCUS) are being explored to reduce greenhouse gas emissions from its operations. For instance, the global CCUS market is projected to grow significantly, reaching an estimated USD 50 billion by 2030, indicating a strong trend towards adopting such technologies.

Investing in these advanced processes directly aids in meeting stricter environmental regulations and can significantly enhance the company's corporate image. Technologies such as waste heat recovery systems can improve energy efficiency, leading to cost savings and a reduced carbon footprint. Efficient water usage technologies are also critical, especially in water-scarce regions where petrochemical plants often operate.

- Technological Advancement: Adoption of CCUS and waste heat recovery systems to curb emissions and boost energy efficiency.

- Compliance and Image: Enhanced regulatory compliance and improved brand reputation through green initiatives.

- Water Management: Implementation of water-saving technologies to address operational challenges and environmental concerns.

R&D in Circular Economy Solutions

Technological advancements in the circular economy are rapidly reshaping the petrochemical landscape. Innovations in chemical recycling of plastics and textiles, for instance, offer new pathways for feedstock recovery. Companies like Hengyi Petrochemical can leverage these technologies to create a more sustainable business model.

The development of bio-based feedstocks for petrochemicals is another critical area. These alternatives to traditional fossil fuels reduce reliance on non-renewable resources and lower carbon footprints. Hengyi's investment in or adoption of these bio-based solutions could significantly bolster its position in a future economy prioritizing sustainability.

- Chemical Recycling Growth: The global chemical recycling market is projected to reach approximately $10.5 billion by 2028, indicating substantial technological progress and market demand.

- Bio-based Feedstock Investment: Investments in bio-based chemicals and materials are steadily increasing, with many major petrochemical players announcing ambitious targets for renewable feedstock utilization by 2030.

- Hengyi's Potential: By integrating these circular economy technologies, Hengyi Petrochemical can enhance resource efficiency, reduce waste, and meet evolving regulatory and consumer expectations for environmental responsibility.

Hengyi Petrochemical's technological trajectory is marked by a strong push towards digitalization and automation. By 2025, the integration of AI-driven predictive maintenance is expected to yield efficiency gains of 5-10% for leading petrochemical firms, a benefit Hengyi is poised to capture. Furthermore, the adoption of digital twin technology is anticipated to enhance operational control and quality assurance in complex manufacturing environments.

The company is also investing in sustainable production technologies, including carbon capture, utilization, and storage (CCUS), aiming to reduce its environmental footprint. The global CCUS market is projected for substantial growth, highlighting the industry-wide trend towards emission reduction technologies. Efficient water management systems are also critical, especially given the operational needs of petrochemical plants.

| Technological Focus | Key Advancements | Expected Impact | Industry Trend Data |

| Digitalization & Automation | AI-driven predictive maintenance, Digital Twins | Improved efficiency (5-10% gain), enhanced operational control, reduced downtime | By 2025, digital twins expected to boost control in manufacturing. |

| Sustainable Technologies | CCUS, Waste Heat Recovery, Water-efficient systems | Reduced emissions, improved energy efficiency, lower operational costs, enhanced corporate image | Global CCUS market projected to reach USD 50 billion by 2030. |

| Circular Economy | Chemical Recycling, Bio-based Feedstocks | Resource efficiency, waste reduction, sustainable business models, reduced reliance on fossil fuels | Global chemical recycling market projected to reach ~$10.5 billion by 2028. |

Legal factors

Environmental regulations are tightening globally, impacting petrochemical operations like Hengyi Petrochemical. China, a key market, has been progressively strengthening its environmental protection laws, focusing on air and water pollution control. For instance, the nation's revised Environmental Protection Law, effective from 2015 and further reinforced by subsequent policies, mandates stricter emission standards for industries, including petrochemicals. Non-compliance can result in significant fines, with penalties often calculated daily and potentially reaching millions of yuan, as seen in various enforcement actions against polluting enterprises.

Hengyi must navigate these evolving legal landscapes, which necessitate substantial investments in cleaner production technologies and waste management systems. Operational changes might include upgrading emission control equipment to meet new standards for sulfur dioxide (SO2) and nitrogen oxides (NOx), as well as implementing advanced wastewater treatment processes. Failure to comply not only risks financial penalties but also potential operational shutdowns, as demonstrated by stricter enforcement campaigns initiated by Chinese environmental authorities in recent years, impacting production continuity for non-compliant facilities.

Hengyi Petrochemical operates within a stringent legal environment concerning labor and worker safety. Compliance with China's Labor Contract Law and regulations on occupational health and safety is paramount, directly influencing HR policies and operational procedures. Failure to adhere can lead to significant fines and reputational damage.

Adherence to these labor laws impacts Hengyi's human resource policies by dictating hiring practices, wage structures, and employee benefits. For instance, the minimum wage in key operational regions like Zhejiang province was updated in 2024, requiring adjustments to compensation packages. Furthermore, robust safety protocols are essential to prevent workplace accidents, which in 2023, saw industrial injury insurance claims impacting the overall operational costs for many manufacturing firms.

The company's risk management strategy must incorporate proactive measures to ensure compliance with evolving labor and safety standards. This includes regular safety audits, employee training programs, and staying abreast of legislative changes, such as potential updates to the Law on Prevention and Control of Occupational Diseases anticipated in the 2024-2025 period. Such diligence mitigates legal liabilities and operational disruptions.

Hengyi Petrochemical must navigate a complex web of legal requirements concerning product safety and quality. This includes stringent regulations for petrochemicals and textile fibers across key markets, such as REACH in Europe and TSCA in the United States, which govern chemical registration, evaluation, and authorization. Failure to comply can result in significant fines and market exclusion.

Meeting international standards, like ISO 9001 for quality management and various industry-specific safety certifications, is crucial for Hengyi to avoid legal liabilities. For instance, the Global Recycled Standard (GRS) impacts the textile fiber segment, requiring traceability and verification of recycled content. In 2023, the global petrochemical market faced increased scrutiny on environmental impact and product safety, leading to stricter enforcement of existing regulations and the introduction of new ones in several major economies.

Anti-Trust and Competition Laws

Anti-trust and competition laws are a significant legal consideration for Hengyi Petrochemical. These regulations are designed to prevent monopolies and ensure fair competition within the petrochemical industry, impacting how Hengyi can strategize for market share, pursue mergers and acquisitions, or engage in collaborations. For instance, China's Anti-Monopoly Law, enacted in 2008 and subject to ongoing enforcement and potential revisions, scrutinizes business practices that could stifle competition. Any significant market consolidation or partnership by Hengyi would likely face regulatory review to ensure it doesn't create an unfair advantage or limit consumer choice.

The enforcement of these laws can directly influence Hengyi's operational and strategic flexibility. For example, if Hengyi were to consider acquiring a competitor or entering into a joint venture, regulatory bodies would assess the potential impact on market concentration. In 2023, China's State Administration for Market Regulation (SAMR) continued its focus on ensuring fair market competition across various sectors, including energy and chemicals, indicating a proactive stance in monitoring industry dynamics.

- Market Share Impact: Strict adherence to anti-trust laws may limit Hengyi's ability to aggressively expand its market share through acquisitions if such moves are deemed to create a dominant market position.

- Merger and Acquisition Scrutiny: Potential mergers or acquisitions by Hengyi would be subject to thorough review by competition authorities to prevent the formation of monopolies or significant reductions in competition.

- Collaboration Agreements: Joint ventures and other collaborative agreements must be structured to avoid anti-competitive practices, such as price-fixing or market allocation, to comply with legal frameworks.

- Regulatory Compliance Costs: Hengyi incurs costs related to ensuring compliance with evolving anti-trust regulations, including legal counsel and internal review processes, especially as it operates in a global market with varying competition laws.

International Trade Laws and Sanctions

International trade laws and sanctions significantly influence Hengyi Petrochemical's operations, affecting its capacity to source raw materials and distribute finished goods worldwide. Navigating the intricate web of customs regulations and trade agreements is crucial for maintaining global market access and avoiding penalties. For instance, in 2023, the global trade landscape saw continued adjustments due to geopolitical tensions, impacting supply chain stability for petrochemical companies like Hengyi.

Compliance with these legal frameworks is paramount. Hengyi must adhere to diverse import/export controls and anti-dumping duties that vary by country. The company's ability to manage these complexities directly impacts its cost structure and market competitiveness. Recent trade disputes, such as those involving major economies, highlight the potential for tariffs to increase operational expenses and disrupt established trade routes.

- Global Trade Volume: The World Trade Organization (WTO) projected a 2.6% increase in global merchandise trade volume for 2024, indicating a potential rebound and opportunities for companies like Hengyi, but also highlighting the need for careful navigation of trade policies.

- Sanctions Impact: Economic sanctions imposed by various nations can restrict access to critical feedstock or markets, forcing companies to find alternative sourcing or sales channels, thereby increasing logistical costs and potentially reducing profit margins.

- Customs Duties: Varying customs duties on refined petroleum products and chemical intermediates can significantly alter the landed cost of imports and the competitiveness of exports, requiring constant monitoring and strategic tariff management.

- Regulatory Compliance: Hengyi faces stringent compliance requirements related to product standards, environmental regulations, and trade documentation in each jurisdiction it operates in, with non-compliance leading to fines or market exclusion.

Hengyi Petrochemical operates under a robust legal framework governing intellectual property (IP) rights, crucial for protecting its innovations in petrochemical processes and product development. China's increasingly stringent IP laws, including the Patent Law and Trademark Law, necessitate proactive measures to safeguard proprietary technologies and brand identity. Failure to secure and defend IP can lead to significant financial losses and competitive disadvantages.

The company must actively manage its IP portfolio to prevent infringement and capitalize on its innovations. This involves registering patents for new chemical processes and trademarks for its product lines. For example, in 2023, China saw a significant increase in patent applications in the chemical sector, underscoring the competitive IP landscape. Hengyi's strategy must include monitoring for potential infringements and pursuing legal remedies when necessary, ensuring its technological edge is maintained.

Compliance with IP laws impacts Hengyi’s R&D investment decisions and its ability to enter into licensing agreements or joint ventures. Protecting trade secrets related to proprietary formulations and manufacturing techniques is equally vital. The company must implement strong internal controls and employee agreements to prevent the unauthorized disclosure of sensitive information, especially as it expands into new international markets with varying IP protection standards.

Environmental factors

Global and national pressures to curb greenhouse gas emissions are intensifying, directly affecting energy-intensive industries like petrochemicals. Hengyi Petrochemical, as a major player, faces scrutiny regarding its carbon footprint. For instance, China, where Hengyi operates, has pledged to peak carbon emissions before 2030 and achieve carbon neutrality by 2060, creating a significant regulatory environment.

This push towards decarbonization translates into potential financial implications for Hengyi. The introduction or expansion of carbon taxes and emission trading schemes could increase operational costs. For example, the European Union's Carbon Border Adjustment Mechanism (CBAM) could indirectly impact Hengyi if its products are exported to the EU. Consequently, substantial investment in lower-carbon technologies and more efficient processes will be crucial for maintaining competitiveness and compliance.

The petrochemical industry, including companies like Hengyi, faces significant environmental scrutiny regarding plastic and textile waste. There's a global push towards circular economy models, aiming to minimize waste and maximize resource utilization. This shift necessitates innovative approaches to waste management and recycling.

Hengyi Petrochemical is increasingly focused on reducing its waste footprint and exploring recycling initiatives. While specific 2024/2025 figures for Hengyi's recycling rates are not yet widely published, the broader industry saw significant investment in advanced recycling technologies in 2024. For instance, the global chemical recycling market was projected to reach over $10 billion by 2025, indicating a strong trend toward incorporating recycled content into new products.

Hengyi Petrochemical's operations are inherently tied to natural resource consumption, with water being a critical input for cooling and processing in petrochemical manufacturing. The increasing global focus on sustainability and the very real threat of water scarcity in many regions present significant environmental challenges.

Effective water management is therefore paramount. Companies like Hengyi must invest in and implement advanced water recycling and conservation technologies to mitigate operational risks and environmental impact. For instance, in 2024, regions heavily reliant on petrochemicals have seen water stress indices rise, impacting industrial water availability and cost.

Pollution Control and Mitigation

Hengyi Petrochemical, like many in its industry, faces scrutiny over air and water pollution. In 2024, the company continued to invest in advanced emission control systems and wastewater treatment facilities to comply with increasingly stringent environmental regulations in China and globally. These efforts are crucial for maintaining its social license to operate and avoiding potential fines or operational disruptions.

The company's commitment to sustainability is reflected in its ongoing capital expenditures. For instance, Hengyi has allocated significant funds towards upgrading its Brunei facility to incorporate best-in-class pollution abatement technologies. This includes investments in flue gas desulfurization (FGD) units and advanced membrane bioreactors for wastewater treatment, aiming to reduce sulfur dioxide and nitrogen oxide emissions, as well as improve water quality discharged from its operations.

- Investment in Advanced Technologies: Hengyi Petrochemical has been actively deploying technologies such as selective catalytic reduction (SCR) for NOx control and enhanced volatile organic compound (VOC) recovery systems across its plants.

- Regulatory Compliance: The company's pollution control strategies are designed to meet or exceed national environmental standards, such as those set by China's Ministry of Ecology and Environment, which are continually being tightened.

- Ecological Footprint Reduction: By investing in cleaner production processes and waste minimization techniques, Hengyi aims to reduce its overall environmental impact, including greenhouse gas emissions and water consumption.

- Sustainability Reporting: Hengyi's 2024 sustainability reports highlight progress in reducing pollutant discharge intensity per unit of production, demonstrating a tangible effort towards environmental stewardship.

Biodiversity and Ecosystem Impact

Hengyi Petrochemical, like any major industrial player, faces scrutiny regarding its broader environmental footprint beyond direct emissions. This includes managing land use for its facilities and mitigating the risk of accidental spills that could devastate local ecosystems and biodiversity. The company's commitment to ecological stewardship is crucial for maintaining its social license to operate and for long-term sustainability.

In 2023, China's Ministry of Ecology and Environment continued to emphasize stricter regulations on industrial land use and pollution prevention, impacting companies like Hengyi. While specific spill data for Hengyi isn't readily available in public reports, the industry average for petrochemical facilities in Asia saw a slight decrease in reported minor spill incidents in 2024 compared to previous years, suggesting a growing focus on operational safety and containment protocols.

- Land Use Management: Hengyi's expansion projects require careful planning to minimize habitat disruption and consider the ecological value of occupied land.

- Spill Prevention and Response: Robust containment systems and rapid response plans are vital to prevent and manage potential leaks, protecting water sources and soil health.

- Biodiversity Conservation Efforts: Proactive measures, such as habitat restoration or supporting local conservation initiatives, can demonstrate a commitment to offsetting operational impacts on surrounding flora and fauna.

The global push for decarbonization directly impacts Hengyi Petrochemical, with China aiming for peak emissions before 2030 and carbon neutrality by 2060. This regulatory landscape necessitates significant investment in lower-carbon technologies to maintain competitiveness and compliance, especially with mechanisms like the EU's Carbon Border Adjustment Mechanism potentially affecting exports.

Hengyi faces increasing pressure to adopt circular economy principles and reduce waste, particularly plastic and textile waste. The global chemical recycling market was projected to exceed $10 billion by 2025, signaling a strong industry trend towards incorporating recycled content, a move Hengyi is also exploring.

Water scarcity and sustainability concerns are critical for Hengyi's operations, which rely heavily on water for cooling and processing. Investing in advanced water recycling and conservation technologies is essential to mitigate risks, particularly as water stress indices rose in key industrial regions during 2024.

The company is actively investing in pollution control, including advanced emission control systems and wastewater treatment facilities, to meet tightening environmental regulations. For instance, upgrades at its Brunei facility include flue gas desulfurization units and advanced membrane bioreactors, demonstrating a commitment to reducing its ecological footprint.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Hengyi Petrochemical is built on a robust foundation of data from official government publications, international economic organizations, and leading industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.