Heidrick & Struggles International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heidrick & Struggles International Bundle

Heidrick & Struggles International operates in a dynamic executive search landscape shaped by intense rivalry and significant buyer power. Understanding the nuances of supplier relationships and the threat of new entrants is crucial for navigating this competitive arena.

The complete report reveals the real forces shaping Heidrick & Struggles International’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Heidrick & Struggles' core 'suppliers' are the elite executive talent they place and their own specialized consultants. The demand for top-tier leaders, especially those with expertise in areas like AI or digital transformation, remains intensely competitive and supply is often limited.

This scarcity of specialized skills empowers these individuals, giving them considerable leverage over compensation and benefits. Consequently, this directly influences Heidrick & Struggles' capacity to secure and retain these key professionals for client projects, impacting their operational costs and service delivery.

The specialized expertise of Heidrick & Struggles' own consultants acts as a significant supplier force. These individuals possess extensive networks, deep industry knowledge, and unique assessment capabilities, forming a critical asset for the firm.

The firm's value proposition is directly enhanced by the specialized skills and established client relationships of its consultants. Their individual reputations are often key drivers for securing and executing client engagements.

Heidrick & Struggles' reliance on attracting and retaining these high-caliber professionals underscores their power as a supplier group. In 2023, the firm reported revenue of $718.4 million, a testament to the value delivered by its consultant base.

The compensation expectations of top executive talent are a significant factor in the bargaining power of suppliers for Heidrick & Struggles. These highly sought-after professionals command substantial salaries and benefits, directly impacting the cost of talent acquisition for the firm's clients.

For example, compensation trends in the alternative asset management sector, a key area for executive search, saw modest increases from 2022 to 2024. This indicates a persistent strong demand for specialized skills and experience, further solidifying the leverage of these executive candidates.

Heidrick & Struggles must consistently offer competitive and attractive compensation packages to secure top-tier candidates for their clients. This necessity directly influences project costs and, consequently, the firm's profit margins in a competitive landscape.

Scarcity of Niche Skills

The scarcity of niche skills significantly bolsters supplier power, especially in the executive search domain. As demand surges for leaders possessing specialized, future-oriented capabilities like digital fluency, sustainability acumen, and adept change management, the talent pool for these roles shrinks, making such individuals highly sought after. This dynamic compels executive search firms to engage in intense competition for a limited supply of uniquely qualified candidates.

For instance, in 2024, the demand for AI and machine learning experts in leadership roles saw a substantial increase, with some reports indicating a 40% year-over-year growth in executive search mandates for these positions. Similarly, the emphasis on Environmental, Social, and Governance (ESG) leadership has driven a similar competitive landscape for sustainability-focused executives. Heidrick & Struggles, like its peers, must therefore navigate this environment where the suppliers of these critical skills hold considerable leverage.

- Digital Fluency: Companies actively seek leaders who can drive digital transformation, increasing the value of candidates with proven track records in this area.

- Sustainability Expertise: The growing importance of ESG mandates makes leaders with sustainability knowledge highly desirable, creating a competitive market for their services.

- Change Management: In a rapidly evolving business landscape, executives skilled in navigating and implementing change are in high demand, amplifying their bargaining power.

- Limited Talent Pool: The concentration of these sought-after skills within a relatively small group of individuals inherently strengthens their negotiating position with executive search firms.

Consultant Productivity and Retention

Heidrick & Struggles International places significant emphasis on consultant productivity, often tracked by metrics like annualized net revenue per consultant. For instance, in the first quarter of 2024, the firm reported a net revenue per consultant that underscores the critical nature of this productivity measure in driving financial performance.

Retaining seasoned consultants is paramount, as their expertise directly influences the firm's ability to deliver high-quality services and nurture client loyalty. The departure of key personnel can disrupt ongoing projects and strain client relationships, impacting revenue streams.

The firm's strategy includes substantial investments in its internal talent pool. This focus on development and retention aims to ensure consistent delivery quality and foster deeper, more enduring relationships with clients, thereby mitigating the impact of supplier power.

- Consultant Productivity Metric: Heidrick & Struggles monitors annualized net revenue per consultant to gauge efficiency.

- Impact of Retention: Losing experienced consultants can negatively affect service delivery and client continuity.

- Talent Investment: The firm actively invests in its consultants to maintain service standards and client relationships.

The bargaining power of suppliers for Heidrick & Struggles is significantly influenced by the scarcity of elite executive talent and the specialized expertise of their own consultants. In 2024, demand for leaders in areas like AI and digital transformation saw substantial growth, with some reports indicating a 40% year-over-year increase in executive search mandates for these roles, thereby increasing supplier leverage.

These highly sought-after professionals command premium compensation packages, directly impacting Heidrick & Struggles' costs and profit margins. The firm must offer competitive remuneration to secure and retain these individuals, as their departure can disrupt client relationships and revenue streams.

Heidrick & Struggles invests heavily in its internal talent pool to mitigate this supplier power, focusing on consultant productivity, measured by metrics like annualized net revenue per consultant. For instance, the firm's Q1 2024 performance highlighted the importance of this metric.

| Skill Area | Demand Trend (2024) | Impact on Supplier Power |

|---|---|---|

| AI & Machine Learning Leadership | Substantial Increase | High Leverage |

| Digital Transformation Leaders | Strong Growth | Significant Leverage |

| ESG & Sustainability Executives | Increasing Importance | Growing Leverage |

| Change Management Specialists | High Demand | Elevated Leverage |

What is included in the product

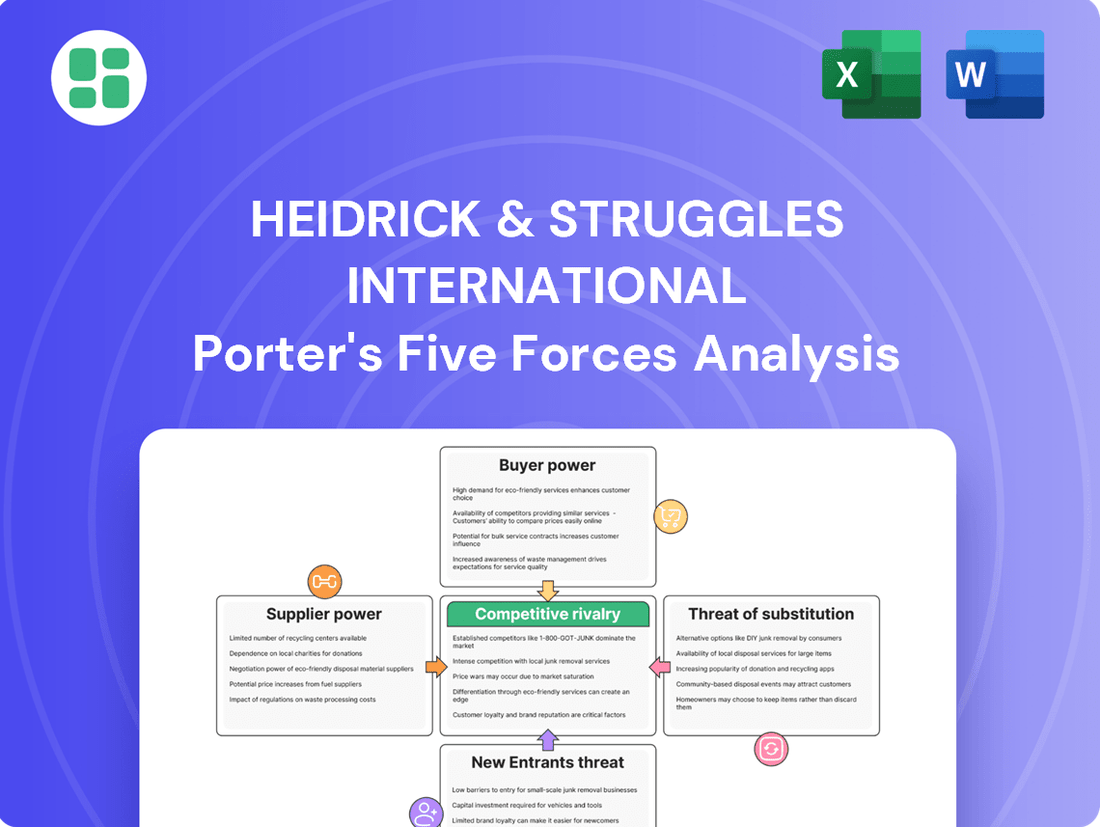

Explores the competitive intensity, buyer and supplier power, threat of new entrants and substitutes within the executive search industry, specifically for Heidrick & Struggles International.

Instantly pinpoint competitive threats and opportunities with a dynamic, visual representation of each force, enabling proactive strategy adjustments.

Customers Bargaining Power

Heidrick & Struggles' diverse client base significantly weakens the bargaining power of individual customers. The firm serves a wide array of industries worldwide, meaning no single client holds substantial sway over pricing or terms.

For instance, in 2024, Heidrick & Struggles reported in its 2025 Form 10-K that no single client represented more than 2% of its net revenue. Furthermore, the top ten clients combined accounted for only about 7% of the firm's total revenue, underscoring the limited leverage any one customer possesses.

Clients of executive search firms like Heidrick & Struggles International have a significant number of alternatives available. Competitors such as Korn Ferry, Spencer Stuart, and Russell Reynolds Associates offer similar global executive search services, directly challenging Heidrick’s market share. In 2024, the executive search market continued to see robust activity, with major players reporting strong revenue growth, indicating a competitive environment where client choice is paramount.

While customers can switch between executive search firms, the high stakes involved in C-suite and board-level recruitment significantly temper their bargaining power. Clients understand that the cost of a mis-hire at this executive level can be millions in lost productivity and strategic misdirection, making the fees of a specialized firm like Heidrick & Struggles a justifiable investment.

In 2023, the average cost of a bad hire in the US was estimated to be over $124,000, a figure that escalates dramatically for senior leadership roles. This reality underscores the value clients place on Heidrick & Struggles' deep industry knowledge, vast executive networks, and meticulous assessment processes, which are designed to mitigate these substantial risks.

Client Sophistication and Scrutiny

Client sophistication significantly impacts the bargaining power of customers in the executive search and consulting industry. Large organizations, in particular, are becoming much more discerning. They no longer rely solely on a firm's name; instead, they meticulously assess factors like demonstrable results, specialized knowledge, and the clarity and effectiveness of the search process itself.

This elevated level of scrutiny forces firms like Heidrick & Struggles to continuously prove their worth. They must offer customized solutions that directly address the unique challenges and requirements of each client. For instance, in 2024, clients increasingly demanded data-driven insights into candidate pipelines and diversity metrics, pushing search firms to invest in advanced analytics and reporting capabilities.

- Increased Demand for Measurable ROI: Clients are pushing for quantifiable outcomes from executive search engagements, moving beyond anecdotal evidence of success.

- Focus on Niche Expertise: Sophisticated buyers seek firms with deep, specialized knowledge in specific industries or functional areas, reducing the appeal of generalist providers.

- Transparency in Process and Pricing: Clients expect clear communication regarding search methodologies, timelines, and fee structures, leading to more rigorous vendor evaluation.

Demand for Leadership Advisory

The persistent demand for leadership advisory services, fueled by intricate macroeconomic landscapes, rapid digital evolution, and the critical need for agile leadership, significantly bolsters Heidrick & Struggles' market standing. Businesses are actively seeking specialized external guidance to enhance workforce adaptability and craft robust leadership frameworks.

This continuous need for impactful results underscores the inherent value that dedicated advisory firms bring to their clients. For instance, in 2024, the global leadership development market was projected to reach approximately $45 billion, reflecting a strong and ongoing investment in leadership capabilities.

- Sustained Demand: Companies globally continue to prioritize leadership development and advisory services to navigate complex business environments.

- Key Drivers: Digital transformation, economic volatility, and the imperative for organizational agility are primary catalysts for this demand.

- Market Growth: The leadership advisory sector is experiencing robust growth, with projections indicating continued expansion in the coming years.

- Value Proposition: Specialized firms like Heidrick & Struggles offer critical expertise that directly addresses these evolving organizational needs.

The bargaining power of customers for Heidrick & Struggles remains relatively low due to the firm's diversified client base, where no single client dominates revenue. In 2024, no single client accounted for more than 2% of net revenue, with the top ten clients representing only about 7% of total revenue, limiting individual client leverage.

Clients face numerous alternatives in the executive search market, with competitors like Korn Ferry and Spencer Stuart offering similar global services. However, the high cost of executive mis-hires, estimated to exceed $124,000 for senior roles in 2023, makes clients prioritize specialized expertise and risk mitigation, justifying Heidrick & Struggles' fees.

Sophisticated clients in 2024 increasingly demand demonstrable results and transparency, pushing firms to provide data-driven insights and customized solutions. This focus on ROI and niche expertise, coupled with the sustained global demand for leadership advisory services projected to reach $45 billion in 2024, further reinforces Heidrick & Struggles' value proposition.

| Factor | Impact on Customer Bargaining Power | Supporting Data (2023-2024) |

|---|---|---|

| Client Diversification | Lowers | No single client > 2% of net revenue; Top 10 clients < 7% of total revenue. |

| Availability of Alternatives | Moderate | Strong competition from firms like Korn Ferry, Spencer Stuart. |

| Switching Costs/Risk of Mis-hire | Lowers | Cost of executive mis-hire > $124,000 (2023 estimate); High stakes in C-suite recruitment. |

| Client Sophistication & Demand for ROI | Lowers | Clients demand data-driven insights, transparency, and specialized expertise. |

Preview Before You Purchase

Heidrick & Struggles International Porter's Five Forces Analysis

This preview showcases the exact, professionally crafted Porter's Five Forces analysis for Heidrick & Struggles International that you will receive immediately upon purchase. The document is fully formatted and ready for your immediate use, providing a comprehensive overview of the competitive landscape impacting the executive search firm. You can trust that what you see here is precisely the detailed analysis you will gain access to, with no hidden placeholders or sample content.

Rivalry Among Competitors

Heidrick & Struggles operates in a highly competitive landscape, dominated by several global powerhouses. Rivalry is intense as firms like Korn Ferry, Spencer Stuart, Russell Reynolds Associates, and Egon Zehnder vie for the same high-caliber talent and client mandates across diverse industries and geographies.

These established global competitors possess significant brand recognition and extensive networks, enabling them to secure a substantial portion of the executive search market. For instance, in 2023, Korn Ferry reported revenues of $2.7 billion, highlighting the scale of operations these firms maintain.

Heidrick & Struggles, like its peers in executive search, faces intense rivalry fueled by reputation and established global networks. Firms that have consistently delivered successful placements and impactful consulting engagements build strong client trust, a critical differentiator. For instance, in 2023, the top global executive search firms reported significant revenue growth, underscoring the value placed on proven track records and extensive networks.

Competitive rivalry is heating up as firms expand beyond executive search into areas like leadership assessment and consulting. Heidrick & Struggles, for instance, has reported notable growth in its Heidrick Consulting and On-Demand Talent divisions, demonstrating this shift. Companies offering comprehensive leadership solutions are better positioned to compete.

Geographic and Industry Specialization

While Heidrick & Struggles operates globally, intense competition often surfaces within specific geographic markets and specialized industry sectors. Many firms cultivate deep expertise in areas such as technology, healthcare, or financial services, fostering concentrated rivalry within these particular niches.

Heidrick & Struggles' Q4 2024 performance highlights this dynamic, with reported revenue growth across the Americas, Europe, and Asia Pacific. This broad-based increase suggests the firm faces competition across multiple key regions, with specialized firms likely vying for market share within each.

- Regional Competition: Heidrick & Struggles faces rivals in each major geographic market it serves, from North America to Europe and Asia.

- Industry Specialization: Competition intensifies within specific sectors like technology and healthcare, where firms develop niche expertise.

- Q4 2024 Revenue Growth: The company's revenue increases across Americas, Europe, and Asia Pacific in Q4 2024 underscore the need for competitive strategies tailored to diverse regional demands.

Impact of Economic Conditions

Economic fluctuations and market uncertainties can significantly intensify competitive rivalry in the executive search industry. When the economy slows, clients often postpone or scale back on hiring initiatives, leading to a smaller pool of available mandates and increased competition among search firms for those opportunities. This cost-consciousness can also pressure firms to lower their fees, squeezing margins.

Despite these headwinds, Heidrick & Struggles demonstrated robust financial performance. For the second quarter of 2025, the company reported net revenue of $235.5 million, a 1.5% increase compared to the same period in 2024. Furthermore, diluted earnings per share reached $0.45, indicating strong profitability even amidst a potentially challenging economic backdrop. This resilience suggests an ability to effectively manage competitive pressures.

Firms that can prove their value and adaptability during periods of economic uncertainty are well-positioned to gain market share. This often involves:

- Demonstrating a deep understanding of evolving client needs in a volatile market.

- Offering specialized expertise that remains critical regardless of economic cycles.

- Maintaining strong client relationships built on trust and consistent delivery.

- Adapting service offerings to address immediate client challenges, such as talent retention or strategic workforce planning.

Heidrick & Struggles faces intense competition from global executive search firms like Korn Ferry and Spencer Stuart, who also boast strong brand recognition and extensive networks. This rivalry is further amplified by the trend of firms expanding their services beyond traditional executive search into leadership assessment and consulting, a strategic shift also embraced by Heidrick & Struggles. The firm’s Q4 2024 revenue growth across key regions like the Americas, Europe, and Asia Pacific indicates it's actively competing in diverse markets, often against specialized firms focusing on specific industries.

| Competitor | 2023 Revenue (USD billions) | Key Service Areas |

|---|---|---|

| Korn Ferry | 2.7 | Executive Search, Interim Management, Talent Acquisition, Leadership Development |

| Spencer Stuart | N/A (Private) | Executive Search, Board Services, Succession Planning |

| Russell Reynolds Associates | N/A (Private) | Executive Search, Board Advisory, Digital Transformation |

| Egon Zehnder | N/A (Private) | Executive Search, Leadership Assessment, Board Consulting |

SSubstitutes Threaten

The rise of sophisticated in-house talent acquisition teams presents a significant threat of substitution for executive search firms. Many large corporations now possess robust internal recruitment functions, capable of handling a substantial portion of their executive hiring. This trend particularly impacts the demand for external services when filling less senior or more common specialized positions, directly reducing the need for outside expertise.

In 2024, a notable percentage of Fortune 500 companies have invested heavily in their internal talent acquisition infrastructure. This investment allows them to manage a greater volume of executive searches, from identifying candidates to onboarding, thereby diminishing their reliance on external search partners. Consequently, firms like Heidrick & Struggles face increased competition from these internal capabilities, especially for roles that do not require highly niche or C-suite level expertise.

The rise of platforms like LinkedIn, with its over 1 billion members globally as of early 2024, directly challenges traditional executive search by allowing companies to bypass intermediaries. Furthermore, sophisticated AI recruitment tools are streamlining candidate sourcing and initial screening, potentially reducing the perceived need for specialized search firms for many roles.

These digital solutions offer a more cost-effective and faster alternative for identifying talent, especially for mid-level positions. While these tools excel at data aggregation and initial filtering, they currently lack the nuanced understanding of cultural fit and deep relationship building crucial for securing top-tier executive placements, a core strength of firms like Heidrick & Struggles.

Broader management consulting firms, like McKinsey & Company and Boston Consulting Group (BCG), present a significant threat of substitutes for Heidrick & Struggles. These giants, with their extensive reach and deep expertise, offer a wide array of services including leadership development, organizational design, and change management. These offerings often overlap with Heidrick & Struggles' core leadership consulting segments, providing clients with alternative avenues for strategic organizational advice.

While not their primary focus, these large consulting firms can step in when clients seek holistic strategic and organizational guidance. The global management consulting market is substantial, estimated to have reached over $300 billion in 2023, and continues its upward trajectory. This growth signifies a robust market where alternative solutions are readily available, intensifying the competitive landscape for executive search and leadership advisory firms.

Fractional and Interim Leadership

The growing availability of fractional and interim leadership models presents a significant threat to traditional executive search firms like Heidrick & Struggles. Companies are increasingly turning to these flexible arrangements, engaging senior executives on a part-time or project basis to fill critical roles or spearhead specific initiatives. This trend offers a compelling alternative, potentially dampening the demand for full-time, permanent executive placements.

This shift is driven by a desire for agility and cost-effectiveness. Businesses can access top-tier talent without the long-term commitment and overhead associated with permanent hires. For instance, a 2024 survey indicated that over 60% of companies are considering or actively using fractional executives for specialized projects, highlighting the increasing acceptance of this model.

- Fractional Leadership: Highly experienced executives work part-time or on a project basis, offering specialized skills without full-time commitment.

- Interim Management: Provides senior-level leadership for temporary periods, addressing immediate needs or managing transitions.

- Cost Efficiency: Companies can achieve significant savings compared to the total cost of a full-time executive, including salary, benefits, and onboarding.

- Flexibility: Allows businesses to scale their leadership needs up or down rapidly in response to market changes or project requirements.

Independent Consultants and Marketplaces

The rise of independent consultants and online marketplaces presents a significant threat of substitution for traditional executive search firms like Heidrick & Struggles. These platforms allow companies to directly source specialized expertise for leadership assessment, coaching, and project-based needs, bypassing established firms. For instance, platforms like Toptal and Upwork have seen substantial growth, connecting businesses with freelance professionals across various sectors, including strategy and leadership development.

This trend is amplified by the increasing demand for agile and on-demand talent solutions. Companies are increasingly seeking flexibility and cost-effectiveness, which independent consultants and marketplaces can often provide. In 2024, the gig economy continued its expansion, with a growing percentage of the workforce engaging in freelance or contract work, indicating a sustained shift towards alternative talent acquisition models.

- Growth of Freelance Platforms: Online marketplaces for specialized talent continue to expand, offering direct access to individual experts.

- Demand for Agility: Businesses are prioritizing flexible and on-demand solutions for leadership and project-based consulting needs.

- Cost-Effectiveness: Engaging independent consultants can often be more budget-friendly than traditional advisory firm fees.

- Direct Sourcing: Organizations can bypass intermediaries and directly vet and hire individual specialists for targeted engagements.

The threat of substitutes for executive search firms like Heidrick & Struggles is multifaceted, encompassing internal talent acquisition, digital platforms, management consulting, and flexible work arrangements. Companies are increasingly building robust in-house recruitment capabilities, reducing reliance on external search partners, especially for non-niche roles.

Digital platforms such as LinkedIn, with over 1 billion members globally as of early 2024, and AI-driven recruitment tools offer faster, more cost-effective alternatives for sourcing candidates, though they may lack the nuanced understanding of cultural fit that executive search firms provide.

Broader management consulting firms and the growing trend of fractional and interim leadership also present significant substitutes. These alternatives offer holistic strategic advice and flexible talent solutions, respectively, catering to businesses seeking agility and cost-efficiency, as evidenced by a 2024 survey indicating over 60% of companies consider fractional executives.

The expansion of online marketplaces for independent consultants further diversifies the substitute landscape, allowing direct access to specialized expertise for leadership assessment and coaching, a trend amplified by the continued growth of the gig economy in 2024.

| Substitute Category | Key Characteristics | Impact on Executive Search | Market Trend Data (2023-2024) |

|---|---|---|---|

| In-house Talent Acquisition | Cost-effective for high volume, direct control over process | Reduces demand for external firms, especially for mid-level roles | Increased investment in internal recruitment infrastructure by Fortune 500 companies in 2024 |

| Digital Platforms (e.g., LinkedIn, AI Tools) | Speed, broad reach, data-driven candidate sourcing | Bypasses intermediaries, streamlines initial screening | LinkedIn's global membership exceeding 1 billion by early 2024 |

| Management Consulting Firms | Holistic strategic and organizational advice, leadership development | Offers alternative solutions for leadership advisory needs | Global management consulting market exceeded $300 billion in 2023 |

| Fractional/Interim Leadership | Flexibility, cost-efficiency, access to specialized skills | Dampens demand for permanent executive placements | Over 60% of companies considering/using fractional executives (2024 survey) |

| Independent Consultants/Marketplaces | Agility, on-demand expertise, direct sourcing | Provides alternative avenues for specialized leadership services | Continued expansion of the gig economy and freelance platforms in 2024 |

Entrants Threaten

The executive search and leadership consulting sector presents significant hurdles for newcomers. A primary barrier is the absolute necessity for a robust reputation, expansive professional networks, and profound industry-specific knowledge. For instance, Heidrick & Struggles, a leader in this field, has cultivated decades of trust and expertise, which is not easily replicated.

The need for a significant capital investment to establish a global presence acts as a substantial barrier for potential new entrants. Building an international network of offices, robust technological infrastructure, and a team of seasoned consultants demands considerable financial resources, making it challenging for smaller, newer firms to compete effectively with established global players like Heidrick & Struggles.

In 2024, the executive search industry continues to see consolidation, with larger firms leveraging their scale. For instance, major players often have dedicated teams and advanced digital platforms that new entrants would struggle to replicate without substantial upfront investment, estimated to be in the tens of millions of dollars for a meaningful global footprint.

Reputation and brand recognition are critical barriers for new entrants in the executive search industry, directly impacting Heidrick & Struggles. Clients often prioritize firms with a long-standing history of successful placements and positive client experiences, making it difficult for newcomers to gain trust.

Established firms like Heidrick & Struggles benefit from decades of building strong relationships and a demonstrable track record. This brand equity is a significant hurdle for new players, as attracting high-value clients and top-tier candidates requires more than just offering services; it demands proven success and industry credibility.

In 2024, the executive search market continues to value established networks and a deep understanding of specific industries. New entrants must invest heavily in building their brand and demonstrating expertise to compete with firms that already possess this inherent advantage, a process that can take years.

Emergence of Niche and Tech-Enabled Firms

The threat of new entrants for Heidrick & Struggles is influenced by the emergence of specialized, tech-savvy firms. These new players often target niche markets or leverage advanced technology to carve out their space.

Boutique firms, for instance, can gain a foothold by offering deep expertise in specific industries, functions, or even geographic areas, providing a level of specialization that larger firms might not match. This focused approach allows them to attract clients seeking tailored solutions.

Furthermore, the rise of recruitment platforms powered by artificial intelligence and other digital tools presents a significant avenue for new entrants. These tech-enabled solutions can streamline parts of the traditional executive search process, potentially disrupting established models and creating new competitive pressures.

- Niche Specialization: Boutique firms focusing on specific sectors, like fintech or healthcare, can attract clients seeking highly targeted talent acquisition.

- Technological Disruption: AI-driven platforms are increasingly automating candidate sourcing and initial screening, lowering entry barriers for tech-focused competitors.

- Agile Business Models: New entrants can operate with leaner overheads compared to established players, allowing for more competitive pricing or investment in cutting-edge technology.

Talent Acquisition Innovation

The talent acquisition landscape is shifting dramatically, with a growing focus on skills over traditional credentials and a rise in flexible work arrangements. This evolution can indeed lower some long-standing barriers to entry for new firms. For instance, in 2024, a significant percentage of companies reported adopting skills-based hiring practices, making it easier for agile newcomers to demonstrate value without relying on established networks.

Innovative startups can leverage these trends by offering specialized, tech-enabled solutions for skills assessment and remote talent sourcing. They can bypass the need for extensive legacy relationships by providing more efficient and cost-effective services. This agility allows them to capture market share, particularly in sectors where adaptability and speed are paramount.

- Skills-based hiring adoption: Reports from 2024 indicated that over 60% of organizations were increasing their focus on skills-based hiring, reducing reliance on traditional qualifications.

- Growth in remote work: The continued prevalence of remote and hybrid models opens up global talent pools, diminishing the advantage of firms with geographically concentrated networks.

- Emergence of AI in recruitment: New entrants are often at the forefront of integrating AI-powered tools for candidate sourcing and screening, offering more efficient alternatives to established players.

- Cost-effectiveness of new models: Agile firms can operate with lower overheads, enabling them to offer competitive pricing that challenges incumbent recruitment agencies.

The threat of new entrants for Heidrick & Struggles remains moderate, primarily due to high barriers like reputation and extensive networks. However, specialized firms and tech-driven platforms are emerging, leveraging niche markets and AI to offer more agile and potentially cost-effective solutions.

In 2024, the executive search industry saw continued investment in technology by established players, with firms like Korn Ferry reporting digital transformation initiatives. This investment aims to solidify their advantage against smaller, tech-native competitors who can more easily adopt new AI tools for candidate sourcing and initial screening, potentially lowering the cost of entry for specialized services.

While established firms like Heidrick & Struggles benefit from decades of relationship building, new entrants are finding avenues through specialized recruitment platforms and a focus on skills-based hiring, a trend that over 60% of organizations were increasing in 2024, reducing the reliance on traditional credentials and networks.

| Barrier | Impact on New Entrants | 2024 Trend Relevance |

|---|---|---|

| Reputation & Networks | High | Still critical, but tech-enabled outreach can mitigate somewhat |

| Capital Investment | High | Global presence still requires significant capital |

| Industry Expertise | High | Niche specialization by new entrants can compete |

| Technological Advancement | Moderate | AI and digital platforms lower entry barriers for tech-savvy firms |

Porter's Five Forces Analysis Data Sources

Our Heidrick & Struggles International Porter's Five Forces analysis is built upon a foundation of comprehensive data, including publicly available financial reports, industry-specific market research, and insights from leading economic and business intelligence platforms.