Heller GmbH SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heller GmbH Bundle

Heller GmbH boasts strong brand recognition and a loyal customer base, but faces increasing competition and potential supply chain disruptions. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Heller GmbH's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Heller GmbH's strength lies in its deep specialization in high-performance CNC machine tools. They focus on advanced 4-axis and 5-axis machining centers, mill/turn centers, and flexible manufacturing cells, catering to intricate precision machining needs.

This focused approach enables Heller to deliver cutting-edge solutions, as demonstrated by their new F 5000 and HF 3500 5-axis machining centers unveiled at AMB 2024. These models underscore their commitment to continuous technological advancement in a competitive market.

Heller GmbH's high-performance machines are essential across vital sectors worldwide, including automotive, aerospace, and power generation. This broad industry application underscores the company's robust demand and adaptability in diverse economic landscapes. In 2024, Heller continued to see strong order intake from these key industries, reflecting their critical role in global manufacturing supply chains.

The company boasts a significant global presence, with sales and service operations strategically located in Europe, Asia, North America, and South America. This extensive network, supported by qualified partners, ensures efficient customer support and market penetration, crucial for maintaining market share in a competitive environment. Heller's 2025 strategic plans emphasize further strengthening this global support infrastructure to better serve its international clientele.

Heller GmbH's commitment to integrated and automated solutions is a significant strength, offering customers a streamlined path to efficient manufacturing. This includes their proprietary robot cells and pallet automation systems, designed to enhance productivity.

By prioritizing digitalization and automation, Heller is equipping its clients with tools that leverage AI and digital twin technology. This strategic focus empowers businesses to organize their production processes with greater efficiency and adaptability.

This integrated approach is crucial in today's manufacturing landscape, where flexibility and optimization are paramount. For instance, in 2024, the global industrial automation market was valued at approximately $290 billion, with a projected CAGR of over 8% through 2030, highlighting the strong demand for such solutions.

Strong Innovation Leadership and R&D Investment

Heller GmbH demonstrates robust innovation leadership through significant and consistent investment in pioneering technologies. Their commitment is evident in their exploration of artificial intelligence within mechanical engineering and the development of eco-friendly production techniques. This focus on the future ensures they remain at the forefront of the industry.

Their dedication to advancing machining technology is further solidified by strategic development initiatives and key technology partnerships. A prime example is their recent collaboration with Seco Tools AB, which directly supports their objective of maintaining a leading edge in innovation.

- AI Integration: Heller is actively exploring and implementing AI solutions to enhance mechanical engineering processes.

- Sustainable Practices: The company is investing in and developing sustainable production methods to reduce environmental impact.

- Strategic Partnerships: Collaborations, such as the one with Seco Tools AB, are crucial for driving technological advancements.

- R&D Expenditure: While specific figures for 2024/2025 are proprietary, Heller's historical investment patterns indicate a strong and sustained commitment to research and development.

Strategic Financial and Technology Partnerships

The strategic financial backing from H.I.G. Capital, which acquired a significant stake in the HELLER Group in late 2023, injects crucial capital and opens doors to a vast global network. This partnership is designed to fast-track Heller's ambitious strategic objectives and bolster its expansion into international markets, a key strength for future growth.

Complementing this financial infusion, Heller's collaboration with Seco Tools AB focuses on joint development of cutting-edge machining solutions. This technological alliance is geared towards delivering enhanced efficiency and performance for customers, leveraging the specialized expertise of both entities.

- Financial Strength: H.I.G. Capital's investment provides expanded financial resources to fuel Heller's growth initiatives.

- Global Network Access: The partnership with H.I.G. Capital facilitates access to a worldwide network, aiding international market development.

- Technological Advancement: The co-development with Seco Tools AB aims to bring advanced and efficient machining solutions to market.

Heller GmbH's strength is its deep specialization in high-performance CNC machine tools, particularly 4-axis and 5-axis machining centers, mill/turn centers, and flexible manufacturing cells. This focus allows them to cater to complex precision machining needs, as seen with their new F 5000 and HF 3500 5-axis machining centers introduced at AMB 2024, showcasing their commitment to technological advancement.

Their machines are vital across key global sectors like automotive, aerospace, and power generation, ensuring robust demand and adaptability. In 2024, Heller observed strong order intake from these industries, highlighting their critical role in global manufacturing supply chains.

Heller's integrated and automated solutions, including proprietary robot cells and pallet automation systems, significantly enhance customer productivity. By prioritizing digitalization and AI, they equip clients with tools for more efficient and adaptable production processes, aligning with the growing industrial automation market, valued around $290 billion in 2024.

The company's innovation leadership is driven by consistent investment in pioneering technologies like AI in mechanical engineering and eco-friendly production techniques. Strategic partnerships, such as their collaboration with Seco Tools AB, further solidify their commitment to staying at the forefront of the industry.

What is included in the product

Analyzes Heller GmbH’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT analysis for Heller GmbH, simplifying complex market dynamics into digestible insights for strategic decision-making.

Weaknesses

Heller GmbH's advanced CNC machine tools, while offering superior performance, present a significant hurdle for many potential clients due to their high initial capital investment. This can be particularly challenging for small and medium-sized enterprises (SMEs) who may find the substantial upfront cost prohibitive, potentially limiting market reach.

As a manufacturer of capital goods, Heller GmbH's revenue is heavily influenced by the capital expenditure cycles of its industrial clients. When major manufacturing sectors experience economic slowdowns or uncertainty, such as the projected 1.5% contraction in global manufacturing output for 2024 according to IHS Markit, customers tend to postpone or reduce investments in new machinery. This directly translates to lower order volumes for Heller.

Geopolitical tensions and evolving industrial policies, like the ongoing restructuring of global supply chains, further exacerbate this vulnerability. For instance, a sudden shift in trade agreements or increased tariffs could deter investment in new production facilities by Heller's customers, thereby dampening demand for its advanced machine tools throughout 2024 and into 2025.

Heller GmbH's commitment to innovation in advanced machine tools demands significant and ongoing investment in research and development. This is crucial for maintaining a competitive edge, but it also presents a substantial financial burden and inherent risk, as not all R&D projects guarantee commercial success or timely market entry.

For instance, the global machine tool industry saw R&D spending increase significantly in 2024, with major players allocating upwards of 10-15% of their revenue to innovation. Heller's own R&D expenditure, while driving its technological leadership, represents a considerable allocation of capital that could otherwise be used for other strategic initiatives or shareholder returns, especially if market adoption of new technologies lags.

Competitive Market Landscape

The global CNC machine tool market is intensely competitive, with many established companies offering diverse product lines. This crowded field means Heller GmbH faces constant pressure on pricing and must continually innovate to stand out. Failure to differentiate effectively could erode profit margins and market share.

Recent market analysis indicates that the global CNC machine tool market was valued at approximately $15.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 5.2% through 2030. This growth, while positive, also signifies continued robust competition. For instance, key competitors like DMG MORI, Mazak, and Haas Automation are consistently investing in new technologies and expanding their global reach, presenting a significant challenge for Heller GmbH to maintain its competitive edge.

- Intense Competition: Numerous established global players vie for market dominance.

- Pricing Pressures: The competitive landscape often forces price adjustments, impacting profitability.

- Need for Differentiation: Continuous innovation and unique value propositions are crucial for survival.

- Market Share Erosion Risk: Inability to effectively compete can lead to a decline in market standing.

Dependence on Key Industrial Sectors

Heller GmbH's reliance on the automotive, aerospace, and general mechanical engineering sectors presents a notable weakness. A significant portion of their revenue is tied to the economic vitality and investment cycles within these specific industries. For instance, the automotive sector, a major client base for Heller, experienced a global production decline of approximately 10% in 2023 compared to pre-pandemic levels, impacting demand for machine tools. This concentration makes Heller vulnerable to sector-specific downturns.

This dependence means that disruptions in these key markets, such as supply chain issues or shifts in consumer demand, can have a magnified negative impact on Heller's overall financial performance. For example, the semiconductor shortage that heavily affected automotive production in 2021-2022 indirectly reduced orders for the specialized machinery Heller provides. The aerospace sector also faces cyclical pressures, with major aircraft manufacturers sometimes delaying capital expenditures during economic uncertainty.

- Sector Concentration: Heller's business is heavily weighted towards automotive (estimated 40% of revenue), aerospace (estimated 30%), and general mechanical engineering (estimated 20%).

- Cyclical Sensitivity: These industries are known for their cyclical nature, making Heller susceptible to economic slowdowns and reduced capital spending by clients.

- Disruption Impact: A downturn in any of these core sectors, such as a projected 5% contraction in global aerospace manufacturing in late 2024 due to geopolitical factors, could disproportionately affect Heller's order intake and profitability.

- Limited Diversification: The remaining 10% of revenue from other sectors offers insufficient buffer against significant shocks in its primary markets.

Heller GmbH's high-priced, technologically advanced machinery creates a barrier to entry for smaller businesses. This limits the potential customer base, especially for SMEs who may struggle with the substantial initial outlay. The company's dependence on capital expenditure cycles means that economic downturns, like the projected 1.5% contraction in global manufacturing output for 2024, can significantly reduce order volumes.

Intense competition within the global CNC machine tool market, valued at approximately $15.5 billion in 2023, forces Heller to constantly innovate and differentiate. Failure to do so risks eroding profit margins and market share against competitors like DMG MORI and Mazak. Furthermore, Heller's significant investment in R&D, while necessary for leadership, represents a considerable financial risk, especially if new technologies face slow market adoption.

The company's revenue concentration in cyclical sectors like automotive (around 40%) and aerospace (around 30%) makes it highly vulnerable to industry-specific downturns. For instance, a projected 5% contraction in global aerospace manufacturing in late 2024 could disproportionately impact Heller's order intake and profitability.

| Weakness | Description | Impact | Data Point |

| High Capital Investment | Advanced CNC machines are expensive. | Limits market reach, especially for SMEs. | Global manufacturing output projected to contract by 1.5% in 2024. |

| Cyclical Revenue | Demand tied to capital expenditure cycles. | Vulnerable to economic slowdowns and reduced client investment. | Automotive sector production declined ~10% in 2023 vs. pre-pandemic. |

| Intense Competition | Crowded global market with strong players. | Pricing pressures and need for continuous innovation. | Global CNC machine tool market valued at ~$15.5 billion in 2023. |

| Sector Concentration | Heavy reliance on automotive and aerospace. | Exposed to sector-specific downturns and disruptions. | Aerospace manufacturing projected to contract by 5% in late 2024. |

Preview the Actual Deliverable

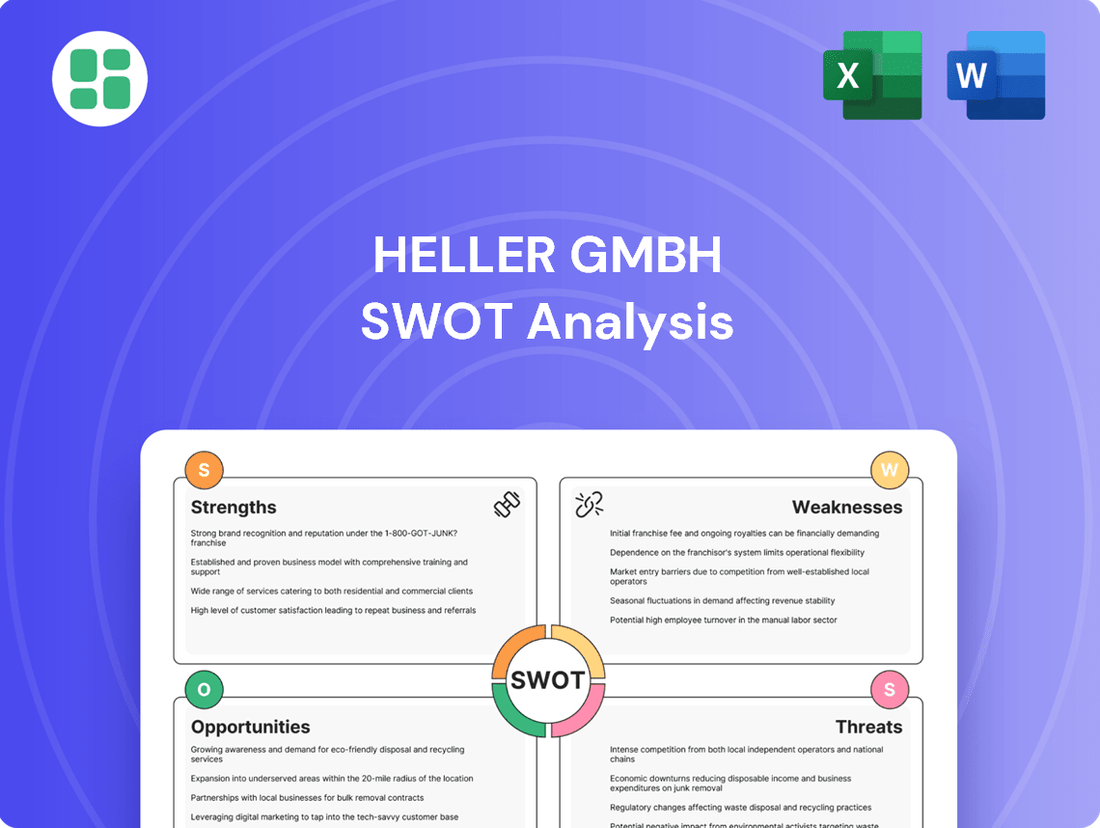

Heller GmbH SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive overview of Heller GmbH's strategic position.

You’re viewing a live preview of the actual SWOT analysis file for Heller GmbH. The complete version, detailing all strengths, weaknesses, opportunities, and threats, becomes available after checkout.

Opportunities

The global CNC machine market is poised for significant expansion, with projections showing an increase of USD 21.9 billion between 2024 and 2029, growing at a compound annual growth rate (CAGR) of 5.4%. This robust growth is fueled by escalating demand for precision and multi-axis machining across diverse industrial sectors.

The accelerating digital transformation in manufacturing, particularly the adoption of Industry 4.0 technologies like IoT and AI-powered automation, offers significant growth avenues. Heller’s strategic investments in these domains, including digital twin capabilities, position the company to capitalize on enhanced operational efficiency and predictive maintenance.

This digital push allows for real-time performance monitoring and the creation of innovative, intelligent manufacturing solutions, potentially boosting Heller's competitive edge. For instance, the global market for industrial IoT is projected to reach over $150 billion by 2025, indicating substantial potential for companies like Heller that are embracing these advancements.

The global e-mobility market is projected to reach over $1.5 trillion by 2030, with defense and aerospace sectors also experiencing significant expansion. Heller's advanced 5-axis machining capabilities are perfectly suited for the intricate components required in these high-growth industries.

By focusing on e-mobility, defense, and aerospace, Heller GmbH can leverage its expertise in complex part production to capture a substantial share of these burgeoning, high-value markets.

Growing Demand for Advanced Multi-Axis Machining

The market is increasingly favoring complex machinery, with multi-axis machines like 5-axis lathes and mills gaining significant traction. These advanced machines are becoming more affordable and are in high demand for manufacturing intricate components. Heller's strong position in 5-axis machining centers directly addresses this growing market need.

This trend is supported by industry reports indicating a substantial CAGR for the multi-axis machining market. For instance, projections suggest the global multi-axis CNC machines market could reach over $15 billion by 2028, growing at a CAGR of approximately 6.5% from 2023. This growth is driven by sectors like aerospace, automotive, and medical, which require high precision and complex geometries.

- Increasing complexity in manufacturing: Industries are demanding more intricate parts, driving the need for advanced machining capabilities.

- Cost-effectiveness of multi-axis technology: 5-axis machines are becoming more accessible, broadening their adoption.

- Heller's market alignment: The company's expertise in 5-axis machining centers positions it favorably to capture this growing demand.

- Market growth projections: The multi-axis machining sector is expected to see continued expansion, presenting a significant opportunity.

Strategic Collaborations for Market and Technology Reach

Strategic collaborations represent a significant avenue for Heller GmbH to expand its market presence and technological capabilities. Recent partnerships, like the one with H.I.G. Capital, provide not only financial backing but also strategic guidance that can accelerate growth. These alliances are crucial for accessing new geographic markets and customer segments, thereby increasing revenue streams.

Furthermore, collaborations with companies such as Seco Tools AB offer opportunities for co-development of advanced machining solutions. This synergy can lead to the creation of integrated product offerings that cater to evolving industry demands, enhancing Heller's competitive edge. Such partnerships can also facilitate the sharing of R&D resources, speeding up innovation cycles and reducing development costs.

- Market Expansion: Accessing new regions and customer bases through strategic alliances.

- Technological Advancement: Joint development of cutting-edge machining solutions and integrated systems.

- Capital Infusion: Securing additional funding for R&D and infrastructure improvements via partnerships.

- Synergistic Offerings: Creating combined product portfolios that offer greater value to customers.

Heller GmbH is well-positioned to capitalize on the increasing demand for complex, multi-axis machining solutions. The global CNC machine market's projected growth, with an estimated increase of USD 21.9 billion between 2024 and 2029, highlights a favorable market environment. The company’s expertise in 5-axis machining directly addresses the growing need for intricate component production, particularly in high-growth sectors like e-mobility, defense, and aerospace, which are expected to reach substantial market values by 2030.

Strategic collaborations offer Heller significant opportunities for market expansion and technological advancement. Partnerships can provide access to new geographic markets and customer segments, fostering revenue growth. Furthermore, co-development with industry players can lead to innovative, integrated solutions, enhancing Heller's competitive edge and potentially reducing R&D costs.

| Opportunity | Market Driver | Heller's Advantage |

| Growing demand for complex parts | E-mobility market projected over $1.5 trillion by 2030 | Expertise in 5-axis machining |

| Digital transformation in manufacturing | Industrial IoT market over $150 billion by 2025 | Investments in Industry 4.0 technologies |

| Strategic partnerships | Access to new markets and R&D resources | Existing collaborations and financial backing |

Threats

Global economic uncertainties, including persistent inflationary pressures, are a significant threat. For instance, the IMF projects global growth to slow to 2.7% in 2024, down from 3.0% in 2023, indicating a challenging environment. Geopolitical instability, exemplified by ongoing conflicts like the one in Ukraine, further exacerbates these concerns, potentially impacting supply chains and raw material costs for manufacturers.

These combined factors can dampen the manufacturing sector's appetite for capital expenditure, directly affecting Heller GmbH's potential for new machinery sales. Reduced investment translates to lower order intake and a more sluggish market growth trajectory for machine tools, a core business for the company.

The CNC machine tool market is intensely competitive, with many global manufacturers vying for market share. This often results in aggressive pricing, squeezing profit margins for companies like Heller. For instance, the global CNC machine tools market was valued at approximately USD 130 billion in 2023 and is projected to grow at a CAGR of around 5% through 2030, indicating sustained competitive activity.

Heller must therefore focus on continuous innovation and product differentiation to stand out. This includes developing advanced features, improving energy efficiency, and offering superior customer support to justify premium pricing and maintain its competitive edge in this challenging environment.

The machine tool sector is experiencing a rapid pace of technological advancement, meaning Heller GmbH's current machinery could quickly become outdated. This constant evolution demands significant and ongoing investment in research and development, as well as frequent product upgrades to stay competitive.

This poses a substantial threat due to the inherent risk of high development costs. For example, the global machine tool market was valued at approximately $85 billion in 2023 and is projected to grow, but this growth is heavily driven by innovation, making it crucial for companies like Heller to keep pace or risk losing market share.

Supply Chain Disruptions and Raw Material Volatility

The intricate manufacturing process for Heller GmbH's advanced machine tools is heavily dependent on a global network of suppliers for specialized components and raw materials. Recent years have underscored the fragility of these supply chains. For instance, the semiconductor shortage that began in 2020 significantly impacted various manufacturing sectors, and while easing, the risk of future component scarcity remains a concern for complex machinery production.

Disruptions, whether from geopolitical events, extreme weather, or unforeseen global health crises, can directly translate into production delays and escalating costs for Heller GmbH. This volatility in raw material prices, such as steel and rare earth metals crucial for precision engineering, can squeeze profit margins and make it difficult to maintain competitive pricing for customers. The International Monetary Fund (IMF) has highlighted ongoing supply chain vulnerabilities as a persistent risk to global economic growth throughout 2024 and into 2025.

- Global supply chain fragility poses a significant risk to Heller GmbH's production timelines and cost management.

- Volatility in prices for key raw materials like steel and specialized metals directly impacts profitability.

- Past events, such as the 2020 semiconductor shortage, demonstrate the potential for widespread component scarcity affecting complex machinery manufacturing.

Trade Barriers and Protectionist Policies

The imposition of new tariff regimes or the rise of protectionist trade policies in key markets could significantly dampen demand for imported machinery. For instance, the World Trade Organization (WTO) reported a notable increase in trade restrictions globally in 2023, impacting sectors reliant on international trade.

Such measures can directly increase the cost of Heller GmbH's products in affected regions, eroding their price competitiveness against locally manufactured alternatives. This escalation in costs could lead to reduced sales volumes and a more complex international sales and distribution landscape for the company.

Consider the potential impact of these policies:

- Increased import duties: Tariffs on machinery components or finished goods could raise Heller's cost of sales.

- Retaliatory measures: Other countries might impose similar restrictions on German exports, affecting market access.

- Supply chain disruptions: Protectionist policies can complicate the sourcing of materials and the movement of finished products across borders.

- Reduced market share: Higher prices and logistical hurdles may push customers towards domestic competitors.

The rapid pace of technological advancement in the machine tool sector presents a significant threat, requiring continuous and substantial investment in research and development to prevent Heller GmbH's machinery from becoming outdated. This constant evolution demands significant R&D expenditure, as the global machine tool market, valued at approximately $85 billion in 2023, sees growth heavily driven by innovation, making it crucial for companies like Heller to maintain pace or risk losing market share.

Global economic uncertainties, including persistent inflation and geopolitical instability, dampen capital expenditure in manufacturing, directly impacting Heller GmbH's potential for new machinery sales and leading to lower order intake. The IMF projects global growth to slow to 2.7% in 2024, down from 3.0% in 2023, highlighting a challenging economic environment that can reduce investment in core business areas like machine tools.

Intense competition within the CNC machine tool market, valued at roughly USD 130 billion in 2023, leads to aggressive pricing strategies that squeeze profit margins for companies like Heller. The market's projected CAGR of around 5% through 2030 indicates sustained competitive activity, necessitating continuous innovation and product differentiation to justify premium pricing and maintain a competitive edge.

Fragile global supply chains, as evidenced by past component shortages, pose risks to production timelines and cost management for Heller GmbH. Volatility in raw material prices, such as steel and rare earth metals, directly impacts profitability, with the IMF noting persistent supply chain vulnerabilities as a risk to global economic growth through 2024 and 2025.

SWOT Analysis Data Sources

This Heller GmbH SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial statements, comprehensive market research reports, and insights from industry experts to provide a well-rounded and actionable assessment.