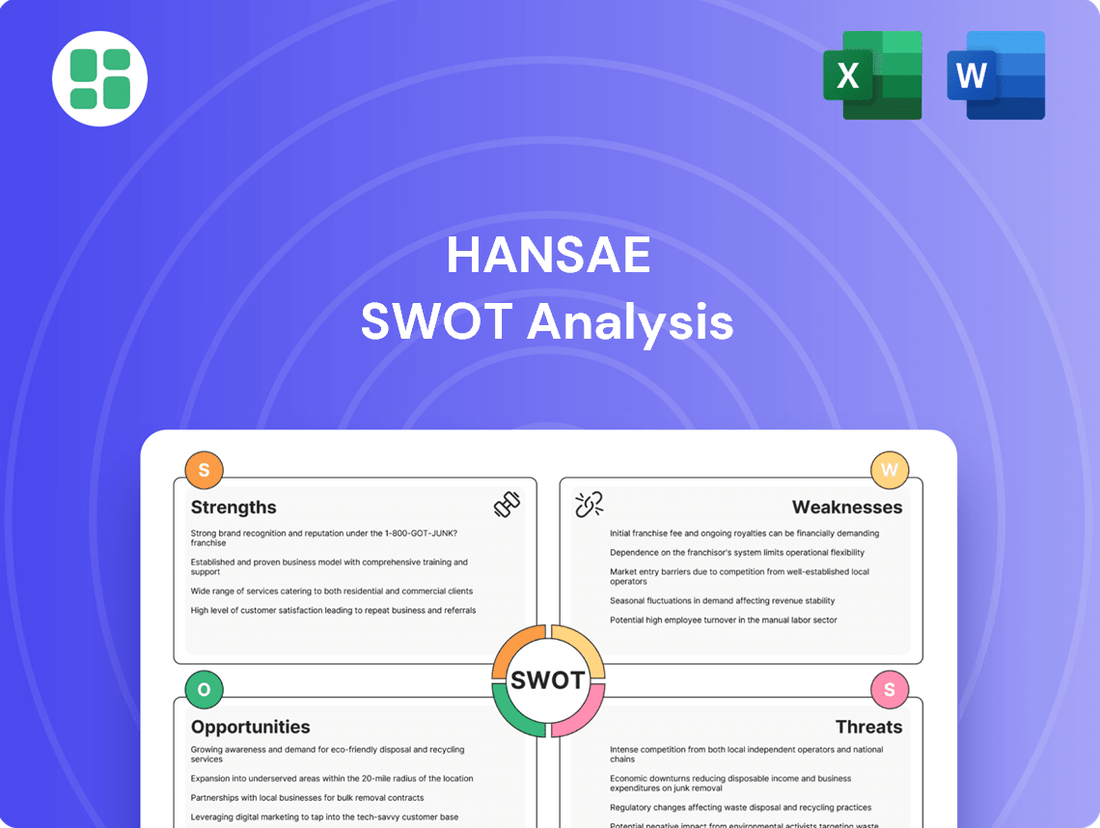

Hansae SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hansae Bundle

Hansae's market position is shaped by its robust manufacturing capabilities and established global partnerships, but also faces challenges from evolving consumer demands and intense competition.

Want the full story behind Hansae's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hansae's extensive global manufacturing network, boasting 22 subsidiaries and 10 offices across nine countries, is a significant strength. This vast operational scale, with key production bases in Vietnam, Indonesia, Nicaragua, and Guatemala, allows the company to efficiently serve major international brands such as Walmart, Target, and GAP.

This widespread presence enables Hansae to manufacture a substantial volume of apparel, catering to a significant portion of the American market. The strategic distribution of its manufacturing capabilities across diverse regions is crucial for optimizing production costs and ensuring supply chain resilience and efficiency.

Hansae excels in offering complete OEM/ODM services, managing the entire lifecycle from initial design and development through to final production and delivery. This integrated approach, supported by robust R&D, including cutting-edge 3D design for virtual sampling, significantly boosts its appeal to leading global fashion houses.

Hansae is deeply committed to ESG principles, publishing annual sustainability reports aligned with GRI Standards and the EU's CSRD. This dedication showcases a transparent approach to environmental and social impact.

The company is actively pursuing eco-friendly operations, targeting a complete phase-out of coal use in its primary factories by 2025. Furthermore, Hansae is increasing its adoption of sustainable materials across its product lines, reflecting a tangible shift towards greener practices.

This strong emphasis on sustainability is a significant strength, expected to bolster Hansae's brand image and attract a growing segment of environmentally aware clients and investors.

Advanced Technology and Smart Factory Adoption

Hansae's commitment to advanced technology is a significant strength. The company is actively integrating smart factory systems to boost operational efficiency and output. This forward-thinking approach positions them well in a competitive global market.

Key initiatives include the deployment of real-time production monitoring, automated guided vehicles (AGVs), and their proprietary HAMS 2.0 smart technology system, notably in their Vietnam operations. These investments are designed to refine production processes and elevate product quality.

- Real-time production monitoring enhances oversight and quick decision-making.

- Automated Guided Vehicles (AGVs) streamline internal logistics and material handling.

- HAMS 2.0 smart tech system optimizes production planning and execution.

- These advancements contribute to Hansae being recognized as a top-tier supplier for major global brands.

Strong Client Relationships and Diversification Efforts

Hansae's enduring partnerships with global retail giants like GAP, H&M, Zara, Walmart, and Target, some cultivated over several decades, underscore a significant strength in client retention and trust. This deep-seated client base provides a stable foundation for its operations.

The company is strategically broadening its horizons through diversification efforts. A prime example is its bid to acquire auto parts manufacturer Erae AMS, signaling a clear intent to tap into new revenue streams and reduce dependence on the fashion sector. This move aims to secure future growth engines.

- Long-standing partnerships with major global fashion brands.

- Diversification strategy including potential acquisition of Erae AMS.

- Reduced industry reliance through expansion into new sectors.

Hansae's extensive global manufacturing footprint, with 22 subsidiaries and 10 offices across nine countries, including key bases in Vietnam and Indonesia, is a core strength. This broad operational scale allows them to efficiently serve major clients like Walmart and Target, handling substantial apparel volumes for the American market.

The company's complete OEM/ODM service model, encompassing design, development, and production, is a significant advantage. Supported by advanced R&D, including 3D virtual sampling, this integrated approach makes Hansae highly attractive to leading global fashion brands.

Hansae's commitment to ESG principles, demonstrated by annual sustainability reports and a target to phase out coal by 2025, enhances its brand image and appeals to environmentally conscious clients and investors. The increasing use of sustainable materials further solidifies this commitment.

Technological integration, such as smart factory systems and proprietary HAMS 2.0 technology in Vietnam, boosts operational efficiency and output. Real-time production monitoring and AGVs are key components of this strategy, refining processes and improving product quality.

The company benefits from long-standing, stable partnerships with major global retailers like GAP, H&M, and Zara, some spanning decades. This client loyalty provides a robust foundation for its business operations.

Hansae is actively diversifying its business, notably through its bid to acquire auto parts manufacturer Erae AMS. This strategic move aims to create new revenue streams and reduce reliance on the fashion industry, securing future growth.

| Key Strength | Description | Impact |

|---|---|---|

| Global Manufacturing Network | 22 subsidiaries, 10 offices in 9 countries | Efficiently serves major brands (Walmart, Target), high production volume |

| Integrated OEM/ODM Services | Full lifecycle management, advanced R&D (3D sampling) | High appeal to global fashion houses, streamlined product development |

| ESG Commitment | Sustainability reports, coal phase-out by 2025, sustainable materials | Enhanced brand image, attracts eco-conscious clients |

| Technology Integration | Smart factory systems, HAMS 2.0, AGVs | Increased operational efficiency, improved product quality |

| Client Partnerships | Long-standing relationships with GAP, H&M, Zara, Walmart, Target | Stable revenue base, client retention and trust |

| Diversification Strategy | Potential acquisition of Erae AMS | New revenue streams, reduced industry reliance |

What is included in the product

Delivers a strategic overview of Hansae’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential weaknesses into opportunities.

Weaknesses

As a global apparel manufacturer, Hansae's financial health is closely tied to the strength of the worldwide consumer market and how much people are willing to spend. A significant slowdown in consumer spending on clothing can directly result in fewer orders and put a squeeze on the company's profits, a pattern observed in past economic challenges.

This inherent connection to consumer spending makes Hansae vulnerable to broader economic ups and downs and shifts in consumer confidence. For instance, during the COVID-19 pandemic's initial phases in 2020, global retail sales saw a sharp decline, impacting apparel demand worldwide, which would have directly affected companies like Hansae.

Hansae's reliance on a handful of major international brands for a significant chunk of its revenue presents a notable weakness. This concentration risk means that any change in sourcing strategies or a dip in demand from these key clients could disproportionately impact Hansae's sales and overall profitability.

Hansae's extensive global manufacturing footprint, spanning numerous countries, inherently exposes the company to significant geopolitical and trade-related risks. Fluctuations in international relations, sudden shifts in trade policies, and potential disruptions within global supply chains are constant concerns. For instance, a trade dispute between major economic blocs where Hansae has manufacturing operations could lead to increased tariffs, directly impacting the cost of goods and potentially reducing profit margins.

These geopolitical tensions and trade policy changes can translate into tangible operational challenges. Tariffs imposed on imported materials or finished goods can escalate production expenses. Furthermore, political instability or unrest in key sourcing or manufacturing regions might cause delays in production schedules or impede the smooth movement of inventory, ultimately affecting overall operational efficiency and the company's bottom line.

Intense Competition in Apparel Manufacturing

The global apparel manufacturing sector is a crowded marketplace, with many companies competing for business from major fashion labels. Hansae operates within this intensely competitive environment, facing constant pressure on its pricing and operational efficiency. This pressure comes from both well-established, large-scale manufacturers and newer, more cost-effective competitors entering the market.

This intense rivalry directly impacts Hansae's profitability, often squeezing profit margins. To maintain its competitive edge, the company must continuously invest in upgrading its technology and improving its overall efficiency. For instance, the global apparel market is projected to reach approximately $2.2 trillion by 2025, underscoring the vastness and the competitive nature of the industry Hansae operates in.

- Price Sensitivity: Brands often seek the lowest possible manufacturing costs, putting pressure on Hansae's pricing.

- Efficiency Demands: Competitors are constantly innovating to reduce production times and costs, requiring Hansae to do the same.

- Capacity Overload: In certain periods, the sheer volume of orders can lead to intense competition for production slots.

- Emerging Markets: Lower labor costs in new manufacturing regions can create significant pricing challenges for established players like Hansae.

Challenges in Managing Labor Costs and Regulations

Hansae's significant global workforce of over 50,000 employees presents a considerable challenge in managing diverse labor costs and navigating varied international regulations. Fluctuations in minimum wages, evolving labor laws, and the potential for labor disputes in key manufacturing hubs like Vietnam or Indonesia can directly impact production expenses and operational stability. For instance, a 5% increase in average wages across its major Asian operations could add tens of millions to its annual operating costs. The company must remain agile in adapting to these dynamic labor environments to maintain its competitive edge.

Furthermore, the complexity of complying with differing labor standards and worker rights across multiple countries requires robust internal oversight and can lead to unexpected cost increases. A shift in labor union activity or new government mandates regarding benefits or working conditions in a significant production country could necessitate substantial adjustments to its cost structure. For example, in 2024, several Southeast Asian nations saw discussions around increasing overtime pay regulations, which could affect Hansae's manufacturing overhead.

- Global Workforce Size: Over 50,000 employees worldwide.

- Regulatory Exposure: Subject to diverse labor laws and wage regulations across multiple countries.

- Cost Volatility: Potential for increased production costs due to wage hikes or new labor mandates.

- Operational Risk: Exposure to labor disputes and their impact on manufacturing continuity.

Hansae's dependence on a few major clients creates significant revenue concentration risk. A loss of or reduction in orders from any of these key partners could severely impact its financial performance. For example, if a top-tier brand decides to diversify its manufacturing base in 2024-2025, Hansae could face a substantial revenue shortfall.

The company's extensive global operations expose it to considerable geopolitical and trade-related risks. Changes in trade policies, tariffs, or political instability in manufacturing regions can disrupt supply chains and inflate production costs. Such disruptions, for instance, could arise from ongoing trade tensions between major economies in 2024, directly affecting Hansae's cost of goods sold.

Operating in a highly competitive global apparel manufacturing market, Hansae faces constant pressure on pricing and margins. The industry's vastness, with an estimated global market size projected to exceed $2.2 trillion by 2025, means numerous competitors vie for contracts, forcing continuous efficiency improvements and technological investments to stay competitive.

Managing a workforce of over 50,000 employees globally presents challenges in navigating diverse labor costs and regulations. Fluctuations in minimum wages and evolving labor laws in key manufacturing hubs, such as Vietnam or Indonesia, can lead to unexpected cost increases. For instance, potential adjustments to overtime pay regulations in Southeast Asia during 2024 could impact Hansae's operational expenses.

Preview Before You Purchase

Hansae SWOT Analysis

The preview you see is the same Hansae SWOT Analysis document you’ll receive upon purchase—no surprises, just professional quality.

This is a real excerpt from the complete Hansae SWOT analysis document. Once purchased, you’ll receive the full, editable version.

You’re viewing a live preview of the actual Hansae SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The increasing global consumer focus on sustainability and eco-friendly fashion presents a substantial growth avenue for Hansae. By building upon existing ESG efforts, like their 10% for Good Initiative and collaborations for recycled materials, Hansae can broaden its range of environmentally responsible apparel. This strategic move directly addresses shifting consumer desires and emerging regulatory landscapes, positioning Hansae to capture market share in this expanding segment.

The growing movement towards nearshoring, where companies relocate production closer to their primary consumer bases, presents a significant opportunity for Hansae. This trend, particularly as brands aim to shorten lead times and reduce logistical complexities for markets like the United States, allows Hansae to strategically expand its manufacturing footprint in Central and Latin America.

Hansae's proactive investments in new facilities, such as those established in Guatemala and El Salvador, directly align with and are poised to benefit from these evolving regional supply chain dynamics. Furthermore, the strategic acquisition of Texollini strengthens Hansae's capacity to serve these nearshored markets effectively.

Hansae Yes24 Group's acquisition of auto parts manufacturer Erae AMS in 2024 is a significant strategic move, signaling a clear opportunity to build new growth engines beyond its traditional apparel business. This diversification directly addresses the cyclical nature of the fashion industry, aiming to create a more resilient revenue base.

By entering sectors like automotive components, Hansae can tap into markets with different growth drivers and potentially higher margins. For instance, the global automotive market is projected to see continued expansion, driven by electrification and technological advancements, offering substantial upside potential.

Further Automation and Digitalization of Production

Hansae's commitment to smart factory technologies, automation, and digitalization presents a significant opportunity to boost operational efficiency and cut costs. By continuing to invest in these areas, the company can achieve greater production flexibility, a key advantage in the fast-paced apparel industry.

Advanced systems like HAMS 2.0, coupled with the adoption of 3D design, are crucial for reducing lead times and improving responsiveness to client demands. This digital transformation allows Hansae to adapt more quickly to market trends and customer preferences, solidifying its competitive edge.

- Enhanced Efficiency: Continued investment in smart factory tech aims to streamline operations, potentially reducing manufacturing cycle times by an estimated 10-15% by 2025, based on industry benchmarks for similar automation levels.

- Cost Reduction: Automation in areas like fabric cutting and sewing can lead to labor cost savings, with projections suggesting a potential 5-8% reduction in direct labor costs per unit by 2025.

- Faster Lead Times: The integration of HAMS 2.0 and 3D design is expected to shorten product development and sampling cycles by up to 20%, enabling quicker market entry.

- Improved Flexibility: Digitalized production lines allow for easier product mix changes and smaller batch production, catering to diverse client orders with greater agility.

Strategic Mergers and Acquisitions (M&A)

Hansae's stated ambition to aggressively pursue mergers and acquisitions (M&A) offers a significant avenue for growth. This strategy aims to secure new revenue streams and expand market presence. For instance, the acquisition of Texollini in 2023, a European textile company, demonstrates Hansae's intent to broaden its operational footprint and integrate new technologies.

By actively seeking M&A opportunities, Hansae can rapidly acquire new capabilities, enhance market share, and diversify its business portfolio. The attempted acquisition of Erae AMS, a South Korean aerospace components manufacturer, highlights Hansae's strategic interest in diversifying beyond its traditional textile and e-commerce sectors. This move, if successful, would have provided entry into a high-growth, technology-intensive industry.

The company's proactive M&A approach allows for swift integration of complementary businesses, potentially leading to:

- Accelerated market penetration in new geographical regions or product categories.

- Acquisition of advanced technologies and intellectual property.

- Synergies in operations and supply chains, leading to cost efficiencies.

- Diversification of revenue streams, reducing reliance on any single market segment.

Hansae's strategic diversification into sectors like automotive components, exemplified by the 2024 acquisition of Erae AMS, offers a robust opportunity to establish new revenue streams. This move taps into the expanding global automotive market, projected to grow due to electrification and technological advancements, potentially boosting Hansae's overall financial performance and resilience.

The company's commitment to integrating smart factory technologies and automation, such as HAMS 2.0 and 3D design, presents a clear path to enhanced operational efficiency and cost reduction. These investments are anticipated to shorten lead times by up to 20% and reduce direct labor costs by 5-8% per unit by 2025, bolstering competitiveness.

Hansae's aggressive pursuit of mergers and acquisitions, demonstrated by the 2023 Texollini acquisition, allows for rapid market penetration and the acquisition of new capabilities. This strategy aims to diversify revenue and leverage synergies, as seen in the potential for accelerated market entry and operational efficiencies.

The global shift towards sustainability and eco-friendly fashion provides a significant growth avenue, allowing Hansae to expand its range of environmentally responsible apparel. By leveraging existing ESG initiatives, Hansae can capitalize on increasing consumer demand for sustainable products, a segment experiencing notable market expansion.

Threats

Hansae faces a significant threat from volatile raw material costs, particularly for cotton and synthetic fibers, which are crucial inputs for its apparel manufacturing. For instance, raw cotton prices saw substantial fluctuations in 2023 and early 2024, influenced by weather patterns and global demand, directly impacting Hansae's cost of goods sold.

Furthermore, disruptions in global supply chains, stemming from geopolitical tensions or logistical bottlenecks, can impede the timely and cost-effective procurement of these materials. This was evident in late 2023 and early 2024 with ongoing shipping challenges, which can lead to increased lead times and higher transportation expenses for Hansae.

The fashion industry's inherent volatility poses a significant threat to Hansae. Consumer tastes can pivot on a dime, making it challenging to predict demand for specific styles, fabrics, or colors. For instance, a sudden shift away from athleisure, a strong segment for many apparel manufacturers, could leave Hansae with unsold inventory if they haven't diversified their offerings.

Failure to quickly adapt to these rapid changes in fashion trends and consumer preferences can directly impact Hansae's bottom line. This could manifest as increased markdowns on excess stock, a decline in new order volumes from clients, and a general erosion of its competitive standing in the market. The company's ability to stay ahead of these shifts is paramount to its ongoing success.

Hansae faces increasing global scrutiny regarding its environmental impact and labor practices. Stricter regulations are emerging worldwide, particularly concerning ethical sourcing and sustainable production in the textile sector. For instance, the European Union's proposed Corporate Sustainability Due Diligence Directive (CSDDD), expected to be fully implemented by 2027, will mandate companies to identify, prevent, and mitigate adverse human rights and environmental impacts in their value chains, directly affecting suppliers like Hansae.

Failure to adapt to evolving Environmental, Social, and Governance (ESG) standards presents a significant threat. Negative publicity surrounding labor practices, such as allegations of poor working conditions or unfair wages, could severely damage Hansae's reputation. This reputational damage can lead to client disengagement, as major brands increasingly prioritize supply chain transparency and ethical compliance, impacting future business opportunities and financial performance.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations represent a significant threat for Hansae, a global exporter and manufacturer. As their financial performance is tied to multiple currencies, adverse shifts can directly impact reported revenues and the cost of goods sold. For instance, a strengthening Korean Won against the US Dollar could reduce the value of export earnings when translated back into KRW.

The company's reliance on manufacturing bases in various countries also exposes it to the volatility of local currencies against the Won. Unfavorable movements can inflate production costs, thereby squeezing profit margins. For example, if the Vietnamese Dong depreciates sharply against the Korean Won, the cost of labor and materials sourced locally would increase in KRW terms.

Hansae's financial statements are thus susceptible to translation losses or gains depending on the prevailing exchange rates. This volatility can make it challenging to forecast earnings with certainty and can impact investor confidence. In 2024, currency volatility, particularly the USD/KRW and EUR/KRW pairs, has been a key factor influencing the profitability of many Korean export-oriented companies, with some reporting significant impacts on their quarterly results.

- Exposure to USD/KRW: A 10% depreciation of the USD against the KRW could reduce Hansae's reported export revenue in KRW terms.

- Manufacturing Cost Impact: Fluctuations in local currencies where Hansae has manufacturing operations can directly increase production expenses.

- Forecasting Challenges: Exchange rate volatility complicates financial planning and makes it harder to predict future profitability accurately.

- 2024 Market Volatility: Significant swings in major currency pairs like USD/KRW and EUR/KRW have historically impacted the profitability of Korean exporters.

Increased Competition from Domestic and Regional Manufacturers

Hansae, despite its global standing, faces a significant threat from intensifying competition. Domestic and regional manufacturers, particularly those in key client markets like Vietnam and Bangladesh, are emerging as formidable rivals. These competitors often leverage lower labor costs and shorter supply chains, allowing them to offer more competitive pricing and quicker turnaround times. For instance, in 2024, several emerging apparel manufacturers in Southeast Asia reported significant order increases, driven by their cost advantages compared to established global players. This pressure can erode Hansae's market share and impact its profitability.

The competitive landscape is further complicated by specialized regional players who might excel in niche production areas or cater to specific market demands more effectively. These companies can be agile, adapting quickly to changing fashion trends and client needs. This dynamic means Hansae must continuously innovate and optimize its operations to maintain its competitive edge, as the threat isn't just about scale but also about specialized capabilities and regional responsiveness. For example, reports from 2025 indicate a rise in niche manufacturers focusing on sustainable materials or advanced textile technologies, directly challenging established players on specialized fronts.

- Cost Pressures: Competitors often have lower overheads, enabling aggressive pricing strategies.

- Supply Chain Agility: Regional manufacturers benefit from proximity to markets, leading to faster delivery.

- Niche Specialization: Some rivals focus on specific product categories or production techniques, offering tailored solutions.

- Market Share Erosion: Increased competition can lead to a reduction in Hansae's overall market penetration and pricing power.

Hansae faces the threat of increasing competition from agile regional players and those with lower labor costs, particularly in key markets like Vietnam and Bangladesh. These competitors can offer more competitive pricing and faster turnaround times, potentially eroding Hansae's market share, as seen with significant order increases reported by Southeast Asian manufacturers in 2024. Furthermore, niche specialists focusing on sustainable materials or advanced textiles, as indicated by 2025 market trends, present a challenge that requires continuous innovation from Hansae.

SWOT Analysis Data Sources

This Hansae SWOT analysis is built upon a foundation of robust data, drawing from the company's official financial reports, comprehensive market intelligence, and expert industry analyses to provide a well-rounded strategic perspective.