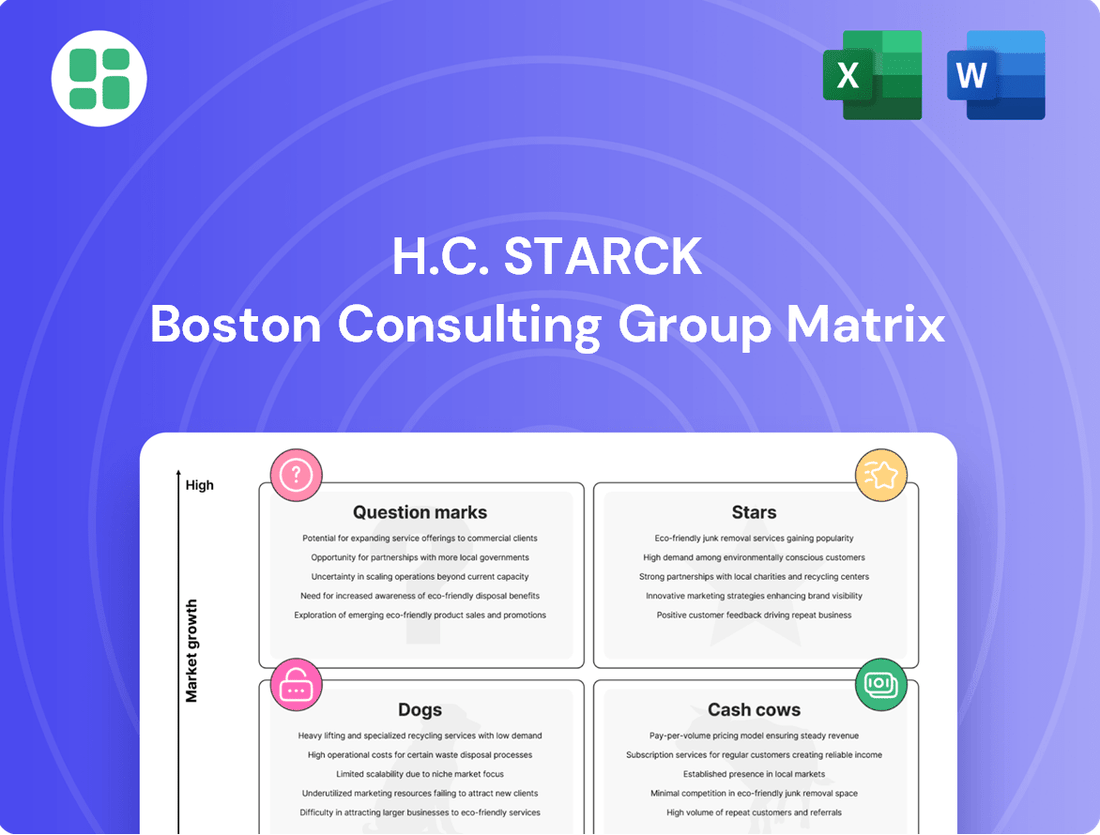

H.C. Starck Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H.C. Starck Bundle

Explore the strategic positioning of H.C. Starck's product portfolio with our insightful BCG Matrix preview. Understand where their offerings fall as Stars, Cash Cows, Dogs, or Question Marks, and begin to grasp their market dynamics.

Ready to transform this understanding into decisive action? Purchase the full BCG Matrix report for a comprehensive breakdown, including detailed quadrant analysis and actionable strategies to optimize H.C. Starck's product investments and resource allocation.

Stars

H.C. Starck's advanced materials, particularly specialized tungsten powders and alloys for additive manufacturing, are positioned as a strong contender in a rapidly expanding market. The aerospace, medical, and defense sectors are driving this growth, seeking intricate components with exceptional density and strength.

The demand for these high-performance 3D-printed parts is on a steep upward trajectory, with the global additive manufacturing market projected to reach over $60 billion by 2030. H.C. Starck's established expertise in producing high-quality metal powders gives it a distinct advantage in capturing a significant share of this evolving landscape.

The electronics industry, especially semiconductor manufacturing, is a major driver for high-purity refractory metals like tungsten and molybdenum. This demand is expected to continue its upward trajectory.

As technology pushes forward, the requirement for these metals in sophisticated packaging and integrated circuits is expanding. This trend is a key indicator of the sector's growth potential.

H.C. Starck's specialization in high-purity materials positions it favorably within this expanding market. The company's focus directly addresses the needs of this high-growth area, suggesting a strong market standing and promising future prospects.

Next-generation aerospace and defense alloys, particularly those based on refractory metals, are indispensable for cutting-edge applications like hypersonic aircraft and advanced rocket propulsion. These materials offer unparalleled resistance to extreme temperatures and exceptional strength, crucial for lightweight components in next-generation military systems. The aerospace sector's continuous drive for lighter, more heat-resistant materials fuels significant market expansion.

H.C. Starck's specialized knowledge in these demanding alloys places them at the forefront of this high-growth, high-value market. For instance, the global aerospace market was valued at approximately $840 billion in 2023 and is projected to grow substantially in the coming years, with advanced materials being a key enabler of this growth.

Materials for Emerging Clean Energy Technologies

The global push for clean energy, encompassing everything from fusion reactors to advanced solar and wind power, is creating a significant demand for specialized materials. Refractory metals, known for their ability to endure extreme temperatures and harsh environments, are at the forefront of this technological revolution. For instance, the development of next-generation fusion reactors relies heavily on materials that can withstand immense heat and radiation, a niche where tungsten and molybdenum excel.

H.C. Starck is well-positioned to capitalize on this burgeoning market. Their expertise in developing and supplying high-performance refractory metals like tungsten and molybdenum makes them a key player. These metals are essential for critical components in emerging clean energy systems, from electrodes in high-temperature plasma applications to specialized alloys for advanced turbine blades in renewable energy generation.

The market for these advanced materials is projected for substantial growth. For example, the global clean energy market was valued at over $1.5 trillion in 2023 and is expected to continue its upward trajectory, with significant investment flowing into research and development of new energy technologies. This directly translates to increased demand for the specialized materials H.C. Starck provides.

- Market Growth: The clean energy sector's expansion fuels demand for refractory metals.

- Key Materials: Tungsten and molybdenum are crucial for fusion and advanced renewables.

- H.C. Starck's Role: The company's expertise in supplying these materials positions it for growth.

- Investment Trends: Significant R&D investment in clean energy technologies drives material innovation and demand.

Specialized Tungsten Products for Electric Vehicles (EVs)

The electric vehicle (EV) sector is booming, driving demand for advanced materials. Tungsten, with its exceptional strength and heat resistance, is becoming crucial for EV components like batteries and motors. H.C. Starck's expertise in specialized tungsten products allows them to capitalize on this expanding market.

The global EV market is projected to reach over $1.5 trillion by 2030, with a compound annual growth rate (CAGR) of approximately 18%. Tungsten's density and high melting point make it ideal for improving the efficiency and durability of EV powertrains and battery systems.

- EV Market Growth: Expected to exceed $1.5 trillion by 2030.

- Tungsten's Role: Enhances efficiency and performance in EV batteries and motors.

- H.C. Starck's Position: Innovating specialized tungsten products for this high-growth sector.

H.C. Starck's advanced materials, particularly specialized tungsten powders and alloys for additive manufacturing, are positioned as a strong contender in a rapidly expanding market. The aerospace, medical, and defense sectors are driving this growth, seeking intricate components with exceptional density and strength. The demand for these high-performance 3D-printed parts is on a steep upward trajectory, with the global additive manufacturing market projected to reach over $60 billion by 2030. H.C. Starck's established expertise in producing high-quality metal powders gives it a distinct advantage in capturing a significant share of this evolving landscape.

Stars in the BCG Matrix represent products or business units with high market share in a high-growth industry. These are typically the most promising areas for investment, as they have the potential to generate significant future profits. H.C. Starck's advanced materials for additive manufacturing, clean energy, and electric vehicles fit this profile due to the substantial growth projected in these sectors and the company's strong position within them.

What is included in the product

The H.C. Starck BCG Matrix analyzes business units based on market share and growth, guiding strategic decisions for investment and resource allocation.

H.C. Starck BCG Matrix: A clear, visual tool to identify and address underperforming business units, transforming strategic challenges into actionable growth opportunities.

Cash Cows

Tungsten carbide powders are a bedrock for traditional cutting tools, drills, and wear-resistant components, serving a broad manufacturing base. This segment represents a mature, stable market where H.C. Starck commands a significant and long-standing market position.

The consistent, high demand for these essential powders translates into a reliable and substantial cash flow for H.C. Starck. For instance, the global cemented carbide market, heavily reliant on tungsten carbide, was valued at approximately USD 17.5 billion in 2023 and is projected to grow steadily, underscoring the enduring demand for these foundational materials.

Molybdenum products are vital for conventional steel production, acting as a key alloying agent that significantly boosts strength, toughness, and corrosion resistance. This makes them indispensable for established industrial and construction sectors.

The market for these molybdenum products is mature, characterized by consistent, high-volume demand. In 2024, global steel production, a primary driver for molybdenum demand, was projected to remain robust, with estimates suggesting around 1.9 billion metric tons of crude steel output, a slight increase from 2023.

H.C. Starck benefits from a strong market position due to its established reputation for quality. This allows them to maintain a high market share in this segment, ensuring a steady and predictable generation of cash flow from these essential products.

The market for refractory metals like tungsten and molybdenum in industrial furnaces and high-temperature equipment is mature, showing steady but modest growth. For instance, the global industrial furnace market was valued at approximately $10.5 billion in 2023 and is projected to grow at a CAGR of around 3.5% through 2030, highlighting its stable demand.

H.C. Starck's tungsten and molybdenum components are crucial for these demanding applications, known for their durability and performance in extreme conditions. These products are vital for industries like aerospace, automotive, and manufacturing, where consistent high-temperature processing is essential.

These offerings act as Cash Cows for H.C. Starck due to their long product lifecycles and the critical nature of their function in industrial operations. This reliability translates into a predictable and consistent revenue stream, underpinning the company's financial stability.

Tungsten Mill Products for Traditional Electronics

Tungsten mill products, like filaments and electrodes, remain vital for traditional electronics, powering everything from lighting to welding. These are classic examples of cash cows within H.C. Starck's portfolio.

Despite some markets being mature, H.C. Starck benefits from consistent replacement demand. Their robust supply chain and unwavering commitment to quality allow them to maintain a significant market share in these established sectors.

- Steady Revenue: These products generate a predictable and reliable income stream for the company.

- Market Maturity: While growth is limited, the consistent demand in established applications ensures stability.

- Established Position: H.C. Starck's long-standing presence and quality reputation solidify their market leadership.

- Replacement Demand: The ongoing need to replace worn-out components fuels continuous sales.

High-Density Tungsten for Counterweights and Shielding

High-density tungsten alloys are crucial for applications demanding significant weight in compact spaces, like counterweights in aerospace and automotive industries, and balancing components in precision machinery. These markets are well-established and represent a steady demand for H.C. Starck's specialized materials.

H.C. Starck's deep knowledge of tungsten metallurgy gives them a significant edge, allowing them to capture a substantial portion of the market share in these consistent revenue-generating segments. For example, the global market for tungsten alloys was estimated to be worth billions of dollars in 2024, with counterweights and shielding being key drivers.

- Market Maturity: Applications like counterweights and radiation shielding are in a mature phase, indicating stable but not necessarily high-growth demand.

- Competitive Advantage: H.C. Starck's specialized expertise in high-density tungsten alloys positions them strongly against competitors in these niche areas.

- Revenue Stability: These segments are known for providing consistent and reliable revenue streams, contributing to the company's overall financial stability.

- Key Applications: Essential uses include aerospace counterweights, medical radiation shielding (e.g., in CT scanners), and high-performance sports equipment.

Cash Cows in H.C. Starck's portfolio, like tungsten carbide powders and molybdenum products, represent mature markets with consistent, high demand. These segments benefit from H.C. Starck's established market position and reputation for quality, ensuring a steady and predictable generation of cash flow. The ongoing need for these essential materials in various industrial applications, from cutting tools to steel production, fuels continuous sales and contributes significantly to the company's financial stability.

| Product Segment | Key Applications | Market Maturity | H.C. Starck Advantage | Revenue Contribution |

|---|---|---|---|---|

| Tungsten Carbide Powders | Cutting tools, drills, wear-resistant components | Mature, stable | Significant, long-standing market position, quality reputation | Reliable, substantial cash flow |

| Molybdenum Products | Steel production (alloying agent) | Mature, consistent high-volume demand | Strong market position, established reputation | Steady, predictable cash flow |

| Tungsten Mill Products | Filaments, electrodes (lighting, welding) | Mature, consistent replacement demand | Robust supply chain, quality commitment | Predictable and consistent revenue stream |

| High-Density Tungsten Alloys | Aerospace counterweights, medical shielding | Well-established, steady demand | Deep metallurgical expertise, niche market share | Consistent and reliable revenue streams |

Delivered as Shown

H.C. Starck BCG Matrix

The H.C. Starck BCG Matrix preview you're viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content – you get the complete, ready-to-use strategic analysis. Our commitment is to provide you with the exact professional-grade report designed to offer clear insights into H.C. Starck's product portfolio. You can confidently use this preview as a direct representation of the valuable strategic tool that will be yours to download and implement.

Dogs

In the realm of commoditized, low-purity tungsten powders, H.C. Starck confronts a highly saturated market. This intense competition, fueled by numerous players, translates directly into significant price pressures and consequently, thin profit margins.

For H.C. Starck, these undifferentiated product lines present a challenge in carving out a distinct competitive advantage or securing a substantial market share. The low-purity segment, in particular, may struggle to command premium pricing, impacting overall profitability.

These specific tungsten powder segments likely contribute minimally to H.C. Starck's total revenue. Furthermore, they could potentially drain valuable resources and capital without yielding commensurate returns, posing a drag on the company's financial performance.

Refractory components for obsolete lighting technologies, such as those used in incandescent or halogen bulbs, fall into the Dogs category of the H.C. Starck BCG Matrix. As the world shifts towards LEDs and other energy-efficient lighting, the market for these older components is shrinking rapidly.

The global lighting market is increasingly dominated by LEDs, which accounted for over 70% of the market in 2023, a significant jump from around 40% in 2020. This trend directly impacts the demand for refractory metals in legacy lighting, leading to low growth and declining revenues for H.C. Starck in this segment.

Continuing to invest in refractory components for obsolete lighting would likely yield diminishing returns, as market share and demand continue to contract. H.C. Starck's focus needs to be on areas with higher growth potential to maintain profitability and competitive advantage.

Certain basic molybdenum products, such as molybdenum oxide and ferromolybdenum, fall into the Dogs category within the H.C. Starck BCG Matrix. These offerings provide minimal value-added differentiation and contend with intense competition from a multitude of global suppliers.

These products are situated in low-growth markets, where H.C. Starck faces challenges in capturing or sustaining significant market share. For instance, the global molybdenum market, while essential for steel production, experienced a modest growth rate of approximately 2-3% in recent years leading up to 2024, with prices fluctuating based on demand from key sectors like automotive and construction.

Consequently, these basic molybdenum products often result in low profit margins and can tie up valuable capital without generating substantial returns. In 2023, the average price for molybdenum concentrate hovered around $15-$20 per pound, a figure that reflects the commodity nature and competitive pressures faced by producers of basic molybdenum forms.

Legacy Products with Declining Industrial Relevance

Legacy products within H.C. Starck that are tied to declining industrial sectors, such as certain types of refractory metals used in older manufacturing processes, would fit this description. These product lines face shrinking demand and possess minimal scope for significant innovation, thereby limiting their market appeal and growth potential.

These offerings typically represent low market share within markets that are contracting. For instance, if a particular grade of tungsten carbide, once essential for a now-obsolete industrial application, continues to be produced, it would likely fall into this category. Such products often become cash traps, consuming resources without generating substantial returns.

The strategy for these products is clear: divestment or a carefully managed phase-out. This approach allows H.C. Starck to reallocate capital and R&D efforts towards more dynamic and profitable areas of its business. For example, divesting a low-margin, legacy product line could free up millions in working capital that can be reinvested in high-growth areas like advanced materials for the electronics or aerospace industries.

- Declining Industrial Demand: Products linked to industries experiencing secular decline, such as legacy components for vacuum tube technology, would be prime examples.

- Limited Innovation Potential: These product lines have reached a technological plateau with little prospect for significant upgrades or new applications.

- Cash Trap Characteristics: Continued investment to maintain production of these items yields diminishing returns, draining resources.

- Strategic Divestment: The optimal path involves exiting these markets to redirect resources towards innovation and growth segments.

Outdated Metal Recycling Methods

Outdated metal recycling methods at H.C. Starck could be categorized as Dogs in the BCG Matrix. If the company still employs older, less efficient, or environmentally taxing processes that newer, more sustainable technologies are replacing, these would represent a low market share in a rapidly evolving, sustainability-focused market.

These legacy methods likely generate low returns relative to the operational costs and investments needed to maintain them. For instance, if older smelting techniques require significantly more energy than modern induction furnaces, the cost per unit of recycled metal would be higher, eroding profitability.

While H.C. Starck is actively investing in advanced recycling technologies, any remaining older processes would struggle to compete. The global push for circular economy principles, as highlighted by initiatives like the EU's Circular Economy Action Plan, favors innovative and resource-efficient recycling. Companies not adopting these advancements risk falling behind.

- Low Market Share: Older recycling methods are being phased out globally in favor of more efficient and environmentally friendly alternatives.

- Low Growth Potential: The market for sustainable recycling is growing, but outdated methods are unlikely to capture significant share in this expanding segment.

- Negative Cash Flow: The higher operational costs associated with less efficient processes can lead to negative cash flow, especially when compared to newer technologies.

- Strategic Disadvantage: Relying on outdated methods can damage a company's reputation and competitive standing in an industry increasingly prioritizing environmental, social, and governance (ESG) factors.

Products categorized as Dogs within H.C. Starck's portfolio represent areas with low market share in low-growth or declining markets. These segments typically offer minimal differentiation and face intense competition, leading to low profitability and potentially draining valuable resources.

For example, certain basic molybdenum products, like molybdenum oxide, are in this category. The global molybdenum market, while important for steel, sees modest growth, around 2-3% leading up to 2024, with prices fluctuating around $15-$20 per pound in 2023, reflecting commodity pressures.

Similarly, refractory components for obsolete lighting technologies, such as those for incandescent bulbs, are Dogs. The lighting market is now over 70% LEDs as of 2023, drastically reducing demand for older components.

The strategic approach for these Dog products is often divestment or a managed phase-out to reallocate capital to more promising growth areas.

| Product Category | Market Share | Market Growth | Profitability | Strategic Recommendation |

|---|---|---|---|---|

| Basic Molybdenum Products | Low | Low | Low | Divest/Phase-out |

| Refractory Components for Obsolete Lighting | Very Low | Declining | Very Low | Divest/Phase-out |

Question Marks

H.C. Starck is making substantial investments in its proprietary black mass recycling technology for lithium-ion batteries, signaling a strategic move towards a significant plant construction. This focus aligns with the burgeoning battery recycling market, driven by the surge in electric vehicle (EV) adoption and stringent sustainability requirements.

The battery recycling sector is experiencing robust growth, with projections indicating a market size of approximately $14.7 billion by 2027, up from an estimated $5.1 billion in 2022. However, H.C. Starck’s market share in this nascent recycling venture is currently minimal. This is largely due to the technology being in its early stages of industrial deployment, necessitating considerable capital outlay to achieve meaningful market penetration and competitive positioning.

Novel biocompatible tungsten materials for advanced medical implants, while a high-growth prospect, currently represent a question mark for H.C. Starck. These specialized applications, though promising, face slow initial market adoption, leading to a low current market share despite significant R&D investment. The path to widespread use requires substantial marketing and clinical validation, making their future market position uncertain.

The market for specialized refractory metal catalysts in emerging chemical processes, especially those geared towards sustainability and innovative synthesis, presents a significant growth opportunity. H.C. Starck's expertise in refractory metals positions them well to capitalize on this trend.

While H.C. Starck's refractory metals are well-suited for these advanced applications, their current market penetration in these developing areas is likely minimal. This suggests a potential "Question Mark" in the BCG matrix, requiring strategic evaluation.

To transform these promising applications into market "Stars," H.C. Starck would need to commit substantial resources to research and development, alongside robust customer adoption initiatives. For instance, the global catalyst market was valued at approximately $45 billion in 2023 and is projected to grow significantly, with emerging technologies driving a portion of this expansion.

Advanced Sputtering Targets for Next-Gen Displays

The market for advanced sputtering targets, particularly for emerging display technologies like micro-LEDs and flexible screens, is experiencing robust growth. This sector is driven by continuous innovation, with the global display market projected to reach approximately $149 billion by 2025, indicating significant demand for enabling materials. H.C. Starck's focus on specialized refractory metal targets positions them to capitalize on this trend, although their current market share in this highly technical niche may require strategic development.

Capturing a larger segment of the next-generation display market necessitates ongoing investment in research and development for these advanced sputtering targets. The rapid pace of technological advancement means that staying ahead requires dedicated resources to refine material properties and manufacturing processes. For instance, the micro-LED market alone is anticipated to grow substantially, with some projections suggesting a CAGR exceeding 30% in the coming years, underscoring the potential rewards for market leaders.

- Market Growth: The global display market is expanding, with next-generation technologies like micro-LEDs showing particularly strong growth potential, estimated to surpass $10 billion by 2027.

- Technological Investment: Continuous R&D is crucial for refractory metal sputtering targets to meet the stringent requirements of advanced displays, such as improved conductivity and durability.

- Competitive Landscape: While the niche is growing, H.C. Starck's market share may be nascent, requiring strategic efforts to establish a stronger presence against established players and new entrants.

- Opportunity: The demand for high-performance materials in displays presents a significant opportunity for companies capable of delivering specialized sputtering targets that enhance display quality and longevity.

Tungsten-based Materials for Future Energy Storage Solutions

H.C. Starck's exploration into tungsten-based materials for future energy storage, such as solid-state and multivalent-ion batteries, positions them in a high-growth but nascent market. While the global battery recycling market was valued at approximately USD 1.5 billion in 2023 and is projected to reach over USD 5 billion by 2030, the specific segment for novel materials like tungsten is still in its early stages of development and adoption.

This strategic focus represents a long-term investment with significant risk due to the unproven market penetration of these advanced materials. However, the potential rewards are substantial, given the ongoing demand for more efficient and sustainable energy storage solutions.

- High Growth Potential: The broader future energy storage market, beyond lithium-ion recycling, is experiencing rapid expansion, driven by the need for improved battery technologies.

- Nascent Market Adoption: Tungsten-based materials for these advanced batteries are currently in the early stages of market adoption, leading to a low current market share for H.C. Starck in this specific niche.

- Long-Term Investment Horizon: Success in this area requires patience and significant investment, as market acceptance and widespread application of these novel materials will take time.

- High Risk, High Reward: While the risks are considerable due to technological and market uncertainties, the potential for significant returns exists if H.C. Starck successfully develops and commercializes viable tungsten-based energy storage solutions.

H.C. Starck's ventures into novel biocompatible tungsten materials for medical implants, advanced refractory metal catalysts for sustainable chemical processes, and specialized sputtering targets for next-generation displays all represent potential "Question Marks" in the BCG matrix. These areas show promising market growth, but H.C. Starck's current market share is likely minimal due to early-stage technology and market adoption.

Significant investment in R&D and market development is required to transform these opportunities into market "Stars." For instance, the global catalyst market was valued at approximately $45 billion in 2023, with emerging technologies driving expansion, and the micro-LED market is projected for substantial growth.

The success of these ventures hinges on H.C. Starck's ability to navigate technological hurdles, secure customer adoption, and outpace competitors in rapidly evolving sectors. The company's strategic allocation of resources will be critical in determining whether these "Question Marks" evolve into profitable market leaders or remain underdeveloped.

| Business Area | Market Growth Potential | Current Market Share | Strategic Challenge | BCG Category |

|---|---|---|---|---|

| Biocompatible Tungsten (Medical) | High (specialized niche) | Low (early adoption) | Clinical validation, Market education | Question Mark |

| Refractory Metal Catalysts | High (sustainability focus) | Low (nascent applications) | Process integration, Customer acquisition | Question Mark |

| Sputtering Targets (Next-Gen Displays) | Very High (e.g., micro-LEDs) | Low to Moderate (technical niche) | R&D for material properties, Competitive differentiation | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, industry growth rates, and competitor analysis, to provide a clear strategic overview.