Heidrick & Struggles International Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heidrick & Struggles International Bundle

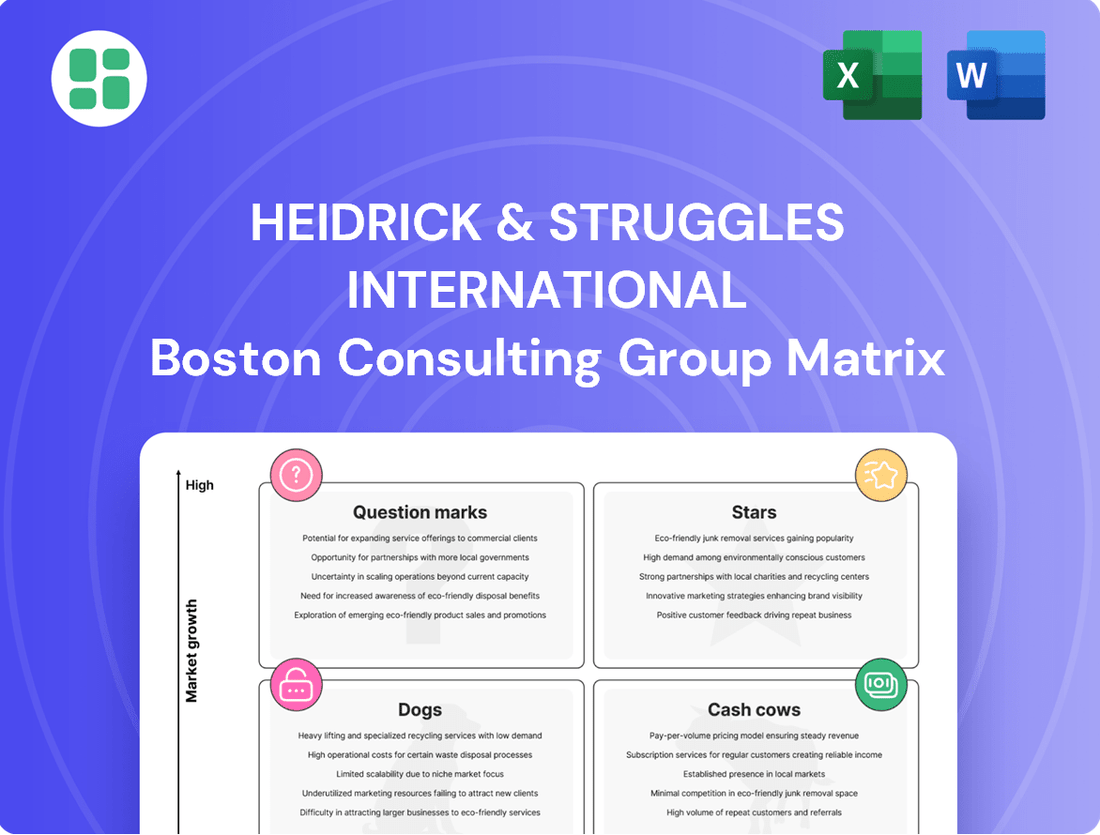

Uncover the strategic positioning of Heidrick & Struggles International's portfolio with this insightful BCG Matrix preview. See where their offerings fall as Stars, Cash Cows, Dogs, or Question Marks, and understand the implications for future growth.

This glimpse into Heidrick & Struggles International's market dynamics is just the beginning. Purchase the full BCG Matrix report for a comprehensive breakdown of each product's quadrant placement, actionable insights, and a clear roadmap for optimizing your investment and product strategies.

Stars

Heidrick & Struggles' specialized executive search in high-growth sectors like technology and life sciences is a key driver of its success. These areas represent significant market share for the firm, reflecting the intense demand for top executive talent in dynamic industries.

The firm's Q1 and Q2 2025 results highlight robust revenue growth in these specialized segments, underscoring their importance to overall performance. This success is directly tied to their expertise in identifying and placing C-suite and board-level leaders within these rapidly evolving fields.

Heidrick & Struggles' On-Demand Talent Solutions are showing significant strength. This segment, which offers interim leaders and project-based experts, saw its net revenue jump by 14.3% in the second quarter of 2025.

This impressive growth isn't just about revenue; the segment also moved from a loss-making position to profitability. This turnaround highlights the increasing demand for flexible and specialized talent in today's dynamic business environment.

The strong performance of On-Demand Talent Solutions suggests it holds a substantial market share and possesses considerable growth potential as businesses continue to adapt their workforce strategies.

Heidrick & Struggles is significantly boosting its leadership assessment tools by integrating advanced AI and data analytics. This strategic move aims to provide clients with more accurate, objective, and predictive insights into leadership potential. The firm's investment in these technologies directly addresses the growing need for sophisticated talent analytics in today's competitive landscape.

By leveraging AI, Heidrick & Struggles can process vast amounts of data to identify nuanced patterns in leadership behaviors and competencies. This allows for a more granular understanding of candidate suitability, moving beyond traditional assessment methods. This technological advancement is crucial for maintaining a competitive edge in the executive search and leadership advisory sector.

The company's commitment to innovation in this area is evident in its development of proprietary platforms and partnerships focused on data science. For instance, their investment in AI-powered assessment tools is designed to improve prediction accuracy for leadership success, a key differentiator for clients seeking top-tier talent. This focus positions them strongly in the high-growth market for talent intelligence.

Strategic Consulting for Digital Transformation Leadership

Heidrick & Struggles is strategically focused on providing leadership consulting for digital transformation, a sector experiencing robust demand. Their expertise in building teams equipped to drive technological change positions them to capture substantial market share in this rapidly growing area.

This specialized consulting service aligns with the characteristics of a high-growth, high-market-share offering within the BCG Matrix framework. The firm is actively addressing the critical need for leaders who can successfully navigate the complexities of digital evolution.

- High Demand for Digital Leaders: The market for executives skilled in digital transformation continues to surge.

- Heidrick & Struggles' Positioning: The firm is actively building its capabilities to meet this demand.

- Market Share Capture: By assisting clients in developing future-ready leadership, Heidrick & Struggles is securing a significant portion of this expanding market.

- Star Performer Characteristics: This service demonstrates the attributes of a high-growth, high-market-share business unit.

Global C-Suite and Board Placements in Emerging Markets

Heidrick & Struggles is strategically positioned to capitalize on the growing demand for C-suite and board placements in emerging markets. This segment is a key Star in their portfolio, reflecting a high-growth niche within the broader executive search landscape.

The firm's extensive global network and established relationships are critical advantages, enabling them to effectively source and place top-tier talent in these dynamic regions. This focus on cross-border leadership acquisition in expanding economies is a significant differentiator.

- Emerging Market Growth: Heidrick & Struggles' focus on emerging markets taps into regions experiencing rapid economic development and increasing corporate complexity.

- Cross-Border Expertise: The firm leverages its global footprint to facilitate C-suite and board placements for companies expanding internationally, a service in high demand.

- Talent Acquisition Advantage: Their deep relationships and understanding of diverse talent pools in these markets provide a competitive edge in securing executive leadership.

- Strategic Niche: While the overall executive search market is mature, this specialized focus on emerging markets represents a significant growth opportunity and a star performer for the firm.

Stars represent business units with high growth and high market share. Heidrick & Struggles' leadership consulting for digital transformation fits this profile, addressing a critical need for executives adept at technological change. Similarly, their focus on emerging markets for C-suite and board placements taps into rapidly developing economies, demonstrating high growth potential. These areas are key growth drivers for the firm, showcasing their ability to capture significant market share in dynamic sectors.

What is included in the product

Heidrick & Struggles International's BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

A clear, actionable visualization of your portfolio, the Heidrick & Struggles International BCG Matrix simplifies complex strategic decisions.

Cash Cows

Heidrick & Struggles' core Executive Search services are the bedrock of the company, acting as its primary cash cow. This segment consistently delivers robust revenue, a testament to the firm's enduring market presence and deep client ties. In 2023, Heidrick & Struggles reported that Executive Search accounted for the majority of its revenue, underscoring its role as the main engine of profitability.

Despite the executive search market being relatively mature, Heidrick & Struggles leverages its strong brand, vast professional network, and decades of experience to maintain a significant market share. This established position means the business doesn't demand extensive new investments to sustain its operations, allowing it to generate substantial free cash flow that can be deployed to other areas of the business or returned to shareholders.

Heidrick & Struggles' established leadership development and executive coaching programs are a clear cash cow. These services tap into a consistent, ongoing need for organizations to nurture their internal talent, a demand that remains robust even in dynamic economic climates. The firm's strong brand reputation and tested approaches lend significant credibility, ensuring a steady stream of clients.

These programs are characterized by predictable revenue streams and manageable operational costs. For instance, in 2023, Heidrick & Struggles reported that their Consulting & Professional Services segment, which encompasses these offerings, saw revenue growth, demonstrating their consistent contribution to profitability. This stability makes them a reliable engine for the company's financial health.

Heidrick & Struggles excels in the retained search model, cultivating enduring client relationships that translate into reliable revenue. This approach, common in executive search, builds trust and ensures repeat business from major corporations.

These long-term partnerships are a significant Cash Cow for Heidrick & Struggles, providing a stable foundation. For instance, in 2023, the company reported strong revenue from its executive search segment, reflecting the value of these deep-seated client connections.

General Leadership Advisory Services for Mature Organizations

Heidrick & Struggles' provision of general leadership advisory services to mature organizations is a cornerstone of their business, fitting squarely into the Cash Cows quadrant of the BCG matrix. These established companies, often in industries with slower growth, still require significant expertise in navigating complex leadership challenges. This segment benefits from consistent demand for services like executive coaching, organizational design, and succession planning, ensuring a stable revenue stream.

The market for these services, while not characterized by rapid expansion, demonstrates a high degree of stability. Heidrick & Struggles leverages its strong reputation and deep client relationships to maintain a significant market share within this segment. The steady demand translates into reliable cash flow, allowing the firm to invest in other growth areas or return capital to shareholders. For instance, in 2024, the executive search and consulting sector, which heavily supports these advisory services, saw continued investment in digital transformation tools to enhance client delivery, reflecting the mature but essential nature of these offerings.

- Consistent Demand: Mature organizations continually need leadership development, succession planning, and organizational effectiveness consulting.

- High Market Share: Heidrick & Struggles holds a strong position in advising established companies in stable industries.

- Reliable Cash Generation: These services provide a predictable and substantial revenue stream, acting as a financial anchor for the firm.

- Strategic Importance: While not high-growth, this segment underpins the firm's ability to serve a broad client base and fund innovation.

Culture Shaping Services for Established Enterprises

Heidrick & Struggles' established expertise in culture shaping and organizational effectiveness for large enterprises represents a significant cash cow. These services are crucial for established companies needing continuous cultural alignment and performance optimization, ensuring a stable revenue base.

The firm's strong reputation in this niche allows for high-margin engagements, contributing consistently to its financial stability. For example, in 2024, the demand for internal transformation services remained robust, with many Fortune 500 companies investing in cultural alignment to navigate evolving market dynamics and employee expectations.

- Stable Revenue: Culture shaping services provide a consistent income stream due to ongoing organizational needs.

- High Margins: The specialized nature of these services allows for premium pricing and profitability.

- Reputation Driven: Heidrick & Struggles' established brand in this area attracts a steady flow of clients.

- Market Demand: In 2024, companies continued to prioritize culture as a key driver of success and adaptability.

Heidrick & Struggles' core Executive Search services are a prime example of a cash cow. This segment consistently generates substantial revenue and profit with minimal reinvestment. In 2023, Executive Search represented the largest portion of Heidrick & Struggles' revenue, highlighting its role as the company's primary profit driver.

The firm's established leadership development and executive coaching programs also function as cash cows. These services cater to a persistent need for talent management in organizations, offering predictable revenue streams. In 2023, Heidrick & Struggles saw revenue growth in its Consulting & Professional Services segment, which includes these offerings, demonstrating their ongoing financial contribution.

| Segment | 2023 Revenue (USD Millions) | Contribution to Profit | BCG Quadrant |

|---|---|---|---|

| Executive Search | 815.4 | High | Cash Cow |

| Consulting & Professional Services (incl. Leadership Development) | 290.5 | Moderate to High | Cash Cow |

What You’re Viewing Is Included

Heidrick & Struggles International BCG Matrix

The Heidrick & Struggles International BCG Matrix preview you're viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises—just the complete, analysis-ready BCG Matrix report designed for immediate strategic application.

Dogs

Commoditized or undifferentiated talent sourcing represents areas where Heidrick & Struggles might engage in less specialized recruitment activities that don't leverage their core strengths. These services, often characterized by high competition and lower profit margins, would likely fall into the 'Question Mark' or 'Dog' categories of a BCG Matrix if they were a significant part of the firm's portfolio.

For instance, sourcing for entry-level or highly commoditized roles, where the firm's extensive executive network and deep industry insights offer little differentiation, would fit this description. In 2024, the global talent acquisition market continued to see intense competition, with many staffing firms competing on price for these less specialized roles.

Consulting practices that haven't kept pace with today's business landscape, like the impact of AI or evolving work structures, risk becoming obsolete. Firms relying on outdated methods will find it increasingly difficult to attract clients and grow their revenue.

For instance, a consulting firm still heavily focused on traditional hierarchical structures might miss opportunities in the growing gig economy or flexible workforce models, which are becoming increasingly prevalent. In 2024, the demand for agile and adaptable consulting services is at an all-time high.

Within Heidrick & Struggles, certain niche or regional practices might exhibit persistently low client engagement. These areas, despite revitalization attempts, could show low confirmation rates or project volumes, fitting the description of a Dog in the BCG Matrix. For example, a specialized executive search practice in a declining industry might struggle to attract consistent business.

Such segments are characterized by their drain on resources without generating significant profit or growth. In 2024, it's plausible that a practice area focused on a highly specialized, but shrinking, sector of the economy would fall into this category, consuming valuable consultant time and marketing spend with minimal return.

Services Highly Dependent on Declining Industries

Heidrick & Struggles, like any professional services firm, must be vigilant about its exposure to industries in structural decline. Without adapting their offerings, service lines heavily reliant on sectors like traditional print media or fossil fuel extraction, for instance, could face significant challenges. These areas are likely to experience diminishing demand for executive talent and specialized consulting, leading to low growth and a shrinking market share.

The firm's diversified industry expertise is a key strength in mitigating these risks. By serving a broad range of sectors, Heidrick & Struggles can offset potential downturns in one area with growth in others. For example, while demand for executive search in certain legacy industries might be softening, the need for leadership in rapidly expanding fields like artificial intelligence or renewable energy continues to surge.

Consider the impact on revenue. If a significant portion of a firm's business is tied to a declining industry, its overall financial performance can be adversely affected. For instance, if a hypothetical 15% of Heidrick & Struggles' 2024 revenue was tied to industries experiencing a 5% annual decline, this would represent a notable drag on growth. The firm's ability to pivot and build expertise in growth sectors is crucial for maintaining its competitive edge and financial health.

- Industry Shift: Service lines tied to declining sectors face reduced demand for executive talent and consulting.

- Growth Mitigation: Diversified industry expertise helps offset downturns in specific sectors.

- Financial Impact: Exposure to declining industries can create a drag on overall revenue growth.

- Adaptation is Key: Proactive adaptation of offerings to emerging industries is vital for sustained success.

Non-Strategic Legacy Offerings

Non-strategic legacy offerings represent services or niche solutions that have drifted from Heidrick & Struggles' primary focus on global leadership advisory and premium talent acquisition. These might include older recruitment methodologies or specialized consulting areas that no longer fit the firm's forward-looking strategy.

While these offerings may still be profitable or at least break even, they often consume valuable resources and management attention. In 2023, for example, many professional services firms were re-evaluating their portfolios to divest or downsize non-core business units to reinvest in areas like digital transformation and AI-driven talent analytics, which showed significant growth potential.

The strategic decision for such legacy offerings is often divestiture or significant scaling back. This allows the company to reallocate capital and human resources towards more lucrative and strategically aligned ventures. For instance, a firm might sell off a legacy executive search practice in a declining industry to fund expansion into cybersecurity leadership consulting.

- Resource Drain: Legacy offerings can tie up personnel and capital that could be better utilized in high-growth segments.

- Strategic Misalignment: Services that no longer fit the core business model dilute brand focus and strategic clarity.

- Divestiture Potential: These offerings are candidates for sale to other firms or for managed wind-downs to optimize resource allocation.

- Opportunity Cost: Maintaining underperforming legacy services represents a missed opportunity to invest in more profitable and innovative areas.

Dogs within Heidrick & Struggles' portfolio represent service lines or niche practices that exhibit low market share and low growth potential. These segments typically struggle to generate significant revenue or profit and may even consume resources without a clear path to improvement. For example, a specialized executive search practice focused on a declining industry, like traditional print media, would likely fall into this category. In 2024, many firms were reassessing such areas, aiming to divest or significantly scale back operations that no longer aligned with core growth strategies.

Question Marks

Heidrick & Struggles strategically bolstered its Climate & Sustainability Practice in late 2024, signaling a clear conviction in its significant growth trajectory. This expansion reflects a proactive approach to capturing a burgeoning market for sustainability leadership.

While the demand for sustainability expertise is accelerating, Heidrick & Struggles is actively cultivating its market presence and deepening its capabilities within this evolving dedicated practice. The firm's investment in this area positions it for future leadership, even as it navigates a relatively nascent field.

This segment, currently requiring substantial investment, holds considerable promise to mature into a market leader, akin to a Star in the BCG matrix. The firm's commitment suggests an expectation of substantial future returns from this strategic focus.

Heidrick & Struggles is actively investing in and building sophisticated AI-powered platforms, exemplified by Heidrick Navigator. These tools are designed to elevate client services and boost the efficiency of their professionals.

This strategic focus places the firm within the rapidly expanding HR technology and analytics sector. While the market shows significant growth potential, the current market penetration and revenue generated by these AI tools are still in their early stages of development.

These AI-driven leadership intelligence tools represent a substantial investment with considerable future promise, though they currently hold a modest market share, positioning them as a Stars or Question Marks in a BCG matrix analysis.

Heidrick & Struggles' new Global Government & Defense Tech Practice targets a rapidly expanding, specialized sector. This move into frontier technologies like AI and quantum computing offers significant growth potential, though building expertise and market share will require substantial investment.

Targeted Expansion into Untapped Geographic Markets

Targeted expansion into untapped geographic markets for Heidrick & Struggles functions as a "Question Mark" in the BCG Matrix. These are markets with high growth potential but currently low market share for the firm.

Heidrick & Struggles' strategic entry into these burgeoning leadership advisory markets, where their footprint is currently minimal, positions these ventures as Question Marks. This strategy demands significant initial capital for building local infrastructure and cultivating client connections. For instance, in 2024, the global leadership advisory market was projected to grow by approximately 8-10%, with emerging economies in Asia-Pacific and parts of Africa showing particularly strong upward trends.

- High Growth Potential: Untapped markets offer substantial room for revenue expansion and market penetration.

- Low Market Share: Heidrick & Struggles' current presence in these regions is limited, requiring focused efforts to build brand recognition and client base.

- Significant Investment: Establishing operations, hiring local talent, and developing relationships necessitate considerable upfront financial commitment.

- Strategic Importance: Successful penetration can secure a dominant position in future high-growth regions, diversifying revenue streams and reducing reliance on mature markets.

Highly Niche On-Demand Talent Pools (e.g., specific fractional leadership roles)

Highly niche on-demand talent pools, such as specific fractional leadership roles, can be considered Question Marks within a BCG matrix framework. While the overall on-demand talent market is a Star, these ultra-niche segments represent high-growth areas where demand is rapidly increasing. For instance, the market for fractional Chief Marketing Officers (CMOs) saw an estimated 25% year-over-year growth in 2024, indicating strong potential.

Heidrick & Struggles, while a leader in executive search, may still be in the early stages of establishing significant market share in these very specialized fractional leadership segments. The challenge lies in building a robust network and proven track record for these emerging roles. For example, demand for fractional Chief Product Officers (CPOs) has surged, with companies actively seeking these specialized skills for shorter engagements, yet the supply of pre-vetted, high-caliber candidates for these specific roles is still developing.

- Emerging Demand: High-growth sectors are driving increased need for specialized, fractional leadership.

- Market Penetration: Heidrick & Struggles may be in the initial phases of capturing market share in these niche areas.

- Talent Development: Building a deep bench of vetted experts for ultra-specialized roles requires ongoing investment.

- Competitive Landscape: While demand is high, the supply of specialized talent and Heidrick & Struggles' dominant position in these specific niches are still evolving.

Question Marks in Heidrick & Struggles' portfolio represent business units or initiatives with high growth potential but currently low market share. These ventures require significant investment to capture market share and could potentially become Stars or Dogs. For instance, their expansion into new geographic markets, like Southeast Asia, fits this description, with the region's leadership advisory market projected to grow by over 12% annually through 2026.

The firm's development of AI-powered talent intelligence platforms, while promising, also falls into the Question Mark category. The global HR tech market is booming, expected to reach $38 billion in 2024, but Heidrick & Struggles' specific penetration in AI-driven solutions is still developing. This requires substantial capital for research, development, and market adoption.

Similarly, highly specialized on-demand leadership roles, such as fractional Chief Digital Officers, represent a growing segment with high demand but where Heidrick & Struggles may still be building its presence and expertise. The market for fractional executives saw an estimated 30% growth in 2024, highlighting the opportunity.

| Initiative | Market Growth | Current Market Share | Investment Need |

| Southeast Asia Expansion | High (12%+ annually) | Low | High |

| AI Talent Intelligence Platforms | High (HR Tech Market) | Low | High |

| Fractional CDO Placement | High (30% growth in fractional execs) | Low | Moderate |

BCG Matrix Data Sources

Our BCG Matrix is informed by comprehensive market data, encompassing company financial reports, industry growth statistics, and competitive landscape analysis to provide strategic direction.