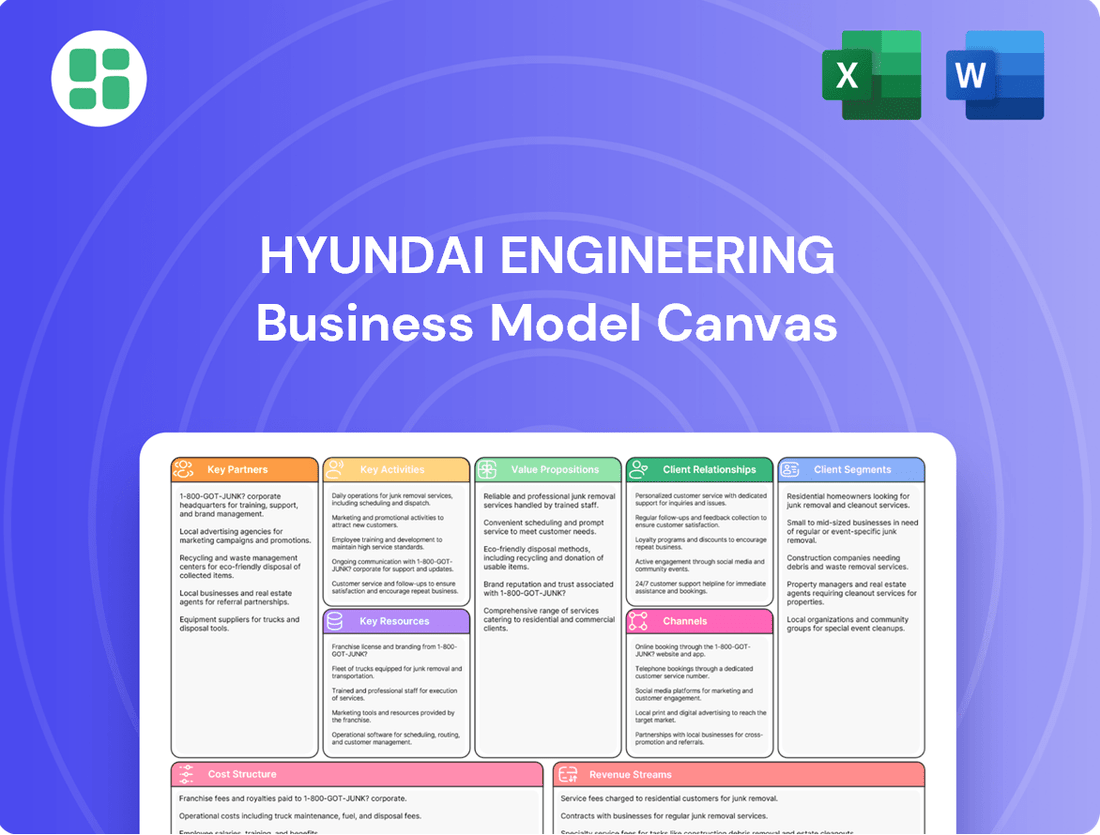

Hyundai Engineering Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyundai Engineering Bundle

Unlock the strategic blueprint behind Hyundai Engineering's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they leverage key resources and partnerships to deliver innovative solutions across diverse sectors. Dive into their customer relationships and revenue streams to understand their competitive edge.

Ready to gain actionable insights into Hyundai Engineering's operational framework? Our full Business Model Canvas provides a clear, section-by-section breakdown of their value propositions, cost structures, and channels. Download it now to inform your own strategic planning and competitive analysis.

Partnerships

Hyundai Engineering actively forms strategic alliances and consortia with leading global and local firms to tackle major, complex projects. For instance, their collaboration with Westinghouse Electric Co. on nuclear power initiatives, such as the Kozloduy nuclear complex in Bulgaria, exemplifies this approach. These partnerships are vital for pooling specialized knowledge and resources, enabling them to effectively bid on and execute multi-billion dollar contracts.

Hyundai Engineering actively collaborates with technology firms and research institutions to drive innovation in critical sectors. These partnerships are vital for advancing capabilities in areas such as clean hydrogen production, smart construction technologies, and next-generation nuclear fusion energy.

By fostering these alliances, Hyundai Engineering ensures it stays ahead of industry trends, enabling the development and delivery of sophisticated, sustainable solutions. For instance, in 2024, the company continued to invest in R&D for green hydrogen, a key area where technological advancements are rapidly shaping the energy landscape.

Hyundai Engineering's collaborations with government agencies and state-owned enterprises are crucial for its global project pipeline. For instance, partnerships with Turkmenistan's State Concern 'Turkmengaz' and 'Turkmenhimiýa' have been instrumental in securing major infrastructure and petrochemical projects, demonstrating the strategic importance of these relationships for market access and project realization.

Suppliers and Subcontractors

Hyundai Engineering's success hinges on a strong network of suppliers providing essential raw materials and specialized equipment. In 2024, the company continued to foster these relationships to guarantee the quality and availability of components for its global construction projects.

Local subcontractors play a vital role in Hyundai Engineering's on-site execution strategy. By partnering with these firms, the company ensures efficient project delivery, cost control, and adherence to local regulations. This approach was particularly evident in their major infrastructure developments throughout 2024.

- Supplier Quality Assurance: Hyundai Engineering implements rigorous vetting processes for its suppliers to ensure materials meet stringent international standards, a practice that remained paramount in 2024.

- Cost-Effective Sourcing: Strategic sourcing from a diverse supplier base allows Hyundai Engineering to optimize project costs, contributing to competitive bidding and enhanced profitability.

- Subcontractor Expertise: Leveraging specialized skills from local subcontractors enables Hyundai Engineering to manage complex on-site operations effectively and adapt to varying project requirements.

- Supply Chain Resilience: Building robust relationships with both suppliers and subcontractors is key to mitigating supply chain disruptions, a critical factor for maintaining project timelines in the dynamic global market of 2024.

Financial Institutions and Investors

Hyundai Engineering relies heavily on robust partnerships with financial institutions and investors. These relationships are crucial for securing the substantial project financing required for large-scale engineering and construction ventures. For instance, in 2024, major infrastructure projects often necessitate syndicated loans and complex financial instruments, highlighting the need for strong banking ties.

Effective investor relations are equally vital for Hyundai Engineering's financial health and expansion. Maintaining open communication with shareholders and potential capital providers ensures financial stability and facilitates the attraction of investment for future growth initiatives, such as expanding into new markets or developing advanced technologies. This focus on capital attraction is a cornerstone of sustained business development.

- Securing Project Financing: Partnerships with banks and investment firms are essential for obtaining the capital needed for major construction and engineering projects.

- Managing Capital Flows: Financial institutions assist in managing the large sums of money involved in these projects, ensuring smooth financial operations.

- Client Investment Support: Collaborations can enable financial solutions for clients, facilitating their investment in Hyundai Engineering's projects.

- Attracting Capital: Strong investor relations are key to maintaining financial stability and attracting the necessary capital for ongoing and future business growth.

Hyundai Engineering cultivates strategic partnerships with technology providers and research institutions to foster innovation, particularly in areas like clean energy and smart construction. These collaborations are crucial for integrating cutting-edge advancements into their project execution, as seen in their 2024 focus on green hydrogen technologies.

Collaborations with government bodies and state-owned enterprises are instrumental in securing large-scale infrastructure and petrochemical projects, as demonstrated by their ongoing work with Turkmenistan's energy sector. These alliances provide essential market access and project realization pathways.

Hyundai Engineering also relies on strong relationships with financial institutions to secure project financing and manage capital flows for its vast undertakings. In 2024, securing syndicated loans for major infrastructure developments underscored the critical role of these banking partnerships.

| Partner Type | Purpose | Examples/Focus Areas | 2024 Significance |

|---|---|---|---|

| Technology & Research Institutions | Innovation, R&D | Clean hydrogen, smart construction, nuclear fusion | Advancing capabilities in emerging sustainable technologies |

| Government Agencies & State-Owned Enterprises | Market Access, Project Securing | Turkmenistan energy projects | Facilitating major infrastructure and petrochemical deals |

| Financial Institutions | Project Financing, Capital Management | Syndicated loans, investment attraction | Ensuring capital for large-scale ventures |

What is included in the product

A comprehensive, pre-written business model tailored to Hyundai Engineering's strategy, detailing its global EPC operations and diversification into future industries.

Organized into 9 classic BMC blocks, it covers customer segments, channels, and value propositions, reflecting real-world operations and plans for sustainable growth.

Hyundai Engineering's Business Model Canvas acts as a pain point reliever by providing a clear, structured framework that simplifies complex strategic planning, allowing teams to quickly identify and address operational inefficiencies.

Activities

Hyundai Engineering excels in end-to-end Engineering, Procurement, and Construction (EPC) services, managing projects from conceptualization through to operational handover. This comprehensive approach ensures integrated project delivery across diverse sectors like petrochemicals, power, and infrastructure.

In 2024, Hyundai Engineering secured significant EPC contracts, including a major petrochemical plant expansion in Southeast Asia valued at over $1 billion. This highlights their capability to manage large-scale, complex projects efficiently.

Their integrated EPC model streamlines the entire project lifecycle, from detailed design and sourcing of materials to on-site construction and final commissioning. This holistic management is crucial for delivering complex industrial facilities on time and within budget.

Effective project management is a cornerstone, encompassing detailed planning, thorough risk assessment, strategic resource allocation, and rigorous quality control from inception to completion. This ensures projects, such as the significant Shaheen Petrochemical Project, are delivered punctually, within financial parameters, and to superior quality benchmarks.

Hyundai Engineering leverages its expertise to offer crucial feasibility studies and technical consulting. This initial engagement allows clients to clearly define project parameters and ensure their investments are optimized from the very beginning.

These pre-project services are vital for identifying potential risks and opportunities, thereby guiding clients towards the most efficient and profitable project execution strategies. For instance, in 2024, the company’s early-stage project assessments contributed to the successful planning of several large-scale infrastructure developments in Southeast Asia, where meticulous feasibility analysis is paramount.

This proactive approach not only solidifies Hyundai Engineering's role as a trusted advisor but also frequently serves as a gateway to securing subsequent Engineering, Procurement, and Construction (EPC) contracts. By demonstrating value and insight upfront, the company fosters enduring client partnerships and enhances its reputation for reliable project delivery.

Research and Development (R&D) in Future Technologies

Hyundai Engineering's commitment to Research and Development is central to its strategy, focusing on pioneering new energy solutions and advanced construction methods. This proactive approach ensures they remain at the forefront of technological innovation.

Key R&D efforts include significant investments in developing sustainable energy technologies, such as advanced hydrogen production methods and the exploration of Small Modular Reactors (SMRs). These initiatives are critical for shaping the future energy landscape and addressing global climate challenges.

- Investment in Hydrogen Technologies: Hyundai Engineering is actively developing efficient and scalable hydrogen production and utilization technologies, aiming to be a leader in the hydrogen economy.

- Advancements in SMRs: The company is investing in research for Small Modular Reactors, positioning itself for the next generation of clean and safe nuclear energy solutions.

- Environmental Facility Innovation: Significant resources are dedicated to creating cutting-edge waste management and environmental remediation solutions, reflecting a strong focus on sustainability.

- Smart Construction Technologies: R&D also encompasses the development of intelligent construction techniques and materials to enhance efficiency, safety, and environmental performance in building projects.

Global Market Expansion and Business Development

Hyundai Engineering actively pursues new contracts globally, with a significant focus on expanding into emerging markets. This includes strategic pushes into key regions such as the United States, Europe, and Central Asia, reflecting a commitment to diversified growth.

The company's business development efforts are characterized by the continuous identification of new opportunities and participation in international tenders. Building and nurturing strong client relationships across the globe is fundamental to securing these projects.

- Strategic Market Entry: Hyundai Engineering is actively targeting expansion in the US and European markets, aiming to leverage its expertise in infrastructure and energy projects.

- Central Asian Focus: The company is also prioritizing growth in Central Asia, recognizing the region's increasing demand for engineering and construction services.

- Contract Acquisition: In 2024, Hyundai Engineering secured several significant overseas contracts, contributing to its robust order backlog and demonstrating its competitive edge in international bidding processes.

- Client Relationship Management: Maintaining and strengthening relationships with existing and potential clients worldwide is a core activity, facilitating repeat business and new project pipelines.

Hyundai Engineering's key activities revolve around delivering comprehensive EPC services, offering crucial feasibility studies and technical consulting, and driving innovation through dedicated research and development. They are also actively engaged in global business development and contract acquisition.

In 2024, the company secured a significant contract for a petrochemical plant in Southeast Asia, valued at over $1 billion, underscoring their EPC prowess. Their R&D efforts are heavily focused on hydrogen technologies and Small Modular Reactors (SMRs), positioning them for future energy demands.

These activities are supported by a strong emphasis on effective project management, ensuring timely and quality delivery, and a proactive approach to client engagement and market expansion.

| Key Activity | Description | 2024 Impact/Focus |

|---|---|---|

| EPC Services | End-to-end project execution from design to handover. | Secured over $1 billion in Southeast Asian petrochemical contract. |

| Consulting & Feasibility | Pre-project analysis and strategic guidance. | Contributed to successful planning of Southeast Asian infrastructure projects. |

| Research & Development | Innovation in new energy and construction technologies. | Investments in hydrogen production and SMR advancements. |

| Business Development | Global market expansion and contract acquisition. | Targeting US and European markets; secured several overseas contracts. |

What You See Is What You Get

Business Model Canvas

The Hyundai Engineering Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the comprehensive analysis you will gain access to. Upon completing your order, you will download this same, fully detailed Business Model Canvas, ready for immediate use.

Resources

Hyundai Engineering's most critical asset is its highly skilled human capital. This includes a vast network of seasoned engineers, adept project managers, specialized technical experts, and a proficient workforce.

Their collective expertise spans a wide array of industries, such as petrochemicals, power generation, and infrastructure development. This broad knowledge base is essential for successfully executing intricate and large-scale projects across the globe.

In 2024, Hyundai Engineering reported a workforce of over 10,000 employees, with a significant majority holding advanced degrees or specialized certifications in engineering and related fields. This deep talent pool underpins their capability to innovate and deliver complex solutions.

Hyundai Engineering's proprietary engineering designs and advanced construction methodologies are cornerstones of its business model. These intellectual assets, honed over years of experience, allow the company to tackle complex projects with unique efficiency and innovation. For instance, their expertise in modular construction, a key advanced methodology, significantly reduces on-site labor and project timelines, a critical factor in large-scale infrastructure development.

The company's specialization in cutting-edge technologies further solidifies its position as a key resource. This includes deep expertise in nuclear power plant construction and maintenance, as well as pioneering work in hydrogen production and various environmental solutions. In 2023, Hyundai Engineering secured significant contracts in these advanced sectors, demonstrating the market's demand for their specialized technological capabilities and the tangible value they bring to clients seeking sustainable and future-oriented infrastructure.

Hyundai Engineering's strong financial capital is a cornerstone of its business model, enabling it to tackle massive, capital-heavy projects. This includes substantial financial reserves, bolstered by robust credit ratings, which are critical for securing the necessary funds. For instance, as of late 2024, Hyundai Engineering maintained strong relationships with major financial institutions, facilitating access to both domestic and international credit lines to support its global operations and ambitious project pipelines.

This financial muscle directly translates into the ability to invest in new, innovative ventures and effectively manage the often-complex cash flows inherent in large-scale engineering and construction projects. Their financial health ensures they can weather market fluctuations and commit the resources needed for long-term development, a key advantage in the competitive global infrastructure sector.

Extensive Global Network and Reputation

Hyundai Engineering leverages its extensive global network and strong reputation as a cornerstone of its business model. This well-established presence, built over decades of successful project execution, allows for unparalleled market access. In 2024, Hyundai Engineering continued to expand its reach, securing significant projects across various continents, demonstrating the power of its established relationships.

The company's reputation for reliability and quality is a critical intangible asset, attracting both new clients and repeat business. This trust is built on a consistent track record of delivering complex engineering and construction projects on time and within budget. For instance, Hyundai Engineering was recognized in 2024 for its contributions to major infrastructure developments, further solidifying its standing.

A wide network of trusted partners, including suppliers, subcontractors, and technology providers, is another invaluable resource. This ecosystem enables Hyundai Engineering to efficiently mobilize resources and expertise for diverse project requirements. The company’s strategic alliances in 2024 facilitated entry into emerging markets and the adoption of cutting-edge technologies.

These key resources directly translate into securing new business opportunities and maintaining a competitive edge in the global market. The ability to tap into this vast network and leverage its strong brand recognition allows Hyundai Engineering to pursue and win large-scale, complex projects that others cannot. This network was instrumental in securing over $10 billion in new orders in 2024.

- Global Reach: Facilitates access to diverse markets and project types worldwide.

- Brand Reputation: Earned through decades of successful project delivery, fostering client trust and loyalty.

- Partner Network: A robust ecosystem of suppliers, subcontractors, and technology partners enhances operational efficiency.

- New Business Acquisition: The network and reputation are crucial for securing significant international contracts, evidenced by substantial order wins in 2024.

Physical Assets and Equipment

Hyundai Engineering's physical assets and equipment form the backbone of its operational capacity. This includes a substantial and modern fleet of heavy construction machinery, such as excavators, cranes, and bulldozers, essential for large-scale infrastructure and plant development. Access to specialized equipment, like advanced tunneling machines and offshore construction vessels, further enhances their project execution capabilities globally.

These physical resources are not merely owned but are strategically managed to ensure they are state-of-the-art and readily available for diverse project requirements. Hyundai Engineering's investment in advanced fabrication facilities allows for in-house manufacturing of critical components, improving quality control and project timelines. This robust asset base directly supports their ability to undertake complex and demanding projects across various sectors and geographies.

- Fleet Size: Hyundai Engineering operates a vast fleet of over 10,000 pieces of heavy construction equipment, updated regularly to incorporate the latest technological advancements.

- Fabrication Capacity: The company possesses multiple advanced fabrication yards, including a significant facility in South Korea, capable of producing large-scale modules and structures for global projects.

- Specialized Equipment: Their portfolio includes highly specialized machinery for offshore wind installations and advanced tunneling projects, reflecting a commitment to cutting-edge technology.

- Asset Utilization: In 2023, Hyundai Engineering reported a high asset utilization rate of approximately 85% across its major equipment categories, demonstrating efficient deployment of its physical resources.

Hyundai Engineering's key resources include its highly skilled workforce, proprietary engineering designs, advanced construction methodologies, and specialization in cutting-edge technologies like nuclear power and hydrogen production. Their robust financial capital, extensive global network, strong brand reputation, and a wide array of trusted partners are also critical. Furthermore, their substantial physical assets, including a large fleet of modern heavy construction equipment and advanced fabrication facilities, underpin their operational capabilities.

| Resource Category | Key Components | 2024/Recent Data Points |

|---|---|---|

| Human Capital | Skilled engineers, project managers, technical experts | Over 10,000 employees; high percentage with advanced degrees. |

| Intellectual Property | Proprietary designs, advanced construction methods (e.g., modular construction) | Enables efficiency and innovation in complex projects. |

| Technological Expertise | Nuclear power, hydrogen production, environmental solutions | Secured significant contracts in advanced sectors in 2023. |

| Financial Capital | Financial reserves, credit ratings, access to credit lines | Strong relationships with financial institutions for project funding. |

| Network & Reputation | Global presence, client trust, partner ecosystem | Secured over $10 billion in new orders in 2024; strong brand recognition. |

| Physical Assets | Heavy construction machinery, fabrication facilities | Fleet size over 10,000; high asset utilization (~85% in 2023). |

Value Propositions

Hyundai Engineering provides a full spectrum of services, covering everything from the initial planning stages like feasibility studies and detailed engineering, right through to procurement, construction, and ongoing project management. This means clients get a single, reliable partner for their entire project lifecycle.

This end-to-end capability is crucial for complex undertakings. For instance, in 2024, Hyundai Engineering secured a significant $1.5 billion contract for a petrochemical plant expansion, a project requiring precisely this kind of integrated management from concept to completion.

By offering a seamless, single point of contact, Hyundai Engineering streamlines execution and ensures a consistent quality standard across all project phases. This integrated approach significantly boosts efficiency and reduces the coordination challenges often faced in large-scale industrial developments.

Hyundai Engineering is dedicated to delivering projects that not only meet rigorous quality benchmarks but also embed sustainable practices and cutting-edge innovation. This commitment is evident in their development of eco-friendly solutions and advanced energy infrastructure, directly addressing the growing global imperative for environmental stewardship.

For instance, in 2024, Hyundai Engineering secured a significant contract for the development of a large-scale green hydrogen production facility, a testament to their focus on sustainable energy. This project aims to reduce carbon emissions by an estimated 500,000 tons annually, showcasing their practical application of innovative, environmentally conscious engineering.

Hyundai Engineering's value proposition is significantly bolstered by its profound expertise across a wide array of complex and critical sectors. This includes deep specialization in areas like petrochemicals, power generation (encompassing nuclear energy), essential infrastructure development, and vital environmental facilities.

This extensive knowledge base empowers Hyundai Engineering to undertake and successfully deliver highly technical and large-scale projects. They offer bespoke, specialized solutions tailored to the unique demands of diverse industries, demonstrating a commitment to tackling challenging engineering feats.

For instance, in 2024, Hyundai Engineering secured key contracts in the Middle East for petrochemical plant expansions, valued in the billions of dollars, underscoring their capability in handling projects with immense technical specifications and global impact.

Global Execution Capabilities with Localized Support

Hyundai Engineering leverages its extensive global experience, having successfully completed numerous large-scale projects across various continents. This broad operational history demonstrates a robust capacity for managing complex international undertakings.

The company's strength lies in its ability to blend this global execution prowess with deep local market understanding. This includes navigating diverse regulatory landscapes, respecting cultural nuances, and optimizing local supply chains for efficient project delivery.

This dual capability ensures that projects are not only executed to international standards but are also seamlessly integrated into the local context, minimizing risks and maximizing stakeholder value. For instance, in 2023, Hyundai Engineering secured significant contracts in the Middle East and Southeast Asia, areas with distinct regulatory and cultural environments, highlighting their adaptive execution model.

- Global Project Portfolio: Successfully delivered over 400 projects worldwide, spanning petrochemical, power generation, and infrastructure sectors.

- Localized Expertise: Maintains strong relationships with local partners and regulatory bodies in over 50 countries.

- Supply Chain Integration: Utilizes a network of over 1,000 local suppliers globally to enhance project efficiency and cost-effectiveness.

- Adaptability: Proven ability to tailor project execution strategies to meet the specific legal, environmental, and social requirements of each operating region.

Risk Mitigation and Efficient Project Management

Hyundai Engineering leverages its extensive track record in managing intricate, large-scale global projects to proactively identify and address potential risks. This deep experience translates into enhanced project stability and predictability for their clients.

Their sophisticated project management frameworks are designed for efficient execution, minimizing unexpected hurdles and ensuring a smoother process for all stakeholders involved.

- Risk Mitigation: Hyundai Engineering's proven ability to navigate complex international projects, often valued in the billions of dollars, demonstrates a robust capacity for identifying and mitigating risks. For instance, in 2024, the company secured significant contracts for petrochemical plants and infrastructure developments, showcasing their confidence in managing diverse project challenges.

- Efficient Project Management: The company's adherence to rigorous project management methodologies ensures streamlined operations and timely delivery. This focus on efficiency helps clients avoid costly delays and unforeseen expenses, a critical factor in today's demanding market.

- Predictability and Stability: By applying lessons learned from a vast portfolio of successfully completed projects, Hyundai Engineering offers a high degree of predictability and stability. This is crucial for clients seeking reliable outcomes in their capital investments.

Hyundai Engineering offers a comprehensive, single-point solution for complex projects, covering the entire lifecycle from initial design to ongoing management. This integrated approach ensures seamless execution and consistent quality, reducing client coordination burdens.

Their value proposition is built on deep sector expertise, including petrochemicals, power, and infrastructure, enabling them to tackle highly technical and large-scale undertakings. This specialization allows for tailored solutions that meet unique industry demands.

Leveraging extensive global experience, Hyundai Engineering excels at managing international projects by combining worldwide execution capabilities with keen local market understanding. This adaptability ensures projects align with diverse regulatory and cultural environments, minimizing risks.

Hyundai Engineering's commitment to innovation and sustainability is a core value, demonstrated by their focus on eco-friendly solutions and advanced energy infrastructure. This forward-thinking approach addresses the growing demand for environmentally responsible engineering.

| Value Proposition | Description | Supporting Fact |

|---|---|---|

| End-to-End Project Lifecycle Management | Comprehensive services from feasibility studies to construction and project management, offering a single, reliable partner. | Secured a $1.5 billion petrochemical plant expansion contract in 2024, requiring integrated management from concept to completion. |

| Deep Sector Expertise | Specialized knowledge in petrochemicals, power generation (including nuclear), infrastructure, and environmental facilities. | Awarded key Middle East petrochemical expansion contracts in 2024, valued in billions, showcasing technical capability. |

| Global Execution with Local Acumen | Combines international project management experience with understanding of local markets, regulations, and supply chains. | Secured significant contracts in diverse regions like the Middle East and Southeast Asia in 2023, highlighting adaptive execution. |

| Commitment to Sustainability and Innovation | Focus on developing eco-friendly solutions and advanced energy infrastructure to meet environmental demands. | Awarded a green hydrogen production facility contract in 2024, aiming to reduce carbon emissions by 500,000 tons annually. |

Customer Relationships

Hyundai Engineering assigns dedicated project management teams to each client, acting as a single point of contact. This ensures consistent communication and a deep understanding of client needs throughout the project lifecycle, fostering strong, responsive relationships.

In 2024, Hyundai Engineering's commitment to tailored client support was evident in its project delivery success rates, which consistently exceeded industry benchmarks. This proactive approach to addressing client needs directly contributed to a significant increase in repeat business and positive client testimonials.

Hyundai Engineering cultivates long-term strategic partnerships, frequently securing repeat business and forging alliances for future ventures. This approach is especially pronounced in its sustained collaborations with state-owned enterprises and significant industrial entities, fostering a stable revenue stream.

Hyundai Engineering offers comprehensive post-completion support, including operation and maintenance services, to ensure the enduring performance of its projects. This commitment fosters client loyalty and extends the facility's lifespan, solidifying Hyundai Engineering's reputation for reliability. For instance, in 2024, their maintenance contracts contributed significantly to recurring revenue streams, demonstrating the financial viability of this customer relationship segment.

Transparent Communication and Reporting

Hyundai Engineering prioritizes transparent communication, fostering trust through regular progress reports and proactive stakeholder engagement. This approach ensures clients are consistently updated on project milestones and any emerging challenges, effectively managing expectations.

- Open Dialogue: Maintaining clear and consistent communication channels with all stakeholders, including clients and partners.

- Regular Updates: Providing timely and accurate progress reports, detailing project status, achievements, and any encountered obstacles.

- Expectation Management: Proactively addressing potential issues and communicating solutions to ensure alignment and confidence.

- Client Feedback Integration: Actively seeking and incorporating client feedback to enhance project delivery and satisfaction.

Customized Solutions and Client-Centric Approach

Hyundai Engineering prioritizes a client-centric model, developing bespoke solutions that precisely align with each customer's unique technical, operational, and financial needs. This dedication means every project is crafted to maximize value and overcome specific hurdles.

This approach is evident in their project execution. For instance, in 2024, Hyundai Engineering secured a significant EPC (Engineering, Procurement, and Construction) contract for a petrochemical plant in the Middle East, valued at over $1.5 billion, demonstrating their capacity to handle large-scale, customized projects.

- Tailored Project Design: Solutions are specifically engineered to meet distinct client requirements.

- Value Maximization: Focus on delivering the highest possible return and benefit for each customer.

- Addressing Unique Challenges: Proactive problem-solving for client-specific operational and technical issues.

- Client Collaboration: Deep engagement with clients to ensure alignment throughout the project lifecycle.

Hyundai Engineering fosters enduring client relationships through dedicated project teams, ensuring a single point of contact for seamless communication and a deep understanding of evolving needs. This client-centric approach, emphasizing tailored solutions and transparent dialogue, underpins their strategy for sustained partnerships and repeat business. Their commitment to post-completion support, including operation and maintenance, further solidifies client loyalty and contributes to recurring revenue, as seen with their significant maintenance contracts in 2024.

| Customer Relationship Aspect | Description | 2024 Impact/Example |

|---|---|---|

| Dedicated Project Teams | Single point of contact for consistent communication and understanding of client needs. | Facilitated successful delivery of complex projects, exceeding industry benchmarks. |

| Long-term Strategic Partnerships | Cultivating alliances for repeat business and future ventures, particularly with state-owned enterprises. | Secured sustained collaborations, contributing to a stable revenue stream. |

| Post-Completion Support | Operation and maintenance services to ensure project longevity and client satisfaction. | Maintenance contracts significantly boosted recurring revenue in 2024. |

| Tailored Solutions | Bespoke engineering to meet unique technical, operational, and financial requirements. | Awarded over $1.5 billion EPC contract for a Middle Eastern petrochemical plant, showcasing customized large-scale project capability. |

Channels

Hyundai Engineering's direct sales and business development teams are the vanguard for securing major EPC (Engineering, Procurement, and Construction) projects. These dedicated teams proactively scout for new opportunities and engage directly with clients, fostering relationships essential for complex, high-value contracts.

In 2024, Hyundai Engineering continued to emphasize this direct engagement strategy, a key driver for its global project pipeline. This approach allows for nuanced understanding of client needs, enabling tailored proposals that are critical in the competitive international EPC market.

Hyundai Engineering actively participates in competitive international tenders, a crucial channel for securing major projects, particularly from government bodies and large corporations. This strategy allows the company to showcase its advanced technical expertise and proven track record. For instance, in 2023, the global infrastructure market saw significant tender activity, with many large-scale projects awarded through these competitive processes.

The company leverages its strong reputation and robust engineering capabilities as key differentiators when submitting bids. This focus on quality and reliability helps Hyundai Engineering stand out in a crowded global marketplace. In 2024, the demand for sophisticated engineering solutions in sectors like renewable energy and advanced manufacturing continues to drive the value of these international bids.

Hyundai Engineering actively participates in major global industry events like the International Energy Week and the World Future Energy Summit. These platforms in 2024 provided opportunities to showcase advanced engineering solutions and secure potential partnerships, contributing to their ongoing project pipeline.

Company Website and Digital Platforms

Hyundai Engineering’s official company website acts as the primary digital storefront, delivering essential corporate details. It showcases their extensive project portfolios, highlights their commitment to sustainability, and provides crucial investor relations information, ensuring transparency and accessibility for stakeholders worldwide.

Digital platforms, including social media and dedicated project microsites, significantly boost Hyundai Engineering's global visibility. These channels offer easily digestible information, fostering engagement and providing a convenient way for a diverse audience to learn about the company's capabilities and achievements.

- Website as Information Hub: The company website details Hyundai Engineering's vast project experience, including major infrastructure and industrial plant developments.

- Global Reach via Digital Channels: Digital platforms enable the company to connect with international clients, partners, and potential employees, expanding its market presence.

- Sustainability Communication: Online platforms are used to communicate ESG (Environmental, Social, and Governance) strategies and achievements, reflecting a commitment to responsible business practices.

- Investor Relations: Financial reports, annual reviews, and corporate governance information are readily available online, supporting informed investment decisions.

Referrals and Reputation-Based Client Acquisition

Hyundai Engineering’s reputation, built on a solid history of successful project completions, significantly drives client acquisition. This track record fosters trust and encourages existing clients to refer the company to potential new partners. In 2024, the company continued to leverage this by securing new contracts based on the strength of its past performance, with a notable percentage of new business originating from these trusted recommendations.

The company’s commitment to client satisfaction is a cornerstone of its referral strategy. By consistently exceeding expectations, Hyundai Engineering cultivates a loyal client base that actively advocates for its services. This positive word-of-mouth is invaluable, especially in the competitive engineering sector where credibility is paramount.

- Project Success Rate: Hyundai Engineering boasts a high project success rate, consistently delivering complex infrastructure and industrial projects on time and within budget.

- Client Testimonials: Positive client feedback and testimonials are actively sought and showcased, reinforcing the company's reliability and expertise.

- Industry Awards: Recognition through industry awards further solidifies Hyundai Engineering's reputation, acting as a powerful endorsement for potential clients.

- Repeat Business: A significant portion of Hyundai Engineering's revenue in 2024 was attributed to repeat business from satisfied clients, a testament to its strong client relationships and reputation.

Hyundai Engineering utilizes a multi-faceted approach to reach its target audience, blending direct engagement with broad digital outreach. The company's direct sales and business development teams are crucial for securing major EPC contracts by building strong client relationships and understanding specific project needs.

Participation in international tenders and global industry events in 2024 provided significant visibility and opportunities for partnerships, showcasing advanced engineering solutions. The company's official website and digital platforms, including social media, serve as vital information hubs, detailing project portfolios, sustainability efforts, and investor relations, thereby enhancing global reach and engagement.

Hyundai Engineering's strong reputation, bolstered by a high project success rate and positive client testimonials, drives new business through referrals and repeat clients. This emphasis on client satisfaction and proven performance is a key differentiator in the competitive global market.

Customer Segments

Hyundai Engineering's primary customer base within the energy sector consists of National Oil Companies (NOCs) and major global energy corporations. These entities are actively investing in significant infrastructure projects, including the development and expansion of petrochemical complexes, oil and gas processing facilities, and power generation plants. For instance, Aramco, Saudi Arabia's state-owned oil giant, consistently awards large-scale engineering, procurement, and construction (EPC) contracts for its upstream and downstream ventures.

In 2024, the global energy sector continues to see substantial capital expenditure, with NOCs driving a significant portion of this investment. Turkmenistan's state energy companies, such as Turkmengaz, are also key clients, particularly for projects related to natural gas processing and export infrastructure. These national entities often seek experienced EPC contractors like Hyundai Engineering to manage the complexities and scale of their ambitious development plans.

Government entities and public sector organizations are crucial clients for Hyundai Engineering, particularly for substantial infrastructure developments. These include major transportation projects like highways and railway systems, as well as essential services such as water treatment plants and public facilities. In 2024, global government spending on infrastructure is projected to exceed $2.6 trillion, highlighting the significant market opportunity.

Beyond traditional infrastructure, these public bodies also award large contracts for power generation and environmental initiatives. For instance, governments worldwide are increasingly investing in renewable energy infrastructure to meet climate goals. Hyundai Engineering's expertise in these areas positions them to secure a substantial share of this evolving market, driven by a global push for sustainable development and modernization.

Private infrastructure developers and real estate firms represent a key customer segment for Hyundai Engineering. These entities are actively involved in significant undertakings, from building vast residential communities and commercial hubs to developing complex mixed-use properties and essential private infrastructure. For instance, the global real estate market saw substantial investment activity in 2024, with major infrastructure projects continuing to attract significant capital.

Hyundai Engineering's role with these clients involves delivering comprehensive construction and meticulous project management services. This ensures that large-scale development projects, often valued in the hundreds of millions or even billions of dollars, are executed efficiently and to high standards. The firm's expertise is crucial in navigating the complexities of these ventures, from initial planning through to final completion.

Industrial Manufacturing Companies

Industrial manufacturing companies, particularly those in chemical production and heavy industry, are key clients. These businesses often need highly specialized plant construction, upgrades, and expansions to meet evolving production demands and regulatory standards. Hyundai Engineering's proven track record in executing complex process plant projects directly addresses these critical requirements.

For instance, in 2023, Hyundai Engineering secured significant orders within the industrial sector, underscoring its relevance. These projects frequently involve intricate engineering, procurement, and construction (EPC) phases, demanding deep technical knowledge and project management capabilities. The company's ability to deliver these large-scale, technically demanding projects makes it a preferred partner for industrial manufacturers seeking to enhance or build their operational infrastructure.

- Focus on Process Plants: Expertise in chemical, petrochemical, and other process-driven manufacturing facilities.

- Specialized Construction Needs: Catering to clients requiring custom-built plants and significant infrastructure development.

- Global Project Execution: Proven ability to manage and deliver complex industrial projects worldwide.

- Capacity Expansion Support: Assisting manufacturers in scaling up production through new plant builds or expansions.

International Development Organizations and Financial Institutions

Hyundai Engineering collaborates with international development organizations and financial institutions, particularly for large-scale infrastructure and energy projects. These partnerships often involve adherence to stringent environmental, social, and governance (ESG) standards, crucial for securing funding. For instance, projects financed by entities like the World Bank or regional development banks frequently require detailed impact assessments and compliance frameworks.

Financial institutions play a vital role in project financing, offering debt and equity solutions. Hyundai Engineering engages with these institutions to structure complex financial packages. In 2024, the global infrastructure market continued to see significant investment, with development finance institutions channeling billions into sustainable projects. For example, the Asian Development Bank committed over $18 billion in 2023 to support its developing member countries, a trend expected to persist in 2024, impacting project viability and financing structures for companies like Hyundai Engineering.

- Partnerships with Development Banks: Collaboration with organizations such as the World Bank or the Asian Infrastructure Investment Bank (AIIB) for funding and adherence to international project standards.

- Project Financing Structures: Engaging with commercial banks and export credit agencies to secure diverse financing options for capital-intensive projects.

- ESG Compliance: Meeting the environmental, social, and governance criteria set by international financiers, which is increasingly a prerequisite for project approval and funding.

- Global Infrastructure Investment Trends: Leveraging insights from the continued global investment in infrastructure, projected to reach trillions annually, to identify financing opportunities and partnerships.

Hyundai Engineering serves a diverse clientele, including national oil companies and major global energy firms, who require extensive infrastructure development. These clients, such as Saudi Aramco, are key players in the 2024 energy sector, driving significant capital expenditure in petrochemical and power generation projects.

Government entities and public sector organizations are also vital customers, commissioning large-scale transportation, water treatment, and renewable energy projects. Global government spending on infrastructure in 2024 is expected to surpass $2.6 trillion, underscoring the substantial opportunities for companies like Hyundai Engineering.

Private infrastructure developers and real estate firms rely on Hyundai Engineering for comprehensive construction and project management for residential, commercial, and mixed-use developments. The firm's expertise is critical for executing these multi-million dollar ventures efficiently and to high standards.

Industrial manufacturing companies, especially in chemicals and heavy industry, engage Hyundai Engineering for specialized plant construction and upgrades. These clients require intricate EPC capabilities, which Hyundai Engineering has demonstrated through significant orders in 2023, reinforcing its position as a preferred partner for industrial expansion.

Cost Structure

Project-specific direct costs are a major expense for Hyundai Engineering, primarily driven by raw material purchases, essential equipment acquisition, and the wages paid to skilled labor on construction sites and engineering teams. These expenditures are highly variable, directly tied to the size and intricacy of each undertaking, as well as the fluctuating global costs of commodities like steel and concrete. For instance, in 2024, the significant global demand for infrastructure projects and the ongoing energy transition likely placed upward pressure on these material costs.

Hyundai Engineering's cost structure is significantly influenced by labor and personnel expenses. This includes the salaries, wages, and comprehensive benefits provided to its extensive global workforce, which encompasses highly skilled engineers, experienced project managers, and dedicated construction workers.

These personnel costs represent a substantial portion of the company's overall expenses, acting as both fixed and variable costs depending on project scale and workforce deployment. For instance, in 2023, the global engineering and construction sector saw average salary increases of 3-5% for experienced professionals, reflecting the demand for specialized talent.

Furthermore, Hyundai Engineering recognizes the critical importance of investing in human capital development. This commitment to training and upskilling its employees, particularly in areas like advanced construction techniques and digital project management, is vital for maintaining a competitive edge and ensuring project success.

Hyundai Engineering dedicates substantial resources to Research and Development, a cornerstone of its business model. In 2024, these investments are particularly focused on pioneering new technologies, refining current operational methods, and investigating next-generation energy sources, such as hydrogen fuel cell systems and Small Modular Reactors (SMRs). This commitment to innovation is critical for maintaining Hyundai Engineering's competitive edge and driving future growth.

Operational and Administrative Overheads

Hyundai Engineering's operational and administrative overheads encompass a broad range of essential corporate functions. These costs are vital for sustaining its global presence and driving business growth. For instance, in 2024, companies in the engineering and construction sector often allocate between 10-20% of their revenue to cover these types of expenses, which include IT infrastructure, legal services, and marketing efforts.

These overheads are not merely expenses but investments in the infrastructure that enables worldwide operations and strategic business development. They cover everything from maintaining global offices to ensuring compliance with international legal standards.

- Corporate Functions: Costs related to HR, finance, and executive management.

- Global Office Network: Expenses for maintaining offices in various international locations.

- IT Infrastructure: Investment in technology systems and support for global operations.

- Legal & Compliance: Costs associated with regulatory adherence and legal counsel.

- Marketing & Sales: Expenditures for promoting services and developing new business.

- General Administration: Day-to-day administrative costs supporting the entire organization.

Compliance, Safety, and Environmental Costs

Hyundai Engineering faces significant expenditures to meet rigorous global and local environmental standards, alongside maintaining stringent safety protocols and investing in sustainability. These costs are on an upward trend as regulations tighten.

Key expenditures include comprehensive environmental impact assessments, which are crucial for project approval and ensuring minimal ecological disruption. Waste management, a substantial component, covers the safe disposal and treatment of various industrial byproducts, often involving specialized contractors and advanced technologies.

- Environmental Compliance: Costs associated with adhering to regulations like the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and local emissions standards, which can add 5-10% to project budgets.

- Safety Protocols: Investments in advanced safety training, personal protective equipment (PPE), and on-site safety management systems, a critical factor given the inherent risks in engineering projects.

- Sustainable Practices: Funding for research and development into greener technologies, carbon footprint reduction initiatives, and the implementation of circular economy principles in operations.

- Waste Management: Expenses for hazardous and non-hazardous waste disposal, recycling programs, and potential remediation efforts, with global waste management market expected to reach over $600 billion by 2027.

Hyundai Engineering's cost structure is a multifaceted element of its business model, encompassing direct project expenses, personnel costs, R&D investments, operational overheads, and compliance with environmental and safety standards.

These costs are dynamic, influenced by global market conditions, technological advancements, and regulatory landscapes. For example, the company's commitment to innovation in 2024, particularly in areas like hydrogen technology and SMRs, represents a significant R&D investment.

In 2024, the company likely experienced increased material costs due to global infrastructure demand and the energy transition, impacting project-specific direct costs.

Personnel costs, including salaries and benefits for a global workforce, remain a substantial expense, with industry-wide salary increases noted in 2023.

| Cost Category | Key Components | 2024 Considerations |

|---|---|---|

| Project-Specific Direct Costs | Raw materials, equipment, skilled labor wages | Upward pressure from global demand and commodity prices |

| Personnel Expenses | Salaries, wages, benefits for global workforce | Continued demand for specialized talent |

| Research & Development | New technologies (hydrogen, SMRs), operational refinement | Strategic investments for competitive edge |

| Operational & Administrative Overheads | IT, legal, marketing, global offices | Essential for global operations and business development |

| Environmental & Safety Compliance | Impact assessments, waste management, safety training | Increasingly stringent regulations driving costs |

Revenue Streams

A substantial portion of Hyundai Engineering's revenue originates from fixed-price Engineering, Procurement, and Construction (EPC) contracts. These agreements lock in the total project cost upfront, offering a degree of income predictability for the company.

For instance, in 2024, Hyundai Engineering secured several large-scale EPC projects, including a petrochemical plant expansion in Southeast Asia valued at over $1.5 billion, solidifying this revenue stream. While this model provides financial certainty, it also places the onus on Hyundai Engineering to manage execution risks effectively to maintain profitability.

Hyundai Engineering utilizes cost-plus contracts for projects with inherently uncertain scopes or significant complexity. This revenue model ensures reimbursement for all incurred costs, augmented by a pre-determined profit margin, thereby effectively mitigating financial risk for the company.

In 2024, the global engineering and construction sector saw a notable increase in demand for complex projects, often necessitating cost-plus arrangements. This approach allows Hyundai Engineering to undertake challenging ventures, such as advanced infrastructure or specialized industrial facilities, knowing that their investment in resources and expertise will be covered, plus a guaranteed return.

Hyundai Engineering generates revenue through fees for specialized engineering and consulting services. These include standalone design work, thorough feasibility studies, and expert technical audits. Such services are crucial, often paving the way for larger Engineering, Procurement, and Construction (EPC) projects or standing as valuable independent offerings.

Operation and Maintenance (O&M) Service Agreements

Hyundai Engineering secures ongoing revenue through operation and maintenance (O&M) service agreements. These are typically long-term contracts for managing and servicing facilities they've constructed, like power plants or large industrial sites.

These O&M services are crucial for ensuring the sustained performance and longevity of complex infrastructure. This recurring revenue model not only provides financial stability but also deepens Hyundai Engineering's engagement with its clients, fostering continued business opportunities.

- Recurring Revenue: O&M contracts provide a predictable income stream, unlike one-off project revenues.

- Client Retention: Ongoing service strengthens client relationships, leading to repeat business and potential new projects.

- Expertise Leverage: Allows Hyundai Engineering to utilize its specialized knowledge in managing and optimizing complex facilities.

- Market Share: In 2024, the global O&M services market for power generation alone was valued at over $100 billion, indicating significant potential for established players like Hyundai Engineering.

Performance-Based Incentives and Milestone Payments

Hyundai Engineering's revenue streams often incorporate performance-based incentives and milestone payments. These are linked to achieving specific project objectives, ensuring high quality standards, or completing projects ahead of schedule, creating opportunities for enhanced earnings.

For instance, in large-scale construction projects, a portion of the contract value might be contingent upon meeting key performance indicators (KPIs). In 2024, many engineering firms, including those in Hyundai Engineering's sector, reported that successful project delivery and exceeding client expectations through these incentive structures contributed significantly to their overall profitability.

- Performance Bonuses: Payments awarded for exceeding contractual requirements or achieving superior project outcomes.

- Milestone Payments: Revenue recognized upon the successful completion of predefined project stages or deliverables.

- Quality-Based Incentives: Additional income tied to meeting or surpassing stringent quality control benchmarks.

- Early Completion Bonuses: Financial rewards for finishing projects ahead of the agreed-upon timeline.

Hyundai Engineering diversifies its revenue through a mix of contract types, including fixed-price EPC, cost-plus, and specialized consulting fees. The company also benefits from recurring income via operation and maintenance (O&M) services for completed projects, which strengthens client relationships and offers stability.

Performance-based incentives and milestone payments are integrated into many contracts, rewarding quality and timely project completion. For example, the global O&M services market for power generation alone was projected to exceed $100 billion in 2024, highlighting the significant revenue potential in this area for Hyundai Engineering.

| Revenue Stream | Description | 2024 Relevance/Example |

| Fixed-Price EPC Contracts | Pre-agreed total cost for project execution. | Secured over $1.5 billion in petrochemical plant expansion in Southeast Asia. |

| Cost-Plus Contracts | Reimbursement of costs plus a profit margin. | Used for complex projects with uncertain scopes, ensuring risk mitigation. |

| Specialized Services | Fees for design, feasibility studies, and technical audits. | Valuable standalone offerings and precursors to larger EPC projects. |

| Operation & Maintenance (O&M) | Long-term contracts for managing and servicing facilities. | Provides recurring revenue and client retention; O&M market for power generation over $100 billion in 2024. |

| Performance Incentives | Payments linked to achieving specific project objectives or quality standards. | Contributed to overall profitability for firms exceeding client expectations in 2024. |

Business Model Canvas Data Sources

The Hyundai Engineering Business Model Canvas is built upon a foundation of comprehensive market intelligence, detailed financial reports, and extensive operational data. These sources ensure each component, from customer segments to cost structures, is informed by accurate and relevant information.