Hanover Insurance Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanover Insurance Group Bundle

The Hanover Insurance Group operates in a dynamic insurance landscape shaped by intense competition, moderate buyer power, and the ever-present threat of new entrants. Understanding the leverage of suppliers and the potential for substitute products is crucial for navigating this market effectively.

The complete report reveals the real forces shaping Hanover Insurance Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The property and casualty insurance sector, including The Hanover Insurance Group, depends heavily on reinsurance to manage significant risks. A concentrated reinsurance market, where a few major companies dominate, grants these suppliers substantial leverage. This concentration means reinsurers can command higher prices and dictate more stringent terms, directly impacting Hanover's operational costs and profitability.

The insurance industry's reliance on sophisticated technology and data analytics means suppliers of these specialized solutions wield significant bargaining power. Companies like The Hanover depend on these providers for essential functions such as underwriting and claims processing. For instance, in 2024, the global InsurTech market was valued at over $10 billion, highlighting the substantial investment and dependence on technology providers.

The availability of specialized talent, such as actuaries, underwriters, data scientists, and IT experts, significantly impacts supplier power for The Hanover. A scarcity of these professionals, or intense competition for their skills, can escalate labor expenses or hinder The Hanover's capacity for innovation and strategic execution. This dynamic essentially represents the supplier power of human capital.

Capital Market Conditions

The Hanover Insurance Group's reliance on capital markets for solvency and growth means that conditions here significantly impact its operational leverage. When capital markets are robust, with high investor confidence and low interest rates, Hanover benefits from a lower cost of capital, making it easier and cheaper to raise funds for expansion or to bolster its reserves. For instance, in early 2024, the insurance sector saw a renewed interest from investors, with companies like The Hanover able to access capital more readily compared to periods of market volatility.

Conversely, periods of economic uncertainty or rising interest rates can tighten capital availability and increase the cost of borrowing or issuing equity. This directly translates to a higher 'cost of capital' for Hanover, effectively increasing the bargaining power of capital market providers. If interest rates climb, as they have in recent years, the yield demanded by investors on insurance company debt or equity increases, making capital more expensive. This dynamic is crucial for understanding the supplier side of Hanover's financial structure.

- Cost of Capital Influence: Rising interest rates, such as the Federal Reserve's rate hikes through 2023 and into 2024, directly increase the cost of debt and equity capital for insurers like The Hanover.

- Investor Sentiment: Positive market sentiment in 2024 has generally supported insurance company valuations, making equity issuance more favorable than in tighter market conditions.

- Solvency Requirements: Regulatory solvency requirements necessitate maintaining adequate capital, meaning that when capital markets are restrictive, the pressure on insurers to secure this capital intensifies, empowering capital providers.

Influence of Independent Agents

Independent agents, while a key distribution channel for The Hanover Insurance Group, wield significant bargaining power. They act as crucial intermediaries, deciding which insurance products and carriers to offer their clients. This ability to direct substantial business volume grants them leverage to negotiate commission rates and demand specific product features or service levels.

The collective influence of these agents is a critical factor in The Hanover's market access and sales performance. In 2024, independent agents continued to be a dominant force in the property and casualty insurance market, with many studies indicating they write a significant majority of commercial lines business. For example, in the independent agent channel, The Hanover reported growth in its commercial lines in 2024, underscoring the importance of these relationships.

- Independent agents control client access to insurance products.

- Their ability to direct business volume allows for commission negotiation.

- They can demand tailored product features and service standards.

- Maintaining strong agent relationships is vital for market penetration.

The bargaining power of suppliers for The Hanover Insurance Group is influenced by several factors, including the concentration of the reinsurance market and the availability of specialized talent. Reinsurers, often a concentrated group, can command higher prices due to the essential risk management services they provide, directly impacting Hanover's costs.

Furthermore, suppliers of critical technology and data analytics solutions, operating in a market valued at over $10 billion in 2024, hold significant sway. The scarcity of specialized human capital, such as actuaries and data scientists, also increases labor costs and can impede innovation, thereby enhancing the bargaining power of these skilled professionals.

| Supplier Type | Impact on Hanover | 2024 Data/Context |

|---|---|---|

| Reinsurers | Higher operational costs, dictated terms | Concentrated market, essential risk management |

| Technology Providers | Dependence for core functions, potential cost increases | Global InsurTech market > $10 billion |

| Specialized Talent | Increased labor expenses, potential innovation delays | Scarcity of actuaries, data scientists |

What is included in the product

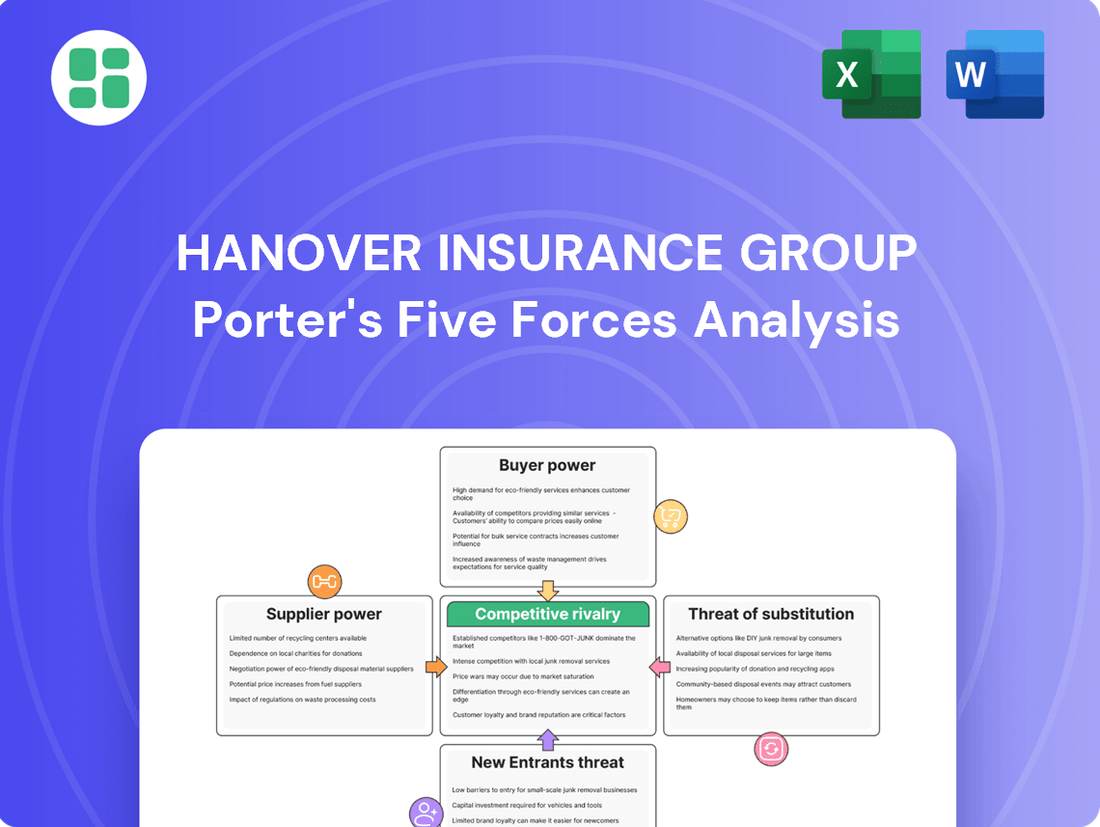

This Porter's Five Forces analysis for The Hanover Insurance Group evaluates the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitutes within the property and casualty insurance industry.

Instantly visualize competitive pressures with a pre-built, interactive model that highlights key threats and opportunities for The Hanover Insurance Group.

Customers Bargaining Power

For commoditized insurance products, such as personal auto or homeowners insurance, customers typically experience low costs and minimal effort when switching providers. This ease of transition significantly empowers consumers to actively seek out better pricing or more favorable terms from competing insurers, thereby placing considerable pressure on The Hanover Insurance Group to maintain competitive pricing and service levels.

Customers, particularly in straightforward insurance categories, frequently prioritize price and can easily utilize online tools to compare options. This accessibility to information means they can readily check quotes and coverage details, compelling The Hanover to maintain competitive pricing to win and keep clients. This trend is especially noticeable in personal insurance segments where price adjustments are a significant consideration for consumers.

The digital age has significantly leveled the playing field for insurance consumers. Information asymmetry, a historical advantage for insurers, is rapidly diminishing as online platforms and independent agents provide unprecedented access to policy details, pricing comparisons, and carrier performance metrics. This transparency empowers customers, enabling them to make more informed choices and directly influencing their bargaining power.

Influence of Independent Agents on Choice

The Hanover's reliance on independent agents significantly shapes customer bargaining power. These agents act as intermediaries, guiding customers towards insurers based on their perceived value, including coverage options, service quality, and claims efficiency.

This dynamic empowers customers because their chosen agents can steer them away from The Hanover if better alternatives are presented. For instance, if an agent consistently receives positive feedback on a competitor's claims process, they are likely to recommend that competitor, effectively reducing The Hanover's leverage.

In 2024, the independent agency channel remained a dominant force in property and casualty insurance distribution, with many insurers reporting that over 80% of their business flowed through these channels. This highlights how crucial agent relationships are in influencing customer choice and, consequently, their bargaining power.

- Independent agents influence customer choice by recommending specific carriers.

- This indirect influence increases customer bargaining power.

- Agent recommendations are based on coverage, service, and claims handling.

- The independent agency channel is a critical distribution method in the P&C insurance market.

Potential for Self-Insurance by Commercial Clients

Larger commercial clients, possessing substantial financial reserves and advanced risk management capabilities, can opt to self-insure or utilize alternative risk transfer methods. This reduces their dependence on insurers like The Hanover, thereby increasing their bargaining power.

For instance, in 2024, many large corporations continued to explore captive insurance arrangements to manage their insurance costs and tailor coverage. This trend directly impacts the demand for traditional insurance products, giving these sophisticated buyers more leverage.

- Self-Insurance Trend: A growing number of large commercial entities are investigating or implementing self-insurance strategies.

- Financial Capacity: Clients with significant balance sheets can absorb smaller losses internally, lessening the need for external insurance.

- Risk Management Sophistication: Advanced risk assessment and mitigation techniques empower clients to manage their own risk profiles more effectively.

- Alternative Risk Transfer: Options like captive insurance and finite risk programs offer clients greater control and potential cost savings, shifting power away from traditional insurers.

The bargaining power of customers for The Hanover Insurance Group is significantly influenced by the ease of switching providers, especially for commoditized products like personal auto insurance. In 2024, price comparison websites and digital tools continued to empower consumers, allowing them to readily access quotes and coverage details, thereby compelling insurers to maintain competitive pricing. This transparency, coupled with low switching costs, means customers can easily shift to competitors offering better deals, directly impacting The Hanover's pricing strategies and customer retention efforts.

| Factor | Impact on Customer Bargaining Power | Example/Data (2024) |

|---|---|---|

| Switching Costs | Low switching costs increase bargaining power. | Minimal financial or effort required for consumers to change auto insurance providers. |

| Information Availability | High availability of information empowers customers. | Online comparison tools provide easy access to pricing and coverage details from multiple insurers. |

| Price Sensitivity | High price sensitivity amplifies bargaining power. | Consumers, especially in personal lines, prioritize price, leading them to seek the lowest cost options. |

| Customer Concentration | Low concentration of customers with any single insurer increases individual bargaining power. | The Hanover serves a broad market, meaning individual customers have little leverage due to their small market share. |

Preview the Actual Deliverable

Hanover Insurance Group Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for The Hanover Insurance Group, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering a comprehensive understanding of the competitive landscape for this major insurer.

Rivalry Among Competitors

The property and casualty insurance sector in the U.S. is both mature and highly fragmented. This means there are many companies competing, from large national insurers like State Farm and Berkshire Hathaway to smaller regional and specialized providers. This intense competition forces players to constantly innovate and offer competitive pricing to attract and retain customers.

In 2024, the U.S. property and casualty insurance market continued to exhibit this fragmented nature. With a vast number of carriers, including established giants and emerging specialists, rivalry remains a defining characteristic. This dynamic is further fueled by a relatively stable, albeit sometimes cyclical, growth environment where market share gains are hard-won.

The Hanover Insurance Group operates in a market where many standard insurance products, such as auto and homeowners insurance, can be viewed as largely similar. This product homogeneity intensifies competition, often pushing insurers to vie for customers based on price, the quality of their customer service, or unique policy features. In 2023, the property and casualty insurance industry saw continued price competition, particularly in personal lines, as insurers sought to gain market share.

The Hanover actively works to distinguish itself by offering robust coverage options, proactive risk management services, and leveraging technology to enhance the customer experience. However, maintaining a clear and sustainable differentiation in the face of competitors also emphasizing these areas presents an ongoing challenge for the company.

The insurance industry, particularly in personal and commercial lines, is characterized by intense competition. This often translates into significant pricing pressure, especially when market growth slows or the availability of insurance capacity is high. For instance, in 2024, many insurers faced challenges in maintaining premium rates due to an oversupply of capacity in certain segments.

Hanover Insurance Group has actively countered this by emphasizing disciplined underwriting and implementing strategic pricing adjustments. This approach aims to bolster profitability by ensuring premiums adequately reflect risk, a crucial tactic in a market where maintaining healthy margins is paramount. Their focus on this strategy highlights the ongoing need to balance competitive pricing with financial prudence.

High Exit Barriers

The insurance sector faces substantial hurdles for companies looking to leave the market. These include complex regulatory requirements, the long-term nature of claims liabilities, and the significant capital already invested in operations and infrastructure. For instance, in 2023, the average solvency capital requirement for European insurers remained a substantial barrier to exit for many.

These high exit barriers often result in companies that are underperforming or struggling financially remaining active participants in the industry. Instead of ceasing operations, they might engage in aggressive pricing strategies or offer less favorable terms to maintain market share, thereby intensifying competition for established players like The Hanover Insurance Group.

- Regulatory Obligations: Insurers must meet specific capital and solvency ratios, making a swift exit difficult.

- Long-Tail Liabilities: Many insurance policies, especially in lines like workers' compensation or environmental liability, can remain open for decades, requiring ongoing capital reserves.

- Capital Investments: Significant investments in IT systems, distribution networks, and brand building create sunk costs that discourage exit.

- Market Persistence: Struggling insurers often stay in the market, driving down prices and increasing rivalry.

Strategic Initiatives and Catastrophe Management

Competitors in the insurance sector are heavily investing in strategic initiatives to build a competitive advantage. These investments often focus on catastrophe mitigation, advanced technology adoption, and expanding geographic footprints.

The Hanover Insurance Group actively participates in this competitive landscape. Their efforts to reduce catastrophe losses and improve their combined ratio in 2024 highlight their commitment to enhancing financial performance and solidifying their market position.

- Strategic Investments: Competitors are pouring resources into catastrophe modeling and risk management technologies.

- Technological Advancement: Investments in AI and data analytics are crucial for underwriting accuracy and claims processing efficiency.

- Geographic Diversification: Expanding into new markets helps spread risk and capture growth opportunities.

- Hanover's Performance: In 2024, The Hanover demonstrated success in managing catastrophe losses, contributing to a stronger combined ratio.

The competitive rivalry within the property and casualty insurance sector, where The Hanover Insurance Group operates, is exceptionally fierce. This stems from a market populated by numerous players, ranging from national giants to specialized regional insurers, all vying for market share. In 2024, this fragmentation persisted, with many companies offering similar core products, leading to intense price competition and a constant need for differentiation through service and innovation.

The Hanover actively combats this by focusing on disciplined underwriting and strategic pricing, aiming to balance competitiveness with profitability. For instance, in 2023, price competition was particularly noticeable in personal lines of insurance, a trend that continued into 2024, impacting premium rate stability for many carriers.

Furthermore, high exit barriers in the insurance industry, such as regulatory capital requirements and long-tail liabilities, mean that even struggling firms often remain in the market. This can lead to aggressive pricing tactics that further intensify rivalry, a challenge The Hanover addresses through its focus on risk management and technological enhancements to customer experience.

Competitors are also heavily investing in areas like catastrophe mitigation and advanced technology, with The Hanover making similar strategic investments in 2024 to improve its combined ratio and solidify its market standing.

| Metric | 2023 (Approximate) | 2024 (Projected/Early Data) | Impact on Rivalry |

| Industry Fragmentation | High (Numerous Insurers) | High (Continued) | Intensifies competition, price pressure |

| Price Competition | Significant, especially in personal lines | Continued | Drives need for cost efficiency and value-added services |

| Competitor Investment in Tech | Increasing | Increasing (AI, Data Analytics) | Creates differentiation opportunities, potential for new entrants |

| Hanover's Combined Ratio | Targeting improvement | Demonstrated improvement | Indicates successful risk management and pricing strategies |

SSubstitutes Threaten

For large corporations, the ability to self-insure or create captive insurance companies presents a significant alternative to traditional commercial insurance. This strategy allows them to manage their own risk and potentially lower expenses, particularly for recurring losses. For instance, in 2023, reports indicated a growing trend of large enterprises exploring captive solutions to gain greater control over their insurance programs and reduce overall costs.

Government-backed insurance programs, like the National Flood Insurance Program (NFIP), directly compete with private insurers for certain risks. For instance, the NFIP provided over $12.5 billion in flood insurance coverage in 2023, demonstrating a significant market presence that can limit the growth opportunities for private flood insurance providers. This government intervention can cap the premium potential and market share for companies like The Hanover in these specialized insurance sectors.

Sophisticated financial instruments, often termed Alternative Risk Transfer (ART) mechanisms, present a significant threat to traditional reinsurance. These include instruments like catastrophe bonds, industry loss warranties (ILWs), and various other derivatives that allow for the transfer and management of complex or large-scale risks outside the conventional insurance and reinsurance markets. For instance, the global market for insurance-linked securities (ILS), which encompasses many ARTs, saw significant growth, with total ILS capacity estimated to be around $90 billion in early 2024, demonstrating a substantial alternative to traditional reinsurance capacity.

Enhanced Risk Management and Prevention Technologies

The increasing sophistication of risk management technologies presents a significant threat of substitution for traditional insurance products. Advances like IoT sensors in homes and vehicles, coupled with telematics and predictive analytics, empower policyholders to proactively reduce their risk exposure. This shift means customers might see less need for insurance that primarily focuses on indemnification, as they become more capable of preventing losses themselves.

For instance, the adoption of telematics in auto insurance, which monitors driving behavior, has shown a tangible impact. In 2024, a significant portion of auto insurers are offering or expanding telematics programs, with some studies indicating potential premium reductions of up to 10-15% for safe drivers. This trend suggests a move towards usage-based insurance and a diminished reliance on traditional coverage models for certain risks.

- Technological Advancements: IoT, telematics, and predictive analytics empower policyholders to mitigate risks.

- Reduced Demand for Indemnification: Proactive risk management can lessen the need for traditional loss coverage.

- Impact on Auto Insurance: Telematics programs, offering potential premium savings, are gaining traction in 2024.

- Shift in Value Proposition: Insurers may need to adapt from pure indemnification to risk prevention services.

Emergence of Insurtech Solutions

The rise of insurtech presents a significant threat of substitutes for The Hanover Insurance Group. These agile companies are creating novel ways to deliver insurance, often sidestepping traditional structures. Think on-demand coverage or peer-to-peer models; these can directly compete with established offerings.

Insurtechs are not just innovating; they are actively capturing market share. For instance, in 2024, insurtech funding continued to flow, with significant investments in platforms offering personalized micro-insurance and usage-based policies. These alternatives can be particularly appealing to younger demographics or those seeking highly specific coverage, potentially eroding The Hanover's customer base in those segments.

- Insurtech Funding: Global insurtech funding reached over $10 billion in the first half of 2024, indicating strong investor confidence in new insurance models.

- Product Innovation: Companies are launching specialized products like on-demand ride-sharing insurance or parametric insurance triggered by specific events, directly challenging traditional policies.

- Customer Acquisition: Insurtechs often leverage digital channels and data analytics to acquire customers more efficiently, posing a competitive challenge to established insurers' distribution strategies.

- Partnership vs. Disruption: While some insurtechs partner with incumbents, a growing number aim to become direct competitors, offering a complete substitute for certain insurance lines.

The threat of substitutes for The Hanover Insurance Group is multifaceted, encompassing self-insurance, government programs, alternative risk transfer, technological advancements, and insurtech innovations. These alternatives offer customers different ways to manage risk, potentially reducing demand for traditional insurance products and services.

Large corporations increasingly opt for self-insurance or captive insurance companies, a trend that continued in 2023 as businesses sought greater control and cost savings. Government-backed programs, such as the NFIP which provided over $12.5 billion in flood coverage in 2023, also serve as direct substitutes in specific markets. Furthermore, the global market for insurance-linked securities, a form of alternative risk transfer, was estimated at around $90 billion in early 2024, highlighting a substantial alternative to traditional reinsurance.

Technological advancements, particularly in areas like telematics in auto insurance, empower policyholders to proactively manage and reduce their own risks. For instance, telematics programs in 2024 offer potential premium reductions of 10-15% for safe drivers, signaling a shift away from pure indemnification. Insurtechs, fueled by over $10 billion in global funding in the first half of 2024, are actively launching innovative products like on-demand or parametric insurance, directly challenging established offerings and capturing market share, especially among younger demographics.

| Substitute Category | Example | Market Trend/Data (2023-2024) | Impact on Hanover |

|---|---|---|---|

| Self-Insurance/Captives | Large corporations managing their own risk | Growing trend observed in 2023 for cost control. | Reduced demand for commercial policies from large clients. |

| Government Programs | National Flood Insurance Program (NFIP) | Provided over $12.5 billion in coverage in 2023. | Limits market share and premium potential in specific sectors. |

| Alternative Risk Transfer (ART) | Insurance-Linked Securities (ILS) | Global ILS capacity around $90 billion in early 2024. | Offers alternatives to traditional reinsurance capacity. |

| Technological Advancements | Telematics in Auto Insurance | Potential 10-15% premium savings for safe drivers (2024). | Shifts focus from indemnification to risk prevention services. |

| Insurtech Innovations | On-demand/Parametric Insurance | Over $10 billion in insurtech funding (H1 2024). | Challenges traditional products and customer acquisition strategies. |

Entrants Threaten

High capital requirements act as a significant barrier to entry in the property and casualty insurance sector. New companies need substantial funds to cover underwriting, build necessary reserves, and sustain initial operations. For instance, The Hanover Insurance Group's robust financial standing, evidenced by its substantial investment portfolio and significant net premiums written, highlights the scale of investment needed to compete effectively.

The insurance sector is a minefield of regulations, with state and federal governments imposing stringent licensing, solvency, and consumer protection rules. For instance, in 2024, the National Association of Insurance Commissioners (NAIC) continued to emphasize robust capital requirements and market conduct examinations, which can cost new entrants millions in setup and ongoing compliance. These extensive regulatory hurdles represent a significant barrier, deterring potential new competitors from entering the market by demanding substantial upfront investment and expertise.

Building strong brand recognition and customer trust in the insurance industry is a lengthy and costly endeavor. The Hanover Insurance Group, like many established insurers, has cultivated a reputation over decades, fostering loyalty that acts as a significant barrier to entry for newcomers. For instance, in 2023, The Hanover reported a net written premium of $7.5 billion, reflecting the scale of its established customer base and market presence.

Difficulty in Establishing Distribution Networks

For insurers like The Hanover that rely on independent agents, establishing strong distribution networks presents a significant barrier to entry for new competitors. Entrants must dedicate substantial capital and time to recruit and cultivate relationships with these agents, often needing to offer attractive commissions and support to gain traction. By mid-2024, the independent agent channel continues to be a cornerstone of the P&C insurance industry, with many carriers reporting that over 80% of their business flows through this model.

Developing alternative, scalable distribution channels also demands considerable investment and strategic planning. New entrants might explore direct-to-consumer models or digital platforms, but these require sophisticated technology infrastructure and extensive marketing to build brand awareness and customer trust. For instance, the cost of acquiring a new customer through digital channels can range from $50 to $200, depending on the complexity of the product and the marketing strategy employed.

- Agent Recruitment Costs: New entrants face substantial upfront costs in recruiting and onboarding independent agents, including training, licensing support, and initial commission incentives.

- Brand Loyalty and Trust: Established insurers benefit from years of building trust and loyalty with their agent networks, making it difficult for newcomers to dislodge existing relationships.

- Scalability Challenges: Building a distribution network that can effectively handle a large volume of business, as seen with major players like The Hanover, requires significant operational scaling and investment.

- Digital Channel Investment: While digital channels offer an alternative, they necessitate considerable investment in technology, cybersecurity, and marketing to compete with established, agent-driven models.

Access to Data and Advanced Analytics

The insurance industry's reliance on extensive historical data and advanced analytics presents a significant barrier to new entrants. Effectively underwriting and pricing risks requires access to vast datasets and sophisticated modeling capabilities, areas where established players like The Hanover have made substantial investments.

Newcomers would face considerable challenges in amassing comparable data reserves and developing the advanced analytics and AI tools necessary to compete. For instance, The Hanover has been actively enhancing its data analytics platforms, aiming to improve risk selection and operational efficiency, a process that takes years and significant capital to replicate.

- Data Acquisition Costs: New entrants must invest heavily to build or acquire the necessary historical data sets, which are crucial for accurate risk assessment.

- Analytical Expertise: Developing and maintaining the advanced analytics and AI capabilities requires specialized talent and ongoing technological investment.

- Incumbent Advantage: Established insurers like The Hanover benefit from years of data accumulation and refinement of their analytical models, creating a competitive moat.

The threat of new entrants for The Hanover Insurance Group is moderate, primarily due to high capital requirements and extensive regulatory hurdles within the property and casualty insurance sector. New companies need substantial funds to cover underwriting, build reserves, and sustain operations, with significant investment required to compete effectively.

Established players like The Hanover benefit from decades of brand building and customer trust, making it difficult for newcomers to gain market share. Furthermore, the reliance on established agent networks and the significant investment needed for digital channel development present additional barriers.

| Barrier | Description | Impact on New Entrants |

| Capital Requirements | Substantial funds needed for underwriting, reserves, and operations. | High barrier, requiring significant financial backing. |

| Regulatory Compliance | Stringent state and federal licensing, solvency, and consumer protection rules. | Demands considerable upfront investment and expertise. |

| Brand Loyalty and Trust | Decades of cultivation needed to build customer and agent relationships. | Difficult for newcomers to displace established players. |

| Distribution Networks | Establishing and maintaining relationships with independent agents. | Requires substantial capital, time, and incentives. |

| Data and Analytics | Access to vast historical data and advanced modeling capabilities. | Incumbents have a significant advantage due to accumulated data. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hanover Insurance Group is built upon a foundation of comprehensive data, including their annual reports, SEC filings, and investor presentations. We supplement this with insights from reputable industry research firms and insurance trade publications to capture a holistic view of the competitive landscape.