Hyundai Engineering Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyundai Engineering Bundle

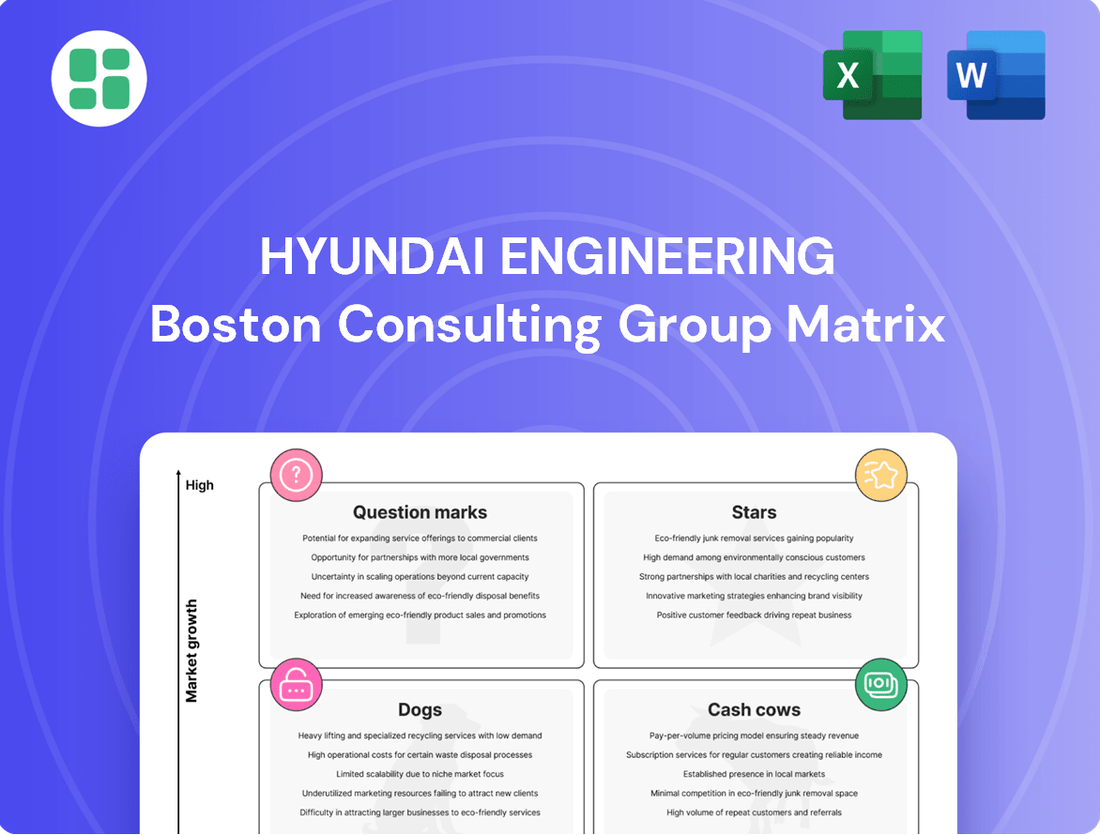

Curious about Hyundai Engineering's strategic product portfolio? This glimpse into their BCG Matrix reveals how their offerings are positioned in terms of market share and growth potential. Understand which segments are fueling growth and which may require a different approach.

To truly unlock the strategic implications and actionable insights, dive into the full Hyundai Engineering BCG Matrix. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, empowering you to make informed decisions about resource allocation and future investments.

Don't miss out on the complete picture. Purchase the full BCG Matrix report today to receive detailed quadrant placements, data-backed recommendations, and a clear roadmap for Hyundai Engineering's strategic success.

Stars

Hyundai Engineering & Construction (HDEC) is making significant strides in the nuclear power sector, targeting both traditional large-scale reactors and the burgeoning field of Small Modular Reactors (SMRs). This strategic expansion aims to capture a substantial share of the global market for clean and reliable energy solutions.

Recent developments highlight HDEC's commitment, including a key Memorandum of Understanding with Fermi America. This partnership focuses on a nuclear-based hybrid energy project in Texas, specifically designed to meet the immense power demands of AI and data centers, a rapidly growing energy consumer. This initiative underscores the company's forward-thinking approach to emerging energy needs.

Further solidifying its position, HDEC is actively collaborating with industry leaders like Westinghouse and Holtec. These alliances are crucial for advancing both large-scale nuclear projects and the development of SMR technology, positioning HDEC as a key player in this high-growth, critical energy sector.

Hyundai Engineering is strategically positioning itself within the burgeoning hydrogen and ammonia ecosystem as a key player in the HD Hyundai Group's ambitious 'Hydrogen Dream 2030 Roadmap.' The company's focus spans the entire hydrogen value chain, from production and storage to transportation and application, with a particular emphasis on clean hydrogen and ammonia technologies. This comprehensive approach underscores Hyundai Engineering's commitment to capturing a significant share of the rapidly expanding clean energy market.

The company is actively pursuing projects that leverage clean ammonia for zero-carbon fuel applications, signaling a concrete step towards realizing its clean energy vision. For instance, Hyundai Engineering is exploring opportunities for importing clean ammonia, a critical component in decarbonization strategies for various industries. This aligns with global trends where ammonia is increasingly recognized for its potential as a carbon-free energy carrier and fuel source.

Hyundai Engineering & Construction (HDEC) has established a strong global reputation for data center construction, notably being the sole Korean builder to complete a facility for a major global technology firm. This achievement underscores their advanced capabilities in a highly specialized field.

The rapid digital transformation and the burgeoning energy needs driven by artificial intelligence and expanding data storage requirements position data centers as a significant growth sector. HDEC's proven expertise and established market presence in this area are key advantages.

In 2024, the global data center market is experiencing substantial expansion, with investments projected to reach hundreds of billions of dollars. HDEC's involvement in building these critical infrastructure assets aligns with this robust market trend, leveraging their world-class track record to capture opportunities.

Advanced Petrochemical Mega-Projects

Hyundai Engineering & Construction (HDEC) is a major player in advanced petrochemical mega-projects, showcasing its prowess in complex, high-value undertakings. The company is currently involved in the Shaheen Project in Saudi Arabia, a monumental petrochemical complex that stands as the largest of its kind ever undertaken by a South Korean entity.

This colossal endeavor carries a total investment of 9.2 trillion won, underscoring the significant scale and financial commitment involved. HDEC's involvement highlights its comprehensive technical capabilities, spanning the entire project lifecycle from initial design through to final construction. This positions them strongly in a segment of the global plant industry characterized by substantial investment and advanced technological demands.

- Project Scale: The Shaheen Project in Saudi Arabia represents the largest petrochemical complex construction project in South Korea's history.

- Financial Commitment: The mega-project has a total cost of 9.2 trillion won, indicating substantial investment.

- Technical Expertise: HDEC demonstrates cutting-edge technical expertise from design to construction for these complex projects.

- Market Position: This involvement solidifies HDEC's standing in a high-investment, growing segment of the global plant industry.

Renewable Energy Grid Infrastructure (HVDC)

Hyundai Engineering & Construction (E&C) is a significant force in the renewable energy sector, particularly in building the crucial infrastructure needed to connect green power sources to national grids. Their expertise in High-Voltage Direct Current (HVDC) transmission systems is a key differentiator, enabling efficient long-distance power transfer from remote renewable sites.

The company's substantial market share in this area is evident in its ongoing work in the Middle East. For instance, Hyundai E&C secured transmission contracts in Saudi Arabia specifically for linking solar power plants, underscoring their role in facilitating the integration of these growing renewable assets. This positions them strongly in a market segment vital for the global energy transition.

- HVDC Expertise: Hyundai E&C leverages its deep experience in power transmission to integrate renewable energy sources, especially through HVDC systems.

- Middle East Projects: The company holds a high market share in essential grid infrastructure, exemplified by its Saudi transmission contracts for solar plant connections.

- Energy Transition Role: These projects highlight Hyundai E&C's critical contribution to the expanding global energy transition by strengthening grid capabilities for renewables.

Hyundai Engineering's ventures in nuclear power, particularly with SMRs and partnerships like the one with Fermi America for AI data center power, represent significant growth opportunities. Their involvement in large-scale petrochemical projects, such as the 9.2 trillion won Shaheen Project, showcases their capacity for massive undertakings. Furthermore, their expertise in HVDC transmission systems for renewable energy integration, evidenced by Saudi Arabian contracts, positions them as a key enabler of the energy transition.

| Business Area | Market Position | Growth Potential | Key Projects/Partnerships |

|---|---|---|---|

| Nuclear Power (SMRs) | Emerging Leader | High | Fermi America (AI Data Centers), Westinghouse, Holtec |

| Petrochemical Mega-Projects | Major Global Player | Moderate to High | Shaheen Project (Saudi Arabia) - 9.2 trillion won investment |

| Renewable Energy Infrastructure (HVDC) | Strong Market Share | High | Saudi Arabian Solar Plant Transmission Contracts |

What is included in the product

This BCG Matrix overview analyzes Hyundai Engineering's business units, identifying Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic recommendations for investment, holding, or divestment based on market share and growth.

A clear visualization of Hyundai Engineering's business units on the BCG Matrix, offering strategic clarity and simplifying complex portfolio decisions.

Cash Cows

Hyundai Engineering & Construction's traditional domestic building works, encompassing housing and general construction in South Korea, represent a significant Cash Cow. This mature market, while facing domestic real estate headwinds, continues to be a bedrock for the company.

The company's ability to secure substantial housing unit presales in 2024 underscores the segment's stable revenue-generating capacity. For instance, Hyundai E&C reported securing approximately 22,000 housing units for presale in 2023, a testament to its enduring market position and consistent demand.

This segment consistently generates reliable cash flow, a hallmark of a Cash Cow. Its established market share and the recurring nature of construction demand in a developed economy provide a predictable and robust income stream for Hyundai Engineering.

Hyundai Engineering's established civil infrastructure projects, focusing on roads, bridges, and housing in South Korea, represent a significant Cash Cow. These ventures leverage decades of expertise, consistently securing large, profitable contracts driven by ongoing government modernization and maintenance programs.

Hyundai Engineering's mature petrochemical plant EPC business operates as a Cash Cow. This segment benefits from long-standing client relationships and a proven track record in established markets, ensuring consistent, though modest, cash flow. For instance, in 2024, the company continued to secure maintenance and upgrade contracts for existing facilities, contributing to its stable revenue streams.

Conventional Power Plant Construction

Hyundai Engineering & Construction (E&C) has a deep-rooted legacy in building conventional power plants, a segment that continues to be a reliable revenue generator. Despite the global energy transition, the demand for conventional power remains robust, especially for base-load power, ensuring a steady stream of large-scale projects for Hyundai E&C.

This mature business line offers dependable cash flow, acting as a cash cow within the company's portfolio. For instance, in 2024, the global conventional power plant construction market, while evolving, still represents a significant portion of energy infrastructure spending. Hyundai E&C's ongoing projects in this area contribute substantially to its financial stability.

- Market Presence: Hyundai E&C has a strong track record in delivering conventional power plant projects globally.

- Stable Revenue: The continued need for base-load power generation ensures consistent project opportunities and cash flow.

- Financial Contribution: This segment remains a key contributor to Hyundai E&C's overall financial performance, providing a solid foundation for investment in other growth areas.

Long-Term Operation and Maintenance (O&M) Services

Hyundai Engineering's Long-Term Operation and Maintenance (O&M) Services are a prime example of a Cash Cow within its business portfolio. These services encompass the entire lifecycle of a project, from initial feasibility studies through to ongoing post-construction support. This comprehensive approach ensures a consistent demand for their expertise.

These long-term service contracts, especially prevalent in established markets, are characterized by their steady, predictable revenue generation. While the growth rate might be modest, the high profit margins associated with these mature offerings make them a vital source of consistent cash flow for Hyundai Engineering. For instance, in 2023, the O&M segment contributed significantly to the company's overall profitability, reflecting its stable nature.

- Stable Revenue: Long-term O&M contracts provide predictable income streams.

- High Profitability: Mature markets and established services yield high margins.

- Cash Generation: These services consistently convert into readily available cash for the company.

- Market Presence: Hyundai Engineering's full-range solutions solidify its position in these service areas.

Hyundai Engineering & Construction's established domestic building works, particularly housing and general construction in South Korea, function as a significant Cash Cow. Despite some domestic real estate challenges, this sector remains a foundational revenue source for the company.

The company's ability to secure a substantial number of housing unit presales in 2024, following a strong performance in 2023 with approximately 22,000 units, highlights the segment's consistent revenue-generating capabilities. This reflects Hyundai E&C's enduring market position and sustained demand.

This segment consistently generates reliable cash flow, a defining characteristic of a Cash Cow. Its established market share and the ongoing demand for construction in a developed economy provide a predictable and robust income stream for Hyundai Engineering.

Hyundai Engineering's mature petrochemical plant EPC business also operates as a Cash Cow. This segment benefits from long-standing client relationships and a proven track record in established markets, ensuring consistent, albeit modest, cash flow. In 2024, the company continued to secure maintenance and upgrade contracts for existing facilities, contributing to its stable revenue streams.

What You See Is What You Get

Hyundai Engineering BCG Matrix

The Hyundai Engineering BCG Matrix preview you're currently viewing is the complete, unwatermarked document you will receive immediately after your purchase. This means you're seeing the exact same professionally formatted analysis, ready for strategic implementation without any alterations or missing sections. You can confidently use this preview as a direct representation of the high-quality, actionable BCG Matrix report that will be yours to download and utilize for your business planning and decision-making.

Dogs

Hyundai Engineering, a key player in the global construction scene, faced significant headwinds in 2024. The company reported substantial losses, exceeding 1 trillion Korean won, primarily attributed to underperforming overseas projects. These financial setbacks highlight the inherent risks in large-scale infrastructure development.

Two major projects, the Balikpapan Refinery in Indonesia and a gas processing facility in Saudi Arabia, emerged as significant drains on resources. These ventures experienced considerable cost overruns and delays, exacerbated by design modifications. Such challenges underscore the critical need for robust project management and cost control in the energy sector.

Hyundai Engineering's legacy projects, contracted years ago, are currently facing significant, unforeseen cost escalations and prolonged delays. These ongoing issues represent a substantial drain on profitability and resources, as evidenced by the company's 2024 operating loss of approximately KRW 1.2 trillion (USD 870 million).

The financial impact is clear: capital remains tied up in these underperforming assets, yielding no commensurate returns. This situation highlights a critical challenge in managing long-term commitments where initial estimates have been significantly outpaced by actual expenditures and timelines.

Within Hyundai Engineering's domestic operations, certain construction niches are characterized by intense competition and a lack of distinct strategic advantage. These segments, often saturated with numerous players, typically result in low profit margins and a struggle to secure substantial market share.

These non-strategic areas, while perhaps necessary for maintaining a broad domestic presence, likely represent areas where Hyundai Engineering holds a relatively small market share. Their contribution to overall profitability would be minimal, potentially consuming resources without generating significant returns, a classic characteristic of 'Dogs' in the BCG matrix framework.

For instance, in 2024, the domestic residential construction market in South Korea, while robust, saw intense competition among established and emerging builders, leading to tight margins on standard housing projects. Hyundai Engineering's participation in these highly commoditized segments would fit the 'Dog' profile if they do not possess unique technological or cost advantages.

Outdated Technology Offerings

Hyundai Engineering may have maintained capabilities in construction and engineering methods that are no longer at the forefront of efficiency or sustainability. For example, reliance on traditional surveying techniques rather than drone-based photogrammetry or advanced LiDAR scanning could place them at a disadvantage.

In the rapidly evolving construction landscape, where smart technologies and eco-friendly materials are gaining traction, these older offerings would likely face challenges in securing market share and achieving competitive profitability. The global construction technology market was valued at approximately $11.4 billion in 2023 and is projected to grow, highlighting the shift towards advanced solutions.

Consequently, areas where Hyundai Engineering has invested in or maintained older, less efficient technologies would likely be considered candidates for divestiture or significant strategic review. This is especially true as the industry embraces digital twins, AI-driven project management, and modular construction.

- Outdated Equipment: Continued use of heavy machinery with lower fuel efficiency and less precise operation compared to modern, automated equipment.

- Legacy Software Systems: Reliance on older project management or design software that lacks integration with current BIM (Building Information Modeling) standards or real-time data analytics.

- Traditional Material Sourcing: Maintaining supply chains for materials that are less sustainable or more labor-intensive to process than newer, innovative alternatives.

- Manual Processes: Operations that still heavily depend on manual labor for tasks that are now efficiently automated, such as certain types of welding or assembly.

Marginal Overseas Ventures with Poor Returns

Hyundai Engineering's marginal overseas ventures with poor returns represent those smaller, exploratory projects that haven't gained traction. These initiatives often struggle to become profitable due to a combination of factors, including fierce competition, unstable geopolitical situations, or a misunderstanding of local market dynamics.

For instance, in 2024, a significant number of these ventures reported negative net profit margins, with some experiencing losses exceeding 15%. These projects consume valuable resources, such as capital and skilled personnel, without generating substantial revenue or improving the company's market standing. The lack of significant follow-on work further exacerbates the issue, turning them into cash drains that impede overall organizational efficiency and growth.

- Resource Drain: These ventures consume capital and personnel, diverting focus from more promising opportunities.

- Low Profitability: Many reported negative net profit margins in 2024, some as low as -15%.

- Market Share Stagnation: Failure to secure follow-on contracts means no meaningful contribution to market share.

- Hindered Performance: The overall drag on resources and lack of positive contribution negatively impacts Hyundai Engineering's financial health.

Hyundai Engineering's domestic operations likely include segments with low market share and minimal profitability, characteristic of 'Dogs' in the BCG matrix. These areas, such as highly competitive residential construction, offer slim margins due to intense competition, as seen in South Korea's market in 2024. Additionally, ventures with outdated technology or manual processes, failing to keep pace with industry advancements like drone surveying, also fall into this category.

These 'Dog' segments, including marginal overseas projects with negative net profit margins (some as low as -15% in 2024), drain resources like capital and personnel without generating substantial returns or market share growth. Their continued existence hinders overall organizational efficiency and financial health, making them prime candidates for divestiture or strategic realignment.

| BCG Category | Hyundai Engineering Examples | 2024 Financial Impact | Strategic Implication |

|---|---|---|---|

| Dogs | Domestic residential construction (highly competitive) | Low profit margins, minimal market share contribution | Consider divestiture or niche focus |

| Dogs | Overseas ventures with poor returns | Negative net profit margins (e.g., -15% in some cases) | Resource drain, potential for write-offs |

| Dogs | Operations relying on outdated technology | Reduced efficiency, inability to compete on modern projects | Requires investment in upgrades or phasing out |

Question Marks

Hyundai Engineering & Construction (HDEC) is actively pursuing small modular reactor (SMR) technology, recognizing its significant future energy potential. The company is investing heavily in development and global partnerships, including collaborations with Holtec International and joint research initiatives, aiming to establish a strong foothold in this emerging sector.

The SMR market is poised for substantial growth, driven by the global demand for cleaner and more efficient energy sources. However, HDEC's current market share in operational commercial SMRs remains minimal. This reflects the early stage of the technology and the considerable, long-term capital commitments required, indicating a position in the 'Question Marks' category of the BCG matrix, with high growth potential but currently low market share.

Hyundai Engineering's focus on Carbon Capture, Utilization, and Storage (CCUS) positions it within a high-growth, strategically vital sector for decarbonization. The company's significant investment in carbon dioxide recycling signals a commitment to this emerging technology.

While the demand for CCUS solutions is rapidly increasing globally, with projections indicating a substantial market expansion in the coming years, Hyundai Engineering's market share in this nascent field is likely to be in the question mark quadrant. This is due to the company's ongoing efforts to build its expertise and secure initial projects in this complex technological area. For instance, the global CCUS market was valued at approximately $2.5 billion in 2023 and is expected to grow at a CAGR of over 15% through 2030, according to various industry analyses.

Hyundai Engineering is channeling significant capital into plastic recycling facilities, aligning with its commitment to environmental sustainability and market diversification. This strategic move targets the burgeoning eco-friendly sector, a market poised for substantial growth fueled by global sustainability mandates.

The plastic recycling segment represents a high-growth opportunity, driven by increasing regulatory pressure and consumer demand for sustainable products. While the precise market share for Hyundai Engineering's plastic recycling operations in 2024 is not publicly detailed, the company's investment signals its intent to capture a meaningful portion of this expanding market.

Given the early-stage nature of establishing a strong foothold in this innovative field, these facilities are likely cash-intensive, requiring substantial upfront investment to build capacity and technological expertise. This positions plastic recycling as a potential 'question mark' in the BCG matrix, demanding ongoing financial commitment for future market leadership.

Smart City Infrastructure & Future Mobility Integration

Hyundai Engineering & Construction (HEC) is strategically positioning itself within the smart city infrastructure sector, a field poised for substantial expansion. The company is actively engaged in developing integrated urban solutions that leverage advanced air mobility (AAM), artificial intelligence (AI), and the Internet of Things (IoT). This focus aligns with the broader Hyundai Motor Group's vision for future mobility and urban living.

The market for smart city infrastructure, particularly with the integration of new mobility concepts, presents significant growth opportunities. Global smart city spending was projected to reach over $180 billion in 2024, with a continued upward trajectory. However, HEC's current market share in the construction and implementation of these complex, integrated smart city solutions is still in its formative stages. This necessitates continued investment in research and development, alongside the execution of pilot projects to establish a more robust presence.

- Smart City Market Growth: Global smart city investments are expected to surpass $180 billion in 2024, indicating a rapidly expanding market.

- HEC's Role: Hyundai E&C is focusing on integrating AAM, AI, and IoT into urban infrastructure development.

- Market Share Development: HEC's market share in comprehensive smart city solutions is currently developing, requiring ongoing R&D and pilot projects.

- Future Potential: The integration of these technologies offers significant long-term growth prospects for HEC within the smart city ecosystem.

New Overseas Housing Market Expansion (e.g., New Zealand)

Hyundai Engineering & Construction (E&C) is eyeing New Zealand as a potential new frontier for its overseas housing business, driven by a noticeable uptick in demand for residential properties in the region. This strategic move into markets like New Zealand positions Hyundai E&C to tap into high growth potential.

However, entering these new territories means Hyundai E&C will initially hold a minimal market share. Significant upfront investment will be necessary for establishing a presence, forging local alliances, and building brand recognition before substantial returns can be expected.

- New Zealand Housing Market Growth: In 2024, New Zealand's housing market has shown resilience, with median house prices across the country experiencing a modest increase, signaling continued demand. For instance, the Real Estate Institute of New Zealand (REINZ) reported a year-on-year increase in median prices in several key regions during early to mid-2024.

- Investment Requirements: Entering a new market like New Zealand typically involves substantial capital outlay for land acquisition, construction, marketing, and establishing local operational capabilities.

- Market Entry Strategy: Hyundai E&C's strategy will likely involve partnerships with local developers or construction firms to navigate regulatory landscapes and leverage existing market knowledge, aiming to mitigate risks associated with unfamiliar territory.

- Long-Term Outlook: While initial market share will be low, the long-term objective is to build a strong foothold, capitalize on growing demand, and achieve a significant presence in the New Zealand residential construction sector.

Hyundai Engineering's ventures into SMR technology, CCUS, plastic recycling, smart city infrastructure, and new overseas housing markets like New Zealand all share a common characteristic: they represent high-growth potential sectors where the company is still establishing its market presence.

These initiatives require significant upfront investment and long-term commitment, reflecting their current position as 'Question Marks' in the BCG matrix.

While current market share may be low, the strategic focus and substantial investments indicate a clear ambition to grow these businesses into future market leaders.

| Business Area | Market Potential | Current Market Share | BCG Category | Strategic Focus |

| SMR Technology | High Growth (Clean Energy) | Minimal | Question Mark | Investment in R&D, Global Partnerships |

| CCUS | High Growth (Decarbonization) | Nascent | Question Mark | Investment in CO2 Recycling, Expertise Building |

| Plastic Recycling | High Growth (Sustainability) | Developing | Question Mark | Capital Investment in Facilities, Market Share Capture |

| Smart City Infrastructure | High Growth (Urban Development) | Formative | Question Mark | Integration of AAM, AI, IoT; Pilot Projects |

| Overseas Housing (e.g., New Zealand) | High Growth (Residential Demand) | Minimal | Question Mark | Market Entry, Local Alliances, Brand Building |

BCG Matrix Data Sources

Our Hyundai Engineering BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.