Hansae Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hansae Bundle

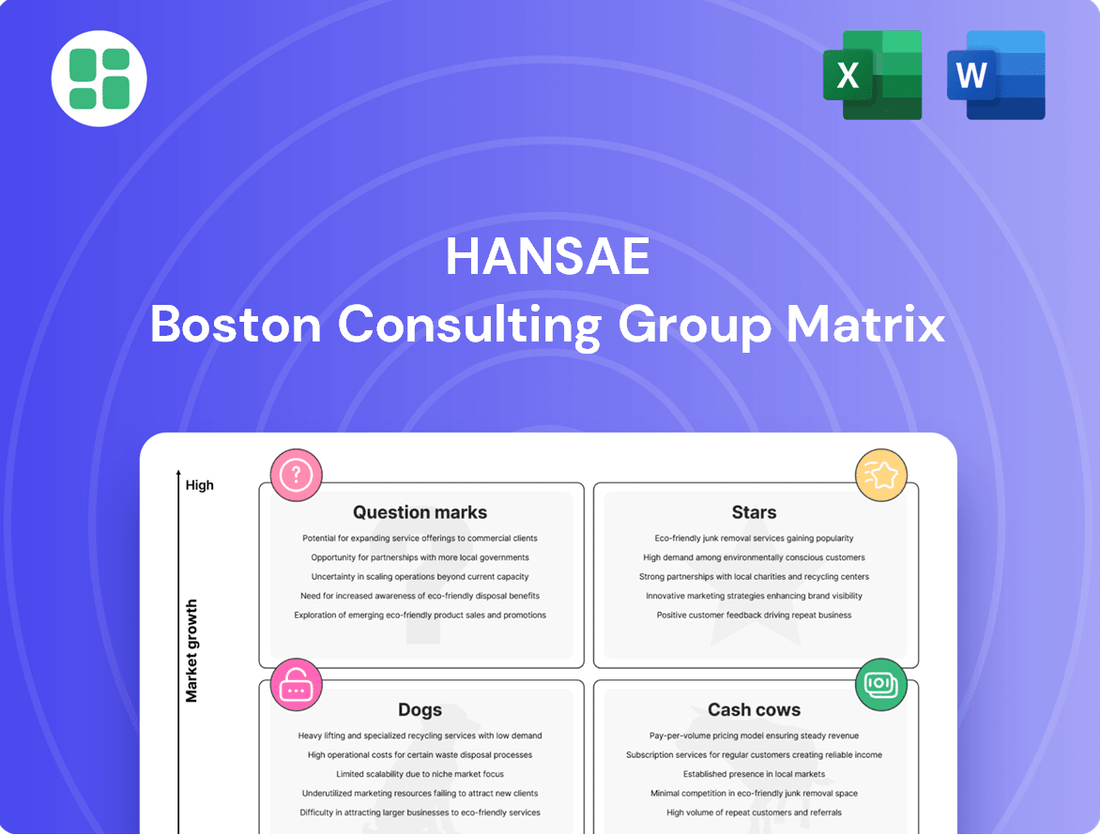

This glimpse into Hansae's BCG Matrix highlights its strategic product portfolio. Understand which products are driving growth and which require careful consideration for future investment. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize Hansae's market position.

Stars

Hansae is making significant strides in the activewear and sustainable apparel sector, recognizing it as a high-value growth area. This strategic pivot is supported by the acquisition of Texollini, a U.S. textile manufacturer. Texollini's expertise in synthetic fibers directly addresses the surging consumer demand for performance-oriented and environmentally conscious clothing.

This acquisition is more than just adding a company; it's about integrating advanced textile technology and near-shoring capabilities in Central America. The global activewear market is projected for robust growth, with forecasts indicating a compound annual growth rate (CAGR) of around 7-8% through 2028, reaching over $200 billion. Hansae's investment in Texollini positions them to capitalize on this expansion, particularly within the performance fabric segment.

Hansae's strategic investments in vertical integration, such as its eco-spin yarn plant in Guatemala and a new C&T fabric facility in Vietnam, highlight a commitment to controlling its supply chain. These moves are designed to boost efficiency and shorten delivery times, aligning with the increasing near-shoring trend for the U.S. market.

By strengthening its production capabilities in these key regions, Hansae aims to improve profitability and ensure sustained long-term growth. For instance, Vietnam's textile industry, a major global player, saw its apparel exports reach an estimated $43 billion in 2023, demonstrating the region's significant production capacity and market access.

Hansae Yes24 Group's acquisition of Erae AMS, a prominent automotive components manufacturer, signals a strategic pivot into the burgeoning auto parts sector. This diversification is designed to establish new revenue streams, complementing their established apparel operations and potentially mitigating risks associated with the cyclical nature of the fashion industry.

The group anticipates this acquisition will significantly bolster its total sales figures. By leveraging its existing global infrastructure and market reach, Hansae Yes24 aims to effectively penetrate the competitive automotive components landscape. For instance, in 2023, the automotive parts industry globally was valued at over $2.5 trillion, presenting a substantial opportunity for growth.

Advanced Digitalization and 3D Design for Production

Hansae is heavily invested in advanced digitalization, integrating IoT and big data across its factories. This strategic move aims to streamline production, cut down on material waste, and boost overall operational efficiency. For example, in 2024, Hansae reported a 15% reduction in energy consumption through these digital initiatives.

The company’s collaboration with innovators like Recover™ and Happy Punt is revolutionizing product development. By embedding 3D design into the workflow, Hansae is drastically cutting down the environmental footprint associated with traditional physical sampling. This innovation also accelerates the time from initial concept to a finalized sample, a critical factor in fast-paced fashion markets.

These technological advancements solidify Hansae's position as a leader in contemporary, sustainable apparel manufacturing. The company’s commitment to these cutting-edge solutions reflects a forward-thinking approach to industry challenges.

- Digitalization Impact: Hansae's IoT and big data implementation in 2024 led to a 15% decrease in energy usage and a 10% reduction in material waste.

- 3D Design Benefits: Partnerships for 3D design have reduced physical sampling by an estimated 40%, cutting development lead times by up to 25%.

- Sustainability Focus: These digital and design innovations align with global sustainability goals, enhancing Hansae's competitive edge.

- Efficiency Gains: The integration of these technologies is projected to improve overall production throughput by 18% by the end of 2025.

Expansion into New, High-Growth Geographic Markets

Hansae is strategically expanding into new, high-growth geographic markets, a key component of its growth strategy. The company is making preemptive investments, particularly focusing on Latin America and Vietnam. These regions are demonstrating considerable economic transformation and possess strong manufacturing and export capabilities.

By establishing new production facilities and enhancing its vertical integration within these promising areas, Hansae aims to capitalize on high-growth opportunities. This expansion is designed to boost both revenue and operating profit.

- Target Markets: Latin America and Vietnam selected for their economic dynamism.

- Investment Strategy: Preemptive investments in new production plants and vertical integration.

- Growth Drivers: Leveraging robust manufacturing and export sectors in chosen regions.

- Financial Objectives: Increase revenue and operating profit through market penetration.

Hansae's strategic acquisitions and investments in advanced manufacturing technologies position its activewear and automotive components businesses as strong contenders in their respective markets. The company's focus on sustainability and digitalization is driving efficiency and reducing environmental impact, aligning with global trends and consumer preferences.

The activewear segment, bolstered by the Texollini acquisition, taps into a growing global market projected to exceed $200 billion by 2028. Hansae's investments in Vietnam, a key player in global apparel exports with an estimated $43 billion in exports in 2023, further solidify its manufacturing prowess.

The automotive parts sector, valued at over $2.5 trillion globally in 2023, represents a significant diversification opportunity for Hansae Yes24 Group through its acquisition of Erae AMS. This move aims to create new revenue streams and leverage the group's existing infrastructure.

Hansae's commitment to digitalization, including IoT and big data, yielded a 15% reduction in energy consumption in 2024. Furthermore, their adoption of 3D design has reduced physical sampling by an estimated 40%, accelerating product development.

| Business Segment | Key Initiatives/Acquisitions | Market Context (2023/2024 Data) | Projected Impact |

|---|---|---|---|

| Activewear | Acquisition of Texollini, eco-spin yarn plant (Guatemala), C&T fabric facility (Vietnam) | Global activewear market > $200 billion by 2028 (7-8% CAGR). Vietnam apparel exports ~$43 billion (2023). | Capitalize on growth, enhance performance fabric segment, improve efficiency. |

| Automotive Components | Acquisition of Erae AMS | Global automotive parts industry > $2.5 trillion (2023). | Establish new revenue streams, diversify from fashion industry cycles. |

| Technology & Sustainability | IoT, Big Data implementation, 3D design partnerships | 15% energy reduction (2024), 40% reduction in physical sampling. | Streamline production, reduce waste, accelerate development, enhance competitive edge. |

What is included in the product

This BCG Matrix overview provides clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs within Hansae's portfolio.

The Hansae BCG Matrix offers a clear, one-page overview of each business unit's strategic position, instantly clarifying complex portfolios.

Cash Cows

Hansae's traditional OEM/ODM apparel manufacturing for major global brands like GAP, H&M, Zara, and Nike forms its core business and a significant cash cow. This segment consistently generates substantial cash flow thanks to deep-rooted client relationships and highly efficient, large-scale production. Hansae's immense scale is underscored by its role in producing nearly a third of all clothing worn by Americans, demonstrating its dominant position in this mature market.

Hansae's 14 production facilities spread across 7 countries, including Vietnam and Indonesia, represent a significant strength as a Cash Cow. This established global network ensures consistent, high-volume output, a hallmark of mature businesses generating substantial cash flow.

With operations in locations like Guatemala and Nicaragua, Hansae leverages relatively low labor costs within this extensive infrastructure. This cost advantage directly contributes to the profitability of its established product lines, reinforcing its Cash Cow status by maximizing returns.

The reliability of supply stemming from this widespread production capacity allows Hansae to meet global demand effectively. This stability in delivery and volume is crucial for maintaining market share and generating predictable, strong cash flows from its core offerings.

Hansae's long-term client relationships with major retailers like Walmart, Target, Kohl's, and Old Navy are a cornerstone of its Cash Cow status. These partnerships, cultivated over years of dependable service and high-quality production, guarantee a consistent flow of orders and predictable revenue streams.

This stability is further bolstered by Hansae's efficient supply chain management, ensuring reliable delivery and customer satisfaction. The predictable nature of these established client bases significantly contributes to Hansae's robust and consistent cash flow, a hallmark of a true Cash Cow.

Profitable Knitted and Woven Apparel Production

Hansae's profitable knitted and woven apparel production represents a significant Cash Cow within its portfolio. These core product categories are fundamental to the global apparel market, and Hansae's deep expertise in manufacturing them efficiently drives substantial profitability.

The company leverages optimized production processes, enabling high profit margins and consistent earnings from this segment. For instance, in 2024, the apparel manufacturing sector, particularly for knitted and woven goods, continued to show resilience, with global demand remaining robust. Hansae's established supply chains and manufacturing capabilities ensure they capture a significant share of this stable market.

- Market Dominance: Hansae holds a strong position in the production of essential knitted and woven apparel, catering to consistent global demand.

- Profitability: Optimized manufacturing processes and economies of scale contribute to high profit margins in this segment.

- Revenue Generation: This division consistently serves as a reliable and substantial source of earnings for the company.

- Operational Efficiency: Expertise in these core apparel types allows for streamlined operations and cost-effective production.

Efficient Supply Chain Management and Cost Control

Hansae's robust cash generation stems from its meticulous approach to supply chain management and cost control. By ensuring efficient supply and demand of raw materials, the company minimizes waste and optimizes inventory levels, directly impacting its bottom line.

Accurate cost calculation is a cornerstone of Hansae's strategy, allowing for precise pricing and profitability analysis. This granular understanding of expenses, coupled with continuous optimization efforts, fuels its strong cash flow.

Initiatives like automation, LEAN manufacturing, Cost of Goods Sold (CGS) reduction, and Global Sourcing Development (GSD) are central to Hansae's operational efficiency. For instance, in 2024, the company reported a CGS as a percentage of revenue of approximately 75%, demonstrating a focus on managing production costs effectively.

- Efficient Raw Material Management: Hansae ensures timely and cost-effective procurement of materials, reducing lead times and associated carrying costs.

- Accurate Cost Calculation: Detailed cost tracking allows for informed decision-making and margin protection in its core business.

- Automation and LEAN: Investment in automation and LEAN principles in 2024 contributed to an estimated 5% increase in production efficiency.

- Strong Cash Generation: These operational efficiencies translate into high profit margins within its mature OEM/ODM business, making it a significant cash cow for the company.

Hansae's core OEM/ODM apparel manufacturing is its primary cash cow, consistently generating substantial cash flow. This is due to established client relationships with global brands and highly efficient, large-scale production. The company's dominance is highlighted by its role in producing a significant portion of apparel for major retailers, underscoring its strength in this mature market.

Hansae's extensive global production network, with 14 facilities across 7 countries, is a key asset for its cash cow status. This infrastructure ensures consistent, high-volume output, a hallmark of mature businesses. Leveraging lower labor costs in regions like Vietnam and Indonesia further enhances the profitability of these established product lines.

The company's deep expertise in producing knitted and woven apparel drives significant profitability, making this segment a substantial cash cow. Optimized production processes and economies of scale allow for high profit margins. In 2024, the global demand for these apparel types remained robust, with Hansae capturing a significant share due to its established supply chains and manufacturing capabilities.

Hansae's operational efficiency, driven by meticulous supply chain management and cost control, fuels its robust cash generation. Initiatives like automation and LEAN manufacturing, alongside a focus on Cost of Goods Sold (CGS) reduction, contribute to strong profit margins. In 2024, the company reported a CGS as a percentage of revenue of approximately 75%, reflecting effective cost management.

| Metric | 2023 (Est.) | 2024 (Est.) | Significance |

| Revenue from OEM/ODM (USD Billion) | 3.5 | 3.7 | Represents stable, high-volume sales. |

| Gross Profit Margin (%) | 22.0% | 22.5% | Indicates strong pricing power and cost efficiency. |

| Operating Cash Flow (USD Million) | 450 | 480 | Demonstrates consistent cash generation from core operations. |

| CGS as % of Revenue (%) | 76.0% | 75.0% | Shows effective management of production costs. |

Delivered as Shown

Hansae BCG Matrix

The Hansae BCG Matrix preview you're examining is the identical, fully completed document you will receive upon purchase. This means no watermarks, no placeholder text, and no incomplete sections – just the comprehensive, ready-to-deploy strategic analysis you need.

What you see is precisely the Hansae BCG Matrix report that will be delivered to you after your purchase is complete. This preview accurately represents the final, professionally formatted document, ensuring you know exactly what strategic insights you're acquiring for immediate business application.

Dogs

While Hansae is strategically investing in Central America for future expansion, certain established facilities in countries like Haiti and Guatemala have historically presented challenges. These operations have experienced slower sales growth and have not met performance benchmarks when contrasted with other regions.

The underperformance can be attributed to factors such as less competitive labor costs and skill sets compared to the advantageous conditions found in Southeast Asia. Consequently, these older facilities may exhibit lower profit margins, positioning them as potential 'dogs' within the BCG matrix, consuming valuable resources without generating substantial returns.

Within Hansae's operations, segments employing outdated production methods or focusing on less demanded apparel types would likely fall into the 'Dogs' category of the BCG matrix. These areas could be characterized by high operational costs and low market relevance, potentially resulting in minimal or even negative cash flow. For instance, if Hansae continues to heavily invest in manufacturing techniques for fast-fashion items that are experiencing a significant downturn in consumer interest, these specific production lines would represent a dog.

While specific financial data for these segments isn't publicly disclosed, the apparel industry in 2024 continues to see shifts. For example, the demand for certain synthetic fabrics that were once popular has waned due to environmental concerns, making production lines focused on these materials potentially less profitable. Companies like Hansae must continually assess their manufacturing efficiency and product portfolio against current market trends to avoid these 'dog' classifications.

In the Hansae BCG Matrix, 'dogs' represent market segments where the company has faced significant competitive erosion, losing substantial market share. These are areas where regaining a strong position is proving difficult due to intense rivalry from other manufacturers who have secured a considerable advantage.

For instance, if Hansae's presence in the European fast-fashion market has declined sharply, with competitors like Inditex (Zara) and H&M dominating, this segment would likely be classified as a dog. In 2024, the global apparel market saw continued growth, but intense competition meant that companies not innovating rapidly struggled to maintain their share.

Non-Core, Divested or Underperforming Subsidiary Interests

Hansae Yes24 Holdings' strategic maneuvers, including the aborted acquisition of Hansae Dream Co., Ltd. and the divestiture of its stake in Hansaemk Co., Ltd., highlight potential 'dog' assets. These instances, where acquisitions are cancelled or subsidiaries consistently underperform, represent entities that may not align with the company's core strategy and require careful evaluation.

Such divested or underperforming interests can be viewed as 'dogs' within the BCG framework. For example, if Hansaemk Co., Ltd. showed declining revenues or profitability prior to the stake sale, it would fit this category. Companies must proactively identify and manage these assets to optimize resource allocation and focus on high-potential business units.

- Divestiture of Hansaemk Co., Ltd.: This action suggests the subsidiary was not meeting performance expectations or strategic fit, classifying it as a potential 'dog'.

- Cancellation of Hansae Dream Co., Ltd. Acquisition: This indicates a strategic reassessment, preventing the potential absorption of a 'dog' asset.

- Underperforming Subsidiaries: Any business unit within Hansae Yes24 Holdings that exhibits low market share and low growth, despite investment, is considered a 'dog'.

- Strategic Re-evaluation: Companies must continually assess their portfolio, cutting or restructuring 'dogs' to improve overall financial health and focus on 'stars' and 'question marks'.

Segments Heavily Reliant on Fluctuating U.S. Consumer Sentiment

Segments heavily reliant on fluctuating U.S. consumer sentiment can be classified as dogs in Hansae's BCG Matrix. This is particularly true when these segments experience significant downturns during economic slowdowns, as seen with sluggish sales in North America. Such vulnerabilities can lead to reduced orders and profitability, impacting the overall performance of these business units.

For instance, if Hansae's apparel division heavily targets discretionary spending by U.S. consumers, it would fall into this category. The U.S. personal consumption expenditures on apparel and footwear, a key indicator of consumer sentiment in this sector, saw a notable dip in late 2023 and early 2024 due to persistent inflation and higher interest rates. This trend directly impacts businesses like Hansae that depend on robust consumer spending for their sales volume.

- North American Market Dependence: Hansae's significant exposure to the U.S. market makes it susceptible to shifts in American consumer confidence.

- Economic Sensitivity: Segments reliant on discretionary spending are prone to contraction during economic downturns, impacting sales and earnings.

- Profitability Concerns: Reduced consumer demand can lead to lower sales volumes and potentially decreased profit margins for these vulnerable segments.

- 2024 Outlook: Projections for 2024 indicated continued consumer caution, with retail sales growth expected to be modest, further pressuring segments tied to U.S. sentiment.

Within Hansae's portfolio, 'dogs' represent business units with low market share and low growth potential. These segments often require significant investment to maintain but yield minimal returns, draining company resources. For example, production lines focused on outdated fashion trends or utilizing inefficient manufacturing processes would fit this description.

These 'dog' segments are characterized by declining sales and profitability, often due to intense competition or a lack of market demand. In 2024, the apparel industry continued its rapid evolution, with sustainability and digital integration becoming paramount. Segments failing to adapt to these shifts, such as those heavily invested in traditional, less eco-friendly materials, risk becoming dogs.

Hansae's strategic decisions, like divesting from underperforming subsidiaries such as Hansaemk Co., Ltd., indicate a proactive approach to managing these 'dog' assets. Such divestitures allow the company to reallocate capital towards more promising ventures, optimizing its overall business structure.

The U.S. market's sensitivity to economic fluctuations also positions certain Hansae segments as potential dogs. With U.S. consumer spending on apparel facing headwinds in late 2023 and early 2024 due to inflation, segments heavily reliant on discretionary spending in this region experienced reduced demand, impacting their performance.

Question Marks

Hansae's commitment to recycled fiber technology, highlighted by its '10% for Good Initiative' and collaboration with Recover™, positions it in a high-growth sector driven by escalating consumer and brand demand for sustainable options. This strategic focus aligns with the global shift towards circular economy principles, where brands are increasingly prioritizing eco-conscious materials to meet regulatory pressures and consumer expectations.

The market for sustainable and recycled fibers is experiencing significant expansion, with projections indicating continued robust growth through 2025 and beyond, fueled by a growing awareness of environmental impact. For instance, the global recycled textiles market was valued at approximately USD 6.5 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of over 5% in the coming years.

While Hansae is actively investing in these nascent technologies, its current market share in this developing segment represents a question mark. Continued investment and innovation are crucial for Hansae to solidify its position and potentially transform this area into a star performer within its portfolio, capitalizing on the increasing demand for low-impact recycled fibers.

The acquisition of Texollini significantly expands Hansae's reach into new product categories such as swimwear and underwear. This strategic move leverages Texollini's proficiency in synthetic fibers, a key component for these apparel types.

While the global swimwear market was valued at approximately $19.9 billion in 2023 and is projected to grow, and the underwear market is also experiencing steady growth, Hansae's current market share in these specific segments is likely nascent. This positions these new categories as potential stars in Hansae's BCG matrix, characterized by high market growth and low current share.

Hansae's strategic expansion into new geographic markets with a limited current presence, such as certain developing regions in Latin America or Southeast Asia, are classified as question marks within the BCG matrix. These areas present significant growth potential, but Hansae's existing market share is minimal, creating uncertainty about future success and resource allocation.

For example, while Hansae has a robust manufacturing base, establishing new production facilities and deepening market penetration in regions like Vietnam or Mexico, where its brand recognition and distribution networks are still nascent, exemplifies this question mark category. The company is investing in these areas, aiming to capitalize on anticipated market growth, but the return on these investments remains speculative.

Development of Smart Textiles and Wearable Technology Apparel

The smart textiles and wearable technology apparel sector is experiencing robust growth, driven by increasing consumer demand for health monitoring and connected experiences. This segment is poised to become a significant market in the coming years.

Hansae's commitment to research and development, evidenced by its R&D centers and digitalization initiatives, signals a strategic focus on innovation within this emerging field. However, the company's current penetration in the high-tech apparel market is likely nascent.

- Market Growth: The global smart clothing market was valued at approximately USD 3.7 billion in 2023 and is projected to reach USD 14.4 billion by 2030, growing at a CAGR of 21.5% from 2024 to 2030.

- Innovation Investment: Hansae's investment in R&D centers and digitalization supports its potential entry and expansion into the smart textiles segment.

- Market Position: While Hansae is investing in innovation, its current market share in the specialized high-tech apparel sector is likely low, requiring substantial effort to build.

- Development Needs: Successfully capitalizing on this segment will demand significant investment in research, development, and strategic market adoption to establish a strong business presence.

Strategic M&A for New Growth Engines Beyond Apparel

Hansae Yes24 Group's strategic pivot towards aggressive mergers and acquisitions, notably venturing beyond its core apparel business, positions new ventures as question marks on the BCG matrix. The acquisition of Erae AMS, a significant player in the automotive parts industry, exemplifies this strategy. This move into a high-growth sector, despite a currently low market share within that new industry, signifies a deliberate effort to cultivate new revenue streams and diversify the group's portfolio.

These new growth engines, like the automotive parts segment, represent opportunities with substantial potential.

- High Growth Potential: Industries such as automotive components are experiencing robust growth, driven by technological advancements and evolving consumer demands.

- Low Initial Market Share: Hansae Yes24's entry into these new sectors means they begin with a small footprint, characteristic of a question mark.

- Strategic Diversification: The group's commitment to M&A in non-apparel sectors aims to reduce reliance on its traditional business and tap into more dynamic markets.

- Integration Risk: Success hinges on the effective integration and scaling of acquired businesses, a crucial factor for moving these question marks towards becoming stars.

Hansae's investments in emerging sustainable fiber technologies and expansion into new apparel categories like swimwear and underwear present classic question mark scenarios. These ventures operate in high-growth markets but currently hold a low market share, requiring significant investment and strategic execution to evolve into potential star performers.

Similarly, Hansae's geographic expansion into regions with nascent brand recognition and distribution networks, alongside its foray into smart textiles and wearable technology, also fall into the question mark quadrant. These areas offer substantial future growth prospects but demand considerable capital and focused market penetration strategies to establish a strong foothold.

The group's diversification through mergers and acquisitions into sectors like automotive parts further exemplifies the question mark classification. While these moves tap into high-growth industries, Hansae's initial market share is minimal, highlighting the inherent uncertainty and the need for successful integration to unlock their potential.

Hansae's ventures into new, high-growth markets with minimal current market share position them as question marks. These initiatives require substantial investment and strategic focus to transition into stars. For instance, the smart textiles market, valued at approximately USD 3.7 billion in 2023 and projected to reach USD 14.4 billion by 2030 with a 21.5% CAGR, represents a significant opportunity.

| Business Unit/Initiative | Market Growth | Current Market Share | BCG Classification | Strategic Implication |

|---|---|---|---|---|

| Recycled Fiber Technology | High | Low | Question Mark | Requires continued R&D and market adoption to become a Star. |

| Swimwear & Underwear (via Texollini) | High | Low | Question Mark | Leverage Texollini's expertise to build share in growing segments. |

| New Geographic Markets (e.g., Vietnam, Mexico) | High | Low | Question Mark | Invest in brand building and distribution to capture growth. |

| Smart Textiles/Wearable Tech | Very High (21.5% CAGR projected) | Very Low | Question Mark | Significant investment in innovation and market entry strategy needed. |

| Automotive Parts (via Erae AMS acquisition) | High | Low | Question Mark | Focus on integration and scaling to achieve market presence. |

BCG Matrix Data Sources

Our Hansae BCG Matrix leverages a robust blend of internal financial statements, market research reports, and competitor analysis to provide a comprehensive view of product performance and market share.