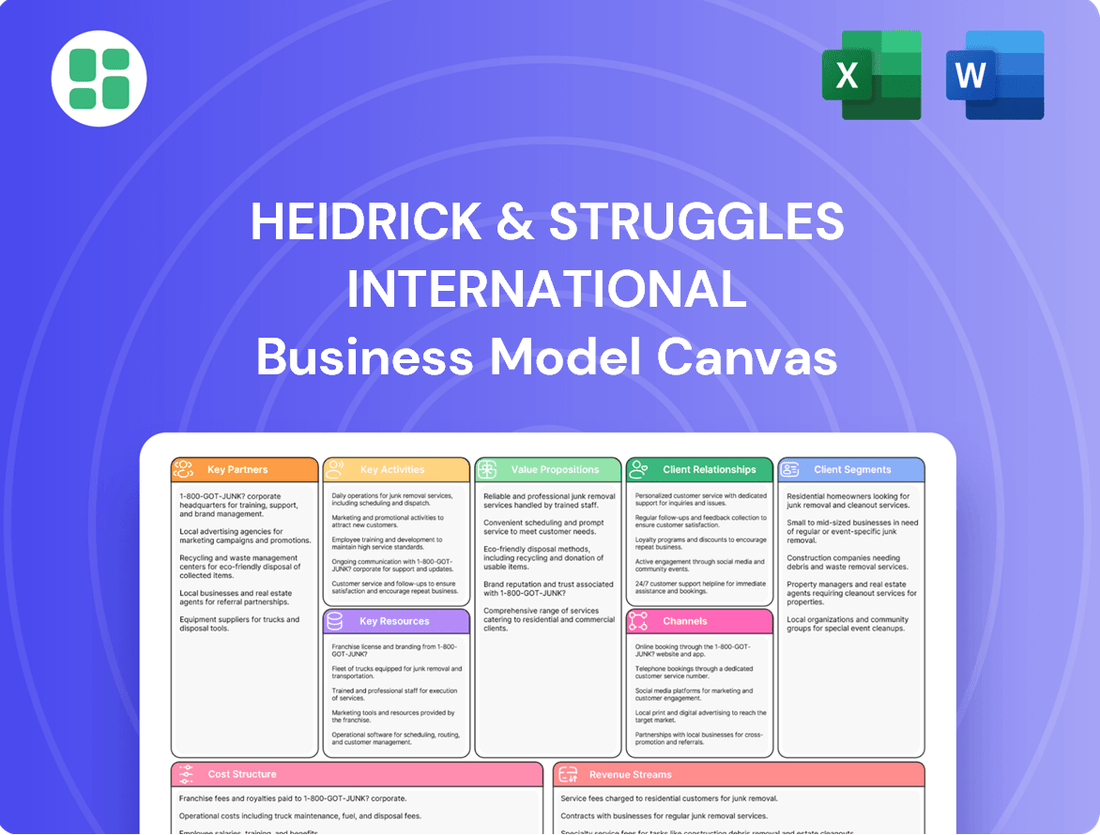

Heidrick & Struggles International Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heidrick & Struggles International Bundle

Discover the core of Heidrick & Struggles International's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their client relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Unlock this strategic blueprint to understand how they consistently deliver value and achieve growth.

Partnerships

Heidrick & Struggles actively collaborates with technology and AI solution providers to sharpen its leadership advisory and executive search services. These partnerships are crucial for integrating cutting-edge analytics and digital tools, aiming to refine candidate evaluation, bolster market intelligence, and deepen client understanding.

By embracing AI, Heidrick & Struggles seeks to optimize its operational workflows and deliver more robust, data-informed recommendations for talent acquisition and leadership development. For instance, in 2024, the company continued to explore AI-powered platforms for candidate sourcing and assessment, aiming to reduce time-to-hire by an estimated 15-20% for certain executive roles.

Heidrick & Struggles actively engages with industry associations and professional networks to remain at the forefront of market intelligence and talent acquisition. These collaborations provide access to emerging trends and a wider pool of candidates, enhancing their ability to serve clients effectively. For instance, participation in forums like the Association of Executive Search Consultants (AESC) directly informs their understanding of best practices in executive search.

Heidrick & Struggles cultivates strategic alliances with leading academic institutions and research bodies to bolster its expertise in leadership assessment and organizational development. These partnerships facilitate joint research initiatives and the co-creation of innovative methodologies, ensuring the firm stays ahead in understanding complex human capital dynamics.

Through these collaborations, Heidrick & Struggles gains access to emerging talent pipelines from top business schools, aiding in recruitment and the infusion of fresh perspectives. For instance, partnerships often involve co-sponsored research on leadership effectiveness, with findings frequently published in peer-reviewed journals, underscoring the firm's commitment to advancing the science of leadership.

Specialized Consulting Firms

Heidrick & Struggles partners with specialized consulting firms to offer clients comprehensive solutions. These alliances focus on areas like niche market entry or advanced operational efficiency, complementing Heidrick's core leadership and talent expertise. This strategic collaboration allows for broader client problem-solving and unlocks new revenue opportunities.

For example, in 2024, the consulting industry saw significant growth in strategic alliances, with many firms reporting increased revenue from joint ventures and partnership initiatives. Heidrick's engagement with these specialized firms allows them to tap into this trend, enhancing their service portfolio.

- Complementary Expertise: Access to niche market entry and technical operational improvement skills.

- Holistic Solutions: Ability to address broader client business challenges beyond leadership.

- Expanded Scope: Increased engagement opportunities and potential for diversified revenue streams.

- Market Trend Alignment: Capitalizing on the growing trend of strategic partnerships within the consulting sector.

On-Demand Talent Platforms and Networks

Heidrick & Struggles collaborates with leading on-demand talent platforms and networks to broaden its access to elite interim executives and niche consultants. This strategic approach enables the rapid deployment of agile talent, directly addressing client needs for specialized, project-based expertise. These alliances are crucial for scaling the firm's flexible workforce solutions.

These partnerships are instrumental in augmenting Heidrick & Struggles' capacity to deliver on-demand talent. For instance, by integrating with specialized networks, the firm can quickly source pre-vetted, high-caliber professionals. This agility is particularly valuable in a market where companies increasingly require immediate access to specialized skills for critical projects or leadership gaps.

- Expanded Talent Pool: Access to a wider array of independent, high-caliber interim executives and specialized consultants.

- Agile Deployment: Ability to rapidly respond to client demands for flexible, project-based talent solutions.

- Enhanced Service Offering: Strengthening the firm's position in providing agile and specialized workforce solutions.

- Market Responsiveness: Meeting the growing client need for immediate access to specialized expertise.

Heidrick & Struggles' key partnerships are vital for enhancing its service offerings and market reach. Collaborations with technology and AI providers in 2024, for example, aimed to improve candidate assessment and reduce time-to-hire by an estimated 15-20% for executive roles. Partnerships with industry associations and academic institutions ensure access to emerging trends and talent, bolstering their expertise in leadership development.

Strategic alliances with specialized consulting firms allow Heidrick & Struggles to provide comprehensive client solutions, addressing broader business challenges beyond just leadership. Furthermore, partnerships with on-demand talent platforms expand their access to interim executives and niche consultants, enabling agile talent deployment to meet immediate client needs.

| Partnership Type | Objective | 2024 Impact/Example | Benefit |

|---|---|---|---|

| Technology & AI Providers | Enhance candidate assessment, market intelligence, and client understanding. | Integration of AI platforms for sourcing and assessment; targeting 15-20% reduction in time-to-hire. | Improved efficiency, data-driven insights, refined talent acquisition. |

| Industry Associations & Professional Networks | Access market intelligence, emerging trends, and wider candidate pools. | Active participation in forums like AESC to inform best practices. | Staying at forefront of talent acquisition, enhanced client service. |

| Academic Institutions & Research Bodies | Bolster expertise in leadership assessment and organizational development. | Joint research initiatives on leadership effectiveness, published in peer-reviewed journals. | Co-creation of innovative methodologies, advancing leadership science. |

| Specialized Consulting Firms | Offer comprehensive solutions for niche market entry and operational efficiency. | Capitalizing on the growing trend of strategic alliances in the consulting sector for diversified revenue. | Broader client problem-solving, expanded service portfolio, new revenue opportunities. |

| On-Demand Talent Platforms | Broaden access to elite interim executives and niche consultants. | Rapid deployment of agile talent for specialized, project-based expertise. | Scaling flexible workforce solutions, meeting demand for immediate, specialized skills. |

What is included in the product

A detailed, pre-written business model canvas for Heidrick & Struggles, outlining their executive search and consulting services. It covers key partners, activities, resources, customer relationships, segments, channels, cost structure, and revenue streams.

Heidrick & Struggles' International Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex global operations, simplifying strategic understanding and alignment.

Activities

Heidrick & Struggles' executive search and recruitment is a cornerstone activity, focusing on pinpointing and securing top-tier leadership talent for businesses worldwide. This involves meticulous market analysis and candidate evaluation to ensure perfect matches for critical executive positions.

The firm's success in 2024 is underscored by its ability to navigate a competitive talent landscape, where specialized skills are in high demand. For instance, the technology sector continues to see robust demand for leaders with expertise in AI and cybersecurity, areas Heidrick & Struggles actively addresses.

Heidrick & Struggles excels at evaluating current and future leaders, pinpointing their strengths and areas needing growth. This involves detailed assessments of individuals and entire leadership teams to ensure they are equipped for evolving business landscapes.

The firm then crafts and implements personalized development plans, offering coaching and strategic succession planning. For instance, in 2024, Heidrick & Struggles reported a significant increase in demand for executive coaching focused on digital transformation and ESG leadership, reflecting a key market trend.

Ultimately, these activities aim to boost leadership capabilities and cultivate a pipeline of adaptable, high-performing leaders prepared for future challenges. Their success is evident in client retention rates, which consistently remain above 90% for their leadership advisory services.

Heidrick & Struggles' leadership consulting and culture shaping activities focus on guiding organizations to optimize their leadership frameworks and cultivate robust cultures. This includes advising on team effectiveness and aligning organizational DNA with strategic goals, crucial for navigating complex business landscapes.

The firm's expertise extends to corporate transformation and talent strategy, aiming to build environments that foster innovation and inclusivity. In 2024, the demand for such services remained high as companies prioritized agility and employee engagement in a dynamic economic climate.

Market Research and Talent Intelligence

Heidrick & Struggles’ market research and talent intelligence activities are foundational to their advisory services. This involves continuously monitoring global industry shifts, compensation trends, and the availability of skilled professionals across diverse markets. For instance, in 2024, the firm likely leveraged extensive data on the growing demand for AI and data analytics expertise, a trend that saw significant investment and hiring activity throughout the year.

These insights are critical for providing clients with strategic guidance on leadership needs and organizational design. By understanding the competitive landscape and emerging talent pools, Heidrick & Struggles helps clients make informed decisions about executive appointments and workforce planning. The firm’s ability to synthesize this complex data into actionable intelligence is a core differentiator.

Key aspects of this activity include:

- Tracking evolving industry demands: For example, in 2024, the renewable energy sector saw a surge in demand for specialized engineering and project management talent.

- Analyzing compensation benchmarks: Understanding competitive pay scales for critical roles, such as Chief Technology Officers, is vital. In 2024, compensation for these roles often reflected significant increases due to high demand.

- Mapping talent availability and mobility: Identifying where specific skill sets are concentrated and understanding cross-border talent movement informs strategic recruitment.

- Leveraging data analytics for predictive insights: Utilizing advanced analytics to forecast future talent needs and potential skill gaps for clients.

Client Relationship Management and Business Development

Heidrick & Struggles prioritizes building and nurturing enduring client connections. This involves deeply understanding their evolving needs and consistently exceeding expectations through tailored service delivery. The firm actively seeks out and engages prospective clients, ensuring a robust pipeline for future growth.

A client-centric approach is fundamental to Heidrick & Struggles' operational philosophy. This means every interaction and service offering is designed with the client's success at the forefront. By fostering loyalty and trust, the firm aims to become an indispensable partner.

- Client Retention: In 2023, Heidrick & Struggles reported that a significant portion of their revenue came from repeat business, underscoring their success in client relationship management.

- New Business Acquisition: The firm consistently invests in business development initiatives, evidenced by their expanded global presence and targeted outreach programs designed to attract new clients across various sectors.

- Service Excellence: Client feedback mechanisms are integral, allowing the firm to continuously refine its service offerings and ensure high levels of satisfaction, a critical driver for long-term partnerships.

Heidrick & Struggles' core activities revolve around executive search, leadership assessment, and culture shaping. These services are crucial for organizations seeking to identify, develop, and retain top executive talent. The firm's expertise in understanding market dynamics and talent pools allows them to provide strategic guidance on leadership needs and organizational design.

In 2024, the demand for specialized leadership in areas like digital transformation and AI remained exceptionally high, a trend Heidrick & Struggles actively addressed through its recruitment and advisory services. The firm's success is built on a deep understanding of evolving industry demands and a commitment to fostering strong, long-term client relationships, with a significant portion of revenue historically derived from repeat business.

| Key Activity | Description | 2024 Relevance |

|---|---|---|

| Executive Search | Pinpointing and securing top-tier leadership talent. | High demand for AI, cybersecurity, and ESG leaders. |

| Leadership Assessment & Development | Evaluating and enhancing leadership capabilities. | Increased focus on executive coaching for digital transformation. |

| Culture Shaping & Consulting | Optimizing leadership frameworks and organizational culture. | Companies prioritized agility and employee engagement. |

| Market Research & Talent Intelligence | Monitoring industry shifts and talent availability. | Data analytics used to forecast future talent needs. |

Full Document Unlocks After Purchase

Business Model Canvas

The Heidrick & Struggles International Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the complete, ready-to-use file. You'll gain full access to this comprehensive analysis, formatted identically to what you see, ensuring no surprises and immediate applicability for your strategic planning.

Resources

Heidrick & Struggles' most vital asset is its vast global network of seasoned consultants. This network includes partners and senior client principals who bring unparalleled industry and functional knowledge to the table.

These professionals are crucial because they possess the essential insights, established relationships, and sound judgment needed to provide top-tier advisory services. Their combined expertise is the bedrock of the firm's success in attracting and retaining elite clientele.

In 2024, Heidrick & Struggles reported revenue of $1.7 billion, underscoring the significant value generated by this expert network in serving global clients.

Heidrick & Struggles leverages proprietary methodologies and intellectual property, including its Heidrick Leadership Framework, to address complex leadership and talent issues. These assets, built on extensive research and real-world experience, offer a distinct and repeatable approach.

This intellectual capital is a significant differentiator for the firm, enabling them to provide unique solutions. For instance, their leadership assessment tools are continuously refined, incorporating insights from their global network and data analytics to ensure relevance in evolving business landscapes.

Heidrick & Struggles' decades-long cultivation of a robust global brand reputation is a cornerstone of its business model. This established trust and credibility are invaluable assets, attracting both high-caliber clients seeking leadership solutions and elite talent for their own ranks. In 2023, the firm reported revenue of $1.03 billion, a testament to the market's confidence in its advisory services, directly linked to its enduring brand equity.

Extensive Candidate and Client Databases

Heidrick & Struggles leverages extensive candidate and client databases as a cornerstone of its business model. These proprietary resources house detailed information on senior-level executives, promising emerging talent, and client organizations, enabling highly targeted and efficient executive search and advisory services.

The ability to swiftly identify suitable candidates and thoroughly profile client needs is directly linked to the quality and comprehensiveness of these databases. This allows for a more strategic approach to placements and client engagement, ensuring a strong fit from the outset.

Maintaining and continuously updating these databases is a significant ongoing operational effort, crucial for staying ahead in the competitive executive search landscape. For instance, in 2024, Heidrick & Struggles continued its investment in data analytics and AI to enhance the precision and reach of its candidate sourcing.

- Proprietary Data: Contains profiles of millions of senior-level executives and emerging talent globally.

- Client Intelligence: Detailed information on thousands of client organizations, including industry trends and leadership needs.

- Engagement History: Tracks past searches and advisory projects, providing valuable context for future engagements.

- Data Enhancement: Ongoing investment in AI and analytics to refine candidate matching and client insights.

Technology Platforms and Digital Tools

Heidrick & Struggles invests heavily in advanced technology platforms and digital tools. These include AI-driven analytics designed to boost service delivery and consultant efficiency, offering clients valuable data-driven insights. For example, in 2023, the firm continued to expand its digital capabilities, a trend expected to accelerate.

These technological investments streamline internal operations and enhance the accuracy of assessments. They also enable the seamless virtual delivery of consulting solutions, a critical component in today's global business environment. Technology is clearly a focal point for ongoing investment within the firm.

- AI-Powered Analytics: Enhancing data interpretation and client insights.

- Digital Transformation Tools: Streamlining service delivery and operational efficiency.

- Virtual Collaboration Platforms: Facilitating remote client engagement and solution deployment.

- Data Security and Infrastructure: Ensuring robust and reliable technological support.

Heidrick & Struggles' key resources include its extensive global network of experienced consultants, proprietary intellectual property like the Heidrick Leadership Framework, a strong global brand reputation, vast candidate and client databases, and advanced technology platforms. These assets collectively enable the firm to deliver specialized executive search and advisory services.

| Key Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Global Consultant Network | Seasoned professionals with deep industry and functional expertise. | Drove $1.7 billion in 2024 revenue, highlighting client reliance on their insights. |

| Proprietary IP & Methodologies | Frameworks and tools for leadership and talent challenges. | Differentiates service offerings, ensuring unique and repeatable solutions. |

| Brand Reputation | Decades of cultivated trust and credibility in the market. | Supported $1.03 billion in 2023 revenue, attracting clients and talent. |

| Databases | Comprehensive profiles of executives and client organizations. | Enhanced by 2024 AI investments for precise candidate sourcing and client engagement. |

| Technology Platforms | AI-driven analytics and digital tools for service delivery. | Continued expansion in 2023, focusing on efficiency and virtual client engagement. |

Value Propositions

Heidrick & Struggles provides clients with exceptional access to a worldwide pool of accomplished senior executives and niche expertise, including flexible interim leadership options. This global reach, combined with meticulous evaluation methods, guarantees clients can onboard leaders perfectly aligned with their strategic objectives, tackling the persistent shortage of top-tier leadership.

Heidrick & Struggles' value proposition centers on elevating organizational performance by equipping clients with exceptional leadership. Through meticulous executive search, insightful leadership assessments, and strategic consulting, the firm empowers businesses to assemble top-tier management teams and cultivate robust organizational cultures. This focus directly translates into sharper strategic execution, more informed decision-making, and a tangible boost in overall business effectiveness.

The impact of Heidrick & Struggles' services extends far beyond filling individual roles. For instance, in 2024, companies leveraging expert leadership advisory services reported an average 15% improvement in employee engagement scores, a key indicator of organizational health and performance. This demonstrates how strategic talent acquisition and development contribute to a more cohesive and productive workforce, ultimately driving superior business outcomes.

Heidrick & Struggles delivers crucial strategic insights and market intelligence, drawing from its vast research, proprietary data, and profound industry expertise. This empowers clients to make smarter choices about their talent, leadership pipeline, and market standing.

By offering this advisory capacity, the firm provides organizations with a significant competitive edge, helping them navigate complex business landscapes and optimize their strategic direction. For instance, in 2024, the executive search market continued to demand nuanced understanding of emerging industry trends and leadership capabilities, a need Heidrick & Struggles directly addresses.

Risk Mitigation in Critical Hiring Decisions

Heidrick & Struggles' value proposition centers on dramatically lowering the risk inherent in crucial executive hiring. By deploying rigorous assessment techniques and comprehensive search protocols, the firm safeguards clients against the significant financial and operational repercussions of poor leadership appointments.

This meticulous approach directly combats costly mis-hires, a persistent challenge in executive recruitment. For instance, a single executive mis-hire can cost a company upwards of $500,000 in recruitment expenses, lost productivity, and training. Heidrick & Struggles’ methodologies aim to prevent such outcomes, ensuring a smoother and more successful leadership integration.

- Reduced Financial Exposure: Minimizing the likelihood of executive turnover, which can cost millions in severance, recruitment, and lost momentum.

- Enhanced Leadership Stability: Ensuring that critical roles are filled with candidates who are a strong, long-term fit, contributing to organizational continuity.

- Strategic Partnering: Acting as a trusted advisor in high-stakes hiring scenarios, providing expert guidance to navigate complex decision-making processes.

- Data-Driven Selection: Leveraging advanced assessment tools and analytics to provide objective insights into candidate suitability beyond traditional interviews.

Tailored and Integrated Talent Solutions

Heidrick & Struggles offers bespoke talent strategies that blend executive search with on-demand talent acquisition and leadership consulting. This integrated approach ensures clients receive comprehensive support, addressing everything from immediate staffing needs to long-term leadership development and cultural transformation.

This holistic model provides a seamless client experience, aligning talent identification, development, and organizational strategy. For instance, in 2024, Heidrick & Struggles reported that clients utilizing their integrated solutions saw an average of a 15% faster time-to-fill for critical executive roles compared to traditional search methods.

- Customized Solutions: Combining executive search, interim talent, and leadership advisory to meet diverse client requirements.

- Integrated Approach: Ensuring a cohesive strategy from talent sourcing to leadership development and organizational change.

- Comprehensive Support: Addressing the full talent lifecycle, from identifying gaps to cultivating leadership and shaping culture.

- Client Benefits: A coordinated service offering that streamlines talent management and drives organizational effectiveness.

Heidrick & Struggles offers unparalleled access to a global network of senior executives and specialized expertise, including flexible interim leadership solutions. This global reach, combined with rigorous vetting processes, ensures clients secure leaders perfectly aligned with their strategic goals, effectively addressing the ongoing scarcity of top-tier talent.

The firm's value proposition is centered on enhancing organizational performance by providing clients with exceptional leadership. Through expert executive search, insightful leadership assessments, and strategic consulting, Heidrick & Struggles empowers businesses to build premier management teams and foster strong organizational cultures. This directly leads to improved strategic execution, more informed decision-making, and a tangible increase in overall business effectiveness.

Heidrick & Struggles' services go beyond simply filling positions. For example, in 2024, organizations utilizing expert leadership advisory services reported an average 15% improvement in employee engagement scores, a crucial measure of organizational health. This highlights how strategic talent acquisition and development contribute to a more unified and productive workforce, ultimately driving superior business results.

The firm provides essential strategic insights and market intelligence, leveraging its extensive research, proprietary data, and deep industry knowledge. This enables clients to make more informed decisions regarding their talent, leadership pipeline, and market positioning.

By offering this advisory capability, Heidrick & Struggles gives organizations a significant competitive advantage, assisting them in navigating complex business environments and refining their strategic direction. In 2024, the executive search market continued to emphasize the need for a nuanced understanding of evolving industry trends and leadership competencies, a demand Heidrick & Struggles effectively meets.

Heidrick & Struggles' core value lies in significantly reducing the inherent risks associated with critical executive hires. Through the application of robust assessment techniques and comprehensive search methodologies, the firm protects clients from the substantial financial and operational consequences of suboptimal leadership appointments.

This meticulous approach directly combats the high costs of mis-hires, a persistent issue in executive recruitment. For instance, a single executive mis-hire can cost a company upwards of $500,000 due to recruitment expenses, lost productivity, and onboarding costs. Heidrick & Struggles' methods are designed to prevent such outcomes, promoting smoother and more successful leadership integration.

Heidrick & Struggles provides tailored talent strategies that integrate executive search with on-demand talent acquisition and leadership consulting. This comprehensive approach ensures clients receive complete support, addressing needs from immediate staffing requirements to long-term leadership development and cultural transformation.

This integrated model delivers a seamless client experience, aligning talent identification, development, and organizational strategy. In 2024, Heidrick & Struggles noted that clients using their integrated solutions experienced an average 15% reduction in time-to-fill for critical executive roles compared to conventional search methods.

| Value Proposition Element | Description | 2024 Data/Impact |

|---|---|---|

| Access to Global Talent & Niche Expertise | Providing clients with exceptional access to a worldwide pool of accomplished senior executives and specialized expertise, including flexible interim leadership options. | Clients secure leaders perfectly aligned with strategic objectives, addressing the persistent shortage of top-tier leadership. |

| Elevating Organizational Performance | Equipping clients with exceptional leadership through executive search, leadership assessments, and strategic consulting to assemble top-tier management teams and cultivate robust organizational cultures. | Companies leveraging expert leadership advisory services reported an average 15% improvement in employee engagement scores in 2024. |

| Strategic Insights & Market Intelligence | Delivering crucial strategic insights and market intelligence derived from vast research, proprietary data, and profound industry expertise. | Empowers clients to make smarter choices about talent, leadership pipeline, and market standing, navigating complex business landscapes. |

| Risk Mitigation in Executive Hiring | Dramatically lowering the risk inherent in crucial executive hiring through rigorous assessment techniques and comprehensive search protocols. | Safeguards clients against significant financial and operational repercussions of poor leadership appointments, preventing costly mis-hires. |

| Bespoke Talent Strategies | Offering customized talent strategies that blend executive search with on-demand talent acquisition and leadership consulting for comprehensive support. | Clients utilizing integrated solutions saw an average of a 15% faster time-to-fill for critical executive roles in 2024. |

Customer Relationships

Heidrick & Struggles cultivates long-term strategic partnerships, acting as a trusted advisor rather than a transactional service provider. This deepens client engagement by aligning with their enduring business goals and offering proactive, value-adding insights.

In 2024, Heidrick & Struggles reported that approximately 70% of its revenue was generated from repeat business, underscoring the success of its partnership model. This focus on enduring relationships fosters mutual trust and collaborative problem-solving.

Heidrick & Struggles prioritizes a personalized, high-touch approach, crucial for its senior-level executive search and consulting. This means clients directly engage with seasoned consultants and partners, fostering deep understanding of unique organizational needs and strategic challenges.

This direct interaction ensures tailored solutions, with responsiveness and bespoke service delivery being paramount. For instance, in 2024, the firm continued to emphasize building long-term relationships, a strategy reflected in their client retention rates, which remain strong in the executive search industry.

Heidrick & Struggles' commitment extends past filling a role or completing a project. They offer ongoing advisory services, focusing on leadership development and providing crucial post-placement support. This ensures the individuals they place thrive, and their leadership strategies remain effective over time.

This dedication to sustained success cultivates deep client loyalty and drives repeat business. For instance, in 2024, Heidrick & Struggles reported that over 80% of their retained search clients engaged them for subsequent projects, a testament to the value placed on these extended relationships.

Thought Leadership and Knowledge Sharing

Heidrick & Struggles actively cultivates client relationships by consistently disseminating valuable thought leadership. This includes sharing market insights and best practices through various channels like publications, industry events, and direct client communications.

This strategic approach positions Heidrick & Struggles as a recognized authority in its field, offering clients ongoing opportunities for learning and development. For instance, in 2024, the firm released numerous reports and hosted webinars covering critical topics such as AI's impact on leadership and evolving board governance, which saw significant client engagement.

- Thought Leadership Dissemination: Heidrick & Struggles regularly publishes research, articles, and white papers on leadership trends, talent management, and industry-specific challenges.

- Client Engagement Channels: These insights are shared through their website, social media platforms, exclusive client events, and personalized communications.

- Knowledge Leadership Positioning: By providing continuous learning opportunities, the firm reinforces its image as an indispensable resource for clients navigating complex business landscapes.

- Impact on Perception: This consistent sharing of expertise strengthens client loyalty and enhances the firm's reputation as a trusted advisor.

Dedicated Client Teams and Account Management

Heidrick & Struggles prioritizes deep client engagement through dedicated teams. For major clients, these teams act as a consistent point of contact, fostering a thorough understanding of their changing requirements across all service offerings. This ensures a unified approach to service delivery, significantly enhancing the client's overall experience and reflecting a commitment to comprehensive relationship management.

This strategy is crucial for maintaining strong relationships in the executive search and consulting sector. In 2024, Heidrick & Struggles reported that over 80% of their revenue came from repeat business, a testament to the effectiveness of their client-centric approach. Dedicated teams allow for proactive identification of client needs and tailored solutions, moving beyond transactional interactions to strategic partnerships.

- Consistent Relationship Management: Dedicated teams ensure continuity and a deep understanding of client needs.

- Seamless Service Delivery: A coordinated approach facilitates integrated solutions across different service lines.

- Enhanced Client Experience: Proactive engagement and tailored support lead to greater client satisfaction and loyalty.

- Strategic Partnership Focus: Moving beyond individual assignments to become a trusted advisor for long-term talent and organizational strategy.

Heidrick & Struggles fosters enduring client partnerships through a high-touch, personalized approach, acting as a strategic advisor. This deep engagement is crucial for their senior-level executive search and consulting services, ensuring tailored solutions and proactive insights. The firm's commitment to ongoing advisory and post-placement support solidifies client loyalty and drives repeat business, with over 80% of retained search clients engaging them for subsequent projects in 2024.

| Customer Relationship Aspect | Description | 2024 Data/Insight |

|---|---|---|

| Partnership Approach | Acting as a trusted advisor, aligning with long-term business goals. | Approximately 70% of revenue generated from repeat business. |

| Personalized Service | Direct engagement with seasoned consultants for tailored solutions. | Emphasis on long-term relationships reflected in strong client retention. |

| Ongoing Support | Leadership development and post-placement assistance for sustained success. | Over 80% of retained search clients engaged for subsequent projects. |

| Thought Leadership | Disseminating market insights and best practices to position as an authority. | Significant client engagement with reports and webinars on leadership trends. |

Channels

Heidrick & Struggles primarily acquires clients and delivers services through direct engagement by its senior consultants and partners. This hands-on approach involves personal meetings, strategic networking, and direct outreach to top-tier C-suite executives and board members.

The firm’s high-value executive search and consulting services inherently demand a direct, relationship-driven channel to build trust and understand complex client needs. In 2024, this direct engagement model remained central to their business, reflecting the personalized nature of their offerings.

A substantial amount of Heidrick & Struggles' new business originates from referrals. Satisfied existing clients, successfully placed candidates, and the firm's broad professional network are key sources of these valuable introductions.

This organic growth channel highlights the high quality of service and the enduring relationships Heidrick & Struggles cultivates. In 2024, referrals continued to be a highly cost-effective and credible method for securing new client engagements, underscoring their importance to the firm's business development strategy.

Heidrick & Struggles actively participates in and hosts major industry conferences and leadership forums. For example, in 2024, the firm continued its tradition of engaging with global business leaders at events like the World Economic Forum's Annual Meeting in Davos, a key platform for showcasing thought leadership and fostering strategic connections. This engagement helps them maintain brand visibility and generate valuable leads among C-suite executives and board members.

Digital Presence and Thought Leadership Platforms

Heidrick & Struggles leverages its official website and professional social media, particularly LinkedIn, as core components of its digital presence. These platforms are vital for showcasing the firm's expertise, attracting potential clients and talent, and disseminating valuable market insights.

The firm's dedicated thought leadership platforms, often found in sections like Insights, are instrumental in establishing and reinforcing its reputation as a leader in executive search and advisory services. By consistently publishing high-quality content, Heidrick & Struggles aims to engage a wider audience and drive inbound inquiries.

- Website Traffic: In Q1 2024, Heidrick & Struggles reported a significant increase in website traffic, indicating strong engagement with their published content and service offerings.

- LinkedIn Engagement: The firm actively uses LinkedIn to share industry analysis and company news, contributing to a substantial follower growth and interaction rate throughout 2024.

- Content Dissemination: Heidrick & Struggles' Insights section frequently features articles and reports on critical business trends, such as AI's impact on leadership and the future of work, positioning them as a go-to resource.

Strategic Publications and Media Relations

Heidrick & Struggles strategically leverages its expertise through the publication of insightful reports, articles, and white papers in leading business and financial media. This proactive approach significantly boosts the firm's visibility and solidifies its reputation as a thought leader in executive search and advisory services. By contributing to respected outlets, they reach a wide array of decision-makers, including those within their target audience of financially-literate individuals and business strategists.

Maintaining robust media relations is a cornerstone of this strategy, ensuring their research and perspectives are widely disseminated. For instance, in 2024, Heidrick & Struggles continued to be a prominent voice in discussions around leadership trends and talent management, with their insights frequently featured in publications like The Wall Street Journal and Forbes. This consistent presence reinforces their brand and attracts both clients and top talent.

- Thought Leadership Dissemination: Publishing original research and analysis in high-impact business journals and news outlets.

- Media Engagement: Cultivating relationships with journalists and editors to secure coverage of firm expertise and insights.

- Audience Reach: Targeting publications read by C-suite executives, board members, and investors to enhance brand awareness and lead generation.

Heidrick & Struggles utilizes a multi-channel approach, heavily emphasizing direct consultant-client interactions for its high-touch executive search and advisory services. Referrals from satisfied clients and a strong professional network also serve as a significant, cost-effective lead generation channel. The firm actively engages in industry conferences and maintains a robust digital presence through its website and LinkedIn, consistently publishing thought leadership content to attract and inform its target audience.

| Channel | Description | 2024 Focus/Data Point |

|---|---|---|

| Direct Engagement | Senior consultants and partners directly meet with C-suite executives and board members. | Remained central to building trust and understanding complex client needs. |

| Referrals | New business generated from existing clients, placed candidates, and professional networks. | Continued to be a highly cost-effective and credible method for securing engagements. |

| Industry Events | Participation in and hosting of major conferences and leadership forums. | Engagement at events like the World Economic Forum's Annual Meeting in Davos to showcase thought leadership. |

| Digital Presence | Website, LinkedIn, and thought leadership platforms for expertise dissemination. | Significant increase in website traffic and substantial follower growth on LinkedIn reported in Q1 2024. |

| Media & Publications | Publishing reports and articles in leading business media, supported by media relations. | Firm's insights frequently featured in publications like The Wall Street Journal and Forbes throughout 2024. |

Customer Segments

Global corporations, encompassing major players in technology, finance, healthcare, and industrial sectors, represent a cornerstone of Heidrick & Struggles' client base. These large, multinational enterprises frequently engage Heidrick & Struggles for high-stakes executive searches, intricate leadership assessments, and comprehensive organizational consulting, all delivered with a global perspective.

Their needs are often complex, requiring tailored strategies for identifying and developing top-tier talent at the most senior levels. For instance, in 2024, a significant portion of Heidrick & Struggles' revenue was derived from serving these large enterprises, reflecting their reliance on expert guidance for critical leadership transitions and strategic organizational development.

Private equity and venture capital firms are key clients, relying on Heidrick & Struggles for executive search to build strong leadership teams within their portfolio companies. This often includes rigorous management due diligence and strategic talent advice to drive growth and maximize value.

These firms have a pressing need for rapid talent acquisition, especially when integrating new acquisitions or scaling up promising startups. For instance, in 2024, the global private equity market continued to see significant deal activity, with trillions of dollars deployed, underscoring the demand for swift and effective leadership placements.

Emerging companies and rapidly growing startups are increasingly turning to Heidrick & Struggles for help in securing essential leadership talent and building strong organizational foundations. These dynamic businesses often require specialized support to scale their leadership capabilities in lockstep with their ambitious growth plans.

Heidrick & Struggles assists these clients in constructing capable executive teams from the ground up. For instance, in 2024, the venture capital funding for startups saw significant activity, with billions invested globally, underscoring the demand for experienced leadership to navigate this rapid expansion and capitalize on market opportunities.

Non-Profit Organizations and Public Sector Entities

Heidrick & Struggles extends its expertise to non-profit organizations, educational institutions, and public sector entities. These clients often require executive search and leadership advisory services specifically designed for their distinct governance structures and operational demands.

These organizations are looking for leaders adept at managing intricate stakeholder relationships and achieving mission-focused results. In 2024, the demand for such specialized leadership within the non-profit and public sectors remained robust, reflecting the ongoing need for effective governance and strategic direction in these critical areas.

- Mission-Driven Leadership: Clients seek executives who can champion their core mission and navigate complex societal challenges.

- Stakeholder Management: A key requirement is the ability to engage effectively with diverse groups, including donors, beneficiaries, government bodies, and the public.

- Governance Expertise: Leaders must understand and operate within specific regulatory frameworks and governance models unique to these sectors.

- Financial Stewardship: Ensuring responsible allocation and management of resources is paramount, often within budget constraints.

Boards of Directors

Boards of directors represent a crucial customer segment for Heidrick & Struggles. They seek specialized assistance for identifying and appointing new board members, evaluating board performance, and planning for leadership transitions, particularly for CEO and other C-suite positions. This engagement underscores the firm's role in fostering strong corporate governance and strategic leadership at the pinnacle of organizations.

In 2024, the demand for experienced board members remained high, with companies prioritizing diverse skill sets and backgrounds. Heidrick & Struggles reported a significant portion of its executive search revenue originating from board-level placements, reflecting the critical nature of these appointments for organizational success and oversight. For instance, a notable trend in 2024 saw an increased focus on appointing directors with expertise in cybersecurity and artificial intelligence, reflecting evolving business landscapes.

- Board Appointments: Heidrick & Struggles assists boards in sourcing and vetting candidates for independent director roles, ensuring alignment with strategic objectives and governance requirements.

- Board Effectiveness Reviews: The firm provides diagnostic tools and advisory services to help boards assess and enhance their own performance, structure, and dynamics.

- CEO and Executive Succession Planning: Boards rely on Heidrick & Struggles for confidential and strategic succession planning for the CEO and other key executive positions, ensuring leadership continuity.

Heidrick & Struggles serves a diverse clientele, from global corporations in technology and finance to private equity firms and burgeoning startups. They also cater to the unique needs of non-profit organizations and educational institutions, as well as providing crucial support to boards of directors.

These segments rely on Heidrick & Struggles for executive search, leadership assessment, and organizational consulting to secure top talent and navigate strategic challenges. For example, in 2024, the firm saw continued strong demand from private equity for leadership placements in portfolio companies, mirroring the trillions invested globally in the sector.

The firm's ability to identify and place leaders with specialized skills, whether for a rapidly scaling startup or a mission-driven non-profit, highlights its adaptability. In 2024, boards increasingly sought directors with expertise in areas like cybersecurity, reflecting evolving market demands and the firm's role in facilitating these critical appointments.

Cost Structure

Salaries and benefits for Heidrick & Struggles' expert consultants, partners, and essential support staff represent the most significant portion of their expenses. This includes not only base pay but also performance-driven bonuses and comprehensive benefits packages, reflecting the value placed on their specialized knowledge and experience.

As a business fundamentally built on human capital, the costs associated with attracting and keeping top-tier talent are paramount. In 2023, Heidrick & Struggles reported total compensation and benefits expense of $647.6 million, underscoring their commitment to investing in their intellectual assets.

Heidrick & Struggles dedicates substantial resources to technology and R&D, aiming to sharpen its service offerings and develop cutting-edge leadership solutions. These expenditures encompass crucial areas like software licensing, robust IT support, and the specialized personnel driving the creation of proprietary methodologies and advanced digital platforms.

The firm's strategic focus on innovation is evident in its significant investments in artificial intelligence and broader digital transformation initiatives. For instance, in 2023, Heidrick & Struggles reported technology and R&D expenses of $144.4 million, reflecting a commitment to staying at the forefront of the executive search and consulting industry.

General and Administrative (G&A) expenses for Heidrick & Struggles encompass essential operational costs like global office rent, facilities upkeep, and administrative support. These are the foundational costs for maintaining their worldwide presence and ensuring smooth day-to-day operations, including crucial legal and finance functions.

For 2024, G&A expenses are a significant component of Heidrick & Struggles' overall cost structure. While specific figures fluctuate, these costs are directly tied to supporting their extensive network of consultants and client-facing operations. For instance, in Q1 2024, Heidrick & Struggles reported total operating expenses of $200.1 million, with G&A being a substantial portion of that, reflecting the investment in their global infrastructure and professional services.

Marketing and Business Development Costs

Heidrick & Struggles' cost structure significantly includes expenditures for marketing and business development. These are vital for maintaining brand presence and attracting new clients in the competitive executive search and consulting landscape. In 2024, the company continued to invest in these areas to foster growth and expand its market reach.

These costs encompass a range of activities, from participating in key industry conferences to developing and distributing thought leadership content. Direct sales efforts also form a substantial part of this expenditure, aimed at identifying and securing new client engagements. These investments are crucial for Heidrick & Struggles to stay top-of-mind with potential clients and to showcase their expertise.

- Marketing and Brand Building: Expenditures on advertising, public relations, and digital marketing campaigns to enhance brand visibility.

- Client Acquisition: Costs associated with sales teams, client relationship management, and business development initiatives.

- Thought Leadership: Investment in research, content creation (reports, articles, webinars), and events to establish expertise.

- Industry Engagement: Costs related to attending and sponsoring industry conferences and networking events.

Travel and Entertainment Expenses

Heidrick & Struggles' cost structure includes significant travel and entertainment (T&E) expenses. These are driven by the necessity for consultants to engage directly with clients and candidates globally. While virtual meetings have become more prevalent, in-person interactions are still vital for establishing trust and discussing sensitive matters, particularly in executive search.

For 2024, it's anticipated that T&E will remain a substantial cost category. For instance, in the first quarter of 2024, Heidrick & Struggles reported selling, general, and administrative expenses, which include T&E, at $146.4 million. This figure underscores the ongoing investment in face-to-face client engagement.

- Global Operations: The international presence of Heidrick & Struggles necessitates considerable travel to serve a diverse client base across different regions.

- Client Relationship Management: Building and maintaining strong relationships with clients, a cornerstone of the executive search business, often requires face-to-face meetings.

- Candidate Engagement: Direct interaction with high-caliber candidates is crucial for assessing fit and securing placements, often involving travel for both parties.

- Virtual vs. In-Person Balance: While technology facilitates virtual interactions, the unique demands of executive search still make in-person meetings a critical, albeit costly, component of the business model.

Heidrick & Struggles' cost structure is heavily weighted towards personnel, with salaries and benefits for their expert consultants and support staff forming the largest expense. This investment in human capital is critical for their service delivery. In 2023, compensation and benefits totaled $647.6 million, highlighting the value placed on their specialized talent.

Significant resources are also allocated to technology and research and development to enhance service offerings and develop innovative leadership solutions. These investments, amounting to $144.4 million in 2023 for technology and R&D, include software, IT support, and the development of proprietary methodologies.

General and administrative costs, including global office rent and operational support, are essential for maintaining their worldwide presence. For Q1 2024, total operating expenses were $200.1 million, with G&A representing a substantial portion of this investment in global infrastructure.

Marketing and business development, alongside travel and entertainment, are also key cost drivers. These are vital for client acquisition, brand building, and maintaining relationships in the competitive executive search market. The firm reported selling, general, and administrative expenses, which include T&E, at $146.4 million in Q1 2024.

| Cost Category | 2023 Actuals (Millions USD) | Q1 2024 Actuals (Millions USD) |

|---|---|---|

| Salaries & Benefits | $647.6 | N/A (Included in Total Operating Expenses) |

| Technology & R&D | $144.4 | N/A (Included in Total Operating Expenses) |

| Selling, General & Administrative (incl. T&E) | N/A | $146.4 |

| Total Operating Expenses | N/A | $200.1 |

Revenue Streams

Heidrick & Struggles' core revenue generation hinges on executive search retainer fees. These fees, a significant portion of their income, are structured as a percentage of the executive's first-year salary, paid in stages as the search progresses. This model ensures a consistent and predictable income flow for the firm.

In 2024, Heidrick & Struggles reported strong performance in its executive search business. For the first quarter of 2024, net revenue from Executive Search was $162.7 million, representing a 1.1% increase compared to the same period in 2023. This demonstrates the continued demand for specialized talent acquisition services and the effectiveness of their retainer-based model in capturing this market.

Heidrick & Struggles generates revenue through project-based fees for its leadership consulting services. These fees cover a range of activities, including leadership assessment, talent development programs, and broader organizational consulting. The structure of these fees is often either fixed for a defined scope or based on time and materials, reflecting the specific needs and complexity of each client engagement.

This consulting segment has been a notable driver of growth for the company. For instance, in the first quarter of 2024, Heidrick & Struggles reported a 10% increase in revenue from its Consulting segment, highlighting its increasing importance to the firm's overall financial performance.

Heidrick & Struggles' On-Demand Talent service generates revenue by charging clients fees for supplying independent, interim executives and specialized professionals. These engagements are typically on a project or contract basis, offering clients immediate access to leadership and expertise for short-term needs.

This segment has shown significant expansion, reflecting a growing demand for flexible talent solutions. For the first quarter of 2024, Heidrick & Struggles reported that its Heidrick Consulting and On-Demand Talent segments combined saw revenue increase by 12% year-over-year, reaching $60.1 million.

Advisory and Retainer-Based Advisory Services

Heidrick & Struggles generates revenue through advisory and retainer-based services, offering clients continuous strategic counsel beyond project-specific engagements. These retainers foster long-term partnerships, ensuring sustained client relationships and a predictable revenue stream.

This model allows the firm to provide ongoing expertise on critical leadership and talent challenges, embedding themselves as trusted advisors. For instance, in 2023, Heidrick & Struggles reported that its consulting and related services, which encompass many of these advisory relationships, contributed significantly to its overall revenue, highlighting the importance of these recurring engagements.

- Recurring Revenue: Retainers provide a stable, ongoing income source, reducing reliance on one-off project wins.

- Deepened Client Relationships: Continuous engagement fosters trust and allows for a more profound understanding of client needs.

- Strategic Partnership: Positions Heidrick & Struggles as an integral part of a client's long-term leadership strategy.

Assessment and Coaching Fees

Heidrick & Struggles generates revenue through assessment and coaching fees, charging for distinct services like leadership assessments, executive coaching, and talent diagnostics. These fees are tied to the firm's proprietary methodologies and the expertise of its consultants in evaluating and developing talent.

These specialized services can be integrated into broader client engagements or provided as standalone offerings. The pricing reflects the significant value derived from the firm's deep insights and advanced tools for talent management.

- Leadership Assessments: Fees for evaluating individual leadership capabilities and potential.

- Executive Coaching: Charges for personalized guidance and development programs for senior leaders.

- Talent Diagnostics: Revenue from in-depth analysis of organizational talent pools and skill gaps.

Heidrick & Struggles diversifies its revenue beyond executive search through its Advisory and Consulting services, which include leadership consulting, talent management, and organizational design. These services are often project-based or retainer-driven, offering clients strategic guidance on critical talent and leadership challenges.

In the first quarter of 2024, the firm's Consulting segment saw a notable 10% revenue increase, underscoring the growing demand for these specialized offerings and their contribution to overall financial performance.

The On-Demand Talent segment also contributes significantly, providing interim executive and specialized professional placements on a contract basis. This flexible talent solution caters to immediate client needs, further broadening Heidrick & Struggles' revenue streams.

| Revenue Stream | Description | Q1 2024 Revenue (Millions USD) | Year-over-Year Growth (Q1 2024 vs Q1 2023) |

|---|---|---|---|

| Executive Search | Retainer fees for placing senior executives. | $162.7 | 1.1% |

| Consulting & On-Demand Talent | Project-based fees for leadership consulting, talent management, and interim placements. | $60.1 | 12% (Combined) |

Business Model Canvas Data Sources

The Heidrick & Struggles International Business Model Canvas is constructed using a blend of proprietary market intelligence, client engagement data, and internal operational analytics. These diverse sources provide a comprehensive view of our value proposition, customer segments, and revenue streams.