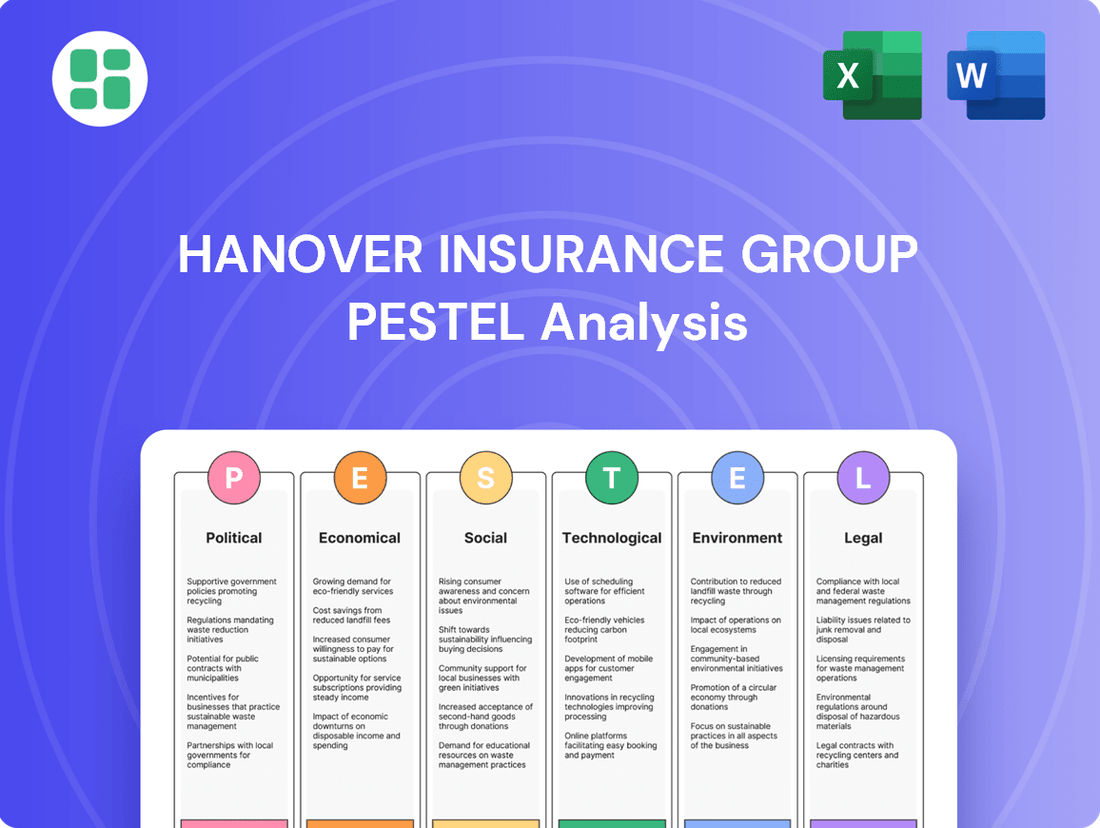

Hanover Insurance Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanover Insurance Group Bundle

Gain a strategic advantage by understanding the external forces shaping Hanover Insurance Group's future. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting the insurance industry. Discover how these trends present both opportunities and challenges for Hanover. Download the full analysis now to unlock actionable insights and refine your market strategy.

Political factors

The insurance sector faces intense regulatory oversight, and shifts in government policies directly affect The Hanover Insurance Group. Heightened federal and state scrutiny, especially around data privacy, consumer rights, and equitable pricing, translates to increased expenses for compliance.

For instance, the NAIC's ongoing development of new guidelines for third-party data usage and predictive modeling, as seen with their recent focus on transparency in outcomes, necessitates significant investment in updated systems and processes for insurers like Hanover.

Changes in corporate tax rates significantly influence The Hanover's bottom line and strategic planning. For instance, if a new administration enacts policies to reduce the corporate tax rate, as seen with the Tax Cuts and Jobs Act of 2017 which lowered the federal rate from 35% to 21%, it could directly boost The Hanover's reported net income and free up capital for reinvestment or shareholder returns.

Conversely, any increase in tax liabilities, whether through higher corporate rates or new excise taxes on insurance products, would diminish profitability and potentially constrain the company's ability to pursue growth initiatives or maintain competitive pricing. The ongoing political landscape and potential shifts in fiscal policy remain a critical consideration for The Hanover's financial performance and capital allocation strategies.

Rising geopolitical tensions, such as ongoing conflicts and trade disputes, create significant market uncertainty. This volatility directly impacts investment valuations for companies like The Hanover Insurance Group, potentially affecting balance sheet equity. For instance, the S&P 500 experienced notable fluctuations in 2024 due to these global instability factors.

Global instability can also disrupt reinsurance markets, a critical component for property and casualty insurers. Changes in the availability or cost of reinsurance, driven by geopolitical events, can lead to unexpected cost increases for insurers. Furthermore, supply chain disruptions stemming from these tensions may increase the cost of materials needed to settle claims, presenting potential cost shocks.

Government Response to Climate Change

Government policies and initiatives aimed at mitigating climate change, such as mandates for climate-risk disclosures and the promotion of sustainable investment practices, significantly shape the operational landscape for insurers like The Hanover Insurance Group. For instance, the SEC's proposed climate disclosure rules, expected to be finalized in 2024, will require companies to report on their climate-related risks and emissions, impacting how insurers assess and underwrite such exposures.

Regulators are intensifying their scrutiny of insurers' exposure to climate-related risks, demanding robust capital reserves to cover the escalating frequency and severity of natural catastrophe events. This regulatory pressure, exemplified by the National Association of Insurance Commissioners' (NAIC) ongoing work on climate risk capital modeling, compels companies like Hanover to proactively adapt their underwriting models and investment portfolios to reflect these evolving risks.

- Increased Regulatory Scrutiny: Insurers face growing pressure from bodies like the NAIC to demonstrate resilience against climate-related financial risks.

- Disclosure Mandates: Upcoming regulations, such as the SEC's climate disclosure rules, will require detailed reporting on climate risks, influencing strategic planning.

- Capital Reserve Requirements: Regulators are pushing for higher capital reserves to absorb potential losses from an increase in severe weather events.

- Sustainable Investment Push: Government incentives and mandates encourage insurers to shift towards more sustainable investment strategies, impacting asset allocation.

Consumer Protection Regulations

State insurance departments are actively scrutinizing auto insurance practices, particularly concerning disclosure and overcharging. Consumers are voicing increasing concerns about rising rates and potential coverage gaps, prompting regulators to demand greater transparency from insurers like Hanover. For instance, in 2024, several states initiated investigations into auto insurance pricing models, citing potential unfairness.

Looking ahead to 2025, new regulations are anticipated to heavily emphasize data disclosures, retention, and security. This shift is a direct response to growing anxieties surrounding the extensive data collection by insurance companies and the associated privacy liability risks. Hanover will need to adapt its data handling practices to comply with these evolving mandates, ensuring robust protection for policyholder information.

- Increased Scrutiny: State regulators are focusing on disclosure and overcharge issues in auto insurance.

- Consumer Concerns: Policyholders are raising alarms about rate hikes and coverage lapses.

- Data Privacy Focus: Future regulations will likely target data disclosures, retention, and security.

- Liability Risks: Concerns over data collection and privacy are driving new compliance requirements.

Government actions, from tax policy shifts to climate change initiatives, directly influence The Hanover Insurance Group's operations and profitability. For example, the SEC's proposed climate disclosure rules, anticipated for finalization in 2024, will necessitate detailed reporting on climate-related risks, impacting how insurers like Hanover assess and underwrite such exposures.

Regulatory bodies, including the NAIC, are increasing scrutiny on climate risk capital modeling, pushing for robust reserves to cover escalating natural catastrophe losses. This trend, coupled with ongoing state-level investigations into auto insurance pricing models in 2024 due to consumer concerns about fairness and rising rates, highlights a dynamic regulatory environment.

Anticipated 2025 regulations will likely emphasize data disclosures, retention, and security, addressing growing anxieties around privacy liability risks associated with extensive data collection by insurance companies.

Geopolitical tensions, such as ongoing conflicts and trade disputes, create market uncertainty, impacting investment valuations and potentially disrupting reinsurance markets, as evidenced by S&P 500 fluctuations in 2024.

What is included in the product

This PESTLE analysis of The Hanover Insurance Group examines how external macro-environmental factors like political stability, economic conditions, social trends, technological advancements, environmental regulations, and legal frameworks impact its operations and strategy.

It provides actionable insights for stakeholders to navigate the evolving landscape and capitalize on emerging opportunities within the insurance sector.

Offers a clear, actionable breakdown of the external forces impacting Hanover Insurance Group, simplifying complex market dynamics for strategic decision-making.

Economic factors

Interest rate fluctuations directly affect The Hanover Insurance Group's profitability by impacting its investment income. As of late 2024, the Federal Reserve has maintained a relatively stable, albeit higher, interest rate environment compared to the preceding years. This has generally benefited insurers like Hanover, as higher yields on their bond portfolios translate to increased net investment income.

For instance, a modest increase in average bond yields can significantly boost an insurer's bottom line. In 2023, The Hanover reported net investment income of $1.1 billion. Should interest rates remain elevated or trend slightly upward in 2024 and 2025, this figure is expected to see continued positive growth, bolstering the company's financial performance.

Inflation significantly impacts Hanover Insurance Group by driving up claims costs. For instance, in property insurance, the price of building materials and labor for repairs has risen considerably. Similarly, auto insurance sees higher expenses due to increased costs for replacement parts and vehicle repairs. This trend was evident in late 2023 and early 2024, with the Consumer Price Index (CPI) showing persistent, albeit moderating, inflation.

To counter these rising loss costs, Hanover, like other insurers, must continue to implement rate adjustments. While the pace of premium growth may slow from the rapid increases seen in 2023, strategic rate hikes are crucial. These adjustments are necessary to ensure that premiums adequately cover the escalating claims expenses and preserve underwriting profitability. For example, many property and casualty insurers sought average rate increases in the high single digits to low double digits throughout 2023 and into 2024 to address these inflationary pressures.

The Hanover Insurance Group's performance is closely tied to overall economic growth, which directly impacts the demand for its diverse insurance offerings, from auto and home to commercial policies. A robust economy generally translates to increased consumer and business spending, providing a fertile ground for insurance sales.

In 2024 and looking into 2025, economists are forecasting moderate but steady economic growth in the United States, with GDP expected to expand by around 2.0% to 2.5%. This stability supports consumer confidence and discretionary spending, crucial for lines like auto and homeowners insurance.

Furthermore, the real estate market plays a significant role. As of early 2024, interest rates, while fluctuating, have remained at levels that encourage home buying and commercial property development. This trend is anticipated to boost demand for homeowners' and commercial property insurance, presenting The Hanover with valuable volume growth opportunities.

Market Competition and Pricing

The insurance landscape is increasingly competitive, especially within commercial and cyber insurance sectors. This heightened competition can lead to softer pricing, which in turn puts pressure on profitability for companies like The Hanover. For instance, during 2024, many commercial property and casualty insurers experienced rate moderation due to increased market capacity and a desire to gain market share.

Despite The Hanover’s robust premium growth, ongoing competitive pressures necessitate a disciplined approach to underwriting. This means the company may need to strategically decline certain new business opportunities to uphold its underwriting standards and protect its financial performance from adverse selection.

- Increased competition in commercial and cyber insurance is a significant factor.

- Softer rates and pressure on profitability are direct consequences of this competition.

- The Hanover's premium growth is strong, but competitive pressures require careful selection of new business.

- Maintaining underwriting discipline is key to navigating a competitive market.

Natural Catastrophe Losses and Reinsurance Costs

The increasing frequency and severity of natural disasters, largely attributed to climate change, are significantly impacting the insurance industry. These events directly reduce underwriting profits and drive up the cost of reinsurance, which is essentially insurance for insurance companies. For example, early 2025 has already seen substantial wildfire losses, quickly depleting the industry's allocated catastrophe budgets.

Insurers such as Hanover Insurance Group must actively manage these risks. This involves implementing rigorous pricing strategies to reflect the heightened exposure and carefully controlling the amount of risk they take on in vulnerable areas.

- Climate change is escalating natural catastrophe losses.

- Reinsurance costs are rising due to increased claims.

- Early 2025 wildfire losses have significantly impacted industry catastrophe budgets.

- Disciplined pricing and exposure management are crucial for insurers like Hanover.

Economic growth directly influences demand for Hanover's insurance products. Moderate U.S. GDP growth of around 2.0-2.5% is projected for 2024-2025, supporting consumer and business spending. The real estate market, buoyed by stable interest rates in early 2024, should also drive demand for homeowners' and commercial property insurance, presenting volume opportunities for Hanover.

The competitive landscape, particularly in commercial and cyber insurance, is intensifying. This leads to softer pricing, impacting profitability, as seen with rate moderation in the commercial P&C market during 2024. Hanover’s strong premium growth necessitates disciplined underwriting to manage adverse selection and maintain financial performance.

Rising inflation continues to push up claims costs for property and auto insurance due to increased material and parts expenses. While inflation moderated in early 2024, insurers like Hanover must continue strategic rate adjustments, potentially in the high single to low double digits, to offset these escalating costs and preserve underwriting margins.

Higher interest rates, maintained by the Federal Reserve through late 2024, benefit insurers like Hanover through increased net investment income. With 2023 net investment income at $1.1 billion, continued elevated rates in 2024-2025 are expected to further boost this figure, supporting overall financial performance.

| Economic Factor | Impact on Hanover | 2024-2025 Outlook | Key Data Point |

| Economic Growth | Drives demand for insurance | Moderate (2.0-2.5% GDP) | Supports consumer/business spending |

| Interest Rates | Boosts investment income | Stable/Slightly Higher | $1.1 billion net investment income (2023) |

| Inflation | Increases claims costs | Moderating but Persistent | Property/Auto repair cost increases |

| Competition | Pressures profitability | Intensifying (Commercial/Cyber) | Rate moderation in P&C market (2024) |

Full Version Awaits

Hanover Insurance Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of The Hanover Insurance Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Sociological factors

Customers today expect insurers to offer tailored policies and seamless digital interactions. This means companies like Hanover need to prioritize digital upgrades, including online sales and better customer service via apps and websites. For instance, a 2024 report indicated that over 70% of insurance customers prefer managing their policies online.

Demographic shifts are reshaping insurance needs, with younger generations, particularly Millennials and Gen Z, increasingly seeking usage-based insurance models and bundled financial planning services. For instance, by 2025, Millennials are projected to represent a significant portion of the workforce, driving demand for flexible and digitally accessible insurance solutions. This necessitates Hanover's adaptation in product development and customer engagement to align with these evolving preferences, potentially expanding into niche markets like cyber liability or specialized pet insurance to capture these growing segments.

Public perception of the insurance sector, including companies like The Hanover Insurance Group, is significantly shaped by experiences with rate adjustments, the efficiency of claims processing, and the overall value consumers feel they receive. In 2024, many consumers, particularly in states heavily affected by climate change, are grappling with substantial premium hikes, fueling anxieties about affordability and the industry's responsiveness.

Maintaining robust public trust is paramount for insurers. This trust is eroded when policyholders perceive a lack of transparency or feel their concerns are not adequately addressed, especially during periods of escalating costs. For instance, reports from early 2025 indicate that customer satisfaction scores in the property insurance market have seen a dip in regions with high climate risk, highlighting the need for insurers to adopt more customer-centric approaches and clear communication strategies.

Workforce Trends and Talent Acquisition

The insurance industry, including The Hanover, is grappling with significant hurdles in attracting and keeping skilled professionals, especially those with expertise in cutting-edge fields like artificial intelligence, cybersecurity, and advanced data analytics. This talent gap is a critical concern as the sector increasingly relies on technological innovation.

To counter this, The Hanover must prioritize robust employee development programs and cultivate an environment that champions diversity and inclusion. Such initiatives are vital for drawing in and retaining the specialized talent needed to drive its strategic objectives and technological advancements forward. For instance, a 2024 report by the U.S. Bureau of Labor Statistics projected a 10% growth in computer and information technology occupations by 2032, highlighting the demand for these skills across industries.

- Talent Acquisition Challenges: Shortage of specialized skills in technology and data analytics within the insurance sector.

- Retention Strategies: Focus on employee development and fostering an inclusive company culture.

- Industry Demand: Growing need for tech-savvy professionals, with IT occupations expected to grow significantly.

- Hanover's Imperative: Attracting and retaining skilled talent is crucial for strategic growth and technological initiatives.

Social Inflation and Litigation Trends

Social inflation, characterized by rising jury awards and escalating legal expenses, is a significant concern for insurers like The Hanover. This trend directly impacts claims costs, particularly in liability-focused business segments. For instance, the average jury award in large commercial auto liability cases saw a notable increase in recent years, putting pressure on profitability.

This upward pressure on claims necessitates robust reserve management and influences how The Hanover prices its commercial auto and general liability policies. The increasing frequency and severity of lawsuits, often driven by broader societal attitudes towards corporate responsibility and the pursuit of larger settlements, demand a proactive approach to risk mitigation and pricing adjustments.

- Increased Litigation Costs: Legal defense costs continue to climb, impacting the overall expense ratio for liability lines.

- Jury Award Trends: Recent data indicates a persistent upward trend in the size of jury verdicts, especially in cases involving severe injuries or perceived corporate negligence.

- Impact on Commercial Auto: The commercial auto sector is particularly vulnerable to social inflation due to the high potential for severe accidents and associated litigation.

- Reserve Adequacy: Insurers must maintain adequate reserves to cover the potential for higher-than-anticipated claims payouts driven by these societal and legal trends.

Customer expectations for personalized insurance and seamless digital experiences are paramount, with a 2024 survey revealing over 70% of policyholders prefer online management. This trend underscores Hanover's need to enhance its digital platforms for sales and customer service, aligning with the growing preference for digital interactions among consumers.

Demographic shifts, particularly the rise of Millennials and Gen Z, are driving demand for usage-based insurance and integrated financial planning services. By 2025, these younger generations will constitute a larger workforce segment, necessitating flexible, digitally-enabled insurance solutions from companies like Hanover.

Public perception is heavily influenced by rate adjustments and claims processing efficiency, with significant premium hikes in 2024 causing affordability concerns, especially in climate-vulnerable regions. Maintaining transparency and addressing customer anxieties are critical for insurers to retain trust.

The insurance sector faces a critical talent shortage in areas like AI and cybersecurity, with IT occupations projected to grow by 10% by 2032. Hanover's focus on employee development and diversity is vital for attracting and retaining the specialized skills needed for technological advancement.

Social inflation, marked by rising jury awards and legal costs, significantly impacts liability claims, particularly in commercial auto. The average jury award in large commercial auto liability cases has seen a notable increase, pressuring insurer profitability and necessitating careful reserve management and pricing adjustments.

| Sociological Factor | Impact on Insurance | Hanover's Response/Consideration | Relevant Data/Trend (2024-2025) |

|---|---|---|---|

| Customer Expectations | Demand for personalization and digital interaction | Prioritize digital upgrades, online sales, and app-based customer service | Over 70% of customers prefer online policy management (2024) |

| Demographic Shifts | Growing demand for usage-based and bundled services from younger generations | Adapt product development and engagement for Millennials and Gen Z | Millennials to represent a significant workforce portion by 2025 |

| Public Perception & Trust | Concerns over rate hikes and claims processing efficiency | Enhance transparency and customer-centric approaches, especially in high-risk areas | Dipped customer satisfaction in property insurance in climate-risk regions (early 2025) |

| Talent Acquisition | Shortage of tech and data analytics expertise | Invest in employee development and foster diversity & inclusion | Projected 10% growth in IT occupations by 2032 (U.S. Bureau of Labor Statistics) |

| Social Inflation | Increased litigation costs and jury awards, especially in liability lines | Strengthen reserve management and adjust pricing for commercial auto and general liability | Notable increase in average jury awards in large commercial auto liability cases |

Technological factors

The Property and Casualty (P&C) insurance sector is seeing a significant surge in the adoption of Artificial Intelligence (AI) and Machine Learning (ML). These technologies are fundamentally changing how insurers approach risk assessment, identify fraudulent activities, and manage the entire claims lifecycle. For instance, AI-powered tools can analyze vast datasets to predict claim severity with greater accuracy, potentially reducing payout costs.

The Hanover Insurance Group is actively investing in its data, analytics, and technology infrastructure to boost operational efficiency and support its expansion plans. The company is specifically leveraging AI to refine its underwriting processes, making more informed decisions about policy pricing and risk selection. Furthermore, AI is being deployed to enhance customer service interactions, offering quicker responses and personalized support.

The insurance industry, including The Hanover, is seeing significant investment in digital transformation and cloud adoption. Insurers are moving towards modern, cloud-native platforms to boost operational efficiency, enhance customer experiences, and ensure better regulatory compliance. This strategic shift is crucial for agility and scalability.

Cloud-first strategies are enabling insurers to achieve greater agility, improve security, and reduce costs. For The Hanover, this means faster deployment of new products and services, better data analytics capabilities, and a more resilient IT infrastructure. The global cloud computing market is projected to reach over $1.3 trillion by 2025, highlighting the scale of this technological trend.

The escalating frequency and sophistication of cyberattacks, such as ransomware and supply chain compromises, present a substantial risk to insurers like The Hanover, while simultaneously fueling a burgeoning market for cyber insurance. This dynamic necessitates that The Hanover not only fortify its internal defenses but also continuously refine its cyber insurance products and risk evaluation methodologies to keep pace with this evolving threat landscape.

In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, underscoring the critical need for robust cybersecurity measures and comprehensive cyber insurance. The Hanover, as a key player in this sector, must invest in advanced threat detection and response systems to safeguard its own operations and develop innovative policy solutions that address the increasingly complex risks faced by its clients.

Internet of Things (IoT) and Telematics

The integration of Internet of Things (IoT) devices and telematics is fundamentally reshaping the insurance landscape, allowing companies like The Hanover Insurance Group to move towards usage-based and behavior-driven pricing models. This shift is fueled by the availability of real-time data, which significantly enhances the accuracy of risk assessment.

This real-time data empowers insurers to implement more dynamic pricing strategies and craft personalized policies. This is particularly impactful in sectors like auto and property insurance, where The Hanover can leverage this technology to more precisely price risk, leading to potentially more competitive offerings and improved profitability.

For instance, telematics data can inform premiums based on actual driving habits, such as mileage, speed, and braking patterns. In property insurance, IoT sensors can monitor environmental factors like water leaks or smoke, enabling proactive risk mitigation and potentially lower claims.

- Enhanced Risk Assessment: IoT and telematics provide granular, real-time data, enabling more accurate underwriting and pricing.

- Personalized Policies: Insurers can offer tailored coverage and premiums based on individual behavior and risk profiles.

- Proactive Risk Management: Connected devices allow for early detection of potential issues, reducing claims frequency and severity.

Insurtech Innovations and Competition

The insurance landscape is being reshaped by Insurtech startups, which are leveraging advanced technologies to offer innovative products and services. This trend is forcing traditional insurers like The Hanover to adapt rapidly to remain competitive. For instance, the global Insurtech market was valued at approximately $11.1 billion in 2023 and is projected to grow significantly, indicating a strong push for digital transformation within the industry.

To navigate this evolving market, The Hanover needs to enhance its product offerings and service delivery. Exploring embedded insurance, where insurance is integrated into other consumer purchases, and utilizing low-code/no-code platforms for faster development are crucial strategies. These approaches allow for quicker adaptation to changing customer expectations and a more agile response to market demands.

- Insurtech Market Growth: The global Insurtech market is experiencing robust expansion, highlighting the increasing adoption of technology in insurance.

- Embedded Insurance Potential: Integrating insurance into non-insurance products offers new distribution channels and customer engagement opportunities.

- Platform Agility: Low-code/no-code platforms enable faster product development and customization, crucial for staying ahead of competitors.

- Customer-Centricity: Technological advancements allow insurers to better understand and cater to evolving customer needs and preferences.

Technological advancements are profoundly altering the insurance sector, with AI and ML driving innovation in risk assessment and claims processing. The Hanover Insurance Group is actively investing in these areas to improve underwriting and customer service.

Digital transformation, including cloud adoption, is a key focus for insurers like The Hanover, aiming for greater efficiency and improved customer experiences; the global cloud market is expected to exceed $1.3 trillion by 2025.

The rise of Insurtech startups, with the global market valued at approximately $11.1 billion in 2023, is pushing traditional players to innovate, with embedded insurance and agile development platforms becoming critical strategies.

| Technology | Impact on Insurance | The Hanover's Focus | Market Data (2024/2025) |

|---|---|---|---|

| AI/ML | Enhanced risk assessment, fraud detection, claims automation | Underwriting refinement, customer service improvement | AI in insurance market projected significant growth |

| Cloud Computing | Operational efficiency, scalability, agility | Digital transformation, modernizing IT infrastructure | Global cloud market to exceed $1.3 trillion by 2025 |

| IoT/Telematics | Usage-based pricing, proactive risk mitigation | Personalized policies, dynamic pricing models | Growing adoption in auto and property insurance |

| Insurtech | New products, innovative services, digital distribution | Adapting to competition, exploring embedded insurance | Global Insurtech market ~$11.1 billion (2023) |

Legal factors

The Hanover Insurance Group, like all insurers, faces increasing scrutiny regarding data privacy and security. Regulations such as those proposed by the National Association of Insurance Commissioners (NAIC) are setting stricter standards for data disclosures, retention periods, and overall security measures. For instance, the NAIC's Insurance Data Security Model Law, adopted by many states, mandates comprehensive data security programs and breach notification procedures.

Compliance with these evolving legal frameworks is not just about avoiding fines, which can be substantial, but also about maintaining customer trust. A data breach could lead to significant reputational damage and loss of business. The Hanover must invest in robust cybersecurity infrastructure and ongoing training to ensure adherence to these critical legal requirements, especially as data volumes and sophistication of threats continue to grow.

Changes in insurance contract law and evolving liability standards are critical for Hanover. For instance, the increasing prevalence of social inflation, a trend where litigation costs and jury awards rise faster than general inflation, directly impacts claims expenses. This phenomenon, coupled with a rise in class-action lawsuits, puts pressure on insurers like Hanover to accurately price policies and maintain adequate reserves.

In 2024, the insurance industry continues to grapple with the financial implications of these legal shifts. For commercial auto lines specifically, which Hanover operates within, liability pressures are escalating. This necessitates ongoing, dynamic adjustments to premium pricing and the establishment of sufficient financial reserves to cover potential claims, ensuring the company's long-term solvency and profitability.

Developing and launching new insurance products, such as Hanover's Workers' Comp Advantage, necessitates navigating a complex web of regulatory approvals. This process ensures adherence to state-specific insurance laws and federal guidelines, a critical step before any product reaches the market.

Hanover Insurance Group must meticulously ensure its entire product suite, from established specialty lines to innovative new offerings, meets all applicable legal and compliance standards. Failure to comply can lead to significant fines and market access restrictions, impacting financial performance.

Antitrust and Competition Laws

Antitrust and competition laws are crucial in the insurance sector, ensuring a level playing field. These regulations prevent monopolistic practices and promote fair competition, which is particularly relevant given the intense rivalry, especially in the middle-market insurance segment. In 2024, the U.S. property and casualty insurance market experienced significant competition, with net premiums written growing by an estimated 6.2% according to industry reports.

For companies like The Hanover, this competitive environment necessitates strategic responses. Insurers may engage in selective underwriting, focusing on profitable niches, and adjust pricing to remain competitive while ensuring profitability. This dynamic is shaped by regulatory oversight aimed at preventing anti-competitive behavior, ensuring that market forces, rather than collusion, dictate pricing and product availability.

- Regulatory Scrutiny: Antitrust laws actively monitor the insurance industry to prevent unfair market dominance.

- Middle Market Dynamics: Intense competition in the middle market prompts insurers to refine underwriting and pricing strategies.

- Profitability vs. Competition: Companies like The Hanover must balance competitive pricing with maintaining healthy profit margins.

- Compliance Focus: Adherence to competition guidelines is paramount for sustainable operations in the insurance sector.

Climate-Related Disclosure Mandates

Regulatory bodies worldwide are increasingly mandating climate-related disclosures for insurers. This means companies like The Hanover must now detail how they are integrating climate risks into their underwriting, ensuring sufficient capital for natural disasters, and reporting on their investments in carbon-heavy sectors.

This evolving legal landscape presents a significant compliance challenge, requiring substantial investment in data collection, analysis, and reporting infrastructure. For instance, the SEC's proposed climate disclosure rules, while facing ongoing debate, signal a clear direction towards greater transparency in climate-related financial risks for U.S. companies.

- Increased Compliance Burden: Insurers face growing legal obligations to report on climate-related risks and strategies.

- Capital Adequacy Scrutiny: Regulators are focusing on ensuring insurers hold adequate capital reserves to withstand climate-driven natural catastrophes.

- Investment Portfolio Transparency: There's a push for insurers to disclose their exposure to industries contributing to climate change.

- Evolving Regulatory Landscape: The dynamic nature of climate disclosure rules necessitates continuous adaptation and investment in compliance measures.

The legal landscape for insurers like Hanover is increasingly complex, particularly concerning data privacy. Regulations such as the NAIC's Insurance Data Security Model Law, adopted by many states, mandate robust data security programs and breach notification protocols, impacting how Hanover handles sensitive customer information.

Furthermore, evolving liability standards and legal precedents, including the impact of social inflation on litigation costs, directly influence Hanover's claims expenses and reserve requirements. This necessitates continuous adaptation of pricing strategies and risk management practices to navigate these legal shifts, especially in volatile commercial auto lines.

Antitrust and competition laws are also critical, ensuring fair market practices. In 2024, the competitive U.S. property and casualty insurance market, which saw an estimated 6.2% growth in net premiums written, requires companies like Hanover to strategically balance competitive pricing with profitability, all under regulatory oversight.

The increasing regulatory focus on climate-related disclosures, exemplified by evolving SEC proposals, also presents a significant legal challenge. Hanover must invest in systems to report on climate risk integration, capital adequacy for natural disasters, and investment portfolio transparency.

Environmental factors

The increasing frequency and intensity of natural disasters, including wildfires, severe storms, and floods, directly affect property and casualty insurers like The Hanover by driving up claims expenses. For instance, the first half of 2025 experienced significant insured losses from these types of events, putting pressure on established risk assessment methods.

Insurers like The Hanover Insurance Group are increasingly expected to move beyond simply covering losses to actively managing and reducing climate-related risks. This means integrating climate science into how they assess and price policies, working with others to set standards for infrastructure that can withstand climate impacts, and developing new insurance products for regions facing significant climate challenges.

The financial implications are substantial. For instance, the insurance industry's exposure to climate-related events is growing; in 2023, insured losses from natural catastrophes globally reached an estimated $135 billion, according to Swiss Re. This pressure necessitates innovation in underwriting and risk modeling to maintain profitability and solvency.

Hanover Insurance Group, like all insurers, faces increasing pressure to integrate Environmental, Social, and Governance (ESG) principles into its operations and investment portfolios. This surge in demand, driven by both the public and regulators, directly impacts how the company manages risk and allocates capital, particularly concerning climate-related issues.

New regulations are emerging that require insurers to disclose the potential financial implications of climate change. For instance, by the end of 2024, many jurisdictions will expect more robust reporting on climate risk exposure, pushing companies like Hanover to refine their risk modeling and investment strategies to align with sustainability criteria and avoid stranded assets.

Resource Scarcity and Supply Chain Impacts

Resource scarcity, exacerbated by climate events, directly affects The Hanover's ability to fulfill claims efficiently. For instance, disruptions in the supply of lumber or specialized auto parts can significantly increase repair costs and extend the time it takes to settle property and casualty claims. This strain on supply chains is a growing concern for insurers aiming to maintain service levels.

The increasing frequency and severity of extreme weather events, such as hurricanes and floods, are key drivers of resource scarcity. In 2023, global insured losses from natural catastrophes were estimated to be around $110 billion, according to Swiss Re. This highlights the potential for widespread damage and the subsequent demand for building materials, which can quickly become depleted, leading to higher prices and longer lead times for The Hanover's claims adjusters.

- Increased Material Costs: Lumber prices, for example, can fluctuate dramatically. Following major storms in 2023, some regions saw significant spikes in the cost of essential construction materials.

- Extended Repair Timelines: Shortages of skilled labor and specific parts can delay property repairs and vehicle restorations, impacting customer satisfaction and increasing the duration of claim payouts.

- Geopolitical Supply Chain Vulnerabilities: Global events can also disrupt the flow of goods, affecting everything from microchips needed for vehicle repair to specialized components for infrastructure.

Demand for Green and Sustainable Insurance Products

Policyholders are increasingly seeking insurance that aligns with environmental, social, and governance (ESG) principles, driving demand for sustainable and green products. This shift presents a significant opportunity for The Hanover to develop innovative coverage solutions that address evolving environmental risks and consumer preferences.

This growing demand opens avenues for new product development, such as parametric insurance. Parametric policies, which trigger payouts based on specific, measurable environmental events like rainfall levels or wind speeds, can offer faster claims processing and greater certainty for policyholders facing climate-related impacts.

The market for ESG-focused insurance is expanding rapidly. For example, the global sustainable insurance market was valued at approximately $870 billion in 2023 and is projected to reach over $1.5 trillion by 2028, indicating substantial growth potential for insurers that can cater to this trend.

- Growing Policyholder Demand: A significant portion of consumers, particularly millennials and Gen Z, express a preference for brands and products that demonstrate strong environmental and social responsibility.

- ESG Integration: Insurers are increasingly integrating ESG factors into their underwriting and investment strategies to mitigate long-term risks and capture new market segments.

- Innovation in Coverage: The development of climate-resilient insurance products, including parametric solutions, is crucial for addressing the increasing frequency and severity of natural disasters.

- Market Growth: The sustainable insurance sector is experiencing robust growth, with projections indicating continued expansion as climate awareness and regulatory pressures increase.

Environmental factors significantly impact insurers like The Hanover, primarily through increased claims from extreme weather events. For example, global insured losses from natural catastrophes were around $110 billion in 2023, a figure expected to rise. This necessitates a shift towards proactive risk management and the development of climate-resilient products. Additionally, growing demand for ESG-aligned insurance presents opportunities for innovation, with the sustainable insurance market projected to exceed $1.5 trillion by 2028.

| Factor | Impact on Hanover | Data Point |

|---|---|---|

| Extreme Weather Events | Increased claims, higher operating costs | Global insured losses from natural catastrophes: ~$110 billion (2023) |

| Climate Risk Regulation | Need for enhanced disclosure and reporting | Many jurisdictions expected enhanced reporting by end of 2024 |

| Resource Scarcity | Higher repair costs, extended claim settlement times | Fluctuations in construction material costs post-disasters |

| ESG Demand | Opportunity for new product development, market growth | Sustainable insurance market projected to exceed $1.5 trillion by 2028 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Hanover Insurance Group is constructed using a comprehensive blend of official government publications, reputable financial news outlets, and industry-specific research reports. This ensures a thorough understanding of political, economic, social, technological, legal, and environmental factors impacting the insurance sector.