Heidelberg Materials Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heidelberg Materials Bundle

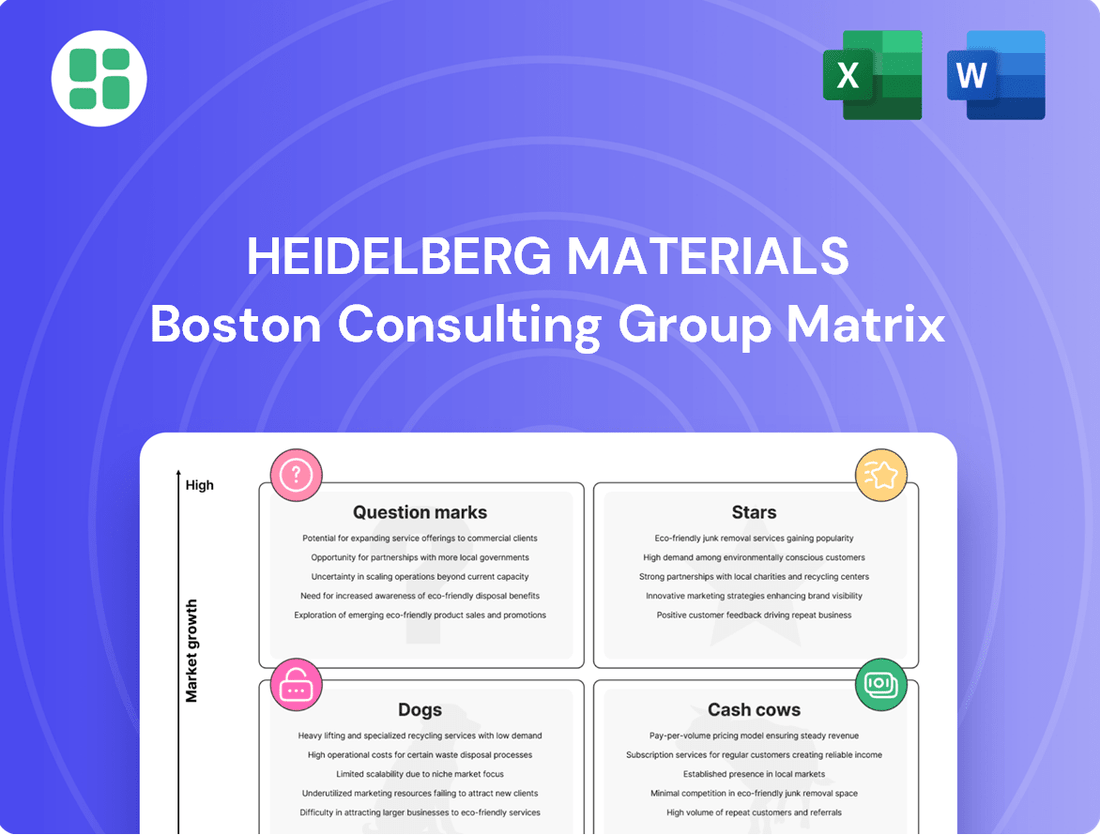

Heidelberg Materials' BCG Matrix offers a strategic snapshot of their product portfolio, highlighting potential growth areas and resource drains. Understanding where their key offerings fall – as Stars, Cash Cows, Dogs, or Question Marks – is crucial for informed decision-making.

This glimpse into Heidelberg Materials' strategic positioning is just the beginning. Purchase the full BCG Matrix report to unlock detailed quadrant analysis, data-driven recommendations, and a clear roadmap for optimizing their product mix and capital allocation.

Stars

evoZero® Carbon-Captured Cement is a star in Heidelberg Materials' BCG Matrix, representing a groundbreaking net-zero cement solution. Its high growth potential is evident in the rapidly decarbonizing construction sector, with all of its 2025 production already pre-sold, underscoring strong market demand and a leading position for this innovative, high-value product.

Heidelberg Materials is significantly investing in digital solutions for construction, notably AI-driven automation for Environmental Product Declarations (EPDs). This innovation accelerates the process of providing customers with crucial carbon footprint data, a key differentiator in today's market.

This digital push is a high-growth area, enhancing operational efficiency across all 100 of its cement plants through predictive analytics. By enabling faster market entry for sustainable products, Heidelberg Materials is solidifying its competitive advantage and driving industry modernization.

Heidelberg Materials' investment in calcined clay cement production, exemplified by the April 2025 commissioning of the world's largest plant in Ghana, places it squarely in a high-growth, sustainable materials market. This strategic move is driven by calcined clay's ability to significantly reduce reliance on CO₂-emitting clinker, a critical factor in the industry's decarbonization efforts.

With the global construction sector increasingly prioritizing low-carbon alternatives, calcined clay cement represents a substantial opportunity for market share expansion. Heidelberg Materials' leadership in scaling this innovative technology positions it to benefit from evolving regulatory landscapes and growing customer demand for environmentally responsible building materials.

Carbon Capture and Utilisation (CCU) Projects

Projects like CAP2U in Lengfurt, Germany, which became operational in 2025, are positioned as stars in Heidelberg Materials' BCG matrix. These initiatives focus on capturing CO₂ for industrial reuse, targeting high-growth markets such as food and chemicals. This strategic move transforms captured CO₂ from a waste product into a valuable raw material, creating new revenue streams.

Heidelberg Materials is leveraging its core operations to drive innovation in carbon utilization. The CAP2U project, for instance, is expected to capture approximately 70,000 tonnes of CO₂ annually, demonstrating a tangible commitment to this emerging sector. This pioneering effort highlights the company's potential for market expansion beyond its traditional building materials business.

- Innovation in CO₂ Reuse: CAP2U in Lengfurt, Germany, operational from 2025, captures CO₂ for sectors like food and chemicals.

- New Revenue Streams: Transforms captured CO₂ into a valuable raw material, opening up new market opportunities.

- Market Expansion Potential: Extends Heidelberg Materials' reach beyond traditional building materials into high-growth utilization markets.

- Operational Scale: The CAP2U project aims to capture around 70,000 tonnes of CO₂ annually, showcasing significant operational capacity.

North American Market Expansion (Strategic Acquisitions)

Heidelberg Materials' strategic acquisitions in North America, such as the acquisition of Giant Cement Holding Inc. in the U.S. and the assets of BURNCO in Edmonton, Canada, are key drivers for its growth strategy. These moves are designed to significantly expand the company's presence in vital markets. For instance, the 2024 acquisition of Giant Cement Holding Inc. added substantial capacity in the U.S. Southeast, a region experiencing robust construction activity.

These acquisitions are crucial for diversifying Heidelberg Materials' revenue streams and capitalizing on the increasing demand for sustainable building materials. The North American market, particularly in regions slated for infrastructure development, presents high growth potential. By integrating these new assets, the company aims to enhance its market share and leverage synergies across its operations.

- Acquisition of Giant Cement Holding Inc. (2024): Strengthened U.S. market position, adding significant cement production capacity.

- Acquisition of BURNCO assets (2025): Expanded footprint in Canada, particularly in the Western region, focusing on aggregates and ready-mix concrete.

- Market Focus: Targeting regions with strong infrastructure investment and a growing preference for eco-friendly construction solutions.

- Strategic Objective: To achieve increased market share and revenue growth through consolidation and operational efficiencies in North America.

Heidelberg Materials' eco-friendly cement innovations, like evoZero® and calcined clay cement, along with its CO₂ capture projects such as CAP2U, are positioned as stars in its BCG matrix. These represent high-growth, high-market-share products and initiatives, reflecting significant investment and strong market adoption potential in the evolving construction landscape.

The company’s strategic acquisitions in North America, including Giant Cement Holding Inc. in 2024 and BURNCO assets in 2025, also fall into the star category. These moves bolster Heidelberg Materials' market presence and capacity in key growth regions, aligning with the increasing demand for sustainable building solutions.

| Product/Initiative | Market Growth | Market Share | BCG Category |

|---|---|---|---|

| evoZero® Carbon-Captured Cement | High (Decarbonizing Construction) | High (Pre-sold 2025 Production) | Star |

| Calcined Clay Cement | High (Sustainable Materials Demand) | High (World's Largest Plant in Ghana) | Star |

| CAP2U CO₂ Capture Project | High (CO₂ Reuse Markets) | High (New Revenue Streams) | Star |

| North American Acquisitions (2024-2025) | High (Robust Construction Activity) | High (Expanded Market Presence) | Star |

What is included in the product

Heidelberg Materials' BCG Matrix offers a strategic view of its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

A clear BCG Matrix visualizing Heidelberg Materials' portfolio helps prioritize investments, relieving the pain of resource allocation uncertainty.

Cash Cows

Heidelberg Materials' traditional cement production in established markets, such as Germany, acts as a significant cash cow. This core business consistently generates substantial cash flow, underpinning the company's financial stability.

In 2024, the company reported a record result from current operations (RCO) of €3.2 billion. This strong performance, achieved despite declining volumes in certain areas, highlights the segment's robust profit margins maintained through effective cost control and strategic pricing.

Heidelberg Materials' aggregates business, encompassing essential materials like sand, gravel, and crushed rock, represents a cornerstone of their operations. This segment operates within a mature market, yet Heidelberg Materials maintains a leading global presence, ensuring a consistent and substantial contribution to the company's revenue and profitability.

The aggregates market is characterized by significant barriers to entry, such as substantial capital investment and regulatory hurdles. This, combined with regional pricing power, allows the aggregates segment to generate robust and reliable cash flow. While growth prospects are relatively modest, the stability of this income stream is vital.

In 2023, Heidelberg Materials reported that its Aggregates segment generated a significant portion of its earnings before interest, taxes, depreciation, and amortization (EBITDA). The company's strategic focus on operational excellence and efficient resource management within this mature segment underscores its role as a dependable cash generator, providing the financial foundation for investments in growth areas.

Heidelberg Materials' ready-mixed concrete operations are a cornerstone of its business, holding a significant market share in a mature but vital construction sector. These operations are strategically integrated with cement and aggregate production, creating streamlined supply chains that generate consistent and dependable cash flow for the company.

The demand for ready-mixed concrete, while experiencing low growth, remains stable, translating into predictable earnings. For instance, in 2023, Heidelberg Materials reported substantial revenue from its Aggregates & Cement segment, which includes concrete, demonstrating the reliable financial contribution of these mature businesses.

Established European Operations

Heidelberg Materials' established European operations represent a significant cash cow. These mature markets, while experiencing slower growth, benefit from the company's dominant market share and highly efficient operational structures, ensuring consistent and robust cash generation.

The strong financial performance from these European segments is crucial. For instance, in 2024, the company reported significant contributions from its European activities, underpinning its overall profitability. These consistent earnings are instrumental in funding Heidelberg Materials' investments in growth areas and innovation across its global portfolio.

- Dominant Market Share: Heidelberg Materials holds leading positions in key European markets, allowing for pricing power and stable demand.

- Operational Efficiencies: Advanced logistics and production facilities in Europe contribute to high margins and cost competitiveness.

- Steady Cash Flow: Despite low market growth, these operations provide a reliable and substantial source of free cash flow for the company.

- Strategic Funding: Profits generated here are vital for financing R&D and expansion into emerging markets.

Existing Infrastructure and Logistics Networks

Heidelberg Materials' existing infrastructure and logistics networks are true cash cows. Their vast global footprint of production plants, quarries, and distribution channels is a mature asset that consistently generates strong, reliable cash flow. This is driven by their deep market penetration and highly optimized operations.

These established assets don't demand significant new investment for growth or promotion. Instead, they deliver high returns because they are fundamental to the construction supply chain. For instance, in 2024, the company continued to leverage its integrated network, which includes over 3,000 operational sites globally, to ensure efficient delivery of essential building materials.

- Global Reach: Operates in over 50 countries, ensuring broad market access.

- Operational Efficiency: Optimized logistics reduce costs and improve delivery times.

- Consistent Cash Flow: Mature assets require minimal investment while generating steady revenue.

- Market Dominance: Facilitates widespread distribution of core products, solidifying market position.

Heidelberg Materials' core cement production in established European markets, like Germany, functions as a significant cash cow. This foundational business consistently generates substantial cash flow, contributing to the company's financial stability.

In 2024, the company reported a strong result from current operations (RCO) of €3.2 billion, with its mature segments playing a crucial role in this performance. This highlights the robust profit margins maintained through effective cost control and strategic pricing in these established areas.

The aggregates business, a key component of Heidelberg Materials' operations, also acts as a cash cow. Despite operating in a mature market, the company's leading global presence ensures a consistent and substantial contribution to revenue and profitability, providing a stable income stream.

Heidelberg Materials' ready-mixed concrete operations, integrated with cement and aggregate production, also represent a dependable cash generator. The stable, albeit low-growth, demand for these products translates into predictable earnings, reinforcing their cash cow status.

| Heidelberg Materials' Cash Cow Segments | Key Characteristics | 2024 Financial Impact (Illustrative) |

| Established European Cement Production | Dominant market share, operational efficiencies, pricing power. | Significant contribution to RCO, underpinning financial stability. |

| Aggregates Business | High barriers to entry, regional pricing power, global presence. | Consistent and substantial contribution to revenue and profitability. |

| Ready-Mixed Concrete | Strategic integration with cement and aggregates, stable demand. | Predictable earnings, reliable financial contribution. |

What You’re Viewing Is Included

Heidelberg Materials BCG Matrix

The Heidelberg Materials BCG Matrix you are previewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed by industry experts, will be delivered directly to you, ready for immediate strategic application. You can be confident that no watermarks or sample content will be present; only the complete, actionable report awaits.

Dogs

Older, less efficient cement or aggregate plants that have not undergone significant modernization or decarbonization efforts may represent Dogs in Heidelberg Materials' portfolio. These facilities likely have lower market share in their specific sub-regions due to higher operational costs and environmental footprints, leading to minimal profitability or even cash drain. For example, in 2023, Heidelberg Materials reported that its European operations, which include many older facilities, faced increased energy costs and regulatory pressures, impacting margins.

Segments in declining regional markets, often characterized by low growth and low returns, represent potential 'Dogs' within Heidelberg Materials' portfolio. For example, operations in parts of Eastern Europe that have seen reduced construction investment, coupled with a modest market share for Heidelberg Materials in those specific areas, could fit this category. This situation ties up capital without generating substantial profit, impacting overall efficiency.

Certain highly carbon-intensive, niche product lines with dwindling demand represent potential 'Dogs' for Heidelberg Materials. These specialized materials face shrinking markets due to stricter environmental regulations and a growing preference for sustainable alternatives. In 2024, the global construction industry's increasing focus on embodied carbon means that products with a high carbon footprint are becoming less attractive, directly impacting their market viability and potential for growth.

Minority Stakes in Non-Strategic Joint Ventures

Minority stakes in non-strategic joint ventures would likely fall into the Dogs category of the BCG Matrix for Heidelberg Materials. These are typically small, non-controlling interests in partnerships that don't align with the company's core focus on sustainability and digital innovation.

These ventures often operate in markets with limited growth potential and may generate low returns. For instance, a small stake in a regional concrete producer in a mature market might fit this description. Heidelberg Materials could consider divesting these assets to reallocate capital towards more promising strategic initiatives.

- Low Growth Markets: Investments in sectors with projected annual growth rates below 5% could be considered Dogs.

- Non-Strategic Alignment: Ventures not contributing to sustainability goals or digital transformation efforts.

- Limited Influence: Minority stakes (e.g., less than 20%) offer little control over strategic direction.

Legacy IT Systems and Manual Processes

Legacy IT systems and manual processes at Heidelberg Materials represent significant operational drag. These older, often disconnected systems, particularly those lacking AI automation in areas like EPD creation, severely limit efficiency and data visibility. For instance, in 2024, companies relying on manual data entry experienced an average of 15% more errors compared to automated systems, impacting downstream decision-making.

These internal operational "units" consume substantial resources, including labor and time, with minimal return on innovation. This reliance on outdated infrastructure can significantly slow the adoption of new, efficiency-boosting technologies. In 2023, the average cost for a company to maintain legacy IT systems was estimated to be 3-4 times higher than modern cloud-based solutions, directly impacting operational costs and agility.

- Operational Inefficiency: Older systems and manual workflows lead to slower processing times and increased risk of human error.

- Data Transparency Gaps: Lack of integration hinders real-time data access and comprehensive analysis, crucial for strategic planning.

- High Maintenance Costs: Maintaining legacy IT infrastructure is often more expensive than investing in modern, scalable solutions.

- Hindered Innovation: Dependence on outdated technology slows down the integration of new digital tools and AI capabilities.

Heidelberg Materials' "Dogs" likely include older, less efficient plants and niche product lines with declining demand. These operations, often found in mature or shrinking markets, struggle with higher operational costs and a weaker competitive position. For example, in 2023, European cement operations faced significant energy cost increases, impacting profitability for less modernized facilities.

Segments in low-growth regions or those not aligned with sustainability goals also fit the Dog profile. These might be minority stakes in non-strategic joint ventures or legacy IT systems hindering digital transformation. In 2024, the construction industry's push for lower embodied carbon makes carbon-intensive products less viable, further pushing such offerings into the Dog category.

These "Dogs" tie up capital and resources without generating substantial returns, potentially draining profitability. Divesting or restructuring these units allows for capital reallocation to more promising, sustainable growth areas within Heidelberg Materials' portfolio.

| Category | Characteristics | Example for Heidelberg Materials (Hypothetical) | Impact on Portfolio |

|---|---|---|---|

| Operational Assets | Older, less efficient plants; high carbon footprint | A legacy cement plant in a mature European market with high energy costs. | Low profitability, cash drain, potential regulatory risk. |

| Market Segments | Declining regional markets; niche products with shrinking demand | Specialized, high-carbon concrete additives facing regulatory pressure. | Minimal market share, low growth potential, capital inefficiency. |

| Strategic Investments | Non-strategic joint ventures; minority stakes | A small stake in a regional concrete producer with limited growth prospects. | Low returns, lack of strategic alignment, opportunity cost. |

| Internal Operations | Legacy IT systems; manual processes | Outdated ERP systems lacking AI integration for EPD management. | Operational inefficiency, high maintenance costs, hindered innovation. |

Question Marks

Heidelberg Materials' early-stage Carbon Capture and Storage (CCS) projects, like the GeZero initiative at its Milke plant in Germany, are positioned as Question Marks in the BCG Matrix. These ventures, with technical planning commencing in late 2024 and construction slated for 2026, embody substantial investment for future decarbonization growth but face uncertainty regarding market acceptance and commercial success.

While Brevik CCS is a Star, other exploratory CCS projects are still in their infancy. The GeZero project, for instance, requires significant capital outlay, reflecting its high-risk, high-reward profile. Its potential to become a future Star hinges on overcoming technological hurdles and establishing a robust market for captured carbon.

Emerging digital construction platforms, extending beyond EPD automation to incorporate AI for project optimization and novel customer engagement, would likely fall into the Question Mark category within the Heidelberg Materials BCG Matrix. These ventures operate in nascent markets characterized by significant growth potential but currently exhibit low market penetration. For instance, the global construction technology market was projected to reach over $11.8 billion in 2024, indicating substantial expansion opportunities.

These innovative digital services demand considerable investment to achieve widespread adoption and secure a dominant market share. Companies venturing into this space must allocate resources for research, development, and market education to overcome initial hurdles. Success in these areas is paramount for Heidelberg Materials to solidify its position as a leader in digital transformation within the construction industry.

Heidelberg Materials' ventures into hydrogen-fueled cement production pilots fall squarely into the Question Mark category of the BCG Matrix. While the potential for deep decarbonization is immense, these projects are in their nascent stages, demanding substantial research and development funding.

These pilots represent a high-growth potential area, aiming to revolutionize cement production by drastically reducing its carbon footprint. However, the technology is still being refined, and significant hurdles remain in terms of technological maturity and the necessary infrastructure development. For instance, the global hydrogen production capacity in 2024 is still developing, with significant investments needed to scale up green hydrogen production for industrial use.

The financial implications are that these initiatives are cash-intensive, with uncertain returns in the short to medium term. Success could unlock a substantial market advantage, but the risk of failure or delayed commercialization is considerable, mirroring the characteristics of a Question Mark requiring careful strategic evaluation and sustained investment.

Recycled Content Building Materials (New Applications)

Recycled content building materials in new applications often represent a question mark in the BCG matrix for companies like Heidelberg Materials. These innovative products, while crucial for sustainability goals, might currently have a low market share and high investment needs. For instance, products utilizing a significant percentage of construction and demolition waste, such as recycled aggregate in concrete or asphalt, are gaining traction but still require substantial market development and regulatory support to compete with traditional materials.

- Low Market Share: Despite growing demand for sustainable construction, products with high recycled content often represent a small fraction of the overall building materials market.

- High Investment Needs: Developing and scaling up new applications for recycled materials requires significant investment in research, technology, and market education.

- Market Acceptance Challenges: Overcoming established norms and gaining acceptance for performance and durability of recycled content materials can be a hurdle.

- Supply Chain Development: Establishing reliable and consistent supply chains for high-quality recycled materials is often necessary for widespread adoption.

New Market Entries with Sustainable Solutions

Heidelberg Materials might consider new market entries with sustainable solutions, targeting geographical areas or specialized construction niches where its green alternatives, like low-carbon concrete for industrial use, are in high demand but its current market share is minimal. These ventures, while demanding significant initial investment and carrying inherent uncertainty, hold the promise of substantial future returns due to the growing preference for environmentally friendly building materials.

For instance, entering the burgeoning Asian market for sustainable infrastructure projects presents a prime opportunity. In 2024, the global green building market was valued at approximately $1.4 trillion and is projected to grow significantly. Heidelberg Materials could leverage its expertise in low-carbon concrete to capture a share of this expanding sector.

- Targeting niche markets: Focusing on high-growth segments like modular construction or pre-fabricated sustainable building components.

- Geographical expansion: Entering regions with strong government mandates for carbon reduction in construction, such as parts of Northern Europe or select North American cities.

- Investment in R&D: Allocating capital towards developing and tailoring sustainable solutions for specific industrial applications, increasing their market appeal.

- Partnership strategies: Collaborating with local developers or construction firms to accelerate market penetration and reduce entry risks.

Heidelberg Materials' early-stage carbon capture and storage (CCS) projects, like the GeZero initiative, are classic Question Marks due to their substantial investment needs and uncertain market success. These ventures, such as the Milke plant project with construction planned for 2026, require significant capital for future decarbonization growth but face hurdles in market acceptance and commercial viability.

Emerging digital construction platforms, including AI for project optimization, also fall into the Question Mark category. These operate in nascent markets with high growth potential but low current penetration, exemplified by the global construction technology market projected to exceed $11.8 billion in 2024.

Heidelberg Materials' hydrogen-fueled cement production pilots are also Question Marks, demanding considerable R&D funding for their deep decarbonization potential. Despite offering revolutionary benefits, the technology and infrastructure require significant development, mirroring the evolving global hydrogen production capacity in 2024.

Recycled content building materials in new applications represent another Question Mark. These products, while vital for sustainability, often have low market share and high investment needs, needing market development and regulatory support to compete with traditional materials.

| Heidelberg Materials' Question Marks | Market Potential | Investment Needs | Current Market Share | Key Challenges |

|---|---|---|---|---|

| Early-stage CCS Projects (e.g., GeZero) | High (Decarbonization) | Very High | Low | Market acceptance, Commercial viability |

| Digital Construction Platforms (AI-driven) | High (Industry Efficiency) | High | Low | Adoption, Market education |

| Hydrogen-Fueled Cement Pilots | Very High (Deep Decarbonization) | Very High | Negligible | Technological maturity, Infrastructure |

| Recycled Content Materials (New Applications) | Growing (Sustainability) | High | Low | Market development, Regulatory support |

BCG Matrix Data Sources

Our Heidelberg Materials BCG Matrix leverages comprehensive market data, including financial reports, industry analyses, and strategic assessments, to provide accurate business unit positioning.