Hanover Insurance Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanover Insurance Group Bundle

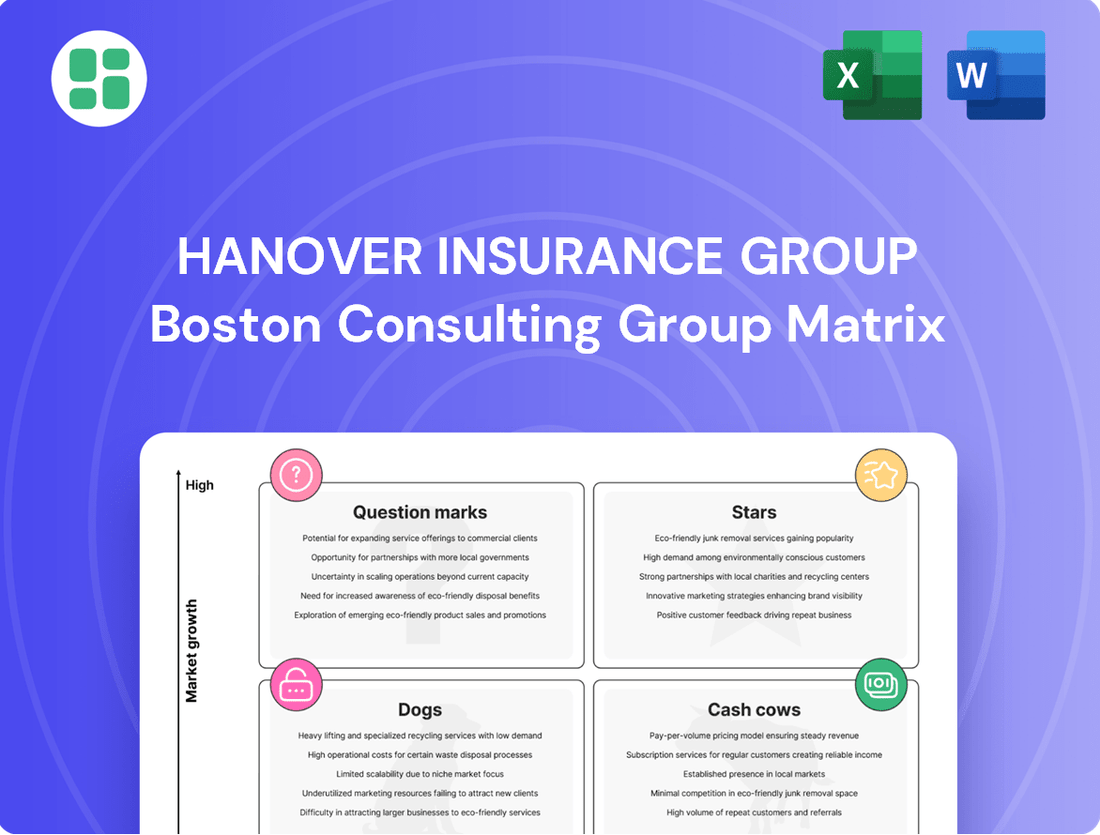

Curious about The Hanover Insurance Group's strategic product positioning? Our BCG Matrix preview offers a glimpse into their market performance, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain access to detailed quadrant placements, data-backed recommendations, and a clear roadmap for optimizing your investment and product decisions within the insurance sector.

Stars

Hanover's Specialty insurance lines are a key growth driver, with net premiums written seeing a 5.4% increase in the first quarter of 2025. This segment, encompassing areas like professional liability, marine, and specialty property & casualty, benefits from targeting niche markets. These specialized areas often offer higher profit margins due to reduced competition.

The company is strategically investing in both its people and technology within these specialty areas to foster even greater expansion. Evidence of this focus is seen in the average renewal price increases of 7.8% recorded in the second quarter of 2025, indicating strong demand and pricing power in these lines.

The cyber insurance market is experiencing substantial growth, making it a prime candidate for a Star in the BCG Matrix. As businesses increasingly rely on digital infrastructure, the need for comprehensive protection against cyber threats is paramount. While Hanover Insurance Group's specific market share in this niche isn't publicly broken down, their strategic emphasis on specialty lines indicates a strong potential for expansion and innovation in this rapidly evolving sector.

Emerging risk coverages represent a critical area for Hanover Insurance Group, encompassing new and evolving insurance needs. These are often driven by significant societal and technological shifts, such as the increasing impacts of climate change, the integration of autonomous vehicles, and the potential liabilities arising from artificial intelligence. Hanover's strategic positioning in these nascent markets is designed to capture early growth and establish a strong foothold.

The company's focus on emerging risks aligns with a broader strategy to capitalize on future opportunities. For instance, the cyber insurance market, a prime example of an emerging risk, saw substantial growth. In 2023, the global cyber insurance market was valued at approximately $12 billion and is projected to reach over $30 billion by 2028, indicating the significant potential for insurers like Hanover to gain market share by offering tailored solutions in these rapidly developing sectors.

Targeted Personal Lines Expansion

Hanover Insurance Group is focusing on a targeted expansion within the personal lines insurance market, aiming to increase policy counts by enhancing profitability. This strategy leverages specific geographic opportunities within a generally mature sector, potentially creating significant growth pockets.

Their approach emphasizes bundling auto, home, and umbrella policies, a tactic that demonstrably boosts customer retention. For instance, in 2024, Hanover reported a continued focus on this cross-selling initiative, contributing to a more stable and growing customer base.

- Targeted Geographic Expansion: Hanover is identifying and prioritizing specific regions for growth in personal lines, rather than a broad market approach.

- Profitability-Driven Growth: The company's strategy centers on increasing policy counts through improved profitability metrics in these targeted areas.

- Customer Retention through Bundling: Hanover is actively promoting the bundling of auto, home, and umbrella policies to enhance customer loyalty and reduce churn.

- 2024 Performance Indicators: Initiatives like bundling contributed to positive trends in customer retention and policy count growth in key segments during 2024.

AI-Enhanced Underwriting and Claims

Hanover Insurance Group is strategically investing in artificial intelligence (AI) to revolutionize its underwriting and claims processes. This focus on technology is designed to sharpen risk assessment, boost operational efficiency, and expedite claims handling, ultimately strengthening its market position.

The company anticipates that AI-driven tools will significantly increase the processing speed for high-quality submissions in its Excess and Surplus (E&S) lines, potentially doubling throughput. This technological advancement is crucial for maintaining a competitive edge in an insurance landscape increasingly shaped by digital innovation.

- AI Investment: Hanover is channeling resources into AI and other advanced technologies.

- Efficiency Gains: Expect improved operational efficiency and better pricing accuracy.

- Competitive Advantage: The tech focus aims to drive market share in a digital-first environment.

- E&S Throughput: AI is projected to double processing capacity for high-quality E&S submissions.

Stars in Hanover's portfolio represent high-growth, high-market-share segments. The company's specialty insurance lines, particularly cyber insurance, fit this description. These areas demand significant investment but offer substantial returns due to their rapid expansion and strong pricing power.

Hanover's commitment to innovation and targeted growth in niche markets positions these segments for continued success. The strategic investment in AI for underwriting and claims processing further enhances the efficiency and competitiveness of these high-potential areas.

The cyber insurance market, a prime example of a Star, is projected to grow significantly, offering Hanover a prime opportunity to capture market share. This focus on emerging risks and technological advancement underscores their strategy to lead in dynamic insurance sectors.

| Segment | Growth Rate | Market Share | Investment Focus |

| Specialty Insurance | High | High | Technology, Talent |

| Cyber Insurance | Very High | Growing | Innovation, Risk Management |

| Emerging Risks | High | Developing | Strategic Positioning |

What is included in the product

The Hanover Insurance Group's BCG Matrix analyzes its business units, identifying Stars for growth, Cash Cows for stable income, Question Marks for potential, and Dogs for divestment.

The Hanover Insurance Group BCG Matrix provides a clear, one-page overview, alleviating the pain of complex strategic analysis.

Cash Cows

Personal automobile insurance is a cornerstone for Hanover Insurance Group, operating within a mature and stable market where it holds a considerable share. This segment consistently delivers strong performance, evidenced by its positive combined ratios and strategic price adjustments.

In 2024, Hanover's personal lines experienced notable profitability improvements. The company reported a combined ratio for its personal lines segment that was below 100%, indicating underwriting profitability. Furthermore, net premiums written in this segment saw a healthy increase, underscoring its role as a significant cash generator for the group.

Homeowners insurance at Hanover Insurance Group functions as a classic cash cow. Similar to auto insurance, it's a well-established product with steady demand, ensuring consistent revenue. In 2024, Hanover continued to bolster this segment, refining pricing and terms, which contributed to a solid performance.

While natural disasters can introduce volatility, the underlying underwriting results for homeowners insurance, when excluding catastrophic events, are robust. This resilience makes it a dependable source of cash flow for the group. For instance, in the first quarter of 2024, Hanover reported a combined ratio of 94.1% for its property and casualty segment, which includes homeowners, demonstrating profitable underwriting before considering major losses.

Traditional Commercial Property Coverage, a cornerstone for small and mid-sized businesses, is a solid performer for Hanover Insurance Group. This segment is a reliable source of income, consistently bringing in over a third of the company's total net premiums written. For example, in 2023, this sector alone contributed over $3 billion in net premiums, showcasing its significant weight within Hanover's portfolio.

Standard General Liability Insurance (Core Commercial)

Standard General Liability Insurance, a cornerstone of commercial protection, represents a mature market with enduring demand. Hanover Insurance Group's Core Commercial segment, encompassing this vital coverage, demonstrates a robust market standing. This segment is a consistent generator of reliable cash flow for the organization.

The predictable revenue stream from general liability is a key characteristic of a cash cow. In 2024, the property and casualty insurance industry, where general liability resides, continued to show resilience. For example, industry-wide net written premiums in the U.S. for commercial lines were projected to see moderate growth, underscoring the stable demand for foundational products like general liability.

- Market Maturity: General liability is a foundational insurance product with consistent, predictable demand across most industries.

- Hanover's Position: The Core Commercial segment, including general liability, holds a strong market position for Hanover Insurance Group.

- Financial Contribution: This segment provides a stable and reliable source of cash flow, contributing significantly to Hanover's overall financial health.

- Reserve Development: Favorable prior-year reserve development within this segment further enhances its cash flow generation and stability.

Workers' Compensation Insurance

Workers' Compensation insurance is a mature and often regulated line of business, exhibiting consistent demand from employers across various industries. Hanover Insurance Group likely views this segment as a Cash Cow due to its stable premium generation and predictable claims patterns. In 2024, the workers' compensation market continued to be a significant contributor to the P&C insurance sector. For instance, industry-wide direct written premiums for workers' compensation were estimated to be around $60 billion in the US for 2024, reflecting its substantial size and stability.

Hanover's strategic focus on streamlining operations and enhancing customer retention within its workers' compensation offerings, including the implementation of new onboarding programs, underscores its role as a reliable cash generator. This commitment suggests an effort to maximize efficiency and loyalty in a segment that provides steady revenue streams. The company’s emphasis on operational efficiency in this mature market is designed to preserve its profitability and cash-generating capabilities.

The steady premiums and predictable claims patterns inherent in workers' compensation contribute significantly to Hanover's overall profitability. This stability allows for consistent cash flow, which can then be reinvested in other areas of the business or returned to shareholders. As of the first quarter of 2025, Hanover reported that its commercial lines, which include workers' compensation, continued to demonstrate solid performance, with retention rates remaining strong, indicating the ongoing stability of this business line.

Key characteristics of Hanover's Workers' Compensation as a Cash Cow:

- Mature and stable demand from employers.

- Consistent premium generation and predictable claims.

- Focus on operational efficiency and customer retention to maximize profitability.

- Significant contributor to overall company profitability due to its stable nature.

Hanover's personal automobile and homeowners insurance segments are classic cash cows. These lines operate in mature markets with consistent demand, ensuring steady revenue generation. In 2024, Hanover reported a combined ratio below 100% for its personal lines, indicating underwriting profitability, and continued to refine pricing in homeowners insurance, contributing to solid performance despite potential weather volatility.

The company's traditional Commercial Property Coverage and Standard General Liability Insurance also function as cash cows. These segments serve foundational business needs, generating reliable income streams that contribute over a third of Hanover's net premiums written. For instance, commercial lines, including these, showed strong retention in early 2025, underscoring their stability.

Workers' Compensation insurance is another key cash cow for Hanover, benefiting from consistent employer demand and predictable claims. The company's focus on operational efficiency and customer retention in this mature market maximizes profitability. Industry-wide, workers' compensation premiums were estimated to be around $60 billion in the US for 2024, highlighting the segment's substantial and stable nature.

| Segment | Market Characteristic | Hanover's Contribution | 2024/2025 Data Point |

|---|---|---|---|

| Personal Auto | Mature, Stable | Strong Performance, Profitability | Combined Ratio < 100% (Personal Lines) |

| Homeowners | Mature, Steady Demand | Consistent Revenue, Robust Underwriting (Excluding Catastrophes) | Combined Ratio 94.1% (P&C Segment, Q1 2024) |

| Commercial Property | Established, Essential | Reliable Income, Significant Premium Contribution | Contributed > $3 Billion (Net Premiums, 2023) |

| General Liability | Mature, Enduring Demand | Predictable Revenue, Stable Cash Flow | Projected Moderate Growth (Industry-Wide Commercial Lines) |

| Workers' Compensation | Mature, Regulated, Consistent Demand | Steady Premiums, Predictable Claims, Strong Retention | Estimated $60 Billion (Industry-Wide Premiums, 2024) |

What You’re Viewing Is Included

Hanover Insurance Group BCG Matrix

The BCG Matrix analysis of The Hanover Insurance Group you are previewing is the complete, unwatermarked document you will receive upon purchase. This comprehensive report, meticulously prepared with current market data, offers actionable insights for strategic decision-making, and will be delivered directly to you without any modifications or demo content.

Dogs

Certain highly specialized or very small commercial insurance lines within Hanover's portfolio might be experiencing a downturn, characterized by low market share and heightened competition. These segments are likely showing minimal growth and contributing little to the company's overall profitability.

For instance, if a niche line like specialized marine cargo insurance saw only a 1% growth in 2024 compared to the industry average of 5%, and its contribution to Hanover's net written premiums was less than 0.5%, it would fit this description. Such underperforming areas can tie up valuable capital without yielding adequate returns, prompting strategic reviews or potential divestment.

Geographically concentrated catastrophe-prone personal lines represent a potential 'Dog' in Hanover Insurance Group's BCG Matrix. Despite mitigation efforts, persistent high exposure in volatile regions for personal insurance could lead to sustained low profitability. This is due to frequent, significant catastrophe losses, which drain capital without generating adequate returns, consequently limiting growth prospects.

Outdated insurance products and bundles can be a significant drag on a company's performance, often falling into the Dogs category of the BCG Matrix. These are offerings that simply aren't keeping pace with what customers want or what competitors are providing. Think of policies that lack modern features or are bundled in ways that no longer make sense in today's market.

The consequence of this stagnation is a predictable decline in their appeal. We see this reflected in shrinking policy counts and a general struggle to bring in new customers. For Hanover Insurance Group, products in this category would likely show diminishing returns on investment, making it a strategic imperative to either revamp them significantly or consider phasing them out altogether to reallocate resources more effectively.

Highly Competitive, Low-Margin Small Commercial Segments

Within the small commercial insurance market, Hanover Insurance Group, like many insurers, faces pockets of intense competition that can significantly squeeze profit margins. This dynamic often results in low market share and limited growth for Hanover in these specific, highly competitive sub-segments. For instance, in certain niche areas of small commercial, pricing wars can become so aggressive that profitability targets are difficult to meet, even with strong underwriting practices.

These challenging segments may demand a disproportionate amount of marketing and underwriting resources from Hanover, yielding only marginal returns. This can occur even when the broader Core Commercial segment shows positive overall trends. The strain on resources in these low-margin areas can detract from investments in more promising growth opportunities.

Data from 2024 indicates that the small commercial market, while generally robust, experienced varying levels of profitability across different product lines and geographic regions. For example, while cyber liability for small businesses saw significant premium growth, traditional general liability in densely populated urban areas faced intense price competition. Hanover’s performance in these specific competitive niches directly impacts its overall standing in the BCG matrix.

- Intense competition drives down pricing in certain small commercial niches.

- Profit margins are compressed, limiting Hanover's growth and market share in these areas.

- Disproportionate resources may be allocated to these low-margin segments for minimal gain.

- Overall positive trends in Core Commercial can be offset by struggles in specific, highly competitive sub-segments.

Legacy Run-off Business

The Hanover Insurance Group's 'Other' segment, which includes a block of run-off voluntary assumed property and casualty pools business, exemplifies a 'Dog' in the BCG Matrix. This business line, from which Hanover has not actively participated since 1995, is characterized by its lack of growth and the continuous need for liability management without the potential for new premium generation.

This legacy business consumes resources, such as administrative and claims handling costs, without contributing to future revenue streams. For instance, while specific financial figures for this exact segment are not publicly detailed as a standalone item in recent reports, such run-off operations generally represent a drain on capital and management attention. In 2023, companies managing significant run-off portfolios often report expenses related to these legacy liabilities, which can impact overall profitability metrics.

- Lack of Growth Potential: The business has been inactive since 1995, indicating no organic expansion or market share increase.

- Resource Consumption: Ongoing management of existing liabilities requires expenditure without corresponding new revenue.

- No Future Revenue: The absence of active participation means no new premiums are being written.

- Strategic Disadvantage: It ties up capital and management focus that could be better allocated to growth-oriented segments.

Certain niche insurance products within Hanover's portfolio, particularly those with declining market relevance or facing intense competition, are likely classified as Dogs. These offerings typically exhibit low market share and minimal growth prospects, demanding resources without generating significant returns. For example, a specialized product line that experienced a 2% year-over-year decline in policy count during 2024, while the broader market grew by 4%, would fit this profile.

These 'Dog' segments can tie up capital and management attention that could be better deployed in more promising areas of the business. The strategic imperative is often to either revitalize these offerings through innovation or consider divesting them to streamline operations and focus on core strengths.

An example could be an outdated personal lines product that hasn't been updated to reflect current consumer needs or competitive offerings. In 2024, such products might show a market share of less than 1% in their category, with a negative growth rate, indicating a clear need for strategic intervention.

The 'Other' segment, encompassing run-off business from voluntary assumed P&C pools inactive since 1995, represents a classic 'Dog'. This segment consumes administrative and claims handling costs without generating new revenue, effectively draining capital. While specific 2024 figures for this exact segment aren't itemized, the nature of run-off portfolios means ongoing expenses without future premium growth, impacting overall profitability.

Question Marks

The insurance industry's rapid move to digital platforms, including direct-to-consumer sales and collaborations with insurtech firms, places Hanover Insurance Group in a potential Question Mark position. These emerging channels represent a significant growth opportunity, but Hanover might currently hold a smaller market share compared to digitally-focused rivals.

For instance, the global insurtech market size was valued at USD 11.5 billion in 2023 and is projected to grow substantially. To compete effectively, Hanover likely needs to make considerable investments in technology and marketing to build a strong online presence and capture customer interest in these evolving distribution avenues.

Hanover Insurance Group is strategically targeting new states for personal lines expansion, aiming for diversification. These new ventures represent potential growth areas, but initial market share is expected to be modest as Hanover establishes its presence and builds relationships with local agents. For instance, in 2024, the personal lines segment of the insurance industry saw significant shifts, with some states experiencing higher growth rates than others, making targeted expansion crucial for market penetration.

Hanover Insurance Group could expand into specialized risk management advisory services, targeting complex and emerging risks beyond traditional insurance. This would position them to capture growth in a fee-based advisory market that may still be developing for the company. Such an expansion, while requiring investment in expertise and technology, could attract new clients and diversify revenue streams.

Advanced Predictive Analytics for Niche Markets

Investing in advanced predictive analytics for niche markets, like specialized professional liability or unique commercial ventures, positions these initiatives as Question Marks within Hanover Insurance Group's BCG Matrix. While these technologies promise to uncover new revenue streams and offer a competitive edge, the significant upfront investment in developing and integrating them for nascent markets means low current market share, even with high projected future growth.

For instance, consider the burgeoning market for cyber insurance tailored to specific industries like healthcare or critical infrastructure. While the overall cyber insurance market is expanding rapidly, with premiums projected to reach hundreds of billions globally by 2025, the specialized sub-segments require highly granular data and sophisticated modeling. Hanover's investment in predictive analytics for these areas could unlock significant potential, but initial adoption and market penetration will likely be slow.

- High Investment, Low Current Share: Developing bespoke predictive models for niche markets demands substantial R&D and data infrastructure costs, resulting in a small initial market footprint.

- High Growth Potential: These niche markets, such as specialized liability for emerging technologies or unique commercial risks, are often experiencing rapid expansion, offering substantial future upside.

- Uncertainty of Adoption: The effectiveness and acceptance of advanced analytics in these specialized areas are still being proven, adding an element of risk to the investment.

- Strategic Importance: Securing a foothold in these high-potential niches early through technological differentiation can establish Hanover as a market leader.

Customized Solutions for Complex Commercial Accounts

The Hanover Insurance Group could position its highly customized, complex insurance solutions for large or unique commercial accounts as a potential Star or Question Mark in a BCG Matrix analysis. This segment, while perhaps currently having a smaller market share, represents a significant opportunity for high growth due to the substantial premiums associated with bespoke offerings.

Developing these specialized solutions demands considerable investment in resources and expert underwriting capabilities. However, the potential return on investment is substantial, targeting less penetrated, higher-value market niches. For instance, in 2024, the commercial insurance market saw continued demand for tailored risk management strategies, particularly for businesses facing evolving cyber threats and supply chain disruptions, areas where complex accounts often require intricate coverage.

- High Growth Potential: Targeting specialized needs of large or unique commercial entities.

- Lower Market Share: Currently a less penetrated segment for highly customized solutions.

- Resource Intensive: Requires significant investment in specialized underwriting and service.

- Substantial Premium Opportunity: Bespoke offerings can command higher pricing and profitability.

Hanover's ventures into new states for personal lines expansion are classic Question Marks. While these markets offer high growth potential, Hanover's current market share is likely modest as it establishes its presence and builds agent relationships.

Similarly, investments in advanced predictive analytics for niche markets, like specialized professional liability, also fall into the Question Mark category. These areas promise significant future growth, but the substantial upfront investment in technology and data infrastructure means a low current market share.

The company's expansion into specialized risk management advisory services also represents a Question Mark. This fee-based market has high growth potential, but Hanover's current penetration and market share are likely limited as it builds expertise and client relationships in these complex areas.

The development of highly customized insurance solutions for large or unique commercial accounts can be viewed as a Question Mark or a potential Star. While these bespoke offerings target a high-growth, high-premium segment, Hanover's current market share in this specialized area may be relatively small, requiring significant investment in underwriting expertise and resources.

BCG Matrix Data Sources

Our Hanover Insurance Group BCG Matrix leverages comprehensive data from annual reports, investor filings, and industry-specific market research to accurately assess business unit performance and market dynamics.