H.C. Starck Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H.C. Starck Bundle

H.C. Starck operates in a landscape shaped by intense competition, the significant bargaining power of its suppliers, and the constant threat of substitutes. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping H.C. Starck’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The global supply of critical refractory metals, such as tungsten, is highly concentrated. China is the dominant producer, accounting for roughly 80-86% of worldwide output. This concentration gives significant leverage to the primary raw material suppliers.

Recent export restrictions implemented by China have further amplified this supplier bargaining power. This situation creates a heightened risk of supply chain disruptions and price volatility for companies like H.C. Starck Tungsten GmbH, impacting their operational costs and strategic planning.

H.C. Starck Tungsten GmbH's need for high-purity refractory metals and specialized alloys means suppliers who can consistently meet these exacting standards hold significant sway. These suppliers often cater to a specialized segment of the market, meaning there aren't many other options available.

The complexity and time involved in qualifying new suppliers for these critical materials further bolster the bargaining power of existing ones. For instance, in 2023, the global market for tungsten powder, a key input for H.C. Starck, saw price fluctuations driven by supply chain disruptions and demand from advanced manufacturing sectors, highlighting the sensitivity to supplier capabilities.

Geopolitical tensions, such as those impacting rare earth elements or strategic minerals, can significantly disrupt supply chains. For instance, in 2023, China, which dominates global rare earth production, continued to implement export controls, affecting pricing and availability for downstream industries. This situation highlights how policies from dominant producing nations directly influence the bargaining power of suppliers in critical material markets.

Supplier Investment in Upstream Integration

Major suppliers in the refractory metals sector are actively investing in upstream mining and processing. This strategic move, observed throughout 2024 and into early 2025, strengthens their grip on the entire supply chain. For instance, companies like Global Tungsten & Rare Metals are expanding their mining operations, aiming for greater control over raw material sourcing.

This upstream integration means suppliers can more effectively dictate terms to downstream manufacturers. By managing the process from extraction through initial processing, they reduce their reliance on external factors and gain leverage. This consolidation can significantly diminish the bargaining power of companies like H.C. Starck, which depend on these raw materials.

- Upstream Investment: Refractory metal suppliers are increasing capital expenditure on mining and primary processing facilities.

- Supply Chain Control: Vertical integration from mine to initial processing allows suppliers to manage costs and availability more directly.

- Impact on Downstream: This consolidation can lead to less favorable pricing and supply terms for manufacturers reliant on these integrated suppliers.

Limited Substitutability of Core Materials

The bargaining power of suppliers for H.C. Starck is significantly influenced by the limited substitutability of core materials like tungsten and molybdenum. While alternatives might exist for less demanding uses, the unique properties of these metals, such as their exceptionally high melting points and extreme hardness, are often irreplaceable in H.C. Starck's specialized, high-performance products. This lack of readily available substitutes for critical applications grants suppliers of these specific metals considerable leverage.

For instance, in applications demanding extreme heat resistance, such as in the semiconductor industry's wafer manufacturing equipment or in advanced aerospace components, tungsten and molybdenum are frequently the only viable options. The global production of refined tungsten concentrate, a key input for H.C. Starck, is concentrated among a few major producing countries, with China dominating the market. In 2023, China accounted for approximately 70% of global tungsten mine production, highlighting the limited geographic diversity of supply.

- Unique Properties: Tungsten and molybdenum offer unparalleled melting points and hardness, crucial for H.C. Starck's advanced material solutions.

- Indispensability: For high-tech sectors like aerospace and semiconductors, these metals are often the only materials that meet stringent performance requirements.

- Supplier Concentration: The global supply chain for these critical raw materials is relatively concentrated, increasing supplier influence.

- Market Dependence: H.C. Starck's reliance on these specific, hard-to-substitute metals strengthens the bargaining position of their upstream suppliers.

The bargaining power of suppliers for H.C. Starck is amplified by the highly concentrated nature of critical refractory metal production, particularly tungsten, where China holds a dominant share. This concentration, coupled with recent export restrictions, significantly increases supplier leverage and poses risks of supply chain disruptions and price volatility.

The specialized nature of H.C. Starck's material requirements, demanding high purity and specific alloys, limits the pool of qualified suppliers. This scarcity, combined with the lengthy and complex supplier qualification process, further strengthens the hand of existing suppliers who can consistently meet these stringent demands.

Geopolitical factors and upstream integration by major suppliers, observed through 2024, are consolidating control over raw material sourcing. This trend allows suppliers to dictate terms more effectively, diminishing the bargaining power of downstream manufacturers like H.C. Starck.

The limited substitutability of key metals like tungsten and molybdenum in high-performance applications, such as aerospace and semiconductors, means suppliers of these materials possess considerable leverage. For example, in 2023, China's approximately 70% share of global tungsten mine production underscores the dependence on a few key suppliers.

| Factor | Description | Impact on H.C. Starck |

|---|---|---|

| Supplier Concentration | China's dominance in tungsten production (approx. 70% in 2023). | Increased leverage for Chinese suppliers. |

| Export Restrictions | China's recent implementation of export controls. | Heightened risk of supply disruption and price volatility. |

| Material Specificity | Irreplaceable properties of tungsten and molybdenum in advanced applications. | Limited alternatives for H.C. Starck, strengthening supplier position. |

| Upstream Integration | Suppliers investing in mining and primary processing (2024 trends). | Greater control over costs and availability, potentially unfavorable terms for H.C. Starck. |

What is included in the product

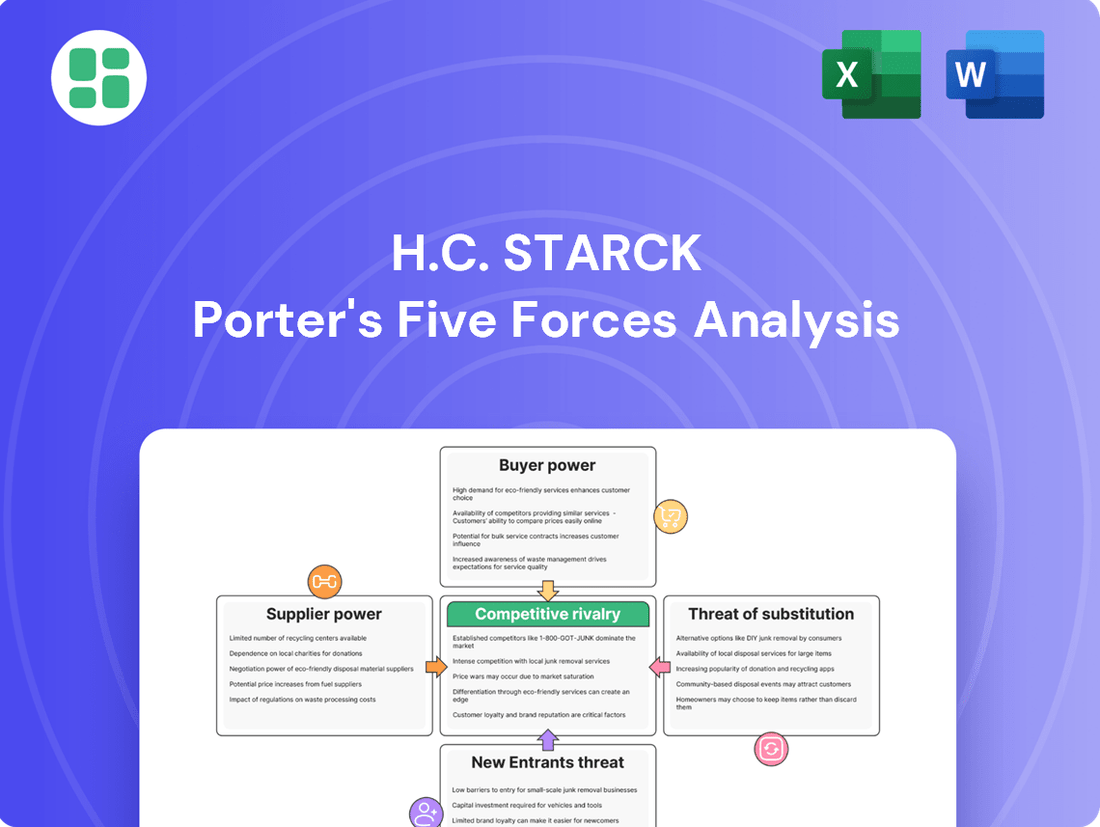

This analysis meticulously examines the five competitive forces impacting H.C. Starck, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes within its specialized markets.

H.C. Starck's Porter's Five Forces analysis provides a clear, one-sheet summary of all competitive pressures—perfect for quick, informed strategic decision-making.

Customers Bargaining Power

H.C. Starck Tungsten GmbH caters to a broad spectrum of specialized industries, including cutting tools, medical technology, aerospace, and lighting. This wide reach means the company isn't overly dependent on any single client. However, customers in these advanced sectors are often large, knowledgeable corporations with substantial buying influence and exacting quality standards.

These sophisticated clients frequently have very specific application requirements that H.C. Starck's offerings are uniquely suited to meet. Despite this specialized demand, they also expect competitive pricing and a dependable supply chain, which can put pressure on H.C. Starck's margins and operational flexibility.

For highly specialized industries like aerospace and medical technology, customers face substantial hurdles when considering a switch from H.C. Starck. These include rigorous qualification processes and performance validation, which can take years and significant investment to complete. For instance, a new material supplier for a critical aircraft component might need to undergo extensive testing and gain approvals from aviation authorities, a process that can cost millions and delay product development significantly.

Customers in sectors like aerospace and electronics, where H.C. Starck operates, consistently seek advancements and higher product performance. This persistent demand necessitates significant investment in research and development by H.C. Starck, often exceeding 5% of revenue for specialty materials companies. For instance, the growing additive manufacturing market, which saw global revenues reach approximately $15.1 billion in 2023, highlights this trend, with clients expecting continuous improvements in powder quality and consistency.

H.C. Starck's specialized powders for additive manufacturing and battery recycling showcase its commitment to innovation. However, this very demand for cutting-edge solutions empowers customers to negotiate better pricing and terms. Their sophisticated technical understanding allows them to accurately gauge the value of H.C. Starck's offerings, further strengthening their bargaining position.

Global Competition Among Downstream Industries

H.C. Starck's customers operate in intensely competitive global downstream industries. This global competition forces them to relentlessly pursue cost efficiencies and superior value in their raw material sourcing. Consequently, these customers possess significant bargaining power, directly influencing H.C. Starck's pricing and terms.

For instance, in the semiconductor industry, a key market for high-performance materials, global players are constantly vying for market share. In 2024, the semiconductor market experienced significant price pressures due to oversupply in certain segments, amplifying the need for cost-effective inputs from suppliers like H.C. Starck. Customers in this sector will actively seek out suppliers offering the best combination of material performance and price to maintain their own competitive standing.

- Customer Cost Sensitivity: Downstream industries facing global price wars must minimize their input costs, making them highly sensitive to the pricing of specialized materials.

- Supplier Alternatives: The availability of alternative suppliers for highly engineered materials empowers customers to switch if H.C. Starck's offerings are not competitively priced or do not meet their value expectations.

- Demand for Value: Customers are not just buying materials; they are buying solutions that contribute to their product's performance and cost-effectiveness, driving a continuous search for optimal value.

Strategic Customer Relationships and Vertical Integration

The acquisition of H.C. Starck Tungsten GmbH by Mitsubishi Materials Corporation in 2020, a significant customer, highlights a strategic move towards vertical integration. This integration allows Mitsubishi Materials to secure a stable supply of tungsten powder, a critical component for their cemented carbide tools. For instance, Mitsubishi Materials is a major player in the global tooling market, with sales exceeding ¥1.9 trillion (approximately $13 billion USD) in fiscal year 2023.

This consolidation of buyer power within a larger entity can significantly shift the bargaining dynamics for remaining tungsten powder suppliers. It potentially leads to more integrated supply chains and shared objectives between the buyer and the acquired entity, H.C. Starck Tungsten. Such moves are often driven by the desire to create synergies, reduce costs, and strengthen overall market position by controlling key aspects of the value chain.

- Strategic Integration: Mitsubishi Materials' acquisition of H.C. Starck Tungsten GmbH exemplifies vertical integration, aiming to control a vital raw material supply.

- Buyer Power Shift: This move consolidates buyer power, potentially increasing leverage over other raw material suppliers in the tungsten industry.

- Synergy Creation: The acquisition is intended to foster synergies, optimize supply chains, and enhance the market standing of the combined entities.

- Market Impact: Such vertical integration can influence pricing and availability for other participants in the tungsten powder and cemented carbide markets.

Customers of H.C. Starck, particularly those in demanding sectors like aerospace and semiconductors, wield considerable bargaining power due to their sophisticated technical needs and the competitive pressures they face. Their ability to negotiate is amplified by their deep understanding of material performance and their constant pursuit of cost efficiencies. This is evident in industries where price wars in 2024 pressured semiconductor manufacturers to seek the best value from their material suppliers.

The strategic acquisition of H.C. Starck Tungsten GmbH by Mitsubishi Materials Corporation in 2020, a significant customer, underscores this buyer power. This vertical integration allows Mitsubishi Materials to secure critical tungsten powder supplies for its cemented carbide tools, a market where it holds substantial sales. This consolidation can shift market dynamics, potentially increasing leverage for the integrated entity over other raw material providers.

| Customer Characteristic | Impact on Bargaining Power | Supporting Data/Example |

|---|---|---|

| Technical Sophistication & Specific Needs | High | Customers in aerospace and medical technology require highly specialized materials with exacting standards. |

| Cost Sensitivity due to Downstream Competition | High | Global competition in sectors like semiconductors in 2024 intensified the need for cost-effective inputs. |

| Switching Costs (for Customers) | Low (for specialized applications) | Rigorous qualification processes for new materials in aerospace can take years and cost millions. |

| Vertical Integration by Major Customers | Very High | Mitsubishi Materials' 2020 acquisition of H.C. Starck Tungsten GmbH to secure supply for its $13 billion (FY2023) tooling business. |

Full Version Awaits

H.C. Starck Porter's Five Forces Analysis

This preview displays the complete H.C. Starck Porter's Five Forces Analysis you will receive upon purchase. You are viewing the exact, professionally formatted document, ensuring no discrepancies between the preview and your downloaded file. This comprehensive analysis is ready for immediate use, providing you with all the insights into H.C. Starck's competitive landscape.

Rivalry Among Competitors

The refractory metals and high-performance metal powder market is a highly specialized global sector. Competition is fierce among a select group of major companies, each vying for dominance through innovation and strategic alliances.

H.C. Starck Tungsten GmbH faces formidable rivals like Xiamen Tungsten, CMOC, Molymet, Plansee Group, and Kennametal Inc. These industry leaders are continuously pushing the boundaries of product development and technological advancement to capture market share.

Competitive rivalry in the refractory metals sector, including companies like H.C. Starck, is intensely driven by continuous investment in research and development. This R&D focus aims to enhance material properties, develop novel alloys, and pioneer advanced manufacturing solutions to stay ahead. For instance, H.C. Starck's commitment is evident in its specialized product lines like starck2print® for additive manufacturing powders and starck2charge® for battery recycling technologies, both critical for maintaining a competitive edge in evolving markets.

Differentiation among players in this space hinges on delivering superior performance, exceptional purity, and tailor-made application-specific solutions. Companies that can consistently innovate and offer materials with enhanced characteristics, such as improved thermal resistance or conductivity, often capture greater market share. The ability to provide customized solutions for demanding industries like aerospace, electronics, and energy storage is a key determinant of success and a primary driver of rivalry.

While the refractory metals market operates globally, production and demand are notably concentrated in key regions. Asia-Pacific, particularly China, dominates both production and consumption, followed by Europe and North America. This geographical concentration means that shifts in regional economic conditions or trade policies can have a disproportionate impact on the industry.

Companies actively pursue geographical expansion to tap into burgeoning markets and diversify their operations. For instance, in 2024, several leading refractory metals producers announced plans for new facilities or acquisitions in Southeast Asia and Eastern Europe, aiming to capture growing demand from the electronics and automotive sectors in those areas. This strategic push intensifies competition as established players and new entrants battle for market share in these expanding territories.

Impact of Raw Material Volatility and Sustainability

Fluctuations in raw material prices, such as tungsten and molybdenum, directly impact H.C. Starck's cost of goods sold. For instance, tungsten prices saw significant volatility in 2023, with some market reports indicating price increases of over 20% for certain grades due to supply chain disruptions and increased demand from the electronics sector.

The growing demand for sustainable sourcing, including conflict-free minerals and energy-efficient production, adds another layer of complexity. Companies investing in robust recycling processes and demonstrating strong environmental, social, and governance (ESG) credentials, like those outlined in the EU's Critical Raw Materials Act, are better positioned to mitigate risks and attract environmentally conscious customers.

- Price Volatility: Tungsten prices in early 2024 remained elevated, with some sources reporting year-on-year increases of 15-25% for key industrial grades, impacting production costs.

- Sustainability Demands: The EU's Critical Raw Materials Act, enacted in 2023, mandates increased domestic sourcing and recycling, pushing companies like H.C. Starck to invest in circular economy models.

- Competitive Advantage: Companies with integrated recycling capabilities, such as those reclaiming valuable metals from spent catalysts or manufacturing scrap, can reduce reliance on primary extraction and gain a cost advantage.

- Operational Complexity: Managing these dual pressures requires sophisticated supply chain management, advanced processing technologies, and transparent reporting on sustainability metrics, increasing operational overhead.

Strategic Alliances and Acquisitions

The specialized materials industry is seeing significant consolidation through strategic alliances and acquisitions. A prime example is Mitsubishi Materials' acquisition of H.C. Starck, a move designed to bolster its market standing and unlock operational efficiencies. This trend of consolidation creates larger, more integrated players with expanded product offerings and advanced research and development capabilities.

These strategic maneuvers directly impact competitive rivalry by intensifying pressure on companies that remain independent. Competitors that do not participate in such consolidations may find themselves at a disadvantage in terms of scale, innovation, and market reach. This dynamic reshapes the competitive landscape, potentially leading to increased price competition or a need for further consolidation among remaining players.

- Industry Consolidation: Mitsubishi Materials' acquisition of H.C. Starck exemplifies the trend of strategic alliances and mergers in the specialized materials sector.

- Synergy Pursuit: These deals are often driven by the pursuit of synergies, aiming to improve efficiency and market position.

- Competitive Landscape Shift: The consolidation creates larger entities with enhanced R&D and broader product portfolios, intensifying pressure on standalone competitors.

The competitive rivalry within the refractory metals and high-performance metal powder market is intense, driven by a limited number of global players. Companies like H.C. Starck Tungsten GmbH, Xiamen Tungsten, and Plansee Group continuously invest in R&D to enhance material properties and develop advanced manufacturing solutions. Differentiation is key, focusing on superior performance, purity, and customized applications for demanding sectors such as aerospace and electronics.

Geographical concentration in Asia-Pacific, particularly China, along with Europe and North America, means regional economic shifts significantly influence competition. Companies are expanding into emerging markets, further intensifying the battle for market share. Price volatility of raw materials like tungsten, which saw increases of over 20% in some grades in 2023, adds another layer of competitive pressure, alongside growing demands for sustainable sourcing and ESG compliance.

Consolidation through acquisitions, such as Mitsubishi Materials acquiring H.C. Starck, is reshaping the landscape by creating larger, more integrated entities. This trend intensifies competition for remaining independent players, forcing them to innovate and scale to maintain their market position.

| Key Competitors | Primary Focus Areas | 2024 Market Trend Impact |

|---|---|---|

| Xiamen Tungsten | Tungsten products, rare earths | Dominant producer, leveraging scale and integration |

| CMOC | Molybdenum, tungsten, specialty metals | Expanding global footprint, strategic acquisitions |

| Plansee Group | Refractory metals (tungsten, molybdenum, tantalum, niobium) | Innovation in powder metallurgy and high-temperature applications |

| Kennametal Inc. | Tungsten carbide, engineered components | Focus on advanced materials for industrial applications |

SSubstitutes Threaten

While tungsten and molybdenum are prized for their exceptional properties, other materials can step in as substitutes, though often with performance or cost compromises. For instance, in demanding high-temperature applications, molybdenum, tantalum, and rhenium can be considered as alternatives to tungsten. However, their effectiveness hinges on specific needs such as oxidation resistance or the overall economic viability.

In the realm of alloy steels, the threat of substitutes for molybdenum is significant. Elements such as boron, chromium, niobium, and vanadium can often perform similar functions, especially in applications where extreme hardness or corrosion resistance is required. For instance, advancements in steelmaking in 2024 continue to explore these alternatives to manage cost fluctuations, as molybdenum prices can be volatile, impacting the overall cost of high-performance alloys.

For general refractory materials used in high-temperature furnaces, graphite and tantalum present themselves as strong substitutes for traditional materials. Graphite's excellent thermal conductivity and resistance to thermal shock make it a cost-effective choice for certain furnace linings. Tantalum, while more expensive, offers superior corrosion resistance in extremely aggressive chemical environments, making it a viable substitute where molybdenum-based alloys might otherwise be considered for their heat resistance.

The ultimate decision to substitute often boils down to a careful evaluation of material properties versus the associated processing costs and the specific demands of the application. In 2024, manufacturers are increasingly leveraging advanced simulation tools to predict performance, helping to justify the adoption of substitute materials that might offer a better cost-benefit ratio without compromising critical performance metrics.

Ongoing advancements in materials science, particularly in non-metallic and composite materials, present a growing threat of substitution for refractory metals. Research and development in areas like advanced ceramics and high-performance composites are yielding materials with properties that can rival or even surpass traditional metals in certain applications. For instance, the aerospace sector's increasing focus on lightweighting, a trend that gained further momentum in 2024 with new aircraft designs emphasizing fuel efficiency, actively seeks out these alternative material solutions.

Technological Shifts and Additive Manufacturing

The rise of advanced manufacturing techniques, particularly additive manufacturing (AM) or 3D printing, presents a nuanced threat. While H.C. Starck supplies powders for AM, the underlying technology's progression could lead to the development of entirely new material compositions or designs that minimize the need for traditional refractory metal powders, thereby impacting demand for H.C. Starck's core offerings.

This evolution in manufacturing capabilities can foster innovative material combinations and optimized designs. For instance, AM allows for complex geometries and lattice structures that can achieve desired performance characteristics with less raw material. This efficiency gain directly challenges the volume-based demand for conventional refractory metal powders.

Consider the growth in the AM market. The global 3D printing market was valued at approximately $15.1 billion in 2023 and is projected to reach over $100 billion by 2030, indicating a significant shift in manufacturing paradigms. This expansion suggests that alternative material solutions and manufacturing processes enabled by AM could gain substantial traction.

- Technological Advancement: Additive manufacturing's increasing sophistication allows for novel material integration and design optimization.

- Material Efficiency: AM can create complex parts using less material, potentially reducing the overall volume demand for traditional refractory metal powders.

- Market Growth: The rapid expansion of the 3D printing sector, with projections indicating a market value exceeding $100 billion by 2030, signifies a growing alternative to conventional manufacturing methods.

- New Material Development: AM's capabilities may spur the creation of new material substitutes or hybrid solutions that offer comparable or superior performance with reduced reliance on H.C. Starck's current product portfolio.

Cost-Performance Trade-offs

The decision to switch to substitute materials hinges on a careful cost-performance evaluation. If the prices of key refractory metals like tungsten or molybdenum experience substantial increases, or if new technologies narrow the performance difference while lowering the cost of alternatives, the threat of substitution intensifies. Customers will weigh whether the premium associated with refractory metals is truly warranted by the specific demands of their applications.

For instance, in the cutting tool industry, while tungsten carbide offers superior hardness and wear resistance, the rising price of tungsten concentrate, which saw fluctuations in 2024 impacting raw material costs, might push manufacturers to explore high-performance ceramics or advanced steels for less demanding applications. This cost-benefit analysis is critical.

- Price Sensitivity: Fluctuations in the global price of tungsten, which averaged around $30-35 per kilogram in early 2024 for standard grades, directly influence the attractiveness of substitutes.

- Performance Parity: Advances in alternative materials, such as new polymer composites or advanced ceramics, are continuously reducing the performance gap in specific use cases, making them more viable replacements.

- Application Demands: The critical nature of an application, such as in aerospace or high-temperature industrial processes, dictates the acceptable level of performance compromise, thereby influencing the threat of substitution.

The threat of substitutes for H.C. Starck's refractory metals is a significant consideration, driven by both material performance and cost-effectiveness. While these metals offer unique properties, advancements in alternative materials and manufacturing processes are continually narrowing the gap. This dynamic forces users to re-evaluate the necessity of premium refractory metals for their specific applications.

In 2024, the drive for cost optimization in industries like automotive and electronics means that even minor price increases in tungsten or molybdenum can make substitutes more attractive. For example, while tungsten carbide remains dominant in cutting tools due to its hardness, manufacturers are increasingly exploring advanced ceramics or specialized steels for applications where extreme wear resistance isn't the absolute priority, especially given tungsten concentrate prices that saw some volatility in early 2024.

Furthermore, the rapid growth of additive manufacturing (AM) presents a dual threat. While H.C. Starck supplies powders for AM, the technology itself enables the development of novel material compositions and optimized designs that could reduce the overall demand for traditional refractory metal powders. The global 3D printing market, projected to exceed $100 billion by 2030, underscores this shift towards alternative manufacturing and material solutions.

The ultimate decision to substitute often comes down to a detailed cost-benefit analysis, where performance requirements are weighed against the total cost of ownership. As new materials emerge and manufacturing techniques evolve, the competitive landscape for refractory metals will continue to shift, demanding constant innovation and strategic pricing from suppliers like H.C. Starck.

| Substitute Material Category | Potential Applications | Key Advantage | Potential Drawback | 2024 Trend/Consideration |

|---|---|---|---|---|

| Advanced Ceramics | Cutting tools, furnace linings, wear-resistant components | High hardness, excellent thermal stability, chemical inertness | Brittleness, higher processing costs for complex shapes | Increasing adoption in niche applications due to improved toughness and cost-competitiveness. |

| High-Performance Alloy Steels | Automotive components, structural parts, tooling | Good balance of strength, hardness, and toughness; cost-effective | Lower temperature resistance compared to refractory metals | Ongoing development of specialized alloys to match specific performance needs at lower costs. |

| Composite Materials (e.g., Carbon Fiber Reinforced Polymers) | Aerospace components, sporting goods, automotive lightweighting | High strength-to-weight ratio, corrosion resistance | Lower temperature limits, potential for delamination | Continued focus on lightweighting in aerospace and automotive sectors is driving demand. |

| Other Refractory Metals (Tantalum, Rhenium) | High-temperature applications, aerospace alloys, medical implants | Specific properties like superior oxidation or corrosion resistance | Generally higher cost than tungsten or molybdenum | Used in highly specialized applications where their unique properties justify the premium. |

Entrants Threaten

The manufacturing of high-performance metal powders and complex shaped parts from refractory metals, like those H.C. Starck specializes in, requires enormous capital investment. Think specialized furnaces, atomizers, and advanced processing machinery; these aren't cheap. For instance, setting up a state-of-the-art refractory metal powder production facility can easily run into hundreds of millions of dollars, a significant hurdle for any new player.

This high entry cost, coupled with the need for robust infrastructure, acts as a powerful deterrent. New companies must not only afford the equipment but also the land, utilities, and specialized workforce needed to operate efficiently. Without massive financial backing, entering this market competitively is practically impossible, effectively limiting the threat of new entrants.

The threat of new entrants is significantly lowered by H.C. Starck's proprietary technology and deep R&D expertise. Existing players have cultivated decades of specialized knowledge and patented processes for creating high-purity, application-specific materials. For instance, in the advanced ceramics sector, where H.C. Starck is a key player, the development of novel material compositions and manufacturing techniques can take years and require substantial investment, often exceeding tens of millions of dollars in R&D annually.

Newcomers face a steep climb to replicate this technological prowess and meet stringent performance benchmarks. The significant lead times and capital expenditure necessary for comparable R&D efforts create a formidable barrier. This accumulated intellectual property acts as a robust competitive moat, making it challenging for new companies to enter and compete on a level playing field, particularly in specialized markets like aerospace or electronics where material performance is critical.

New companies looking to enter the tungsten and molybdenum markets face substantial barriers related to securing essential raw materials. The global supply of these critical metals is highly concentrated, often in geopolitically sensitive regions, making consistent access a significant challenge. For instance, China dominates global tungsten production, accounting for approximately 70% of mine production in recent years, creating inherent supply chain risks for any new entrant not already established within these networks.

Established companies often possess the advantage of long-term, preferential agreements with mining operations and processing facilities. These existing relationships, coupled with potential investments in integrated supply chains or advanced recycling technologies, create a formidable moat that new entrants must overcome. In 2024, the price volatility of tungsten, influenced by these supply dynamics, underscored the difficulty for newcomers to secure cost-effective and predictable raw material inputs.

Stringent Regulatory and Certification Requirements

Industries H.C. Starck serves, like aerospace, medical, and defense, demand rigorous quality, performance, and environmental certifications. For instance, the aerospace sector often requires AS9100 certification, a complex and time-consuming process. New companies entering these markets face substantial hurdles in securing such approvals and establishing a reputation for dependability, which can easily take several years and significant capital investment.

Compliance with evolving environmental regulations, such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe, further complicates market entry. These regulations necessitate extensive testing and documentation for chemical substances, adding considerable operational complexity and cost.

- High Capital Investment: New entrants must allocate significant funds towards achieving industry-specific certifications and meeting stringent quality control standards.

- Lengthy Certification Processes: Obtaining approvals from bodies like the FDA for medical applications or FAA for aerospace can take years, creating a substantial barrier.

- Environmental Compliance Costs: Adhering to global environmental standards, like those concerning hazardous materials, requires ongoing investment in compliance and sustainable practices.

- Reputation and Track Record: Established players like H.C. Starck benefit from decades of proven performance and reliability, which new entrants struggle to replicate quickly.

Established Customer Relationships and Reputation

Established customer relationships and a strong reputation act as significant deterrents to new entrants. Building trust and fostering long-term partnerships within industries that demand reliability and proven performance is a substantial hurdle. H.C. Starck's century-long legacy and its established reputation for high-quality materials offer a formidable competitive edge that newcomers would find exceedingly difficult to match in a short timeframe.

Customer loyalty, cemented by consistent product quality and robust technical support, represents a valuable and hard-to-replicate asset for H.C. Starck. For instance, in the demanding aerospace sector, where material failure can have catastrophic consequences, customer retention rates for established suppliers like H.C. Starck are typically very high, often exceeding 90% for key accounts. This loyalty is not easily swayed by lower prices alone, as the cost of qualification and the risk associated with unproven materials are substantial.

- Reputation as a Barrier: H.C. Starck's century of operation has cultivated a reputation for quality and reliability, making it difficult for new entrants to gain customer trust.

- Customer Loyalty: Long-standing relationships built on consistent performance and technical support create high switching costs for customers in critical industries.

- Industry Demands: Sectors like aerospace and medical technology prioritize proven materials, where the risk of using unproven alternatives outweighs potential cost savings.

- Time to Replicate: The time and investment required for a new entrant to build a comparable track record and customer base are extensive.

The threat of new entrants into H.C. Starck's specialized refractory metals market is considerably low. The immense capital required for advanced manufacturing facilities, often in the hundreds of millions of dollars, presents a significant financial barrier. Furthermore, the need for specialized expertise and established supply chain relationships, particularly for critical materials like tungsten and molybdenum, deters potential new competitors.

Proprietary technology and extensive R&D investment, often in the tens of millions annually, create a substantial knowledge gap that new entrants must bridge. Rigorous industry certifications, such as AS9100 for aerospace, add years and significant costs to market entry. These combined factors, including established customer loyalty and a strong reputation for reliability, create formidable barriers that effectively limit new competition.

| Barrier Type | Description | Impact on New Entrants | Example Data Point (2024) |

|---|---|---|---|

| Capital Investment | Setting up advanced refractory metal powder production can cost hundreds of millions. | High barrier, requires substantial funding. | Facility setup costs estimated at $200M-$500M. |

| Technology & R&D | Proprietary processes and decades of specialized knowledge. | Steep learning curve, difficult to replicate. | Annual R&D spend in advanced ceramics can exceed $50M. |

| Raw Material Access | Concentrated global supply of tungsten (70% by China). | Supply chain risks, difficulty securing consistent inputs. | Tungsten price volatility in 2024 highlighted supply challenges. |

| Certifications & Reputation | Rigorous industry standards (e.g., AS9100) and long-standing trust. | Time-consuming and costly to obtain approvals and build credibility. | Aerospace certifications can take 3-5 years. |

Porter's Five Forces Analysis Data Sources

Our H.C. Starck Porter's Five Forces analysis is built upon a foundation of comprehensive data, including company annual reports, industry-specific market research from firms like CRU Group and Wood Mackenzie, and public financial filings.