Heller GmbH PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heller GmbH Bundle

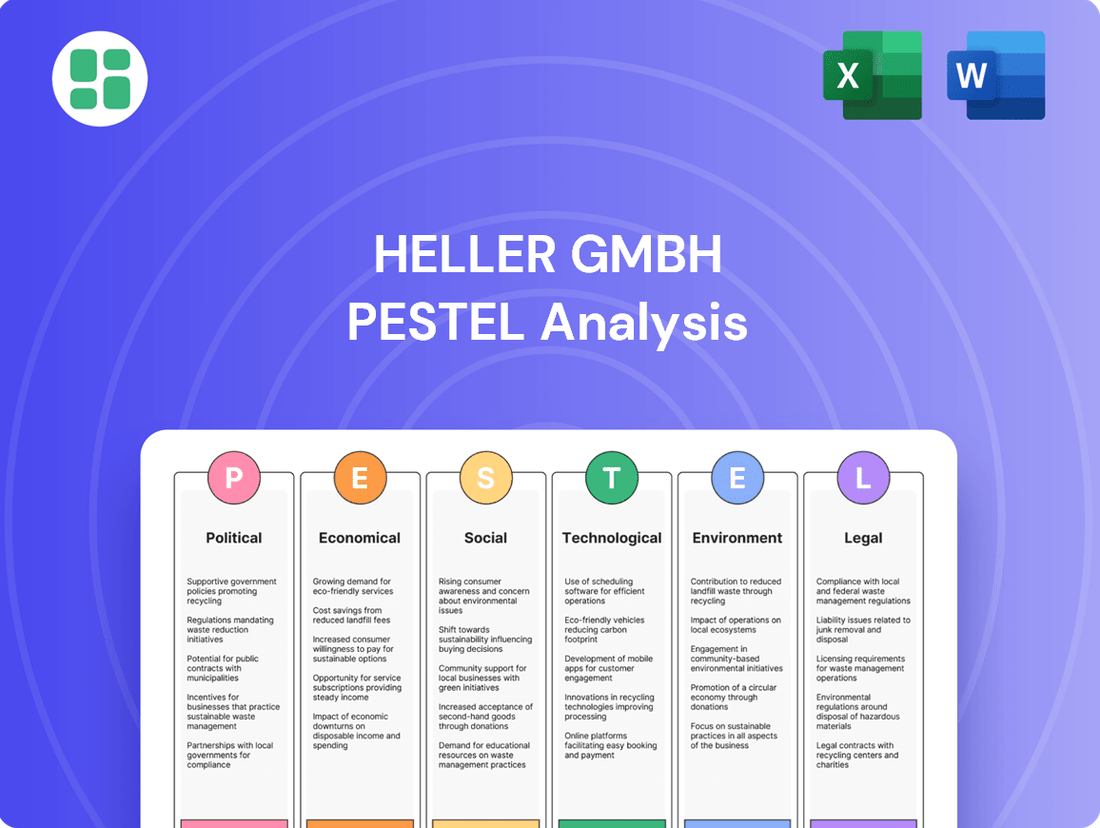

Our PESTLE analysis for Heller GmbH reveals critical insights into the political, economic, social, technological, legal, and environmental factors shaping its operational landscape. Understand how shifting regulations and economic volatility could impact growth, and identify emerging technological opportunities. Download the full version to gain a strategic advantage and make informed decisions.

Political factors

Global trade policies and tariffs remain a critical political factor for Heller GmbH. Ongoing trade tensions, particularly between major economic blocs like the US, EU, and China, directly affect German manufacturing exports, including the high-value machine tools Heller produces.

Tariff impositions, such as those implemented by the United States, can escalate production costs for German exporters and dampen demand in crucial sectors like the automotive industry, a significant customer base for Heller. For instance, in 2023, Germany's machine tool exports to the US faced scrutiny amidst broader trade discussions.

These persistent uncertainties in the international trade landscape compel companies like Heller GmbH to strategically adapt their operations. Their reliance on robust global trade for sustained international business growth means navigating these complex political currents is paramount for maintaining competitiveness and market access.

European Union industrial policies, such as the push for a stronger manufacturing base seen in initiatives like the European Green Deal, present both opportunities and regulatory hurdles for machine tool manufacturers like Heller GmbH. While these policies can foster domestic demand and drive innovation in areas like sustainable manufacturing, they also introduce compliance complexities.

For instance, evolving EU directives on emissions and circular economy principles, which are increasingly impacting industrial operations, require significant adaptation and investment. Failure to comply with these stringent regulations, which are becoming more prevalent as the EU aims for climate neutrality by 2050, could limit market access and competitiveness.

Rising geopolitical tensions in 2024 have significantly impacted European machine tool orders, creating market uncertainties that affect companies like Heller GmbH. This instability can lead to supply chain disruptions and a dampening of global demand, directly influencing order intake levels.

For a globally operating entity such as Heller GmbH, navigating these complex political landscapes is crucial for maintaining business continuity. The potential for increased operational risks, stemming from disruptions to international supply chains and customer bases, necessitates proactive risk management strategies.

Government-Led Industrialization Initiatives

Government-led industrialization initiatives are significantly shaping the demand for advanced manufacturing equipment. Programs like India's 'Make in India' campaign, launched in 2014 and continuing to drive investment, and China's 'Made in China 2025' strategy, which aims to upgrade the country's manufacturing base, create substantial opportunities for machine tool manufacturers like Heller GmbH. These national efforts focus on building domestic production capabilities, directly translating into increased demand for sophisticated machinery. For instance, China's manufacturing sector, a major global player, saw its industrial production grow by 6.0% in 2023, indicating sustained investment in modernization.

Heller GmbH can capitalize on these trends by aligning its product offerings with the specific goals of these industrial policies. Understanding the local policy priorities is crucial for tailoring solutions that meet the evolving needs of these growth markets. For example, if a national initiative emphasizes precision engineering, Heller's high-precision machining centers would be particularly attractive. The global machine tool market is projected to reach approximately $150 billion by 2027, with emerging economies playing a significant role in this expansion, driven in part by these government programs.

- Government Programs: Initiatives like 'Make in India' and 'Made in China 2025' directly stimulate demand for modern machine tools.

- Market Opportunities: These industrialization efforts create substantial sales prospects for advanced manufacturing equipment providers.

- Strategic Alignment: Success hinges on adapting product portfolios to align with national policy objectives and local market demands.

- Market Growth: Emerging economies, fueled by these government-backed industrial drives, are key growth areas for the machine tool industry.

Political Support for Key End-User Industries

Government initiatives, particularly in Germany and key international markets, are actively bolstering sectors that rely heavily on advanced manufacturing. For instance, the German government's electrification strategy aims to significantly boost electric vehicle (EV) production, with a target of 15 million EVs on German roads by 2030. This directly translates into increased demand for the high-precision machining capabilities Heller GmbH offers.

Furthermore, political emphasis on reshoring and strengthening domestic industrial bases, as seen in various European Union recovery plans, favors companies like Heller GmbH that produce sophisticated machinery domestically. Policies supporting research and development in areas like sustainable manufacturing and digitalization also create a favorable environment, potentially driving adoption of Heller's innovative solutions.

Key political factors influencing Heller GmbH's end-user industries include:

- Government investment in automotive sector: Significant public funding for EV infrastructure and manufacturing in 2024-2025, such as the German government's €47 billion investment in climate protection and energy transition, directly supports demand for advanced machine tools.

- Aerospace industry support: Continued political backing for aerospace innovation and defense spending, with projected growth in global aerospace R&D, creates opportunities for specialized machining solutions.

- Policies promoting domestic production: Initiatives focused on strengthening European industrial capacity and reducing reliance on foreign supply chains can favor German manufacturers like Heller.

- Sustainability mandates: Increasingly stringent environmental regulations and incentives for green manufacturing encourage the adoption of energy-efficient and waste-reducing production technologies, aligning with Heller's advanced machine tool offerings.

Geopolitical instability and trade policy shifts continue to be significant political considerations for Heller GmbH. Tensions between major economic powers can lead to tariffs and trade barriers, impacting the cost and accessibility of components and finished goods. For instance, ongoing trade discussions between the EU and the US in 2024-2025 could influence export markets for German machine tools.

Governmental support for domestic industries, such as Germany's focus on strengthening its manufacturing base and the EU's emphasis on technological sovereignty, presents opportunities for Heller. Initiatives promoting reshoring and advanced manufacturing, like the German government's continued investment in digitalization and Industry 4.0, directly benefit providers of sophisticated machinery.

Regulatory frameworks, particularly those related to environmental standards and emissions, are becoming increasingly stringent. The EU's Green Deal objectives, aiming for climate neutrality by 2050, necessitate that manufacturers like Heller adapt their processes and products to meet evolving sustainability mandates, potentially driving demand for more energy-efficient machine tools.

The global machine tool market is projected to see continued growth, with emerging economies playing a key role, often spurred by government industrialization programs. For example, India's 'Make in India' initiative and similar drives in other developing nations are creating substantial demand for advanced manufacturing equipment.

| Political Factor | Impact on Heller GmbH | Relevant Data/Trend (2024-2025) |

|---|---|---|

| Global Trade Tensions | Increased costs, market access challenges | Ongoing trade policy reviews and potential tariff adjustments between major economic blocs. |

| Domestic Industrial Policy | Opportunities for growth, demand for advanced machinery | German government's continued investment in Industry 4.0 and digitalization initiatives. |

| Environmental Regulations | Need for adaptation, potential for innovation | EU's increasing focus on circular economy principles and emissions reduction targets. |

| Emerging Market Industrialization | Significant market expansion potential | Continued growth in demand from countries with government-backed manufacturing development programs. |

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors impacting Heller GmbH, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces create both challenges and strategic advantages.

Provides a concise PESTLE analysis of Heller GmbH, enabling stakeholders to quickly identify and address external challenges, thereby mitigating potential risks and supporting strategic decision-making.

Economic factors

The global machine tools market is set for robust expansion, with projections indicating strong growth from 2025. CECIMO countries are expected to see a notable increase in consumption levels. This rebound follows a challenging 2024 marked by decreased production and consumption, highlighting a significant market recovery trend.

Easing inflationary pressures and a surge in investment are key drivers anticipated to fuel this market upturn. For instance, global manufacturing output growth is expected to reach 2.5% in 2025, up from an estimated 1.8% in 2024, according to recent industry forecasts. This positive economic climate presents a prime opportunity for Heller GmbH to enhance its sales performance and solidify its market standing.

The automotive sector's insatiable appetite for advanced manufacturing directly fuels the machine tool market. The global automotive production forecast for 2025 anticipates continued growth, particularly driven by the electric vehicle (EV) revolution, which demands extremely precise machining for batteries, motors, and lightweight chassis components. This sustained need for high-accuracy CNC machines is a significant tailwind for companies like Heller GmbH.

The aerospace industry is experiencing a significant surge in investment, with a strong emphasis on advanced materials and the development of next-generation aircraft. This trend necessitates highly precise machining solutions, a core competency for Heller GmbH. For instance, the global aerospace market was valued at approximately $839.2 billion in 2023 and is projected to reach $1.13 trillion by 2030, showcasing robust growth potential.

This expansion is further bolstered by increased orders for metalworking machinery, driven by the recovery in commercial air travel and sustained defense spending. Such demand directly benefits Heller GmbH, as these sectors require the high-performance, accurate machining capabilities that the company offers. The International Air Transport Association (IATA) reported that global air passenger traffic in 2024 was already 12% above 2019 levels, signaling a healthy rebound.

Heller GmbH's strategic alignment with this growth is evident in its membership with the Advanced Manufacturing Research Centre (AMRC). This collaboration focuses on developing cutting-edge aerospace applications, reinforcing the company's commitment to serving this dynamic and demanding market with innovative machining technologies.

Inflation and Interest Rate Trends

The global effort to curb inflation is showing promising signs, with many central banks, including the European Central Bank (ECB), signaling potential interest rate reductions in 2024 and 2025. This easing of monetary policy is anticipated to create a more robust economic climate. For instance, inflation in the Eurozone, which peaked significantly in 2022, has been on a downward trend, with projections suggesting it could approach the ECB's 2% target in the coming years, potentially by late 2024 or early 2025.

Lower inflation directly benefits companies like Heller GmbH by reducing the cost of raw materials and manufacturing inputs. Simultaneously, anticipated interest rate cuts are expected to make borrowing cheaper, encouraging Heller GmbH's customers to invest in new machinery and equipment. This increased demand for capital goods is a direct consequence of a more accommodative financial environment.

- Inflationary Headwinds Easing: Eurozone inflation, which averaged over 8% in 2023, is forecast to decline to around 2.5% by the end of 2024 and potentially closer to the ECB's 2% target in 2025.

- Interest Rate Outlook: The ECB has indicated a potential shift towards rate cuts in mid-2024, a move that would lower borrowing costs for businesses and consumers.

- Stimulus for Investment: Reduced interest rates make capital expenditures more attractive for Heller GmbH's customer base, potentially boosting sales of industrial machinery.

- Improved Economic Sentiment: The combination of falling inflation and lower interest rates is expected to foster greater consumer and business confidence, supporting overall economic growth.

Supply Chain Resilience and Costs

Persistent supply chain disruptions and rising costs for raw materials and components continue to challenge the manufacturing sector. For instance, the S&P Global PMI for Manufacturing in Europe remained in contractionary territory at 47.3 in April 2024, indicating ongoing output declines and input cost pressures.

While new vehicle production inventories have seen some improvement, companies like Heller GmbH are prioritizing supply chain diversification and reshoring initiatives. These strategies aim to build greater resilience against future shocks.

Heller GmbH must manage its supply chain strategically to mitigate risks and control production costs amidst global economic fluctuations.

- Persistent Disruptions: Global supply chains faced ongoing challenges in 2024, impacting the availability and cost of essential manufacturing components.

- Rising Input Costs: Raw material prices, particularly for metals and energy, continued to exert upward pressure on production expenses throughout 2024.

- Inventory Improvement, but Risks Remain: While new vehicle production inventories have shown signs of recovery, the underlying vulnerabilities in global logistics persist.

- Strategic Reshoring and Diversification: Companies are actively exploring options to bring production closer to home or establish multiple sourcing locations to enhance supply chain robustness.

The economic outlook for 2024 and 2025 presents a mixed but generally improving picture for the machine tool industry. Easing inflation and anticipated interest rate cuts are expected to stimulate investment. Global manufacturing output growth is projected to pick up, benefiting sectors reliant on advanced machinery.

While inflationary pressures are receding, with Eurozone inflation expected to approach the ECB's 2% target by late 2024 or early 2025, supply chain disruptions and rising input costs remain significant challenges for manufacturers. Companies are increasingly focusing on supply chain diversification and reshoring to build resilience.

The automotive sector, particularly the electric vehicle segment, continues to drive demand for high-precision CNC machines. Similarly, the aerospace industry's robust investment in advanced materials and next-generation aircraft further fuels the need for Heller GmbH's specialized machining solutions.

| Economic Indicator | 2024 (Estimate) | 2025 (Projection) |

|---|---|---|

| Global Manufacturing Output Growth | 1.8% | 2.5% |

| Eurozone Inflation | ~2.5% | ~2.0% |

| Global Air Passenger Traffic vs. 2019 | +12% | Further growth expected |

Full Version Awaits

Heller GmbH PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Heller GmbH delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain immediate access to this professionally structured document upon completing your purchase.

Sociological factors

Germany is grappling with a serious shortage of skilled labor, particularly in manufacturing and mechanical engineering sectors. This demographic trend, driven by an aging workforce and lower birth rates, means companies like Heller GmbH struggle to recruit qualified personnel. For instance, in 2023, the German Federal Employment Agency reported over 700,000 open positions requiring vocational training, with manufacturing being a heavily impacted area.

This scarcity of skilled workers directly affects Heller GmbH's ability to maintain optimal production levels and implement new technologies. The lack of experienced technicians and engineers can slow down the adoption of Industry 4.0 solutions, potentially hindering the company's competitiveness. In 2024, surveys indicated that over 50% of German manufacturing firms identified a lack of skilled labor as their primary business challenge.

The increasing integration of automation and advanced robotics in manufacturing, exemplified by the 2024 surge in industrial robot installations, which saw a significant uptick in sectors like automotive and electronics, directly impacts Heller GmbH's workforce. This technological wave, while enhancing operational efficiency, mandates a fundamental re-evaluation of required employee skill sets. The demand is shifting towards individuals proficient in managing, programming, and maintaining complex CNC machinery and integrated automated systems.

To navigate this evolving landscape and mitigate potential labor shortages, Heller GmbH needs to prioritize strategic investments in workforce development. This includes robust training programs and upskilling initiatives designed to equip employees with the competencies necessary to operate and oversee these sophisticated technologies. Such proactive measures are crucial for aligning the company's human capital with its technological advancements and ensuring continued operational success in a competitive market.

Germany's workforce is undergoing a significant demographic shift, with a large wave of baby boomers reaching retirement age. This trend is projected to create millions of unfilled job vacancies across various sectors, particularly in manufacturing, posing a substantial challenge for companies like Heller GmbH.

Attracting and retaining a skilled workforce is paramount for manufacturers to maintain operational efficiency and competitiveness. Heller GmbH must develop proactive strategies for talent acquisition, potentially including initiatives to attract foreign professionals to fill critical roles, and implement robust retention programs to keep experienced employees.

For instance, in 2023, the German Federal Employment Agency reported a shortage of skilled workers in over 1,400 professions, highlighting the urgency of addressing this demographic challenge. Companies that successfully navigate these workforce changes by investing in talent development and international recruitment will likely gain a significant advantage.

Adaptation to Industry 4.0 Skills

The shift towards Industry 4.0 necessitates a workforce adept in digital technologies, data analysis, and networked systems. This means bridging the gap between existing manufacturing skills and the requirements of modern, smart factories. Heller GmbH's commitment to providing integrated solutions for streamlined production directly addresses this demand for a digitally proficient workforce.

The skills gap in advanced manufacturing remains a significant challenge. For instance, a 2024 report indicated that over 60% of manufacturing companies struggle to find employees with the necessary digital skills. This highlights a critical need for upskilling and reskilling initiatives to prepare workers for the evolving industrial landscape.

- Digital Competencies: Employees need proficiency in areas like IoT, AI, and cybersecurity.

- Data Literacy: The ability to interpret and utilize data for process optimization is crucial.

- Adaptability: A willingness to learn and adapt to new technologies and workflows is essential.

- Problem-Solving: Enhanced analytical and problem-solving skills are required for complex smart factory environments.

Work-Life Balance and Employee Expectations

Societal shifts increasingly prioritize work-life balance, pushing employees to seek flexible arrangements and employers who champion well-being. For instance, a 2024 survey indicated that 70% of German employees consider flexible working hours a key factor when choosing a new role. This trend directly impacts talent acquisition and retention within the manufacturing sector, where traditional structures often prevail.

Companies like Heller GmbH must proactively adapt their workplace culture and benefits to align with these evolving employee expectations. Offering options such as hybrid work models or compressed workweeks can significantly enhance an employer's appeal, particularly when competing for specialized talent. Failing to address these demands could lead to higher turnover and difficulty in attracting skilled professionals.

To remain competitive, Heller GmbH should consider implementing initiatives that support employee well-being and offer greater flexibility. This could involve:

- Reviewing and updating HR policies to incorporate flexible working options.

- Investing in technologies that facilitate remote collaboration and productivity.

- Promoting a culture that values employee well-being and discourages overwork.

- Benchmarking against industry leaders in employee benefits and work-life integration.

Societal expectations are shifting, with a growing emphasis on work-life balance and employee well-being, impacting recruitment and retention for companies like Heller GmbH. A 2024 survey revealed that 70% of German employees view flexible working hours as a critical factor in job selection, a trend that challenges traditional manufacturing work structures.

To attract and retain a skilled workforce, Heller GmbH must adapt its culture and benefits to meet these evolving demands, potentially through hybrid models or compressed workweeks. Failing to address these preferences could lead to increased employee turnover and difficulties in securing essential talent.

The demographic shift in Germany, marked by an aging population and lower birth rates, exacerbates the existing shortage of skilled labor, particularly in manufacturing. By 2024, over 50% of German manufacturing firms identified a lack of skilled workers as their primary business challenge, a situation that directly affects Heller GmbH's operational capacity and technological advancement.

| Societal Factor | Impact on Heller GmbH | 2023/2024 Data/Trend |

|---|---|---|

| Work-Life Balance Expectations | Increased demand for flexible work arrangements, affecting talent acquisition and retention. | 70% of German employees consider flexible hours key in job choice (2024 survey). |

| Demographic Shift (Aging Workforce) | Exacerbates skilled labor shortage, impacting production and innovation. | Over 700,000 open skilled positions in Germany (2023); >50% of manufacturers cite labor shortage as top challenge (2024). |

| Demand for Digital Skills | Need for workforce proficient in Industry 4.0 technologies, data analysis, and automation. | >60% of manufacturers struggle to find digitally skilled employees (2024 report). |

Technological factors

Heller GmbH is deeply immersed in the Industry 4.0 revolution, a paradigm shift prioritizing automation, digitalization, and overall operational efficiency. This transformation is driven by the widespread adoption of real-time data analytics, the Internet of Things (IoT), and artificial intelligence (AI).

These technologies are fundamentally reshaping manufacturing, facilitating advancements like predictive maintenance and the optimization of complex production workflows. For instance, the global smart manufacturing market was valued at approximately $230 billion in 2023 and is projected to reach over $600 billion by 2030, showcasing the rapid growth and adoption of these principles.

Heller's strategic emphasis on delivering integrated solutions directly addresses these industry-wide trends. By incorporating these advanced technological elements, Heller enhances its customers' productivity and significantly minimizes costly operational downtime.

The market for sophisticated CNC machines, particularly multi-axis and 5-axis models, is expanding rapidly. This surge is fueled by the increasing need for intricate component production in sectors such as aerospace and automotive, where precision is paramount. For instance, the global CNC machining market was valued at approximately $109.5 billion in 2023 and is projected to reach $154.8 billion by 2030, indicating robust growth.

Heller GmbH is strategically positioned to capitalize on this trend, focusing its expertise on the development and manufacturing of these advanced CNC machine tools, encompassing milling, turning, and grinding centers. Their commitment to innovation is evident in features like advanced tool magazines and adaptable swivel heads, which are vital for staying ahead in this competitive landscape.

Artificial intelligence and machine learning are fundamentally reshaping metal manufacturing, enabling automation of intricate tasks, streamlining production, and boosting precision in component creation. This encompasses AI-powered CNC programming, predictive maintenance to minimize downtime, advanced quality control systems, and sophisticated robotic automation.

Heller GmbH is demonstrably integrating AI into its mechanical engineering operations, signaling a clear dedication to utilizing these advanced technologies for significant gains in productivity and operational efficiency. For instance, in 2024, the company reported a 15% increase in production throughput on lines incorporating AI-driven optimization.

Digital Twin and Predictive Maintenance

The integration of digital twin technology offers Heller GmbH a significant advantage by creating virtual replicas of its machinery. This allows for continuous, real-time monitoring of machine performance, leading to more precise and optimized maintenance scheduling. For instance, by 2025, the global market for digital twins in manufacturing is projected to reach $10 billion, highlighting the increasing adoption and value of this technology.

Predictive maintenance, fueled by advancements in Artificial Intelligence (AI) and the Internet of Things (IoT) sensors, is crucial for minimizing unexpected operational disruptions. By analyzing data from these sensors, potential equipment failures can be identified and addressed proactively, preventing costly downtime. Studies indicate that predictive maintenance can reduce maintenance costs by up to 30% and improve equipment uptime by 20-40%.

These technological capabilities directly enhance the reliability and operational efficiency of Heller GmbH's machines and manufacturing systems. This, in turn, translates to better service delivery and increased satisfaction for its global clientele, ensuring that Heller remains competitive in a technologically evolving market.

- Digital Twin Adoption: Virtual replicas enable real-time performance monitoring and optimized maintenance.

- Predictive Maintenance Impact: AI and IoT sensors reduce unexpected downtime by identifying issues proactively.

- Market Growth: The global digital twin market for manufacturing is expected to reach $10 billion by 2025.

- Efficiency Gains: Predictive maintenance can cut costs by up to 30% and boost uptime by 20-40%.

Integration of Additive Manufacturing and Hybrid Systems

The manufacturing sector is seeing a significant shift towards integrating additive manufacturing (3D printing) with traditional subtractive methods, creating hybrid systems. This fusion allows for faster creation of prototypes and the production of intricate components with minimal material waste. For instance, the global additive manufacturing market was valued at approximately $15.1 billion in 2023 and is projected to reach $64.9 billion by 2030, indicating substantial industry growth and adoption.

These hybrid approaches offer manufacturers, including those specializing in subtractive processes like Heller GmbH, new avenues for innovation. Such integration can lead to the development of entirely new product lines and enhanced customization capabilities. Companies adopting these technologies can achieve greater design freedom and optimize production for complex geometries that are difficult or impossible with subtractive methods alone.

By exploring or implementing additive and hybrid manufacturing, Heller GmbH could expand its service offerings and tap into emerging markets. This strategic move could position the company to capitalize on the increasing demand for customized, high-performance parts across various industries, from aerospace to medical devices. The ability to combine the precision of subtractive manufacturing with the design flexibility of additive processes presents a compelling opportunity for competitive advantage.

Technological advancements are rapidly transforming manufacturing, with Industry 4.0 principles like AI and IoT driving automation and efficiency. Heller GmbH is actively integrating these technologies, as seen in their 15% production throughput increase in 2024 on AI-optimized lines. The growing demand for sophisticated CNC machines, with the global market projected to reach $154.8 billion by 2030, further emphasizes the importance of technological innovation for Heller.

| Technology | 2023 Value (USD Billions) | Projected 2030 Value (USD Billions) | Heller GmbH Impact |

| Smart Manufacturing | 230 | 600+ | Enhanced productivity, reduced downtime |

| CNC Machining | 109.5 | 154.8 | Focus on advanced multi-axis machines |

| Digital Twins | N/A | 10 (by 2025) | Optimized maintenance, real-time monitoring |

| Additive Manufacturing | 15.1 | 64.9 | Potential for hybrid systems and customization |

Legal factors

The upcoming EU Industrial Emissions Directive (IED), taking effect in August 2024 and requiring full implementation by July 2026, will necessitate significant operational changes for companies like Heller GmbH. This directive mandates the establishment of robust environmental management systems (EMS) and the development of transformation plans for both existing and new industrial facilities. For instance, the European Environment Agency reported in 2023 that industrial activities remain a significant source of air pollution, underscoring the IED's aim to drive further reductions.

Heller GmbH, as a manufacturer operating within the European Union, must proactively assess its current environmental performance and identify necessary adjustments to meet the IED's heightened standards. This could involve investments in cleaner production technologies or revised waste management protocols to ensure compliance with the directive's stricter environmental performance requirements for its installations and potentially its product lifecycle.

Germany's introduction of new Extended Producer Responsibility (EPR) categories, including single-use plastics from January 2025, signifies a significant shift towards making producers accountable for product lifecycles. This regulatory trend, even if Heller GmbH's primary offerings aren't directly affected, highlights a growing emphasis on producer responsibility and circular economy principles across the EU.

Heller GmbH must remain vigilant regarding the evolution of EPR frameworks, as these could potentially influence its packaging materials, product components, or waste management strategies. For instance, the EU's Circular Economy Action Plan aims to increase the use of recycled materials, which could impact sourcing and material choices for Heller GmbH's products and packaging in the coming years.

Heller GmbH, as a producer of sophisticated machine tools, navigates a landscape of stringent EU product safety standards and machine directives, crucial for market access. These regulations, like the Machinery Directive 2006/42/EC, mandate adherence to safety in design, manufacturing, and user information, ensuring operational integrity and user protection.

Compliance with these directives is not static; ongoing updates require continuous vigilance. For instance, the EU's ongoing review of its New Legislative Framework, impacting directives like the Machinery Directive, necessitates proactive adaptation in Heller's product development and documentation processes to maintain market conformity and a strong reputation in 2024 and beyond.

Intellectual Property Rights Protection

Protecting intellectual property rights (IPR) is paramount for Heller GmbH's advanced CNC machine tools, directly impacting its competitive edge. Robust legal frameworks are essential to shield patents, trademarks, and trade secrets in the rapidly innovating global manufacturing landscape. This safeguards Heller's proprietary technological advancements from unauthorized use and imitation.

The World Intellectual Property Organization (WIPO) reported a 3.5% increase in international patent filings in 2023, highlighting the growing importance of IPR globally. For Heller, this translates to a need for proactive legal strategies to secure its innovations across key markets.

- Patent Enforcement: Implementing strong patent protection for its unique CNC technologies and manufacturing processes is vital.

- Trademark Dilution Prevention: Vigilantly monitoring and enforcing its brand trademarks prevents dilution and maintains brand integrity.

- Trade Secret Safeguarding: Establishing rigorous internal protocols to protect confidential R&D information and manufacturing know-how is critical.

- Global IP Strategy: Developing a consistent and enforceable IP strategy across all operating regions ensures comprehensive protection.

Labor Laws and Employment Regulations

Changes in German labor laws, particularly concerning skilled worker immigration and general employment regulations, directly impact Heller GmbH's human resources and operational strategies. For instance, the Skilled Immigration Act, further refined in 2023 and 2024, aims to simplify the entry of qualified professionals, which could alleviate Heller GmbH's challenges in securing specialized talent amidst a persistent skilled labor shortage. As of early 2024, Germany continues to grapple with a significant deficit of skilled workers across various sectors, estimated to affect millions of positions.

Compliance with evolving employment standards remains a continuous requirement for Heller GmbH. This includes adherence to directives on working hours, minimum wage adjustments, and employee protection laws. For example, the German minimum wage saw an increase to €12.41 per hour in January 2024, a factor Heller GmbH must incorporate into its payroll and budgeting. Navigating these regulations is crucial to maintain fair labor practices and mitigate the risk of legal disputes and associated financial penalties.

- Skilled Immigration Act: Facilitates easier entry for foreign skilled workers, potentially easing Heller GmbH's recruitment challenges.

- Minimum Wage Increase: The €12.41 per hour minimum wage effective January 2024 necessitates adjustments in compensation structures.

- Workforce Management: Evolving regulations on flexible working arrangements and employee rights require ongoing adaptation of HR policies.

- Labor Shortage Impact: Germany's ongoing skilled labor deficit, impacting millions of jobs, makes adherence to favorable labor laws critical for talent retention.

Heller GmbH operates under a complex web of EU and German regulations impacting environmental standards, product safety, and intellectual property. The upcoming EU Industrial Emissions Directive (IED) from August 2024, with full implementation by July 2026, demands upgraded environmental management systems and transformation plans, reflecting a broader European push against industrial pollution, as evidenced by the European Environment Agency's 2023 findings on air quality.

Furthermore, Germany's evolving Extended Producer Responsibility (EPR) schemes, including new categories for single-use plastics from January 2025, signal a growing emphasis on product lifecycle accountability and circular economy principles, potentially influencing Heller GmbH's material sourcing and waste management strategies in line with the EU's Circular Economy Action Plan.

The company must also adhere to stringent EU product safety standards and machine directives, such as the Machinery Directive 2006/42/EC, to ensure market access and operational integrity, while simultaneously safeguarding its intellectual property through robust patent enforcement and trade secret protection, a critical factor given the 3.5% rise in global patent filings reported by WIPO in 2023.

In terms of labor law, Germany's Skilled Immigration Act, refined in 2023-2024, aims to ease the entry of qualified professionals to combat the persistent skilled labor shortage, estimated to affect millions of positions as of early 2024, while the January 2024 minimum wage increase to €12.41 per hour necessitates adjustments in Heller GmbH's compensation structures and workforce management policies.

| Regulatory Area | Key Legislation/Trend | Impact on Heller GmbH | Effective/Relevant Period |

|---|---|---|---|

| Environmental | EU Industrial Emissions Directive (IED) | Mandatory EMS upgrades, transformation plans | Aug 2024 (effective), Jul 2026 (full implementation) |

| Product Lifecycle | German Extended Producer Responsibility (EPR) | Potential impact on packaging, material sourcing | Jan 2025 (new categories) |

| Product Safety | EU Machinery Directive 2006/42/EC | Ensuring compliance for market access | Ongoing |

| Intellectual Property | Global IP trends (WIPO data) | Need for strong patent and trade secret protection | 2023 data, ongoing |

| Labor Law | German Skilled Immigration Act | Facilitates recruitment of skilled workers | 2023-2024 refinements |

| Labor Law | German Minimum Wage | Requires adjustments in compensation | €12.41/hr from Jan 2024 |

Environmental factors

Germany's National Circular Economy Strategy, adopted in December 2024, emphasizes resource efficiency and waste reduction, aiming to reshape the nation's economic and environmental landscape. This strategy actively encourages the adoption of recycled materials and cutting-edge technologies to foster greater circularity within industries.

Heller GmbH can align with these goals by developing machinery with extended lifespans, integrating material recycling capabilities into its manufacturing, and encouraging its clientele to adopt more resource-efficient practices. This proactive approach not only supports national environmental objectives but also positions Heller GmbH as a leader in sustainable industrial solutions.

Increasing regulatory and market pressure is pushing manufacturers towards energy-efficient processes and products to shrink their carbon footprints. This trend is particularly relevant as global efforts to combat climate change intensify, with many nations setting ambitious net-zero targets for 2050 and beyond. For instance, the European Union's Green Deal aims to make the bloc climate-neutral by 2050, impacting industrial operations significantly.

Heller GmbH's commitment to integrated solutions for efficient and productive manufacturing directly addresses this environmental concern. By optimizing production lines, Heller's technology can help clients reduce their energy consumption per unit produced. This not only lowers operational costs for customers but also contributes to their own sustainability goals, aligning with the growing demand for eco-friendly industrial practices.

Developing and promoting machines with enhanced energy efficiency presents a significant competitive advantage for Heller GmbH. As industries face stricter emissions standards and consumer preferences shift towards sustainable brands, companies that offer demonstrably greener solutions will likely gain market share. For example, advancements in machine tool design, such as improved spindle efficiency and optimized cooling systems, can lead to substantial energy savings, potentially reducing a client's energy bills by 10-20% depending on the application.

The metal cutting industry, a core sector for Heller GmbH, faces increasing pressure regarding waste generation. In 2024, estimates suggest that up to 30% of raw material can be lost as scrap in certain machining processes, highlighting the urgency for waste reduction. Heller GmbH's focus on optimizing cutting patterns and promoting the use of advanced, sustainable materials directly addresses this environmental challenge.

By developing machines engineered for higher material utilization, Heller GmbH can significantly impact the environmental footprint of its clients. For instance, innovations in nesting software for sheet metal processing, a technology increasingly integrated into advanced CNC machines, can reduce material offcuts by as much as 10-15%. This not only benefits the environment but also offers direct cost savings to customers in sectors like automotive manufacturing, which in 2024 continued to prioritize lightweighting and material efficiency to meet fuel economy standards.

ESG Reporting and Sustainability Standards

Companies are facing mounting pressure to adopt Environmental, Social, and Governance (ESG) reporting standards, showcasing their dedication to sustainability. This involves clear disclosure of environmental footprints, resource usage, and waste handling practices. For instance, in 2024, the EU's Corporate Sustainability Reporting Directive (CSRD) expanded reporting obligations to more companies, emphasizing the regulatory push.

Heller GmbH must proactively embed ESG principles into its core business strategy and external messaging. This adaptation is crucial for aligning with stakeholder demands and fulfilling evolving regulatory mandates, such as those driven by the CSRD which aims for greater transparency and comparability in sustainability information across the EU.

Key areas for Heller GmbH's ESG focus include:

- Environmental Impact: Tracking and reducing carbon emissions, water consumption, and waste generation.

- Resource Management: Implementing circular economy principles and sustainable sourcing.

- Transparency: Providing clear and verifiable data on ESG performance to investors and the public.

- Regulatory Compliance: Staying ahead of evolving environmental regulations and reporting frameworks.

Impact of Climate Change Policies on Supply Chains

Global climate change policies, including the push for a low-carbon economy, are significantly reshaping supply chain logistics and the availability of raw materials. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully operational in 2026, will impose costs on imported goods based on their embedded carbon emissions, potentially increasing the cost of components for companies like Heller GmbH.

As governments worldwide enact more stringent emissions targets and carbon pricing, Heller GmbH can anticipate rising expenses for transportation and energy. For example, the average price of EU Allowances (EUAs) in the Emissions Trading System (ETS) has fluctuated, impacting the cost of carbon-intensive energy sources used in logistics and manufacturing. In 2024, EUA prices have ranged significantly, reflecting the market's response to policy changes and economic activity.

Adapting supply chain strategies and integrating cleaner production methods are therefore crucial for mitigating these impacts. This could involve optimizing shipping routes to reduce fuel consumption or sourcing materials from suppliers with lower carbon footprints. Companies are increasingly investing in renewable energy for their operations and exploring electric or hydrogen-powered fleets for transportation to align with sustainability goals and manage future regulatory costs.

- Increased Transportation Costs: The cost of carbon-intensive fuels is likely to rise due to carbon pricing, impacting logistics expenses for Heller GmbH.

- Material Availability Shifts: Policies favoring sustainable materials may alter the availability and cost of traditional resources.

- Regulatory Compliance: Stricter emissions regulations require investment in cleaner technologies and processes throughout the supply chain.

- Supply Chain Resilience: Diversifying suppliers and optimizing logistics for reduced environmental impact enhances long-term resilience.

Environmental regulations and a growing emphasis on sustainability are significantly influencing the manufacturing sector. Germany's National Circular Economy Strategy, adopted in December 2024, mandates greater resource efficiency and waste reduction, directly impacting how companies like Heller GmbH operate and design their products.

The push towards energy efficiency and reduced carbon footprints is intensifying, with initiatives like the EU's Green Deal aiming for climate neutrality by 2050. This trend necessitates that manufacturers adopt cleaner production methods and offer energy-saving solutions to remain competitive and compliant.

Waste generation, particularly in metal cutting, remains a critical environmental concern, with estimates in 2024 suggesting up to 30% of raw material can be lost as scrap. Heller GmbH's focus on optimizing material utilization through advanced machine design and software is a direct response to this challenge.

Companies are increasingly required to adhere to Environmental, Social, and Governance (ESG) reporting standards, with the EU's CSRD expanding these obligations. Proactive ESG integration is essential for Heller GmbH to meet stakeholder expectations and regulatory mandates for transparency in environmental performance.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Heller GmbH is meticulously constructed using data from reputable sources including government economic reports, industry-specific market research, and reputable news outlets. We prioritize up-to-date information on political stability, economic indicators, technological advancements, and environmental regulations to provide a comprehensive overview.