Hengyi Petrochemical Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hengyi Petrochemical Bundle

Hengyi Petrochemical faces intense competition, with significant threats from new entrants and powerful buyers influencing pricing. The company's reliance on key suppliers also presents a critical dynamic.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hengyi Petrochemical’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Hengyi Petrochemical's dependence on crucial raw materials like crude oil and paraxylene (PX) places significant weight on supplier bargaining power. These feedstocks are the bedrock for Hengyi's production of PTA and polyester, making their consistent and cost-effective supply paramount.

The global market for these commodities is inherently volatile, heavily influenced by geopolitical events and decisions from major oil-producing groups like OPEC+. For instance, fluctuations in crude oil prices, which saw Brent crude averaging around $82 per barrel in early 2024, directly impact Hengyi's feedstock costs, highlighting the suppliers' leverage.

The petrochemical industry, including companies like Hengyi Petrochemical, often relies on a limited number of crude oil and key feedstock suppliers, such as paraxylene. In 2024, the global supply of crude oil remained influenced by major producers, and the availability of specific petrochemical feedstocks can be even more concentrated. This concentration means that a few large suppliers can wield significant power, dictating prices and supply conditions, which directly impacts Hengyi's cost of goods sold and overall profitability.

Switching suppliers for critical raw materials like purified terephthalic acid (PX) for Hengyi Petrochemical can be a costly endeavor. These costs aren't just about finding a new vendor; they encompass the expenses associated with establishing new logistics chains, implementing rigorous quality control measures for the new material, and potentially recalibrating existing production machinery to ensure compatibility and optimal performance. For instance, a change in PX supplier might necessitate significant investments in testing and validation to guarantee the quality of Hengyi's polyester products.

These substantial switching costs effectively limit Hengyi's operational flexibility. When it becomes difficult or expensive to change suppliers, existing suppliers gain leverage. This means suppliers of key inputs like PX can potentially dictate terms, including pricing and delivery schedules, with greater confidence, thereby strengthening their bargaining power over Hengyi.

Availability of substitutes for raw materials

The availability of substitutes for raw materials significantly impacts Hengyi Petrochemical's bargaining power with its suppliers. While there's a growing interest in bio-based alternatives for petrochemical products, their commercial viability and large-scale production are still in early stages.

The current limited availability of cost-effective and readily scalable substitutes for traditional petroleum-based feedstocks means Hengyi has fewer options for sourcing its primary inputs. This scarcity inherently strengthens the bargaining position of existing suppliers, as Hengyi faces greater challenges in switching to alternative raw material providers.

- Limited Commercial Viability of Bio-based Feedstocks: Despite advancements, the widespread adoption of bio-based alternatives for petrochemical production remains constrained by economic feasibility and production scale.

- Supplier Dependence for Traditional Feedstocks: Hengyi's reliance on conventional petroleum-based feedstocks, for which viable substitutes are scarce, grants suppliers considerable leverage in price negotiations.

- Impact on Input Costs: The lack of readily available, cost-competitive substitutes directly influences Hengyi's raw material procurement costs, potentially squeezing profit margins.

Supplier's ability to forward integrate

The bargaining power of suppliers can be significantly amplified when they possess the ability to engage in forward integration. If Hengyi Petrochemical's key raw material providers also operate their own downstream petrochemical production facilities, they could strategically allocate their output to their internal operations first. This scenario would naturally restrict the availability of raw materials for external customers like Hengyi, potentially leading to supply shortages and upward price pressure.

This vertical integration by suppliers directly diminishes Hengyi Petrochemical's negotiating leverage. When suppliers can capture more of the value chain, they become less reliant on Hengyi as a customer. For instance, if a major supplier of purified terephthalic acid (PTA), a key feedstock for Hengyi's polyester production, also produces polyester fibers, they might prioritize their own fiber manufacturing, impacting Hengyi's PTA supply. In 2023, PTA prices saw fluctuations, with some periods experiencing tighter supply dynamics, illustrating this vulnerability.

- Supplier Forward Integration Threat: Suppliers with downstream capabilities can prioritize their own production, limiting Hengyi's raw material access.

- Reduced Negotiating Power: Hengyi's leverage decreases as suppliers capture more of the value chain.

- Price and Supply Volatility: Forward integration can lead to increased raw material costs and supply instability for Hengyi.

Hengyi Petrochemical faces considerable supplier bargaining power due to its reliance on concentrated sources of critical raw materials like crude oil and paraxylene (PX). The limited number of major global suppliers for these feedstocks, coupled with significant switching costs for Hengyi, allows suppliers to influence pricing and supply terms. For example, in early 2024, crude oil prices remained a key factor, with Brent crude averaging around $82 per barrel, directly impacting Hengyi's input expenses.

The lack of readily available and cost-competitive substitutes for petroleum-based feedstocks further strengthens supplier leverage. While bio-based alternatives are emerging, their commercial viability and scale are still developing, leaving Hengyi dependent on traditional suppliers. This dependence can lead to price volatility and impact Hengyi's profit margins, as seen in PTA price fluctuations during 2023 due to supply dynamics.

Moreover, the potential for supplier forward integration poses a risk. If suppliers also engage in downstream production, they may prioritize their own operations, potentially limiting supply to Hengyi and increasing its raw material costs. This scenario reduces Hengyi's negotiating power and can create supply instability.

| Factor | Hengyi Petrochemical Impact | 2024 Data/Trend |

|---|---|---|

| Supplier Concentration | High dependence on few suppliers for crude oil and PX | Global crude oil supply influenced by major producers; PX supply can be concentrated. |

| Switching Costs | Significant costs for logistics, quality control, and machinery recalibration | High investments needed for new PX supplier validation. |

| Availability of Substitutes | Limited viable, cost-effective substitutes for petroleum-based feedstocks | Bio-based alternatives in early stages of commercialization. |

| Supplier Forward Integration | Risk of suppliers prioritizing their own downstream production | Potential supply constraints and price increases for Hengyi. |

What is included in the product

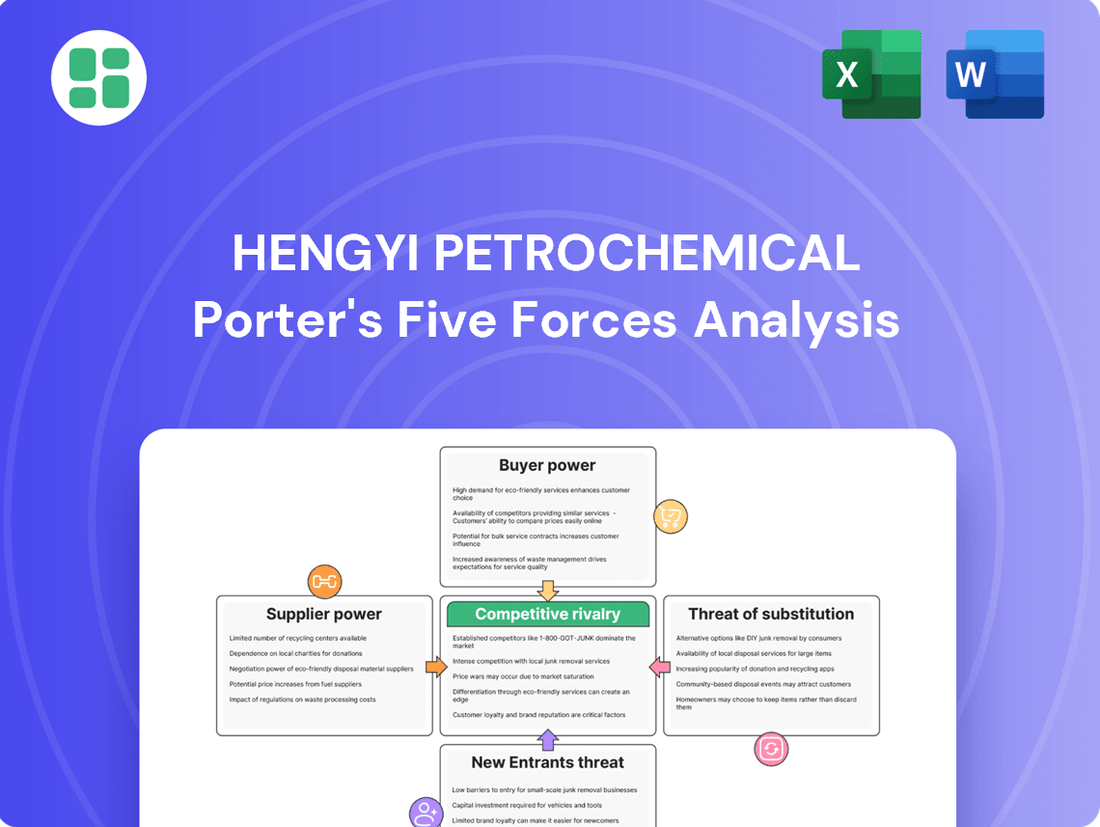

This analysis of Hengyi Petrochemical examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the potential of substitute products within the petrochemical industry.

Instantly grasp the competitive landscape of Hengyi Petrochemical with a visual spider chart, highlighting key pressures from rivals, suppliers, and buyers.

Easily adjust the analysis to reflect shifts in raw material costs or emerging substitute products, providing actionable insights for strategic adjustments.

Customers Bargaining Power

Hengyi Petrochemical's customer base spans a wide array of sectors, including vital industries like textiles, packaging, and automotive manufacturing. This diversity means that while many customers purchase smaller quantities, the presence of large industrial clients or major textile producers who buy in significant volumes can shift the balance of power. These high-volume purchasers can leverage their substantial order sizes to negotiate more favorable pricing and terms, directly impacting Hengyi's profitability.

In the commodity markets for PTA and polyester fibers, customers are extremely sensitive to price. This means that for Hengyi Petrochemical, keeping prices competitive is paramount. For instance, in 2023, the average price of PTA fluctuated significantly, impacting downstream purchasing decisions. This intense price sensitivity directly limits Hengyi's power to increase its own prices.

The global petrochemical market, especially for PTA and polyester, is currently experiencing significant overcapacity, with many producers vying for business. This abundance of suppliers means customers have a wide array of choices when sourcing their materials.

This situation directly translates to increased bargaining power for customers. They can readily switch to competitors if Hengyi Petrochemical’s pricing or service levels are not competitive. For instance, in 2024, the global PTA capacity was estimated to be over 100 million tons per year, with utilization rates often below 80%, highlighting the intense competition.

Customer's ability to backward integrate

Large downstream customers in the textile and packaging sectors, like integrated giants, possess the financial muscle and strategic drive to consider producing their own PTA or polyester fibers. This capability significantly amplifies their bargaining power against suppliers such as Hengyi Petrochemical.

The potential for these major buyers to engage in backward integration means they can credibly threaten to bring production in-house if supplier terms become unfavorable. For instance, major textile manufacturers in China, a key market for Hengyi, often operate with substantial capital reserves, enabling such strategic moves.

- Customer Integration Threat: Large downstream customers can produce their own PTA or polyester fibers, reducing reliance on Hengyi.

- Financial Capacity: Key buyers often have the financial resources to invest in backward integration.

- Strategic Incentive: Controlling raw material supply offers cost advantages and supply chain stability for customers.

- Market Leverage: The mere possibility of backward integration strengthens customers' negotiation position with Hengyi.

Product differentiation and uniqueness

For commodity products like standard PTA and polyester fibers, differentiation is challenging for Hengyi Petrochemical. If Hengyi's offerings are largely indistinguishable from those of its competitors, customers possess significant leverage. This allows them to easily switch suppliers based on price alone, thereby increasing their bargaining power.

However, Hengyi Petrochemical can strategically mitigate this customer power by focusing on developing higher value-added or specialized products. For instance, in 2024, the company continued its efforts to move into more advanced materials, although specific market share gains in these niche areas are still developing.

- Differentiated products reduce price sensitivity.

- Commodity products increase customer switching ease.

- Hengyi's focus on specialty chemicals aims to counter customer power.

Hengyi Petrochemical faces significant customer bargaining power, particularly in commodity markets like PTA and polyester fibers where price sensitivity is high and differentiation is minimal. The extensive global overcapacity in these sectors, with PTA capacity exceeding 100 million tons annually in 2024, grants customers numerous supplier options, amplifying their ability to switch and negotiate favorable terms. This dynamic limits Hengyi's pricing flexibility.

Large industrial customers, especially those in textiles and packaging, possess the financial capacity and strategic incentive for backward integration, meaning they could potentially produce their own PTA or polyester. This threat, coupled with their substantial purchasing volumes, significantly strengthens their negotiating position with Hengyi.

| Factor | Impact on Hengyi | Supporting Data (2024 Estimates/Trends) |

|---|---|---|

| Price Sensitivity | Limits Hengyi's pricing power | High competition in PTA/polyester markets |

| Supplier Availability | Increases customer switching ease | Global PTA capacity > 100 million tons/year |

| Backward Integration Threat | Strengthens customer negotiation | Large textile/packaging firms have financial capacity |

| Product Differentiation | Low differentiation increases customer leverage | Commodity nature of PTA and polyester fibers |

Preview Before You Purchase

Hengyi Petrochemical Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Hengyi Petrochemical, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You'll gain a clear understanding of the industry's competitive landscape and Hengyi's strategic positioning.

Rivalry Among Competitors

The global petrochemical landscape, particularly for PTA and polyester, is densely populated with competitors. Many of these are substantial entities, especially those based in Asia, creating a fiercely competitive environment. This sheer volume and scale of players directly escalate the battle for market dominance.

While the global petrochemical industry is expected to expand, specific segments like PTA and polyester have experienced decelerating demand growth and overcapacity. For instance, PTA capacity in China alone saw significant additions, leading to tighter margins.

This slowdown in demand growth for key products directly fuels competitive rivalry. Companies must aggressively compete for a larger share of the available market, often leading to price wars and increased promotional activities to secure sales volume.

Hengyi Petrochemical faces intense rivalry because many of its products, like basic olefins and aromatics, are treated as commodities. This lack of unique features means competition often boils down to who offers the lowest price. For instance, in 2024, the global petrochemical market saw significant price volatility for key building blocks such as ethylene and propylene, directly impacting Hengyi's pricing power.

Compounding this issue are the low switching costs for customers. Buyers of petrochemicals can readily shift their business to another supplier if they find a slightly better deal. This ease of movement means Hengyi must constantly monitor and adjust its pricing strategies to retain market share, especially when faced with competitors who might have cost advantages or excess capacity.

Exit barriers

The petrochemical industry, and by extension Hengyi Petrochemical, faces significant exit barriers due to the immense capital tied up in specialized plants and sophisticated equipment. These assets are often highly specific to petrochemical production, making them difficult to repurpose or sell at a reasonable value if a company decides to exit. This immobility of capital means that even when market conditions turn unfavorable, companies are often compelled to continue operating rather than abandon their investments.

This reluctance to exit, even during periods of reduced demand or profitability, can exacerbate competitive rivalry. It often leads to persistent oversupply in the market, as companies strive to maintain production levels to cover fixed costs. Consequently, this oversupply can drive down prices, intensifying price-based competition among players like Hengyi Petrochemical and its rivals.

For example, in 2024, the global petrochemical industry experienced fluctuating demand, yet many large-scale facilities continued production. Companies with substantial investments, such as those in integrated refining and petrochemical complexes, found it challenging to scale back operations significantly without incurring substantial losses. This dynamic contributed to a competitive landscape where price discipline was often difficult to maintain.

- High Capital Intensity: Petrochemical plants require billions of dollars in upfront investment, making divestment extremely costly.

- Specialized Assets: Equipment is often purpose-built, limiting resale options and increasing losses upon exit.

- Operational Continuity: Companies often prioritize continued operation to offset fixed costs, even in weak markets.

- Market Oversupply: High exit barriers contribute to persistent oversupply, fueling price wars and intense rivalry.

Strategic stakes and diversity of competitors

The petrochemical industry is characterized by a wide array of competitors, each with distinct strategic aims. State-owned enterprises often prioritize national resource security and import substitution, while privately held firms are typically driven by profit and market share growth. This divergence in objectives fuels varied competitive tactics, from aggressive pricing by profit-focused entities to strategic capacity expansions by national champions, intensifying rivalry.

Hengyi Petrochemical operates within this complex landscape. For instance, in 2024, major state-backed players like Sinopec and PetroChina continued to invest heavily in upstream and downstream integration to bolster China's domestic supply chains. Simultaneously, private entities and international joint ventures are often more agile, focusing on niche markets or advanced materials. This dynamic means that competitive pressures can shift rapidly, influenced by government policies, global commodity prices, and technological advancements.

- Diverse Strategic Objectives: Competitors range from state-owned enterprises focused on national self-sufficiency to private companies driven by profit maximization.

- Varied Competitive Behaviors: This diversity leads to unpredictable and intense market competition, with different players employing distinct strategies.

- Impact on Rivalry: The mix of state-backed and private entities creates a dynamic environment where strategic decisions by one group can significantly influence the actions of others.

The competitive rivalry within the petrochemical sector, particularly for products like PTA and polyester where Hengyi Petrochemical operates, is exceptionally high. This is driven by a large number of significant players, especially in Asia, and a market characterized by decelerating demand growth and existing overcapacity, as seen with PTA in China. The commodity nature of many petrochemicals means competition often centers on price, with low customer switching costs forcing constant price adjustments.

Companies often maintain operations despite unfavorable conditions due to high exit barriers, leading to persistent oversupply and intensified price wars. This is evident in 2024, where many large facilities continued production amidst fluctuating demand, making price discipline difficult. The diverse strategic objectives of competitors, from state-owned enterprises focused on self-sufficiency to profit-driven private firms, further fuel this intense and dynamic rivalry.

| Competitor Type | Strategic Focus | Impact on Rivalry |

| State-Owned Enterprises | National security, import substitution | Strategic capacity expansion, stable supply |

| Private Companies | Profit maximization, market share | Aggressive pricing, agile market response |

| International Joint Ventures | Niche markets, advanced materials | Technological innovation, specialized competition |

SSubstitutes Threaten

The threat of substitutes for Hengyi Petrochemical’s products is significant, particularly within the textile and packaging sectors. In textiles, natural fibers such as cotton and wool, alongside other synthetics like nylon and acrylic, offer viable alternatives to polyester fibers. For instance, the global cotton market alone was valued at approximately $60 billion in 2023, showcasing a substantial alternative.

In the packaging industry, polyethylene terephthalate (PET), a key product for companies like Hengyi, faces competition from materials like glass, metal, and paper. The demand for sustainable packaging solutions is also driving interest in these traditional substitutes. In 2024, the global paper packaging market is projected to reach over $300 billion, indicating the scale of these alternative options.

While natural fibers like cotton and wool offer distinct properties, polyester, a key product for Hengyi Petrochemical, often wins on its price-performance ratio. Its affordability, coupled with impressive durability and versatility, makes it a go-to material across many industries.

Emerging bio-based polyesters present a potential substitute. However, their current higher production costs, as seen in the premium pricing of some sustainable textile options, limit their immediate widespread adoption as a direct, cost-competitive replacement for conventional polyester.

Customer willingness to switch to substitutes for Hengyi Petrochemical's products is a significant factor. Environmental concerns are increasingly pushing consumers and industries towards recycled plastics and bio-based alternatives, directly impacting demand for virgin petrochemicals. For instance, the global recycled plastics market was valued at approximately $45 billion in 2023 and is projected to grow substantially, indicating a clear shift in customer preference.

Cost fluctuations in crude oil and natural gas, the primary feedstocks for petrochemicals, also play a crucial role in customer propensity to substitute. When oil prices surge, the economic viability of alternative materials becomes more attractive. In 2024, volatile energy markets, influenced by geopolitical events and supply chain disruptions, have made price hedging and the exploration of cost-competitive substitutes a priority for many downstream industries.

Evolving consumer preferences for specific material properties, such as biodegradability or enhanced performance characteristics, further influence the threat of substitutes. Industries are actively seeking materials that align with sustainability goals and offer superior functionality, potentially diverting demand away from traditional petrochemical derivatives. This trend is evident in the automotive and packaging sectors, where lightweight, sustainable materials are gaining traction.

Technological advancements in substitutes

Technological advancements are continuously creating more viable alternatives to petrochemical products, especially in materials science. Ongoing research in bio-based polymers, for instance, aims to replicate the properties of traditional plastics using renewable resources, potentially reducing reliance on fossil fuels. The global bioplastics market was valued at approximately $50.5 billion in 2023 and is projected to reach $101.9 billion by 2030, indicating significant growth and a growing threat to conventional petrochemicals.

Furthermore, innovations in textile-to-textile recycling are gaining traction. These processes allow for the breakdown and re-spinning of old fabrics into new fibers, creating a circular economy for textiles that bypasses the need for virgin petrochemical-based synthetics. In 2024, investments in advanced recycling technologies for plastics, including chemical recycling methods that can handle mixed waste streams, are expected to increase, further strengthening the substitute threat.

The development of advanced natural fibers also presents a competitive challenge. Materials like enhanced bamboo fibers, advanced cotton processing, and new types of plant-based composites offer improved performance characteristics, sometimes rivaling or exceeding those of synthetic fibers derived from petrochemicals. These innovations are driven by consumer demand for sustainability and corporate ESG (Environmental, Social, and Governance) goals, pushing industries to explore and adopt these alternatives.

- Bio-based Polymers: Market growth from $50.5 billion (2023) to $101.9 billion (2030) highlights increasing competitiveness.

- Textile Recycling: Advanced chemical recycling technologies are improving efficiency and expanding the scope of recyclable materials.

- Natural Fiber Innovation: Enhanced properties of materials like bamboo and advanced cotton offer performance parity with synthetics.

Regulatory pressure and sustainability trends

Increasing environmental regulations and a global push towards sustainability are accelerating the development and adoption of greener alternatives in the petrochemical sector. This societal shift encourages industries to reduce reliance on fossil fuel-derived materials, thereby increasing the threat of substitutes for products like those from Hengyi Petrochemical.

For instance, the European Union’s Green Deal aims for climate neutrality by 2050, driving demand for bio-based plastics and recycled materials. By 2024, the global bioplastics market was projected to reach over $20 billion, demonstrating a significant and growing substitute market.

- Growing demand for bio-based plastics: These alternatives offer a lower carbon footprint compared to traditional petrochemicals.

- Increased investment in recycling technologies: Advanced chemical recycling methods are making it more viable to use recycled plastics, reducing the need for virgin materials.

- Government incentives for sustainable materials: Policies promoting the use of eco-friendly products directly challenge the market share of conventional petrochemicals.

- Consumer preference shifts: A significant portion of consumers, estimated to be over 60% in many developed markets by 2024, actively seek out products with sustainable packaging and origins.

The threat of substitutes for Hengyi Petrochemical's products remains a critical factor, especially as sustainability gains prominence. While polyester, a core product, benefits from its cost-effectiveness and durability, alternatives like natural fibers and recycled materials are increasingly competitive. The growing market for bioplastics and advancements in textile recycling directly challenge traditional petrochemical derivatives.

Consumer preferences and regulatory pressures are key drivers in this shift. For example, the global bioplastics market was valued at approximately $50.5 billion in 2023 and is projected for substantial growth, indicating a clear trend towards more environmentally friendly options. This increasing demand for sustainable alternatives directly impacts the market for virgin petrochemicals.

Technological innovations in materials science are also expanding the range of viable substitutes. Enhanced natural fibers and advanced recycling techniques are offering performance parity with synthetics, further intensifying the competitive landscape for petrochemical producers like Hengyi.

| Substitute Category | Key Materials | Market Size (approx. 2023) | Projected Growth Driver |

|---|---|---|---|

| Natural Fibers | Cotton, Wool, Bamboo | Global Cotton: $60 Billion | Consumer preference for natural feel, biodegradability |

| Bioplastics | PLA, PHA | Global Bioplastics: $50.5 Billion | Environmental regulations, corporate ESG goals |

| Recycled Materials | Recycled PET, Recycled Plastics | Global Recycled Plastics: $45 Billion | Circular economy initiatives, waste reduction targets |

| Paper & Metal Packaging | Paperboard, Aluminum | Global Paper Packaging: >$300 Billion (2024 projection) | Demand for sustainable packaging solutions |

Entrants Threaten

The petrochemical industry, encompassing refining and PTA/polyester production, demands colossal upfront investments. For instance, building a new integrated refining and petrochemical complex can easily run into billions of dollars, creating a formidable financial hurdle for any prospective competitor looking to enter the market.

Economies of scale present a significant barrier for new entrants in the petrochemical industry. Established giants like Hengyi Petrochemical leverage massive production capacities, allowing them to spread fixed costs over a larger output. This translates to lower per-unit production costs, a crucial advantage in a price-sensitive market.

For instance, Hengyi Petrochemical's integrated refining and chemical complexes are designed for high-volume throughput, enabling them to negotiate better prices for raw materials and achieve greater efficiency in logistics. A new player would need to invest billions to even approach such scale, making it incredibly difficult to match existing cost structures and compete effectively on price from the outset.

Established petrochemical players like Hengyi Petrochemical boast deeply ingrained distribution networks, often built over decades. These networks are crucial for reaching downstream customers efficiently, from plastics manufacturers to textile producers. Newcomers would struggle to replicate this reach, facing significant hurdles in securing reliable and cost-effective access to these vital channels.

Government policy and regulatory hurdles

Government policy and regulatory hurdles present a significant barrier to entry in the petrochemical sector. New entrants must contend with stringent environmental regulations, complex permitting processes, and licensing requirements, especially for large-scale production facilities. For instance, in 2024, China, a major hub for petrochemicals, continued to enforce strict environmental protection laws, requiring substantial upfront investment in compliance technology for any new plant. Navigating these requirements can be both time-consuming and capital-intensive, deterring potential new competitors.

These regulatory landscapes often favor established players who have already invested in compliance infrastructure and possess the expertise to manage ongoing regulatory changes. The cost and complexity associated with meeting these standards can effectively limit the number of new companies that can realistically enter the market.

- Environmental Compliance Costs: New petrochemical plants often face millions in upfront costs for emissions control and waste management systems to meet 2024 standards.

- Permitting Delays: Obtaining necessary environmental permits can take years, delaying market entry and increasing initial project expenses.

- Licensing Requirements: Specific operational licenses, often tied to safety and environmental performance, can be difficult for new, unproven entities to secure.

- Policy Uncertainty: Evolving regulations, such as potential carbon pricing mechanisms introduced or strengthened in 2024, create uncertainty and increase risk for new entrants.

Brand identity and customer loyalty

In the petrochemical industry, brand identity and customer loyalty, while less pronounced than in consumer goods, still pose a significant barrier for new entrants. Established companies like Hengyi Petrochemical have cultivated long-standing relationships with buyers, built on a reputation for consistent quality and reliable supply. This trust is hard-won and difficult for newcomers to replicate. For instance, in 2023, Hengyi Petrochemical reported revenues of approximately RMB 158.7 billion, underscoring its substantial market presence and the loyalty it commands from its customer base.

New entrants face the daunting task of investing heavily not just in production capacity but also in building trust and a track record. Overcoming the established network of suppliers and customers requires substantial marketing efforts and a proven commitment to service. The capital expenditure required to match the scale and efficiency of incumbents like Hengyi, which operates integrated refining and chemical complexes, further amplifies this challenge.

- Established Reputation: Hengyi Petrochemical benefits from decades of operational history, fostering customer trust.

- Supplier Relationships: Long-term contracts and partnerships with raw material suppliers create a stable supply chain.

- Customer Loyalty: Existing clients are often hesitant to switch from reliable, known suppliers.

- Investment Barrier: New entrants need significant capital to build brand recognition and secure market share against established players.

The threat of new entrants for Hengyi Petrochemical is relatively low due to substantial capital requirements and established economies of scale. Building new, large-scale petrochemical facilities requires billions of dollars in investment, a significant barrier for potential competitors. For instance, in 2024, the cost of constructing a world-scale ethylene cracker alone can exceed $10 billion.

Existing players like Hengyi Petrochemical benefit from massive production capacities, which lower per-unit costs and make it difficult for newcomers to compete on price. Hengyi's integrated operations, spanning refining to polyester, allow for significant cost efficiencies. For example, in 2023, Hengyi Petrochemical reported revenues of approximately RMB 158.7 billion, indicating its substantial scale and market penetration.

Furthermore, stringent government regulations, particularly concerning environmental compliance, add to the entry barrier. New plants in 2024 must adhere to strict emissions standards and undergo lengthy permitting processes, often taking years and costing millions in compliance technology. This regulatory landscape favors established companies that have already invested in these areas and possess the expertise to navigate evolving policies.

| Barrier Type | Description | Estimated Cost/Impact |

|---|---|---|

| Capital Requirements | Building new integrated petrochemical complexes | Billions of USD (e.g., $10B+ for an ethylene cracker) |

| Economies of Scale | Leveraging massive production capacities for lower unit costs | Requires matching existing high-volume throughput |

| Government Regulations | Environmental compliance, permitting, licensing | Millions in upfront costs for technology; years for permits |

| Established Relationships | Brand loyalty, supplier/customer networks | Difficult to replicate decades of trust and contracts |

Porter's Five Forces Analysis Data Sources

Our Hengyi Petrochemical Porter's Five Forces analysis is built upon a foundation of robust data, including Hengyi's annual reports, industry-specific market research from IHS Markit and Wood Mackenzie, and global economic indicators from the World Bank.