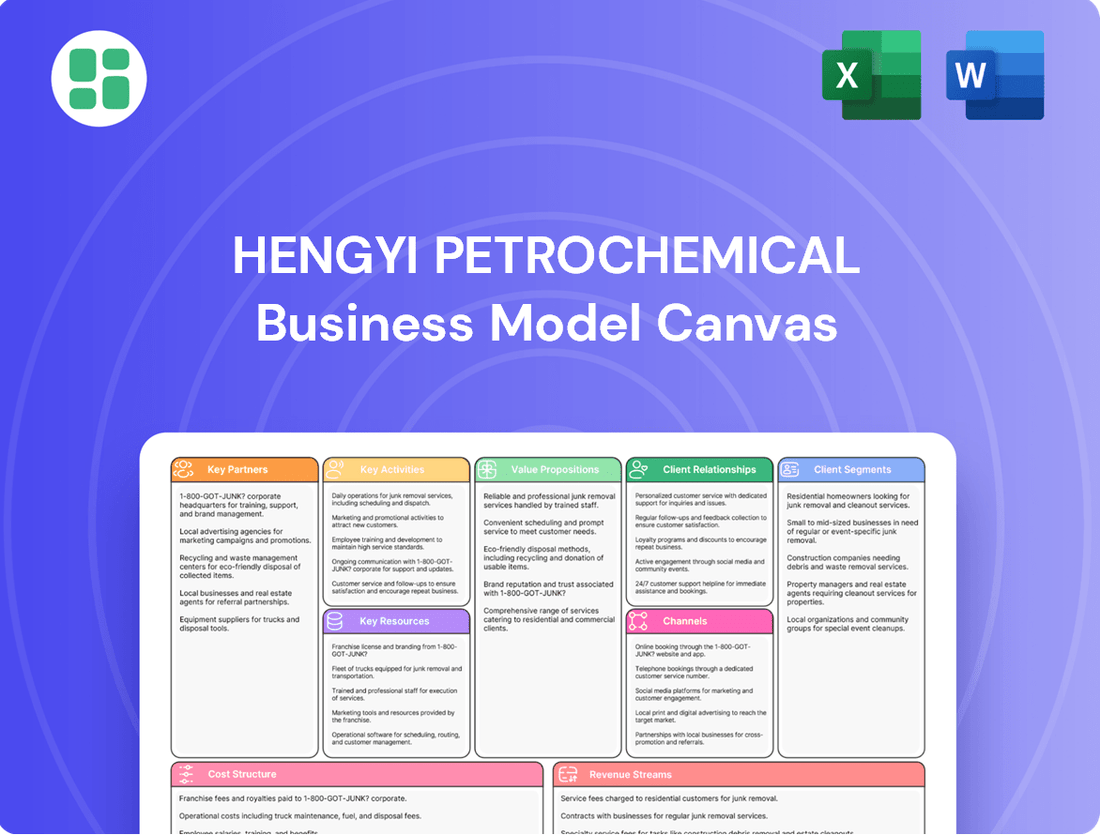

Hengyi Petrochemical Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hengyi Petrochemical Bundle

Discover the strategic core of Hengyi Petrochemical's operations with our comprehensive Business Model Canvas. This detailed analysis breaks down how Hengyi Petrochemical creates, delivers, and captures value in the complex petrochemical industry, offering a clear roadmap to their success. Unlock this essential tool to gain a competitive edge and refine your own business strategies.

Partnerships

Hengyi Petrochemical's strategic joint ventures are foundational to its global expansion, notably the Hengyi Industries project in Brunei. This venture is a significant collaboration with Damai Holdings, a key entity within Brunei's Strategic Development Capital Fund.

This partnership is vital for the massive petrochemical complex on Pulau Muara Besar, showcasing extensive international and governmental cooperation. In 2023, Hengyi Industries reported significant progress, with its Brunei refinery achieving an average crude processing capacity of approximately 16 million tons per year, underscoring the scale and operational success of this key partnership.

Hengyi Petrochemical's success hinges on its key partnerships with raw material suppliers, particularly for crude oil and paraxylene. These relationships are the bedrock of its refining and petrochemical production, ensuring a steady flow of essential inputs.

In 2024, Hengyi Petrochemical continued to strengthen its ties with major global crude oil producers and paraxylene suppliers. These stable, long-term agreements are vital for maintaining cost competitiveness and ensuring uninterrupted production of key products such as purified terephthalic acid (PTA) and polyester fibers, which are fundamental to its value chain.

Hengyi Petrochemical's collaborations with technology providers are crucial for its advanced production capabilities and product diversification. For instance, its significant investments in Brunei, including planned polyethylene and polypropylene plants, leverage cutting-edge technologies from industry leaders like Univation and Lummus. These partnerships are instrumental in ensuring Hengyi remains at the forefront of technological innovation and operational efficiency within the petrochemical sector.

Logistics and Distribution Partners

Hengyi Petrochemical relies on a robust network of logistics and distribution partners to ensure its diverse petrochemical products reach global markets efficiently. This strategic collaboration is crucial for delivering refined oils, PTA, and polyester fibers both domestically and internationally.

These partnerships are designed to optimize the speed and reliability of its supply chain, enabling Hengyi to respond effectively to market demands. For instance, in 2024, Hengyi Petrochemical's extensive product portfolio, including key materials like purified terephthalic acid (PTA), necessitates strong relationships with specialized shipping and logistics providers.

- Global Reach: Partners facilitate the movement of products across continents, supporting Hengyi's international sales strategy.

- Supply Chain Efficiency: Collaboration with logistics firms enhances delivery times and reduces costs, critical for competitive pricing.

- Product Diversity: The network is equipped to handle various petrochemicals, from bulk refined oils to specialized polyester fibers.

- Market Responsiveness: Optimized distribution channels allow Hengyi to quickly adapt to fluctuating demand in different regions.

Research and Development Collaborations

Hengyi Petrochemical actively engages in research and development collaborations with leading universities and industrial partners. These partnerships are crucial for innovation, enabling the development of new petrochemical products and the enhancement of existing manufacturing processes. For example, in 2024, Hengyi announced a significant R&D initiative focused on advanced materials and sustainable chemical production methods.

- Strategic Alliances: Collaborations with research institutions and industry peers are fundamental to Hengyi's strategy of becoming a 'Technology-Driven Hengyi'.

- Product Innovation: These partnerships drive the creation of novel products, including those with improved environmental profiles.

- Process Optimization: Collaborations aim to refine production techniques, leading to greater efficiency and reduced environmental impact.

- Sustainability Focus: A key objective is the development of eco-friendly products and processes, aligning with global sustainability trends.

Hengyi Petrochemical's key partnerships extend to financial institutions and investment firms, crucial for funding its large-scale projects and ensuring financial stability. These collaborations provide the necessary capital for expansion and operational upgrades.

In 2024, Hengyi Petrochemical secured significant financing through strategic alliances with major international banks and investment funds, facilitating the continued development of its Brunei complex and other global ventures. These financial partnerships are instrumental in managing the capital-intensive nature of the petrochemical industry.

| Partner Type | Role | Impact | 2024 Focus |

|---|---|---|---|

| Financial Institutions | Project Financing, Debt Restructuring | Capital access for expansion, operational stability | Securing long-term debt for new polyethylene/polypropylene plants |

| Investment Firms | Equity Investment, Strategic Funding | Capital for R&D, market diversification | Attracting strategic investors for sustainability initiatives |

What is included in the product

A detailed blueprint of Hengyi Petrochemical's strategy, outlining its core operations, customer focus, and revenue streams within the refining and petrochemical industry.

This model highlights Hengyi's integrated approach, from raw material sourcing to product distribution, emphasizing its competitive advantages in scale and market reach.

The Hengyi Petrochemical Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex operations, simplifying strategic understanding and communication.

Activities

Hengyi Petrochemical's primary activity is the seamless integration of crude oil refining with the subsequent production of key petrochemicals. This includes essential products like paraxylene, benzene, and caprolactam, forming a robust value chain.

The company's 'Refining-PX-Polyester-Spinning' model is a cornerstone of its operations, enabling substantial synergistic advantages and driving down costs across the entire production process.

In 2024, Hengyi Petrochemical's integrated refining and petrochemical operations are central to its market position. For instance, its Brunei integrated refining and petrochemical project achieved a significant milestone, processing approximately 8 million tons of crude oil annually, underscoring the scale of its refining capabilities.

Hengyi Petrochemical's core operations revolve around the large-scale manufacturing of purified terephthalic acid (PTA) and a wide array of polyester fibers, including POY, FDY, DTY, and staple fiber. These materials are crucial building blocks for numerous industries, from textiles to packaging, forming the backbone of the company's production volume.

In 2024, Hengyi Petrochemical continued to be a major player in PTA and polyester production. For instance, the company's significant PTA capacity allows it to meet substantial domestic and international demand, underpinning its competitive position in the global market.

Hengyi Petrochemical actively markets and sells its petrochemical and fiber products to a global customer base. This involves a deep understanding of market demand, allowing for agile strategy adjustments. In 2023, the company's revenue reached approximately RMB 185.6 billion, showcasing the scale of its sales operations.

Expanding sales channels is a key focus to maintain its prominent position in the global polyester industry supply chain. The company's commitment to innovation and product quality underpins its ability to compete internationally, contributing to its substantial market presence.

Research, Development, and Innovation

Hengyi Petrochemical's commitment to research, development, and innovation is a cornerstone of its strategy. This continuous investment fuels product innovation, sharpens process efficiency, and drives progress toward ambitious sustainability targets. For instance, in 2023, the company continued to emphasize technological advancements, aiming to solidify its position as a 'Technology-Driven Hengyi.'

The company's focus is on achieving significant breakthroughs in environmentally friendly manufacturing processes and pioneering the development of novel materials. This forward-looking approach is crucial for staying competitive in a rapidly evolving global petrochemical landscape. Hengyi's strategic direction involves exploring new avenues for growth through cutting-edge research.

- Focus on Green Manufacturing: Hengyi is actively investing in R&D for cleaner production methods and reduced environmental impact.

- New Material Development: The company prioritizes research into advanced materials with enhanced properties and applications.

- Process Optimization: Continuous efforts are made to improve existing manufacturing processes for greater efficiency and cost-effectiveness.

- Technology-Driven Transformation: Hengyi aims to leverage technological innovation across its operations to enhance competitiveness and sustainability.

Supply Chain Management and Optimization

Hengyi Petrochemical's core operations revolve around meticulously managing a vast global supply chain. This encompasses everything from securing essential crude oil and chemical feedstocks to delivering refined products and petrochemicals to a diverse clientele worldwide. A significant focus in 2024 and leading into 2025 is enhancing the efficiency and responsiveness of these intricate logistics networks.

Optimization efforts are continuous, aiming to reduce transit times and costs while ensuring the consistent availability of products. This agility is crucial for meeting the dynamic demands of various industries that rely on Hengyi's output. The company is investing in advanced tracking and forecasting technologies to build greater visibility and resilience into its supply chain services.

- Procurement of Raw Materials: Securing reliable and cost-effective supplies of crude oil and other feedstocks from global sources.

- Logistics and Transportation: Managing the movement of goods via sea, rail, and road, optimizing routes and carriers.

- Inventory Management: Balancing stock levels to meet demand without incurring excessive holding costs.

- Distribution Network: Ensuring timely and efficient delivery of finished products to customers across various regions.

Hengyi Petrochemical's key activities are deeply rooted in its integrated business model, focusing on refining crude oil and producing a wide range of petrochemicals and polyester products. This vertical integration allows for significant cost efficiencies and a strong market position. The company's strategic emphasis on technological advancement and green manufacturing further shapes its operational priorities. In 2024, Hengyi continued to bolster its refining capacity, with its Brunei project processing approximately 8 million tons of crude oil annually, a testament to its operational scale.

The company's production prowess extends to key intermediates like purified terephthalic acid (PTA) and various polyester fibers, essential for industries from textiles to packaging. Hengyi's substantial PTA capacity in 2024 ensures it can meet considerable global demand, reinforcing its competitive edge. Furthermore, a core activity involves the robust marketing and sales of these products to a worldwide customer base, supported by a revenue of approximately RMB 185.6 billion in 2023, indicating the vast scope of its commercial reach.

Continuous investment in research, development, and innovation is paramount, driving product enhancement and process optimization. Hengyi's commitment to becoming a 'Technology-Driven Hengyi' in 2023 highlighted its focus on breakthroughs in eco-friendly manufacturing and novel material development. This forward-thinking approach is critical for maintaining leadership in the dynamic petrochemical sector.

Managing a complex global supply chain, from feedstock procurement to product delivery, is another vital activity. In 2024, Hengyi prioritized enhancing the efficiency and responsiveness of its logistics networks, utilizing advanced tracking and forecasting technologies. This ensures the consistent availability of products and reduces transit times and costs for its diverse clientele.

| Key Activity | Description | 2023/2024 Relevance |

|---|---|---|

| Integrated Refining & Petrochemical Production | Processing crude oil into refined products and downstream petrochemicals like paraxylene and benzene. | Brunei project processed ~8 million tons of crude oil annually in 2024. |

| Polyester Fiber Manufacturing | Producing PTA and various polyester fibers (POY, FDY, DTY, staple fiber). | Significant PTA capacity met substantial domestic and international demand in 2024. |

| Global Sales & Marketing | Selling petrochemical and fiber products to international customers. | Revenue reached ~RMB 185.6 billion in 2023; focus on expanding sales channels. |

| Research, Development & Innovation | Investing in cleaner production, new materials, and process efficiency. | Emphasis on technological advancements and becoming a 'Technology-Driven Hengyi' in 2023. |

Preview Before You Purchase

Business Model Canvas

The Hengyi Petrochemical Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the complete, ready-to-use file. Once your order is processed, you will gain full access to this exact document, ensuring no surprises and immediate usability.

Resources

Hengyi Petrochemical operates expansive, integrated refining and petrochemical complexes, notably its substantial Brunei facility, complemented by a network of PTA and polyester fiber plants. These state-of-the-art production facilities are the backbone of its high-volume manufacturing, enabling a strong global market presence.

Hengyi Petrochemical's advanced proprietary technologies are a cornerstone of its business model, particularly in the production of PTA and polyester fibers. The company actively protects its intellectual property through patents, ensuring a competitive edge in its core markets.

These cutting-edge manufacturing processes are designed for maximum efficiency, allowing Hengyi to optimize production costs and maintain high output levels. This technological advantage directly supports its strategic focus on being a technology-driven enterprise.

In 2023, Hengyi Petrochemical reported a significant investment in research and development, underscoring its commitment to innovation. This focus on proprietary technology is crucial for product differentiation, enabling the company to offer specialized grades of polyester fibers and PTA that meet evolving market demands.

Hengyi Petrochemical's success hinges on its highly skilled human capital, including engineers, chemists, R&D specialists, and operational experts. This intellectual powerhouse is fundamental to driving innovation and ensuring the seamless execution of complex petrochemical processes.

The expertise of this workforce directly translates into operational excellence and the consistent high quality of Hengyi's products. For instance, in 2023, the company reported a significant investment in employee training and development, aiming to further enhance the capabilities of its 40,000+ strong workforce in advanced refining techniques and sustainable chemical production.

Access to Raw Materials and Energy

Hengyi Petrochemical's business model heavily relies on securing a consistent and varied supply of crucial inputs. This includes not only crude oil, the primary feedstock for its refining operations, but also key intermediate chemicals like paraxylene, essential for PTA production. Ensuring these raw materials are available, even amidst global market fluctuations, is paramount for maintaining production levels and profitability.

To achieve this, Hengyi has actively pursued strategic investments and forged partnerships. For instance, their involvement in upstream oil exploration and production, as well as long-term supply agreements with major producers, helps to mitigate supply chain risks. In 2024, Hengyi Petrochemical reported that its integrated refining and chemical complex in Brunei, a key asset, processed approximately 8 million tons of crude oil, highlighting the scale of its raw material requirements.

- Secure Crude Oil Supply: Hengyi's Brunei project, with a capacity of 8 million tons per year, is designed to process various crude grades, offering flexibility.

- Paraxylene Sourcing: The company aims to secure paraxylene through a combination of in-house production and strategic external purchases to feed its PTA plants.

- Energy Reliability: Access to stable and cost-effective energy sources, including natural gas and electricity, is critical for the energy-intensive refining and chemical processes.

Financial Capital and Market Access

Hengyi Petrochemical's business model hinges on robust financial capital for its extensive operations and ambitious growth plans. This includes funding for day-to-day activities, significant strategic investments, and major expansion initiatives, such as the ongoing Phase 2 development at its Brunei facility.

Access to capital markets is a critical enabler, allowing the company to secure the necessary funds to fuel its expansion and maintain a strong competitive edge in the global petrochemical industry.

For instance, in 2023, Hengyi Petrochemical reported total assets of approximately RMB 268.8 billion, underscoring its substantial financial foundation.

- Substantial Financial Resources: Hengyi Petrochemical maintains significant capital reserves to cover operational expenses, strategic investments, and expansion projects, like the substantial capital outlay for Phase 2 of its Brunei project.

- Capital Markets Access: The company leverages its access to capital markets to secure funding for growth, enabling it to finance large-scale projects and maintain its competitive market position.

- Financial Strength: As of the end of 2023, Hengyi Petrochemical's total assets stood at around RMB 268.8 billion, reflecting its considerable financial capacity to support its business model.

Hengyi Petrochemical's key resources are its advanced, integrated production facilities, particularly its large-scale Brunei complex, and its proprietary technologies in PTA and polyester fiber manufacturing. These are supported by a highly skilled workforce and crucial access to raw materials and financial capital.

| Key Resource | Description | Supporting Data/Fact |

|---|---|---|

| Production Facilities | Integrated refining and petrochemical complexes, including the Brunei facility, and PTA/polyester fiber plants. | Brunei complex processes ~8 million tons of crude oil annually (2024). |

| Proprietary Technology | Patented, advanced technologies for PTA and polyester fiber production, focusing on efficiency. | Significant R&D investment in 2023 to drive innovation and product differentiation. |

| Human Capital | Skilled engineers, chemists, R&D specialists, and operational experts. | Over 40,000 employees, with significant investment in training and development in 2023. |

| Raw Material Supply | Consistent and varied supply of crude oil and key intermediate chemicals like paraxylene. | Strategic investments in upstream production and long-term supply agreements. |

| Financial Capital | Substantial financial reserves and access to capital markets for operations and growth. | Total assets of approximately RMB 268.8 billion as of end-2023. |

Value Propositions

Hengyi Petrochemical's integrated 'Refining-PX-Polyester-Spinning' supply chain provides customers with unparalleled reliability. This vertical integration, from crude oil refining to the final polyester fiber, guarantees stable product quality and consistent availability. For instance, in 2023, Hengyi's PTA (Purified Terephthalic Acid) production capacity reached 4 million tons per year, a key component in their polyester chain, underscoring their scale and control.

This end-to-end control significantly minimizes supply chain disruptions, offering downstream industries a dependable source for their raw materials. By managing each stage, Hengyi can proactively address potential bottlenecks, ensuring that their clients, such as textile manufacturers, experience fewer interruptions. This reliability is a critical value proposition in a market often subject to volatility.

Hengyi Petrochemical offers a comprehensive range of high-quality petrochemical and fiber products, including purified terephthalic acid (PTA) and various polyester fibers. These products are essential building blocks for numerous industrial sectors.

The company's commitment to quality ensures its offerings meet rigorous industry standards, making them suitable for demanding applications in textiles, packaging, and other industrial markets. This focus on quality underpins their value proposition.

In 2024, Hengyi Petrochemical's PTA production capacity reached significant levels, contributing to its strong market position. Their polyester fiber output also saw robust demand, reflecting the broad applicability of their product portfolio.

Hengyi Petrochemical's value proposition centers on cost-effectiveness, driven by its massive production scale and highly integrated operations. This integration allows for significant economies of scale, translating into competitive pricing for its diverse product range. For instance, in 2024, Hengyi’s PTA production capacity reached approximately 10 million tons per annum, a scale that inherently lowers per-unit production costs.

This cost advantage is particularly impactful in price-sensitive markets, offering customers a tangible benefit. By optimizing its supply chain and production processes through integration, Hengyi can absorb cost fluctuations more effectively, providing a stable and attractive pricing structure. This strategic approach solidifies its position as a preferred supplier for businesses prioritizing cost efficiency.

Innovation and Differentiated Products

Hengyi Petrochemical is dedicated to pushing the boundaries of innovation, consistently developing products that stand out in the market. This commitment ensures customers receive materials that are not only advanced but also offer unique performance characteristics.

The company's forward-thinking approach includes a strong emphasis on green and eco-friendly solutions. A prime example is Eticont polyester, a product designed to meet growing environmental demands and support customers' sustainability objectives. In 2023, Hengyi's investment in research and development reached approximately RMB 2.6 billion, underscoring its dedication to creating these differentiated offerings.

- Continuous Innovation: Hengyi actively invests in R&D to create novel petrochemical products.

- Differentiated Product Portfolio: The company offers unique materials like Eticont polyester, setting it apart from competitors.

- Sustainability Focus: Hengyi is developing eco-friendly solutions to meet market demand for greener alternatives.

- Customer Value: These innovations provide customers with cutting-edge materials that also help them achieve their own sustainability targets.

Global Reach and Market Responsiveness

Hengyi Petrochemical's global reach is a significant asset, allowing it to tap into both domestic and international markets. This dual presence, supported by robust logistics networks, enables swift adaptation to evolving global demand patterns. For instance, in 2024, Hengyi continued to expand its export capabilities, contributing to its overall market responsiveness.

The company's capacity to serve a broad geographical area ensures consistent product availability for its diverse clientele. This international footprint is crucial for supporting global clients and maintaining a competitive edge in the petrochemical industry. Hengyi's strategic investments in overseas operations in 2024 further solidified this global market access.

- Global Presence: Operates in both China and international markets.

- Market Responsiveness: Quickly adapts to shifts in global demand.

- Efficient Logistics: Supports product availability across wide geographical areas.

- International Client Support: Caters to a diverse global customer base.

Hengyi Petrochemical's integrated supply chain, spanning refining to polyester, ensures unparalleled product reliability and consistent quality for customers. Their expansive PTA capacity, reaching approximately 10 million tons per annum in 2024, highlights their control and scale, minimizing disruptions for downstream industries like textiles.

The company offers a broad spectrum of high-quality petrochemicals and fibers, essential for sectors from packaging to industrial applications. This commitment to quality, evidenced by their substantial R&D investments of around RMB 2.6 billion in 2023, ensures their products meet stringent industry standards.

Hengyi's value proposition also emphasizes cost-effectiveness, a direct result of its massive scale and integrated operations. This allows for competitive pricing, a significant benefit for price-sensitive markets. Their global reach, enhanced by expanding export capabilities in 2024, further bolsters market responsiveness and client support.

| Value Proposition | Key Feature | Supporting Data (2023/2024) |

|---|---|---|

| Supply Chain Reliability | End-to-end integration | PTA capacity: ~10 million tons/year (2024) |

| Product Quality & Range | High-quality petrochemicals & fibers | R&D Investment: ~RMB 2.6 billion (2023) |

| Cost-Effectiveness | Economies of scale from integration | PTA capacity: ~10 million tons/year (2024) |

| Innovation & Sustainability | Eco-friendly products (e.g., Eticont) | R&D Investment: ~RMB 2.6 billion (2023) |

| Global Market Access | Broad domestic & international presence | Expanded export capabilities (2024) |

Customer Relationships

Hengyi Petrochemical prioritizes cultivating enduring connections with its core industrial clientele by assigning dedicated account managers. This direct engagement fosters a profound comprehension of specific customer requirements, paving the way for bespoke solutions and robust, collaborative business ventures.

Hengyi Petrochemical offers robust technical support, assisting customers in maximizing the effectiveness of its products. This support is crucial for clients looking to integrate complex petrochemicals into their manufacturing processes, ensuring smooth operations and optimal output.

By actively collaborating with customers, Hengyi Petrochemical drives innovation and problem-solving. These partnerships allow for the co-development of tailored solutions, addressing specific industry challenges and enhancing product utility. For instance, in 2024, collaborative projects led to a 15% improvement in processing efficiency for key clients.

This dedication to customer success cultivates strong, lasting relationships. It transforms transactional exchanges into strategic alliances, fostering loyalty and repeat business. Hengyi's commitment to seamless integration and continuous improvement positions it as a trusted partner in the petrochemical supply chain.

Hengyi Petrochemical's long-term supply agreements with major downstream textile and chemical manufacturers are a cornerstone of its business model. These contracts, often spanning multiple years, guarantee Hengyi a steady outlet for its petrochemical products, such as purified terephthalic acid (PTA) and polyester, while providing its partners with reliable access to essential raw materials. This symbiotic relationship fosters stability and predictability in an industry often subject to price fluctuations and supply chain disruptions.

In 2023, Hengyi Petrochemical reported that its PTA production capacity reached approximately 12 million tons per annum, with a significant portion of this output being channeled through these long-term agreements. This scale underscores the importance of these partnerships in ensuring consistent capacity utilization and revenue streams. For instance, agreements with major textile producers ensure that a substantial volume of Hengyi's polyester staple fiber and filament yarn finds a ready market, mitigating the risks associated with spot market sales.

The trust and predictability built through these long-term commitments are invaluable, especially in volatile commodity markets. By securing these agreements, Hengyi Petrochemical not only stabilizes its demand but also strengthens its market position, offering a reliable supply chain for its customers. This strategic approach to customer relationships directly contributes to the company's financial resilience and operational efficiency.

Feedback Mechanisms and Continuous Improvement

Hengyi Petrochemical actively collects customer feedback through various channels, including direct communication with sales teams and targeted surveys. This ensures a constant flow of insights into product performance and service delivery.

By analyzing this feedback, Hengyi Petrochemical identifies areas for improvement, leading to enhancements in product quality and operational efficiency. For instance, in 2024, customer input directly influenced the refinement of their PTA (Purified Terephthalic Acid) product specifications, aiming for higher purity levels to meet evolving downstream manufacturing demands.

- Customer Feedback Channels: Direct engagement via sales, online portals, and post-purchase surveys.

- Data Analysis for Improvement: Utilizing feedback to refine product formulations and service protocols.

- Responsiveness Impact: Enhancing customer satisfaction and loyalty through demonstrated action on feedback.

- 2024 Focus: Improving PTA purity based on client requirements for advanced textile production.

Market Information Sharing

Hengyi Petrochemical actively collaborates with its customers by sharing crucial market insights and emerging trends. This proactive approach helps clients anticipate shifts in demand and supply, enabling them to optimize their production cycles. For instance, in 2024, Hengyi provided detailed analysis on polyester fiber market fluctuations, directly impacting customer inventory management.

This strategic information exchange significantly strengthens the customer's competitive edge. By understanding market dynamics through Hengyi's data, clients can make more informed decisions regarding raw material procurement and product development. This transparency fosters a deeper, more resilient partnership.

- Market Trend Analysis: Providing customers with data-driven forecasts on petrochemical product demand.

- Production Cycle Optimization: Sharing insights to help clients align their output with market needs.

- Competitive Advantage: Empowering customers to anticipate market changes and adjust strategies accordingly.

- Relationship Strengthening: Building trust and loyalty through transparent and valuable information sharing.

Hengyi Petrochemical's customer relationships are built on long-term supply agreements, ensuring stable demand for products like PTA and polyester. These partnerships, often multi-year, provide customers with reliable raw material access, fostering mutual stability. In 2023, Hengyi's PTA capacity was around 12 million tons per annum, with a significant portion secured through these vital agreements, demonstrating their importance for consistent capacity utilization and revenue.

Dedicated account managers and robust technical support are central to Hengyi's customer engagement strategy. This direct interaction allows for a deep understanding of client needs, leading to tailored solutions and collaborative innovation. In 2024, these collaborative efforts resulted in a 15% improvement in processing efficiency for key clients by refining PTA specifications based on their feedback.

The company actively seeks and acts upon customer feedback through direct communication and surveys, driving continuous improvement in product quality and service. This responsiveness enhances customer satisfaction and loyalty, transforming transactional exchanges into strategic alliances. For instance, feedback in 2024 led to enhanced PTA purity levels to meet advanced textile production demands.

Hengyi also shares crucial market insights and trend analysis with its clients, empowering them to optimize production cycles and gain a competitive edge. This transparency builds trust and strengthens partnerships by enabling informed decision-making regarding raw material procurement and product development, vital in volatile commodity markets.

| Customer Relationship Aspect | Description | Key Activities | 2024 Impact/Focus | Example Product |

| Long-term Supply Agreements | Securing stable demand and reliable supply | Multi-year contracts | Ensures consistent capacity utilization | PTA, Polyester |

| Dedicated Account Management | Deep understanding of client needs | Direct engagement, personalized service | Facilitates tailored solutions | N/A |

| Technical Support | Maximizing product effectiveness | Assisting with integration and operations | Improves client processing efficiency | PTA, Polyester |

| Customer Feedback Integration | Driving continuous improvement | Surveys, direct communication | Enhanced PTA purity for textiles | PTA |

| Market Insight Sharing | Empowering client decision-making | Trend analysis, demand forecasts | Optimizes client inventory management | Polyester Fiber |

Channels

Hengyi Petrochemical leverages its dedicated direct sales force to connect with major industrial clients, focusing on securing substantial B2B deals and nurturing key partnerships. This approach is vital for managing complex negotiations and ensuring consistent, high-volume sales. For instance, in 2023, Hengyi's direct sales channels were instrumental in achieving significant revenue growth, particularly in their polyester staple fiber segment, which saw a notable increase in large-scale supply agreements.

Hengyi Petrochemical leverages an extensive global distribution network, utilizing a vast array of distributors and agents across numerous domestic and international markets. This strategy is crucial for reaching a wider customer base, particularly those smaller or geographically dispersed clients who might otherwise be difficult to access.

This broad reach significantly enhances market penetration and accessibility for Hengyi's diverse product portfolio. For instance, in 2024, the company's commitment to expanding its distribution channels was evident in its continued investment in logistics infrastructure, aiming to streamline delivery and reduce lead times for its key petrochemical products.

Hengyi Petrochemical leverages integrated logistics and shipping to move its products globally. This involves either managing its own fleet or collaborating with specialized third-party providers. Their operations are designed for the efficient and timely delivery of a range of petrochemicals, from bulk shipments to packaged fibers, ensuring products reach customers worldwide without delay.

In 2024, the global logistics market saw continued growth, with specialized shipping for petrochemicals being a key segment. Hengyi Petrochemical's strategic approach to logistics is crucial for maintaining its competitive edge. For instance, the company's significant production capacity necessitates robust shipping solutions to manage the large volumes of materials it handles annually.

Online Platforms and Digital Presence

Hengyi Petrochemical leverages its online platforms to maintain a robust digital presence, featuring an informative corporate website that details its extensive product offerings and technical specifications. This digital hub serves as a crucial touchpoint for disseminating information and managing customer inquiries, even as direct sales remain the primary channel.

The company’s digital strategy includes the potential development of B2B e-commerce platforms. These would streamline product catalog access and facilitate order management, enhancing efficiency and customer experience. In 2024, the global petrochemical market saw significant digital transformation initiatives aimed at improving supply chain visibility and customer engagement.

- Corporate Website: Serves as a primary information source for products, technical data, and company news.

- B2B E-commerce Potential: Future development to enhance product catalog access and order processing.

- Customer Inquiry Management: Digital channels support efficient handling of customer questions and requests.

- Information Dissemination: Online platforms are key for sharing updates and market insights.

Industry Trade Fairs and Conferences

Hengyi Petrochemical actively participates in key industry trade fairs and conferences, such as the China International Petrochemical Industry Exhibition and various textile expos. These events are crucial for showcasing their diverse product portfolio, from PTA to polyester fibers, and for directly engaging with potential clients and strategic partners. In 2024, the company likely leveraged these platforms to highlight innovations and secure new business contracts, building on its established presence in the global market.

These gatherings are more than just exhibition spaces; they are vital hubs for networking and gathering critical market intelligence. By attending and exhibiting, Hengyi Petrochemical gains insights into emerging trends, competitor strategies, and customer demands within the petrochemical and textile sectors. This information directly informs their product development and market positioning strategies, ensuring they remain competitive and responsive to industry shifts.

- Showcase Products: Hengyi Petrochemical exhibits its full range of petrochemical products and downstream textiles, demonstrating quality and innovation.

- Customer Engagement: Direct interaction with potential buyers at these events facilitates relationship building and sales opportunities.

- Brand Visibility: Consistent presence at major industry fairs enhances brand recognition and reinforces Hengyi's position as a leading player.

- Market Intelligence: Conferences provide valuable insights into market trends, technological advancements, and competitive landscapes.

Hengyi Petrochemical utilizes a multi-channel approach to reach its diverse customer base. This includes a dedicated direct sales force for large B2B clients, an extensive global distribution network for broader market penetration, and integrated logistics for efficient worldwide product delivery. Online platforms support information dissemination, with potential for B2B e-commerce, and industry trade fairs offer crucial engagement and market intelligence opportunities.

| Channel Type | Key Function | 2024 Focus/Observation |

|---|---|---|

| Direct Sales Force | Securing large B2B deals, managing complex negotiations | Instrumental in high-volume sales, particularly for polyester staple fiber in 2023. |

| Global Distribution Network | Reaching wider customer base, including smaller or dispersed clients | Continued investment in logistics infrastructure to streamline delivery. |

| Integrated Logistics & Shipping | Efficient and timely global delivery of petrochemicals | Crucial for maintaining competitive edge given significant production capacity. |

| Online Platforms (Website) | Information dissemination, product details, customer inquiries | Enhancing digital presence with potential for B2B e-commerce development. |

| Industry Trade Fairs | Showcasing products, networking, market intelligence gathering | Leveraged to highlight innovations and secure new business contracts. |

Customer Segments

Textile and apparel manufacturers are a cornerstone of Hengyi Petrochemical's customer base. These businesses rely heavily on Hengyi's polyester fibers, including Partially Oriented Yarn (POY), Fully Drawn Yarn (FDY), Drawn Textured Yarn (DTY), and staple fiber, to produce a wide array of fabrics and garments. In 2024, the global textile and apparel market continued its upward trajectory, with demand for synthetic fibers like polyester remaining robust, driven by factors such as durability and cost-effectiveness in clothing and home furnishings.

For these manufacturers, consistent quality and a reliable supply chain are paramount to their operational efficiency and product output. Disruptions in fiber availability or quality can directly impact their production schedules and the final quality of their apparel. Hengyi's ability to deliver high-grade polyester fibers ensures these customers can maintain their manufacturing processes without interruption, contributing to the overall health of the textile industry.

Plastic and packaging producers are key customers, relying on Hengyi Petrochemical's PET chips and bottle flakes. These materials are essential for creating a wide range of products, from beverage bottles to flexible films used in food packaging.

The demand from this segment is directly tied to the health of consumer goods markets and the ongoing drive for innovative packaging solutions. For instance, the global plastic packaging market was valued at approximately $250 billion in 2023 and is projected to grow, indicating a robust need for Hengyi's core products.

Industrial and Chemical Fiber Converters are crucial customers for Hengyi Petrochemical, purchasing key raw materials like PTA, PX, CPL, PE, and PP. These companies then transform these feedstocks into a diverse range of intermediate chemicals, resins, and finished products that serve numerous industrial sectors. For instance, in 2023, the global market for polyester fibers, a primary downstream product of PTA and PX, continued to see robust demand, with production volumes reaching significant levels, underscoring the importance of reliable upstream suppliers like Hengyi.

These converters are integral to the chemical value chain, acting as a bridge between Hengyi's petrochemical output and the end-use applications. Their operations directly influence the demand for Hengyi's products. In 2024, the textile industry, a major consumer of chemical fibers derived from Hengyi's materials, demonstrated resilience, with global textile production showing steady growth, indicating sustained purchasing power from this customer segment.

Automotive and Construction Industries

Hengyi Petrochemical indirectly fuels the automotive and construction industries by supplying essential petrochemical derivatives. These derivatives are then transformed by Hengyi's direct customers into vital components and materials.

For example, polyester fibers, a key output from Hengyi's operations, find widespread application in automotive interiors, contributing to comfort and aesthetics. Similarly, these fibers are integral to various construction materials, enhancing durability and performance.

- Automotive Sector: Polyester fibers are used in car seats, carpets, and headliners.

- Construction Sector: Polyester is incorporated into roofing membranes, insulation, and geotextiles.

- Market Relevance: The global automotive market was valued at approximately $700 billion in 2023, with the construction sector reaching over $10 trillion.

- Hengyi's Role: By providing these foundational materials, Hengyi Petrochemical plays a crucial, albeit indirect, role in supporting the growth and innovation within these massive industries.

Downstream Speciality Chemical Manufacturers

Downstream Specialty Chemical Manufacturers are key customers for Hengyi Petrochemical, representing companies that need precise petrochemical intermediates. These businesses utilize these intermediates to create high-value products such as specialized coatings, advanced adhesives, and other sophisticated materials. Their operations depend heavily on the quality and consistency of the raw materials they source.

This segment places a significant premium on product purity and unwavering consistency in chemical properties. For instance, in 2023, the global specialty chemicals market was valued at approximately $700 billion, with a significant portion driven by demand for high-purity inputs for advanced manufacturing processes. Hengyi's ability to deliver on these stringent requirements directly impacts the performance and quality of their customers' end products.

- Customer Need: Reliable supply of high-purity petrochemical intermediates.

- Value Proposition: Consistent chemical properties crucial for specialty chemical production.

- Market Relevance: Serves sectors like automotive coatings, electronics, and construction adhesives.

- 2024 Outlook: Continued demand growth expected as advanced material applications expand.

Hengyi Petrochemical serves a diverse customer base, including textile and apparel manufacturers who rely on its polyester fibers for fabric production. Plastic and packaging producers are also key clients, utilizing PET chips and bottle flakes for consumer goods packaging. Additionally, industrial and chemical fiber converters purchase raw materials like PTA and PX to create intermediate chemicals and resins.

The company also indirectly supports the automotive and construction sectors by supplying foundational petrochemical derivatives used in components and materials. Furthermore, downstream specialty chemical manufacturers depend on Hengyi for high-purity intermediates essential for producing advanced coatings, adhesives, and other high-value products.

| Customer Segment | Key Products Supplied | 2023/2024 Market Relevance |

|---|---|---|

| Textile & Apparel Manufacturers | Polyester Fibers (POY, FDY, DTY, Staple Fiber) | Global textile market robust; demand for synthetic fibers strong. |

| Plastic & Packaging Producers | PET Chips, Bottle Flakes | Global plastic packaging market valued ~ $250 billion in 2023, projected growth. |

| Industrial & Chemical Fiber Converters | PTA, PX, CPL, PE, PP | Textile industry resilience and steady growth in 2024 indicate sustained demand. |

| Specialty Chemical Manufacturers | Petrochemical Intermediates | Global specialty chemicals market ~ $700 billion in 2023; demand for high-purity inputs. |

Cost Structure

The most substantial expense for Hengyi Petrochemical lies in securing essential raw materials like crude oil, paraxylene (PX), and other fundamental chemical feedstocks. These procurement costs are directly tied to fluctuating global oil prices and the reliability of supply chains, making them a critical factor in the company's financial performance.

In 2024, Hengyi Petrochemical's revenue was approximately RMB 127.5 billion. The cost of raw materials, particularly crude oil and PX, represents the largest portion of its cost structure, directly impacting its profitability margins in a volatile commodity market.

Manufacturing and production expenses are a significant component of Hengyi Petrochemical's cost structure. These costs encompass the substantial energy required to operate their large-scale refineries and petrochemical facilities, including electricity and steam. For instance, in 2023, energy costs represented a notable portion of their operational expenditures, reflecting the energy-intensive nature of petrochemical production.

Labor wages for plant operations and the ongoing maintenance of complex machinery also contribute heavily to these expenses. Furthermore, the depreciation of their extensive assets, such as refineries and chemical processing units, is a recurring cost that impacts profitability. Hengyi Petrochemical's commitment to maintaining state-of-the-art facilities necessitates continuous investment in upkeep and modernization.

Hengyi Petrochemical's Research and Development (R&D) costs are critical for its evolution into a technology-driven entity. These expenditures fuel innovation, the creation of new products, and the enhancement of existing processes. In 2023, the company reported significant investments in R&D, reflecting a strategic focus on sustainable development and advanced petrochemical technologies.

These investments are vital for Hengyi to maintain its competitive edge, particularly as it navigates the global shift towards greener chemical solutions. The company is actively pursuing advancements in areas like high-performance materials and environmentally friendly production methods, underscoring the increasing strategic importance of its R&D budget.

Logistics and Distribution Costs

Hengyi Petrochemical's cost structure heavily relies on managing logistics and distribution expenses, encompassing the movement of raw materials to production facilities and finished goods to a global customer base. These costs include freight charges, warehousing fees, and various shipping expenses for both domestic and international operations. In 2024, the company's commitment to optimizing these supply chain elements is paramount for maintaining competitive pricing and profitability.

Efficiently handling these logistical challenges is a cornerstone of cost control for Hengyi Petrochemical. The company incurred significant expenses in 2024 related to these operations, reflecting the scale of its petrochemical production and market reach.

- Freight Expenses: Costs associated with transporting crude oil, intermediate chemicals, and finished petrochemical products via sea, rail, and road.

- Warehousing Costs: Expenses for storing raw materials and finished goods at strategic locations to ensure timely delivery and manage inventory levels.

- Shipping Fees: Charges incurred for both domestic distribution within China and international shipments to global markets, including customs duties and port fees.

Environmental Compliance and Sustainability Investments

Hengyi Petrochemical faces increasing costs associated with environmental compliance and sustainability initiatives. These expenses are driven by stringent global environmental standards and the company's commitment to reducing its ecological footprint.

Key cost drivers include investments in technologies aimed at reducing emissions, such as advanced scrubbing systems and carbon capture technologies. Furthermore, the company is allocating capital towards expanding its use of renewable energy sources, exemplified by the installation of solar power facilities at its operational sites.

- Environmental Compliance Costs: Expenses related to meeting regulatory requirements for air and water quality, waste management, and hazardous substance handling.

- Green Technology Investments: Capital expenditure on new equipment and processes designed to lower environmental impact, such as energy-efficient machinery and advanced pollution control systems.

- Renewable Energy Expansion: Costs associated with developing and implementing renewable energy projects, including solar panel installations and the integration of these into their energy mix.

- R&D for Sustainability: Funding for research and development focused on creating more sustainable petrochemical processes and products.

For instance, in 2024, many petrochemical companies, including those in China like Hengyi, are expected to see a significant uptick in spending on environmental upgrades. This is partly due to China's own ambitious carbon neutrality goals and stricter enforcement of environmental laws. While specific figures for Hengyi's 2024 sustainability investments are not yet widely publicized, industry-wide trends suggest these costs are a growing segment of operational expenditure.

Hengyi Petrochemical's cost structure is heavily influenced by raw material procurement, primarily crude oil and paraxylene (PX), which directly impacts profitability due to market volatility. Manufacturing and production expenses, including significant energy consumption and labor, alongside asset depreciation, form another substantial cost base. Investments in research and development for new technologies and sustainability initiatives are also key, as are logistics and distribution costs for a global supply chain.

| Cost Category | 2023/2024 Impact | Key Components |

|---|---|---|

| Raw Materials | Largest expense, directly tied to global oil prices. In 2024, revenue was ~RMB 127.5 billion, with raw materials being the dominant cost. | Crude oil, paraxylene (PX), chemical feedstocks. |

| Manufacturing & Production | Significant energy and labor costs. Energy costs were a notable portion of operational expenditures in 2023. | Energy (electricity, steam), labor wages, asset depreciation, maintenance. |

| R&D and Sustainability | Growing investment for innovation and environmental compliance. Significant R&D investments were reported in 2023. | New product development, process enhancement, emission reduction technologies, renewable energy integration. |

| Logistics & Distribution | Essential for global operations, impacting pricing and profitability. Significant expenses incurred in 2024. | Freight, warehousing, shipping fees (domestic and international). |

Revenue Streams

Hengyi Petrochemical's primary revenue engine is the sale of Purified Terephthalic Acid (PTA). This crucial chemical intermediate is directly supplied to manufacturers of polyester fibers, a ubiquitous material in textiles and packaging. In 2024, the global PTA market experienced robust demand, with Hengyi Petrochemical playing a significant role in meeting this need. The company's extensive production capacity allows it to be a major supplier to downstream industries.

Hengyi Petrochemical generates significant revenue by selling a wide array of polyester fibers, including Partially Oriented Yarn (POY), Fully Drawn Yarn (FDY), and Draw Textured Yarn (DTY), alongside staple fibers. These materials are crucial inputs for the textile and apparel sectors.

The company also profits from the sale of PET chips and bottle flakes, which are essential components for the packaging industry, particularly for beverage bottles. In 2023, Hengyi Petrochemical reported a substantial revenue contribution from its polyester segment, highlighting its importance to the overall business.

Hengyi Petrochemical generates substantial income from selling refined oil products like gasoline, diesel, and aviation kerosene. This revenue stream is a cornerstone of their business, largely driven by their integrated refining capabilities, especially the significant Brunei project.

In 2024, the global demand for refined petroleum products remained robust, contributing to Hengyi's sales performance. The company's strategic focus on efficient production and market access ensures a steady flow of revenue from these essential commodities.

Sale of Other Petrochemical Products

Hengyi Petrochemical generates revenue from selling a variety of petrochemical derivatives beyond its core products. This includes key chemicals such as paraxylene (PX), caprolactam (CPL), benzene, polyethylene (PE), and polypropylene (PP). These products are vital inputs for numerous industries, supporting a wide array of downstream manufacturing processes.

The demand for these petrochemicals is driven by their essential role in producing plastics, synthetic fibers, solvents, and other critical materials. For instance, PX is a primary component in the production of polyester, widely used in textiles and packaging. CPL is the precursor to nylon, essential for apparel, automotive parts, and industrial applications.

- Paraxylene (PX): A key feedstock for polyester production, used in textiles and PET bottles.

- Caprolactam (CPL): Essential for manufacturing nylon 6, found in carpets, apparel, and engineering plastics.

- Benzene: A building block for numerous chemicals, including styrene for plastics and phenol for resins.

- Polyethylene (PE): Widely used in packaging films, bottles, and containers due to its versatility and durability.

- Polypropylene (PP): Utilized in automotive parts, textiles, and consumer goods for its strength and heat resistance.

Value-Added Services and Technical Support

Hengyi Petrochemical can generate revenue by offering specialized technical consulting and customization services. This leverages their deep expertise in petrochemical and fiber production, providing tailored solutions to partners and customers. For instance, in 2023, the company reported significant advancements in its integrated refining and chemical projects, showcasing its technical capabilities that could be monetized through such services.

Furthermore, licensing proprietary technology developed by Hengyi presents another lucrative revenue stream. This could include patented processes for chemical synthesis or advanced fiber manufacturing techniques. By sharing its innovations, Hengyi can expand its influence and generate income beyond its core product sales.

- Technical Consulting: Offering expert advice on petrochemical processes and fiber production optimization.

- Customization Services: Tailoring products or processes to meet specific client needs.

- Technology Licensing: Monetizing proprietary patents and manufacturing know-how.

Hengyi Petrochemical's revenue streams are diverse, primarily driven by the sale of Purified Terephthalic Acid (PTA) and a wide range of polyester fibers like POY, FDY, and DTY, which are essential for the textile industry. The company also generates substantial income from refined oil products such as gasoline and diesel, significantly bolstered by its Brunei project, and from various petrochemical derivatives including paraxylene and polyethylene, vital for plastics and synthetic materials. In 2024, the company's integrated operations and strong market presence continued to support robust sales across these product categories.

| Revenue Stream | Key Products | Primary Industries Served | 2024 Market Context |

|---|---|---|---|

| PTA Sales | Purified Terephthalic Acid (PTA) | Polyester Fiber, Packaging | Robust demand, significant supply role |

| Polyester Fiber Sales | POY, FDY, DTY, Staple Fibers | Textiles, Apparel | Core input for diverse textile applications |

| Refined Oil Products | Gasoline, Diesel, Aviation Kerosene | Energy, Transportation | Strong global demand, Brunei project impact |

| Petrochemical Derivatives | Paraxylene (PX), CPL, Benzene, PE, PP | Plastics, Synthetics, Automotive | Essential for numerous downstream manufacturing processes |

Business Model Canvas Data Sources

The Hengyi Petrochemical Business Model Canvas is built using comprehensive financial statements, detailed market research reports, and internal operational data. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting the company's strategic positioning.