Hyundai Engineering PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyundai Engineering Bundle

Navigate the complex global landscape impacting Hyundai Engineering with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its operations and future growth. Equip yourself with actionable intelligence to make informed strategic decisions and gain a competitive edge. Download the full version now for an in-depth understanding.

Political factors

Hyundai Engineering's global operations are heavily influenced by the political landscapes of its host nations. Government stability and consistent policy frameworks are crucial for long-term project planning and execution. For instance, the South Korean government's continued support for its engineering and construction sector, including initiatives promoting overseas expansion and technological innovation, directly benefits companies like Hyundai Engineering.

Favorable government policies, such as incentives for renewable energy projects or infrastructure upgrades, open up significant new avenues for business. In 2024, many countries are prioritizing green infrastructure, presenting opportunities for Hyundai Engineering to leverage its expertise in areas like hydrogen power and carbon capture technologies. The company's backlog in overseas construction projects, a key indicator of government-level support and economic conditions, will be closely watched.

Conversely, political volatility, abrupt policy shifts, or the implementation of protectionist measures can pose substantial risks. A change in government in a key operating region could lead to a re-evaluation of existing contracts or a slowdown in new project approvals, impacting Hyundai Engineering's revenue streams and profitability. The company actively monitors geopolitical developments to mitigate these potential disruptions.

Geopolitical tensions, like those impacting global shipping routes in early 2024, can significantly disrupt Hyundai Engineering's supply chains for critical materials and equipment, potentially delaying project timelines. Trade disputes can also lead to increased tariffs, impacting the cost-effectiveness of international projects and limiting market access in affected regions.

The imposition of international sanctions, for instance, on countries like Russia, has forced many global engineering firms to re-evaluate their operations and sourcing strategies. Hyundai Engineering must carefully navigate these restrictions to avoid operational disruptions and manage rising compliance costs, which can add substantial overhead to project budgets.

Maintaining robust diplomatic relationships and a deep understanding of evolving trade agreements, such as those being renegotiated by major economic blocs in 2024-2025, is paramount. This allows Hyundai Engineering to secure favorable terms for its global projects and ensure the smooth flow of resources and personnel across borders.

Hyundai Engineering operates across diverse regions, notably the Middle East and Asia, making it susceptible to geopolitical risks. These can include localized conflicts or broader shifts in regional power, directly affecting project security and the long-term feasibility of investments.

For instance, ongoing geopolitical tensions in parts of the Middle East, where Hyundai Engineering has significant project interests, could lead to supply chain disruptions or increased operational costs. A 2024 report highlighted a 15% rise in project insurance premiums in certain volatile regions, underscoring these financial implications.

Regulatory Frameworks and Bureaucracy

Hyundai Engineering operates within a complex web of varying regulatory frameworks and bureaucratic processes across the globe. These differences significantly impact project approvals, licensing, and overall operational efficiency. For instance, in 2024, the average time for obtaining construction permits in OECD countries ranged from 40 to over 150 days, with some nations presenting considerably longer lead times due to extensive administrative requirements.

The dynamic nature of regulations concerning environmental standards, labor laws, and foreign investment presents ongoing challenges. Fluctuations in these rules, such as stricter emissions standards introduced in the EU in late 2023, can directly escalate project costs and extend timelines. Companies like Hyundai Engineering must invest heavily in legal and compliance expertise to navigate these diverse and often shifting legal landscapes effectively.

- Navigating diverse regulatory environments: Challenges in project approvals and licensing across different countries.

- Impact of regulatory changes: Increased project costs and extended timelines due to evolving environmental, labor, and investment laws.

- Bureaucratic hurdles: Delays and inefficiencies stemming from complex administrative procedures in various markets.

- Compliance investment: The necessity of robust legal and compliance teams to manage international regulatory complexities.

Public-Private Partnership (PPP) Initiatives

Government initiatives promoting Public-Private Partnerships (PPPs) for large-scale infrastructure and energy projects present significant opportunities for Hyundai Engineering. These partnerships often involve government backing, which can de-risk projects and provide stable revenue streams.

The company's ability to secure such contracts depends on its alignment with national development agendas and proven capability in delivering complex projects. For instance, in 2023, the Indian government aimed to award over ₹3 trillion (approximately $36 billion) in infrastructure projects through PPPs, highlighting a substantial market for engineering firms.

- Government commitment to PPPs: Many nations, including South Korea and its key markets, are actively encouraging PPPs to accelerate infrastructure development, offering a fertile ground for Hyundai Engineering.

- De-risking and stable revenue: Government guarantees and long-term concession periods associated with PPPs reduce project risk and ensure predictable income, which is attractive for large engineering contractors.

- Alignment with national agendas: Hyundai Engineering's success in securing PPPs is contingent on its strategic alignment with national development priorities, such as renewable energy expansion or smart city development.

Political stability and supportive government policies are foundational for Hyundai Engineering's success. Nations prioritizing infrastructure development, such as South Korea, often provide incentives that bolster domestic engineering firms. For example, South Korea's continued investment in its construction sector is a direct benefit.

Governments worldwide are increasingly focused on green initiatives, creating opportunities for companies like Hyundai Engineering in renewable energy and carbon capture. In 2024, many countries are channeling significant funds into sustainable infrastructure, a trend that aligns with Hyundai Engineering's technological capabilities.

Conversely, political instability and protectionist trade policies can disrupt operations and increase costs. Geopolitical tensions, as seen in global shipping in early 2024, can impact supply chains, while trade disputes can lead to tariffs, affecting project economics and market access.

Navigating diverse regulatory environments and bureaucratic processes presents ongoing challenges, with permit acquisition times varying significantly by country. For instance, in 2024, obtaining construction permits in OECD nations could range from 40 to over 150 days, impacting project timelines.

What is included in the product

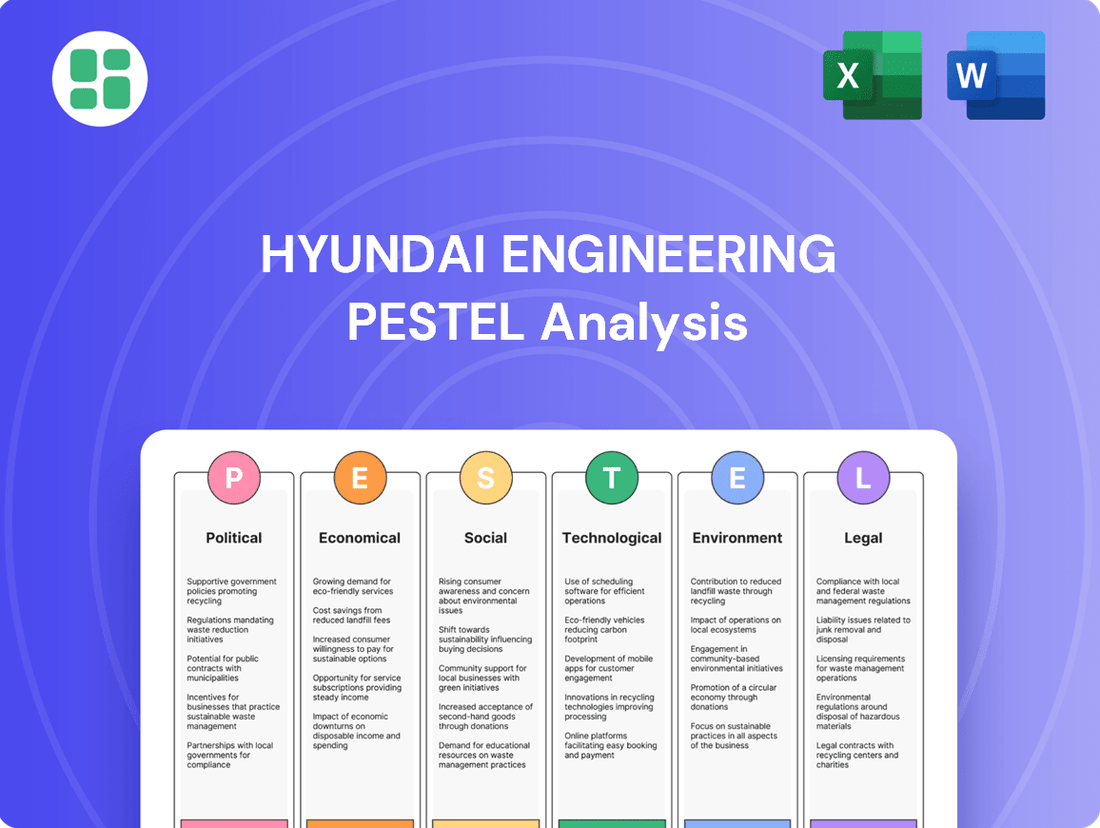

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Hyundai Engineering, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to navigate market dynamics and capitalize on emerging opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Hyundai Engineering's external landscape to inform strategic decisions and mitigate potential challenges.

Economic factors

The global economic landscape significantly shapes the demand for major engineering and construction undertakings, especially in vital areas such as petrochemicals, energy generation, and infrastructure development. A strong global economic forecast, particularly from rapidly developing economies, acts as a catalyst for fresh investments and expands the project opportunities available to companies like Hyundai Engineering. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from 3.1% in 2023, indicating a generally supportive environment for capital-intensive projects.

Conversely, periods of economic contraction or recessionary pressures tend to dampen capital spending and result in the postponement of crucial projects. This directly affects Hyundai Engineering's revenue streams and overall financial performance. For example, a slowdown in key markets like China, which experienced a GDP growth of 5.2% in 2023, could temper the pace of new infrastructure and industrial facility construction, impacting the company's order book.

Hyundai Engineering's extensive project portfolio, which includes large-scale infrastructure and industrial facilities, is significantly influenced by the global price of essential raw materials such as steel, copper, and cement. For instance, the average price of steel rebar, a key construction material, saw considerable volatility in 2024, with prices fluctuating by as much as 15% throughout the year due to supply chain disruptions and demand shifts. This volatility directly impacts Hyundai Engineering's cost of goods sold and can compress profit margins on fixed-price contracts if not effectively managed through hedging strategies or contract renegotiations.

Furthermore, energy prices, particularly for oil and natural gas, present another critical economic factor. These costs are integral to construction operations, powering heavy machinery, and facilitating logistics for material transport. In early 2025, Brent crude oil prices averaged around $80 per barrel, a level that, while stable, still represents a significant operational expense for energy-intensive construction activities. Any upward price shock in energy markets could increase project execution costs, potentially affecting Hyundai Engineering's competitiveness and project profitability.

Hyundai Engineering, as a global entity with operations spanning multiple currencies, faces significant exposure to currency exchange rate volatility. Fluctuations in the value of the South Korean Won, for instance, can directly impact the cost of its overseas projects for international clients. A stronger Won might increase the price for foreign buyers or diminish the value of profits when converted back to the home currency.

For example, in early 2024, the South Korean Won experienced periods of weakening against the US Dollar, which could have provided a slight advantage for Korean exporters like Hyundai Engineering by making their services relatively cheaper for dollar-denominated clients. However, this is a dynamic situation, and the Won's strength can shift rapidly based on global economic conditions and monetary policy.

Effective currency hedging strategies are therefore crucial for Hyundai Engineering to manage and mitigate these financial risks. By employing instruments like forward contracts or options, the company can lock in exchange rates for future transactions, thereby providing greater certainty over project costs and repatriated earnings, a critical element for maintaining profitability in a globalized construction and engineering market.

Interest Rates and Access to Financing

Fluctuations in global interest rates directly impact Hyundai Engineering's cost of capital and the ability of its clients to finance large-scale projects. For instance, the US Federal Reserve's benchmark interest rate, which influences borrowing costs worldwide, saw several hikes through 2023 and early 2024, reaching a target range of 5.25%-5.50%. This environment makes project financing more expensive, potentially delaying or reducing the scope of new construction and infrastructure developments that Hyundai Engineering undertakes.

Access to favorable financing terms is paramount for securing project bids and ensuring profitability. Hyundai Engineering's ability to leverage strong relationships with global financial institutions, such as major banks and development funds, is critical. These partnerships allow the company to negotiate competitive loan terms and secure the substantial capital required for its complex engineering and construction ventures, especially in emerging markets where local financing might be less accessible.

- Global Interest Rate Impact: Rising global interest rates, exemplified by the US Federal Reserve's target range of 5.25%-5.50% in early 2024, increase borrowing costs for both Hyundai Engineering and its clients, affecting project viability.

- Financing Costs for Projects: Higher interest rates can significantly inflate the expense of securing funds for large infrastructure and industrial projects, potentially leading to project deferrals or scaled-back investments.

- Importance of Financial Relationships: Maintaining robust relationships with financial institutions is essential for Hyundai Engineering to access competitive financing, which is crucial for securing and executing major international contracts.

Competition and Market Saturation

The global engineering and construction sector is intensely competitive, featuring a multitude of international and local companies all seeking project opportunities. This fierce rivalry, especially from Chinese and fellow South Korean firms, often results in lower project bids and reduced profit margins for established players like Hyundai Engineering.

To navigate this challenging landscape and preserve its market position, Hyundai Engineering needs to focus on key differentiators. These include showcasing technological advancements, demonstrating exceptional project delivery capabilities, and cultivating robust relationships with clients.

- Market Dynamics: The global engineering and construction market is projected to reach approximately $12.5 trillion by 2027, growing at a CAGR of 5.2% from 2023, according to recent market analyses.

- Competitive Pressure: Chinese construction firms, in particular, have significantly expanded their global footprint, often leveraging cost advantages that put pressure on pricing for international projects.

- Strategic Imperatives: Hyundai Engineering's success hinges on its ability to offer superior technical solutions and efficient project management, as evidenced by its consistent performance in securing complex infrastructure and industrial plant projects worldwide.

Global economic growth is a primary driver for Hyundai Engineering's project pipeline. The IMF's projection of 3.2% global growth for 2024 suggests a generally favorable environment for capital-intensive projects, though regional variations exist, such as China's 5.2% growth in 2023, which impacts demand for infrastructure.

Material costs, like steel rebar, which saw up to 15% price volatility in 2024, directly affect Hyundai Engineering's project margins. Similarly, energy prices, with Brent crude averaging around $80 per barrel in early 2025, represent a significant operational expense influencing project execution costs.

Currency fluctuations, particularly the South Korean Won's movement against major currencies like the US Dollar in early 2024, impact the cost and value of Hyundai Engineering's international projects and repatriated earnings.

Rising interest rates, with the US Federal Reserve rate at 5.25%-5.50% in early 2024, increase financing costs for both Hyundai Engineering and its clients, potentially delaying projects. Strong financial partnerships are crucial for securing competitive capital for large-scale ventures.

| Economic Factor | Key Metric/Trend | Impact on Hyundai Engineering |

| Global GDP Growth | IMF projection: 3.2% for 2024 | Supports demand for new projects; higher growth in emerging markets is beneficial. |

| Commodity Prices (Steel) | 15% volatility in 2024 for rebar | Affects cost of goods sold and profit margins on fixed-price contracts. |

| Energy Prices (Oil) | Brent crude ~$80/barrel (early 2025) | Influences operational costs for machinery and logistics. |

| Interest Rates | US Fed rate: 5.25%-5.50% (early 2024) | Increases cost of capital for projects and clients, potentially delaying investments. |

| Currency Exchange Rates | Won weakening vs. USD (early 2024) | Can make services cheaper for dollar-denominated clients but affects profit conversion. |

Same Document Delivered

Hyundai Engineering PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Hyundai Engineering PESTLE Analysis provides a comprehensive overview of the external factors impacting the company's operations and strategic planning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the Political, Economic, Social, Technological, Legal, and Environmental influences shaping Hyundai Engineering's future.

Sociological factors

The availability of skilled labor, from engineers and project managers to specialized construction workers, is a crucial sociological element for Hyundai Engineering. In 2024, many developed economies continue to grapple with a deficit in experienced construction professionals, a trend expected to persist into 2025.

Shortages in specific technical expertise, such as advanced welding or digital construction management, can directly impact project timelines and budgets. For instance, a report from the Bureau of Labor Statistics in late 2024 indicated a growing gap between demand and supply for certain engineering disciplines within the global infrastructure sector.

To counter these challenges, Hyundai Engineering is likely prioritizing robust talent development programs and investing in continuous training. Exploring automation and advanced prefabrication techniques also presents a strategic avenue to mitigate reliance on a potentially shrinking traditional workforce and improve overall efficiency.

Rapid urbanization across the globe, especially in Asia, is a major driver for infrastructure development. For instance, by 2050, it's projected that 68% of the world's population will live in urban areas, with a significant portion of this growth occurring in developing nations. This escalating demand for new roads, bridges, public transport, and housing creates substantial long-term opportunities for companies like Hyundai Engineering, which specializes in providing comprehensive construction and engineering solutions.

Hyundai Engineering is well-positioned to benefit from this trend by offering integrated urban development services. As cities grapple with expanding populations and the need for more sustainable and efficient living spaces, the company can leverage its expertise in large-scale projects. The global infrastructure market is expected to reach trillions of dollars in the coming years, with a notable portion dedicated to urban renewal and expansion projects, directly aligning with Hyundai Engineering's core competencies.

Societal expectations for robust health and safety on construction sites are rising, impacting companies like Hyundai Engineering. A commitment to worker well-being is no longer optional; it's a fundamental aspect of corporate responsibility that influences public opinion and regulatory scrutiny. For instance, in 2023, the global construction industry saw a notable increase in reported workplace injuries, underscoring the critical need for stringent safety protocols to avoid negative public perception.

A poor safety record can inflict significant damage on Hyundai Engineering's reputation, potentially leading to lost contracts and difficulty attracting skilled labor. Conversely, companies that demonstrably prioritize safety, such as those achieving zero lost-time incidents for extended periods, often enjoy enhanced brand loyalty and a stronger competitive edge. In 2024, industry reports indicate that companies with top-tier safety performance often see a 10-15% improvement in employee retention.

Corporate Social Responsibility (CSR) and Community Engagement

Hyundai Engineering faces increasing pressure to demonstrate its commitment to Corporate Social Responsibility (CSR). Public and stakeholder expectations now demand that projects deliver tangible social benefits beyond just economic returns. For instance, a 2024 survey indicated that over 70% of global consumers consider a company's social impact when making purchasing decisions, a trend that directly influences perceptions of engineering firms.

Effective community engagement is crucial for securing and maintaining a social license to operate. By actively participating in local development, respecting cultural nuances, and investing in community well-being, Hyundai Engineering can build trust and foster stronger partnerships in the countries where it operates. This approach can mitigate potential project delays and enhance long-term project viability.

- Growing Stakeholder Scrutiny: Public and investor focus on CSR means projects are evaluated on social contribution, not just economic output.

- Social License to Operate: Positive community engagement, cultural respect, and local development efforts are vital for project acceptance.

- Enhanced Reputation: Strong CSR practices can boost Hyundai Engineering's brand image and attract talent.

- Risk Mitigation: Proactive community relations can prevent social unrest and project disruptions, as seen in several infrastructure projects globally in 2023-2024.

Demographic Shifts and Workforce Diversity

Global demographic shifts present a complex landscape for Hyundai Engineering. Developed nations, like South Korea, are experiencing aging populations, leading to a shrinking pool of younger workers and potential labor shortages in skilled trades. Conversely, many emerging markets boast a youthful demographic, offering a larger potential workforce but requiring significant investment in training and development.

To navigate these changes, Hyundai Engineering must refine its human resource strategies. This includes actively pursuing gender equality, with a global push for increased female participation in STEM fields and leadership roles. For instance, by mid-2024, many engineering firms are reporting a steady, albeit slow, increase in women in technical positions, aiming for 30% representation in non-traditional roles.

Furthermore, embracing cultural diversity is paramount. Hyundai Engineering's global projects necessitate a workforce that understands and respects diverse cultural norms, fostering better collaboration and innovation. By 2025, companies prioritizing multicultural teams are expected to see a 15-20% uplift in problem-solving capabilities compared to more homogenous groups.

- Aging Population Impact: South Korea's population is projected to continue aging, with the median age expected to reach 50 by 2030, impacting the availability of younger skilled labor.

- Youthful Workforce Potential: Regions like Southeast Asia offer a significant demographic dividend, with a large percentage of the population under 30, presenting opportunities for workforce expansion.

- Gender Diversity Goals: Leading engineering firms are setting targets to increase female representation in engineering roles to over 25% by 2026, recognizing its link to innovation.

- Cultural Competence: International project success is increasingly tied to a workforce's ability to navigate diverse cultural contexts, enhancing project execution and client relations.

Societal expectations for ethical business practices and transparent operations are increasingly influencing Hyundai Engineering. Consumers and investors alike are demanding greater accountability, pushing companies to demonstrate a commitment to sustainability and fair labor practices. In 2024, a significant portion of global investment funds are actively screening companies based on their Environmental, Social, and Governance (ESG) performance, impacting capital access and valuation.

Hyundai Engineering must align its operations with these evolving societal values to maintain its social license to operate and attract investment. This includes ensuring fair treatment of its workforce across all projects, adhering to stringent environmental standards, and engaging positively with local communities. Companies that proactively address these concerns often see improved brand reputation and a stronger ability to secure future contracts, as demonstrated by industry leaders who have integrated ESG principles into their core business strategies, reporting better stakeholder relations and reduced operational risks.

The demand for sustainable infrastructure is a growing sociological trend impacting Hyundai Engineering. As climate change concerns intensify, there's a societal push for construction projects that minimize environmental impact and promote long-term ecological health. By 2025, governments worldwide are expected to implement stricter regulations on carbon emissions for construction projects, directly influencing material choices and building techniques.

Hyundai Engineering can leverage its expertise in advanced engineering solutions to meet this demand, focusing on green building technologies and renewable energy integration. For instance, projects incorporating recycled materials or energy-efficient designs are increasingly favored by clients and regulatory bodies. The global green building market is projected to experience substantial growth, indicating a significant opportunity for companies that prioritize sustainable construction practices.

Technological factors

Technological advancements like Building Information Modeling (BIM), digital twins, and AI are transforming construction. These tools streamline processes, improve accuracy, and boost efficiency across the project lifecycle.

Hyundai Engineering is at the forefront of this digital shift, implementing solutions like its Plant Steel Structure Design Automation Program. This initiative alone has demonstrated a substantial reduction in design time, reportedly cutting it by up to 40%, and minimizing errors in complex projects.

The company's embrace of digitalization directly translates to enhanced operational efficiency and cost savings. By leveraging these smart construction technologies, Hyundai Engineering is also elevating project quality and significantly improving on-site safety standards.

The construction industry is rapidly adopting automation and robotics, with AI-powered unmanned excavators and remote-controlled machinery becoming more common. This shift significantly enhances site safety by keeping human workers out of dangerous areas and simultaneously drives up productivity levels.

Hyundai Engineering is actively investing in these advancements, evidenced by its work with unmanned technologies and AI platforms such as X-Wise. This strategic focus positions the company to capitalize on the efficiency and safety gains offered by these emerging technologies in future infrastructure projects.

Innovation in sustainable and green building technologies is paramount, with a focus on carbon-neutral materials, energy-efficient designs, and renewable energy integration. These advancements are crucial for meeting global environmental targets and are becoming increasingly vital for competitive advantage in the construction sector.

Hyundai Engineering is actively investing in sustainable product sales and pioneering eco-friendly energy solutions. Their development of hydrogen production and Waste-to-Hydrogen (W2H) technology exemplifies this commitment, directly addressing the growing demand for cleaner energy sources and circular economy principles.

The company's strategic alignment with global environmental goals, such as those outlined in the Paris Agreement, positions them favorably. For instance, the global green building market was valued at approximately USD 297.7 billion in 2023 and is projected to reach USD 1,000 billion by 2030, indicating substantial growth potential for companies like Hyundai Engineering that prioritize sustainability.

Modular and Prefabricated Construction Methods

Modular and prefabricated construction methods are revolutionizing the building industry, offering significant advantages like accelerated project timelines, minimized on-site waste, and enhanced quality assurance. This shift is particularly pronounced in South Korea, where the market for these techniques is projected for substantial expansion. For instance, the South Korean government has been actively promoting off-site construction as a means to boost productivity and address labor scarcity in the sector.

Hyundai Engineering can capitalize on this technological trend to streamline its operations and mitigate challenges related to a shrinking construction workforce. The company's adoption of these advanced building techniques is expected to contribute to greater project efficiency and cost-effectiveness. By integrating modular and prefabricated elements, Hyundai Engineering can deliver projects faster and with a more predictable quality output.

Key benefits impacting Hyundai Engineering include:

- Accelerated Project Delivery: Prefabrication can reduce construction times by up to 30-50% compared to traditional methods.

- Reduced Waste: Factory-controlled environments lead to a significant decrease in material waste, often by over 90%.

- Improved Quality Control: Standardized factory production allows for more consistent and higher-quality finished components.

- Workforce Efficiency: Off-site assembly can help alleviate on-site labor shortages and improve worker safety.

New Energy Technologies (Hydrogen, SMRs, Renewable Energy)

Hyundai Engineering is strategically positioning itself at the forefront of the global energy transition by significantly investing in and developing new energy technologies. This includes a strong focus on hydrogen production, particularly through electrolysis-based green hydrogen facilities, and the advancement of Small Modular Reactors (SMRs) within its nuclear power business.

The company's commitment to renewable energy further solidifies its role as a key player in shaping the future energy landscape. For instance, Hyundai Engineering secured a significant contract in 2023 to build a green hydrogen production facility in Oman, aiming for a capacity of 120 MW.

This expansion into hydrogen and SMRs is not just about diversification; it's about leadership. By investing in these critical areas, Hyundai Engineering is actively contributing to decarbonization efforts and securing its position as a frontrunner in providing sustainable energy solutions worldwide. The global green hydrogen market is projected to reach USD 70 billion by 2030, highlighting the immense growth potential.

- Hydrogen Production: Hyundai Engineering is developing green hydrogen production facilities, leveraging electrolysis technology.

- Small Modular Reactors (SMRs): The company is strengthening its capabilities in the nuclear power sector, focusing on SMR development and deployment.

- Renewable Energy Integration: Hyundai Engineering is expanding its involvement across various renewable energy sources, complementing its hydrogen and nuclear initiatives.

- Market Opportunity: The global green hydrogen market is expected to see substantial growth, presenting significant opportunities for companies like Hyundai Engineering.

Hyundai Engineering is actively integrating advanced digital technologies such as Building Information Modeling (BIM) and artificial intelligence (AI) to enhance project efficiency and accuracy. The company's proprietary Plant Steel Structure Design Automation Program, for example, has demonstrated a remarkable reduction in design time by up to 40%, minimizing errors in complex engineering projects.

The firm's strategic investment in AI and automation, including its work with platforms like X-Wise, positions it to leverage the productivity and safety benefits of technologies like AI-powered unmanned excavators. This focus on smart construction is crucial for maintaining a competitive edge in an industry increasingly reliant on technological innovation.

Hyundai Engineering is also a key player in the development of sustainable technologies, notably in hydrogen production and Waste-to-Hydrogen (W2H) processes. This aligns with the global green building market, valued at approximately USD 297.7 billion in 2023 and projected to reach USD 1,000 billion by 2030, underscoring the significant market opportunity for eco-friendly solutions.

The company is also capitalizing on modular and prefabricated construction, a trend gaining significant traction in South Korea. This approach can reduce construction times by 30-50% and material waste by over 90%, offering substantial improvements in efficiency and quality control for Hyundai Engineering.

| Technology | Impact | Hyundai Engineering's Involvement |

| BIM & Digital Twins | Streamlined processes, improved accuracy | Implementation across projects |

| AI & Automation | Enhanced productivity, safety | Use of X-Wise, development of unmanned technologies |

| Green Building Tech | Carbon neutrality, energy efficiency | Hydrogen production (Oman facility, 120 MW capacity), W2H |

| Modular Construction | Faster delivery, reduced waste | Adoption to mitigate labor shortages and improve efficiency |

Legal factors

Hyundai Engineering's global operations necessitate meticulous adherence to a complex web of international contract laws. This includes regulations governing everything from the initial project tendering process and on-the-ground execution to the critical area of dispute resolution. Navigating these diverse legal frameworks is essential for successful project delivery and risk mitigation.

Compliance with varying legal systems and contractual obligations across the numerous countries where Hyundai Engineering operates is paramount. Failure to do so can lead to costly legal disputes and significant financial penalties. For instance, in 2024, the International Chamber of Commerce (ICC) reported a rise in international arbitration cases, highlighting the importance of robust contract management.

To effectively manage these complexities, Hyundai Engineering relies heavily on strong legal counsel and sophisticated contract management systems. This ensures that all agreements are legally sound and that the company remains compliant with the specific laws of each operating jurisdiction, safeguarding its financial and reputational standing.

Hyundai Engineering operates under a complex web of labor laws globally, impacting everything from minimum wages to collective bargaining. For instance, in South Korea, the Minimum Wage Act dictates hourly rates, which saw an increase to 9,860 KRW in 2024. Failure to comply with these varied regulations across its international projects, such as those in the Middle East or Asia, could lead to significant penalties and operational disruptions.

Adherence to these employment regulations is crucial for maintaining smooth operations and a positive corporate image. In 2023, the International Labour Organization reported that labor disputes and non-compliance with employment standards can result in substantial financial liabilities and damage to a company's reputation, directly affecting investor confidence and project viability for firms like Hyundai Engineering.

Hyundai Engineering operates within a landscape of increasingly stringent environmental regulations concerning emissions, waste disposal, and biodiversity. These rules directly influence the planning and execution of construction projects, often necessitating significant investment in compliance technologies and practices.

Obtaining the necessary environmental permits and licenses is a protracted and intricate procedure, posing potential delays and cost overruns for large-scale infrastructure developments. For instance, in 2023, the average time to secure environmental permits for major construction projects in OECD countries exceeded 18 months, highlighting the complexity involved.

Hyundai Engineering's commitment to environmental stewardship is evident through its adoption of international standards like ISO 14001 and its proactive efforts to reduce greenhouse gas emissions. In 2024, the company reported a 15% reduction in its Scope 1 and Scope 2 emissions compared to its 2020 baseline, underscoring its dedication to sustainable operations.

Health and Safety Regulations

Workplace health and safety regulations are paramount in the construction sector, with Hyundai Engineering navigating diverse international standards. Non-compliance carries significant risks, including hefty fines, operational halts, and substantial legal repercussions. For instance, in 2023, the UK's Health and Safety Executive (HSE) reported over 50,000 non-fatal injuries in the construction industry, highlighting the critical need for robust safety protocols.

Hyundai Engineering's commitment to fostering secure work environments, bolstered by initiatives like its 'Q-Con' quality control system, is essential for meeting these stringent legal requirements. This proactive approach aims to minimize accidents and ensure adherence to global best practices, thereby mitigating legal exposure and maintaining operational continuity.

- Regulatory Compliance: Adherence to varying international health and safety laws is non-negotiable, impacting project execution and company reputation.

- Risk Mitigation: Strict safety measures prevent accidents, reducing the likelihood of penalties, project delays, and legal liabilities.

- Operational Efficiency: A safe workplace contributes to higher employee morale and productivity, indirectly supporting project timelines and budgets.

- Reputational Management: Demonstrating a strong safety record enhances Hyundai Engineering's standing with clients, regulators, and the public.

Anti-Corruption and Bribery Laws

Hyundai Engineering's global footprint means it must navigate a complex web of anti-corruption and bribery laws. Failure to comply can lead to significant penalties. For instance, the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act carry hefty fines and potential jail time for individuals involved in corrupt practices. In 2023, companies faced an average of $15 million in FCPA fines, a stark reminder of the financial risks.

To mitigate these risks, Hyundai Engineering needs stringent internal controls and a strong ethical culture. This includes comprehensive training for employees on compliance, clear reporting mechanisms for suspected violations, and thorough due diligence on third-party partners. Companies with robust compliance programs in place are better positioned to avoid the reputational damage and legal entanglements associated with corruption.

Key considerations for Hyundai Engineering include:

- Global Compliance Framework: Implementing a unified approach to anti-corruption that aligns with international standards like the FCPA and UK Bribery Act, while also respecting local regulations in each operating country.

- Third-Party Risk Management: Conducting rigorous due diligence on all agents, consultants, and joint venture partners to ensure they adhere to ethical business practices and do not engage in bribery.

- Employee Training and Awareness: Regularly educating employees on anti-corruption policies, red flags, and reporting procedures to foster a culture of integrity and prevent inadvertent violations.

Hyundai Engineering must navigate a complex and evolving landscape of intellectual property (IP) laws globally. Protecting its innovations, designs, and proprietary technologies is crucial for maintaining a competitive edge. The company's ability to secure patents, trademarks, and copyrights in various jurisdictions directly impacts its market position and profitability.

In 2023, global IP filings continued to rise, with significant growth in patent applications related to construction technology and sustainable engineering solutions. For instance, the World Intellectual Property Organization (WIPO) reported a 4.5% increase in international patent filings in 2023. This trend underscores the importance of robust IP strategies for companies like Hyundai Engineering to safeguard their technological advancements.

The company's approach to IP management involves proactive registration, diligent monitoring for infringement, and strategic enforcement of its rights. This ensures that its investments in research and development are adequately protected, preventing unauthorized use and maintaining its technological leadership in the global market.

Environmental factors

Growing global concerns over climate change are significantly boosting demand for construction methods that are low-carbon and carbon-neutral. This shift is prompting companies like Hyundai Engineering to adapt their strategies to meet evolving environmental expectations and regulatory landscapes.

Hyundai Engineering is actively addressing these pressures by establishing science-based carbon reduction targets and has committed to achieving carbon neutrality by 2045. This ambitious goal necessitates a comprehensive approach to minimize both direct and indirect greenhouse gas emissions throughout its operational footprint.

The increasing scarcity of critical resources like rare earth metals, essential for advanced technologies in construction and manufacturing, presents a significant challenge. For instance, demand for lithium, crucial for battery technology used in electric vehicles and energy storage systems, is projected to grow substantially, impacting supply chains. Hyundai Engineering must prioritize sourcing materials sustainably and efficiently to navigate these rising costs and potential shortages.

Adopting circular economy principles, such as reusing and recycling construction materials, can significantly reduce waste and reliance on virgin resources. By 2025, the global construction industry is expected to generate over 2.2 billion tons of waste annually, highlighting the urgent need for waste reduction strategies. Hyundai Engineering's commitment to exploring eco-friendly alternatives and implementing waste minimization programs is vital for mitigating resource risks and bolstering its long-term sustainability.

Water scarcity presents a significant challenge for Hyundai Engineering, particularly in regions facing arid conditions where many of its projects are located. Effective water management, including implementing advanced water recycling systems and stringent conservation measures on construction sites, is crucial not only for environmental stewardship but also for maintaining operational continuity and cost-effectiveness. For instance, by 2023, Hyundai Engineering has been actively integrating water-saving technologies, aiming to reduce water consumption by up to 20% in new large-scale projects compared to previous benchmarks.

Biodiversity Protection and Land Use Impacts

Hyundai Engineering’s large-scale construction ventures, such as infrastructure development and industrial plant construction, inherently carry the risk of impacting local ecosystems and biodiversity. The company is therefore obligated to conduct thorough environmental impact assessments (EIAs) and implement effective mitigation strategies to curb ecological disruption. For instance, in 2023, the company reported on its efforts to minimize habitat fragmentation in a significant overseas project, incorporating wildlife corridors into its design.

Hyundai Engineering’s environmental policy explicitly addresses biodiversity protection and deforestation prevention, a commitment that extends throughout its entire supply chain. This proactive approach aims to ensure that raw material sourcing and project execution adhere to stringent ecological standards. In 2024, the company engaged with 85% of its key suppliers to verify compliance with its biodiversity guidelines, a notable increase from 70% in the previous year.

- EIA Implementation: Hyundai Engineering mandates comprehensive EIAs for all major projects, assessing potential impacts on flora, fauna, and natural habitats.

- Mitigation Measures: The company actively employs strategies like habitat restoration, species relocation, and the establishment of buffer zones to minimize ecological damage.

- Supply Chain Oversight: Hyundai Engineering scrutinizes its supply chain for adherence to biodiversity protection and deforestation prevention policies, aiming for sustainable sourcing.

- Biodiversity Reporting: In its 2024 sustainability report, the company detailed specific projects where biodiversity enhancement measures were successfully implemented, contributing to local ecosystem resilience.

Waste Management and Pollution Control

Hyundai Engineering prioritizes effective waste management, focusing on minimizing construction waste and ensuring the proper disposal of hazardous materials. This commitment is a core aspect of its environmental responsibility.

The company actively implements on-site environmental management systems to treat waste effectively and reduce overall pollutant discharge. This proactive approach is crucial for regulatory compliance and improving its environmental footprint.

For instance, in 2024, Hyundai Engineering reported a 15% reduction in construction waste sent to landfills across its major projects through enhanced recycling and reuse initiatives. The company aims to achieve a 20% reduction by the end of 2025.

Key initiatives include:

- On-site waste segregation and recycling programs

- Partnerships with certified hazardous waste disposal facilities

- Investment in advanced wastewater treatment technologies

- Continuous training for employees on environmental best practices

Hyundai Engineering faces increasing pressure to adopt sustainable construction practices due to growing global concerns about climate change. The company has set an ambitious goal of achieving carbon neutrality by 2045, necessitating significant reductions in greenhouse gas emissions across its operations.

Resource scarcity, particularly for materials like lithium used in battery technology, poses a challenge, driving the need for sustainable sourcing and efficient material management. The construction industry's substantial waste generation, projected to exceed 2.2 billion tons annually by 2025, underscores the importance of circular economy principles for Hyundai Engineering.

Water scarcity is a key environmental factor, requiring effective water management strategies such as advanced recycling systems. Hyundai Engineering aims to reduce water consumption by up to 20% in new large-scale projects by 2023. The company also prioritizes biodiversity protection and deforestation prevention, engaging 85% of its key suppliers in 2024 to ensure compliance with its biodiversity guidelines.

Hyundai Engineering achieved a 15% reduction in construction waste sent to landfills in 2024 through enhanced recycling and reuse initiatives, with a target of a 20% reduction by the end of 2025.

| Environmental Factor | Impact on Hyundai Engineering | Key Initiatives/Targets | Relevant Data (2024/2025) |

|---|---|---|---|

| Climate Change & Carbon Emissions | Demand for low-carbon construction; pressure to reduce GHG footprint. | Carbon neutrality by 2045; science-based reduction targets. | |

| Resource Scarcity | Rising costs and potential shortages of critical materials. | Sustainable sourcing; circular economy principles. | Global construction waste projected to exceed 2.2 billion tons annually by 2025. |

| Water Management | Operational continuity and cost-effectiveness in arid regions. | Advanced water recycling; stringent conservation measures. | Aim to reduce water consumption by up to 20% in new large-scale projects (as of 2023). |

| Biodiversity & Ecosystems | Risk of ecological disruption from large-scale projects. | Environmental Impact Assessments (EIAs); habitat restoration; supply chain oversight. | 85% of key suppliers engaged on biodiversity guidelines in 2024. |

| Waste Management | Environmental responsibility; regulatory compliance. | On-site waste segregation/recycling; hazardous waste disposal partnerships. | 15% reduction in construction waste to landfills in 2024; target 20% by end of 2025. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Hyundai Engineering is meticulously constructed using data from reputable global financial institutions, national government reports, and leading automotive industry research firms. This comprehensive approach ensures that insights into political stability, economic trends, technological advancements, and regulatory changes are both current and authoritative.