Heidelberg Materials Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Heidelberg Materials Bundle

Heidelberg Materials operates in an industry shaped by intense competition and significant buyer power, as customers often have multiple choices for construction materials. The threat of new entrants is moderate, but established players and high capital requirements create barriers.

The full analysis reveals the real forces shaping Heidelberg Materials’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Heidelberg Materials' operations are fundamentally tied to the availability and cost of key raw materials such as limestone, clay, sand, and gravel. These essential components, often sourced through localized quarrying rights, mean suppliers in prime locations can wield significant influence, particularly when demand surges across the construction sector.

Energy costs, encompassing coal and natural gas, represent another substantial input for Heidelberg Materials. The inherent volatility of global energy markets directly impacts production expenses, and suppliers of these commodities can therefore exert considerable bargaining power, especially during periods of geopolitical instability or supply chain disruptions. For instance, in 2023, natural gas prices saw considerable fluctuations, impacting energy-intensive industries like cement production.

The company's strategic push towards decarbonization, including investments in carbon capture technologies, introduces a new dynamic. The emergence of specialized suppliers for these advanced environmental solutions may grant them increased leverage, as Heidelberg Materials becomes reliant on their unique expertise and equipment to meet its sustainability targets.

The bargaining power of suppliers in logistics and transportation is significant for Heidelberg Materials. The sheer weight and volume of building materials demand specialized transport like trucks, rail, and barges. Suppliers with robust networks and available capacity hold considerable sway, as they are essential for delivering products to customers. Factors such as fluctuating fuel prices and driver shortages, which were notable concerns in 2024, can intensify this supplier leverage, directly affecting Heidelberg Materials' operating expenses.

Suppliers of advanced industrial machinery like kilns and crushers wield considerable influence. This is largely because the initial investment for such specialized equipment is substantial, and few companies can produce these complex systems. For instance, in 2023, the global industrial machinery market was valued at over $2.3 trillion, highlighting the scale of investment involved.

Heidelberg Materials' commitment to technological advancement, particularly in areas like AI-driven operations and predictive maintenance for its plants, means it often depends on suppliers offering cutting-edge solutions. This reliance on specialized, high-tech components can strengthen the bargaining position of these technology providers, as finding alternative suppliers for such niche equipment can be challenging.

Labor and Specialized Skills

The bargaining power of suppliers for Heidelberg Materials is influenced by the availability of skilled labor for critical operations like quarrying, plant management, and technical support. In areas experiencing labor shortages, this can significantly bolster supplier leverage. For instance, in 2024, the construction and materials sector globally continued to grapple with skilled labor deficits, impacting project timelines and operational efficiency for companies like Heidelberg Materials.

Heidelberg Materials' strategic investments in automation and digital technologies are reshaping the labor landscape. The increasing reliance on sophisticated systems for plant operations and maintenance creates a demand for specialized technical expertise. This shift means that providers of these niche skills, such as automation engineers or data scientists focused on industrial processes, can command greater influence and potentially higher costs.

- Skilled Labor Shortages: In 2024, many developed economies reported persistent shortages in skilled trades, affecting the construction materials sector.

- Demand for Technical Expertise: The growing adoption of Industry 4.0 technologies in cement and aggregates production elevates the importance of specialized IT and engineering talent.

- Impact on Operational Costs: A tight labor market for these specialized roles can lead to increased wage pressures, directly impacting Heidelberg Materials' operating expenses.

Environmental and Regulatory Compliance Services

The bargaining power of suppliers in environmental and regulatory compliance services for Heidelberg Materials is elevated due to the intensifying global focus on sustainability. Suppliers providing expertise in carbon reduction, waste management, and environmental adherence are crucial for Heidelberg Materials' strategic goals. For instance, the increasing demand for green building materials and stricter emissions standards mean that specialized service providers can command higher prices and favorable terms.

Heidelberg Materials' proactive stance on decarbonization, aiming for a 47% reduction in CO2 emissions per tonne of cementitious material by 2030 compared to 1990 levels, directly increases the leverage of suppliers offering innovative solutions. Companies that can provide advanced carbon capture technologies or circular economy solutions are in high demand. This reliance on specialized, often proprietary, environmental technologies and services allows these suppliers to exert considerable influence over pricing and contract conditions.

- Increased Demand for Green Solutions: The global market for green building materials is projected to grow significantly, creating a strong demand for compliance services that enable their production.

- Regulatory Pressures: Stricter environmental regulations worldwide, such as those related to CO2 emissions and waste disposal, empower suppliers who can ensure compliance for companies like Heidelberg Materials.

- Technological Expertise: Suppliers offering cutting-edge carbon capture, utilization, and storage (CCUS) technologies or advanced waste-to-resource solutions possess unique capabilities that are vital for Heidelberg Materials' sustainability targets.

- Supplier Concentration: In certain niche areas of environmental technology and consulting, the market may be dominated by a few key players, further enhancing their bargaining power.

Suppliers of raw materials like limestone and clay, especially those with prime locations, hold significant power due to the localized nature of quarrying and the essential role of these materials in cement production. Energy suppliers, particularly for coal and natural gas, also exert considerable influence given the volatile global energy markets and the energy-intensive nature of Heidelberg Materials' operations. For example, in 2023, natural gas price fluctuations directly impacted production costs for many industrial sectors.

The bargaining power of suppliers is amplified by the demand for specialized machinery and advanced technologies. Companies providing critical equipment like kilns and crushers, or cutting-edge solutions for decarbonization such as carbon capture technologies, can leverage their unique offerings. The global industrial machinery market, valued at over $2.3 trillion in 2023, illustrates the substantial investment and reliance on these specialized suppliers.

Logistics and transportation suppliers wield considerable influence due to the high volume and weight of building materials. Factors like fuel price volatility and driver shortages, which were notable concerns in 2024, can intensify this power. Furthermore, skilled labor shortages in critical operational areas, a trend observed globally in 2024 within the construction and materials sector, empower suppliers of specialized technical expertise, leading to increased operational costs for companies like Heidelberg Materials.

Suppliers of environmental and regulatory compliance services are gaining leverage as global sustainability demands intensify. Providers of carbon reduction and waste management expertise are vital for Heidelberg Materials' decarbonization goals, which include a target of 47% CO2 reduction by 2030. The growing market for green building materials and stricter emissions standards empower these specialized service providers, allowing them to command higher prices and favorable terms.

What is included in the product

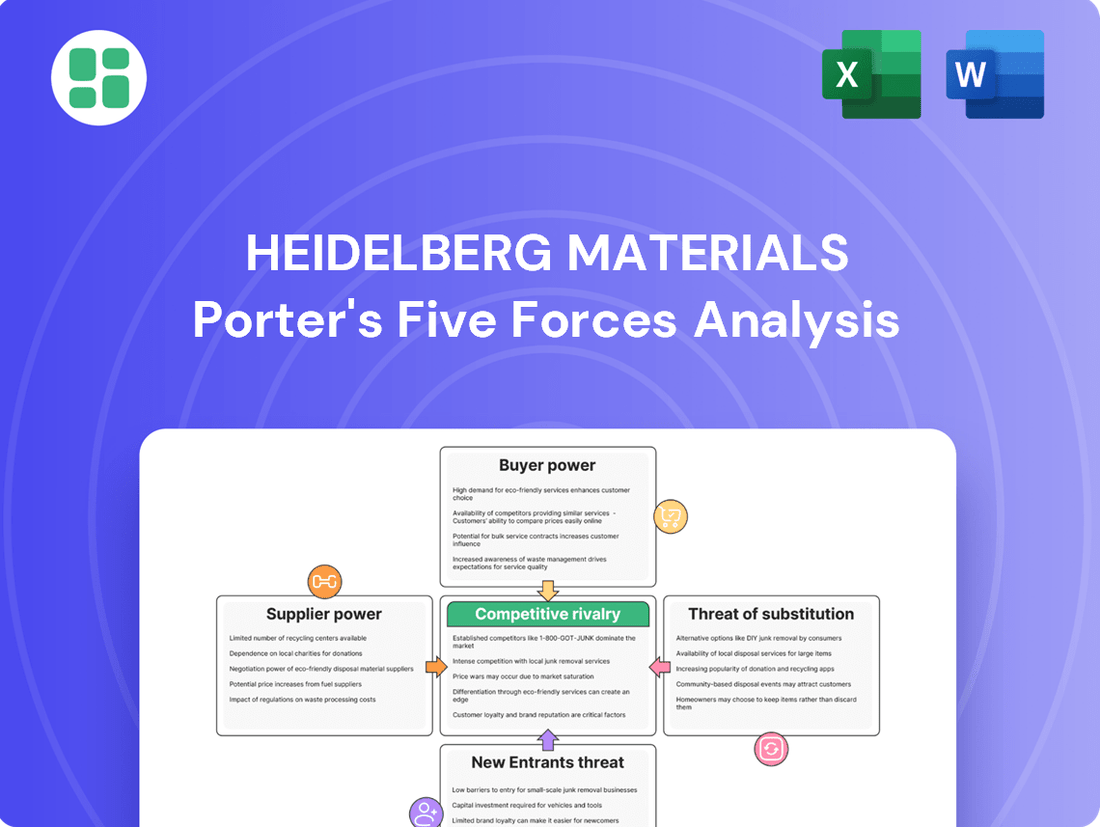

This analysis delves into the competitive forces impacting Heidelberg Materials, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and their collective influence on profitability.

Effortlessly identify and address competitive threats and opportunities within the cement industry, providing a clear roadmap for strategic advantage.

Customers Bargaining Power

Customers undertaking large infrastructure projects, commercial developments, or government contracts, such as those seen in major urban renewal initiatives or national transportation upgrades, possess substantial bargaining power. These buyers procure significant volumes of cement, aggregates, and concrete, often exceeding tens of thousands of tons for a single project. For instance, a major highway construction project could require over 50,000 tons of cement alone.

These large-scale buyers frequently participate in competitive tendering processes, allowing them to compare offers from multiple suppliers. Their considerable purchasing scale empowers them to negotiate favorable prices, customized payment terms, and precise delivery schedules directly with Heidelberg Materials, influencing the supplier's pricing and service offerings.

For commoditized products like cement and aggregates, customers are highly sensitive to price. This means that if Heidelberg Materials raises prices, customers can easily switch to a competitor offering a lower price, especially in a market where there are many suppliers.

In 2024, with general construction demand stabilizing at lower levels, this price sensitivity becomes even more pronounced. Heidelberg Materials must therefore focus on maintaining competitive pricing to hold onto its market share. For instance, if competitors are offering cement at €80 per ton, Heidelberg Materials would struggle to sell at €85 per ton, impacting sales volumes.

The ability for customers to switch suppliers significantly influences Heidelberg Materials' bargaining power. With numerous global and regional building material providers available, customers, especially those purchasing in large volumes, can readily find alternatives if Heidelberg's pricing, quality, or service falters. This ease of switching directly amplifies customer leverage in negotiations.

Demand for Sustainable and Customized Solutions

Customers are increasingly prioritizing sustainable and customized construction materials. This shift empowers them to choose suppliers who offer low-carbon cement or recycled aggregates. For instance, a significant portion of construction projects now incorporate green building standards, driving demand for eco-friendly options. In 2024, the global market for sustainable building materials was projected to reach over $250 billion, highlighting this powerful customer trend.

This growing demand for tailored solutions means customers can exert considerable bargaining power. They can switch to competitors if their specific needs for, say, customized concrete mixes or recycled content are not met competitively. This can put pressure on companies like Heidelberg Materials to innovate and adapt their product offerings to stay relevant and retain market share.

- Customer demand for sustainable materials is a key driver of change in the construction sector.

- The ability to source customized concrete mixes gives customers more leverage.

- Customers may opt for alternatives if sustainable or customized options are not competitively priced.

- Market growth in sustainable building materials underscores customer influence.

Impact of Construction Market Cycles

The cyclical nature of the construction market directly impacts customer bargaining power. When construction activity slows, such as during economic downturns, demand for building materials like those supplied by Heidelberg Materials naturally decreases.

This reduced demand shifts leverage towards customers. They can more effectively negotiate lower prices and more favorable terms as suppliers vie for a smaller pool of projects. For instance, in 2023, global construction output saw varied performance, with some regions experiencing contractions, which would have intensified this customer leverage.

- Increased Price Sensitivity: During construction slowdowns, customers become more price-sensitive, actively seeking the best deals.

- Consolidation of Demand: Fewer active projects mean that larger customers can consolidate their purchasing power, demanding greater concessions.

- Supplier Competition: With lower overall demand, suppliers are more inclined to offer discounts to secure business, further empowering buyers.

Customers, particularly those involved in large-scale infrastructure or commercial projects, wield significant bargaining power due to their substantial order volumes. For example, a single major infrastructure project could necessitate over 50,000 tons of cement, enabling these buyers to negotiate favorable pricing and terms directly with Heidelberg Materials. This power is amplified when customers can easily switch suppliers, especially for commoditized products where price is a primary consideration.

In 2024, with construction demand showing signs of stabilization at lower levels, customer price sensitivity is heightened. Heidelberg Materials must maintain competitive pricing to retain market share, as customers can readily shift to competitors offering lower prices. For instance, a price difference of just €5 per ton of cement could lead to significant volume loss if competitors are priced lower.

The growing demand for sustainable and customized building materials further empowers customers. Projects adhering to green building standards, a market projected to exceed $250 billion globally in 2024, allow customers to select suppliers based on eco-friendly offerings or specific product customizations, influencing Heidelberg Materials' product development and pricing strategies.

| Customer Characteristic | Impact on Bargaining Power | Example Scenario (2024 Context) |

|---|---|---|

| Large Volume Purchasers | High | A government-funded highway project requiring 50,000+ tons of cement can negotiate bulk discounts. |

| Price Sensitivity | High | Customers will switch suppliers if Heidelberg Materials' cement is priced above €80/ton when competitors offer it at €75/ton. |

| Demand for Sustainability | Increasing | Projects specifying low-carbon concrete may favor suppliers meeting these criteria, potentially at a premium if competitors lack offerings. |

| Ease of Switching | Moderate to High | Numerous global and regional suppliers mean customers can easily find alternatives if service or quality falters. |

What You See Is What You Get

Heidelberg Materials Porter's Five Forces Analysis

This preview showcases the complete Heidelberg Materials Porter's Five Forces Analysis, offering a detailed examination of industry competition, buyer and supplier power, and the threat of new entrants and substitutes. The document you see here is precisely the same professionally written and formatted analysis you'll receive immediately after purchase, ready for your immediate use.

Rivalry Among Competitors

Heidelberg Materials faces significant competitive rivalry from global giants like Holcim, Cemex, and CRH. These major players, along with a multitude of strong regional and local competitors, create an intensely competitive environment. This dynamic is especially sharp in established markets where companies battle fiercely for existing customer bases and market share.

In 2023, the global cement market was estimated to be worth around $340 billion, with significant portions dominated by these large multinational corporations. For instance, Holcim reported net sales of CHF 17.5 billion (approximately $19.5 billion USD) in 2023, showcasing the scale of operations these competitors manage.

Heidelberg Materials operates in a capital-intensive building materials sector, meaning substantial investments in plants and quarries are necessary. These high fixed costs create a strong incentive for companies to run their operations at maximum capacity. For instance, in 2024, the construction industry, a key consumer of building materials, saw varied performance across regions, impacting demand and capacity utilization for producers like Heidelberg Materials.

This drive for high capacity utilization often translates into aggressive pricing tactics. When demand falters or supply outstrips needs, companies may engage in price wars to maintain sales volume and cover their fixed expenses. This competitive pressure is a significant factor in the industry's rivalry, as seen in market dynamics where price becomes a primary differentiator during economic slowdowns.

The cement and aggregates industries are largely characterized by commoditized products, meaning they are seen as very similar by customers. This makes it difficult for companies to stand out based on the product itself. For instance, in 2024, the global cement market continued to grapple with this issue, with pricing often dictated by supply and demand dynamics rather than unique product features.

However, companies like Heidelberg Materials strive to differentiate through superior service, efficient logistics, and the development of innovative, sustainable product lines. Heidelberg Materials' focus on eco-friendly cement options and digital customer portals aims to create value beyond the basic material. Despite these efforts, the inherent commoditization means that price remains a crucial factor in customer purchasing decisions, impacting profit margins.

Strategic Acquisitions and Market Expansion

Heidelberg Materials and its rivals are actively involved in strategic acquisitions and divestitures. This maneuvering aims to refine their business portfolios and tap into promising growth regions, with North America being a prime example. This constant reshuffling and the entry or exit of major companies significantly amplify the competitive landscape.

The pursuit of scale and regional leadership through these M&A activities intensifies rivalry. For instance, in 2023, Heidelberg Materials completed the acquisition of a significant cement plant in the US, bolstering its North American presence. Such moves by competitors directly challenge existing market positions and create a more dynamic competitive environment.

- Strategic Acquisitions: Heidelberg Materials' acquisition of the cement plant in the US in 2023 demonstrates a clear strategy to enhance its market share and operational footprint in North America.

- Market Expansion: This expansion into North America is driven by the region's robust construction activity and potential for growth in sustainable building materials.

- Competitive Intensity: The ongoing consolidation and strategic market entries by major players like Heidelberg Materials directly escalate competitive pressures among all industry participants vying for market dominance.

- Portfolio Optimization: Divestitures of non-core assets also play a role, allowing companies to focus resources on high-growth areas and strengthen their competitive standing.

Focus on Decarbonization and Sustainability

The competitive landscape for Heidelberg Materials is significantly shaped by a strong focus on decarbonization and sustainability. Companies are actively vying to develop and market low-carbon concrete and cement alternatives, as well as investing in carbon capture, utilization, and storage (CCUS) technologies. This shift means that innovation in green building materials and environmental performance is becoming a key differentiator.

This intensified rivalry is evident in the significant investments being made across the industry. For instance, in 2024, major players are committing billions to R&D for sustainable solutions. Heidelberg Materials itself announced a €3 billion investment plan through 2030 to accelerate its decarbonization efforts, including the development of CCUS and alternative fuels.

- Industry Investment: Global cement and building materials companies are projected to invest over $100 billion by 2030 in decarbonization technologies.

- Product Innovation: The market is seeing a surge in demand for products like CEM II and CEM III cements, which have lower clinker content and thus lower CO2 emissions.

- Carbon Pricing: The increasing implementation of carbon pricing mechanisms globally, such as the EU Emissions Trading System, further incentivizes the adoption of low-carbon technologies and penalizes high-emission production.

- ESG Performance: Investors and customers are increasingly prioritizing companies with strong Environmental, Social, and Governance (ESG) ratings, making sustainability a critical factor in market share and access to capital.

The competitive rivalry within the building materials sector, particularly for Heidelberg Materials, is fierce and multifaceted. Major global players like Holcim, Cemex, and CRH, alongside numerous regional and local entities, contribute to an intensely competitive market. This rivalry is amplified by the commoditized nature of core products like cement, where price often dictates purchasing decisions, especially during economic downturns. The drive for high capacity utilization, necessitated by significant capital investments in plants and quarries, frequently leads to aggressive pricing strategies among competitors.

Strategic moves, including mergers, acquisitions, and divestitures, further intensify this rivalry as companies seek to consolidate market share and expand into growth regions. For instance, Heidelberg Materials' acquisition of a US cement plant in 2023 aimed to bolster its North American presence. Furthermore, the industry-wide push towards decarbonization and sustainability has introduced a new dimension of competition, with companies investing heavily in low-carbon technologies and products. Heidelberg Materials' €3 billion investment plan through 2030 for decarbonization efforts highlights this trend.

| Competitor | 2023 Net Sales (Approx. USD) | Key Strategic Focus |

|---|---|---|

| Holcim | $19.5 billion | Sustainability, digitalization, diverse building solutions |

| Cemex | $17.4 billion | Decarbonization, circular economy, customer solutions |

| CRH | $32.8 billion | Americas Materials leadership, sustainability, innovation |

SSubstitutes Threaten

The threat of substitutes for Heidelberg Materials' core products, primarily cement and aggregates, is a significant consideration. Alternative building materials such as timber, steel, and increasingly, advanced composites, can replace traditional concrete in various construction applications. For instance, engineered timber products are gaining traction in mid-rise construction, offering a potentially lower embodied carbon alternative. In 2023, the global engineered wood market was valued at approximately $15.8 billion and is projected to grow, indicating a growing preference for these substitutes in certain segments.

The growing adoption of recycled concrete, fly ash, and slag as partial replacements for virgin aggregates and cement directly challenges demand for Heidelberg Materials' core offerings. For instance, in 2024, the European Union continued to push for higher recycled content in construction, with some member states setting targets of over 50% recycled aggregates in new road construction projects.

These alternative materials are gaining traction due to mounting sustainability mandates and the economic advantages of circular economy principles. This shift is particularly evident in regions with strong environmental regulations and where the cost of virgin materials has seen upward pressure, making SCMs increasingly competitive in 2024.

Innovative construction methods like modular construction and 3D printing present a threat by potentially reducing demand for traditional ready-mixed concrete. These techniques can shift production off-site or utilize alternative material forms, thereby decreasing the volume of concrete poured on-site. For instance, the global modular construction market was valued at approximately $100 billion in 2023 and is projected to grow significantly, indicating a growing shift away from traditional on-site building processes.

Bio-based and Eco-friendly Alternatives

Emerging bio-based and eco-friendly alternatives, such as hempcrete and mycelium-based composites, present a growing threat to traditional building materials. While currently occupying a niche market, their adoption is expected to increase as the demand for sustainable construction continues to rise. These innovative materials offer significantly lower embodied carbon footprints and can be sourced from renewable resources, making them attractive substitutes for conventional options, particularly in green building initiatives.

The market for sustainable building materials is expanding. For instance, the global green building materials market was valued at approximately USD 250 billion in 2023 and is projected to reach over USD 450 billion by 2030, indicating a strong growth trend that could accelerate the adoption of bio-based alternatives.

- Growing Demand for Sustainability: Increased consumer and regulatory pressure for environmentally friendly construction practices favors materials with lower embodied energy and carbon emissions.

- Technological Advancements: Ongoing research and development are improving the performance and cost-effectiveness of bio-based materials, making them more competitive.

- Policy Support: Government incentives and building codes that promote sustainable construction can further drive the adoption of these alternatives, potentially impacting Heidelberg Materials' market share in specific segments.

Performance-Based Material Shifts

Advancements in material science present a significant threat of substitutes for Heidelberg Materials. Innovations like self-healing concrete or advanced polymers could offer superior performance, potentially displacing traditional cementitious materials. For instance, research in bio-concrete, which uses bacteria to repair cracks, could offer greater durability and longevity than conventional concrete.

While Heidelberg Materials actively invests in research and development for next-generation materials, external breakthroughs could still disrupt the market. A new composite material, for example, might emerge offering a compelling blend of reduced environmental impact, enhanced strength, and competitive pricing that traditional cement cannot easily match. This necessitates continuous monitoring of emerging technologies and a proactive approach to innovation.

- Material Science Innovations: Emerging materials like self-healing concrete and advanced polymers offer potential performance advantages over traditional cement.

- External Disruptions: Unforeseen innovations from competitors could introduce materials with superior cost, performance, and sustainability profiles.

- Heidelberg Materials' R&D: The company's investment in new material development is crucial to mitigating this threat, aiming to stay ahead of or match external advancements.

The threat of substitutes for Heidelberg Materials is multifaceted, stemming from both established alternative materials and emerging innovations. Engineered timber, for instance, is increasingly viable for mid-rise construction, with the global engineered wood market valued at approximately $15.8 billion in 2023. Furthermore, the push for circular economy principles in 2024 has led to a greater adoption of recycled aggregates and supplementary cementitious materials (SCMs) in many regions, directly impacting demand for virgin products.

The construction industry's embrace of modular building and 3D printing also presents a challenge, as these methods can reduce on-site concrete usage. The modular construction market alone was valued at around $100 billion in 2023. Additionally, the growing market for green building materials, projected to exceed $450 billion by 2030 from $250 billion in 2023, signals a strong demand for more sustainable alternatives, including bio-based composites like hempcrete.

| Substitute Category | Key Materials | 2023 Market Value (Approx.) | Trend/Impact |

|---|---|---|---|

| Engineered Wood | Cross-Laminated Timber (CLT), Glulam | $15.8 billion | Growing adoption in mid-rise construction, lower embodied carbon. |

| Recycled Materials | Recycled Aggregates, Fly Ash, Slag | N/A (Integrated into cement/aggregate markets) | Increasing use driven by sustainability mandates and cost-competitiveness. |

| Modular & 3D Printing | Pre-fabricated components, alternative binders | $100 billion (Modular Construction) | Reduces on-site concrete demand, shifts production focus. |

| Bio-based & Eco-friendly | Hempcrete, Mycelium Composites | Niche, but growing within Green Building Materials market ($250 billion) | Lower embodied carbon, renewable sourcing, favored by green initiatives. |

Entrants Threaten

The building materials sector, especially cement manufacturing, demands substantial initial investments. Think about the cost of constructing production facilities, acquiring specialized machinery, and securing land for quarries. These hefty capital requirements create a significant hurdle, making it difficult for new companies to enter the market and compete effectively.

For instance, establishing a new cement plant can easily cost hundreds of millions, if not billions, of dollars. Heidelberg Materials itself operates numerous large-scale facilities globally, underscoring the industry's capital-intensive nature. This high barrier to entry means fewer new players are likely to emerge, reducing the competitive pressure on existing companies.

New entrants into the cement and building materials sector, like Heidelberg Materials, encounter significant barriers due to stringent regulatory and environmental hurdles. Navigating complex permitting processes for land use, environmental impact assessments, and operational licenses is a time-consuming and costly endeavor. For instance, in 2024, the European Union continued to tighten its emissions trading system (ETS) regulations, increasing compliance costs for all industry players, especially those entering the market.

The escalating global emphasis on decarbonization and sustainable practices introduces additional layers of regulatory complexity. Companies must invest heavily in technologies to reduce carbon footprints, such as carbon capture, utilization, and storage (CCUS), or transition to lower-emission production methods. Heidelberg Materials itself has committed billions to its decarbonization strategy, highlighting the substantial capital required for market entry and ongoing operations in this evolving landscape.

The threat of new entrants in the cement industry is significantly dampened by the formidable economies of scale enjoyed by established players like Heidelberg Materials. These scale advantages translate into lower per-unit production costs due to bulk purchasing of raw materials and optimized logistics. For instance, in 2023, Heidelberg Materials reported a revenue of €20.1 billion, underscoring the sheer operational volume that new entrants would find incredibly difficult and capital-intensive to replicate.

New companies entering the market would face immediate cost disadvantages, struggling to achieve the same cost efficiencies without matching the extensive production capacities and distribution networks already in place. This makes it challenging for them to compete on price, a critical factor in the construction materials sector where margins can be tight.

Established Distribution Networks and Customer Relationships

Heidelberg Materials benefits from deeply entrenched distribution channels and decades-long customer loyalty, especially with large construction firms and government entities. These established relationships are not easily replicated by newcomers.

The sheer scale and efficiency of Heidelberg Materials' global logistics and supply chain infrastructure represent a significant barrier. For instance, in 2023, the company managed a vast network of production sites, terminals, and transportation assets, facilitating timely delivery across diverse markets.

- Established Infrastructure: Heidelberg Materials operates a comprehensive global network of quarries, production facilities, and distribution hubs, making it difficult for new entrants to match their logistical reach and efficiency.

- Customer Loyalty: Long-standing relationships with major construction companies and public sector clients, built on reliability and consistent quality, create a strong switching cost for potential new customers.

- High Capital Investment: Building equivalent distribution networks and securing necessary permits and land rights requires substantial upfront capital, deterring many potential new entrants.

- Brand Reputation: Heidelberg Materials' reputation for quality and dependability, cultivated over many years, provides a significant competitive advantage that new companies struggle to build quickly.

Brand Recognition and Product Standards

In the construction materials sector, brand recognition plays a significant role, even for products that might seem commoditized. Heidelberg Materials, like its peers, benefits from a reputation built on quality, reliability, and robust technical support. This is particularly important for large-scale projects where consistency and performance are paramount. For instance, in 2024, major infrastructure projects often specify materials from trusted suppliers, underscoring the value of established brand loyalty.

New entrants face a considerable hurdle in overcoming this ingrained brand preference. They would need to invest heavily in marketing and demonstrating superior quality to even approach the level of trust that companies like Heidelberg Materials command. Meeting stringent product standards and obtaining necessary certifications also requires substantial upfront capital and time, making it a challenging entry point.

- Established Brand Loyalty: Decades of consistent delivery and customer relationships create a significant barrier for new players.

- Quality and Reliability Reputation: In construction, a proven track record for material performance is non-negotiable for many buyers.

- Technical Support and Expertise: Offering comprehensive support alongside products differentiates market leaders and is costly for newcomers to replicate.

- Stringent Product Standards: Compliance with industry-specific regulations and certifications demands significant investment and time.

The threat of new entrants for Heidelberg Materials is considerably low due to the immense capital required to establish operations. Building new plants and securing necessary resources demands hundreds of millions, if not billions, of dollars. Furthermore, stringent environmental regulations and the need for specialized technology to meet decarbonization goals, like carbon capture, add significant costs and complexity for any potential newcomer in 2024.

Established players like Heidelberg Materials also benefit from substantial economies of scale, leading to lower per-unit production costs. In 2023, Heidelberg Materials reported revenues of €20.1 billion, illustrating the operational volume that new entrants would struggle to match. This cost advantage, coupled with entrenched distribution networks and strong customer loyalty built over decades, makes it exceptionally difficult for new companies to compete effectively on price or service.

| Factor | Impact on New Entrants | Heidelberg Materials' Advantage |

| Capital Investment | Extremely High (billions for new plants) | Existing, scaled infrastructure |

| Economies of Scale | Disadvantage (higher per-unit costs) | Lower production costs, competitive pricing |

| Regulatory Hurdles | Significant (permitting, environmental compliance) | Established compliance systems, navigating complexity |

| Brand Reputation & Loyalty | Difficult to build | Strong relationships, trust in quality |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Heidelberg Materials is built upon a foundation of verified data from annual reports, industry-specific trade journals, and regulatory filings. We also incorporate insights from macroeconomic databases and market research reports to provide a comprehensive view of the competitive landscape.