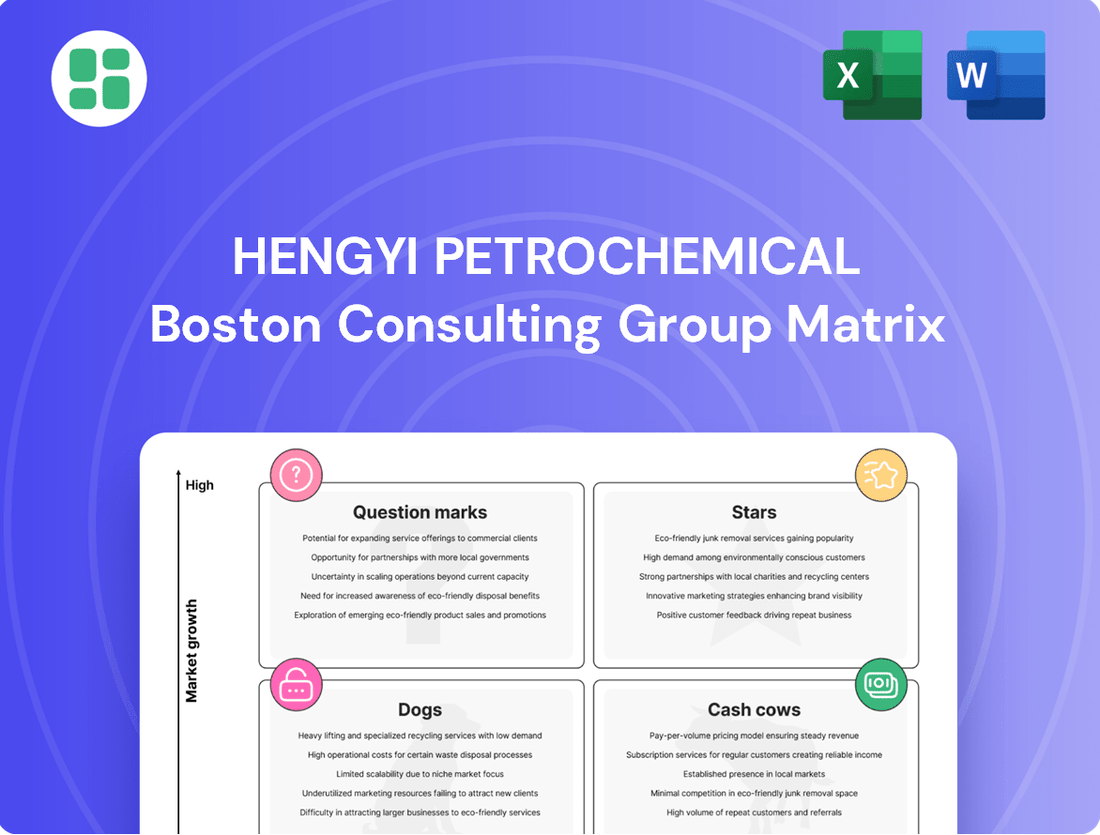

Hengyi Petrochemical Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hengyi Petrochemical Bundle

Curious about Hengyi Petrochemical's market standing? Our BCG Matrix preview offers a glimpse into their product portfolio's potential, highlighting areas of growth and stability.

However, to truly understand their strategic positioning and unlock actionable insights, you need the full picture. Purchase the complete BCG Matrix report for a detailed quadrant-by-quadrant analysis, empowering you to make informed investment and product development decisions.

Stars

Hengyi Petrochemical's 'Technology-Driven Hengyi' strategy is fueling the development of new, high-value-added petrochemical derivatives. This focus on accelerating R&D aims to capture significant share in emerging, high-growth market segments.

These specialized petrochemicals, designed for high-growth applications, are central to Hengyi's diversification efforts. Strategic investments in new technologies are intended to position these products as future market leaders, driving innovation and competitive advantage.

Hengyi Petrochemical's Brunei Phase 2 expansion centers on a new 1.65 million metric tons per annum (MMTA) ethylene cracker and polyethylene plant. This substantial investment targets burgeoning polymer markets, positioning Hengyi to capitalize on high-growth opportunities.

The new facilities are crucial for producing ethylene and polyethylene, essential building blocks for numerous downstream manufacturing sectors. This strategic move underscores Hengyi's ambition to secure a dominant share in these expanding global markets.

The projected completion of this phase is anticipated to provide a significant boost to Brunei's Gross Domestic Product (GDP). This economic impact highlights the project's potential and the strong market demand it aims to serve.

Hengyi Petrochemical's Brunei Phase 2 expansion includes a significant 1 million tonne per annum (MMTA) polypropylene (PP) plant, incorporating advanced production technology. This move leverages the generally robust growth observed in global polypropylene markets, fueled by its widespread use in packaging, automotive components, textiles, and consumer goods. For instance, the global polypropylene market was valued at approximately $100 billion in 2023 and is projected to grow at a CAGR of over 5% through 2030, according to industry reports.

By introducing new, highly efficient capacity, Hengyi is strategically positioned to capture a substantial share of this expanding market. This expansion not only diversifies Hengyi's product portfolio but also enhances its competitive edge in a segment with strong demand fundamentals.

Advanced Polyester Fibers and Differentiated Products

Hengyi Petrochemical is strategically shifting its focus towards advanced polyester fibers and differentiated products like polyester pre-oriented yarn (POY), fully drawn yarn (FDY), drawn textured yarn (DTY), and short fiber. This move targets specific, high-growth niche applications, such as technical textiles and performance apparel.

While the broader polyester fiber market is considered mature, these specialized variants allow Hengyi to capture significant market share within rapidly expanding sub-segments. For instance, the global technical textiles market was valued at approximately USD 220 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 5% through 2030, driven by demand in automotive, construction, and healthcare sectors.

- Polyester POY, FDY, and DTY: These are foundational components for many textile applications, with demand influenced by fashion cycles and industrial use.

- Short Fiber: Used in non-woven applications, such as hygiene products and filtration, a segment experiencing consistent growth.

- Technical Textiles: This category, encompassing materials for industrial, protective, and medical uses, is a key growth driver for advanced polyester fibers.

- Performance Wear: The demand for sportswear and activewear, which utilizes moisture-wicking and durable polyester fibers, continues to rise globally.

Bio-based and Recycled Petrochemical Products

Hengyi Petrochemical's focus on bio-based and recycled petrochemical products demonstrates a strong commitment to green manufacturing and circular economy principles. This strategic direction taps into a rapidly growing market, fueled by increasing consumer and regulatory demand for sustainable materials.

The company's investments in developing bio-based alternatives and recycled polyester are designed to capture significant market share in these emerging sectors. For instance, the global recycled polyester market was valued at approximately USD 9.8 billion in 2023 and is projected to grow substantially, with Hengyi aiming to be a key player.

- Market Growth: The demand for sustainable petrochemicals is a significant trend, with the bio-based chemicals market expected to reach over USD 100 billion by 2027.

- Hengyi's Investment: Hengyi's efforts in recycled polyester production, a key component of the circular economy, position them to benefit from this expansion.

- Competitive Advantage: By investing early in these green technologies, Hengyi aims to establish a competitive edge in a market that is still developing its leaders.

Hengyi Petrochemical's advanced polyester fibers and differentiated products are positioned as Stars in the BCG Matrix. These specialized materials, including POY, FDY, and DTY, target high-growth niche applications like technical textiles and performance apparel. The company's strategic investments in these areas aim to secure significant market share within rapidly expanding sub-segments of the broader polyester market.

The global technical textiles market, a key driver for these advanced fibers, was valued at approximately USD 220 billion in 2023 and is projected to grow at a CAGR exceeding 5% through 2030. Similarly, the demand for performance wear, utilizing specialized polyester fibers, continues its upward trend globally.

Hengyi's strategic shift towards these high-value products, coupled with its focus on bio-based and recycled petrochemicals, reinforces their Star status. These segments represent high market growth potential, with the bio-based chemicals market expected to surpass USD 100 billion by 2027, and Hengyi actively investing to lead in these areas.

| Product Category | Market Segment | Growth Potential | Hengyi's Strategy | 2023 Market Value (Approx.) |

|---|---|---|---|---|

| Advanced Polyester Fibers (POY, FDY, DTY) | Technical Textiles, Performance Apparel | High | Focus on niche applications, R&D | Technical Textiles: USD 220 billion |

| Bio-based Petrochemicals | Sustainable Materials | Very High | Green manufacturing, circular economy | Bio-based Chemicals: Projected > USD 100 billion by 2027 |

| Recycled Polyester | Sustainable Materials | High | Investment in recycling technology | Recycled Polyester: USD 9.8 billion |

What is included in the product

Hengyi Petrochemical's BCG Matrix analysis identifies key business units, guiding strategic decisions for investment, divestment, and resource allocation.

Hengyi Petrochemical's BCG Matrix offers a clear, one-page overview, simplifying complex portfolio analysis for strategic decision-making.

Cash Cows

Hengyi Petrochemical's Purified Terephthalic Acid (PTA) production stands as a prime example of a Cash Cow within its portfolio. PTA is the fundamental building block for polyester, a material ubiquitous in textiles and packaging.

The global PTA market, while mature, exhibits a stable growth trajectory. Projections suggest a Compound Annual Growth Rate (CAGR) of approximately 5.1% to 5.3% between 2024 and 2029, underscoring consistent and reliable demand.

Leveraging its substantial production capacity and entrenched position in the polyester value chain, Hengyi commands a significant market share. This dominance translates into predictable and robust cash flows from its PTA operations, a hallmark of a Cash Cow.

Hengyi Petrochemical's standard grade polyester fiber production stands as a prime example of a Cash Cow within its portfolio. As a large-scale producer, the company benefits from economies of scale in a mature market.

The global polyester fiber market, while experiencing moderate growth, offers stable demand. Projections indicate a compound annual growth rate (CAGR) for standard polyester fibers ranging between 3.6% and 7.42% through 2028, depending on the specific segment and forecast. This steady demand, coupled with Hengyi's established infrastructure and market share, ensures consistent revenue generation.

These operations generate significant and reliable cash flows, requiring minimal reinvestment for growth. Hengyi's ability to produce these standard grades efficiently allows for substantial profit margins, fueling other ventures within the company.

The first phase of Hengyi's Brunei refinery, which began operations in late 2019, boasts an 8 million tonnes per year crude oil refining capacity. This integrated facility supplies refined fuel products and outputs from its petrochemical complex, establishing a reliable source of raw materials and generating steady revenue.

This operational efficiency positions the integrated refining operations in Brunei as a significant cash generator for Hengyi Petrochemical. Its consistent revenue streams from refined product sales are crucial for funding other ventures within the company's portfolio.

Paraxylene (PX) Production

Hengyi Petrochemical's paraxylene (PX) production is a significant contributor to its status as a cash cow. The company's integrated model means PX, a vital component for its large-scale purified terephthalic acid (PTA) operations, is produced internally. This integration likely translates to a substantial market share in PX, particularly for captive use, which underpins a reliable supply chain and offers cost efficiencies.

This internal PX production provides Hengyi with a distinct competitive edge. By controlling a key raw material, the company can better manage production costs and ensure a consistent flow of PTA, a major revenue driver. This operational synergy is crucial for generating stable cash flows, a hallmark of a cash cow business unit.

- PX Production for PTA: Hengyi's substantial PTA output necessitates significant internal PX generation, positioning it as a leader in PX supply for its own needs.

- Cost Advantages: Integrated PX production offers cost savings and a stable supply, enhancing PTA's profitability and contributing to consistent cash generation.

- Market Position: Hengyi's PX operations likely hold a dominant position in the domestic market, especially for captive consumption, securing its cash cow status.

Caprolactam (CPL) Production

Hengyi Petrochemical's caprolactam (CPL) production is positioned as a Cash Cow within its business portfolio. CPL is a fundamental building block for nylon, a widely used material in textiles, automotive parts, and industrial applications.

While precise 2024 growth figures for the CPL market were not explicitly detailed, its role as a core product signifies its established presence in a stable, mature market. This maturity translates into consistent and predictable cash generation, a hallmark of a Cash Cow.

- Established Market Presence: Caprolactam serves a well-developed and consistent demand base, ensuring steady sales volumes.

- Reliable Cash Flow Generation: The mature nature of the CPL market allows Hengyi Petrochemical to generate dependable cash flow, which can be reinvested in higher-growth areas.

- Supporting Other Business Units: Profits from CPL production are crucial for funding research and development, expansion projects, or acquiring new technologies within the company.

- Contribution to Overall Stability: As a Cash Cow, CPL production contributes significantly to Hengyi Petrochemical's financial stability and operational resilience.

Hengyi Petrochemical's Purified Terephthalic Acid (PTA) operations are a significant Cash Cow, benefiting from a stable global market with projected growth. Its substantial production capacity and strong position in the polyester value chain ensure predictable, robust cash flows.

The company's standard grade polyester fiber production also functions as a Cash Cow. This segment enjoys stable demand, with projected CAGRs of 3.6% to 7.42% through 2028, allowing Hengyi to generate consistent revenue with minimal reinvestment.

Hengyi's integrated refining operations in Brunei, with an 8 million tonnes per year crude oil capacity, are a key cash generator. These facilities provide refined fuel products and petrochemical outputs, contributing to consistent revenue streams.

Internal paraxylene (PX) production for PTA is another strong Cash Cow contributor. This integration offers cost advantages and a stable supply chain, enhancing PTA profitability and securing consistent cash generation.

Caprolactam (CPL) production is also identified as a Cash Cow. Its role as a fundamental building block for nylon in established markets ensures reliable cash flow generation, supporting other company ventures.

What You’re Viewing Is Included

Hengyi Petrochemical BCG Matrix

The Hengyi Petrochemical BCG Matrix you are previewing is the identical, unwatermarked, and fully formatted report you will receive immediately after purchase. This comprehensive analysis provides strategic insights into Hengyi Petrochemical's business units, categorized by market share and growth rate, ready for your immediate use in decision-making. You can confidently expect the exact same professional-grade document, free from any demo content, ensuring a seamless integration into your strategic planning processes.

Dogs

Outdated or low-efficiency production assets at Hengyi Petrochemical would likely fall into the Dogs category. These are older units, perhaps not fully integrated with newer, more efficient complexes, that struggle with higher operational costs and lower output compared to state-of-the-art facilities. For instance, if Hengyi still operates older refining units with lower yields or less advanced catalyst technologies, these would represent significant cost disadvantages.

In 2024, the petrochemical industry is heavily focused on energy efficiency and feedstock flexibility. Assets that cannot adapt to these trends, or those with high maintenance costs and limited product diversification, would be prime candidates for the Dogs quadrant. Hengyi's 2023 annual report, for example, might highlight specific older plants that require substantial capital expenditure to remain competitive, or whose output is increasingly sidelined by newer, more profitable lines.

Hengyi Petrochemical's commodity petrochemical trading, particularly segments focused on high-volume, low-margin products without unique competitive advantages, would likely be classified as a 'Dog' in the BCG matrix. These operations are susceptible to intense price wars and can drag down overall profitability.

For instance, in 2024, the global petrochemical market continued to grapple with overcapacity in certain basic chemicals, leading to thin margins for traders. Companies like Hengyi, if heavily involved in these specific commodity trades, would experience this pressure directly, with potential for low returns on investment.

Underperforming niche chemical products within Hengyi Petrochemical's portfolio would be categorized as Dogs. These are products operating in markets with low growth and low market share, meaning they generate minimal revenue and are unlikely to improve. For instance, if Hengyi invested in a specialized polymer for a niche industrial application that saw its primary market shrink by 15% in 2024 due to technological obsolescence, this product would likely be a Dog.

These products drain resources, such as research and development funds or marketing budgets, without yielding significant returns. A prime example could be a specific additive for a declining manufacturing sector where Hengyi's market share has remained stagnant at 3% for the past three years, with overall market demand falling. This situation exemplifies the characteristics of a Dog, consuming capital with little prospect of future profitability.

Non-core, Divested Business Units

Non-core, divested business units in Hengyi Petrochemical's BCG Matrix would represent ventures with low market share and limited growth potential, making them candidates for divestment. For instance, if Hengyi had a small specialty chemical division that consistently underperformed and faced intense competition, it would fall into this category.

The company's strategic move to acquire the remaining stake in Zhejiang Hengyi Hanlin Enterprise Management Co., Ltd. in 2023, for example, signals a focus on consolidating core operations rather than expanding into less promising areas. This type of consolidation often precedes the shedding of non-core assets.

Consider a hypothetical scenario where Hengyi previously held a minority stake in a small, regional plastics manufacturer that experienced declining demand. If this unit generated minimal revenue and required significant investment to remain competitive, it would be a prime candidate for divestiture, freeing up capital for more strategic growth areas.

- Low Market Share: Units with a small percentage of their respective market.

- Divergent Growth Prospects: Businesses facing stagnant or declining industry growth.

- Strategic Non-Alignment: Operations that do not fit with Hengyi's long-term vision.

- Underperformance: Entities consistently failing to meet profitability targets.

Segments Heavily Reliant on Fluctuating Spot Markets

Segments heavily reliant on fluctuating spot markets, lacking long-term contracts or integrated supply chains, could be considered Hengyi Petrochemical's 'Dogs'. These areas often struggle with price volatility, leading to break-even performance or losses. For instance, the petrochemical industry in 2024 experienced significant challenges due to unpredictable crude oil prices, impacting segments exposed to these spot markets.

These vulnerable segments might include:

- Specific commodity chemical production: Where raw material costs fluctuate wildly and product pricing is directly tied to immediate market supply and demand.

- Trading operations in undifferentiated feedstocks: Businesses that primarily buy and sell basic petrochemical inputs without significant value-add or contractual stability.

- Segments with limited downstream integration: Operations that sell intermediate products on the open market rather than utilizing them internally for higher-margin finished goods.

Hengyi Petrochemical's 'Dogs' likely encompass outdated production assets, such as older refining units with lower yields or less advanced technologies, which face higher operational costs and reduced output. In 2024, the industry's focus on energy efficiency and feedstock flexibility means assets unable to adapt, or those with high maintenance costs and limited product diversification, are prime candidates for this category. For example, if Hengyi's 2023 report indicated specific older plants requiring substantial capital to remain competitive, these would represent 'Dogs'.

Commodity petrochemical trading, especially in high-volume, low-margin products without unique advantages, also falls into the 'Dogs' quadrant due to intense price wars and potential drag on profitability. The global petrochemical market in 2024 continued to see overcapacity in basic chemicals, resulting in thin margins for traders. Hengyi's involvement in such trades would directly expose it to these pressures, potentially yielding low returns.

| Hengyi Petrochemical Potential 'Dogs' Segments | Key Characteristics | 2024 Market Context Impact |

|---|---|---|

| Outdated Refining Units | Lower yields, higher operational costs, less advanced technology | Struggle with energy efficiency demands, face cost disadvantages |

| Commodity Trading (Low Margin) | High volume, low margin, lack of competitive advantage | Impacted by price wars and overcapacity in basic chemicals |

| Underperforming Niche Products | Low market share, low growth markets, minimal revenue generation | Drain R&D and marketing resources without significant returns |

| Non-Core Divested Units | Low market share, limited growth, strategic non-alignment | Consolidation efforts may precede divestment of such assets |

Question Marks

While PTA is a strong performer for Hengyi Petrochemical, the company's position in the PET resin and film market is less clear. This segment is experiencing robust growth, largely due to the expanding packaging and beverage industries. In 2023, PET resin alone represented 42.5% of the PTA market, highlighting the significant potential for Hengyi's downstream products.

However, Hengyi's specific market share within this rapidly growing yet highly competitive finished product sector is currently a question mark. To transform this into a star performer, substantial investment will be necessary to capture a larger slice of the PET resin and film market.

Hengyi Petrochemical is actively investing in "green technological innovations" and "low-carbon transformation." This includes exploring areas like advanced chemical recycling and bio-based feedstocks, positioning them for future high-growth markets. These ventures, while promising, currently represent nascent markets with low profitability, classifying them as Question Marks requiring significant research and development funding.

Hengyi Petrochemical's Brunei Phase 2 expansion is set to introduce specialty polymers like butadiene, targeting high-growth markets. While these new products show significant potential, Hengyi's current market share in butadiene is minimal as production ramps up, placing them firmly in the Question Marks category of the BCG Matrix.

These butadiene products require substantial capital investment for production scaling and aggressive market development to gain traction. Success in penetrating these new polymer markets is crucial for transforming them from Question Marks into Stars, driving future revenue and profitability for Hengyi Petrochemical.

Expansion into New Geographical Markets

Expansion into new geographical markets for Hengyi Petrochemical would place it in the question mark category of the BCG matrix. These are markets with high growth potential but where Hengyi currently holds a minimal market share, requiring significant investment to establish a presence.

For instance, while Hengyi has operations in established regions, venturing into emerging economies in Africa or South America, where petrochemical demand is projected to rise significantly, would represent a question mark. These regions often have developing infrastructure and evolving regulatory landscapes, presenting both opportunities and challenges.

- High Growth Potential: Emerging markets often exhibit higher GDP growth rates and increasing industrialization, driving demand for petrochemical products.

- Low Market Share: Hengyi's current penetration in these nascent markets is typically low, meaning it has not yet captured a substantial portion of the available business.

- Significant Investment Required: Entering these markets necessitates substantial capital outlay for building infrastructure, establishing distribution networks, and marketing efforts.

- Strategic Importance: Despite the risks, these markets are crucial for long-term growth and diversification, aiming to transform them into future stars.

Digital and Intelligent Manufacturing Initiatives

Hengyi Petrochemical is actively pursuing digital and intelligent manufacturing upgrades within the chemical fiber sector. This strategic focus aims to enhance operational efficiency and foster innovation. The company is also building a comprehensive big data platform for the chemical fiber industry chain, positioning intelligent manufacturing as a key emerging business.

These initiatives are crucial for Hengyi's long-term competitiveness, representing potential high-growth avenues for both operational improvements and the development of novel business models. While their current market share contribution is minimal, the ongoing investment underscores their importance for future expansion and market leadership.

- Digitalization Efforts: Hengyi is investing in smart factory technologies and data analytics to optimize production processes in its chemical fiber operations.

- Big Data Platform: The development of a comprehensive big data platform for the chemical fiber industry chain is underway, aiming to provide insights and drive intelligent manufacturing.

- Emerging Business: Intelligent manufacturing is being cultivated as a new business segment, leveraging digital advancements for future growth.

- Investment Focus: Significant ongoing investment is allocated to these digital and intelligent manufacturing initiatives, reflecting their strategic importance despite current low market share contribution.

Hengyi Petrochemical's ventures into new product lines and geographical markets, such as specialty polymers like butadiene and emerging economies, represent classic Question Marks. These areas offer high growth potential but currently have minimal market share for Hengyi, demanding significant capital investment and strategic market development to achieve success.

The company's focus on digital and intelligent manufacturing within the chemical fiber sector also falls into this category. While these initiatives are crucial for future competitiveness and hold promise for new business models, their current market share contribution is negligible, necessitating ongoing investment and development.

These Question Marks are critical for Hengyi's long-term strategy, aiming to transform them into future Stars through targeted investments and market penetration. Successfully navigating these nascent markets is key to diversifying revenue streams and ensuring sustained profitability.

| Business Area | Market Growth | Hengyi's Market Share | Investment Need | Potential |

|---|---|---|---|---|

| Specialty Polymers (e.g., Butadiene) | High | Minimal | Substantial | Star |

| Emerging Geographical Markets | High | Low | Significant | Star |

| Intelligent Manufacturing (Chemical Fibers) | High | Negligible | Ongoing | Star |

BCG Matrix Data Sources

Our Hengyi Petrochemical BCG Matrix is built on comprehensive data, including financial disclosures, industry growth rates, and market share analysis.

This analysis leverages official company reports, market research, and expert insights to accurately position Hengyi Petrochemical's business units.