Hyundai Engineering Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyundai Engineering Bundle

Hyundai Engineering operates within a dynamic global market, facing intense competition and evolving customer demands. Understanding the interplay of buyer power, supplier leverage, and the threat of substitutes is crucial for navigating this landscape. Our full Porter's Five Forces analysis offers a deep dive into these critical factors, providing actionable insights to inform your strategic decisions.

The complete report reveals the real forces shaping Hyundai Engineering’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Hyundai Engineering is significantly shaped by the concentration within its key input markets. For critical materials such as high-grade steel, specialized construction equipment, and essential chemicals, a limited number of dominant suppliers can exert considerable influence.

In 2024, the global construction materials market, particularly for specialized steel alloys and advanced concrete formulations, saw consolidation trends. For instance, the market for certain heavy construction machinery components experienced a notable increase in supplier concentration, with the top three global manufacturers accounting for over 60% of market share in specific product categories. This concentration means Hyundai Engineering may face less flexibility in negotiating prices and terms for these vital inputs.

Furthermore, the availability and cost of skilled labor, especially for specialized engineering and construction roles, also represent a supplier dynamic. A shortage of highly specialized engineers or certified technicians can empower labor providers, potentially leading to increased wage demands and impacting project timelines and budgets for Hyundai Engineering.

Suppliers who offer unique or highly specialized inputs significantly bolster their bargaining power. For Hyundai Engineering, this is evident when procuring proprietary technologies or niche services essential for complex petrochemical or power plant projects. The scarcity of readily available alternatives for these critical components directly diminishes Hyundai Engineering's negotiation leverage.

The cost and complexity of switching suppliers directly influence Hyundai Engineering's bargaining power. High switching costs, such as those associated with re-tooling machinery or re-qualifying specialized components, can lock Hyundai Engineering into existing supplier relationships. This makes it harder to negotiate better terms, as suppliers know the expense and effort involved for Hyundai Engineering to find and onboard an alternative. For instance, in 2024, the global average cost for re-tooling a manufacturing line due to a supplier change in the automotive sector, a relevant comparison for engineering projects, was estimated to be upwards of $500,000, highlighting the significant financial barrier.

Threat of Forward Integration

The threat of suppliers integrating forward can significantly bolster their bargaining power against Hyundai Engineering. If a key supplier, particularly one providing specialized technology or critical equipment, could credibly enter the Engineering, Procurement, and Construction (EPC) market themselves, they gain substantial leverage. This would allow them to capture a larger portion of the value chain, potentially offering direct competition to Hyundai Engineering.

While direct forward integration by raw material suppliers is rare, the possibility exists for technology and equipment providers. For instance, a leading provider of advanced modular construction systems might consider offering end-to-end project delivery. This strategic shift would transform them from a component supplier into a direct competitor, fundamentally altering the power dynamic.

- Supplier Leverage: Suppliers gain power if they can credibly threaten to integrate forward into Hyundai Engineering's EPC services.

- Competitive Threat: Specialized technology or equipment manufacturers are more likely to consider forward integration, directly competing with Hyundai Engineering.

- Value Chain Capture: Successful forward integration allows suppliers to capture a greater share of the overall project value.

Importance of Hyundai Engineering to Supplier

Hyundai Engineering's significance as a customer directly impacts its suppliers' leverage. When Hyundai Engineering constitutes a substantial portion of a supplier's sales, that supplier is more inclined to offer favorable terms to retain the business, thereby diminishing their bargaining power. For instance, if a supplier derives over 20% of its annual revenue from Hyundai Engineering, it's likely to be more accommodating.

Conversely, if Hyundai Engineering represents a minor segment of a supplier's client base, the supplier holds greater sway. This is because the loss of Hyundai Engineering as a client would have a minimal impact on the supplier's overall financial health. In such scenarios, suppliers are less pressured to concede to Hyundai Engineering's demands regarding pricing or contract conditions.

- Supplier Dependence: A supplier heavily reliant on Hyundai Engineering for revenue will have reduced bargaining power.

- Customer Diversification: Suppliers with a diverse customer portfolio are less susceptible to pressure from any single client like Hyundai Engineering.

- Revenue Contribution: For example, if Hyundai Engineering accounts for less than 5% of a supplier's total revenue, the supplier's bargaining power remains relatively high.

The bargaining power of suppliers for Hyundai Engineering is influenced by market concentration and the uniqueness of their offerings. In 2024, the construction materials sector saw increased supplier concentration, with top players holding over 60% market share in specialized components. This concentration limits Hyundai Engineering's negotiation flexibility.

High switching costs for specialized inputs, like proprietary technologies, can lock Hyundai Engineering into existing supplier relationships, diminishing its leverage. For instance, re-tooling costs in manufacturing can exceed $500,000, presenting a significant barrier to changing suppliers.

Suppliers who can credibly threaten forward integration, such as technology providers offering end-to-end project delivery, gain substantial leverage over Hyundai Engineering.

Hyundai Engineering's customer significance also plays a role; if it represents a small portion of a supplier's revenue, the supplier's bargaining power increases.

| Factor | Impact on Hyundai Engineering | 2024 Data/Example |

|---|---|---|

| Supplier Concentration | Reduces negotiation flexibility | Top 3 suppliers hold >60% market share in key components |

| Switching Costs | Increases supplier lock-in | Re-tooling costs can exceed $500,000 |

| Forward Integration Threat | Increases supplier leverage | Technology providers may offer EPC services |

| Customer Significance | Low significance increases supplier power | Supplier revenue from Hyundai < 5% |

What is included in the product

This analysis dissects the competitive forces impacting Hyundai Engineering, revealing the intensity of rivalry, buyer and supplier power, the threat of new entrants, and the availability of substitutes.

Instantly identify and address competitive pressures in the engineering sector with a clear, visual breakdown of Hyundai Engineering's Porter's Five Forces.

Empower strategic planning by pinpointing key threats and opportunities, allowing for targeted mitigation and capitalization on market dynamics.

Customers Bargaining Power

Hyundai Engineering's customer base is largely concentrated among very large organizations. These include national oil companies, government bodies, and major corporations that engage in massive infrastructure, power generation, and petrochemical projects. This concentration means a few key clients can represent a significant portion of Hyundai Engineering's revenue.

The sheer scale and financial weight of these clients give them considerable bargaining power. For instance, a single mega-project can be worth billions of dollars, allowing these customers to negotiate terms, pricing, and specifications quite assertively. This is particularly true in 2024, where global infrastructure spending is robust but project financing can also be complex, giving large clients leverage.

Customers' ability to backward integrate significantly influences their bargaining power. If a client can perform engineering, procurement, and construction (EPC) services internally, they become less dependent on companies like Hyundai Engineering, thereby increasing their leverage. For instance, major oil and gas conglomerates, which are key clients for EPC firms, often possess substantial in-house engineering capabilities. In 2024, many of these large corporations continued to invest in their internal technical departments, aiming to streamline project execution and cost control.

Customers in the Engineering, Procurement, and Construction (EPC) sector, like those engaging Hyundai Engineering, exhibit high price sensitivity. This stems from the substantial capital investments required for their projects, often running into billions of dollars. For instance, major infrastructure projects globally frequently see bids from multiple EPC firms, driving down margins.

The growing trend towards greater transparency in bidding processes directly amplifies customer bargaining power. When clients have access to more information about competitive pricing and project costs, they are better positioned to negotiate for lower prices and more advantageous contract terms.

This heightened transparency, coupled with the inherent competitiveness of the EPC market, allows customers to exert significant pressure on pricing. In 2024, the global construction market, a key indicator for EPC activities, continued to face inflationary pressures, making cost-effectiveness a paramount concern for clients, thereby increasing their leverage.

Availability of Alternative EPC Providers

The availability of numerous large and capable global and regional Engineering, Procurement, and Construction (EPC) firms significantly enhances the bargaining power of Hyundai Engineering's customers. This abundance of choice means clients can readily compare offerings and negotiate more favorable terms, as switching costs between comparable providers are relatively low for major projects.

Hyundai Engineering operates within a fiercely competitive environment where many well-established players actively compete for similar large-scale infrastructure and industrial projects. For instance, in 2024, the global EPC market, particularly in sectors like energy and infrastructure, saw intense bidding activity. Companies like Bechtel, Fluor Corporation, and Saipem are consistently vying for the same lucrative contracts, creating a buyer's market where customers can leverage competition to their advantage.

- Numerous Global and Regional EPC Competitors: The market features a wide array of established EPC providers, offering clients a broad selection of potential partners for complex projects.

- Intense Competition for Large-Scale Projects: Major infrastructure and industrial undertakings attract significant interest from multiple EPC firms, intensifying competition and empowering customer negotiation.

- Low Switching Costs for Comparable Services: For customers engaging in large-scale projects, the effort and cost associated with switching between similarly qualified EPC providers are often manageable, increasing their leverage.

Project Complexity and Strategic Importance

For highly complex projects, such as advanced petrochemical plants or large-scale infrastructure, where Hyundai Engineering offers specialized knowledge and proprietary technology, customer bargaining power is reduced. Clients seeking unique solutions or facing significant technical challenges may find fewer alternatives. For instance, in the development of next-generation battery manufacturing facilities, a sector Hyundai Engineering has been actively involved in, clients often prioritize proven expertise over price alone.

When a project is strategically vital for a client's long-term growth or market position, their willingness to negotiate on price might decrease if Hyundai Engineering demonstrates a clear competitive advantage. This is particularly true in sectors like renewable energy infrastructure, where reliability and efficiency are paramount. Hyundai Engineering’s 2023 project wins in offshore wind farm construction, valued in the billions, highlight the demand for their specialized capabilities in critical, high-stakes projects.

- Mitigated Power in Specialized Projects: Hyundai Engineering's unique expertise in areas like advanced nuclear power plant construction or complex chemical processing facilities can significantly lessen customer bargaining power.

- Premium for Guaranteed Quality: Clients in sectors demanding extreme precision and reliability, such as aerospace component manufacturing support, may accept higher costs for Hyundai Engineering's proven track record.

- Strategic Importance Drives Demand: For projects critical to a client's market entry or technological advancement, such as the construction of advanced semiconductor fabrication plants, the strategic value outweighs pure cost considerations, limiting customer leverage.

- Track Record as a Bargaining Chip: Hyundai Engineering's history of successful delivery on large-scale, complex international projects, like the 2022 completion of a major refinery expansion in the Middle East, serves as a strong counter to customer price demands.

Hyundai Engineering's customers, primarily large corporations and government entities, wield significant bargaining power due to their substantial project values and the availability of numerous EPC competitors. This leverage is amplified by increasing price transparency in bidding processes.

However, this power is somewhat diminished when clients require Hyundai Engineering's specialized knowledge or proprietary technology for highly complex projects, where alternatives are scarce. The strategic importance of a project for a client can also reduce their price sensitivity if Hyundai Engineering offers a clear competitive advantage.

| Factor | Impact on Customer Bargaining Power | Example/Data Point (2024 Context) |

|---|---|---|

| Customer Concentration | High | Large national oil companies often award multi-billion dollar projects, giving them substantial negotiation leverage. |

| Availability of Competitors | High | The global EPC market in 2024 features numerous players like Bechtel and Fluor, allowing clients to easily compare and negotiate. |

| Switching Costs | Low to Moderate | For comparable EPC services, clients can switch providers with manageable disruption for major projects. |

| Price Sensitivity | High | Global infrastructure spending in 2024 faces inflationary pressures, making cost-effectiveness a key client concern. |

| Customer Backward Integration | Moderate to High | Major clients often possess in-house engineering capabilities, reducing reliance on external EPC firms. |

| Uniqueness of Hyundai Engineering's Offering | Low | For specialized projects, such as advanced semiconductor fabrication plants, clients prioritize proven expertise, limiting their bargaining power. |

Preview the Actual Deliverable

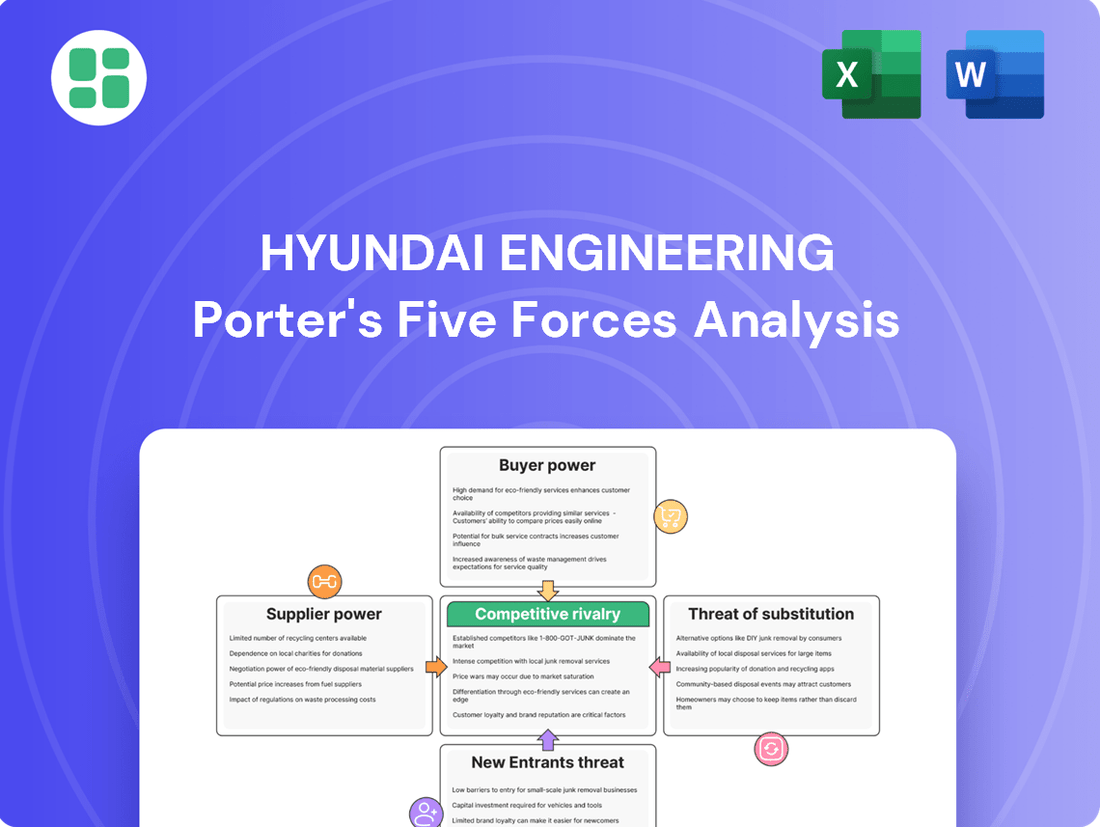

Hyundai Engineering Porter's Five Forces Analysis

This preview showcases the complete Hyundai Engineering Porter's Five Forces Analysis, detailing the bargaining power of buyers, the threat of new entrants, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors within the industry.

The document you are viewing is the exact, professionally formatted analysis you will receive instantly upon purchase, providing a comprehensive understanding of the competitive landscape for Hyundai Engineering.

You're looking at the actual, ready-to-use Porter's Five Forces analysis for Hyundai Engineering. Once your purchase is complete, you’ll get instant access to this exact file, offering actionable insights into market dynamics.

Rivalry Among Competitors

Hyundai Engineering faces a highly competitive landscape in the global engineering, procurement, and construction (EPC) sector, especially for major petrochemical, power, and infrastructure projects. The sheer number of established international and local companies vying for these contracts creates significant rivalry.

Key competitors include other South Korean conglomerates like Samsung Engineering and SK Engineering & Construction, alongside global giants from Europe, North America, and increasingly, China. For instance, in 2023, the global construction market was valued at approximately $13.4 trillion, with a substantial portion dedicated to these large-scale EPC projects, highlighting the scale of competition.

The global Engineering, Procurement, and Construction (EPC) market is expected to see robust growth, with projections indicating a compound annual growth rate (CAGR) of around 5.5% from 2024 to 2030, reaching an estimated value of over $2 trillion by 2030. However, the specific segments where Hyundai Engineering focuses, such as petrochemicals and infrastructure, might experience different growth trajectories. For instance, while renewable energy EPC is booming, traditional oil and gas infrastructure EPC could see more moderate expansion.

When growth in particular EPC segments moderates, competition naturally heats up. Companies like Hyundai Engineering find themselves vying for a more limited pool of projects. This intensified rivalry often translates into more aggressive pricing and bidding strategies as firms seek to secure market share and maintain revenue streams. In 2024, this dynamic is particularly evident in regions with mature industrial bases or where government spending on infrastructure has plateaued.

The Engineering, Procurement, and Construction (EPC) sector, where Hyundai Engineering operates, is characterized by substantial fixed costs. These include investments in specialized machinery, a highly skilled workforce, and robust project management systems. For instance, major EPC firms often maintain significant capital expenditures for heavy equipment fleets and advanced design software, contributing to a high cost structure.

Furthermore, the industry presents considerable exit barriers. Assets are often highly specific to particular projects, making them difficult to redeploy or sell. Coupled with long-term contractual commitments and potential penalties for early termination, these factors can trap companies in the market. This situation intensifies competitive rivalry, as firms are incentivized to continue operating and competing for new projects to cover their fixed costs, even in less favorable economic conditions.

Differentiation and Specialization

Competitive rivalry within the engineering sector, including for Hyundai Engineering, is significantly shaped by how effectively companies can differentiate their offerings. This differentiation often hinges on factors like technological prowess, a commitment to innovation, strong sustainability credentials, impeccable safety records, or deep specialized expertise in niche areas such as intricate environmental projects or cutting-edge power generation solutions.

Hyundai Engineering actively pursues differentiation by concentrating on delivering high-quality, sustainable, and innovative projects. This strategic focus aims to set them apart in a competitive landscape where clients increasingly value reliability and forward-thinking solutions.

- Technological Edge: Hyundai Engineering's investment in R&D, particularly in areas like smart construction and eco-friendly technologies, provides a competitive advantage.

- Sustainability Focus: The company's emphasis on green building and renewable energy projects aligns with global trends, attracting environmentally conscious clients.

- Specialized Expertise: Hyundai Engineering has demonstrated capabilities in complex projects, such as the development of advanced petrochemical plants and large-scale infrastructure, showcasing specialized knowledge that rivals may not possess.

- Innovation in Project Execution: The adoption of digital tools and advanced methodologies in project management contributes to efficiency and quality, further differentiating their service delivery.

Strategic Stakes and Global Expansion

Many global Engineering, Procurement, and Construction (EPC) firms, including Hyundai Engineering, see international expansion and winning major projects as crucial for sustained growth and industry standing. This drive for global reach intensifies competition for significant contracts across various regions.

The pursuit of these landmark projects often involves substantial upfront investment in bidding processes, feasibility studies, and local partnerships. For instance, in 2024, the global EPC market for large infrastructure projects continued to see intense bidding wars, with firms committing millions to secure a single major contract, particularly in emerging economies and renewable energy sectors.

- Global Ambition Fuels Competition: EPC firms worldwide prioritize international projects for growth and reputation, leading to robust rivalry.

- High Stakes in Bidding: Securing landmark contracts demands significant investment in the pre-award phase, creating a barrier to entry and intensifying competition among established players.

- Strategic Importance of Projects: Winning large-scale projects is not just about revenue; it's about market positioning and demonstrating capability to secure future opportunities.

Hyundai Engineering operates in a fiercely competitive global EPC market, where numerous established players and emerging firms vie for major projects. This intense rivalry is exacerbated by high fixed costs and significant exit barriers, compelling companies to continuously pursue new contracts to cover expenses. The pursuit of international projects further intensifies this competition, with substantial investments made in bidding processes for landmark deals.

Companies differentiate themselves through technological innovation, sustainability initiatives, and specialized expertise. For example, Hyundai Engineering's focus on smart construction and eco-friendly solutions aims to provide a competitive edge in a market where clients increasingly value advanced and responsible project execution. The global EPC market's projected growth, estimated at around 5.5% CAGR from 2024 to 2030, indicates continued demand but also sustained competitive pressure.

| Competitor | Key Focus Areas | 2023 Revenue (Approx.) |

|---|---|---|

| Samsung Engineering | Petrochemicals, Infrastructure, Energy | $8.5 billion |

| SK Engineering & Construction | Petrochemicals, Power, Civil Engineering | $7.2 billion |

| Fluor Corporation | Energy, Chemicals, Infrastructure | $13.8 billion |

| Bechtel Group | Infrastructure, Defense, Mining | $30 billion (estimated) |

SSubstitutes Threaten

A significant threat to engineering, procurement, and construction (EPC) firms like Hyundai Engineering comes from clients developing their own in-house capabilities. While building a full-scale internal EPC division for mega-projects is uncommon, some large corporations might manage portions of projects or handle smaller, less complex endeavors internally. This can reduce their need for external EPC providers, impacting revenue streams.

The rise of modular and prefabricated construction presents a significant threat of substitutes for traditional building methods. These off-site construction techniques, where components are manufactured in a controlled factory environment before assembly on-site, are gaining traction. By 2024, the global modular construction market was valued at approximately $160 billion, demonstrating its growing influence.

This shift can directly impact Hyundai Engineering by reducing the need for extensive on-site labor and potentially shortening project completion times. For instance, projects utilizing modular construction can see timelines reduced by 20-50% compared to traditional methods. This efficiency can make them an attractive alternative for clients seeking faster project delivery, thereby diverting demand from full Engineering, Procurement, and Construction (EPC) services that rely heavily on on-site assembly.

New technologies like advanced robotics and AI-driven project management are emerging as potential substitutes for traditional Engineering, Procurement, and Construction (EPC) methods. These innovations can streamline processes and reduce costs, offering clients alternative pathways to project completion.

For instance, the adoption of digital twin technology allows for better simulation and optimization throughout a project lifecycle, potentially reducing the need for extensive on-site traditional construction phases. This can lead to faster delivery and lower overall expenditure for clients.

Furthermore, evolving project delivery models such as integrated project delivery (IPD) and public-private partnerships (PPPs) present alternatives to the standard EPC framework. These models can foster greater collaboration and risk sharing, potentially offering more attractive value propositions than traditional approaches.

Shift to Operations & Maintenance (O&M) Focus

Clients are increasingly focusing on maintaining and upgrading existing infrastructure rather than undertaking entirely new construction projects. This trend toward an Operations & Maintenance (O&M) emphasis can be seen as a significant substitute for traditional Engineering, Procurement, and Construction (EPC) services. For instance, a substantial portion of the global infrastructure spending in 2024 is allocated to refurbishment and modernization efforts, diverting capital that might otherwise fund new builds.

This shift directly impacts the demand for large-scale EPC contracts, as companies like Hyundai Engineering may find fewer opportunities for new plant construction. Instead, the market is seeing a rise in demand for services that extend the lifespan and enhance the efficiency of current assets, such as retrofitting, digitalization of operations, and predictive maintenance solutions. This represents a direct substitution for the traditional model of building new facilities from the ground up.

- Increased O&M Spending: Global infrastructure maintenance and upgrade budgets are projected to grow, representing a significant portion of overall infrastructure investment in 2024.

- Shift in Client Priorities: Clients are prioritizing asset longevity and operational efficiency, favoring O&M contracts over new large-scale construction.

- Reduced Demand for New EPC: The focus on existing assets can lead to a decrease in the number of new, large-scale EPC projects requiring extensive upfront capital.

- Growth in Specialized Services: Demand is rising for specialized O&M services, including digital twins, AI-driven maintenance, and energy efficiency upgrades, as substitutes for new construction.

Decentralized Energy Generation and Smaller-Scale Infrastructure

The increasing adoption of decentralized energy generation, such as distributed solar and microgrids, presents a significant threat of substitution for traditional large-scale power plant Engineering, Procurement, and Construction (EPC) projects. For instance, by 2024, the global distributed solar market is projected to continue its robust growth, with cumulative installations reaching hundreds of gigawatts, directly impacting the demand for massive, centralized power stations.

Furthermore, the development of smaller, more localized infrastructure solutions can bypass the need for extensive, mega-project investments. This shift means that companies like Hyundai Engineering, heavily involved in large EPC contracts, face a potential reduction in the market for their core offerings as smaller, modular solutions gain traction.

- Distributed solar installations are expected to exceed 500 GW globally by the end of 2024.

- Microgrid projects are increasingly favored for their resilience and ability to integrate renewable sources, reducing reliance on large grid infrastructure.

- The capital expenditure for decentralized energy solutions is often lower and more adaptable than for mega-projects, making them attractive alternatives.

The threat of substitutes for traditional EPC services is multifaceted, encompassing alternative construction methods, evolving project delivery models, and a growing emphasis on maintenance over new builds. Modular construction, with its efficiency gains, and decentralized energy solutions like distributed solar are directly impacting the demand for large-scale projects. By 2024, the global modular construction market reached approximately $160 billion, while distributed solar installations were projected to exceed 500 GW globally.

| Substitute Type | Impact on EPC Demand | Key Drivers | 2024 Data/Projections |

|---|---|---|---|

| Modular Construction | Reduces need for extensive on-site labor and traditional assembly | Faster project delivery, cost efficiency | Global market valued at ~$160 billion |

| Operations & Maintenance (O&M) Focus | Shifts capital from new construction to asset upkeep and upgrades | Prioritization of asset longevity and operational efficiency | Significant portion of global infrastructure spending allocated to refurbishment |

| Decentralized Energy (e.g., Distributed Solar) | Decreases demand for large, centralized power plant EPCs | Resilience, integration of renewables, lower capital expenditure | Projected global distributed solar installations >500 GW |

Entrants Threaten

The global Engineering, Procurement, and Construction (EPC) sector, particularly for massive projects in petrochemicals, power, and infrastructure, necessitates substantial upfront capital. Newcomers face the daunting task of securing funding for advanced equipment, cutting-edge technology, and the substantial working capital needed to navigate multi-billion-dollar projects. For instance, a single large-scale LNG plant can easily cost upwards of $20 billion, presenting a formidable financial hurdle.

Clients in the Engineering, Procurement, and Construction (EPC) sector, especially for intricate and high-stakes projects, place immense value on a company's demonstrated experience and a history of successful project completion. This is a significant barrier for new entrants.

Newcomers to the EPC market often struggle to build the essential credibility needed to vie for substantial contracts. Established firms like Hyundai Engineering, with years of proven performance and a portfolio of completed mega-projects, possess a distinct advantage.

For instance, in 2024, major global EPC contracts often require bidders to demonstrate a minimum of 10-15 years of experience in similar complex projects. This track record is not easily replicated by new companies, effectively limiting their ability to challenge established players.

The Engineering, Procurement, and Construction (EPC) sector, where Hyundai Engineering operates, demands a deep pool of highly specialized engineering, project management, and technical expertise. New entrants face a significant hurdle in attracting and retaining this critical talent, a challenge amplified by the industry's reliance on advanced construction technologies and proprietary methodologies. For instance, the global engineering services market was valued at approximately $1.5 trillion in 2023, with a substantial portion dedicated to specialized talent acquisition and technology investment, making it a costly barrier for newcomers.

Regulatory Hurdles and Environmental Compliance

The global engineering and construction sector faces significant regulatory complexities, including stringent environmental standards and varied permitting processes across jurisdictions. New entrants often struggle to establish the necessary compliance infrastructure, making market entry costly and time-consuming.

For instance, in 2024, the European Union's updated environmental regulations, such as the Green Deal initiatives, impose rigorous requirements on construction projects, demanding substantial investment in sustainable practices and materials. This can deter smaller or less experienced companies from competing with established players like Hyundai Engineering, who have existing expertise and resources to manage these demands.

- Regulatory Complexity: Navigating diverse international legal frameworks and compliance standards acts as a substantial barrier.

- Environmental Compliance Costs: Meeting evolving environmental regulations, like those related to carbon emissions and waste management, requires significant upfront investment.

- Permitting Processes: Lengthy and complex permitting procedures can delay project timelines and increase operational costs for new market participants.

- Industry Standards: Adherence to specialized engineering codes and safety protocols necessitates specialized knowledge and robust quality management systems.

Established Client Relationships and Reputation

Hyundai Engineering benefits significantly from its deeply entrenched relationships with major clients, including governments, state-owned enterprises, and large industrial conglomerates. These long-standing partnerships, built over decades, are not easily replicated by newcomers. For instance, in 2023, Hyundai Engineering secured significant projects with key national entities, reinforcing these established ties.

The company's robust reputation for reliability, safety, and delivering high-quality projects acts as a powerful deterrent to new entrants. This trust is a crucial asset in the Engineering, Procurement, and Construction (EPC) sector, where project execution carries substantial risk. Newcomers face a steep uphill battle in cultivating comparable levels of confidence and establishing the necessary networks to win initial, large-scale contracts.

- Established Client Base: Hyundai Engineering's long-standing relationships with governments and major industrial players provide a stable revenue stream and preferential access to new projects.

- Reputational Capital: A proven track record in safety and quality minimizes perceived risk for clients, making it difficult for new entrants to compete on trust alone.

- Network Effects: The company's extensive network of suppliers, subcontractors, and regulatory contacts is a significant barrier, as building such a comprehensive ecosystem takes considerable time and investment.

- Barriers to Entry: The combination of strong client relationships and a stellar reputation creates high barriers to entry, particularly for smaller or less experienced firms aiming for large EPC contracts.

The threat of new entrants for Hyundai Engineering is relatively low due to substantial capital requirements, the need for extensive experience, and the difficulty in acquiring specialized talent. For example, securing financing for projects exceeding $20 billion, like LNG plants, presents a significant financial barrier. Furthermore, in 2024, many EPC contracts demand 10-15 years of experience, a benchmark new firms struggle to meet. The global engineering services market, valued at approximately $1.5 trillion in 2023, highlights the cost of acquiring the necessary expertise and technology.

| Barrier Type | Description | Example/Data Point |

| Capital Requirements | High upfront investment for equipment, technology, and working capital. | Large-scale LNG plants can cost over $20 billion. |

| Experience & Reputation | Clients prioritize proven track records and successful project completion. | 2024 contracts often require 10-15 years of relevant project experience. |

| Specialized Talent | Need for highly skilled engineers and project managers. | Global engineering services market valued at $1.5 trillion (2023), with significant talent costs. |

| Regulatory Hurdles | Navigating complex environmental and permitting regulations. | EU Green Deal initiatives in 2024 impose rigorous sustainable practices requirements. |

Porter's Five Forces Analysis Data Sources

Our Hyundai Engineering Porter's Five Forces analysis is built upon a robust foundation of data, including Hyundai Engineering's official annual reports, investor presentations, and industry-specific market research from reputable firms like IHS Markit and Statista. We also incorporate insights from global economic indicators and regulatory filings relevant to the construction and engineering sectors.