Hanover Insurance Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanover Insurance Group Bundle

Unlock the core strategies behind The Hanover Insurance Group's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer segments, value propositions, and key revenue streams, offering a clear view of how they operate.

Dive deeper into how The Hanover Insurance Group builds and delivers value. Our full Business Model Canvas provides an in-depth look at their channels, customer relationships, and cost structure, making it an invaluable resource for strategic analysis.

Want to understand the engine driving The Hanover Insurance Group's market position? Download the complete Business Model Canvas to explore their key resources, activities, and partnerships, and gain actionable insights for your own business.

Partnerships

The Hanover Insurance Group's primary distribution channel relies heavily on independent agents and brokers. These partners are vital for connecting Hanover's insurance products with individuals, families, and businesses, providing tailored advice and leveraging their local market knowledge. This network is fundamental to Hanover's market reach and ability to acquire new customers.

The Hanover Insurance Group relies on reinsurance companies to manage and mitigate large-scale risks, especially those stemming from catastrophic events. This strategic partnership allows The Hanover to transfer a portion of its underwriting risk, which in turn bolsters its financial stability and its ability to handle substantial claims.

This practice is fundamental within the insurance sector, contributing significantly to maintaining robust balance sheet strength. For instance, in 2023, the property and casualty insurance industry saw significant reinsurance activity as insurers sought to protect themselves from the impacts of climate-related events and other large losses.

The Hanover Insurance Group actively partners with technology and data providers to sharpen its operational efficiency and risk assessment. For instance, in 2024, the company continued its focus on digital APIs for agents, streamlining the quoting and binding process. These collaborations are crucial for enhancing customer experience and enabling more sophisticated pricing models.

Strategic investments in advanced analytics are a cornerstone of The Hanover's approach, allowing for more precise risk selection. The company is also leveraging artificial intelligence across its operations, including claims processing, aiming for significant efficiency gains. These technological integrations are vital for staying competitive in the evolving insurance landscape.

Claims Service Providers

Hanover Insurance Group relies on a robust network of claims service providers to ensure efficient and effective claim resolution. These partnerships are critical for delivering on promises to policyholders.

These collaborations include agreements with auto repair shops, property restoration companies, and legal services. By working with these specialized entities, Hanover can expedite the claims process, ensuring policyholders receive prompt and quality assistance when they need it most.

The strategic aim of these partnerships is to streamline operations and minimize disruption for those experiencing a loss. For instance, in 2024, Hanover continued to emphasize speed and quality in its claims handling, aiming to restore policyholders to their pre-claim condition as quickly as possible.

- Auto Repair Networks: Partnerships with certified auto repair facilities ensure policyholders receive timely and quality repairs after vehicle incidents.

- Property Restoration Specialists: Collaborations with restoration companies provide essential services for property damage, facilitating a swift return to normalcy.

- Legal and Investigative Services: Engaging external legal and investigative experts supports the complex aspects of claims management, ensuring thoroughness and compliance.

Affinity Groups and Associations

The Hanover Insurance Group actively cultivates partnerships with affinity groups and professional associations. These collaborations are designed to deliver specialized insurance products and services directly to the members of these organizations. By aligning with groups that share common interests or professional affiliations, Hanover gains access to distinct customer segments, enabling more precise and effective marketing campaigns.

These strategic alliances are instrumental in expanding Hanover's market reach and fostering the development of niche insurance offerings. For instance, in 2024, the insurance industry saw a continued trend of insurers partnering with professional bodies to offer tailored liability or cyber insurance, reflecting the growing need for specialized coverage. Such arrangements allow Hanover to tailor policies that address the unique risks and needs of specific member groups, thereby enhancing customer value and loyalty.

The benefits of these key partnerships are multifaceted:

- Access to Niche Markets: Partnerships provide direct entry into pre-qualified customer bases with specific insurance requirements.

- Targeted Marketing: Leveraging the communication channels of affinity groups allows for highly focused and efficient outreach.

- Product Specialization: Collaborations facilitate the creation of customized insurance solutions that resonate with the needs of association members.

- Enhanced Brand Credibility: Association with reputable groups can bolster Hanover's reputation and trustworthiness within specific sectors.

Hanover's key partnerships with independent agents and brokers are crucial for market penetration and customer acquisition, forming the backbone of its distribution strategy. Reinsurance partners are vital for risk management, enabling financial stability and the capacity to absorb large losses, a critical function in the volatile insurance landscape. Collaborations with technology and data providers enhance operational efficiency and risk assessment capabilities, with a continued focus in 2024 on digital agent tools and AI integration for improved customer experience and pricing.

Hanover also relies on a network of claims service providers, including auto repair shops and restoration companies, to ensure timely and effective resolution of policyholder claims, a key element in customer satisfaction and retention. Partnerships with affinity groups and professional associations allow for targeted product development and access to specialized customer segments, a strategy that continued to gain traction in 2024 as insurers sought niche market growth.

| Partnership Type | Strategic Importance | 2024 Focus/Data Point |

|---|---|---|

| Independent Agents/Brokers | Distribution & Customer Acquisition | Continued investment in digital APIs for agents |

| Reinsurance Companies | Risk Management & Financial Stability | Mitigating climate-related event risks |

| Technology/Data Providers | Operational Efficiency & Risk Assessment | AI integration in claims processing |

| Claims Service Providers | Customer Satisfaction & Claims Resolution | Emphasis on speed and quality in claims handling |

| Affinity Groups/Associations | Niche Market Access & Product Specialization | Development of tailored liability/cyber insurance |

What is included in the product

A comprehensive, pre-written business model tailored to The Hanover Insurance Group’s strategy, detailing customer segments, channels, and value propositions.

Reflects the real-world operations and plans of The Hanover Insurance Group, organized into 9 classic BMC blocks with full narrative and insights.

The Hanover Insurance Group's Business Model Canvas acts as a pain point reliever by providing a clear, structured overview of their operations, allowing for rapid identification of inefficiencies and opportunities for improvement.

It simplifies complex insurance processes into a digestible format, enabling quick analysis and strategic adjustments to better address customer pain points and market challenges.

Activities

Underwriting and risk selection are central to Hanover Insurance Group's operations, focusing on meticulously assessing and choosing which risks to insure to ensure profitability. This involves rigorous underwriting across personal, commercial, and specialty insurance segments, coupled with competitive pricing strategies.

Hanover prioritizes securing high-quality accounts and makes proactive rate adjustments to enhance its profit margins. For instance, in the first quarter of 2024, Hanover reported a combined ratio of 89.2%, a testament to their effective risk selection and pricing strategies.

Hanover's key activity of claims management and processing is central to its customer promise, focusing on efficiency and transparency. This involves a multi-step process from initial report intake to final payment, aiming for speed and clarity.

In 2024, Hanover continued to invest in technology and training to streamline claims handling, recognizing its direct impact on customer satisfaction and loyalty. The company's approach emphasizes providing policyholders with expert guidance and user-friendly tools throughout the claims journey.

The effectiveness of this process is crucial, as a smooth claims experience can significantly boost customer retention. For instance, in the first quarter of 2024, Hanover reported a claims satisfaction score of 92%, highlighting the success of their diligent processing efforts.

Hanover Insurance Group's core activities revolve around the continuous development and refinement of insurance products and services. This means they are always working to create new offerings and improve existing ones to keep up with what customers want and what the market needs. For example, they might expand their auto insurance to include special add-ons that make it more comprehensive and appealing.

A significant part of this product development involves offering specialized coverage tailored for different industries. This allows businesses in various sectors to get insurance that specifically addresses their unique risks and operational needs. This targeted approach is a key differentiator in the competitive insurance landscape.

Innovation is also a driving force, with Hanover actively leveraging technology to create new solutions. This could involve using data analytics to better understand risk, developing digital platforms for easier customer interaction, or exploring emerging technologies like AI to enhance their underwriting and claims processes. In 2024, the insurance industry saw significant investment in insurtech, with companies like Hanover aiming to stay at the forefront of these advancements.

Agent Relationship Management

The Hanover Insurance Group's key activity revolves around meticulously managing and nurturing its extensive network of independent agents. This is crucial for their distribution model, ensuring these partners have the essential resources to succeed.

This management includes equipping agents with cutting-edge digital tools and comprehensive training programs. The goal is to empower them to effectively market and sell The Hanover's diverse insurance products, fostering a strong and productive partnership.

The company's commitment to agent support is evident in its investment in technology and dedicated personnel. For instance, in 2023, The Hanover reported a significant increase in agent engagement with its digital platforms, reflecting a successful push to streamline operations and enhance the agent experience.

- Digital Platform Enhancement: Continuous investment in user-friendly agent portals and sales enablement tools.

- Training and Development: Offering specialized product training and sales strategy workshops.

- Dedicated Support: Providing responsive field support and underwriting assistance.

- Performance Incentives: Implementing programs that reward successful sales and long-term partnerships.

Investment Management

Hanover Insurance Group actively manages its investment portfolio, a critical activity for generating income from collected premiums and reserves. This strategic management aims to provide stable returns and bolster the company's financial strength.

A significant portion of Hanover's revenue is derived from investment income. In 2023, for example, investment income played a crucial role in the company's overall financial performance, contributing positively to earnings.

The company emphasizes a high-quality investment portfolio, with a strong allocation to fixed-income securities. This focus is designed to ensure capital preservation and consistent income generation.

- Investment Portfolio Management: Actively managing collected premiums and reserves to generate investment income.

- Revenue Generation: Investment income is a substantial revenue stream for the company.

- Portfolio Composition: Primarily invested in high-quality fixed-income securities for stability and returns.

- Financial Strength: This activity directly supports and enhances the company's overall financial stability.

Hanover Insurance Group's key activities center on underwriting and risk selection, where they meticulously assess and choose insurance risks for profitability. This involves rigorous underwriting across personal, commercial, and specialty insurance, alongside competitive pricing. In Q1 2024, Hanover achieved a combined ratio of 89.2%, indicating effective risk management and pricing.

Claims management is another vital activity, focusing on efficient and transparent processing from initial report to final payment. Hanover invested in technology and training in 2024 to improve claims handling, aiming for speed and clarity. Their Q1 2024 claims satisfaction score was 92%, reflecting successful processing efforts.

Product development and innovation are ongoing, with Hanover creating new and improving existing insurance offerings to meet market demands. They focus on specialized coverage for various industries and leverage technology like data analytics and AI to enhance their services. The industry saw significant insurtech investment in 2024, a trend Hanover aims to lead.

Managing its network of independent agents is a crucial activity, providing them with digital tools and training to sell Hanover's products effectively. Agent engagement with digital platforms increased significantly in 2023, showcasing successful operational streamlining.

Hanover also actively manages its investment portfolio to generate income from premiums and reserves, aiming for stable returns and financial strength. Investment income was a substantial revenue contributor in 2023, with the portfolio primarily composed of high-quality fixed-income securities for capital preservation.

| Key Activity | Description | 2024 Data/Example |

| Underwriting & Risk Selection | Assessing and selecting insurance risks for profitability. | Q1 2024 Combined Ratio: 89.2% |

| Claims Management | Efficient and transparent processing of insurance claims. | Q1 2024 Claims Satisfaction Score: 92% |

| Product Development & Innovation | Creating and improving insurance offerings, leveraging technology. | Focus on insurtech advancements in 2024. |

| Agent Network Management | Supporting independent agents with tools and training. | Increased agent engagement with digital platforms in 2023. |

| Investment Portfolio Management | Generating income from premiums and reserves for financial strength. | Investment income contributed positively to 2023 earnings. |

Preview Before You Purchase

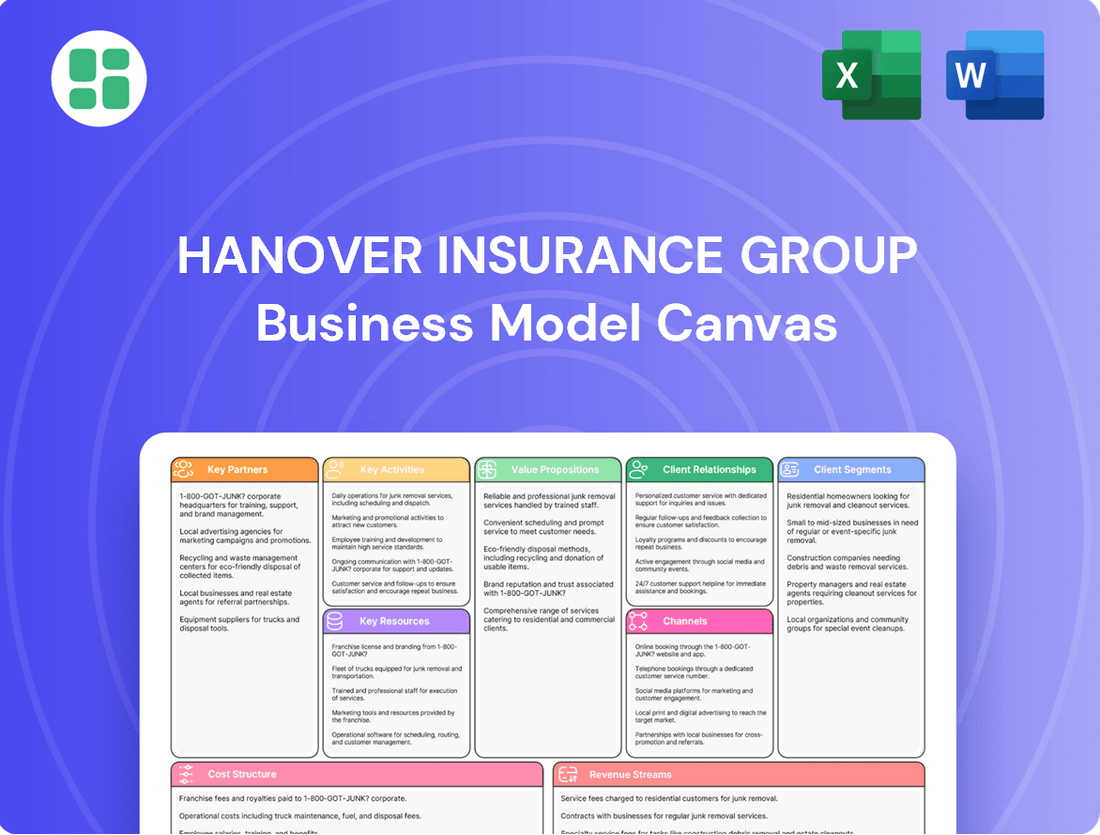

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means you're seeing the complete, unedited structure and content that will be delivered to you, allowing for immediate application and analysis. You can be assured that the file you access after completing your order will be this exact Business Model Canvas, ready for your strategic planning needs.

Resources

Hanover Insurance Group's financial capital and reserves are foundational to its operations, enabling it to absorb unexpected losses and reliably pay claims, thereby ensuring solvency. This strong financial footing is evidenced by its solid financial ratings and a growing book value per share, which stood at $106.12 as of the end of the first quarter of 2024, demonstrating its commitment to policyholders and its underwriting capacity.

Hanover Insurance Group relies heavily on its human capital and expertise. This includes highly skilled professionals such as underwriters, actuaries, claims adjusters, and IT specialists who are critical for effective risk assessment, pricing strategies, and claims management. For instance, in 2024, the company continued to invest in talent development programs to ensure its workforce remains at the forefront of industry knowledge and technological advancements.

The company's performance is directly driven by the deep expertise of its workforce in areas like risk assessment, pricing, claims handling, and technological innovation. An experienced management team, coupled with a talented and dedicated workforce, forms the backbone of Hanover's ability to consistently meet its customer commitments and navigate the complexities of the insurance market.

Hanover Insurance Group's advanced technology infrastructure, encompassing underwriting platforms, claims processing systems, and robust data analytics, is a cornerstone of its operations. This technological backbone allows for streamlined efficiency and sophisticated risk assessment.

The company's investment in artificial intelligence and digital tools, as seen in its 2024 initiatives, underscores its dedication to leveraging cutting-edge technology for competitive advantage. This focus drives innovation in product development and customer engagement.

Brand Reputation and Trust

The Hanover Insurance Group's brand reputation and trust are cornerstones of its business model, acting as critical intangible resources. A long-standing history, dating back to 1906, has fostered a deep sense of reliability and financial strength among its policyholders and a network of independent agents. This established trust is paramount for attracting and retaining business in the competitive insurance landscape.

This reputation is further bolstered by a consistent commitment to excellent customer service and corporate responsibility initiatives. In 2023, for example, The Hanover was recognized by Forbes as one of America's Best Insurance Companies, a testament to its customer-centric approach. This positive brand equity directly translates into a stronger ability to acquire new customers and maintain existing relationships, which are vital for sustained growth.

The importance of trust is evident in customer retention rates. While specific figures for The Hanover are not publicly detailed for this aspect alone, the insurance industry generally sees higher retention among companies with strong reputations. For instance, J.D. Power's 2024 U.S. Auto Insurance Study indicated that customers who reported high levels of trust were significantly more likely to remain with their insurer.

- Brand Reputation: Built on reliability, financial strength, and customer service excellence.

- Trust: Essential for attracting and retaining policyholders and independent agents.

- History: Over a century of operation contributes to brand equity.

- Corporate Responsibility: Commitment to social and ethical practices enhances brand image.

Independent Agent Network

The extensive network of independent agents is a core strength for The Hanover Insurance Group, acting as a vital link to customers. This network provides broad market reach and ensures localized, personalized service, which is crucial for building trust and facilitating policy sales and ongoing support. In 2024, The Hanover continued to leverage this network as a cornerstone of its distinctive distribution strategy, aiming to enhance customer engagement and retention.

These agents are more than just salespeople; they function as trusted advisors to their clients. They build strong relationships by understanding individual needs and offering tailored insurance solutions. This personal touch is a key differentiator in a competitive market, allowing The Hanover to effectively serve a diverse customer base.

- Market Reach: The independent agent network grants The Hanover access to a wide array of markets and customer segments across various geographic regions.

- Customer Relationships: Agents foster deep customer loyalty through personalized advice and dedicated service, enhancing client retention.

- Distribution Strategy: This network is fundamental to The Hanover's approach, enabling efficient policy placement and servicing.

The Hanover Insurance Group's key resources are its robust financial capital, skilled human capital, advanced technology, and strong brand reputation. Financial strength, evidenced by a book value per share of $106.12 as of Q1 2024, underpins its ability to pay claims and maintain solvency. Its workforce, comprising experts in underwriting, actuarial science, and claims, drives effective risk management and innovation, with ongoing investment in talent development in 2024. A century-long history, dating back to 1906, coupled with customer service excellence, as recognized by Forbes in 2023, cultivates trust and brand equity, crucial for customer acquisition and retention.

The company's independent agent network is a critical resource, providing extensive market reach and personalized customer service. These agents act as trusted advisors, fostering strong client relationships and enabling efficient policy distribution and support. In 2024, The Hanover continued to prioritize this network as a cornerstone of its distribution strategy, aiming to deepen customer engagement and loyalty.

| Key Resource | Description | Supporting Data/Initiatives |

|---|---|---|

| Financial Capital & Reserves | Enables solvency and claim payments. | Book value per share: $106.12 (Q1 2024). |

| Human Capital | Expertise in underwriting, actuarial science, claims. | Continued investment in talent development (2024). |

| Technology Infrastructure | Streamlines operations and enhances risk assessment. | Investment in AI and digital tools (2024 initiatives). |

| Brand Reputation & Trust | Fosters customer loyalty and market acquisition. | Forbes recognition as one of America's Best Insurance Companies (2023). |

| Independent Agent Network | Provides market reach and personalized customer service. | Core to distribution strategy (2024 focus). |

Value Propositions

The Hanover Insurance Group offers a broad spectrum of property and casualty insurance, encompassing auto, home, commercial, and specialized coverages. This allows customers to consolidate their insurance needs with one provider, simplifying their protection strategies. In 2024, Hanover reported a robust commercial lines segment, demonstrating its ability to serve diverse business needs effectively.

Beyond just providing policies, Hanover emphasizes risk management services designed to proactively mitigate potential losses for its clients. This dual approach of comprehensive coverage and loss prevention is a core element of their value proposition. For instance, their commitment to helping businesses manage risks was evident in their continued investment in data analytics to identify and address emerging threats throughout 2024.

Hanover Insurance Group's value proposition centers on personalized service delivered through a robust network of independent agents. These agents are more than just salespeople; they are trusted advisors who offer localized support and expert guidance.

Customers receive tailored advice, helping them navigate the often-complex world of insurance and ensuring their policies precisely match their unique needs. This human-centric approach fosters strong relationships and builds confidence.

In 2024, Hanover reported that over 90% of its customers interacted with an independent agent for policy management and claims, highlighting the critical role these professionals play in customer satisfaction and retention.

Hanover Insurance Group offers significant peace of mind by showcasing robust financial strength and stability, ensuring it can meet policyholder obligations even during periods of high claim volume. This reliability is a cornerstone of their value proposition.

Customers gain assurance knowing that Hanover's financial health, often reflected in high ratings from agencies like AM Best, means their claims will be processed and paid. For instance, AM Best affirmed Hanover's Financial Strength Rating (FSR) of A (Excellent) in 2024, a testament to their enduring financial capacity.

Efficient and Transparent Claims Experience

The Hanover Insurance Group's commitment to an efficient and transparent claims experience is a cornerstone of its value proposition. This means policyholders can expect a streamlined, clear, and supportive process during what is often a difficult time. The company focuses on handling claims with speed and keeping customers informed throughout each stage, aiming to restore them to their pre-claim situation as quickly as possible.

This emphasis on ease and rapid resolution is particularly crucial for individuals and businesses facing unexpected losses. In 2024, the insurance industry, including The Hanover, continued to leverage technology to enhance claims processing. For instance, many insurers reported increased adoption of digital tools for first notice of loss (FNOL) and damage assessment, contributing to faster settlement times.

- Streamlined Process: Hanover prioritizes a simplified and efficient claims handling, reducing complexity for policyholders.

- Transparency: Policyholders are kept informed at every step, fostering trust and reducing anxiety during the claims journey.

- Empathetic Support: The company aims to provide necessary assistance and understanding, recognizing the stressful nature of claims.

- Restoration Focus: A key objective is to help policyholders recover and return to their normal operations or lives swiftly.

Tailored Solutions for Specific Needs

Hanover Insurance Group excels by offering specialized insurance products tailored for niche markets and complex risks, especially within their commercial and specialty segments. This focus allows them to craft customized solutions that go beyond standard policies, addressing the unique needs of specific industries or individual client situations.

This capability to deliver bespoke coverage is a key differentiator, providing substantial value to specialized customer groups who require more than a one-size-fits-all approach. For example, in 2024, Hanover continued to expand its offerings in areas like cyber liability and professional liability, demonstrating its commitment to meeting evolving, complex risk exposures.

- Specialized Products: Development of niche insurance products for specific industries and complex risks.

- Customized Solutions: Ability to create bespoke policies beyond standard offerings to meet unique client needs.

- Value Proposition: Significant differentiation and added value for specialized customer segments.

- Market Focus: Strong presence in commercial and specialty lines, catering to distinct market requirements.

Hanover Insurance Group provides comprehensive property and casualty insurance, simplifying protection by allowing customers to consolidate needs with a single provider. Their robust commercial lines segment in 2024 highlights their effectiveness in serving diverse business requirements.

Beyond coverage, Hanover offers risk management services, proactively mitigating client losses. This dual approach of protection and prevention is key. Their 2024 investment in data analytics to identify emerging threats underscores this commitment.

Hanover's value proposition is built on personalized service through independent agents, who act as trusted advisors. These agents provide localized support and expert guidance, ensuring policies precisely match client needs. In 2024, over 90% of customer interactions involved an independent agent, emphasizing their role in satisfaction and retention.

Financial strength and stability are paramount, assuring policyholders that Hanover can meet obligations. This reliability is reinforced by high ratings, such as AM Best's affirmation of Hanover's Financial Strength Rating of A (Excellent) in 2024.

Hanover ensures an efficient and transparent claims experience, simplifying the process during difficult times. They focus on speed and communication to restore policyholders quickly. In 2024, the industry's adoption of digital tools for claims processing contributed to faster settlements.

Hanover excels in offering specialized insurance products for niche markets and complex risks, particularly in commercial and specialty segments. This allows for customized solutions beyond standard policies, meeting unique industry or client needs. Their 2024 expansion into cyber and professional liability demonstrates adaptability to evolving risks.

| Value Proposition Aspect | Description | 2024 Data/Example |

|---|---|---|

| Comprehensive Coverage & Risk Management | One-stop solution for property & casualty needs, with proactive loss mitigation services. | Robust commercial lines segment performance; investment in data analytics for threat identification. |

| Personalized Agent Network | Trusted advisors offering localized support and tailored insurance advice. | Over 90% of customer interactions involved an independent agent in 2024. |

| Financial Strength & Stability | Assurance of ability to meet policyholder obligations, backed by strong financial ratings. | AM Best affirmed Financial Strength Rating of A (Excellent) in 2024. |

| Efficient & Transparent Claims | Streamlined, clear, and supportive claims process focused on rapid restoration. | Industry trend of increased digital tool adoption for faster claims processing. |

| Specialized & Customized Products | Niche insurance offerings for complex risks and unique client needs. | Expansion in cyber liability and professional liability offerings in 2024. |

Customer Relationships

Hanover Insurance Group's customer relationships are primarily built through its extensive network of independent agents. These agents act as the direct link, cultivating personal connections with policyholders by offering ongoing support, expert advice, and a reliable point of contact for all insurance needs, from initial inquiries to claims processing.

This agent-led, high-touch model is designed to foster deep trust and encourage long-term customer engagement. In 2024, Hanover reported that over 90% of its policies were distributed through this agent channel, underscoring the critical role these relationships play in customer retention and satisfaction.

Hanover Insurance Group's dedicated claims support is a cornerstone of their customer relationships. During the often stressful claims process, customers are assigned a specific claims adjuster. This ensures a personal and responsive experience, with clear communication throughout.

This dedicated approach aims to alleviate customer anxiety by providing consistent assistance. Hanover's focus on empathy and efficiency during claims handling is designed to foster trust and loyalty.

The Hanover Insurance Group enhances its agent-centric approach with robust digital self-service options. Customers can leverage online portals and mobile applications for convenient policy management, real-time claim tracking, and streamlined communication. This digital integration, including text updates and easy access to policy documents, ensures customers can manage their insurance needs efficiently and on their own schedule.

Proactive Risk Management Guidance

Hanover Insurance Group actively cultivates customer relationships by offering proactive risk management guidance. This goes beyond simply processing claims, aiming to empower policyholders to prevent losses. For instance, in 2024, Hanover continued to provide a wealth of educational materials, including safety articles and instructional videos, designed to help businesses and individuals identify and mitigate potential hazards.

This commitment is further solidified through strategic partnerships with specialized risk management providers. These collaborations allow Hanover to offer customers access to expert advice and services, such as on-site risk assessments and tailored safety training programs. Such initiatives demonstrate a deep investment in the long-term well-being and security of their clientele.

Key aspects of this proactive approach include:

- Educational Resources: Providing readily accessible safety articles, best practice guides, and video tutorials covering a broad range of potential risks.

- Risk Mitigation Tools: Offering access to tools and checklists that help customers assess their own risk exposures and implement preventative measures.

- Partnership Programs: Collaborating with third-party risk management experts to deliver specialized services like loss control consultations and disaster preparedness planning.

- Claims Prevention Focus: Shifting the emphasis from reactive claim resolution to proactive strategies that minimize the likelihood of claims occurring in the first place.

Loyalty and Retention Programs

Hanover Insurance Group, like many insurers, likely employs loyalty and retention programs to keep customers. These often include incentives for policy renewals, discounts for bundling multiple policies, and a consistent focus on high-quality customer service. These efforts are vital for sustained profitability.

- Renewal Incentives: Offering discounts or enhanced coverage for continuing policies.

- Multi-Policy Discounts: Encouraging customers to consolidate their insurance needs with Hanover.

- Service Quality: Providing reliable claims processing and responsive customer support to build trust.

High customer retention is a cornerstone of profitability in the insurance sector. For instance, the U.S. property and casualty insurance industry saw retention rates often exceeding 85% in recent years, demonstrating the financial impact of keeping existing customers.

Hanover Insurance Group cultivates deep customer relationships through a robust agent network, dedicated claims adjusters, and proactive risk management guidance. This multi-faceted approach, augmented by digital self-service options, aims to foster trust and long-term loyalty.

In 2024, Hanover's commitment to its agent channel remained paramount, with over 90% of policies distributed through this avenue, highlighting the personal touch agents provide in addressing customer needs and concerns.

The insurer's focus on proactive risk management, including educational resources and partnerships with risk experts, aims to prevent losses and enhance customer security, further solidifying these relationships.

Hanover's customer retention efforts, likely including renewal incentives and multi-policy discounts, are crucial for sustained profitability, mirroring industry trends where high retention rates are standard.

| Customer Relationship Aspect | Description | 2024 Data/Trend |

|---|---|---|

| Agent Network | Primary distribution and personal support | Over 90% of policies distributed via agents |

| Dedicated Claims Support | Personalized assistance during claims | Assigned adjuster for responsive communication |

| Risk Management Guidance | Proactive loss prevention and education | Continued provision of safety articles and videos |

| Digital Self-Service | Convenient online and mobile policy management | Enhanced portals and mobile apps for policyholders |

Channels

Independent insurance agents and brokers are the cornerstone of The Hanover Insurance Group's distribution strategy. This vast network acts as the primary sales and service conduit, connecting the company directly with individuals, families, and businesses seeking tailored insurance solutions and local expertise.

These agents are crucial for providing personalized advice and support, making them the most significant channel for Hanover. In 2024, independent agents continued to represent the majority of The Hanover's new business and renewal premiums across its property and casualty lines.

The Hanover's official website and customer portals are crucial digital touchpoints, allowing policyholders to easily access policy details, manage their accounts, and begin the claims process. While not designed for new policy acquisition, these platforms significantly enhance existing customer engagement and offer a wealth of helpful resources.

These online channels prioritize self-service and information accessibility, streamlining interactions for policyholders. In 2024, The Hanover continued to invest in these digital assets, aiming to provide a seamless and efficient experience for their customer base, mirroring industry trends towards digital-first customer service.

The Hanover Insurance Group leverages digital marketing and advertising extensively to connect with potential customers and bolster its independent agent network. This includes targeted online advertising campaigns, a robust social media presence, and informative content marketing strategies designed to build brand awareness and educate the market about The Hanover's diverse insurance products.

In 2024, digital channels are crucial for lead generation, directly feeding interest to the company's independent agents. The Hanover's investment in digital marketing aims to expand its reach beyond traditional methods, ensuring it captures a significant share of the online insurance market. For instance, in the first half of 2024, digital ad spend for the insurance sector saw a notable increase, reflecting the channel's growing importance.

Direct Mail and Print Marketing

Direct mail and print marketing, while often overshadowed by digital strategies, remain valuable channels for The Hanover Insurance Group to connect with specific customer segments. These traditional methods can be particularly effective for promoting new insurance products or highlighting specialized coverage options to a precisely targeted audience.

For instance, in 2024, The Hanover might utilize direct mail campaigns to reach small business owners in a particular geographic area with tailored commercial insurance offerings. Print advertisements in industry-specific publications can also serve to reinforce brand visibility and communicate key value propositions to a professional audience.

These channels complement digital marketing efforts by providing a tangible touchpoint and reinforcing consistent brand messaging across multiple platforms. This multi-channel approach helps ensure broader reach and deeper engagement.

- Targeted Reach: Direct mail allows for precise segmentation, reaching specific demographics or business types with relevant insurance products.

- Brand Reinforcement: Print advertisements in trade journals or local publications can enhance brand recognition and credibility among key audiences.

- Complementary Strategy: These traditional methods work in tandem with digital channels, providing a comprehensive marketing mix.

- Product Promotion: Direct mail and print can be effective for announcing new policies or special offers to existing or potential customers.

Strategic Partnerships and Referrals

The Hanover Insurance Group actively cultivates strategic partnerships beyond its core independent agent network. These alliances serve as crucial channels for customer acquisition, tapping into established client bases of complementary businesses. For instance, collaborations with real estate agencies and mortgage lenders can provide a steady stream of new policyholders during significant life events like home purchases. In 2024, the property and casualty insurance industry saw continued growth in referral-based business, with many insurers reporting a significant portion of new customers originating from such partnerships.

These collaborations extend to industry associations, where The Hanover can gain access to specialized markets and offer tailored insurance solutions. By embedding its offerings within trusted networks, the company enhances its market penetration and brand visibility. This approach is particularly effective in niche markets where direct marketing might be less efficient. For example, partnerships with automotive associations could lead to increased auto insurance sales.

- Real Estate Agencies: Facilitate homeowner's insurance referrals during property transactions.

- Mortgage Lenders: Drive referrals for homeowner's insurance to protect their collateral.

- Industry Associations: Offer specialized insurance products to members, like professional liability for specific trades.

- Financial Advisors: Cross-sell insurance products as part of broader financial planning.

The Hanover Insurance Group utilizes a multi-faceted channel strategy, heavily leaning on its vast network of independent agents and brokers for sales and service. Digital platforms, including the company's website and customer portals, are vital for policyholder engagement and self-service, though not primary for new business acquisition. Digital marketing and advertising are crucial for lead generation, feeding prospects to agents and expanding market reach.

Traditional channels like direct mail and print marketing remain relevant for targeted outreach and brand reinforcement, complementing digital efforts. Strategic partnerships with entities such as real estate agencies and industry associations provide access to new customer segments and drive referral-based business, enhancing market penetration.

| Channel Type | Primary Function | Key Benefit | 2024 Focus |

|---|---|---|---|

| Independent Agents/Brokers | Sales, Service, Local Expertise | Personalized Advice, Broad Reach | Majority of new business and renewals |

| Digital Platforms (Website, Portals) | Policy Management, Information Access | Customer Engagement, Self-Service | Enhancing user experience and resources |

| Digital Marketing/Advertising | Lead Generation, Brand Awareness | Expanded Reach, Targeted Prospects | Capturing online market share, feeding agents |

| Direct Mail/Print | Targeted Promotion, Brand Reinforcement | Specific Segment Reach, Tangible Touchpoint | Promoting specialized products to defined audiences |

| Strategic Partnerships | Customer Acquisition, Niche Market Access | Referral Business, Embedded Offerings | Growth in referral-based business, industry collaborations |

Customer Segments

The Hanover Insurance Group serves individuals and families by providing essential personal lines insurance. This includes coverage for their homes and vehicles, offering peace of mind through auto, home, and umbrella policies. These customers prioritize robust protection, fair pricing, and efficient claims handling, needs The Hanover aims to meet with its diverse product offerings.

In 2024, the personal lines insurance market continued to see steady demand, with homeowners insurance premiums showing an average increase of 5-10% across the industry due to rising construction costs and increased weather-related claims. The Hanover's strategy focuses on delivering value through comprehensive packages tailored to varying coverage requirements, ensuring customers can find the right fit for their financial and protection needs.

Small to mid-sized businesses represent a substantial portion of The Hanover's customer base, seeking essential commercial insurance products. These include crucial coverages like property, general liability, workers' compensation, and commercial auto to safeguard their daily operations.

These businesses actively seek customized insurance policies, expert risk management guidance, and streamlined claims handling to ensure business continuity. The Hanover strategically targets these accounts, prioritizing quality and stability within this vital market segment.

In 2024, The Hanover continued its focus on this segment, recognizing its importance to overall growth and profitability. This segment typically accounts for a significant percentage of the company's written premiums, underscoring its strategic value.

The Hanover Insurance Group actively targets specialized industries and professions, recognizing their need for tailored insurance solutions beyond standard offerings. This includes sectors like marine, where unique risks demand specialized policies, and professional services requiring robust errors and omissions (E&O) coverage. Their expertise in these niche markets allows them to effectively underwrite and service these complex demands.

For instance, in 2023, the specialty insurance market, which encompasses many of these niche segments, continued to show resilience and growth. The Hanover's focus on professional liability, a key component of this segment, is particularly important as the complexity of professional services, from technology consultants to healthcare providers, escalates, driving demand for comprehensive protection against potential claims.

Independent Agents and Brokers (as business partners)

Independent agents and brokers are more than just a distribution channel for The Hanover; they are vital business partners. The company’s success hinges on its ability to offer these agents compelling products, robust support services, and streamlined operational workflows to foster loyalty and attract new partnerships. In 2024, The Hanover continued to invest in its agent relationships, recognizing that their engagement directly amplifies the company's market presence and overall performance.

The value proposition for these agents is multifaceted. The Hanover aims to provide:

- Competitive Products: Offering a diverse and attractive portfolio of insurance solutions that meet the needs of various client segments.

- Strong Support: Providing agents with dedicated resources, underwriting expertise, and marketing assistance to help them succeed.

- Efficient Processes: Ensuring user-friendly technology platforms and responsive service to facilitate smooth business transactions.

High-Net-Worth Individuals

High-net-worth individuals represent a discerning customer segment for Hanover Insurance Group, often requiring elevated policy limits and bespoke coverage for unique assets like luxury vehicles, fine art, or multiple residences. This group values a high degree of personalization and discretion in their insurance interactions, seeking tailored solutions that reflect their affluence and complex needs.

Hanover's 'Prestige' auto insurance package, for instance, caters to this niche by offering premium coverage options, signaling an understanding of the desire for enhanced protection and specialized services. In 2024, the global wealth market continued its expansion, with the number of high-net-worth individuals increasing, underscoring the significant market potential for insurers adept at serving this segment.

- Higher Policy Limits: Catering to substantial asset values.

- Specialized Coverage: Addressing unique risks associated with valuable possessions.

- Personalized Service: Emphasizing discretion and tailored solutions.

- Premium Offerings: Such as the 'Prestige' auto insurance package.

The Hanover Insurance Group strategically targets independent agents and brokers, viewing them as crucial business partners rather than just a distribution channel. This segment is vital for market penetration and overall performance, as agents' engagement directly influences Hanover's reach and success. The company focuses on providing these partners with competitive products, robust support, and efficient processes to foster strong, long-term relationships.

In 2024, the insurance brokerage industry continued its consolidation trend, with independent agents playing a pivotal role in connecting insurers with diverse customer bases. Hanover's commitment to agent support, including digital tools and dedicated relationship managers, aims to ensure these partners can effectively serve their clients and grow their businesses alongside Hanover.

Hanover's value proposition to its agent partners centers on offering a compelling suite of insurance products, backed by strong underwriting expertise and responsive service. This allows agents to confidently present Hanover's solutions to their clients, knowing they are backed by a reliable and supportive insurer.

Cost Structure

The most significant cost for Hanover Insurance Group revolves around claims and the expenses incurred to manage them. This includes the actual payouts to policyholders for covered events, such as property damage repairs or medical bills, and the operational costs associated with investigating, processing, and settling these claims. For instance, in 2024, the company's total cost of revenue, which heavily features claims and loss adjustment expenses, was a substantial portion of its overall expenditures.

These expenses are inherently variable and can be heavily influenced by unpredictable events. Catastrophe losses, like those from major storms or natural disasters, can dramatically increase these costs in a given period. Hanover's ability to accurately price policies and manage its reserves is crucial for mitigating the impact of these fluctuating claims and loss adjustment expenses on its profitability.

Underwriting and operating expenses are a significant component of Hanover Insurance Group's cost structure, covering the crucial functions of risk assessment, policy issuance, and ongoing business administration. These costs are directly tied to the core insurance operations.

Key expenses include the compensation for skilled professionals like underwriters and actuaries who meticulously evaluate risk profiles, alongside the salaries of administrative staff managing policy details and customer service. Furthermore, the group incurs substantial costs for maintaining its physical presence and technological backbone, such as office rent, utilities, and the upkeep of essential IT infrastructure.

In 2024, like previous years, Hanover Insurance Group likely focused on operational efficiency to manage these underwriting and operating expenses. For instance, the insurance industry generally sees administrative expenses as a percentage of gross written premiums; while specific Hanover figures for 2024 are not yet public, industry averages often hover in the low to mid-single digits, reflecting the ongoing effort to streamline processes and leverage technology for cost control.

Hanover Insurance Group’s cost structure heavily features agent commissions, a direct result of their agent-centric distribution model. These commissions are paid for both the initial sale and the renewal of policies, representing a significant operational expense.

Beyond agent compensation, marketing and advertising costs are substantial. These expenditures are crucial for brand promotion and customer acquisition, aiming to attract new policyholders in a competitive market. In 2024, the insurance industry saw continued investment in digital marketing, with companies like The Hanover allocating resources to online channels to reach a broader audience and enhance customer engagement.

Technology and Innovation Investments

Hanover Insurance Group dedicates substantial resources to technology and innovation. These ongoing investments, encompassing the development of new digital platforms, the enhancement of data analytics, and the integration of artificial intelligence, are a significant component of their cost structure. For instance, in 2024, the insurance industry as a whole saw a notable increase in technology spending, with many companies prioritizing digital transformation initiatives to stay competitive.

These expenditures are fundamental to Hanover's strategy for several key reasons. They are critical for boosting operational efficiency across the board, refining the accuracy of risk assessments, and ultimately elevating the experience for both their policyholders and their network of agents. The pursuit of technological advancement is directly tied to their ability to adapt to evolving market demands and deliver superior service.

- Digital Platform Development: Costs associated with building and maintaining user-friendly online portals and mobile applications for customers and agents.

- Data Analytics & AI Integration: Investments in advanced analytics tools and artificial intelligence for improved underwriting, claims processing, and personalized customer engagement.

- Cybersecurity Enhancements: Ongoing spending to protect sensitive customer data and ensure the integrity of digital operations against evolving threats.

- Process Automation: Outlays for implementing robotic process automation (RPA) and other technologies to streamline back-office functions and reduce manual effort.

Regulatory and Compliance Costs

The Hanover Insurance Group operates within a heavily regulated sector, necessitating significant investment in regulatory and compliance activities. These costs encompass legal counsel for navigating complex insurance laws, salaries for dedicated compliance staff, and fees associated with mandatory regulatory filings. For instance, in 2023, the insurance industry as a whole saw increased scrutiny, with companies dedicating substantial resources to adapting to evolving state and federal regulations.

- Legal Fees: Engaging legal experts to interpret and adhere to insurance statutes and directives.

- Compliance Staff: Employing professionals to manage and monitor adherence to all regulatory mandates.

- Filing Fees: Covering administrative charges for submitting required reports and documentation to governing bodies.

- Corporate Governance: Investing in robust governance structures to ensure ethical operations and transparency.

Hanover Insurance Group's cost structure is dominated by claims and loss adjustment expenses, which are inherently variable and sensitive to catastrophic events. Underwriting and operating expenses, including staff compensation and technology infrastructure, are also significant. In 2024, the company, like others in the industry, continued to invest in technology and digital transformation to enhance efficiency and customer experience, alongside managing agent commissions and marketing efforts.

| Cost Category | Key Components | 2024 Industry Trend/Note |

|---|---|---|

| Claims & Loss Adjustment Expenses | Policyholder payouts, claims investigation, processing, settlement | Highly variable, influenced by catastrophes; essential for profitability management. |

| Underwriting & Operating Expenses | Underwriter/actuary salaries, administrative staff, office rent, IT infrastructure | Focus on operational efficiency, with administrative expenses typically in low-to-mid single digits of gross written premiums. |

| Distribution Costs | Agent commissions, marketing, advertising | Significant due to agent-centric model; continued investment in digital marketing for customer acquisition. |

| Technology & Innovation | Digital platforms, data analytics, AI integration, cybersecurity | Increased spending industry-wide in 2024 for digital transformation and competitive advantage. |

| Regulatory & Compliance | Legal fees, compliance staff, filing fees, corporate governance | Ongoing investment to navigate complex and evolving insurance laws and mandates. |

Revenue Streams

The Hanover Insurance Group's core revenue generation comes from insurance premiums. These are the payments policyholders make for coverage across a broad range of products, including personal lines like auto and home, as well as commercial and specialty insurance. The growth in these premiums directly reflects Hanover's success in expanding its customer base and market share.

Investment income is a cornerstone of The Hanover Insurance Group's financial model, stemming from the strategic investment of its substantial premium reserves. In 2024, the company continued to leverage its diversified portfolio, which is heavily weighted towards fixed-income securities, to generate consistent returns through interest, dividends, and capital appreciation.

The Hanover Insurance Group can generate revenue through fees for specialized services that go beyond standard insurance policies. These can include offering expert risk management consulting to help businesses identify and mitigate potential hazards, or providing comprehensive claims administration services for companies that self-insure their risks.

These fee-based services act as a crucial revenue diversifier, supplementing income derived from traditional insurance premiums. For instance, in 2024, many insurance providers are seeing increased demand for tailored risk advisory services as businesses navigate evolving regulatory landscapes and economic uncertainties.

Reinsurance Recoveries

Reinsurance recoveries function as a crucial buffer, not a primary revenue source, for The Hanover Insurance Group. These recoveries significantly mitigate the impact of large or catastrophic claims, thereby safeguarding the company's capital and stabilizing its financial performance. In essence, they act as a financial shield, particularly vital during periods of elevated claim activity.

- Offsetting Losses: Reinsurance agreements allow Hanover to transfer a portion of its risk to reinsurers, meaning that when significant claims occur, a portion of the payout is recovered from these reinsurers.

- Capital Protection: By recovering funds from reinsurers, Hanover protects its own capital reserves from being depleted by unexpectedly high claim costs, ensuring financial stability.

- Earnings Stabilization: This recovery mechanism helps smooth out earnings volatility that might otherwise result from infrequent but severe insured events.

- Example of Impact: For instance, in 2023, The Hanover reported significant catastrophe losses, but the presence of reinsurance recoveries would have substantially reduced the net impact on their bottom line, demonstrating the protective nature of this revenue stream.

Subrogation Recoveries

Hanover Insurance Group also generates revenue through subrogation recoveries. This involves seeking reimbursement from a third party who caused the loss that Hanover had already paid out to its policyholder.

This process is crucial for recouping funds, effectively lowering the net amount of claims paid out by the company. For instance, in 2023, Hanover reported a combined ratio of 94.3%, indicating that a significant portion of their premiums were available to cover claims and expenses, with recoveries playing a role in this efficiency.

- Subrogation: Recovering claim payments from at-fault third parties.

- Financial Benefit: Reduces net claims paid, improving profitability.

- Efficiency Metric: Contributes to a lower combined ratio.

Hanover Insurance Group's revenue streams are diverse, primarily driven by insurance premiums across personal, commercial, and specialty lines. Beyond premiums, investment income from managing reserves is a significant contributor, as seen in their 2024 performance where fixed-income securities generated consistent returns. Additionally, fee-based services, such as risk management consulting and claims administration, offer a valuable revenue diversification, with demand for advisory services notably increasing in 2024 due to evolving business environments.

| Revenue Stream | Description | 2023 Data/2024 Trend |

| Insurance Premiums | Policyholder payments for coverage. | Core revenue driver; growth tied to customer acquisition and market share. |

| Investment Income | Returns from investing premium reserves. | In 2024, continued to benefit from a diversified portfolio, with a focus on fixed-income securities. |

| Fee-Based Services | Revenue from specialized services like risk management. | Growing area, with increased demand for advisory services in 2024. |

| Subrogation Recoveries | Reimbursements from at-fault third parties. | Helped improve profitability, contributing to a 94.3% combined ratio in 2023. |

Business Model Canvas Data Sources

The Hanover Insurance Group's Business Model Canvas is informed by a blend of internal financial data, comprehensive market research reports, and strategic analysis of industry trends. This robust data foundation ensures each component of the canvas accurately reflects the company's operational realities and strategic direction.