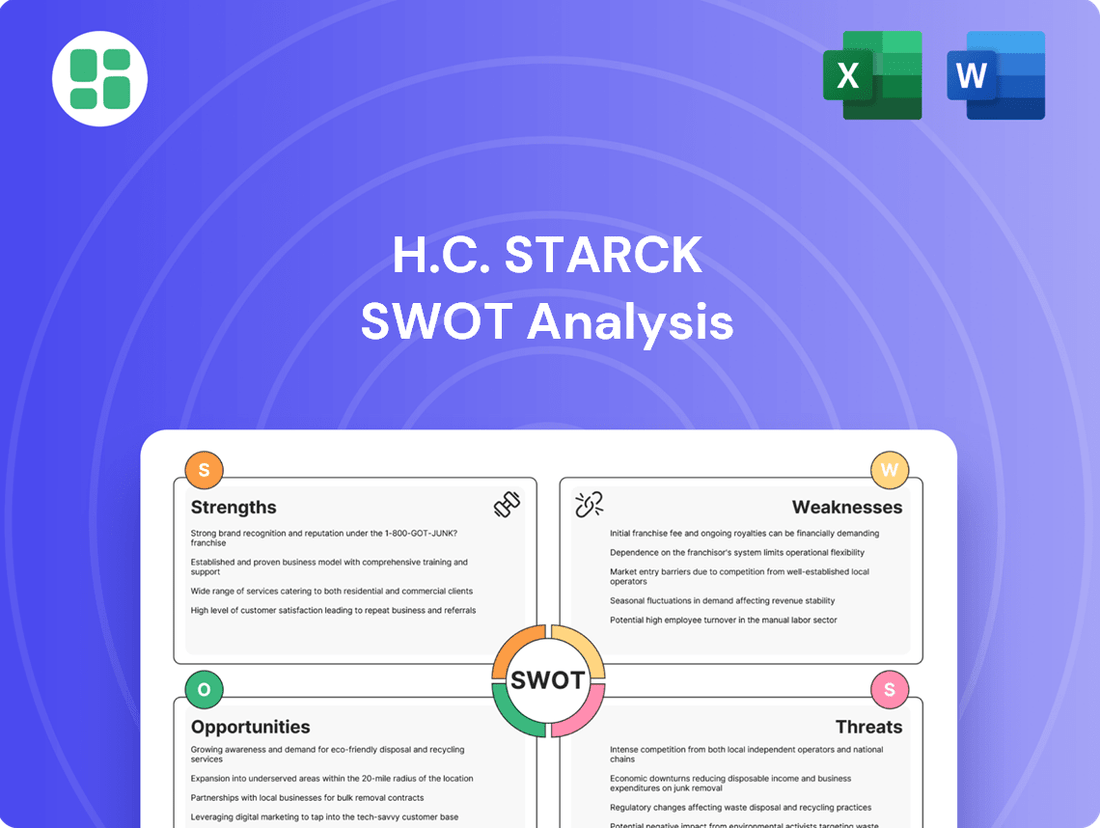

H.C. Starck SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H.C. Starck Bundle

H.C. Starck's market position is defined by its specialized materials expertise, but also faces challenges in global competition and supply chain volatility. Understanding these internal strengths and external threats is crucial for strategic growth.

Want the full story behind H.C. Starck's competitive advantages and potential risks? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

H.C. Starck Tungsten GmbH's primary strength is its highly specialized focus on producing advanced metal powders and intricately shaped components from refractory metals, particularly tungsten and molybdenum. This deep expertise allows them to cater to demanding niche markets where materials must exhibit exceptional properties like extreme heat resistance, high density, and superior wear durability, creating a significant competitive edge.

With a legacy spanning over a century, H.C. Starck has cultivated unparalleled knowledge and cemented its position as a leader in the refractory metals sector. This extensive history translates into a proven track record of innovation and reliability, a critical factor for industries relying on high-performance materials, such as aerospace and advanced manufacturing.

H.C. Starck boasts an impressive global manufacturing and sales network, a significant strength that allows it to serve diverse markets effectively. Its operations span key regions like Europe, North America, and China, ensuring a broad geographical reach.

The company's sales network extends to Japan, bolstered by its recent acquisition by Mitsubishi Materials Corporation. This integration enhances its international operational and sales capabilities, providing access to new markets and customer segments.

H.C. Starck Tungsten GmbH's strength lies in its broad reach across high-tech sectors like cutting tools, medical technology, and aerospace. This diversification means they aren't overly dependent on just one market, offering stability. For instance, the global cutting tools market was projected to reach over $20 billion in 2024, a significant segment for H.C. Starck.

Commitment to Innovation and Recycling Expertise

H.C. Starck Tungsten Powders demonstrates a strong commitment to innovation, evident in its continuous investment in research and development. This includes exploring advanced areas such as AI-driven control systems for production and pioneering new material science applications. The company's dedication to staying at the forefront of technological advancements ensures its competitive edge in the evolving tungsten market.

A significant strength lies in H.C. Starck's world-leading expertise in tungsten recycling. They effectively source a substantial portion of their raw materials through these sustainable practices, reducing reliance on primary mining. This not only contributes to environmental responsibility but also provides a cost-effective and secure supply chain.

Their forward-thinking approach is further exemplified by the development of proprietary recycling technologies, particularly for complex materials like black mass derived from batteries. This strategic focus on recycling innovation positions H.C. Starck to capitalize on the growing demand for circular economy solutions in the materials sector.

- Innovation Focus: Investments in AI-driven control systems and material science research.

- Recycling Leadership: World-leading capabilities in tungsten recycling, sourcing a majority of raw materials sustainably.

- Proprietary Technologies: Development of new recycling solutions for materials like battery black mass.

Strategic Integration with Mitsubishi Materials Group

The strategic integration following Mitsubishi Materials Corporation's acquisition of H.C. Starck Holding GmbH in December 2024 is a significant strength. This union grants H.C. Starck Tungsten GmbH access to Mitsubishi Materials' vast resources and advanced R&D capabilities.

This synergy unlocks substantial market synergies, especially in global tungsten recycling initiatives and cross-selling opportunities. The combined entity is poised to strengthen its standing as a premier global tungsten product provider.

- Enhanced Resource Access: Mitsubishi Materials' financial backing and operational scale provide H.C. Starck with greater capacity for investment and expansion.

- R&D Synergies: The integration facilitates the sharing of technological expertise, accelerating innovation in tungsten material science and application development.

- Market Expansion: Leveraging Mitsubishi Materials' established global network opens new avenues for market penetration and increased sales volume for H.C. Starck's products.

- Recycling Leadership: The combined strength is expected to bolster efforts in sustainable tungsten sourcing and advanced recycling processes, a critical differentiator in the 2025 market landscape.

H.C. Starck Tungsten GmbH's core strength is its specialized expertise in refractory metals, particularly tungsten and molybdenum, enabling it to serve high-demand niche markets requiring exceptional material properties like extreme heat resistance and wear durability.

The company's century-long legacy translates into deep knowledge and a proven track record of innovation, making it a reliable partner for critical industries such as aerospace and advanced manufacturing.

A significant advantage is H.C. Starck's world-leading position in tungsten recycling, sourcing a substantial portion of its raw materials sustainably and cost-effectively, which is crucial for supply chain security and environmental responsibility.

The recent acquisition by Mitsubishi Materials Corporation in December 2024 is a key strength, granting H.C. Starck access to greater resources, advanced R&D, and expanded market reach, reinforcing its global standing.

| Strength | Description | Supporting Data/Context |

| Specialized Expertise | Deep knowledge in tungsten and molybdenum powders and components. | Caters to niche markets demanding extreme heat resistance and wear durability. |

| Long-standing Legacy | Over a century of experience and innovation in refractory metals. | Establishes trust and reliability in sectors like aerospace and advanced manufacturing. |

| Recycling Leadership | World-leading capabilities in tungsten recycling. | Sources a substantial portion of raw materials sustainably, ensuring cost-effectiveness and supply chain security. |

| Strategic Acquisition | Integration with Mitsubishi Materials Corporation (Dec 2024). | Provides access to enhanced resources, R&D, and expanded global market reach. |

What is included in the product

Analyzes H.C. Starck’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

The H.C. Starck SWOT Analysis provides a clear, structured framework to identify and address internal weaknesses and external threats, thereby alleviating strategic uncertainty and guiding proactive risk mitigation.

Weaknesses

H.C. Starck Tungsten GmbH's business is heavily centered on refractory metals, particularly tungsten and molybdenum. This significant reliance on a narrow range of critical raw materials exposes the company to substantial risks from supply chain interruptions and geopolitical pressures impacting these specific minerals.

The critical nature of these materials has been underscored by recent developments, including export controls and escalating trade tensions. For instance, in 2023, global tungsten prices saw fluctuations driven by supply concerns in key producing regions, directly impacting H.C. Starck's input costs and operational stability.

H.C. Starck faces a significant vulnerability due to the inherent price volatility in the tungsten and molybdenum markets. These fluctuations are driven by a complex interplay of global supply and demand, geopolitical tensions, and export policies, particularly from key suppliers like China. For instance, prices for ammonium paratungstate (APT), a crucial tungsten precursor, saw notable increases in early 2025, directly impacting production costs.

This exposure to raw material price swings can compress profit margins and introduce uncertainty into financial planning. When the cost of essential inputs like tungsten and molybdenum rises sharply, H.C. Starck’s ability to maintain stable profitability is challenged, potentially affecting its overall financial resilience.

Operating in the specialized field of high-performance metal powders and complex shaped parts, especially with refractory metals, inherently demands considerable capital for advanced manufacturing facilities and cutting-edge processing equipment. This translates to significant fixed costs and potentially extended timelines for recouping initial investments.

For instance, companies in this sector often invest millions in vacuum furnaces, atomizers, and sophisticated quality control systems. In 2024, the global market for advanced materials, which includes these specialized metal powders, saw capital expenditures rise as companies sought to expand capacity and upgrade technology to meet increasing demand for aerospace and electronics applications.

Furthermore, maintaining these state-of-the-art production capabilities requires ongoing, substantial operational expenses. These include the costs of specialized raw materials, energy-intensive processes, highly skilled labor, and rigorous quality assurance protocols, all contributing to a high cost base.

Niche Market Size Limitations

While H.C. Starck's specialization in high-performance refractory metals is a key strength, it also presents a weakness in terms of market size limitations. This focus means operating within a relatively niche segment compared to broader metal or material industries, potentially capping overall growth potential. The demand is intrinsically linked to specific, high-value applications, which can restrict market expansion opportunities.

The global refractory metals market, though experiencing growth, remains considerably smaller in value when contrasted with more expansive material markets. For instance, while precise figures for 2024/2025 are still emerging, the broader advanced materials market is projected to reach hundreds of billions of dollars, whereas the refractory metals segment, while critical, represents a fraction of that. This inherent scale difference can impact the company's ability to achieve the same level of volume-based growth seen in more commoditized sectors.

- Niche Market Focus: Specialization in refractory metals like tungsten, molybdenum, tantalum, and niobium restricts the customer base to industries with specific high-temperature or high-corrosion resistance needs.

- Limited Volume Potential: Unlike base metals or commodity materials, the demand for refractory metals is driven by specialized applications, leading to lower overall volume requirements.

- Market Size Disparity: The global refractory metals market, estimated to be in the low billions of dollars annually, is significantly smaller than broader material markets, impacting potential revenue ceilings.

- Dependence on Key Industries: Growth is heavily reliant on the performance of sectors such as aerospace, defense, medical technology, and electronics, making H.C. Starck vulnerable to downturns in these specific areas.

Intense Competition in High-Purity Segments

H.C. Starck faces significant challenges due to the highly competitive nature of the high-purity refractory metals market. Several major players dominate this space, driving a need for continuous innovation and aggressive cost management. For instance, the global market for refractory metals, including tungsten, molybdenum, and tantalum, is projected to reach approximately $25 billion by 2025, with a substantial portion attributed to high-purity applications. This intense environment necessitates substantial and ongoing investment in research and development to stay ahead, alongside a relentless focus on operational efficiency to maintain profitability and market share.

Key competitive factors include:

- Technological Advancement: Competitors are heavily investing in new processing techniques and material science to achieve higher purity levels and novel applications.

- Cost Efficiency: Companies are constantly seeking ways to reduce production costs through automation, supply chain optimization, and economies of scale.

- Global Reach: Expanding manufacturing and sales networks globally is crucial for accessing diverse markets and mitigating regional economic downturns.

- Product Specialization: Differentiating through specialized, high-value products tailored to specific industry needs, such as aerospace or advanced electronics, is a common strategy.

H.C. Starck's reliance on a few key raw materials, like tungsten and molybdenum, makes it susceptible to supply disruptions and geopolitical issues affecting these specific minerals. For example, global tungsten prices in 2023 saw volatility due to supply concerns in major producing nations, directly impacting H.C. Starck's input costs and operational stability.

The company also faces challenges from the inherent price volatility in tungsten and molybdenum markets. Fluctuations driven by global supply, demand, and export policies, particularly from China, can compress profit margins. Prices for ammonium paratungstate (APT), a key tungsten precursor, experienced notable increases in early 2025, directly affecting production expenses.

Operating in a niche market for refractory metals means H.C. Starck's growth potential is inherently limited compared to broader material industries. Demand is tied to specialized applications, which restricts market expansion. The refractory metals market, while critical, represents a fraction of the broader advanced materials market, impacting potential revenue ceilings.

The highly competitive landscape of high-purity refractory metals requires continuous innovation and aggressive cost management. Key competitors are investing heavily in new processing techniques and material science, necessitating substantial R&D investment and a focus on operational efficiency to maintain market share.

Full Version Awaits

H.C. Starck SWOT Analysis

The preview you see is the actual H.C. Starck SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This allows you to assess the depth and clarity of our analysis before committing.

This is a real excerpt from the complete H.C. Starck SWOT analysis. Once purchased, you’ll receive the full, editable version, providing comprehensive insights into the company's strategic position.

Opportunities

The burgeoning field of advanced manufacturing, especially metal additive manufacturing (AM), offers substantial growth avenues for H.C. Starck Tungsten GmbH. The global metal 3D printing market, projected to reach $19.4 billion by 2027 according to some forecasts, is a key driver for this opportunity.

As industries increasingly prioritize lightweight components and enhanced performance, the need for specialized metal powders, including tungsten, is escalating. H.C. Starck's strategic investment in its 'starck2print®' powders directly addresses this rising demand, positioning the company to capitalize on this expanding market segment.

Sectors like aerospace, defense, medical devices, electronics, and electric vehicle (EV) batteries are seeing strong growth, driving demand for advanced materials. H.C. Starck's specialized tungsten and molybdenum products are vital for these applications. For instance, the global aerospace market is anticipated to reach approximately $1.1 trillion by 2030, highlighting the significant potential for material suppliers.

H.C. Starck's advanced recycling technologies present a significant growth avenue, capitalizing on the escalating global demand for sustainable materials and circular economy principles. The company's strategic investment in a battery recycling facility in Germany, supported by substantial government grants, underscores its commitment to this sector and is projected to tap into the burgeoning market for recycled critical raw materials.

Synergies and Market Access through Mitsubishi Materials Acquisition

The acquisition of H.C. Starck Tungsten GmbH by Mitsubishi Materials Corporation unlocks significant avenues for growth. This integration is poised to bolster H.C. Starck's research and development efforts, enabling the creation of advanced tungsten materials and applications. Furthermore, it facilitates cross-selling opportunities, leveraging Mitsubishi Materials' extensive global distribution channels to reach a wider customer base.

A key benefit lies in the accelerated development of a global tungsten recycling business. With the increasing focus on sustainability and resource efficiency, this synergy allows for the establishment of robust circular economy models within the tungsten industry. Mitsubishi Materials' commitment to recycling, evident in their existing operations, provides a strong foundation for H.C. Starck to expand its recycling capabilities, potentially capturing a larger share of the growing recycled tungsten market.

- Enhanced R&D: Collaboration with Mitsubishi Materials' advanced materials research centers, potentially leading to breakthroughs in tungsten powder metallurgy and applications in sectors like electronics and aerospace.

- Market Expansion: Gaining access to Mitsubishi Materials' established sales networks in Asia and North America, significantly broadening H.C. Starck's market reach.

- Recycling Business Growth: Leveraging Mitsubishi Materials' expertise and infrastructure to scale up tungsten recycling operations, aligning with global sustainability trends and securing raw material supply.

Development of New Applications and Product Innovations

H.C. Starck's commitment to research and development fuels the creation of novel applications and product innovations. Ongoing exploration into advanced alloys and materials, focusing on enhanced high-temperature strength and superior corrosion resistance, directly translates into new market opportunities. This persistent drive for innovation allows the company to address evolving technological demands and broaden its product offerings.

The company's proactive approach to product development is exemplified by innovations such as 'starck2charge®', a key component for lithium-ion batteries. This focus on emerging technological needs, coupled with a robust R&D framework, positions H.C. Starck to capitalize on growth sectors and expand its market reach.

- Targeted R&D: Focus on alloys with improved high-temperature strength and corrosion resistance.

- Battery Technology: Continued development and market penetration of 'starck2charge®' for lithium-ion batteries.

- Emerging Markets: Leveraging R&D to meet the material demands of rapidly advancing technologies.

- Portfolio Expansion: Introducing new products derived from material science advancements.

H.C. Starck Tungsten GmbH is well-positioned to benefit from the growing demand in advanced manufacturing sectors, particularly metal additive manufacturing. The company's specialized tungsten powders, like the 'starck2print®' line, cater to industries seeking high-performance, lightweight components, a market expected to see significant expansion.

The increasing adoption of advanced materials across aerospace, defense, medical, and electronics industries presents a substantial opportunity. H.C. Starck's expertise in tungsten and molybdenum products aligns perfectly with the material requirements of these high-growth sectors, such as the aerospace market, which is projected to continue its upward trajectory.

The company's strategic focus on recycling, evidenced by its investment in a battery recycling facility, taps into the global push for sustainability and circular economy principles. This venture is poised to capitalize on the increasing value of recycled critical raw materials, a market segment experiencing robust growth and governmental support.

The integration with Mitsubishi Materials Corporation offers a powerful catalyst for growth through enhanced R&D and expanded market access. This synergy is expected to accelerate the development of innovative tungsten materials and applications, while also broadening H.C. Starck's global reach.

| Opportunity Area | Key Driver | H.C. Starck's Role/Product | Market Potential (Illustrative) |

|---|---|---|---|

| Metal Additive Manufacturing | Demand for lightweight, high-performance parts | 'starck2print®' tungsten powders | Global metal 3D printing market projected to reach $19.4 billion by 2027 |

| Advanced Materials in Key Industries | Growth in aerospace, defense, medical, electronics | Specialized tungsten and molybdenum products | Aerospace market projected to reach $1.1 trillion by 2030 |

| Sustainable Recycling | Circular economy principles, resource efficiency | Battery recycling facility investment | Growing market for recycled critical raw materials |

| Synergies with Mitsubishi Materials | Enhanced R&D, global market access | Collaborative innovation, expanded distribution | Leveraging established networks for wider customer reach |

Threats

Geopolitical tensions, especially concerning China's dominance in critical minerals like tungsten and molybdenum, significantly threaten H.C. Starck Tungsten GmbH's supply chain. Export control regulations can trigger shortages and price hikes, directly impacting raw material stability and cost for the company.

The refractory metals sector faces a growing threat from advancements in alternative materials. For instance, high-performance ceramics are increasingly being explored for applications traditionally dominated by tungsten and molybdenum, particularly in areas requiring extreme heat resistance and wear durability. By 2024, the global advanced ceramics market was projected to reach over $20 billion, indicating significant investment and innovation in this space.

This material science evolution means that for certain niche applications, substitutes offering comparable performance, perhaps at a reduced cost or with enhanced properties, could emerge. For example, in specialized electronics or aerospace components, novel composites might offer lighter weight or better thermal management than traditional refractory metal alloys, potentially impacting demand for H.C. Starck's offerings.

H.C. Starck faces significant threats from supply chain disruptions and raw material scarcity. Beyond geopolitical tensions, the mining and processing of refractory metals are inherently susceptible to logistical hurdles, labor shortages, and operational issues at extraction sites. For example, the global tungsten supply chain exhibits structural weaknesses, particularly in smelting and processing outside of China, leading to potential bottlenecks.

Economic Downturns in Key End-Use Industries

Economic downturns in critical sectors like aerospace and automotive pose a significant threat to H.C. Starck. A slowdown in these industries directly translates to diminished demand for the company's specialized refractory metals and advanced ceramics. For instance, the automotive sector, a key consumer, experienced a notable contraction in global production in 2023, with projections for 2024 indicating continued challenges due to supply chain issues and fluctuating consumer demand.

While H.C. Starck benefits from diversification across various end-use markets, a broad economic recession would inevitably dampen enthusiasm for new projects and reduce overall production volumes. This widespread contraction would impact the company’s revenue streams and profitability. As of early 2024, global manufacturing output has shown signs of weakness, with many advanced economies facing inflationary pressures and interest rate hikes, which typically curb industrial investment and material consumption.

- Reduced Demand: Economic slowdowns in aerospace, automotive, and industrial manufacturing directly decrease the need for H.C. Starck's high-performance materials.

- Project Cancellations: Recessions often lead to the postponement or cancellation of new development projects, impacting sales pipelines.

- Lower Production Volumes: A general economic contraction means less manufacturing activity, resulting in lower overall demand for the company's products.

- Profitability Impact: Decreased sales and potential price pressures during economic downturns can significantly affect H.C. Starck's profit margins.

Increasing Environmental Regulations and Sustainability Pressures

H.C. Starck faces significant challenges from escalating environmental regulations and sustainability demands. The manufacturing of high-purity refractory metals, a core business, is inherently energy-intensive and subject to rigorous rules on emissions and waste management. For instance, the European Union's Green Deal initiatives, aiming for climate neutrality by 2050, are progressively tightening environmental standards across industries, including chemical processing and materials production.

These evolving policies translate into higher compliance costs for H.C. Starck, potentially increasing operational expenses related to pollution control, waste treatment, and energy efficiency upgrades. Failure to meet these standards can result in substantial penalties, impacting profitability and potentially disrupting production. For example, stricter air quality standards can necessitate significant investment in advanced filtration systems, while new waste disposal regulations may require costly changes to material handling processes.

The company must navigate a complex landscape of global and regional environmental mandates. This includes adapting to varying regulations in different operating regions, which can create operational complexities and require tailored compliance strategies. The pressure to adopt more sustainable practices extends beyond regulatory compliance, as customers and investors increasingly prioritize environmental, social, and governance (ESG) performance, influencing supply chain decisions and investment flows.

- Increased Compliance Costs: Investments in emission control technology and waste management systems are expected to rise, potentially impacting margins.

- Operational Complexities: Adapting production processes to meet diverse and evolving environmental standards across different jurisdictions presents a significant challenge.

- Potential Penalties: Non-compliance with stringent environmental laws could lead to fines and operational disruptions, affecting financial performance.

- Market Expectations: Growing demand for sustainable products and transparent ESG reporting from customers and investors adds another layer of pressure for H.C. Starck to demonstrate environmental stewardship.

The increasing competition from emerging market players, particularly in Asia, presents a significant threat. These competitors often have lower production costs and can offer similar materials at more competitive prices, potentially eroding H.C. Starck's market share. For example, China's tungsten processing capacity is vast, and its market influence continues to grow.

Technological obsolescence is another concern. As new materials and manufacturing techniques emerge, H.C. Starck must continually invest in research and development to stay ahead. Failure to innovate could lead to its products becoming outdated, especially in fast-evolving sectors like electronics and advanced manufacturing. The pace of innovation in materials science is rapid, demanding constant adaptation.

Global economic uncertainty and potential recessions in key markets like automotive and aerospace directly impact demand for H.C. Starck's specialized products. A slowdown in these sectors, as seen with automotive production challenges in 2023 and early 2024, can lead to reduced orders and lower revenue. This economic sensitivity means the company's performance is closely tied to broader industrial health.

The company also faces threats from fluctuating raw material prices and availability. Dependence on specific minerals, often sourced from geopolitically sensitive regions, exposes H.C. Starck to supply chain risks and price volatility. For instance, tungsten prices can be significantly influenced by supply-demand dynamics and export policies from major producing nations.

SWOT Analysis Data Sources

This H.C. Starck SWOT analysis is built upon robust data from financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded strategic perspective.