H&T Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H&T Group Bundle

The H&T Group exhibits strong brand recognition and a robust product portfolio, but faces potential market saturation and evolving consumer preferences. Understanding these dynamics is crucial for strategic planning.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

H&T Group stands as the UK's largest pawnbroker, boasting an impressive network of over 285 high street stores. This extensive physical footprint grants them significant market penetration and accessibility, a considerable competitive edge. Their ongoing investment in store refurbishments and new openings further solidifies this market leadership.

H&T Group's strength lies in its diversified business model, extending far beyond its traditional pawnbroking roots. The company actively engages in gold buying, retail of new and pre-owned jewelry and watches, foreign currency exchange, and unsecured loans. This multi-pronged strategy creates multiple revenue streams, enhancing overall resilience.

This diversification has demonstrably paid off, as evidenced by H&T's robust financial performance. The company announced record profits in 2024, with significant growth observed across its various service segments. This sustained financial health underscores the effectiveness of their varied offerings.

H&T Group's core lending strategy is built on secured loans, primarily using personal assets like gold and jewelry as collateral. This model significantly reduces lending risk because the loans are non-recourse to the borrower, meaning the company can recover its funds directly from the collateral if the borrower defaults.

The tangible value of the precious metals held as collateral provides a robust foundation for H&T's balance sheet and inventory management. As of the first half of 2024, H&T reported a strong average loan-to-value ratio, demonstrating the inherent security provided by their collateralized lending approach.

Proven Growth and Profitability

H&T Group demonstrated robust financial performance in 2024, achieving a record year with a notable 10% increase in profit before tax. This growth was underpinned by significant expansion in its pawnbroking pledge book and a surge in retail sales, reflecting strong customer engagement and effective market strategies.

Key drivers of this success included:

- Record Financial Performance: 2024 saw H&T Group achieve its highest profit before tax, marking a 10% year-on-year increase.

- Pawnbroking Pledge Book Growth: The company experienced substantial growth in its core pawnbroking operations, indicating increased customer utilization of these services.

- Retail Sales Surge: Retail sales also saw a significant uplift, demonstrating strong demand for H&T Group's product offerings.

- Strategic Acquisitions: The acquisition of Maxcroft in February 2024 further strengthened H&T Group's market position and contributed to its overall growth trajectory.

Strategic Investment in Infrastructure

H&T Group's strategic infrastructure investments are a significant strength, bolstering its retail presence and operational capabilities. The company is actively refurbishing 48 stores, enhancing the customer experience and brand image across its network. This extensive refurbishment program is complemented by plans to open between 8 and 12 new stores throughout 2024, expanding market reach and capturing new customer segments.

Furthermore, H&T is making substantial upgrades to its technology platform. This initiative aims to streamline the online customer journey, making it more intuitive and efficient, while also boosting overall operational efficiency. These technological advancements are vital for remaining competitive in an increasingly digital marketplace and supporting future growth trajectories.

- Refurbishment: 48 stores are undergoing refurbishment to improve the in-store experience.

- Expansion: Plans are in place to open 8-12 new stores in 2024, increasing physical footprint.

- Technology Upgrade: Investments in technology will enhance the online customer journey and operational efficiency.

H&T Group's extensive network of over 285 stores provides significant market reach and customer accessibility. Their diversified revenue streams, including pawnbroking, gold buying, and retail sales, contribute to financial resilience. The company's commitment to upgrading its store portfolio and technology infrastructure further strengthens its competitive position and operational efficiency.

| Strength Area | Description | Supporting Data (2024) |

|---|---|---|

| Market Presence | Largest pawnbroker in the UK with a vast store network. | 285+ high street stores. |

| Diversified Business Model | Multiple revenue streams beyond core pawnbroking. | Pawnbroking, gold buying, retail, foreign exchange, unsecured loans. |

| Financial Performance | Record profits and consistent growth across segments. | 10% increase in profit before tax; substantial growth in pledge book and retail sales. |

| Collateralized Lending | Reduced lending risk through asset-backed loans. | Strong average loan-to-value ratio in H1 2024. |

| Strategic Investments | Enhancing customer experience and expanding reach. | 48 stores undergoing refurbishment; 8-12 new stores planned for 2024; technology platform upgrades. |

What is included in the product

Delivers a strategic overview of H&T Group’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats to inform future strategic decisions.

Offers a clear, actionable framework to identify and address H&T Group's strategic challenges and opportunities.

Weaknesses

H&T Group's significant reliance on its physical store network, despite digital investments, presents a key weakness. This physical footprint, while offering tangible customer interaction, inherently carries higher operational costs than purely online competitors. For instance, in 2023, H&T operated over 250 stores across the UK, each incurring expenses related to rent, utilities, and staffing.

This dependence also exposes H&T to the broader trend of declining footfall on UK high streets. As consumer shopping habits continue to shift towards e-commerce, a sustained reduction in in-person visits could directly impact revenue streams. The company’s 2024 strategy acknowledges this, with plans to optimize store performance, suggesting the ongoing challenge of adapting to evolving retail landscapes.

H&T Group's customer base, often those with less access to traditional banking, is highly sensitive to economic shifts. When inflation rises or unemployment increases, these customers may struggle to repay loans or make purchases, directly impacting H&T's revenue streams and the quality of its loan portfolio.

The pawnbroking sector, including H&T Group, often grapples with a less-than-ideal public image, frequently perceived as a service for those in financial distress rather than a mainstream financial solution. This perception can hinder efforts to attract a wider customer base. For instance, while specific 2024/2025 perception data for H&T is still emerging, industry-wide surveys from late 2023 indicated that roughly 40% of consumers associate pawnbroking primarily with emergency borrowing.

As a company operating under the Financial Conduct Authority's (FCA) purview, H&T Group faces significant regulatory oversight. This necessitates substantial investment in compliance measures, potentially impacting operational flexibility and increasing overheads. The FCA's ongoing focus on consumer protection, particularly in the short-term lending space, means H&T must continuously adapt its practices, which can add to the cost of doing business.

Exposure to Gold Price Volatility

H&T Group's significant reliance on gold buying and retail sales exposes it to substantial gold price volatility. While the current high gold prices are advantageous, a sustained downturn could severely impact the profitability of these core business segments. For instance, if gold prices were to fall by 15% from their current average levels in 2024, it could directly reduce the margin on gold purchased for resale.

Furthermore, a decline in gold values directly affects the collateral held within H&T's pledge book. This could lead to a decrease in the realizable value of assets backing loans, potentially increasing risk for the company. As of early 2025, the average gold price has been around $2,300 per ounce, and a notable drop could shrink the value of pledged items, impacting the company's financial stability.

- Revenue Dependence: A substantial part of H&T's income comes from buying and selling gold and jewelry.

- Profitability Risk: A significant, sustained drop in gold prices could negatively affect profits from these activities.

- Collateral Value Impact: Declining gold values reduce the inherent worth of collateral held in the pledge book.

- Market Sensitivity: The company's financial performance is closely tied to fluctuations in the global gold market.

Increased Operating Costs and Wage Pressure

H&T Group faces a significant headwind with anticipated increases in operating costs. Specifically, the company projects an annual rise in employment costs of around £2 million starting from April 2025. This surge is largely driven by external factors, namely government-mandated increases in National Insurance contributions.

This external cost pressure directly impacts H&T Group's ability to maintain healthy profit margins and operational efficiency. The company will need to implement robust cost control measures to mitigate the effects of these rising expenses.

- Anticipated £2 million annual increase in employment costs from April 2025.

- Primary driver: Government-mandated National Insurance contribution rises.

- Challenge to maintaining profit margins and operational efficiency.

- Necessity for ongoing cost control strategies.

H&T Group's reliance on its extensive physical store network, despite digital efforts, remains a weakness. This network, which included over 250 UK stores in 2023, incurs substantial operational costs compared to online-only businesses. The ongoing shift in consumer behavior towards e-commerce continues to challenge the footfall driving these physical locations.

The company's customer base, often comprised of individuals with limited access to traditional banking, is highly susceptible to economic downturns. Factors like rising inflation or increased unemployment can directly affect their ability to repay loans or make purchases, impacting H&T's revenue and loan portfolio quality.

The pawnbroking industry, including H&T, faces a persistent public image challenge, often being associated with financial distress rather than mainstream financial services. This perception can limit its appeal to a broader customer segment, with industry surveys in late 2023 indicating about 40% of consumers view pawnbroking primarily as an emergency borrowing option.

H&T Group is significantly exposed to gold price volatility, as a substantial portion of its income derives from gold buying and retail sales. A sustained decline in gold prices, for example, a 15% drop from 2024 averages, could materially reduce profit margins on gold transactions and devalue collateral in its pledge book.

| Weakness Area | Description | Impact | Supporting Data/Context |

|---|---|---|---|

| Physical Store Reliance | High operational costs associated with a large physical store network. | Reduced profitability and vulnerability to declining high street footfall. | Operated over 250 UK stores in 2023. |

| Customer Sensitivity | Customer base highly sensitive to economic fluctuations. | Direct impact on revenue and loan portfolio quality during economic downturns. | Customers often have less access to traditional banking. |

| Public Perception | Negative public image of pawnbroking services. | Limited ability to attract a wider customer base. | ~40% of consumers associate pawnbroking with emergency borrowing (late 2023 surveys). |

| Gold Price Volatility | Significant revenue dependence on gold buying and retail. | Profitability risk from price drops and reduced collateral value. | 15% drop in gold prices could significantly impact margins. |

What You See Is What You Get

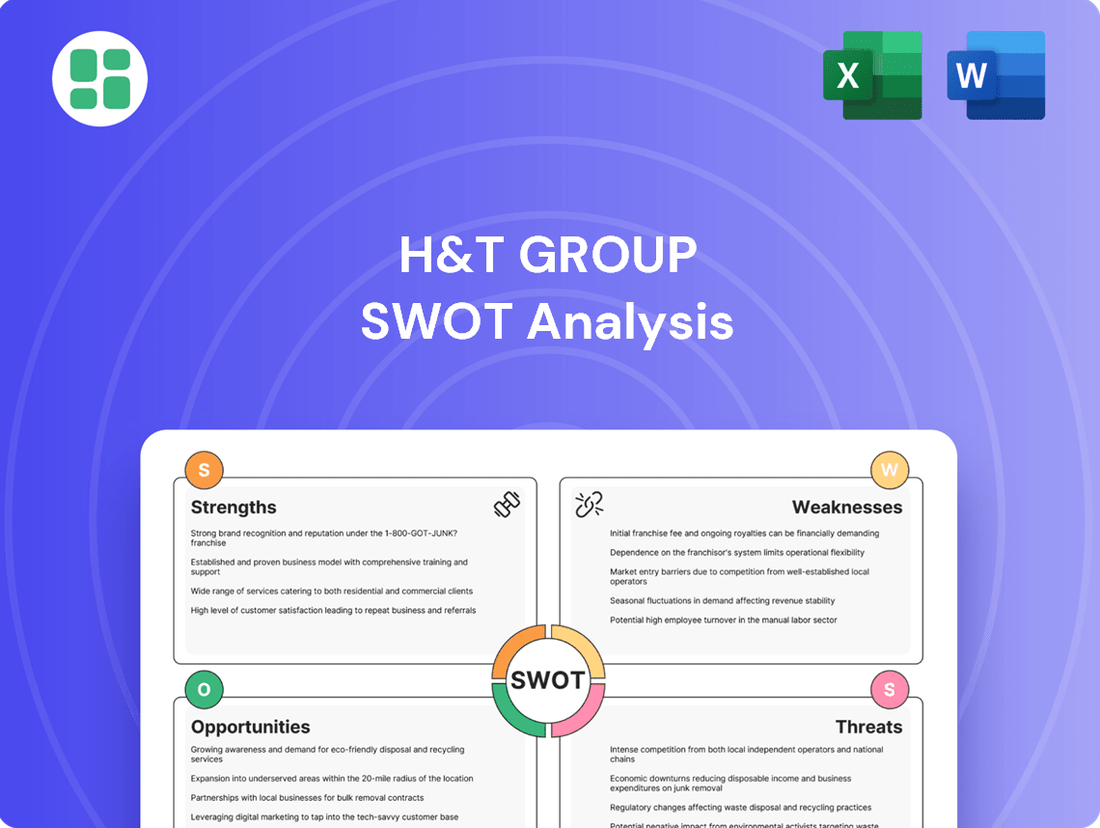

H&T Group SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at the H&T Group's strategic landscape.

This is a real excerpt from the complete document, showcasing the detailed analysis of the H&T Group's Strengths, Weaknesses, Opportunities, and Threats. Once purchased, you’ll receive the full, editable version for your strategic planning.

Opportunities

H&T Group has a substantial opportunity to grow its digital and online services. By improving its online customer experience and expanding e-commerce, the company can reach more customers beyond its physical stores, potentially lowering costs per transaction.

In the first half of 2024, H&T Group reported that online sales were a significant driver of retail growth, highlighting the existing momentum in this channel. Further investment here could unlock substantial new revenue streams and customer acquisition.

H&T Group is ideally positioned to capitalize on market consolidation, especially with some competitors exiting the high-cost credit sector. Its robust balance sheet allows for strategic acquisitions, enhancing its dominant market presence. The successful integration of Maxcroft in 2024, which expanded H&T's market share and loan portfolio, serves as a prime example of this capability.

Persistent high costs of living and elevated interest rates are fueling a significant increase in demand for short-term, small-sum loans. This economic climate, potentially coupled with rising unemployment figures, creates a robust structural growth opportunity for H&T Group's primary pawnbroking services. As traditional lenders continue to face constraints, H&T is well-positioned to capture this expanding market segment.

Leveraging Retail and Gold Market Trends

The persistently elevated price of gold offers a significant avenue for H&T Group's retail and gold acquisition segments. This trend allows the company to attract customers looking to sell their gold, providing a steady stream of inventory. For instance, in the first half of 2024, H&T reported a substantial increase in gold purchasing volumes, directly benefiting from these market conditions.

Expanding its offerings in both new and pre-owned jewelry and watches is a strategic move. This caters to a broad consumer base that values affordability and seeks tangible assets. By diversifying its product mix, H&T can tap into the growing demand for accessible luxury and investment-grade items, particularly in the current economic climate where consumers are more price-conscious.

- Increased Gold Prices: Sustained high gold prices (hovering around $2,300-$2,400 per ounce in mid-2024) create favorable margins for gold purchasing.

- Consumer Demand for Value: Growing consumer interest in pre-owned and value-for-money luxury goods, including jewelry and watches.

- Inventory Acquisition: High gold prices incentivize individuals to sell, providing H&T with a consistent and cost-effective supply of precious metals and items.

- Market Diversification: Broadening the retail selection to include a wider array of new and pre-owned items appeals to a larger customer demographic.

Enhancing ESG Initiatives and Public Perception

H&T Group can bolster its standing by actively pursuing Environmental, Social, and Governance (ESG) efforts. This includes adopting sustainable retail packaging, a move that aligns with growing consumer demand for eco-friendly practices. In 2024, the company's partnership with FareShare, a food redistribution charity, demonstrates a commitment to social responsibility. Such initiatives are crucial for enhancing brand image and public perception in a sector that often faces scrutiny.

By highlighting these ESG commitments, H&T can differentiate itself within the financial services industry. This proactive approach appeals not only to customers who prioritize ethical businesses but also to investors increasingly focused on sustainable and socially conscious companies. For instance, in 2024, many financial institutions reported increased investor interest in ESG-focused portfolios, indicating a market trend H&T can leverage.

- Sustainable Packaging Transition: Implementing eco-friendly packaging solutions in retail operations.

- Charitable Partnerships: Collaborating with organizations like FareShare to address social needs.

- Brand Image Enhancement: Improving public perception through demonstrable commitment to ESG principles.

- Investor Appeal: Attracting investors who prioritize socially responsible and sustainable businesses.

H&T Group's digital expansion offers a clear path to broader customer reach and potentially lower operational costs, as evidenced by online sales being a significant growth driver in H1 2024.

The company is well-positioned for growth through strategic acquisitions, demonstrated by the successful integration of Maxcroft in 2024, which strengthened its market share.

Economic conditions, including high living costs and interest rates, are increasing demand for pawnbroking services, creating a structural growth opportunity for H&T.

Persistently high gold prices, averaging around $2,300-$2,400 per ounce in mid-2024, benefit H&T's gold purchasing volumes and retail margins.

Diversifying retail offerings to include more new and pre-owned jewelry and watches appeals to a wider, value-conscious customer base.

H&T's commitment to ESG, including partnerships like the one with FareShare in 2024, enhances its brand image and investor appeal.

| Opportunity Area | H1 2024 Data/Context | Potential Impact |

|---|---|---|

| Digital & Online Services | Online sales drove retail growth. | Increased customer reach, lower transaction costs. |

| Market Consolidation | Maxcroft acquisition successful in 2024. | Expanded market share and loan portfolio. |

| Demand for Short-Term Loans | Persistent high cost of living. | Increased demand for pawnbroking services. |

| High Gold Prices | Gold prices around $2,300-$2,400/oz (mid-2024). | Higher margins on gold purchasing, increased inventory. |

| Retail Diversification | Growing consumer interest in pre-owned luxury. | Appeals to a broader demographic, taps into value-seeking market. |

| ESG Initiatives | Partnership with FareShare (2024). | Enhanced brand image, improved investor appeal. |

Threats

A significant economic downturn in the UK presents a substantial threat to H&T Group. Such a scenario could devalue the collateral backing their loans, increasing the risk of defaults. For instance, if the UK experiences a recession similar to the one in 2008, where GDP contracted by 6.3%, the value of pledged assets like gold and jewelry could plummet, directly impacting H&T's asset base.

Furthermore, reduced consumer affordability during an economic slump would likely curb discretionary spending, impacting H&T's retail sales of pre-owned goods. This, coupled with a potential rise in loan defaults, could significantly squeeze profit margins and deteriorate the overall quality of their loan portfolio, as seen in periods of high unemployment.

The financial services sector faces ongoing regulatory shifts. For H&T Group, stricter rules from bodies like the Financial Conduct Authority (FCA) could mean higher compliance costs or limitations on lending practices.

For instance, potential caps on interest rates or new consumer protection mandates introduced in 2024 or anticipated for 2025 might directly impact H&T's profitability and the scope of its services.

The financial landscape is increasingly shaped by nimble fintech firms and digital lenders, presenting a significant competitive challenge to H&T Group. These disruptors often leverage technology to provide quicker, more streamlined, and potentially cheaper credit options, directly appealing to customers who prioritize speed and ease of access in their borrowing experiences.

While some traditional high-cost credit providers have scaled back, the digital lending sector continues to expand its reach. For instance, the UK digital lending market saw substantial growth, with transaction volumes expected to continue rising through 2025, indicating a growing customer preference for these online channels. This trend could divert H&T's core customer base seeking immediate financial solutions.

Fluctuations in Interest Rates and Gold Prices

Adverse movements in external market factors, such as a significant drop in global gold prices, could diminish the value of H&T's extensive inventory and the collateral held against its loans. For instance, if the average gold price per ounce, which was around $2,300 in early May 2024, were to fall substantially, the value of H&T's gold holdings would be directly impacted.

Similarly, sustained increases in interest rates could raise the company's borrowing costs for its funding facilities, thereby impacting its net interest margin and overall profitability. As of May 2024, benchmark interest rates in major economies remain elevated, and any further upward trend would directly translate to higher financing expenses for H&T.

- Gold Price Volatility: Global gold prices experienced fluctuations throughout 2023 and into early 2024, with significant swings impacting the underlying value of pledged collateral.

- Interest Rate Sensitivity: H&T's profitability is sensitive to changes in interest rates, as higher rates increase the cost of its wholesale funding, potentially squeezing net interest margins.

- Collateral Valuation Risk: A sharp decline in gold prices, a key asset for H&T's lending operations, poses a direct threat to the value of its loan portfolio and inventory.

Changing Consumer Preferences and High Street Decline

A significant threat for H&T Group stems from evolving consumer preferences, particularly the ongoing shift towards online shopping. This long-term trend could decrease footfall in their physical high street locations, impacting their traditional business model. For instance, in 2024, e-commerce sales in the UK continued to grow, accounting for a substantial portion of total retail spending, a figure projected to rise further.

While H&T is actively investing in its digital presence, a rapid or widespread decline in the importance of brick-and-mortar stores presents a challenge. Such a scenario might necessitate significant and potentially costly strategic adjustments to their retail footprint and operational focus. The retail sector in 2024 saw continued pressure on physical stores, with many retailers reporting declining sales in their high street branches compared to their online counterparts.

- Evolving Consumer Habits: A sustained move towards online channels poses a direct threat to the relevance of H&T's physical store network.

- Digital Investment Strain: While investing in digital, a faster-than-anticipated decline in physical retail could outpace these efforts, requiring more substantial reinvestment.

- High Street Vulnerability: The overall health of the high street, impacted by changing consumer behaviour and economic factors, directly affects H&T's store-based revenue streams.

Increased competition from both established players and new entrants, particularly in the digital lending space, poses a significant threat. These competitors may offer more attractive rates or user experiences, potentially eroding H&T's market share. For example, the UK's digital lending market is projected to see continued growth through 2025, indicating a strong customer preference for online solutions.

Regulatory changes, such as potential interest rate caps or enhanced consumer protection measures anticipated for 2024-2025, could directly impact H&T's profitability and operational flexibility. These changes may necessitate increased compliance costs or limit certain lending practices.

Economic downturns, leading to reduced consumer spending and a decline in collateral values like gold, present a substantial risk. A recession, similar to the 6.3% GDP contraction in 2008, could severely impact H&T's asset base and increase loan defaults.

The ongoing shift in consumer behavior towards online channels threatens the viability of H&T's physical store network. While H&T is investing in digital, a rapid decline in high street importance could necessitate costly strategic adjustments, especially as e-commerce sales in the UK continue to grow and are projected to rise further through 2025.

| Threat Category | Specific Threat | Potential Impact | Relevant Data/Trend (2024-2025) |

|---|---|---|---|

| Competition | Digital Lenders & Fintechs | Market share erosion, reduced pricing power | UK digital lending market growth projected through 2025 |

| Regulatory | Stricter Compliance / Rate Caps | Increased costs, reduced profitability, limited services | Potential new regulations anticipated for 2024-2025 |

| Economic | Recession / Collateral Value Decline | Increased defaults, diminished asset base | UK GDP contraction risk (e.g., 6.3% in 2008) |

| Consumer Behavior | Shift to Online Shopping | Reduced footfall in physical stores, need for digital investment | Continued e-commerce sales growth in UK, projected to rise further |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, drawing from H&T Group's official financial reports, comprehensive market intelligence, and expert industry analyses to provide a thorough and actionable assessment.