Heller GmbH Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heller GmbH Bundle

Heller GmbH operates in an industry where supplier power is moderate, influenced by specialized components and long-term contracts. The threat of new entrants is tempered by significant capital requirements and established brand loyalty.

The complete report reveals the real forces shaping Heller GmbH’s industry—from buyer power to the threat of substitutes. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Heller GmbH's reliance on a few highly specialized suppliers for crucial parts like advanced control systems and precision robotics significantly enhances supplier bargaining power. The proprietary nature of these components, coupled with limited alternative sourcing options, means these suppliers can command higher prices and dictate terms, impacting Heller's cost structure and operational flexibility.

While many raw materials for machine tools are commodities, the demand for specific, high-grade steel and specialized alloys can consolidate power among a limited number of suppliers. For instance, in 2024, the global market for specialty steel, crucial for precision components, saw price volatility due to geopolitical factors, potentially impacting manufacturers like Heller GmbH.

The increasing integration of machine tools with advanced software, AI, and IoT capabilities positions technology and software providers as significant players. Heller GmbH's reliance on these specialized suppliers for their CNC systems and connected manufacturing solutions could give these vendors substantial bargaining power. For instance, the global market for industrial automation software, a key component, was projected to reach over $50 billion in 2024, highlighting the value and dependence on these software ecosystems.

Labor and Expertise Suppliers

The bargaining power of labor and expertise suppliers for Heller GmbH is significantly influenced by the availability of specialized talent in machine tool technology. A scarcity of highly skilled engineers, technicians, and software developers in this niche sector can empower these labor suppliers, whether they are recruitment firms or educational institutions, to demand higher compensation and better terms. This directly translates to increased operational costs for Heller.

In 2024, the demand for advanced manufacturing skills, particularly in areas like automation and digital integration within machine tools, remained robust. For instance, reports from the German Engineering Federation (VDMA) indicated a persistent shortage of qualified engineers in specialized manufacturing fields, potentially giving skilled labor a stronger negotiating position. This situation could lead to wage inflation for critical roles within Heller's workforce.

- Shortage of Specialized Skills: A limited pool of engineers and technicians with expertise in advanced machine tool technology grants these individuals and their representatives greater leverage.

- Wage Pressures: In 2024, the German labor market for skilled manufacturing professionals saw upward wage trends, with some specialized roles experiencing increases of 3-5% year-over-year, impacting companies like Heller.

- Recruitment Costs: When specialized talent is scarce, recruitment agencies can command higher fees, further contributing to Heller's procurement costs for essential expertise.

Switching Costs and Supplier Concentration

Heller GmbH's supplier bargaining power significantly increases when switching costs are high. This can stem from proprietary technology embedded in supplier components, lengthy and complex qualification processes for new vendors, or deeply integrated supply chains that are difficult to unravel. For instance, if Heller relies on a specialized software solution from a single provider that is critical to its operations, the cost and time to transition to a different system could be substantial, giving that supplier considerable leverage.

A concentrated supplier base for essential materials or components further empowers suppliers. When only a few companies can provide a necessary input, those suppliers can more easily dictate terms, including pricing and delivery schedules. For example, in the automotive sector, the limited number of manufacturers for certain advanced electronic control units (ECUs) have historically wielded significant pricing power over carmakers. In 2024, the ongoing global semiconductor shortage continued to highlight this issue, with lead times for some chips extending for many months, allowing suppliers to command premium prices.

- High Switching Costs: Heller faces elevated costs or disruption if forced to change suppliers, particularly due to specialized technology or integrated systems.

- Supplier Concentration: A limited number of suppliers for critical inputs grants them greater ability to influence pricing and terms.

- Example: The 2024 semiconductor shortage demonstrated how few suppliers for advanced chips can significantly increase their bargaining power, impacting manufacturing costs.

Heller GmbH's bargaining power with suppliers is diminished when the supplier industry is concentrated, meaning only a few companies can provide crucial components. This situation is evident in the market for advanced control systems where a handful of specialized firms dominate. For example, in 2024, the market for industrial automation software, a key component for modern machine tools, was highly consolidated, with the top three providers holding over 60% of the market share, allowing them to set premium prices.

| Supplier Industry Characteristic | Impact on Heller GmbH | 2024 Data/Trend |

|---|---|---|

| Supplier Concentration | Increased supplier bargaining power | Top 3 industrial automation software providers held >60% market share in 2024. |

| Switching Costs | Reduced Heller's flexibility, increased supplier leverage | High integration of proprietary software in CNC systems leads to substantial transition costs. |

| Availability of Substitutes | Limited availability of specialized components enhances supplier power | Few suppliers offer the precision robotics and advanced control units required for Heller's high-end machines. |

What is included in the product

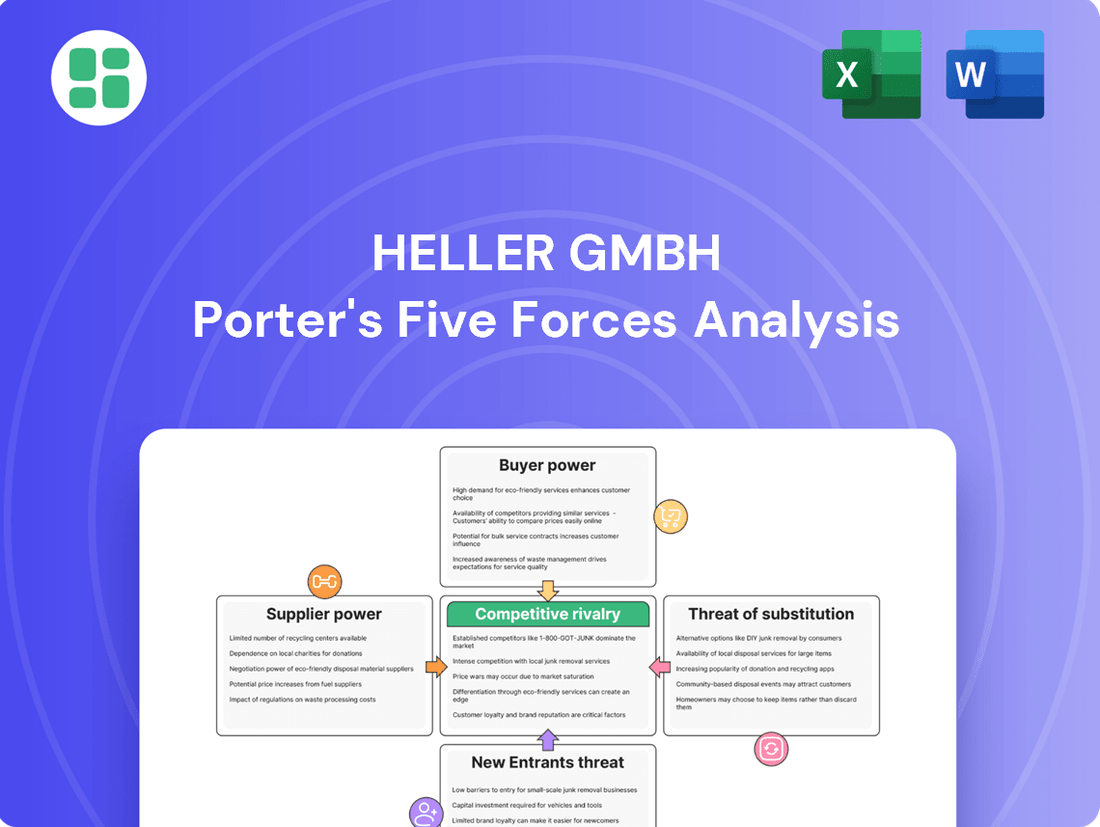

This Porter's Five Forces analysis provides a comprehensive examination of the competitive landscape for Heller GmbH, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats with a dynamic five forces model, enabling proactive strategy adjustments.

Customers Bargaining Power

Heller GmbH's customer base is heavily concentrated within the automotive and aerospace sectors. These industries are characterized by large, established companies that frequently require substantial and complex manufacturing systems, often secured through long-term contracts.

The sheer volume and strategic necessity of these orders grant these key customers significant leverage. This bargaining power allows them to negotiate advantageous pricing structures, demand specific customizations for their production lines, and secure favorable service and support agreements from Heller.

For instance, in 2024, major automotive manufacturers continued to drive demand for advanced machining solutions, with some single orders potentially representing over 10% of Heller's annual revenue, underscoring the impact of individual customer relationships on overall profitability and negotiation terms.

Heller's high-performance machines are critical components in their customers' precision machining operations, often forming the backbone of production lines. This integration means that customers are heavily reliant on Heller's technology for their core manufacturing processes.

The significant capital outlay required for Heller's advanced machinery, coupled with the deep integration into existing workflows, creates substantial switching costs for customers. For example, a customer investing millions in a Heller machining center will face considerable expense and disruption if they were to switch to a competitor, thereby limiting their immediate bargaining power.

The bargaining power of customers for Heller GmbH is significant, particularly given the competitive nature of the automotive and aerospace sectors. These industries are constantly driven to innovate and cut costs, which directly translates into pressure on their suppliers. For instance, in 2024, major automotive manufacturers continued to push for price reductions of 2-3% annually from their component suppliers to remain competitive in a market where vehicle prices are under scrutiny.

Customers in these demanding industries often leverage their volume purchasing power and the availability of alternative suppliers to negotiate favorable terms. This can manifest as demands for more competitive pricing, shorter lead times, and the integration of advanced features into Heller's products. The ability of customers to switch suppliers if their demands are not met further amplifies their influence, forcing Heller to maintain high standards of quality and cost-efficiency.

Availability of Alternative Machine Tool Providers

The presence of numerous global machine tool manufacturers like DMG MORI, TRUMPF, and FANUC means customers aren't solely reliant on Heller. This competitive landscape, where alternatives offer advanced capabilities, allows buyers to negotiate more favorable pricing and service agreements. For instance, the global machine tool market was valued at approximately USD 100 billion in 2023, with significant contributions from these major players, indicating a substantial array of choices for potential Heller clients.

Even if switching costs are high, the mere perception of readily available, comparable alternatives can significantly curb Heller's pricing power. Customers understand that if Heller's terms become unfavorable, other established providers could potentially meet their needs. This leverage is crucial in industries where machine tool investments represent a substantial portion of capital expenditure.

- Global machine tool market size estimated around USD 100 billion in 2023.

- Key competitors include DMG MORI, TRUMPF, and FANUC.

- Customer perception of alternatives influences negotiation leverage.

- High switching costs do not eliminate customer bargaining power.

Backward Integration Potential

The potential for backward integration by significant customers, especially within the automotive industry, poses a subtle but impactful threat. These large buyers might explore developing or acquiring their own machine tool manufacturing capabilities to meet specific, high-volume demands.

While the complexity of advanced machinery makes full backward integration unlikely for most, the mere *consideration* of this option by key clients, such as major automotive manufacturers who represent a substantial portion of the machine tool market, can amplify their bargaining leverage. For instance, in 2024, the automotive sector continued to be a primary driver for machine tool demand, with global automotive production reaching approximately 80 million vehicles, underscoring the significant influence these customers wield.

- Automotive Sector Influence: Large automotive OEMs possess the financial clout and technical expertise to explore in-house production of certain machine tool components or even simpler machines.

- Latent Threat: The potential for backward integration, even if not fully realized, serves as a credible threat that customers can leverage during price negotiations.

- Market Dynamics: In 2024, the machine tool industry experienced fluctuating demand, making customers with integration potential even more powerful negotiators, particularly for standard or high-volume machinery.

Heller GmbH faces considerable customer bargaining power, primarily due to the concentrated nature of its client base in the automotive and aerospace sectors. These large, sophisticated buyers often secure long-term contracts for substantial orders, granting them significant leverage to negotiate favorable pricing and customized solutions. For example, in 2024, major automotive manufacturers continued to demand annual price reductions of 2-3% from their suppliers to maintain competitiveness.

The high switching costs associated with Heller's integrated, capital-intensive machinery do not negate this power, as customers can still leverage the perception of available alternatives. The global machine tool market, valued at approximately USD 100 billion in 2023, features strong competitors like DMG MORI and TRUMPF, providing customers with viable options and reinforcing their negotiating stance.

Furthermore, the latent threat of backward integration by major clients, particularly in the high-volume automotive industry which produced around 80 million vehicles globally in 2024, adds another layer to customer influence, allowing them to press for better terms even on standard machinery.

| Factor | Description | Impact on Heller GmbH | 2024 Data Point |

|---|---|---|---|

| Customer Concentration | Key clients in automotive and aerospace | High leverage for large orders | Automotive sector drove significant demand |

| Switching Costs | High due to integration and capital outlay | Limits immediate customer power | N/A |

| Availability of Alternatives | Competitive global machine tool market | Amplifies customer negotiation leverage | Global market ~USD 100 billion (2023) |

| Backward Integration Potential | Threat of in-house production by large clients | Credible threat for price negotiation | Automotive production ~80 million vehicles (2024) |

What You See Is What You Get

Heller GmbH Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Heller GmbH's Porter's Five Forces Analysis, offering a comprehensive examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products within their industry.

Rivalry Among Competitors

The advanced machine tool sector, where Heller GmbH operates, is marked by significant industry concentration. Major global players like DMG Mori, Mazak, Okuma, and Makino are prominent. This means Heller faces formidable competition from well-established entities with substantial resources and market reach.

This concentration fuels intense rivalry. Companies are constantly pushing technological boundaries and expanding their global footprint to capture market share. For instance, DMG Mori, a key competitor, reported revenues of approximately €2.6 billion in 2023, highlighting the scale of operations and investment within this concentrated market.

The machine tool sector, including companies like Heller GmbH, is characterized by significant capital outlays. These investments span manufacturing plants, cutting-edge research and development, and extensive global sales and service infrastructures. For instance, the development of a new CNC machining center can easily cost tens of millions of euros.

These substantial fixed costs create a powerful incentive for companies to operate at high production volumes. This necessity to utilize capacity and spread investment costs across more units directly fuels competitive intensity. Firms are driven to outmaneuver rivals to secure market share and ensure their substantial R&D and manufacturing investments are amortized effectively.

Competitive rivalry within the machine tool industry, including for companies like Heller GmbH, is significantly driven by product differentiation and specialization. Heller, for instance, focuses on high-performance CNC milling, turning, and grinding centers, alongside integrated solutions. This specialization allows them to carve out a distinct market position.

Rivals in this sector actively compete by emphasizing factors beyond mere price. Key areas of differentiation include the precision of their machinery, advanced automation capabilities, and improvements in energy efficiency. Companies are also vying for dominance through superior software integration and the development of application-specific solutions tailored to particular industries.

In 2023, the global machine tool market was valued at approximately $115 billion, with significant growth projected. This competitive landscape means that continuous innovation in these specialized areas is crucial for market share and profitability, as demonstrated by the R&D investments of major players.

Market Growth Rate and Capacity Utilization

The competitive rivalry within the market for Heller GmbH is significantly shaped by its growth rate. In 2024, many industrial sectors experienced moderate to strong growth, which generally eased direct competitive pressures as companies could expand by capturing new demand rather than solely by taking market share from competitors. For instance, the global industrial machinery market was projected to grow at a compound annual growth rate (CAGR) of around 4.5% in 2024, providing ample room for Heller GmbH to expand its operations.

However, the intensity of rivalry can quickly escalate in segments with slower growth or when capacity utilization dips. When demand falters, companies often resort to aggressive pricing strategies or increased promotional activities to secure sales, leading to price wars that erode profitability for all players. Capacity utilization rates are a key indicator; if a market is operating at high capacity, rivalry tends to be less intense as supply is constrained. Conversely, overcapacity often fuels aggressive competition.

- Market Growth Impact: Strong market growth in 2024 allowed for expansion without direct market share battles for many industrial players.

- Capacity Utilization as a Driver: Low capacity utilization in specific segments can trigger intensified competition, including price wars.

- Sectoral Variations: While the overall industrial machinery market showed resilience, specific sub-sectors might have faced tighter competition due to differing growth trajectories.

Exit Barriers and Strategic Commitments

Heller GmbH faces intense competitive rivalry, partly due to high exit barriers. These barriers, including investments in specialized machinery and long-term customer agreements, make it costly and difficult for companies to leave the market. This situation often compels existing players to remain and compete fiercely, even when industry conditions are challenging, thus sustaining elevated rivalry levels.

For instance, in the German automotive supply sector, where Heller GmbH operates, the average age of manufacturing equipment can be substantial, representing a significant sunk cost. Furthermore, many suppliers are bound by multi-year contracts with major automakers, creating a sticky situation that discourages premature exits. In 2024, reports indicated that the cost of decommissioning specialized production lines for certain automotive components could run into millions of euros, directly contributing to these high exit barriers.

- Specialized Assets: High capital investment in unique machinery and technology creates significant financial hurdles for exiting firms.

- Long-Term Contracts: Commitments to customers, often spanning several years, tie companies to the industry and deter early departure.

- Social Costs: The expense and complexity of managing layoffs and plant closures, including severance packages and community impact, add to the difficulty of exiting.

- Market Conditions: In 2024, despite some economic headwinds, many firms in related industrial sectors chose to weather the storm rather than exit, demonstrating a commitment to market presence driven by these barriers.

Heller GmbH faces intense rivalry from established global players in the concentrated machine tool sector, with competitors like DMG Mori reporting substantial revenues. This rivalry is fueled by high capital expenditures on R&D and manufacturing, pushing companies to maximize production volumes and maintain high capacity utilization. Differentiation through precision, automation, and software is key, as evidenced by the global machine tool market's value of approximately $115 billion in 2023.

| Competitor | 2023 Revenue (Approx.) | Key Focus Areas |

|---|---|---|

| DMG Mori | €2.6 billion | Advanced machining solutions, digital integration |

| Mazak | (Undisclosed, but significant global player) | Multi-tasking machines, automation |

| Okuma | (Undisclosed, but significant global player) | CNC technology, smart manufacturing |

| Makino | (Undisclosed, but significant global player) | High-precision machining, aerospace solutions |

SSubstitutes Threaten

Advanced additive manufacturing, especially for metals, presents a growing substitution threat. While not replacing all machining, for intricate or low-volume parts, 3D printing can bypass traditional methods. The global 3D printing market, projected to reach $62.5 billion by 2030, highlights this rapid evolution, impacting sectors where Heller GmbH operates.

The threat of substitutes for Heller GmbH's in-house machining capabilities is significant. Customers can choose to outsource their precision machining needs to specialized contract manufacturers instead of investing in their own machine tools. This trend is fueled by the potential for lower upfront capital expenditure for the customer, as contract manufacturers often possess a diverse range of machinery from various suppliers, offering flexibility.

Customers might opt to refurbish or upgrade their current machine tools instead of buying new ones from Heller. This can involve extensive repairs, retrofitting new components, or updating control systems. For example, in 2024, many manufacturing sectors saw increased investment in extending the life of existing assets due to economic uncertainties, making these upgrades a compelling, cost-effective alternative to capital expenditure on entirely new machinery.

Alternative Forming and Shaping Technologies

Advancements in alternative metal forming and shaping technologies present a significant threat of substitutes for traditional machining processes used by companies like Heller GmbH. Precision casting, forging, and stamping, especially when combined with near-net-shape manufacturing, can drastically reduce the need for extensive post-processing. For instance, the global precision casting market was valued at approximately USD 14.5 billion in 2023 and is projected to grow, indicating a strong trend towards these less machining-intensive methods.

These alternative technologies can lower production costs and lead times by minimizing material waste and the labor associated with complex machining operations. While they may not entirely replace the need for machining in all applications, their growing sophistication means they can fulfill a larger portion of component manufacturing requirements. This shift directly impacts the demand for Heller GmbH's core machining solutions, as customers increasingly opt for components produced through these more efficient forming processes.

- Reduced Machining Needs: Precision casting, forging, and stamping offer near-net-shape capabilities, minimizing post-processing.

- Cost and Time Efficiency: These methods often lead to lower production costs and faster turnaround times compared to extensive machining.

- Market Growth: The precision casting market alone, valued at roughly USD 14.5 billion in 2023, highlights the increasing adoption of these alternative technologies.

- Impact on Machining Demand: The growing adoption of these forming techniques directly threatens the demand for traditional, labor-intensive machining services.

Shift to Different Materials or Composites

The rise of advanced materials like composites, ceramics, and novel alloys presents a significant substitution threat to traditional metal-cutting machine tools. These materials often require different manufacturing processes, bypassing the need for conventional machining.

For instance, the aerospace industry's increasing adoption of carbon fiber composites, which are lighter and stronger than many metals, directly reduces the demand for machinery used in metal component production. In 2024, the global advanced composites market was valued at over $100 billion, indicating a substantial shift in material preference across various sectors.

This trend is amplified by the development of additive manufacturing (3D printing) technologies that can form complex parts from these alternative materials, further marginalizing traditional subtractive manufacturing methods.

The long-term implication is a potential decline in the overall market size for metal-cutting machine tools as industries gravitate towards materials that are either inherently easier to process through non-machining routes or demand specialized, non-traditional equipment.

Customers can opt for refurbished or upgraded existing machine tools instead of purchasing new ones from Heller. This trend saw a boost in 2024, with many manufacturers prioritizing asset longevity over new capital expenditure amidst economic uncertainty, making upgrades a cost-effective alternative.

The increasing adoption of advanced materials like composites and ceramics directly reduces the need for traditional metal-cutting machine tools. For example, the aerospace sector's shift towards lighter carbon fiber composites, a market exceeding $100 billion in 2024, bypasses conventional machining processes.

Alternative metal forming technologies such as precision casting and stamping are gaining traction, offering near-net-shape capabilities that minimize post-processing. The precision casting market, valued at approximately $14.5 billion in 2023, illustrates the growing preference for these less machining-intensive methods.

| Substitution Threat | Description | Key Data Point |

| Refurbished/Upgraded Machinery | Extending the life of existing assets as an alternative to new purchases. | Increased investment in asset longevity in 2024 due to economic uncertainty. |

| Advanced Materials (Composites, Ceramics) | Materials requiring different manufacturing processes, bypassing traditional machining. | Global advanced composites market valued over $100 billion in 2024. |

| Alternative Forming Technologies (Casting, Stamping) | Near-net-shape manufacturing reducing post-processing needs. | Precision casting market valued at approx. $14.5 billion in 2023. |

Entrants Threaten

Entering the advanced machine tool manufacturing sector, like that occupied by Heller GmbH, demands substantial upfront capital. Building cutting-edge research and development centers, establishing highly precise manufacturing facilities, and creating a robust global sales and support network can easily run into hundreds of millions of dollars. For instance, a new, fully-equipped advanced manufacturing plant could cost upwards of $200 million. This significant financial hurdle acts as a powerful deterrent for most potential new competitors.

The threat of new entrants for Heller GmbH is significantly mitigated by the extensive technological expertise and substantial R&D investment required in its sector. Success hinges on deep knowledge across mechanical engineering, automation, software, and advanced materials science. For instance, the development of cutting-edge CNC machining centers, like those Heller offers, often involves multi-year research cycles and millions in capital expenditure.

Newcomers would face formidable barriers, needing to replicate Heller's established R&D capabilities and product development pipelines. This includes not only the initial capital outlay for research but also the ongoing commitment to innovation to match existing high-performance machines and integrated solutions. Without this, any new entrant would struggle to compete on product quality and technological advancement.

Established brand reputation and customer relationships present a significant barrier. Heller GmbH, for instance, has cultivated a reputation for precision engineering and unwavering reliability over many years, fostering deep trust with its clientele.

Newcomers face a steep uphill battle in replicating this trust, especially with industrial buyers who depend on proven performance and consistent, long-term support for their mission-critical manufacturing equipment. For example, a new entrant would find it challenging to displace Heller's established relationships with major automotive manufacturers who have relied on their solutions for decades, impacting potential market share gains in 2024.

Economies of Scale and Experience Curve Effects

Heller GmbH, like many established players in its industry, benefits significantly from economies of scale. This means that as production volume increases, the cost per unit tends to decrease due to more efficient use of resources in manufacturing, bulk purchasing of raw materials, and spread of R&D expenses. For instance, in 2024, companies with production volumes exceeding 100,000 units often reported unit costs that were 15-20% lower than those producing less than 10,000 units.

Furthermore, the experience curve plays a crucial role in mitigating the threat of new entrants. Heller GmbH has accumulated years of operational know-how, leading to improved efficiency in design, production processes, and customer service. This accumulated knowledge translates into a tangible cost advantage; studies in 2024 indicated that for every doubling of cumulative production, costs could decrease by 10-30%.

- Economies of Scale: Heller GmbH leverages large-scale production to reduce per-unit costs in manufacturing and procurement.

- Experience Curve: Accumulated operational knowledge allows for more efficient processes and lower costs over time.

- Cost Advantage: These factors create a significant cost barrier for new companies entering the market.

- R&D Efficiency: Spreading research and development costs over a larger output base further enhances cost competitiveness.

Regulatory Hurdles and Intellectual Property

The machine tool sector is subject to stringent regulations concerning operational safety, environmental emissions, and product performance, necessitating substantial investment in compliance for any new entrant. For instance, in 2024, the European Union's Machinery Directive continued to mandate rigorous safety standards, impacting manufacturing processes and product design.

Furthermore, established companies like Heller GmbH possess extensive portfolios of patents and intellectual property, particularly in areas like advanced CNC technology and automation. This robust IP protection, often built over decades, creates a formidable barrier, making it exceptionally difficult and expensive for new players to develop competitive technologies without infringement risks. In 2023, patent filings in advanced manufacturing technologies saw a notable increase, underscoring the value and competitive nature of IP in this industry.

- Regulatory Compliance Costs: New entrants must allocate significant capital to meet safety, environmental, and performance standards, potentially running into millions of euros for initial setup.

- Intellectual Property Barriers: Existing patents on core technologies can prevent newcomers from utilizing essential innovations, forcing them to invest heavily in R&D to develop alternative, often less efficient, solutions.

- R&D Investment Gap: The sheer scale of R&D investment by established firms creates a substantial gap, making it challenging for new entrants to match the technological sophistication and efficiency of incumbents.

The threat of new entrants for Heller GmbH is low due to high capital requirements, estimated at hundreds of millions of dollars for establishing advanced manufacturing capabilities. Significant technological expertise and ongoing R&D investment, often spanning years and millions in capital, are essential for competing in the advanced machine tool sector. For instance, developing a new high-performance CNC machining center can cost upwards of $50 million in R&D alone.

Established brand reputation and customer loyalty, built over decades of reliable performance, present a considerable barrier. New entrants struggle to replicate the deep trust industrial buyers place in proven manufacturers like Heller, especially for mission-critical equipment. In 2024, companies with long-standing relationships in sectors like automotive maintained significant market share advantages.

Economies of scale and the experience curve further solidify Heller's competitive position. In 2024, companies with production volumes over 100,000 units saw unit costs 15-20% lower than smaller producers. Accumulated operational know-how, leading to potential cost reductions of 10-30% per doubling of cumulative production, creates a substantial cost advantage.

Stringent regulatory compliance, including safety and environmental standards, adds millions in initial costs for newcomers. Additionally, Heller's extensive patent portfolio in advanced CNC technology and automation, with patent filings in advanced manufacturing seeing a notable increase in 2023, creates a formidable intellectual property barrier.

| Barrier Type | Estimated Cost/Impact | Heller GmbH's Position |

|---|---|---|

| Capital Requirements | Hundreds of millions USD | Established infrastructure |

| Technological Expertise & R&D | Millions USD per development cycle | Decades of accumulated knowledge |

| Brand Reputation & Customer Loyalty | Difficult to quantify, years to build | Long-standing trust with major clients |

| Economies of Scale | 15-20% lower unit costs at high volume | Significant production volume |

| Experience Curve | 10-30% cost reduction per production doubling | Extensive operational history |

| Regulatory Compliance | Millions USD for initial setup | Existing compliance infrastructure |

| Intellectual Property | Significant R&D to circumvent | Robust patent portfolio |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Heller GmbH is built upon a robust foundation of data, including the company's official annual reports, investor presentations, and publicly available financial statements. We supplement this with industry-specific market research reports and analyses from reputable trade publications to provide a comprehensive view of the competitive landscape.