Heidrick & Struggles International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heidrick & Struggles International Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Heidrick & Struggles International's strategic landscape. This comprehensive PESTLE analysis provides actionable intelligence to anticipate market shifts and capitalize on emerging opportunities. Empower your decision-making with expert insights—download the full version now and gain a decisive competitive advantage.

Political factors

Heidrick & Struggles' global operations mean it navigates a complex web of government policies and regulatory environments. For instance, shifts in data privacy laws, like GDPR in Europe, directly affect how the firm handles client and candidate information across borders. The firm's reliance on international talent placement means changes in immigration policies in major economies, such as the United States or the United Kingdom, can significantly impact its operational capacity and service delivery.

Political stability in key regions is paramount for Heidrick & Struggles. In 2024, ongoing geopolitical tensions in Eastern Europe, for example, could dampen demand for executive search and advisory services in affected markets, as companies may delay major leadership decisions. Conversely, stable political environments often correlate with increased business investment and a greater need for strategic leadership consulting.

Global geopolitical uncertainties and shifts in international trade relations create a complex operating environment for Heidrick & Struggles. For instance, ongoing trade tensions between major economies can impact cross-border investments and M&A activity, directly affecting demand for executive search and advisory services. In 2024, organizations are increasingly prioritizing resilience and adaptability in their leadership, a trend amplified by these global uncertainties.

Such volatility can influence client confidence and investment decisions, potentially leading to caution in executive hiring and consulting engagements. Companies facing uncertain trade policies or geopolitical risks may delay strategic hires or reduce spending on external consulting. Heidrick & Struggles needs to demonstrate its value in helping clients navigate these turbulent waters, perhaps by focusing on leadership with strong international experience and crisis management skills.

The firm must actively navigate these dynamics to maintain its global footprint and client relationships. This involves understanding regional political shifts and their potential impact on industries Heidrick & Struggles serves. For example, a sudden imposition of tariffs in a key market could slow down hiring in that region, necessitating a strategic reallocation of resources or a focus on different service offerings.

Heidrick & Struggles navigates a complex landscape shaped by stringent global data privacy regulations. Laws like the General Data Protection Regulation (GDPR) in Europe, which came into full effect in 2018 and continues to be a benchmark, alongside emerging legislation in other key markets, dictate how the firm handles sensitive client and candidate information. Failure to comply can result in substantial fines; for instance, GDPR allows for penalties of up to 4% of global annual revenue or €20 million, whichever is higher.

Maintaining client and candidate trust hinges on rigorous adherence to these evolving legal frameworks. This necessitates robust data governance strategies to ensure compliance across Heidrick & Struggles’ international operations, which span numerous jurisdictions with varying data protection requirements. The firm must continuously adapt its practices to safeguard data integrity and privacy.

Political Influence on ESG and Corporate Governance

Governments worldwide are increasingly mandating ESG disclosures and targets, directly impacting corporate strategy and the need for specialized leadership. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD), fully applicable from 2024 for many companies, requires extensive reporting on sustainability matters, driving demand for Chief Sustainability Officers.

Heidrick & Struggles plays a crucial role in this shift by helping companies identify and recruit leaders with robust ESG credentials. Their work in placing Chief Sustainability Officers and advising on board diversity reflects the growing emphasis on governance structures that can effectively manage these complex issues.

- ESG Mandates: Increasing regulatory requirements for ESG reporting, such as the EU's CSRD, are reshaping corporate priorities.

- Leadership Demand: This regulatory landscape fuels a higher demand for executives with proven ESG expertise and experience.

- Talent Solutions: Firms like Heidrick & Struggles are instrumental in sourcing and placing leaders like Chief Sustainability Officers to meet these evolving needs.

- Governance Focus: Emphasis on board diversity and effective governance frameworks is a direct response to stakeholder and governmental pressure for accountability.

Industry-Specific Regulation and Licensing

The professional services sector, encompassing executive search and consulting, is subject to evolving regulations concerning licensing, ethical standards, and operational transparency. Political decisions impacting industry oversight or professional conduct directly influence Heidrick & Struggles' business operations and ability to access markets.

Anticipating and adapting to these shifts is crucial for sustained success. For instance, in 2024, discussions around enhanced data privacy regulations, such as potential updates to GDPR-like frameworks in various jurisdictions, could necessitate adjustments in how Heidrick & Struggles handles client and candidate information, impacting recruitment processes.

- Regulatory Scrutiny: Increased political focus on ethical practices in recruitment and consulting could lead to stricter compliance requirements.

- Licensing & Certification: Some regions may introduce or strengthen licensing or certification mandates for executive search professionals.

- Transparency Mandates: Governments might push for greater transparency in fee structures and client engagements within the professional services industry.

Political stability and government policies significantly influence Heidrick & Struggles' operational landscape. For example, in 2024, ongoing geopolitical tensions in Eastern Europe could temper demand for executive search services in affected regions. Conversely, stable political environments often correlate with increased business investment and a greater need for strategic leadership consulting, as seen in markets prioritizing economic growth.

Global trade relations and governmental regulations, such as data privacy laws like GDPR, directly impact Heidrick & Struggles' cross-border operations and data handling practices. The firm must navigate varying international legal frameworks to maintain client trust and operational integrity.

Increasingly, governments are mandating Environmental, Social, and Governance (ESG) disclosures and targets, such as the EU's Corporate Sustainability Reporting Directive (CSRD) applicable from 2024 for many companies. This trend drives demand for leaders with ESG expertise, like Chief Sustainability Officers, a key area for executive search firms.

Heidrick & Struggles must adapt to evolving regulations concerning professional services, including licensing and ethical standards. For instance, potential updates to data privacy regulations in 2024 could require adjustments in how the firm manages candidate information, impacting recruitment processes.

What is included in the product

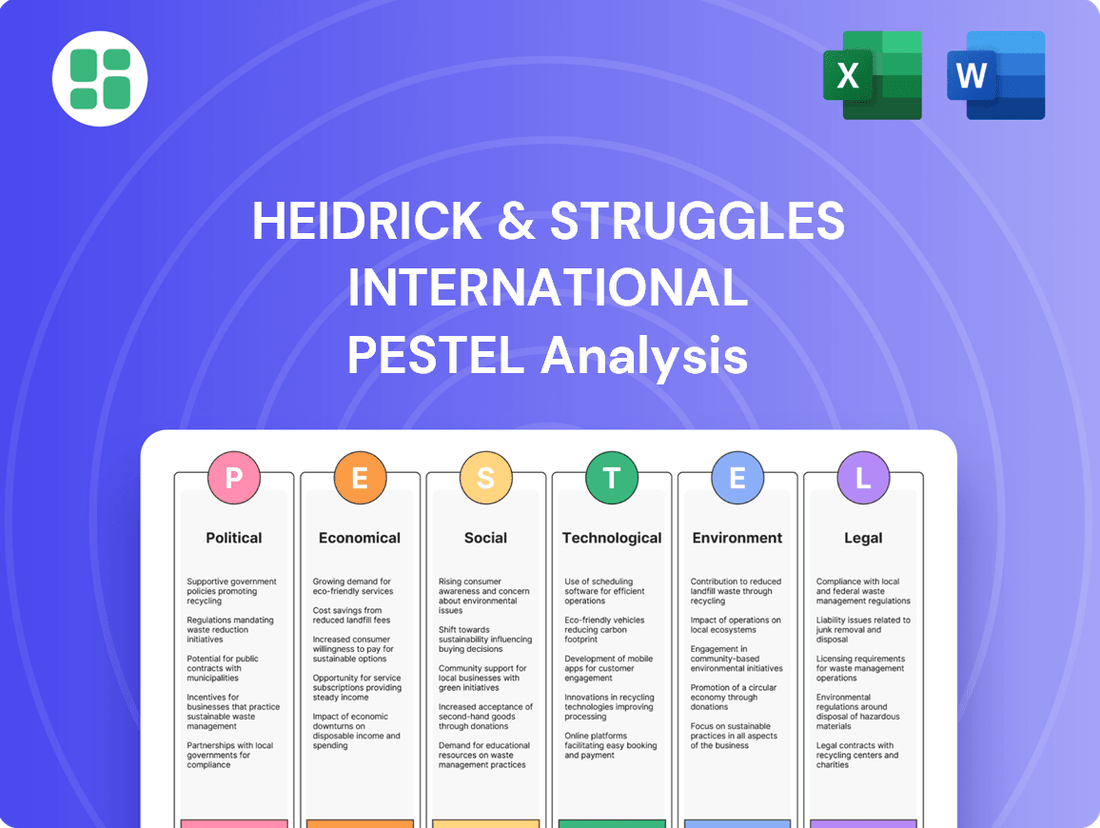

This PESTLE analysis for Heidrick & Struggles International meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the executive search industry.

It provides actionable insights for strategic decision-making by identifying emerging trends and potential disruptions relevant to their global operations.

Provides a clear, actionable framework to identify and mitigate external threats and opportunities, reducing the anxiety of unforeseen market shifts.

Economic factors

Global economic growth significantly impacts the demand for executive search and leadership consulting. Strong economic expansions typically fuel increased hiring and investment in talent, benefiting firms like Heidrick & Struggles. For instance, in 2024, many economies showed resilience, with the IMF projecting global growth at 3.2% for the year, a figure that generally supports robust talent acquisition activities.

However, rising recession risks can lead to client caution and deferred hiring decisions. As of mid-2025, persistent inflation and geopolitical uncertainties continue to pose challenges to sustained global growth. Heidrick & Struggles has observed a trend of potential client hesitancy towards the latter half of 2025, directly linked to these prevailing macroeconomic conditions and the possibility of economic contraction in key markets.

Corporate spending on advisory services, including executive search and leadership consulting, is directly tied to a company's financial health and its strategic objectives. When businesses are performing well and have clear growth plans, they tend to invest more in crucial areas like talent acquisition and leadership development. This is a key driver for firms like Heidrick & Struggles.

However, periods of economic uncertainty can lead to a tightening of corporate budgets. Companies might scale back on what they consider discretionary spending, which can include external advisory services. This trend could potentially impact Heidrick & Struggles' revenue streams as clients become more cautious with their expenditures.

Despite potential economic headwinds, Heidrick & Struggles demonstrated notable resilience. For the second quarter of 2025, the company reported robust revenue growth across all its business segments. This suggests that demand for their specialized services remains strong, even amidst broader economic fluctuations, highlighting the essential nature of their offerings to businesses navigating complex environments.

The ongoing global shortage of exceptional leadership talent is a significant tailwind for Heidrick & Struggles, as it fuels consistent demand for their executive search and advisory services. This scarcity allows the firm to maintain strong pricing power, reflecting the high value placed on securing top executives.

This talent scarcity also contributes to wage inflation for highly skilled leaders, which can indirectly affect Heidrick & Struggles' clients by increasing the overall cost of executive compensation. For instance, in 2024, reports indicated that average executive salaries in the tech sector saw increases of 5-10%, driven partly by the intense competition for specialized roles.

Heidrick & Struggles itself highlights the critical importance of leadership scarcity in its business model, emphasizing that the difficulty in finding truly outstanding leaders is a primary driver of client engagement. This focus underscores the firm's strategic positioning within a market characterized by persistent demand for elite talent.

Foreign Exchange Volatility

Heidrick & Struggles, operating globally, faces risks from fluctuating foreign exchange rates, as a substantial part of its income is generated outside the United States. For instance, a stronger U.S. dollar can reduce the reported value of earnings and revenue from its international branches. This currency exposure is a constant factor in the company's financial planning.

In 2023, Heidrick & Struggles reported that currency headwinds impacted its results. Specifically, the company noted that unfavorable foreign currency movements, particularly against the U.S. dollar, led to a reduction in reported net revenue. This highlights the tangible effect of foreign exchange volatility on the firm's financial performance.

- Currency Impact: Foreign exchange rate fluctuations directly affect the reported financial results of Heidrick & Struggles' international operations.

- U.S. Dollar Strength: A strengthening U.S. dollar can diminish the value of revenues and profits earned in other currencies when translated back into dollars.

- 2023 Performance: The company acknowledged in its 2023 financial reporting that currency headwinds had a negative impact on its net revenue.

- Risk Management: Managing and mitigating these currency risks is a continuous and essential financial strategy for the firm.

Mergers & Acquisitions and Corporate Restructuring

High levels of merger and acquisition (M&A) activity and corporate restructuring directly fuel demand for executive search, leadership assessment, and organizational design expertise. Heidrick & Struggles is well-positioned to capitalize on these strategic business transformations as companies navigate leadership alignment with evolving structures.

The global M&A market saw robust activity in 2024, with deal volumes remaining strong, particularly in sectors like technology and healthcare. For instance, the technology sector alone accounted for a significant portion of M&A deals in the first half of 2024, indicating a continued need for executive talent adept at integrating diverse teams and strategies.

This trend creates substantial opportunities for Heidrick & Struggles to forge deeper client relationships by offering critical support during these pivotal moments of change. The firm’s ability to identify and place leaders who can successfully manage post-merger integration and drive organizational restructuring is a key differentiator.

- Increased M&A activity: Global M&A deal value was projected to exceed $3 trillion in 2024, driven by strategic realignment and technological advancements.

- Demand for integration expertise: Companies undergoing restructuring often require specialized leadership to manage cultural and operational integration, a core service for executive search firms.

- Focus on leadership assessment: The success of M&A hinges on leadership effectiveness; therefore, rigorous assessment of candidates for critical roles is paramount.

- Organizational design services: Restructuring necessitates new organizational blueprints, creating a demand for services that align leadership with optimal structures.

Economic factors significantly shape the demand for Heidrick & Struggles' services, with global growth trends directly influencing hiring and investment in leadership. While a projected global growth of 3.2% in 2024 supported talent acquisition, persistent inflation and geopolitical risks in 2025 created client hesitancy and budget tightening. Despite these economic headwinds, Heidrick & Struggles reported strong revenue growth in Q2 2025, demonstrating resilience and the essential nature of its talent solutions.

| Economic Factor | Impact on Heidrick & Struggles | Relevant Data (2024-2025) |

|---|---|---|

| Global Economic Growth | Drives demand for executive search and leadership consulting. Strong growth leads to increased hiring. | IMF projected global growth at 3.2% for 2024. |

| Recession Risks & Inflation | Leads to client caution, deferred hiring, and potential budget cuts for advisory services. | Persistent inflation and geopolitical uncertainties noted as challenges in mid-2025. |

| Corporate Spending | Directly tied to company financial health and strategic objectives; strong performance encourages investment in talent. | Companies with clear growth plans invest more in talent acquisition and leadership development. |

| Merger & Acquisition (M&A) Activity | Fuels demand for executive search, leadership assessment, and organizational design expertise. | Global M&A deal value projected to exceed $3 trillion in 2024; technology sector saw robust M&A in H1 2024. |

Full Version Awaits

Heidrick & Struggles International PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Heidrick & Struggles International delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the executive search industry. You'll gain immediate access to this detailed report upon completing your purchase.

Sociological factors

There's a powerful global movement advocating for more diversity, equity, and inclusion (DE&I) within leadership positions. This societal shift is compelling companies to re-evaluate their executive teams and talent pipelines.

Heidrick & Struggles is at the forefront of this trend, actively assisting clients in developing more diverse leadership benches. The firm has also embedded DE&I principles into its own operational framework, recognizing its importance for long-term success. For instance, their 2024 leadership reports highlight a growing demand for candidates from underrepresented backgrounds, with a significant percentage of executive searches focusing on DE&I criteria.

This increasing emphasis on DE&I presents a substantial growth avenue for Heidrick & Struggles. It directly addresses evolving client priorities and societal expectations, allowing the firm to offer valuable expertise in a critical area of corporate strategy.

The workforce is changing, with younger generations like Millennials and Gen Z increasingly stepping into leadership roles. These groups often prioritize work-life balance and flexible work arrangements, influencing the kind of leaders companies are looking for and how they engage with talent. Heidrick & Struggles needs to update its methods for finding and evaluating leaders to match these evolving expectations, including a greater acceptance of freelance or project-based workers.

There's a growing expectation for leaders to champion a clear organizational purpose and foster an ethical culture, not just focus on profits. This shift means companies are looking for executives who can inspire with a mission and build strong values. For instance, a 2024 report by Deloitte found that 70% of employees believe a strong sense of purpose is crucial for their engagement.

Heidrick & Struggles is well-positioned to meet this demand. Their services now encompass leadership assessment and cultural consulting, helping businesses build organizations that are both high-performing and purpose-driven. This strategic expansion directly addresses the societal trend towards valuing companies with a positive impact and ethical foundations.

Impact of Remote and Hybrid Work Models

The surge in remote and hybrid work models, accelerated by events in 2020 and continuing through 2024, fundamentally reshapes how organizations operate and require leadership. Heidrick & Struggles is positioned to guide clients through this evolution, focusing on effective management of distributed teams and cultivating engagement in virtual settings. The firm itself has integrated these flexible work arrangements into its strategic approach, reflecting a deep understanding of the changing professional landscape.

This shift demands new leadership competencies, emphasizing adaptability, digital fluency, and the ability to foster a strong culture across dispersed workforces. For instance, a 2024 survey indicated that 70% of companies offer hybrid work options, highlighting the permanence of this trend. Heidrick & Struggles' advisory services are crucial for identifying and developing leaders capable of navigating these complexities, ensuring continued productivity and employee satisfaction.

- Leadership in the Digital Age: Heidrick & Struggles helps clients identify leaders with strong digital communication skills and the ability to build trust remotely.

- Employee Engagement Strategies: The firm advises on creating inclusive virtual environments and fostering a sense of belonging for all employees, regardless of location.

- Talent Acquisition and Retention: Heidrick & Struggles supports organizations in adapting their talent strategies to attract and retain individuals who thrive in flexible work arrangements.

Employee Engagement and Well-being Focus

Societal awareness regarding mental health and employee well-being has surged, prompting organizations to foster supportive work cultures. Heidrick & Struggles' leadership consulting increasingly focuses on advising clients on strategies to boost employee engagement and overall organizational effectiveness, a direct response to this evolving societal expectation.

This trend is demonstrably impacting the consulting landscape. For instance, a 2024 Deloitte survey indicated that 85% of organizations believe employee well-being is critical to business success. Heidrick & Struggles, in turn, reported a notable increase in demand for services related to organizational design and talent management, directly addressing these employee-centric priorities.

- Growing Emphasis on Mental Health: Societal discourse has normalized conversations around mental health, pushing companies to integrate well-being into their core strategies.

- Consulting Demand Shift: Heidrick & Struggles observes a rise in client requests for expertise in building resilient and supportive work environments.

- Impact on Organizational Effectiveness: Companies are recognizing that investing in employee well-being directly correlates with enhanced productivity and reduced turnover, as evidenced by various HR analytics from 2024.

Societal expectations are increasingly prioritizing diversity, equity, and inclusion (DE&I) in leadership roles, driving companies to diversify their executive teams. Heidrick & Struggles actively supports this by helping clients build more inclusive leadership benches, with 2024 reports showing a significant rise in searches for candidates from underrepresented backgrounds.

The workforce demographics are shifting, with younger generations like Millennials and Gen Z entering leadership, valuing work-life balance and flexible arrangements. This necessitates adapting talent acquisition methods to include remote work and project-based roles, a trend Heidrick & Struggles is actively addressing.

There's a growing demand for leaders who champion organizational purpose and ethical culture, not solely profit. Heidrick & Struggles offers consulting on building purpose-driven organizations, aligning with the 2024 finding that 70% of employees consider purpose crucial for engagement.

The widespread adoption of remote and hybrid work models, continuing through 2024, requires leaders adept at managing distributed teams and fostering virtual engagement. Heidrick & Struggles' advisory services are critical for identifying leaders with these new competencies, as 70% of companies offered hybrid work in 2024.

| Sociological Factor | Impact on Heidrick & Struggles | Supporting Data (2024/2025) |

|---|---|---|

| DE&I Imperative | Increased demand for diverse leadership searches; expansion of DE&I consulting services. | Significant percentage of executive searches focused on DE&I criteria; growing client demand for inclusive talent pipelines. |

| Generational Workforce Shifts | Adaptation of talent acquisition to include flexible work and new leadership priorities. | Millennials and Gen Z prioritize work-life balance; increased acceptance of freelance/project-based workers. |

| Purpose-Driven Leadership | Demand for leaders with strong ethics and mission; growth in organizational culture consulting. | 70% of employees believe purpose is crucial for engagement (Deloitte, 2024). |

| Remote/Hybrid Work Models | Need for leaders skilled in virtual management and engagement; integration of flexible work into firm strategy. | 70% of companies offer hybrid work options (2024 survey); focus on digital fluency and remote trust-building. |

Technological factors

Artificial intelligence and advanced data analytics are fundamentally reshaping executive search and leadership advisory. Heidrick & Struggles is actively investing in these technologies to boost client outcomes and internal efficiency. This includes using AI to uncover deeper insights and drive responsible innovation in talent solutions.

The firm's strategic technology investments aim to enhance professional productivity and refine candidate evaluation. For instance, by mid-2024, Heidrick & Struggles reported a significant increase in the utilization of its proprietary AI-powered platforms for candidate sourcing and assessment, leading to an estimated 15% reduction in time-to-hire for certain roles.

Heidrick & Struggles is actively developing digital platforms like Heidrick Navigator to offer clients more accurate and efficient talent identification and retention solutions. This strategic move aims to refine their service delivery model.

These digital tools are crucial for supporting Heidrick & Struggles' growth across executive search, consulting, and on-demand talent services. The firm's investment in technology underscores a commitment to innovation in the talent management space.

The increasing reliance on digital platforms for operations and client interactions amplifies cybersecurity and data protection risks for Heidrick & Struggles. As of early 2025, global spending on cybersecurity is projected to exceed $200 billion, reflecting the growing threat landscape.

Heidrick & Struggles must therefore prioritize continuous investment in advanced cybersecurity measures to safeguard sensitive client and candidate data. Failure to do so could lead to significant financial penalties, reputational damage, and erosion of client trust, which is paramount in the executive search industry.

Demand for Specialized Technology Leadership

The rapid evolution of technology is fueling an intense need for specialized tech leaders. Roles like Chief Information Officers (CIOs), Chief Information Security Officers (CISOs), and executives focused on AI and data analytics are in high demand as companies navigate digital transformation.

Heidrick & Struggles' executive search practice for technology leaders is actively addressing this demand. They focus on pinpointing and securing talent for these crucial positions, recognizing the shifting landscape of compensation and career trajectories within tech leadership.

The market for these specialized roles is robust. For instance, the global market for AI and data analytics services was projected to reach over $250 billion in 2024, underscoring the critical importance of leaders in these domains. Similarly, cybersecurity spending is expected to exceed $200 billion in 2024, highlighting the demand for CISOs.

- High demand for CIOs, CISOs, and AI/Data Analytics leaders due to rapid tech advancements.

- Heidrick & Struggles actively recruits for these specialized technology executive roles.

- Adaptation to new compensation structures and evolving career paths in tech leadership is key.

- The global AI and data analytics market is projected to surpass $250 billion in 2024.

Automation of Recruitment Processes

The recruitment landscape is rapidly evolving with the integration of automation. Tools are now adept at handling initial candidate screening, interview scheduling, and various administrative burdens. This shift is particularly relevant as it frees up valuable human capital for more strategic endeavors.

While Heidrick & Struggles International specializes in executive search, which is inherently relationship-focused and less amenable to full automation, strategic adoption of these technologies can still yield significant benefits. For instance, automating the initial stages of data aggregation or candidate communication can streamline operations.

By leveraging automation for lower-value tasks, Heidrick & Struggles consultants can dedicate more time to the critical aspects of their role: building client relationships, in-depth candidate assessment, and providing high-level advisory services. This focus on value-added activities is crucial for maintaining their competitive edge in the senior-level placement market.

- Efficiency Gains: Automation can reduce the time spent on administrative tasks by an estimated 20-30% in recruitment operations.

- Consultant Focus: By offloading routine tasks, consultants can increase their capacity for client engagement and strategic sourcing by up to 15%.

- Data-Driven Insights: Automated systems can gather and analyze candidate data more effectively, providing richer insights for consultants.

Heidrick & Struggles is heavily investing in AI and advanced data analytics to enhance client outcomes and internal efficiency, aiming for deeper insights and responsible innovation in talent solutions. The firm's proprietary AI platforms saw increased utilization by mid-2024, contributing to an estimated 15% reduction in time-to-hire for specific roles.

The company is developing digital tools like Heidrick Navigator to improve talent identification and retention, refining its service delivery model across executive search, consulting, and on-demand talent services. This technological focus is critical for navigating the escalating cybersecurity risks, with global spending projected to exceed $200 billion in 2025.

The demand for specialized tech leaders, such as CIOs, CISOs, and AI/Data Analytics executives, remains exceptionally high, driven by ongoing digital transformation efforts. Heidrick & Struggles is actively addressing this by recruiting for these critical positions, acknowledging the evolving compensation and career paths within tech leadership.

Automation is streamlining recruitment processes, handling tasks like initial candidate screening and scheduling, thereby freeing up consultants for more strategic client engagement and in-depth candidate assessment. This strategic adoption of technology is expected to increase consultant capacity for value-added activities by up to 15%.

| Technology Focus | Impact/Metric | Data Point |

|---|---|---|

| AI & Data Analytics Investment | Enhanced Client Outcomes & Efficiency | 15% reduction in time-to-hire (mid-2024) |

| Digital Platforms (Heidrick Navigator) | Improved Talent Identification & Retention | Refining service delivery model |

| Cybersecurity Spending | Risk Mitigation & Data Protection | Projected global spending > $200 billion (2025) |

| Automation in Recruitment | Streamlined Operations & Consultant Focus | Up to 15% increase in consultant capacity for strategic tasks |

Legal factors

Heidrick & Struggles navigates a complex web of global data privacy regulations, including the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). Failure to comply can result in significant fines; for instance, GDPR penalties can reach up to 4% of annual global turnover or €20 million, whichever is higher. The firm's commitment to robust data handling practices is paramount for maintaining client confidence and avoiding legal challenges.

Ensuring data collection, processing, and storage align with these varying international laws is a continuous operational challenge. In 2024, data breaches remain a significant concern for businesses globally, with the average cost of a data breach reaching an estimated $4.45 million in 2024 according to IBM's Cost of a Data Breach Report. This underscores the critical need for Heidrick & Struggles to maintain stringent compliance and robust cybersecurity measures.

Heidrick & Struggles, operating globally, must meticulously adhere to a patchwork of employment and labor laws in each country. These regulations cover everything from fair hiring practices and equitable compensation to anti-discrimination statutes and lawful termination procedures. For instance, in 2024, the European Union continued to refine directives on gender pay gap reporting, a key area of compliance for multinational firms.

Navigating these diverse legal landscapes is crucial for avoiding costly litigation and upholding the company's commitment to ethical conduct. Failure to comply can lead to significant fines and reputational damage. This legal complexity directly shapes how Heidrick & Struggles approaches its recruitment and talent management strategies worldwide, ensuring local regulations are integrated into global frameworks.

Anti-discrimination and equal opportunity laws are fundamental to executive search. Heidrick & Struggles must navigate regulations prohibiting bias based on race, gender, age, religion, and other protected traits to ensure fairness in their processes. For instance, in the US, the Civil Rights Act of 1964 and subsequent amendments continue to be paramount, with agencies like the Equal Employment Opportunity Commission (EEOC) enforcing these protections. This commitment to equitable practices is crucial for meeting both legal obligations and the growing demand from clients for diverse leadership pipelines, directly supporting Heidrick & Struggles' own diversity, equity, and inclusion (DE&I) objectives.

Intellectual Property Rights and Confidentiality

Heidrick & Struggles, as an advisory firm, relies heavily on its proprietary methodologies, assessment tools, and unique market insights. Protecting these intellectual property rights is paramount, ensuring their competitive edge. Legal frameworks governing patents, copyrights, and trade secrets are crucial for safeguarding these valuable assets.

Confidentiality is another critical legal factor for Heidrick & Struggles. The firm enters into legally binding confidentiality agreements with both clients and candidates. These agreements protect the sensitive information exchanged during recruitment and advisory engagements, maintaining trust and integrity in their operations.

- Intellectual Property Protection: Heidrick & Struggles actively protects its proprietary assessment tools and research through copyright and trademark laws.

- Confidentiality Agreements: Robust legal agreements are in place with clients and candidates to ensure the safeguarding of sensitive business and personal data.

- Enforcement of IP: The firm pursues legal avenues to prevent unauthorized use or disclosure of its intellectual property, which is a core component of its business model.

- Data Privacy Laws: Compliance with evolving data privacy regulations, such as GDPR and CCPA, is essential for maintaining client and candidate trust.

Corporate Governance and Reporting Requirements

Heidrick & Struggles, as a publicly traded entity, navigates a complex web of corporate governance and financial reporting mandates. These include adherence to Securities and Exchange Commission (SEC) filings and the Sarbanes-Oxley Act, crucial for maintaining transparency and fostering investor trust. For instance, in its 2023 annual report, the company detailed its compliance measures and board oversight structures.

The firm actively implements Environmental, Social, and Governance (ESG) governance frameworks. These frameworks are designed to systematically track progress on sustainability initiatives and proactively manage associated risks. This commitment is reflected in their public disclosures, which increasingly detail ESG performance metrics.

- SEC Filings: Heidrick & Struggles regularly submits Form 10-K (annual) and 10-Q (quarterly) reports, providing detailed financial and operational information to the public and regulators.

- Sarbanes-Oxley Act (SOX): Compliance with SOX ensures the accuracy and reliability of financial reporting and internal controls, a critical aspect of maintaining investor confidence.

- ESG Governance: The company has established specific board committees and management structures to oversee and report on ESG performance, aligning with growing stakeholder expectations for sustainable business practices.

- Transparency and Accountability: These legal and regulatory requirements are fundamental to building and maintaining accountability to shareholders and other stakeholders, ensuring ethical operations.

Heidrick & Struggles must navigate a constantly evolving landscape of global data privacy laws, including GDPR and CCPA, with non-compliance potentially leading to substantial fines. For example, GDPR penalties can reach up to 4% of global annual turnover. The firm's adherence to robust data handling and cybersecurity is critical, especially given that the average cost of a data breach in 2024 was estimated at $4.45 million by IBM.

Employment and labor laws vary significantly across jurisdictions, impacting hiring, compensation, and termination practices. In 2024, the EU's focus on gender pay gap reporting highlights the need for multinational firms like Heidrick & Struggles to ensure equitable practices. Compliance is essential to avoid litigation and maintain ethical standards, directly influencing talent management strategies.

Protecting intellectual property, such as proprietary methodologies and research, is vital for maintaining a competitive edge. Heidrick & Struggles relies on patent, copyright, and trade secret laws to safeguard these assets. Similarly, strict confidentiality agreements with clients and candidates are legally binding, ensuring the secure handling of sensitive information and fostering trust.

As a public company, Heidrick & Struggles is subject to stringent corporate governance and financial reporting regulations, including SEC filings and the Sarbanes-Oxley Act. These requirements ensure transparency and investor confidence. The firm also actively implements ESG frameworks to track sustainability progress and manage related risks, as evidenced in their public disclosures.

Environmental factors

Clients are increasingly prioritizing leaders with strong ESG and sustainability credentials. This shift is driven by a growing awareness of environmental and social issues, influencing purchasing decisions and investor sentiment.

Heidrick & Struggles has responded by bolstering its Climate & Sustainability Practice. This move directly addresses the market's need for executives capable of navigating complex sustainability challenges and opportunities, with a reported 15% increase in searches for sustainability-focused roles in 2024.

Heidrick & Struggles is actively working to shrink its operational environmental impact, focusing on reducing greenhouse gas (GHG) emissions and electricity consumption across its worldwide offices. This dedication to sustainable operations is clearly outlined in their annual Impact Reports, showcasing a commitment to responsible business practices.

The company has established specific targets for emissions reduction, a key component of its strategy to minimize its environmental footprint. For instance, their 2023 Impact Report highlights progress towards achieving these goals, underscoring their proactive approach to environmental stewardship.

Heidrick & Struggles International demonstrates a commitment to robust environmental stewardship by aligning its sustainability reporting with leading global frameworks. This includes adherence to the Global Reporting Initiative (GRI) standards, the Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-related Financial Disclosures (TCFD). Such alignment ensures a high degree of transparency and accountability concerning the firm's environmental performance and its broader impact.

Integration of Climate Preparedness in Growth Strategy

Heidrick & Struggles is actively weaving climate preparedness into its growth strategy, recognizing that long-term success hinges on more than immediate profits. This forward-thinking approach equips both the firm and its clientele to better manage climate-related risks and capitalize on emerging opportunities in an evolving environmental context.

The firm's commitment is underscored by its focus on integrating technology with environmental, social, and governance (ESG) considerations. For instance, Heidrick & Struggles' recent executive search mandates often reflect a growing demand for leaders with expertise in sustainability and climate risk management, indicating a tangible shift in corporate priorities. By 2024, a significant percentage of S&P 500 companies are expected to have dedicated board oversight for climate-related issues, a trend Heidrick & Struggles is well-positioned to support.

- Focus on Sustainability: Heidrick & Struggles prioritizes placing leaders skilled in navigating environmental challenges and driving sustainable business practices.

- Climate Risk Mitigation: The firm helps clients identify and address climate-related operational and reputational risks, fostering resilience.

- Opportunity Identification: Heidrick & Struggles assists companies in spotting and leveraging new market opportunities arising from the green transition and climate adaptation efforts.

- ESG Integration: The company's own growth strategy incorporates ESG principles, aligning its business model with environmental stewardship and long-term value creation.

Advising Clients on Climate Risk and Decarbonization

Heidrick & Struggles actively guides clients through the complexities of climate risk and the imperative of decarbonization. This involves strategic counsel on identifying and mitigating environmental threats, as well as supporting the growth of innovative climate technology companies. The firm also assists established businesses in developing and executing robust decarbonization strategies, contributing to widespread environmental progress.

The firm's advisory services extend to helping companies navigate evolving environmental regulations and investor expectations. For instance, as of early 2025, a significant portion of major corporations are setting net-zero targets, driven by both regulatory pressure and market demand for sustainable practices. Heidrick & Struggles' expertise is crucial in aligning leadership with these ambitious goals.

- Climate Tech Investment: Venture capital funding in climate tech reached an estimated $50 billion globally in 2024, highlighting a strong market for sustainable innovation.

- Decarbonization Demand: Over 70% of S&P 500 companies have publicly announced net-zero or carbon reduction goals by 2024-2025, creating a substantial need for strategic guidance.

- ESG Integration: Investor focus on Environmental, Social, and Governance (ESG) factors continues to grow, with sustainable investments projected to exceed $50 trillion by 2025, influencing corporate strategy.

- Regulatory Landscape: New climate disclosure mandates, such as those from the SEC and EU, are coming into effect in 2024-2025, requiring companies to report on climate-related risks and emissions.

The increasing emphasis on environmental sustainability is shaping leadership demands, with clients actively seeking executives adept at navigating climate challenges and driving ESG initiatives. Heidrick & Struggles has responded by expanding its Climate & Sustainability Practice, reflecting a market where sustainability expertise is becoming a critical differentiator for corporate success.

Heidrick & Struggles is committed to reducing its own environmental footprint, setting specific targets for emissions and energy consumption across its global operations. This internal focus on sustainability aligns with the growing investor and regulatory pressure for corporate environmental responsibility, as evidenced by the firm's adherence to global reporting standards.

The firm's strategic approach integrates climate preparedness, recognizing its impact on long-term business viability and client needs. This foresight positions Heidrick & Struggles to assist companies in managing climate risks and capitalizing on opportunities within the evolving green economy, a trend amplified by significant venture capital flowing into climate tech.

| Environmental Factor | Heidrick & Struggles' Response/Data | Market Context (2024-2025) |

|---|---|---|

| Client Demand for Sustainability Leaders | Bolstered Climate & Sustainability Practice; 15% increase in sustainability-focused searches in 2024. | Growing awareness of ESG influencing purchasing and investment. |

| Operational Environmental Impact | Setting GHG emission and electricity consumption reduction targets; reporting via GRI, SASB, TCFD. | Increased regulatory mandates for climate disclosure (SEC, EU). |

| Climate Risk & Opportunity | Advising on climate risk mitigation and decarbonization strategies; supporting climate tech growth. | Venture capital in climate tech reached ~$50 billion globally in 2024; >70% of S&P 500 companies have net-zero goals. |

PESTLE Analysis Data Sources

Our PESTLE Analysis draws on a diverse range of data, including reports from international organizations like the IMF and World Bank, as well as government publications and reputable industry analysis firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors.