Hansae PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hansae Bundle

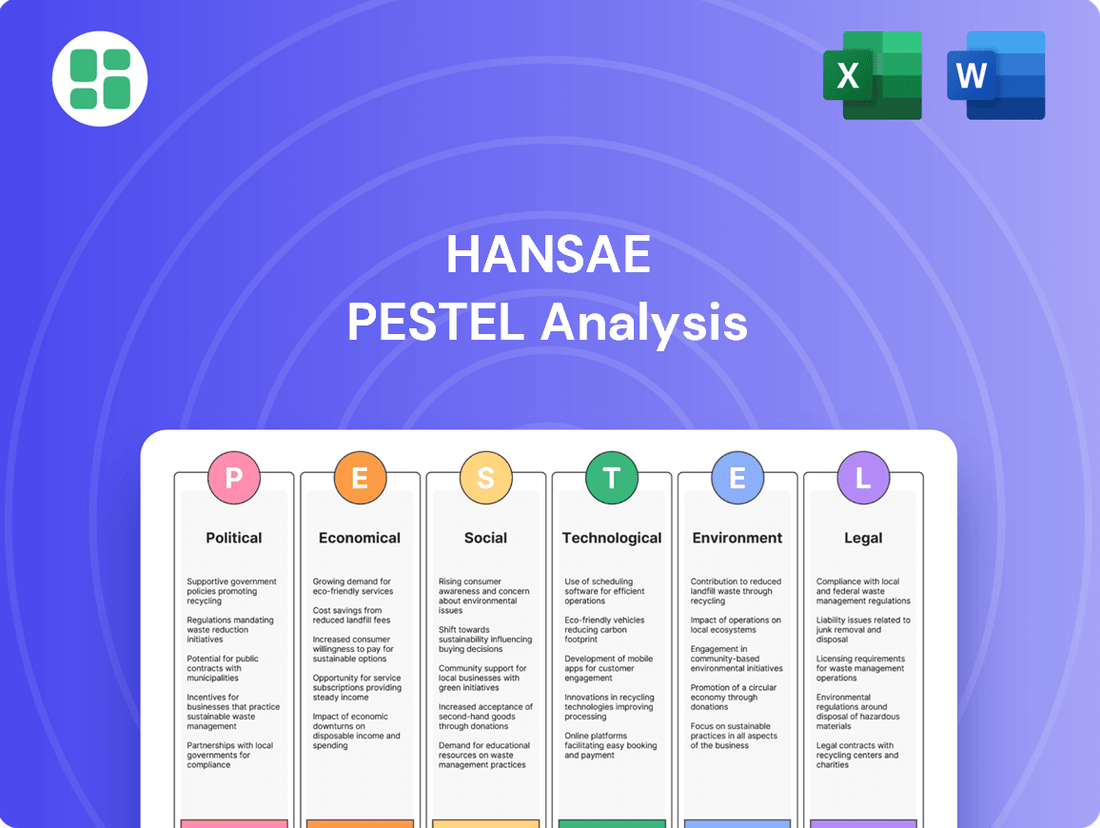

Uncover the critical external factors shaping Hansae's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, social trends, environmental regulations, and legal frameworks create both opportunities and challenges for the company. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full analysis now for immediate insights.

Political factors

Hansae's extensive global manufacturing footprint, serving as an Original Equipment Manufacturer (OEM) and Original Design Manufacturer (ODM) for major apparel brands, makes it particularly sensitive to evolving trade policies. For instance, in 2023, the United States maintained tariffs on goods imported from China, a key sourcing and manufacturing region for many apparel companies, including those Hansae partners with. This directly impacts the landed cost of finished goods, potentially squeezing profit margins for both Hansae and its clients.

Changes in trade agreements, such as potential renegotiations of existing pacts or the introduction of new ones, can also create uncertainty. For example, discussions around the USMCA (United States-Mexico-Canada Agreement) and its rules of origin for textiles can influence where Hansae strategically sources materials and manufactures garments to ensure compliance and cost-effectiveness for its North American clients. A shift in these rules could necessitate costly adjustments to its supply chain operations.

The ongoing geopolitical tensions and the potential for retaliatory tariffs between major economic blocs, like the US and China, present a persistent risk. If new tariffs are imposed on apparel or textile components originating from countries where Hansae has significant operations, such as Vietnam or Bangladesh, it could lead to increased production costs and reduced competitiveness in key export markets like the European Union and the United States, impacting Hansae's export-driven business model.

Hansae's manufacturing footprint spans politically diverse nations like Vietnam, Nicaragua, Guatemala, Indonesia, Myanmar, and Haiti. Political instability in these areas, such as civil unrest or abrupt governmental shifts, directly threatens production continuity and labor access. For instance, Myanmar experienced significant political upheaval in 2021, impacting global supply chains.

Governments in Hansae's key markets, including South Korea and Vietnam, enforce stringent labor and production regulations. These cover minimum wage laws, worker safety standards, and environmental protection measures, impacting operational costs and supply chain management. For instance, Vietnam's minimum wage saw an average increase of around 6% in 2024, a trend Hansae must factor into its production economics.

Non-compliance with these evolving mandates can result in significant penalties, legal disputes, and reputational damage. Hansae's past experiences with labor rights scrutiny underscore the necessity of proactive and comprehensive compliance strategies to mitigate these risks and maintain operational integrity.

International Trade Agreements

Hansae's global operations are significantly impacted by international trade agreements. Favorable agreements, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), can reduce tariffs and streamline customs, directly benefiting Hansae's cost structure and market access in participating countries. For instance, the CPTPP, which came into force for several key nations in 2018-2019 and has seen further ratifications, aims to eliminate tariffs on a wide range of goods, including textiles and apparel.

The absence or renegotiation of these agreements presents a risk. A withdrawal from a major trade bloc or the imposition of new tariffs could increase Hansae's production costs and diminish its competitiveness against manufacturers in regions with more advantageous trade terms. For example, changes to trade policies between major manufacturing hubs and key consumer markets, which are constantly under review, directly influence Hansae's sourcing and distribution strategies.

- Trade Agreement Impact: Favorable trade pacts can lower Hansae's import/export costs by reducing tariffs and non-tariff barriers.

- Market Access: Agreements facilitate smoother entry into new international markets, crucial for a global apparel manufacturer.

- Competitive Dynamics: Changes in trade policy can shift the competitive landscape, favoring or disadvantaging Hansae relative to its peers.

- 2024/2025 Outlook: Ongoing trade discussions and potential adjustments to existing agreements, such as those involving the EU and ASEAN nations, will continue to shape Hansae's operational environment.

Political Stability of Key Export Markets

Hansae's core export markets, including the United States, Europe, and Asia, are significantly impacted by political stability. Fluctuations in consumer confidence within these regions directly correlate with demand for apparel. For instance, the U.S. election cycle in 2024 could introduce policy shifts affecting trade and consumer spending, while ongoing geopolitical tensions in parts of Asia might temper economic growth and discretionary purchases.

Economic slowdowns or political uncertainties in these key markets can lead to reduced consumer spending, directly impacting Hansae's order volumes and overall sales performance. In 2024, many European economies faced inflationary pressures and the lingering effects of energy market volatility, which can dampen consumer appetite for non-essential goods like fashion apparel.

- United States: Political stability influences consumer confidence and trade policies impacting apparel imports.

- Europe: Economic conditions and political developments, such as national elections or EU policy changes, affect demand.

- Asia: Geopolitical stability and economic growth in key Asian markets are crucial for consistent order volumes.

- Consumer Confidence: A direct indicator of spending on discretionary items like clothing, heavily tied to political and economic stability.

Political stability in Hansae's key markets, such as the United States and Europe, directly influences consumer confidence and, consequently, demand for apparel. For example, the U.S. presidential election in 2024 may lead to policy shifts affecting trade and consumer spending, while economic conditions in Europe, impacted by factors like energy prices, can dampen discretionary purchases.

Geopolitical tensions and trade disputes create risks for Hansae's global supply chain. Tariffs imposed between major economic blocs can increase production costs and reduce competitiveness, impacting Hansae's export-driven model. The ongoing review of trade policies between manufacturing hubs and consumer markets necessitates constant strategic adjustments.

Government regulations concerning labor, safety, and environmental protection in countries where Hansae operates, like Vietnam, directly affect operational costs. For instance, Vietnam's minimum wage increases, such as the approximately 6% rise in 2024, require careful financial planning and impact production economics.

Hansae's manufacturing presence in politically diverse nations, including Vietnam and Myanmar, exposes it to risks from civil unrest or governmental changes. Such instability can disrupt production continuity and labor availability, as seen with political upheaval in Myanmar in 2021 impacting global supply chains.

What is included in the product

This Hansae PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Hansae's PESTLE Analysis offers a structured framework to identify and address external factors impacting business, thereby alleviating the pain of uncertainty and reactive decision-making.

Economic factors

Hansae's performance is closely linked to the health of the global economy, as consumer spending on apparel is sensitive to economic ups and downs. A downturn in significant markets such as the United States and Europe could dampen demand for clothing, directly affecting Hansae's revenue and profit margins.

For instance, the International Monetary Fund (IMF) projected global growth to slow to 3.0% in 2024, down from 3.2% in 2023, indicating a cautious consumer environment. This slowdown can translate to reduced discretionary spending on items like fashion.

Despite these broader economic headwinds, Hansae is strategically positioning itself for growth by concentrating on robust and profitable segments, including the activewear market. This focus allows the company to tap into resilient consumer demand even amidst general economic uncertainty.

Hansae's global operations expose it to currency exchange rate volatility. For instance, a strengthening US Dollar against the Korean Won in late 2023 and early 2024 could increase the cost of imported raw materials for Hansae's Korean operations, while simultaneously making its exports to the US more competitive.

Fluctuations directly affect Hansae's bottom line by altering the cost of goods sold and the value of repatriated profits. If the Korean Won depreciates significantly against the Vietnamese Dong, where Hansae has manufacturing facilities, its labor and production costs in Korea could rise when converted back to VND.

For example, if the KRW/USD exchange rate moves from 1,300 KRW/USD to 1,400 KRW/USD, goods priced in USD become more expensive for Korean buyers, impacting Hansae's domestic sales and potentially its sourcing costs if it imports components priced in USD.

Global inflation significantly drives up the prices of essential inputs for apparel manufacturing. For instance, cotton prices, a key raw material for Hansae, saw substantial volatility in 2024, with futures contracts trading at elevated levels compared to pre-pandemic averages, reflecting broader inflationary pressures. Similarly, energy and transportation costs, crucial for logistics, have remained a persistent concern throughout 2024 and into early 2025, directly impacting Hansae's operational expenses.

As a large-scale apparel producer, Hansae is particularly vulnerable to these rising input costs. When the price of raw materials like polyester or cotton, or the cost of shipping finished goods, increases due to inflation, the company's profit margins can be squeezed. This necessitates a strategic approach to supply chain optimization and careful consideration of pricing adjustments to maintain profitability in a challenging economic environment.

Labor Costs and Wage Trends in Manufacturing Hubs

Hansae strategically utilizes lower labor costs in manufacturing hubs like Vietnam, Nicaragua, and Guatemala. For instance, Vietnam's average manufacturing wage was around $250-$300 per month in early 2024, a significant advantage.

However, these regions are experiencing upward pressure on wages. Vietnam's minimum wage saw an increase in 2024, with regional minimum wages ranging from approximately $180 to $210 per month. This trend, coupled with growing labor demand, directly impacts production expenses for companies like Hansae.

To counter these rising costs and maintain competitiveness, Hansae must focus on optimizing its production processes. This includes investing in automation and efficiency improvements.

Furthermore, exploring diversification of manufacturing locations could be a key strategy. This allows for flexibility and risk mitigation against localized labor cost increases or supply chain disruptions.

Supply Chain Disruptions and Logistics Costs

The global apparel supply chain, a critical component for companies like Hansae, continues to grapple with significant vulnerabilities. Shipping delays and rising transportation costs remain persistent challenges. For instance, the Drewry World Container Index, a benchmark for global shipping rates, saw fluctuations throughout 2024, with some routes experiencing double-digit percentage increases compared to the previous year, directly impacting logistics expenses.

These disruptions directly affect Hansae's ability to receive raw materials and deliver finished products on schedule. This can create production backlogs, forcing the company to absorb higher operational costs. Trade restrictions, such as tariffs or import/export controls, further complicate matters, potentially increasing the cost of doing business and limiting market access.

The impact of these supply chain issues can be substantial:

- Increased Lead Times: Delays in shipping can extend the time it takes from order placement to final delivery.

- Higher Freight Costs: Fluctuations in fuel prices and container availability directly translate to elevated transportation expenses.

- Inventory Management Challenges: Unpredictable delivery schedules make it harder for Hansae to optimize inventory levels, potentially leading to stockouts or excess stock.

- Reduced Profit Margins: The combined effect of increased costs and potential production delays can squeeze profit margins if not effectively managed.

Global economic conditions directly influence consumer spending on apparel, a key factor for Hansae. Slowdowns in major markets like the US and Europe can reduce demand for clothing, impacting Hansae's revenue. For example, the IMF projected global growth to be 3.0% in 2024, signaling a potentially cautious consumer spending environment.

Currency exchange rate volatility also poses a risk. A stronger US Dollar against the Korean Won, as seen in late 2023 and early 2024, can make imported raw materials more expensive for Hansae's Korean operations while potentially boosting the competitiveness of its US exports.

Inflationary pressures significantly increase input costs for apparel manufacturing. Key raw materials like cotton and energy prices remained elevated through 2024, directly impacting Hansae's operational expenses and profit margins, necessitating strategic cost management.

Preview the Actual Deliverable

Hansae PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Hansae PESTLE analysis provides a detailed breakdown of the political, economic, social, technological, legal, and environmental factors impacting the company.

You'll gain valuable insights into Hansae's strategic landscape, enabling informed decision-making. The content and structure shown in the preview is the same document you’ll download after payment, offering a complete and actionable resource.

Sociological factors

Consumers are increasingly prioritizing sustainability, with a significant portion of apparel buyers willing to pay more for eco-friendly options. For instance, a 2024 survey indicated that over 60% of Gen Z and Millennials consider a brand's environmental impact when making purchasing decisions. This shift means Hansae, as an OEM/ODM, must integrate recycled materials and ethical production processes to align with these evolving values.

The demand for quality over quantity is also reshaping the fashion landscape, favoring durable, well-made garments that last longer. This aligns with the growing slow fashion movement. Hansae's ability to offer high-quality, long-lasting apparel, potentially through advanced material sourcing and manufacturing techniques, will be crucial for capturing market share in this segment.

Personalization and ethical production are further driving consumer choices. Shoppers want to know the story behind their clothes and feel a connection to the brands they support. Hansae's capacity to offer transparent supply chains and customizable production runs can directly address this desire, enhancing brand loyalty and appeal.

The availability of a skilled labor force is a cornerstone for Hansae's manufacturing operations. In 2024, countries like Vietnam, a key manufacturing hub for Hansae, faced a growing demand for skilled workers, with the manufacturing sector employing over 10 million people. Urbanization trends, such as the increasing migration to cities like Ho Chi Minh City, can further concentrate labor but also intensify competition, potentially driving up wages and impacting production costs.

Demographic shifts also play a significant role. For instance, a younger, growing workforce in many of Hansae's Asian production bases presents an opportunity, but also necessitates investment in training and development to ensure skills align with industry needs. Conversely, aging populations in some developed nations where Hansae might source specialized components could present different labor availability challenges. Hansae's commitment to employee development and welfare programs is a strategic response to these dynamics, aiming to build a loyal and skilled workforce that supports efficient production.

Consumers are increasingly scrutinizing the apparel industry, demanding transparency in labor practices and environmental impact. This rising ethical consciousness pressures companies like Hansae to ensure fair wages and safe working conditions throughout their supply chains. For instance, a 2024 report indicated that over 60% of Gen Z consumers consider a brand's ethical stance when making purchasing decisions.

Hansae's commitment to ethical production directly influences its brand reputation, a critical asset in securing partnerships with global apparel brands. A strong ethical record not only attracts discerning clients but also resonates with end consumers who increasingly align their spending with their values. Brands that prioritize sustainability and fair labor, such as Patagonia, have consistently demonstrated superior customer loyalty and market performance.

Worker Rights and Fair Labor Practices Demands

Hansae operates in a global apparel industry where worker rights and fair labor practices are under intense scrutiny. Many of its manufacturing locations are in regions where labor standards can be a challenge, making adherence to ethical practices crucial. In 2024, reports from organizations like the International Labour Organization (ILO) continued to highlight the persistent issues of low wages and precarious working conditions in key garment-producing countries, impacting companies like Hansae that rely on these supply chains.

Consumers and governments are increasingly demanding transparency and accountability from brands regarding their supply chains. This translates into pressure for fair wages, safe working environments, and responsible sourcing. For instance, by early 2025, several major fashion markets were expected to see new legislation introduced, mirroring initiatives like the European Union's proposed directive on corporate sustainability due diligence, which would hold companies responsible for human rights and environmental abuses in their value chains.

Hansae has responded by implementing robust policies to prohibit child labor and forced labor throughout its supply chain. The company conducts regular audits to ensure compliance with these critical standards. In its 2023 sustainability report, Hansae detailed that it conducted over 150 supplier audits, with a significant focus on labor practices, aiming to identify and rectify any non-compliance issues proactively.

Key aspects of Hansae's commitment include:

- Supplier Code of Conduct: Mandates strict adherence to international labor standards, including prohibitions on child and forced labor.

- Regular Audits: Conducted by internal teams and third-party auditors to verify compliance with labor laws and company policies.

- Worker Grievance Mechanisms: Establishing channels for workers to report concerns without fear of reprisal.

- Training Programs: Educating suppliers and their management on fair labor practices and legal requirements.

Social Media Influence on Brand Perception

Social media platforms are powerful amplifiers of consumer sentiment, capable of rapidly spreading both positive and negative information about a company's operations. For Hansae, this means public discussions about its social and environmental responsibility can quickly shape brand perception, impacting its own image and that of its clients.

This heightened visibility makes transparent communication and a demonstrable commitment to ethical conduct absolutely crucial. For instance, a 2024 report indicated that 65% of consumers consider a brand's social responsibility when making purchasing decisions, highlighting the direct link between public discourse and brand perception.

- Brand Reputation: Social media trends can rapidly alter how consumers view Hansae, affecting client relationships.

- Consumer Activism: Platforms enable swift mobilization of consumer groups to voice concerns about ethical practices.

- Information Dissemination: News, both factual and otherwise, about Hansae's supply chain or labor practices can go viral within hours.

Sociological factors significantly influence consumer behavior and expectations in the apparel industry, impacting Hansae's operational strategies. Growing consumer awareness of ethical production, fair labor, and sustainability is paramount, with a 2024 survey revealing over 60% of Gen Z and Millennials prioritize these aspects in purchasing decisions. This necessitates Hansae's commitment to transparent supply chains and responsible manufacturing to meet evolving market demands and maintain brand appeal.

Technological factors

Hansae is actively integrating automation and Artificial Intelligence (AI) into its manufacturing operations. This strategic move aims to significantly boost efficiency, minimize production errors, and refine overall output processes. For instance, the company is deploying automated guided vehicles (AGVs) and sophisticated smart technology systems, which are designed to accelerate production timelines and offer potential reductions in labor expenses.

Hansae's supply chain is seeing a significant upgrade with digital technologies like the Internet of Things (IoT) and blockchain. These innovations are key to real-time tracking of goods, from the very beginning of production right to the customer's hands. This improved visibility helps ensure product authenticity and builds confidence with consumers.

The adoption of these digital tools allows for enhanced traceability, meaning every step of the supply chain is meticulously documented. This not only strengthens consumer trust through transparency but also aids Hansae in meeting increasingly stringent regulatory requirements. For instance, by 2024, the global market for supply chain management software was projected to reach over $30 billion, highlighting the widespread investment in these digital solutions.

Advances in textile technology are opening new avenues for Hansae. The development of smart fabrics, capable of monitoring vital signs or changing color, and bio-based textiles derived from sustainable sources, offer significant opportunities for product differentiation and meeting evolving consumer preferences. For instance, the global smart textiles market was valued at approximately $4.5 billion in 2023 and is projected to grow substantially, indicating a strong market pull for these innovations.

Hansae's investment in research and development for material innovation is crucial for capitalizing on these trends. By focusing on sustainable and high-performance materials, the company can address the increasing consumer demand for eco-friendly and functional apparel. This strategic focus aligns with market projections showing a CAGR of over 8% for sustainable apparel through 2028, positioning Hansae to capture a larger market share.

3D Design and Virtual Prototyping

Hansae leverages advanced 3D design and virtual prototyping to create digital samples that accurately mimic fabric textures, patterns, and colors. This technological adoption is crucial for streamlining the fashion design process.

This capability significantly cuts down the time and resources needed for design and development. For instance, the fashion industry's overall lead times can be reduced by as much as 30-50% through virtual sampling, as reported by industry analyses in 2024.

By minimizing the requirement for physical prototypes, Hansae not only achieves substantial cost savings but also contributes to environmental sustainability by reducing material waste. A study from 2025 indicates that virtual sampling can cut physical sample production by up to 80%.

Key benefits include:

- Accelerated Design Cycles: Faster iteration and approval of designs.

- Reduced Costs: Significant savings on materials and shipping for physical samples.

- Minimized Waste: Environmental benefits through reduced physical material usage.

- Enhanced Collaboration: Improved communication and feedback among design teams and stakeholders.

E-commerce and Digital Sales Platforms

The exponential growth of e-commerce directly impacts Hansae's operations. As more brands leverage digital sales platforms, the demand for faster production and more flexible supply chains increases. This trend means Hansae, as an OEM/ODM provider, must be highly responsive to its clients' needs, which are increasingly shaped by the rapid pace of online retail.

Hansae's clients' success on platforms like Amazon and Shopify, which saw global e-commerce sales reach an estimated $6.3 trillion in 2023 and are projected to grow further, requires Hansae to optimize its own production and delivery processes. This includes investing in technology and streamlining operations to meet the quick turnaround times expected in the digital marketplace.

The shift to digital channels means Hansae needs to ensure its manufacturing capabilities can support:

- Agile production runs to accommodate fluctuating online demand.

- Efficient logistics for direct-to-consumer fulfillment as client needs evolve.

- High-quality output that meets brand standards for online presentation.

Technological advancements are reshaping Hansae's manufacturing and supply chain. The integration of AI and automation, such as automated guided vehicles, is enhancing efficiency and reducing errors, with the global industrial automation market projected to exceed $300 billion by 2025. Digital technologies like IoT and blockchain are improving supply chain visibility and product authenticity, a trend supported by the projected $30 billion global market for supply chain management software in 2024.

Legal factors

Hansae operates under a complex web of international labor laws, necessitating strict adherence to varying regulations concerning working hours, minimum wages, and the right to unionize across its global manufacturing bases. Failure to comply can result in significant legal penalties, such as fines and operational shutdowns, alongside substantial damage to its brand image. For instance, in 2024, several apparel manufacturers faced increased scrutiny and penalties for non-compliance with local labor laws in Southeast Asia, highlighting the financial risks involved.

Recognizing these risks, Hansae has implemented proactive measures, including raising its minimum employment age above many regional standards and conducting regular, rigorous audits. These initiatives are designed to prevent the exploitation of child labor and forced labor, critical issues that continue to plague parts of the global garment industry. The company's commitment to these standards is crucial for maintaining ethical supply chains and consumer trust in an increasingly transparent market.

Hansae, as a global apparel exporter, must meticulously adhere to diverse trade compliance and customs regulations in each market it serves. This involves accurate import/export documentation, correct product classification, and compliant labeling to prevent costly delays, penalties, or the confiscation of shipments.

For instance, in 2024, the World Trade Organization (WTO) reported that non-tariff barriers, including complex customs procedures and regulatory inconsistencies, continue to represent a significant challenge for international trade, impacting an estimated 10-15% of global trade value.

Shifts in these regulations, such as new tariff structures or stricter rules of origin, can directly influence Hansae’s supply chain efficiency and overall operational costs, potentially affecting its competitive pricing strategies in key markets like the United States and the European Union.

Hansae's Original Design Manufacturing (ODM) model hinges on its ability to create unique designs, making robust intellectual property (IP) protection absolutely critical. Legal frameworks that safeguard patents, copyrights, and trademarks are the bedrock for protecting Hansae's design innovations and preventing unauthorized replication, which directly impacts its competitive standing and revenue generation.

In 2024, the global fashion industry, a key market for Hansae, continued to grapple with the economic impact of design imitation. Reports from industry bodies indicated that losses due to counterfeiting and design infringement in apparel and accessories reached billions of dollars annually, underscoring the financial necessity of strong IP enforcement for companies like Hansae.

Product Safety and Quality Standards

Hansae's commitment to product safety and quality is paramount, directly influenced by stringent standards from its client brands and regulatory bodies in key markets like the US and EU. These regulations often focus on critical areas such as the permissible levels of chemicals in textiles, flammability testing, and the absence of allergenic materials. For instance, the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation imposes strict controls on the use of hazardous substances in manufactured articles, impacting textile production significantly.

Failure to meet these exacting standards can trigger severe repercussions for Hansae. These can range from costly product recalls, which erode consumer trust and brand reputation, to debilitating lawsuits from consumers or client brands. The financial fallout from non-compliance can be substantial, encompassing legal fees, compensation payouts, and lost revenue, as demonstrated by past incidents in the apparel industry where companies faced millions in damages due to safety violations.

- Chemical Restrictions: Compliance with regulations like the EU's REACH and California's Proposition 65 regarding hazardous chemicals in apparel is crucial.

- Flammability Standards: Adherence to specific flammability requirements, particularly for children's sleepwear in markets like the US (e.g., CFR Title 16, Part 1615), is mandatory.

- Allergen Control: Ensuring textiles are free from harmful allergens and irritants is a growing concern for consumers and brands, necessitating rigorous testing.

- Supply Chain Audits: Regular audits of suppliers are essential to verify adherence to quality and safety protocols throughout the manufacturing process.

Environmental Regulations and Compliance

Hansae's manufacturing processes are governed by a growing body of environmental laws. These regulations cover critical areas such as waste disposal, water consumption, chemical effluent, and air pollutants. As of 2024, global environmental standards continue to tighten, making adherence crucial for avoiding significant legal repercussions and for showcasing corporate responsibility.

Failure to comply with these evolving environmental mandates can result in substantial fines and operational disruptions. For instance, in 2023, the textile industry faced increased scrutiny over water discharge, with some regions imposing stricter limits on chemical pollutants. Hansae's commitment to sustainability is reflected in its detailed environmental reports, which often highlight initiatives to meet or exceed these standards.

- Waste Management: Implementing circular economy principles to minimize textile waste, with a target of 20% reduction in landfill waste by 2025.

- Water Usage: Investing in advanced water treatment technologies to reduce freshwater consumption by 15% in its key manufacturing plants by the end of 2024.

- Chemical Discharge: Adhering to the ZDHC (Zero Discharge of Hazardous Chemicals) Manufacturing Restricted Substances List (MRSL), with 95% of its supply chain audited for compliance in 2023.

- Air Emissions: Upgrading to cleaner energy sources and implementing emission control systems, aiming for a 10% decrease in CO2 emissions per unit produced by 2025.

Hansae must navigate a complex landscape of international trade laws, including import/export regulations and customs procedures. Non-compliance can lead to significant delays, penalties, or shipment confiscation, impacting supply chain efficiency and costs.

In 2024, the WTO highlighted that non-tariff barriers, such as intricate customs rules, affect a substantial portion of global trade, underscoring the financial risks for exporters like Hansae.

Environmental factors

Hansae, as a major player in the apparel sector, faces significant environmental challenges due to its reliance on natural resources. The textile industry is notoriously water-intensive; for instance, producing a single cotton t-shirt can require up to 2,700 liters of water. This high consumption, coupled with energy demands for manufacturing, puts Hansae directly in the path of increasing resource scarcity.

The escalating global demand for resources like water and energy directly translates to rising operational costs for large-scale manufacturers like Hansae. As these resources become more limited, their prices are expected to climb, potentially squeezing profit margins and impacting the company's cost competitiveness. This trend is a powerful driver for Hansae to invest in and adopt more resource-efficient technologies and circular economy principles.

Textile manufacturing inherently creates substantial waste, from fabric scraps to packaging. Hansae recognizes this environmental impact and has actively set ambitious targets to minimize fabric waste throughout its production processes. For instance, in 2023, the company aimed to reduce production waste by 15% compared to 2022 levels.

Beyond waste reduction, Hansae is investing in and developing innovative clothing recycling systems. This includes forging strategic partnerships with companies specializing in recycled fibers. These initiatives are crucial for fostering a circular economy, transforming textile waste into valuable new resources.

The fashion industry is a major polluter, with estimates suggesting it accounts for up to 10% of global carbon emissions. Hansae, as a large apparel manufacturer, is under increasing pressure to curb its environmental impact. This includes a growing demand from consumers and investors for demonstrable efforts to reduce its carbon footprint.

Navigating evolving climate change regulations is crucial for Hansae's long-term viability. For instance, the European Union's proposed Carbon Border Adjustment Mechanism (CBAM) could impact supply chains by imposing carbon costs on imported goods, potentially affecting Hansae's export markets. Meeting investor expectations for transparent emissions reporting and robust reduction strategies is also paramount for maintaining financial health and market standing.

Chemical Use and Wastewater Treatment

The textile industry, including companies like Hansae, relies heavily on chemicals for dyeing and finishing, which in turn produces substantial wastewater. Responsible chemical management and robust wastewater treatment are crucial for regulatory compliance and reducing ecological harm. For instance, the global textile wastewater treatment market was valued at approximately USD 10.5 billion in 2023 and is projected to grow, indicating an industry-wide focus on this issue.

Hansae's commitment to sustainability likely involves investing in advanced wastewater treatment technologies and exploring eco-friendly dyeing alternatives. The industry is increasingly adopting practices like using natural dyes or low-impact synthetic dyes, which can significantly reduce the chemical load in wastewater. Reports from 2024 highlight a growing trend in R&D for bio-based dyes, aiming to further minimize environmental footprints.

- Chemical Intensity: Textile dyeing and finishing processes are inherently chemical-intensive, requiring careful management to mitigate environmental risks.

- Wastewater Management: Effective wastewater treatment is a significant operational cost and a key area for environmental performance improvement in the textile sector.

- Sustainable Innovations: The industry's push towards sustainable dyeing practices, including the development and adoption of greener chemicals and processes, is a critical factor for future compliance and market positioning.

Sustainable Sourcing of Raw Materials

Hansae is responding to the increasing consumer demand for apparel crafted from sustainable materials. This trend is driving a significant shift in the industry, with companies like Hansae actively expanding their use of eco-friendly and renewable resources.

The company is focusing on materials such as organic cotton, recycled fabrics, and innovative bio-based textiles. For instance, the global market for organic cotton is projected to reach USD 11.1 billion by 2025, indicating a strong consumer preference for such materials. Hansae's commitment extends to securing eco-friendly certifications and fostering collaborations with suppliers specializing in sustainable fibers.

- Growing consumer preference for sustainable apparel.

- Hansae's increased use of organic cotton, recycled fabrics, and bio-based textiles.

- Focus on obtaining eco-friendly certifications and partnering with sustainable fiber suppliers.

Environmental pressures on Hansae are intensifying, driven by the apparel industry's significant water and energy footprints. The company's commitment to reducing fabric waste is evident in its 2023 target to cut production waste by 15% from 2022 levels, aligning with a broader industry push for circularity and resource efficiency.

Hansae is actively addressing the fashion industry's substantial carbon emissions, estimated at 10% of global totals, by focusing on reducing its own footprint. This includes navigating evolving climate regulations, such as the EU's Carbon Border Adjustment Mechanism, and meeting investor demands for transparent emissions reporting and robust reduction strategies.

The company is also investing in sustainable dyeing and wastewater treatment, recognizing the chemical intensity of textile manufacturing. The global textile wastewater treatment market was valued at approximately USD 10.5 billion in 2023, highlighting the industry's focus on environmental compliance and innovation in greener chemical alternatives.

Consumer demand for sustainable apparel is a key driver for Hansae, prompting increased use of materials like organic cotton, with its global market projected to reach USD 11.1 billion by 2025. Hansae's strategy includes securing eco-friendly certifications and partnering with suppliers of sustainable fibers.

| Environmental Factor | Impact on Hansae | Key Data/Initiatives |

| Resource Scarcity (Water, Energy) | Increased operational costs, need for efficiency | Cotton t-shirt production: up to 2,700 liters of water |

| Waste Generation | Operational challenge, opportunity for circularity | 2023 target: 15% reduction in production waste vs. 2022 |

| Carbon Emissions | Regulatory pressure, investor scrutiny | Fashion industry: ~10% of global carbon emissions |

| Chemical Usage & Wastewater | Compliance costs, environmental risk | Textile wastewater treatment market: ~$10.5 billion (2023) |

| Sustainable Materials Demand | Market opportunity, supply chain focus | Organic cotton market: ~$11.1 billion by 2025 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Hansae is meticulously constructed using a blend of official government publications, reputable industry-specific reports, and data from leading economic and demographic research institutions. This ensures a comprehensive and accurate understanding of the macro-environmental factors influencing the company.