Heidelberg Materials Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heidelberg Materials Bundle

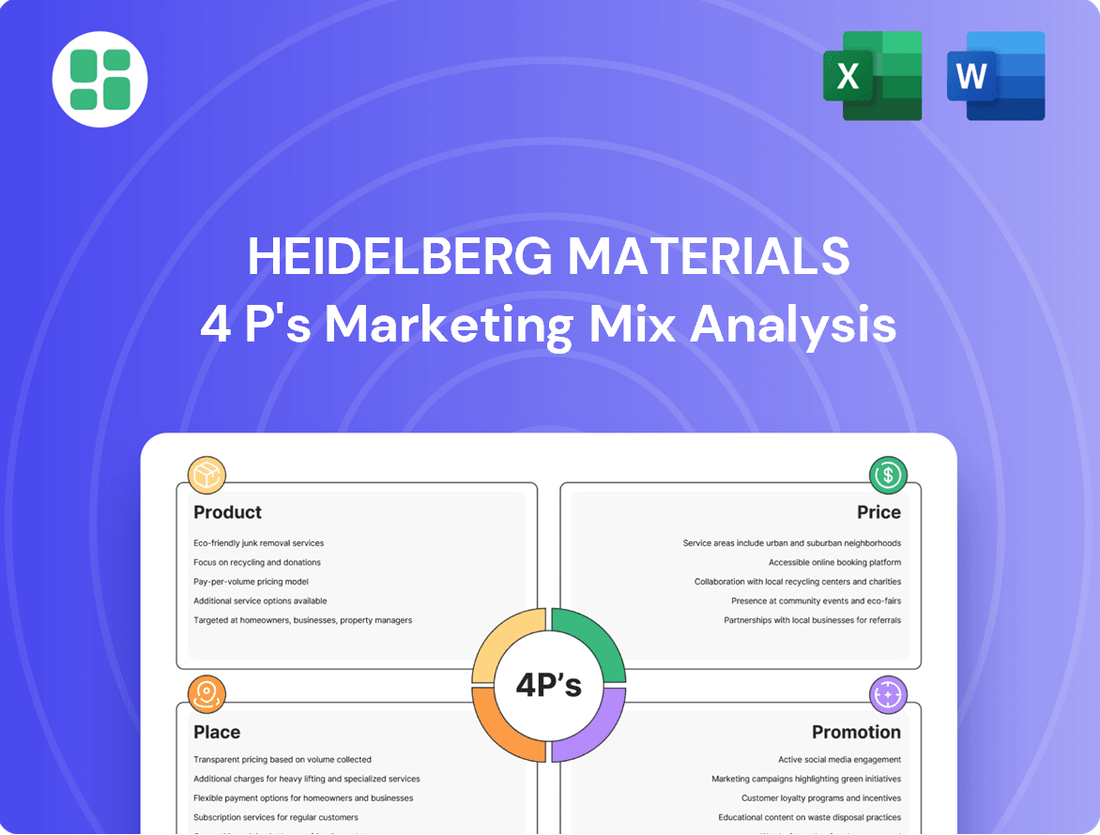

Heidelberg Materials leverages a robust marketing mix, focusing on sustainable building materials (Product) and competitive pricing structures (Price). Their extensive distribution network (Place) ensures widespread availability, while strategic communication campaigns (Promotion) highlight their commitment to innovation and environmental responsibility.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Heidelberg Materials' Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into the building materials sector.

Product

Heidelberg Materials' core product offering encompasses fundamental building materials such as cement, aggregates, and ready-mixed concrete. These are the essential components that underpin virtually all construction activities, from individual homes to significant infrastructure developments.

The company's commitment to quality and reliability ensures that these materials meet the stringent demands of the construction sector. In 2024, Heidelberg Materials reported a significant portion of its revenue derived from its cement and aggregates business lines, highlighting the foundational importance of these products to its overall market position.

Heidelberg Materials' Product strategy highlights their leadership in sustainable construction with evoBuild and evoZero. evoBuild offers a worldwide range of low-carbon and circular products, targeting substantial CO₂ cuts and supporting the circular economy.

evoZero stands out as the first carbon-captured, net-zero cement globally, underscoring their dedication to pioneering industry decarbonization. For instance, in 2024, the company announced plans to scale up its evoBuild range, aiming for a 30% reduction in CO₂ emissions for its concrete products by 2030 compared to 1990 levels.

Heidelberg Materials is heavily investing in digital innovations to transform its product and service portfolio. This includes utilizing AI, like the Giatec SmartMix solution, to boost efficiency in cement production and minimize CO₂ emissions. For instance, in 2024, they aim to further integrate AI for better raw material management, contributing to their sustainability goals.

Furthermore, the company is developing advanced cloud-based platforms to streamline the creation of Environmental Product Declarations (EPDs). This initiative aims to provide customers with greater transparency about the environmental footprint of Heidelberg Materials' products, a critical factor for many in the 2024 construction market seeking greener building solutions.

Tailored Formulations

Heidelberg Materials excels in offering tailored product formulations, a key aspect of their marketing strategy. They develop cementitious materials designed to meet specific project needs and customer preferences, demonstrating a commitment to customization.

This approach includes innovations like cement with reduced clinker content and the incorporation of calcined clay as a sustainable alternative to traditional cement. For instance, in 2024, Heidelberg Materials announced plans to increase the use of supplementary cementitious materials (SCMs) like calcined clay in their products across Europe, aiming to significantly lower the carbon footprint of concrete.

By utilizing alternative fuels and embracing low-carbon solutions, Heidelberg Materials ensures their products deliver optimal performance while actively addressing environmental concerns. This focus on customization and sustainability is a significant differentiator in the market.

- Customization for Project Needs: Formulations adjusted for specific construction demands.

- Low-Carbon Innovations: Development of cement with reduced clinker and calcined clay.

- Environmental Focus: Utilization of alternative fuels to minimize ecological impact.

- Performance Optimization: Ensuring tailored products meet high-performance standards.

Circular Economy Contributions

Heidelberg Materials is deeply invested in the circular economy, focusing on products designed for material reduction and reuse. This strategy directly addresses resource efficiency in the construction sector.

Their commitment is evident in concrete actions, such as the increasing integration of recycled aggregates into their product offerings. Furthermore, they are actively researching and developing methods for the complete recycling of demolition concrete, aiming to substitute virgin materials in new concrete formulations.

This proactive approach is designed to significantly reduce waste generation and optimize resource utilization across the entire construction value chain. For instance, in 2023, Heidelberg Materials reported that recycled and secondary materials accounted for approximately 10% of their total raw material consumption, a figure they aim to grow substantially.

- Product Development: Creating construction materials that facilitate reuse and minimize the need for virgin resources.

- Recycled Aggregates: Actively increasing the percentage of recycled aggregates used in concrete production.

- Demolition Concrete Recycling: Investing in technologies to enable the full recycling of demolition waste for use in new concrete.

- Resource Efficiency: Aiming to reduce waste and maximize the lifespan and recyclability of construction materials.

Heidelberg Materials' product strategy centers on providing essential building materials like cement and aggregates, with a strong emphasis on sustainability and innovation. Their evoBuild range offers low-carbon and circular options, aiming for significant CO₂ reductions, while evoZero represents a net-zero cement breakthrough.

The company is leveraging digital tools, including AI, to enhance production efficiency and reduce emissions, alongside developing cloud platforms for transparent Environmental Product Declarations (EPDs). Tailored formulations, such as those using reduced clinker content and calcined clay, are a key differentiator, further lowering the carbon footprint of their concrete products.

Heidelberg Materials is also committed to the circular economy, incorporating recycled aggregates and developing technologies for full demolition concrete recycling. In 2023, recycled and secondary materials constituted about 10% of their raw material consumption, a figure they are actively working to increase.

| Product Focus | Key Innovations | Sustainability Goal | 2024 Data Point |

|---|---|---|---|

| Core Materials (Cement, Aggregates) | evoBuild (low-carbon/circular), evoZero (net-zero cement) | CO₂ reduction targets, circular economy integration | Significant revenue from cement and aggregates |

| Digital Integration | AI (e.g., Giatec SmartMix), cloud EPD platforms | Production efficiency, emission reduction, transparency | Aiming for further AI integration in raw material management |

| Customization & Circularity | Reduced clinker, calcined clay, recycled aggregates | Resource efficiency, waste reduction, material reuse | Targeting 30% CO₂ reduction for concrete by 2030 (vs. 1990) |

What is included in the product

This analysis provides a professional deep dive into Heidelberg Materials' Product, Price, Place, and Promotion strategies, offering a comprehensive understanding of their marketing positioning.

It's ideal for managers, consultants, and marketers seeking a grounded, data-driven overview of Heidelberg Materials' marketing approach, perfect for reports or strategic benchmarking.

Provides a clear, actionable framework for understanding Heidelberg Materials' marketing strategy, simplifying complex decisions and alleviating the burden of fragmented information.

Offers a concise yet comprehensive overview of Heidelberg Materials' 4Ps, acting as a powerful tool to streamline marketing efforts and reduce strategic uncertainty.

Place

Heidelberg Materials boasts an extensive global integrated network, operating in over 50 countries and encompassing nearly 3,000 locations. This vast reach allows for both local market understanding and global operational synergy.

Their balanced geographical presence is a key asset, enabling them to cater to a wide array of diverse markets effectively. This global footprint is supported by an integrated supply chain, connecting quarries, cement plants, and ready-mix facilities.

Heidelberg Materials prioritizes strategic local production and distribution, a critical element given the high weight-to-value ratio of building materials. Transporting these goods over long distances is simply not cost-effective. This focus ensures materials are readily available where demand is highest.

The company actively establishes distribution terminals to serve growing regional markets efficiently. For instance, their new aggregates terminal in South Carolina leverages rail and other logistical advantages to reach customers. This localized network is key to minimizing freight costs and improving customer accessibility.

In 2024, Heidelberg Materials continued to invest in optimizing its logistics network. The company reported a focus on enhancing regional supply chains to meet local demand more effectively, aiming to reduce transportation expenses which can significantly impact project costs for their construction clients.

Heidelberg Materials is heavily invested in optimizing its supply chain and logistics, a critical component of its marketing mix. Initiatives like the 'Transformation Accelerator' program are designed to streamline operations, with a particular focus on network optimization across Europe. This strategic push aims to enhance the efficiency of material flow and ensure timely delivery to customers.

Further bolstering these efforts are global technical initiatives focused on improving logistics. Heidelberg Materials is also embracing digital transformation, notably through the implementation of Command Alkon's Material Supply application. This digital tool is set to automate raw material ordering processes, a move projected to significantly reduce both administrative overhead and overall logistics expenses.

Direct Sales and Customer Portals

Heidelberg Materials' distribution strategy heavily emphasizes direct sales channels, particularly for its large B2B clientele in the construction sector. This approach allows for a more personalized service, directly addressing the needs of major construction companies and project developers. The company’s commitment to customer convenience is evident in its digital offerings.

To streamline operations and foster stronger client relationships, Heidelberg Materials provides dedicated customer portals and digital tools. These platforms enable clients to easily place orders, monitor delivery schedules, and access essential technical support, significantly boosting efficiency and user experience. This direct engagement model underpins their focus on tailored solutions and robust client partnerships.

- Direct Sales Focus: Primarily targets large construction firms and project developers, ensuring specialized service.

- Digital Customer Platforms: Offers online portals for order management, delivery tracking, and technical assistance.

- Enhanced Client Experience: Aims to improve convenience and efficiency for B2B customers through digital integration.

- Relationship Building: Direct engagement fosters tailored service and strengthens long-term client relationships.

Acquisitions in Growth Markets

Heidelberg Materials actively pursues acquisitions in key growth regions to bolster its market position. In 2024, for instance, the company continued its strategic expansion, with a significant focus on North America and the Asia-Pacific region, areas identified for robust future demand in construction materials.

These strategic moves are designed to enhance production capacity and distribution networks. For example, past acquisitions like Giant Cement Holding Inc. in the US and Midway Concrete in Australia have been pivotal in expanding their operational footprint and product offerings, particularly in sustainable solutions.

The company's acquisition strategy directly supports its objective to meet escalating demand and broaden its portfolio of environmentally friendly products. As of early 2025, Heidelberg Materials reported that its investments in these growth markets were contributing to an increased market share in targeted segments.

- Strategic Acquisitions: Heidelberg Materials targets growth markets like North America and Asia-Pacific.

- Capacity Enhancement: Acquisitions increase production capabilities and distribution reach.

- Sustainable Portfolio: Focus on expanding offerings of eco-friendly building materials.

- Market Share Growth: Investments in 2024 and early 2025 aimed at increasing presence in key segments.

Heidelberg Materials' place strategy centers on a vast, integrated global network of nearly 3,000 locations across over 50 countries. This extensive footprint is crucial because building materials have a high weight-to-value ratio, making localized production and distribution essential to minimize costly long-distance transport. The company actively develops distribution terminals, like the one in South Carolina, to efficiently serve regional demand and reduce freight expenses for customers.

In 2024, Heidelberg Materials continued to focus on optimizing its logistics and supply chain through initiatives like the 'Transformation Accelerator' program, specifically targeting network efficiency in Europe. Digital transformation is also key, with the implementation of Command Alkon's Material Supply application set to automate ordering processes, thereby cutting administrative and logistics costs. This strategic approach ensures materials are available where and when needed, directly impacting project timelines and budgets for their construction clients.

Heidelberg Materials' strategic acquisitions in 2024 and early 2025, particularly in North America and Asia-Pacific, bolster its production capacity and distribution networks. These moves are designed to meet growing demand and expand their portfolio of sustainable products, contributing to increased market share in targeted segments.

| Metric | 2023 (Reported) | 2024 (Target/Focus) | 2025 (Outlook/Focus) |

|---|---|---|---|

| Global Locations | ~3,000 | Continued optimization | Continued optimization |

| Key Growth Markets | North America, Asia-Pacific | Strengthening presence | Further expansion |

| Logistics Investment | Ongoing | Network optimization, Digitalization | Efficiency gains |

What You Preview Is What You Download

Heidelberg Materials 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. It details Heidelberg Materials' 4P's Marketing Mix, covering Product, Price, Place, and Promotion strategies. This comprehensive analysis is ready for your immediate use.

Promotion

Heidelberg Materials champions its sustainability leadership through clear communication, focusing on ambitious decarbonization goals and pioneering low-carbon solutions such as evoBuild and evoZero. This commitment is consistently shared via annual sustainability reports, investor briefings, and public declarations, underscoring their dedication to reaching net-zero concrete by 2050 and spearheading the sector's climate transformation.

Heidelberg Materials actively uses digital marketing to promote its extensive range of products and services, aiming to establish a dominant digital ecosystem within the heavy building materials sector. This strategic focus is evident in their investment in AI technologies to boost operational efficiency. For instance, by mid-2024, they were integrating AI across various business units to optimize production processes and supply chain management, contributing to a projected 5% increase in operational efficiency by year-end.

Central to their digital strategy is the development of cloud-based platforms, such as those facilitating environmental product declarations (EPDs). These tools streamline the process for customers to access crucial sustainability data, reinforcing Heidelberg Materials' commitment to transparency and digital innovation. By the end of 2024, the company planned to have over 1,000 product EPDs available through their digital channels, simplifying compliance and product selection for clients.

The company's digital transformation is designed to complement its portfolio of low-carbon materials with advanced digital services. This approach enhances customer value by offering integrated solutions that address both material performance and digital integration needs. Heidelberg Materials anticipates that its digital service offerings will contribute an additional 3-4% to their revenue growth in the 2024-2025 fiscal period, underscoring the financial impact of their digital ecosystem development.

Heidelberg Materials actively cultivates industry partnerships and collaborations to foster innovation and champion sustainable construction. These alliances are crucial for advancing their goal of carbon neutrality, as seen in their work with the Portland Cement Association on industry-wide roadmaps.

Collaborations with technology firms like Giatec Scientific and Command Alkon are central to developing integrated digital solutions, streamlining operations and enhancing efficiency. For example, their partnership with Command Alkon aims to improve digital connectivity across the construction supply chain.

These strategic alliances not only bolster Heidelberg Materials' credibility but also significantly expand their influence and reach within the broader construction and materials sector, supporting their market position.

Investor Relations and Financial Reporting

Heidelberg Materials cultivates a robust relationship with the financial community through diligent investor relations and transparent financial reporting. This includes detailed annual and sustainability reports, accessible financial statements, and insightful investor presentations. In 2024, the company reported a significant focus on demonstrating strong financial performance and a clear commitment to its ESG targets, aiming to resonate with investors prioritizing both profitability and sustainable growth.

The company's reporting emphasizes disciplined capital allocation strategies and tangible progress on environmental, social, and governance (ESG) objectives. This approach is designed to attract and retain a discerning investor base that demands comprehensive financial data alongside opportunities for sustainable investment. For instance, their 2024 financial disclosures highlighted continued investment in decarbonization technologies, a key ESG metric for many stakeholders.

- Strong Financial Performance: Heidelberg Materials consistently communicates its financial health through regular reporting.

- ESG Commitment: Progress on sustainability goals is a central theme in investor communications.

- Disciplined Capital Allocation: The company outlines its strategic use of capital to drive growth and shareholder value.

- Investor Engagement: Regular presentations and reports foster transparency and trust with the financial community.

Public Relations and Media Engagement

Heidelberg Materials actively leverages public relations and media engagement to communicate significant achievements and strategic directions. This includes issuing press releases, contributing to industry publications, and fostering media relationships to highlight key milestones such as project completions, like the Brevik Carbon Capture and Storage (CCS) plant, and strategic initiatives. For instance, in 2024, the company continued to emphasize its role in the energy transition, with CCS projects being a central theme in its media outreach.

This proactive approach ensures widespread understanding of their progress in decarbonization efforts, portfolio adjustments, and overall business performance. By consistently engaging with media outlets and stakeholders, Heidelberg Materials aims to build a strong reputation for innovation and sustainability. Their media engagement in 2024 often featured updates on their sustainability targets and the tangible progress made towards achieving them, reinforcing their commitment to environmental stewardship.

- Brevik CCS Plant: A key example of a milestone communicated through media engagement, showcasing advancements in carbon capture technology.

- Decarbonization Focus: Media efforts consistently highlight Heidelberg Materials' commitment to reducing its carbon footprint, a critical aspect of its public image.

- Stakeholder Communication: Public relations activities are designed to inform investors, customers, and the general public about the company's strategic direction and achievements.

- Industry Recognition: Engagement with industry publications aims to position Heidelberg Materials as a leader in sustainable building materials and innovative solutions.

Heidelberg Materials employs a multifaceted promotional strategy, heavily leaning on digital channels and sustainability narratives. Their communication emphasizes pioneering low-carbon solutions like evoBuild and evoZero, aiming to solidify their leadership in decarbonization. This is supported by consistent reporting, investor briefings, and public declarations detailing their net-zero concrete by 2050 goal.

The company actively invests in AI and cloud-based platforms to enhance operational efficiency and customer access to critical data, such as over 1,000 planned environmental product declarations by the end of 2024. This digital transformation is projected to contribute an additional 3-4% to revenue growth in the 2024-2025 fiscal period.

Strategic partnerships and robust investor relations are key promotional tools, fostering innovation and transparency. Media engagement, highlighted by milestones like the Brevik Carbon Capture and Storage (CCS) plant, further amplifies their commitment to sustainability and innovation, reinforcing their industry leadership.

Price

Heidelberg Materials utilizes value-based pricing, particularly for its innovative sustainable product lines such as evoBuild and evoZero. These offerings are positioned to command premium pricing due to their reduced environmental footprint and their ability to help customers achieve their own sustainability targets.

This strategy acknowledges the tangible and intangible benefits these products deliver, going beyond mere material cost. The company's ambitious goal of deriving over 50% of its revenue from sustainable products by 2030 underscores the strategic importance and anticipated profitability of this value-driven approach.

Heidelberg Materials places a strong emphasis on cost management and operational efficiency, crucial for navigating volatile energy and raw material prices. Their 'Transformation Accelerator' program is a prime example, designed to deliver substantial annual gross contributions by optimizing their network and improving cross-functional efficiency. For instance, in 2023, this program contributed €640 million to their results, showcasing its direct impact on profitability.

Heidelberg Materials adjusts its pricing based on regional market demand and the intensity of competition. In areas where the construction sector experiences stable but low demand, pricing strategies reflect these conditions. For instance, in 2024, some European markets saw construction output contracting, influencing pricing flexibility for basic materials.

The company enjoys significant pricing power in developed regions for its upstream products like aggregates and cement. This strength stems from substantial barriers to entry, such as high capital investment and regulatory hurdles, coupled with a scarcity of viable substitute materials, allowing for premium pricing strategies.

Long-Term Contracts and Project-Based Pricing

Heidelberg Materials leverages long-term contracts and project-based pricing, a necessity for the significant scale and duration of construction endeavors. This approach ensures predictable revenue streams and allows for highly customized pricing, factoring in project scope, timeline, and the precise material needs of each undertaking.

The company's extensive product and service offerings enable them to present integrated solutions. This bundling strategy, combining various materials and services, provides clients with a convenient and often more cost-effective procurement process.

- Project-Specific Negotiations: Pricing is tailored to individual project requirements, reflecting material volume, delivery logistics, and any specialized product formulations.

- Revenue Stability: Long-term contracts provide a predictable revenue base, mitigating short-term market volatility.

- Bundled Solutions: Heidelberg Materials offers comprehensive packages, combining cement, aggregates, ready-mixed concrete, and potentially related services, simplifying the supply chain for large projects.

- Value-Based Pricing: Pricing reflects the total value delivered, not just the cost of individual materials, considering factors like reliability, technical support, and project management assistance.

External Factors and Economic Conditions

Heidelberg Materials' pricing is significantly shaped by the broader economic landscape. Inflationary pressures in 2024 and 2025 are a key consideration, impacting input costs and, consequently, selling prices for cement and aggregates. Government infrastructure initiatives, such as Germany's proposed EUR 500 billion infrastructure fund, are anticipated to boost demand and support pricing power in the European market. This increased public spending is projected to drive volume recovery, benefiting companies like Heidelberg Materials.

Environmental regulations also exert a considerable influence on pricing. Stricter regulations, while increasing compliance costs, can also act as a barrier to entry for new competitors, thereby supporting more resilient price increases for established players. For example, evolving carbon pricing mechanisms and emissions standards in key markets could necessitate higher prices for lower-carbon products, a segment where Heidelberg Materials is investing.

- Inflationary Impact: Consumer Price Index (CPI) in the Eurozone averaged 5.4% in 2023, with projections for 2024 and 2025 indicating a gradual decrease but still elevated levels compared to pre-pandemic figures, influencing raw material and energy costs for Heidelberg Materials.

- Infrastructure Spending: Germany's commitment to modernizing infrastructure, including transport and energy networks, represents a substantial market opportunity, with an estimated EUR 500 billion in potential investment over the coming years.

- Regulatory Environment: The EU's Green Deal and Fit for 55 package are driving stricter environmental standards, potentially leading to price premiums for sustainable building materials and impacting the cost structure of traditional products.

Heidelberg Materials employs a multi-faceted pricing strategy, balancing value-based premiums for sustainable products with market-driven adjustments for standard offerings. This approach is crucial for navigating cost fluctuations and regional demand dynamics.

The company's pricing power is evident in developed markets for upstream products, supported by high entry barriers and limited substitutes. This allows for premium pricing on essential materials.

Long-term contracts and project-specific negotiations are key, ensuring revenue stability and catering to the unique needs of large-scale construction projects. Bundled solutions further enhance customer value and procurement efficiency.

| Pricing Strategy Element | Description | Impact/Example |

|---|---|---|

| Value-Based Pricing | Premium pricing for sustainable products (e.g., evoBuild, evoZero) reflecting environmental benefits and customer sustainability goals. | Supports higher margins and aligns with the 2030 goal of over 50% revenue from sustainable products. |

| Market-Driven Adjustments | Pricing adapts to regional demand, competition, and economic conditions. | In 2024, contracting construction output in some European markets led to pricing flexibility for basic materials. |

| Cost Management & Efficiency | Focus on optimizing operations to mitigate volatile input costs. | The 'Transformation Accelerator' program delivered €640 million in 2023, directly impacting profitability and pricing flexibility. |

| Pricing Power (Upstream) | Strong pricing ability for aggregates and cement in developed regions due to high barriers to entry. | Allows for premium pricing strategies where competition is limited. |

| Contractual & Project Pricing | Utilizes long-term contracts and project-specific pricing for large-scale construction. | Ensures revenue predictability and allows for customized pricing based on project scope and material needs. |

4P's Marketing Mix Analysis Data Sources

Our Heidelberg Materials 4P's Marketing Mix Analysis is built upon a foundation of verified data, including official company reports, investor communications, and industry-specific market research. We meticulously gather information on their product offerings, pricing strategies, distribution networks, and promotional activities to ensure a comprehensive and accurate representation of their market approach.